Good morning, and happy new year! It's Paul here.

It's another quiet day for results/trading updates.

Many thanks for the continued input from readers, in the comments sections after these articles. It's very useful & worthwhile, often adding information that Graham & I may not be aware of. I'm keen to see this develop more, as feedback I'm getting places a lot of importance on the quality of reader comments here. I think that here at Stockopedia we've already got a reputation for having the highest quality reader comments of any mainstream UK investing site. So it would be great to see that lead grow in 2018 to become unassailable!

On to today's news.

Staffline (LON:STAF)

Share price: 989p (down 2.1% today, at 08:30)

No. shares: 27.8m

Market cap: £274.9m

Staffline, the Staffing and Employability organisation, today issues a trading update for its financial year ended 31 December 2017.

It's an in line result for the year;

The Board is pleased to report that the Group expects to deliver full year results in line with market expectations.

Other points;

Revenue of c.£962m for 2017, up 9% on 2016 (slightly short of £1bn long-term target, which doesn't really matter). Note that much revenue is pass-through - i.e. wages of contractors.

Staffing division is doing well.

Other activities sounds a bit mixed;

PeoplePlus, the Employability, Skills and Justice Division, has also made good progress, continuing to win new contracts as well as benefiting from its focus on improved margins, helping to offset reduced activity from the run off of the Work Programme.

I'm a bit concerned about the last point - I thought that the Work Programme (A govt scheme to get unemployed people back to work) was going to be extended with new contracts. So there's a question mark over that.

Results for 2017 are due out on 24 Jan 2018 - that's a superbly quick reporting schedule - why can't all companies produce their preliminary results this quickly? In my experience, rapid reporting is nearly always a sign of a well-managed business, with strong financial controls. The opposite is also usually true - slow reporting means that a company probably isn't very well managed.

Private investor presentation - Staffline also impresses for treating its private shareholders with equal importance to institutions;

A presentation for private and retail investors will also be held on Wednesday 24 January 2018, starting at 12.00pm at the offices of Buchanan, 107 Cheapside, EC2V 6DN. Admittance is strictly limited to those who register their attendance in advance of the event. To register for the event, please contact Buchanan on 020 7466 5000 orstaffline@buchanan.uk.com.

These meetings have historically been well-attended, and highly informative. Management have impressed me & others with a willingness to answer all questions clearly, and openly. Plus the meeting is unhurried, with plenty of time made available. Again, why don't more companies do this? I think there should always be a meeting and/or webinar organised by companies for private investors, built into the reporting cycle for most companies. Companies which treat their individual shareholders with respect will benefit from greater liquidity in their shares, and probably a higher share price too. It amazes me how many listed companies ignore their private shareholder base, and then wonder why there's no liquidity in the market for their shares.

Valuation - given that this is an in line update, it's likely that forecasts will remain static. FinnCap has confirmed this in a brief note this morning.

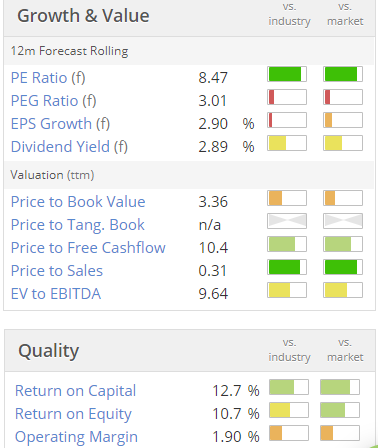

This is how the growth & value figures are looking on Stockopedia;

The PER looks attractively low, for a company which is growing its earnings still. Although EPS growth for 2018 is forecast to be modest. The divis are helpful, and growing. The company also seems to have established a reliable track record operationally - it usually seems to meet expectations, if my memory serves me correctly.

My opinion - I'm not really sure why the share price has drifted down by about a third since the summer. Lots of former momentum stocks have displayed a similar trend. Therefore I feel this one is worth a closer look, as today's update sounds reassuring.

A possible reason for STAF seeing its PER reduced could be worries about E.European workers going back home. Weaker sterling is likely to cause a bit of that effect. I suspect that any hurt feelings are Brexit are probably wearing off by now. Indeed, like so many Brexit-related scare stories, there seems little to no truth in predictions of a mass exodus of foreign workers. I saw some statistics recently which showed that there had not been any exodus of EU workers at all from the UK.

Therefore I think there could be a possible buying opportunity here, maybe? I need to do some more research to refresh my memory on the basics, e.g. the balance sheet, which does have some debt, although not excessive (from memory).

Thinking aloud, another possible downside risk is possible tightening of Government legislation. We've seen a trend in recent years of Governments making direct employment more onerous, hence driving more employers towards using agency staff. I wonder whether a future Corbyn Government might pass legislation which would harm staffing agencies? Generally, I suspect that many investors, myself included, might now be worrying more about a Corbyn Government as a bigger downside risk for shares & the economy than Brexit. I'll come back to that subject in more detail in future.

Carillion (LON:CLLN)

Share price: 17.3p (down 3.7% today, at 09:28)

No. shares: 430.3m

Market cap: £74.4m

FCA investigation - an interesting & unusual announcement today, from this support services group. As if it didn't have enough problems already!

The Financial Conduct Authority (the "FCA") has notified Carillion plc ("Carillion") that it has commenced an investigation in connection with the timeliness and content of announcements made by Carillion between 7 December 2016 and 10 July 2017. Carillion is cooperating fully with the FCA.

I don't have any view on the company's announcements, and would not want to pre-judge the outcome of the FCA investigation. However, I think there is a significant general problem in this area, with misleading information in company announcements. Therefore I welcome any investigations - the more the better, in my view. After all, what's the point in having rules, if they are not policed properly?

I agree with Graham here, that CLLN looks uninvestable currently, due to its terrible, debt-laden balance sheet. It has already indicated that a (probably very large) equity fundraising is needed. Who knows what terms that is likely to be done at (if they can get a fundraising done at all).

Therefore I think the risk of a 100% loss here is far too high to want to punt on it. It might be worth a fresh look, if and when a big fundraising is done. I would rather let other investors take the risk of a deeply discounted fundraising. The share price here won't ever get back to its old levels (without a share consolidation) because there is likely to be massive dilution of existing shareholders in 2018. Either that, or the company might go bust.

Individual, small investors have a great advantage, in that we can exit from shares like this, if things go wrong. Whereas institutions & other large investors are left high & dry. The words of Nigel Wray stuck in my mind, when I interviewed him last year. I asked him what he does if things go badly wrong at companies he invests in. He shrugged, and said, "I go down with the ship!". How does this relate to CLLN? Institutions are high & dry, and under pressure to refinance the company, to save face. Whereas private investors can just walk away, and put it down to experience. Therefore I think it's safest to avoid the temptation to bottom fish with this disaster of a company. Yet another disaster in this sector actually, which is littered with disasters, so a sector that I now steer clear of completely.

Next (LON:NXT)

Share price: 4,804p (up 6.8% today, at 11:05)

No. shares: 146.0m

Market cap: £7,014m

(at the time of writing, I hold a long position in this share)

Trading update - as regulars will know, I like to keep abreast of this High Street behemoth for several reasons - it reports first after Christmas each year, so often gives valuable clues about what is going on generally in the sector. This read-across to other retailers can potentially help us spot opportunities elsewhere, in small caps.

Annoyingly, I read too much bearish claptrap in the press about how Next was heading for a lousy Xmas, and sold much of my much larger previous position in this share. How annoying, because the press were wrong - Next has today announced a solid performance over the Xmas period, relative to expectations. Here are the key points, and my comments;

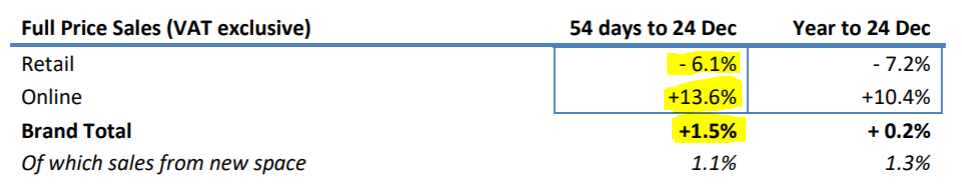

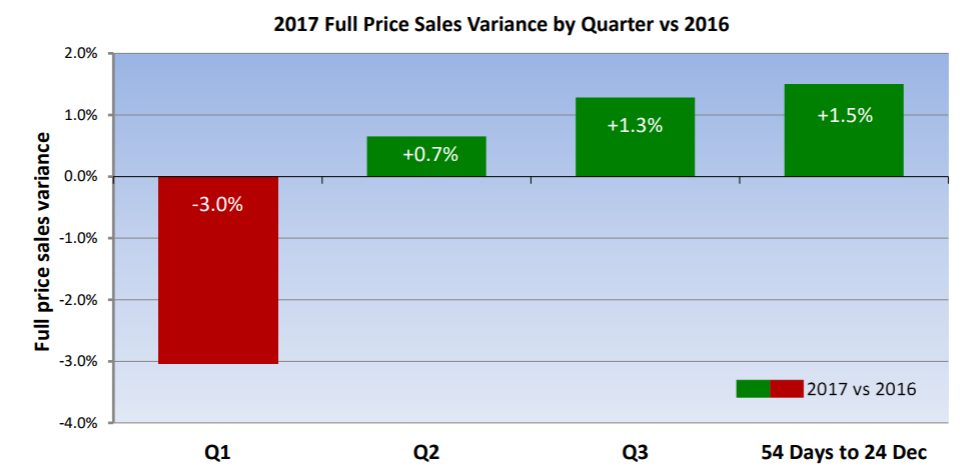

- Improving full price sales trend in Q4 (see chart below)

- Online growth is offsetting declining sales in its physical retail space - so still very much a case of a good growth business (online) holding up the overall figures, against declining physical stores' performance.

- Colder weather in the lead-up to Xmas helped (as it drives sales of higher value winter clothing, such as coats).

- Stock clearance has gone well, with old season stock holdings down 6% on prior year.

- Profit guidance for y/e 31 Jan 2018 is increased by £8m to £725m, which is a drop of -5.7% on last year.

Outlook - there are some very interesting, and rather encouraging points in this;

- Many challenges will continue, but "some of these headwinds will ease" in 2018.

- Cost price inflation - will fall to 2% in H1, and disappear altogether in H2. This confirms that the depreciation of sterling caused one-off price rises, and is rather encouraging in my view.

- Full price sales budget is for a range of -2% to +4%. The mid point of +1% is an improvement on the current year. Remember that Next tend to start off cautiously, then we tend to see improvements & a narrowing of the range as the year progresses.

- Estimated group profit of £705m, down 2.8% on the current (nearly finished) year - not bad - so I think we could see the market re-rate Next as a business that's no longer in significant decline, but has perhaps now stabilised?

- Buybacks - estimate of £300m surplus cashflow (above normal divis) will be used for buybacks. This would buy back about 4.7% of the company's shares, and therefore boost EPS by a similar amount.

- EPS forecast - is to rise by +1.1%. This seems highly significant to me. Next is generating so much cash still, that it can create a rising EPS through big buybacks. This is central to the investing case for this company, and has been for years. I note from the StockReport that it had 172.7m shares in 2011/12, which has reduced every year since, to now sit at 146.0m. You won't find many companies that are paying out generous divis, and also buying back large amounts of its own shares. That's a very pleasing combination.

My opinion - I'm encouraged by this update, so am happy to sit tight on my remaining long position (still one of my larger positions). It seems that reports of the death of the High Street were fake news! The key point is that the best quality retailing operators should not only survive, but trade reasonably well, in the future. A strong product offering is vital, along with a flexible cost base (Next has previously confirmed this, with its relatively short leases, and leverage with landlords to reduce rents on renewal, or walk away). Plus I think retailers need a strong online presence too, which Next has. We also get a profitable consumer finance division thrown in, with Next shares. So its net debt can be ignored, as its debtor book from consumer credit exceeds the related creditors for borrowings.

This is one of very few retailers that I am happy to hold. I think it's good value, and a great quality business, so I shall continue to hold.

Note that Reuters quotes the boss at Next saying this today;

We're a lot more confident than we were at this point last year, which is why we're returning to the share buyback.

He (Lord Wolfson) has a well-deserved track record of telling it like it is - or even being too gloomy. So his words are very much worth taking note of. Apart from when he's on BBC's Question Time - when he tries too hard not to offend anyone, hence ends up sounding way too bland, in my view.

Several other retail shares in my BMUS portfolio have also risen today, probably on the back of Next's reassuring report on Xmas trading. This includes Boohoo.Com (LON:BOO) and SuperGroup (LON:SGP) - both of which I think are lovely, high quality businesses, and I hold personally. It's good to see BMUS having a go at cracking the £4m level - not bad considering it started at £1m in Jan 2015, and doesn't use any gearing.

STOP PRESS! - news is reaching me that apparently John Lewis Xmas trading figures are out, and are good - especially for womenswear. I can't find a link to the original data, so if anyone has it, perhaps you could be kind enough to post it as a comment, then I will copy the link to here, later.

A few quickies to finish off with;

WANdisco (LON:WAND) - contract win of $4.3m announced. It's been sold through IBM, re-branded as "IBM Big Replicate". I turned bullish on this stock last year, and caught a nice move upwards, but the valuation of c.£250m is too rich for me now. It looks like there's something interesting here, possibly? Although revenues are still small, and losses heavy (albeit reducing).

Corero Network Security (LON:CNS) - the company announces what it calls "significant contract wins". However, the sales value only seems to be $0.4m. That's not significant compared with the company's ongoing heavy trading losses. It's difficult to see anything positive about this company. I'm amazed it has managed to raise the funding for such heavy multi-year losses. So a big thumbs down from me, and from the Stockopedia computers which give it a StockRank of only 9.

I have to leave it there for now. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.