Good morning!

Thanks for getting all your requests in.

Today I'm planning to look at:

- GYM (LON:GYM)

- Beeks Financial Cloud (LON:BKS)

- IQE (LON:IQE)

- Johnston Press (LON:JPR)

- Richoux (LON:RIC)

GYM (LON:GYM)

- Share price: 325p (unch.)

- No. of shares: 138 million

- Market cap: £448 million

This is the innovative low-cost gym chain which is currently experiencing rapid growth.

It's one that got away from me, as I was dabbling in the shares below 200p last year. I couldn't quite convince myself to hold on to them, however. I'd be up by nearly 80% if I had.

There could still be a fine opportunity from current levels. So let's take a look at these results.

The company says it is on track to meet market expectations.

Headlines:

- Revenue +36%. An important figure but the group is expanding its estate and has grown by acquisition. So it's not a "like-for-like" number.

- EBITDA margin falls to 30%, "reflecting immature estate profile" and the effect of converting gyms from an acquisition it made last year.

- Adjusted PBT of £7 million.

The adjusted PBT is calculated after adding back in amortisation of acquired intangibles plus exceptional items.

Having looked into it, I think the adjustments aren't terribly out of the ordinary. Note however that exceptional items were pretty big last year (£1.7 million) and are already £1 million in H1 of this year. They are likely to drag on results for as long as The Gym is making acquisitions and lots of changes to its estate. But hopefully these expenses will lead to a lot more profits in the future.

- Small interim dividend. The company has been raising new equity for growth, so the dividend doesn't really matter. It's all about getting bigger for now, rather than producing an income stream.

- 6 new gyms and 13 gyms acquired (total: 147). Still targeting 15 to 20 organic openings for 2018 (will need to do better than 6 in H2!)

- CFO becoming CEO.

There's no reason for the shares to move anywhere today as things are motoring along as expected.

It's a fine pace of growth. As the CEO points out, the number of sites has increased from 100 in October 2017 to already close to 150.

But more than 30 of those sites were acquired from other chains (18 from Lifestyle and 13 from easyGym), so the organic growth rate is much more relaxed than the headline rate.

The strategy is to be "the lowest cost high quality operator" - i.e. it is competing heavily on price against other gyms. From all appearances, this strategy is working. Maybe we can call it the Ryanair of gyms?

Software - it has started using the Workday ($WDAY) ERP system, and is excited about the potential benefits. Sounds good.

New sites - we are guided for an H2 weighting for sites within the M25. Sounds like things are possibly a little slower than expected.

There's an opportunity to rent some sites that have been vacated following retail CVAs. This is a theme we've touched on before - retailers being replaced by experiences.

Premium model - aiming to increase revenue per member with a premium option called "LIVE IT" (link). I can see this having some merit, especially the freedom to use more gyms.

Cash flow - very helpfully, GYM breaks down maintenance capex and expansionary capex.

Having done so, it reckons that after-tax free cash flow generated over the six months was £13.6 million. Another good result, I think.

My view

Based on price action over the past year, I regret not holding on to this. I continue to think it's a good company, executing well, with good growth potential. I would like to see a bit more emphasis on organic growth rather than buying up sites from other chains, although I accept that the acquisitions it made probably had a sound strategic rationale.

EPS is forecast at 12.7p in 2019. With continued growth in market share and the size of the overall low-cost gym segment, I don't consider these shares to be overvalued.

Anecdotally, I happen to be a member of a luxury gym chain (it's one of the select few things that I like to spend on). It's mostly empty throughout the day, which is great, but I've been wondering why. I've concluded that its business model must be to sign up people who don't bother coming in!

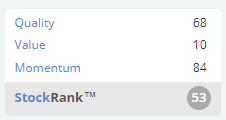

Anyway, here's GYM's StockRank. I'd certainly be interested to buy it at lower levels. For now, I retain a watching brief.

Beeks Financial Cloud (LON:BKS)

- Share price: 84p (+8%)

- No. of shares: 50 million

- Market cap: £42 million

This is still a relatively new stock. If offers facilities for low-latency financial trading, through placing its servers in close to proximity to exchanges around the world. It caters to banks, brokers, hedge funds and private individuals.

Underlying PBT has shot up to £1.2 million for FY 2018 (ending June), excluding IPO costs and amortisation.

As has been mentioned already in the comment thread, the current market cap doesn't enjoy much balance sheet support, as net assets amount to less than £5 million. Tangible net assets are about £4 million.

So this is all about earnings. Beeks has a KPI called "Annualised Committed Monthly Recurring Revenue", which is basically the run rate of revenues, and this is up 47% to £6.9 million.

These are back of the envelope calculations but if revenue was say £8 million in 2019, at a fixed gross margin and with other expenses fixed too, then I estimate that underlying PBT would improve to somewhere in the region of £2.5 million.

(The existing Stocko consensus forecast for FY 2019 revenues is £8.6 million, which is looking a bit optimistic after FY 2018 revenues missed consensus by £0.6 million).

The point is that the forward earnings multiple is not extreme when you look at it this way, and the company is very confident of "continued momentum" and "strong market drivers". It's riding a growth wave that looks set to continue, basically.

I'm not personally tempted to participate, because I feel unable to predict whether this service will be relevant many years from now. The pace of change in automated trading is simply relentless, and I can't imagine what the competitive landscape will look like as communications technologies continue to improve. I'll probably miss out an exciting investment, as a result. But I wish the company every success.

Paul Scott's view (Paul owns BKS shares).

This is a very interesting company, which floated on AIM in Nov 2017. I'm generally very sceptical about new issues, but made an exception in this case, after a friend recommended that I read the Admission Document. Also, I was very impressed with the CEO's presentation at Mello Derby, and increased my position size from small to medium shortly afterwards.

Results today look terrific to me.

- Revenue growth (organic) of 41% - this is a little below forecast, but still highly impressive

- Big rise in gross margin, resulting in gross profit up 90% on last year

- Underlying EPS of 2.27p, giving a PER of just under 38. I've checked the way underlying EPS is calculated, in note 23, and am happy with it. The main adjustment is for one-off IPO-related costs, which is perfectly reasonable to exclude from the number used to value the business

- Maiden dividend of 0.3p, in line with forecast

- Crypto-currency markets may be providing a short term boost to performance. Although the narrative says that most revenues are derived from forex and futures markets

- Possible acquisitions have been assessed, but none has met the company's investment criteria. It sounds as if there might be future acquisitions, which would probably result in some dilution. The CEO's dominant shareholding should however protect us from anything reckless or too dilutive being done

- Balance sheet is small, but strong. No issues there

- Modest Director remuneration, as is often the case with Scottish smaller companies

- Only 821k share options outstanding, which is minimal compared with 50.0m existing shares in issue - good, as it means little dilution in future

- Note that there is a minimal tax charge, so forecasts need to factor in a higher future tax charge. So this flatters EPS at this stage

Paul's Opinion - this is exactly the type of company that I search for, and want to invest in. It's growing strongly, organically. Not only are sales rising, but gross margins are too, giving fantastic operational leverage. The outlook comments are confident.

How to value it? Personally, I see this as an exceptionally good growth company, hence in a bull market, I'm prepared to push the boat out on valuation. This can be risky, if anything goes wrong, but plenty of lowly valued companies also drop heavily on disappointments, and are arguably more likely to disappoint in the first place.

For me, I think this company deserves a premium PER of 50, which based on EPS forecast of 3.6p for the current year, ending 06/2019, suggests a price target of 180p - about double the current share price. Some readers may recoil at paying a PER of 50. However, given that the company has just reported such strong figures, I think it's justified.

There's an update note from a good quality broker today on Research Tree. I think perhaps some investors baulked at the revenue miss, and sold early on today. However, in my view, the more important numbers are gross profit and EPS, which came in ahead of forecast. Indeed the main broker has today increased its 06/2019 EPS forecast.

This share is a reminder that when picking small caps, it's really all about;

- Backing top quality management,

- with a great business model,

- going for a lucrative & perhaps overlooked niche.

Over my sabbatical this summer, I've had lots of thinking time, which has helped me focus more on the above simple 3 points. Short term valuation is less important than the above factors, in my view. So these days I'm more inclined to pass on almost all share ideas. However, for the shares that do meet my rigorous investment criteria, I tend to concentrate my funds into them more heavily than in the past. So when funds permit (am fully invested at present), then I'll be looking to buy the dips with Beeks. As always, this is just my personal opinion, which is not a substitute for readers doing your own research, because sometimes I will be wrong!

IQE (LON:IQE)

- Share price: 102.5p (-1%)

- No. of shares: 761 million

- Market cap: £780 million

Graham here again, taking a look at this heavily-shorted manufacturer of semiconductor wafers. Disclosed short positions persist at 11% of shares outstanding.

(I don't mention this because short-sellers are necessarily correct, but because it means there must be some good arguments in favour of shorting it.)

Results:

- revenue from wafers up 5.4%. Held back by currency headwind of c. 10%.

- gross profit margin down by 1.4 percentage points.

- adjusted PBT down 21% to £7.6 million (after £1 million of adjustments).

- the company suffers a tax charge instead of receiving a tax credit, so reported net income is down 50% to £4.2 million.

Balance sheet - net cash of £40.6 million. It raised almost £100 million in November.

Operations - 7 new reactors so far this year in Newport. Another 3 scheduled during the rest of H2.

CEO comment. The company also provides a second version of adjusted PBT, with another £3.5 million of adjusted expenses, including a currency headwind of £2 million. If you're happy to look at it that way, adjusted PBT is up.

In relation to the additional expenses taken on during the period, the CEO says:

Although the costs of these investments have impacted first half profitability, we are confident they will be pivotal in delivering strong increases in revenue, margin expansion and profitability as 3D sensing is widely adopted in global mobile platforms and other large volume applications.”

Joint ventures

IQE's Singapore and Cardiff joint ventures were the subject of bear speculation earlier this year. The final footnote of today's report details the related party transactions which took place over the last six months with them.

Once again, I don't see any smoking gun as far as these JVs are concerned. The movement in cash is a bit circular (IQE making purchases from the Cardiff JV and also recharging costs to it), but you'd need some very detailed, specific info to prove that something untoward was going on.

My view

I'm impressed by the 55% market share the company claims to have in the wireless market. It's now moving to produce for Android manufacturers - encouraging. It says it's positioned strongly for 3D sensing applications - also very interesting.

Regular readers will know that I love to see big ROCE/ROE numbers. They are associated with growth and free cash flow (because you need to reinvest less of your earnings to get the same result).

IQE has a mixed track record on this front, for reasons we've discussed before (it's in a heavy industry and has had to do a lot of capex spending).

Maybe 3D sensing will be the opportunity that sparks improved returns for shareholders? I'm neutral.

Johnston Press (LON:JPR)

- Share price: 4.1p (-20%)

- No. of shares: 106 million

- Market cap: £4 million

A footnote of a different kind, as JPR looks set to disappear before too long.

Outstanding borrowings of £220 million junk bonds are coming due on 1 June 2019.

There has been no agreement as of yet about what to do with this problem.

Bondholders don't seem terribly interested in a refinancing, and if they want the equity then it is surely theirs for the taking.

JPR shares are equivalent to out-of-the-money call options. In other words, they are likely to expire worthless.

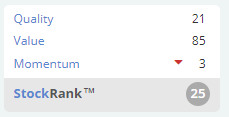

It's reassuring to see that despite superficial value, the StockRanks can detect the danger and classify this as a Value Trap.

Richoux (LON:RIC)

- Share price: 6p (-14%)

- No. of shares: 125 million (before fundraising)

- Market cap: £7.5 million

Subscription to raise approximately £1 million

Richoux Group plc, the owner and operator of 18 restaurants under the Richoux, Villagio, Friendly Phil's, Zintino and The Broadwick brands, today provides a trading update for the 26-week period ended 1 July 2018

This is a small, unprofitable restaurant chain.

H1 revenues will be flat and losses will reduce. Times remain tough.

There is an equity raise for £1.1 million at 6p. A discount to the prevailing share price was understandable in the circumstances.

It's also attempting to conclude a lease sale for £1.35 million in Central London.

In combination with the fundraise, it sounds like the immediate financial strain has been dealt with.

Worth noting that the CEO and his concert party (family members) are subscribing for 6 million of the 18 million new shares, taking their aggregate holding to 29.5%.

Non-executive directors are also subscribing for 7 million of the new shares.

Insiders are invested and are buying - maybe prospects aren't as bad as they first appear?

All done for today. Thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.