Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

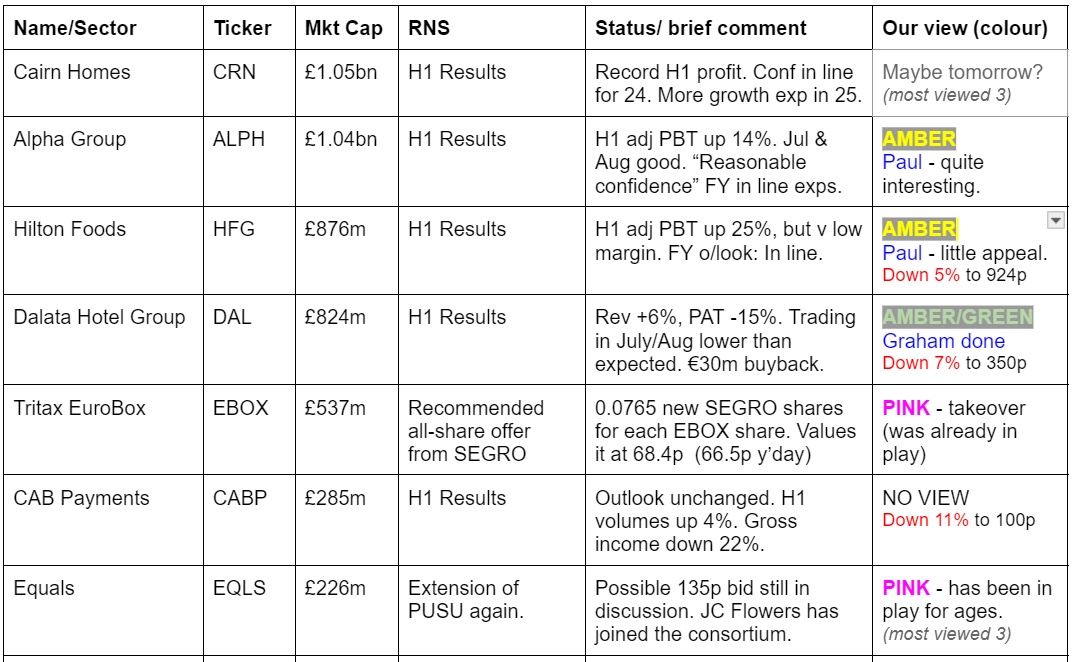

Companies Reporting

Summaries

Dalata Hotel (LON:DAL) - down 4% to 351p (€930m) - H1 Results - Graham - AMBER/GREEN

This hotel group has seen some softness of demand in July/August. Taking a bigger-picture view, however, the company is still earning respectable profit margins despite the challenge of payroll inflation and inflation more generally. UK growth plans are rolling out and the shares offer a material discount to balance sheet equity. This one seems worthy of further investigation to me.

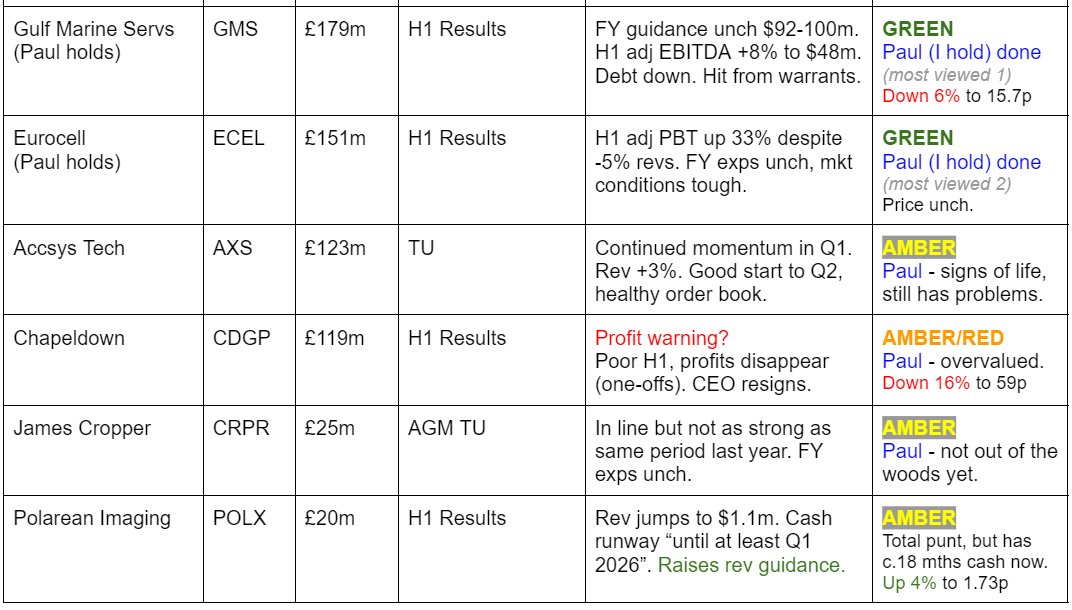

Gulf Marine Services (LON:GMS) (Paul holds) - down 6% to 15.7p (£168m) - H1 Results & Changes re Seafox - Paul - GREEN

More developments with the overhang from major shareholder Seafox. However, I think the more important thing is that trading continues to be strong, and in line with expectations for FY 12/2024. Deleveraging is proceeding well, and new bank facilities are agreed (but not yet signed). Very good visibility with a growing contracted order book that looks sufficient to give a clear run of 2-3 years more prodigious cashflows, which should eliminate net debt altogether, or enable divis, reinvestment, and some debt reduction. I remain bullish.

Craneware (LON:CRW) - £21.96 (£788m) - Management Q&A - Graham - AMBER

Please see below for the notes I took during my management call with this highly-rated software business serving the US healthcare industry.

Eurocell (LON:ECEL) (Paul holds) - unch 145p (£151m) - H1 Results & Buyback extended - Paul - GREEN

Tough sector, but adj PBT for H1 is actually up 33%, despite revenues down 5%. That's due to careful management, and some reduced costs. Lovely balance sheet, and strong cashflows have enabled both generous divis and buybacks of c.10% of the shares. Lots to like here, with a modest valuation, and sector recovery upside in for free. I remain keen GREEN.

Paul's Section

Eurocell (LON:ECEL) - Paul holds

Unch 145p (£151m) - H1 Results & Buyback extended - Paul - GREEN

Eurocell plc, the market leading, vertically integrated UK manufacturer, recycler and distributor of PVC window, door and roofline products, today announces its results for the six months ending 30 June 2024.

Given that we know the housebuilding & building materials sector generally is in the doldrums, I was expecting weak numbers from Eurocell. However, it has surprised me on the upside, with a 33% increase in adj PBT from £6.0m to £8.0m in H1 2024, despite revenues being down 5%. It says this is due to reduced input costs. There’s also been self-help by ECEL, which reduced overheads very quickly when this downturn started a while ago. I find this encouraging. Adjustments are small this year.

Dividends & Buybacks - H1 divi is raised 10% to 2.2p. In 2023 the divis were split 2.0p H1, 3.5p final. Assuming both rise 10% this year, then I make that c.6.0p, providing a yield c. 4.1%. Whereas Stockopedia is showing a forecast yield of 6.0%, which is partly explained by it blending 2024 & 2025 forecasts, but also suggests to me that maybe the broker consensus data might be picking up an unrealistically high forecast? We don’t have access to any broker notes, something ECEL clearly needs to address.

Buybacks have been large - £10m done in H1, and announced today a further £5m. Total thus £15m, which is 10% of the market cap of £150m! Very significant, and a great use of cashflow in my view, whilst shares are cheap. Remember it’s doing this at the (probable) bottom of the economic cycle for the sector.

Outlook for FY 12/2024 -

“Trading conditions continue to be tough in 2024, with ongoing macroeconomic uncertainty impacting our key markets, exacerbated by wet weather and the General Election. Customers remain cautious, resulting in lower investment in home improvements and subdued activity levels in the residential construction market. As a result, H1 sales were 5% below H1 2023.

However, first half adjusted profit before tax was up 33% on H1 2023, as we continue to proactively manage our gross margin and cost base, which has supported a reduction in input cost pricing, and our expectations for the full year remain unchanged.”

"Earlier this year we launched our new strategy, which identified a pathway to building a £500 million revenue business, generating a 10% operating margin, over a five-year period. We have good early momentum with our new strategic initiatives and are becoming increasingly confident that, whilst this is an ambitious target, it is achievable.

"The UK construction market continues to have attractive medium and long-term growth prospects, driven by the structural deficit in new build housing and an ageing housing stock that requires increased repair and maintenance. Overall, we believe the progression of our strategy, together with the actions we have taken on cost and cash flow over the last eighteen months, leave the business well positioned to drive sustainable growth in shareholder value."

Adj basic EPS was 5.6p in H1. It’s not clear from the historic data whether there’s a settled H1:H2 trading bias, as the pandemic messed up all the numbers. 2023 showed a strong H2 bias to profits. The broker consensus this year does this too, pencilling in 14.8p EPS For FY 12/2024. Hopefully that’s the same number that ECEL are working on too - this is where a footnote in RNSs is so helpful, clearly stating what numbers are expected. That’s missing here.

Anyway, assuming that 14.8p FY 12/2024 estimate is accurate, I get a PER of 9.8x which looks good value.

It’s expanding too -

“Branch network expansion: locations identified for 8 new sites, with 2 to be opened in Q4 2024 and 6 in Q1 2025”

Balance sheet - is really strong, as I’ve mentioned many times before. NAV of £106.8m becomes NTAV of £91.6m after eliminating £15.2m of intangible assets.

There’s a little freehold property, £6.9m at end 2023, with most of its sites leased.

Working capital is healthy, with a current ratio of 1.58x, and negligible long-term debt (excl leases).

Overall net bank debt is only £4.3m, improved a lot from £15.2m a year earlier - despite the generous divis and big buyback. That’s been achieved by tight control of working capital - with inventories and receivables both nicely reduced vs a year ago, but trade creditors unchanged. Note that cashflow might deteriorate as sector recovery begins, as cash is likely to be sucked back into working capital.

Cashflow statement - is strong, but remember the lease cash outflows are about £8m in H1, and these appear low down in the statement, so we have to adjust those out of the higher numbers to get something vaguely close to commercial reality!

Paul’s opinion - this strikes me as a well-managed, good quality business. It looks like the sort of thing where management have taken sensible actions to make the business more efficient during this downturn. That could really pay off once demand recovers. Finances are strong, cashflows good, and the shareholder returns have been tremendous, especially the buybacks of c.10% of the company (including today’s newly announced additional buyback of £5m). That will nicely enhance future EPS.

I only have a tiny scrap of shares currently, but ECEL is right up there on my wishlist of positions to add to, in advance of a sector recovery that looks likely in 2025.

What’s it worth? I wouldn’t be surprised if the share price starts with a 2, not a 1, in say 2025 or 2026. And it’s paying decent divis whilst we wait. It’s got to be another GREEN from me.

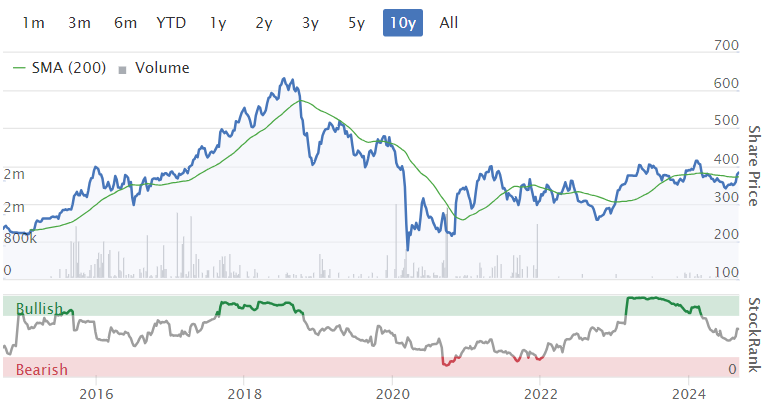

Chartists can tell you more, but this looks like it's bottomed out, and is now in a fresh uptrend, and above the 200-day moving average. StockRank almost jammed on maximum too, so we've got our proverbial mallards neatly lined up!

Gulf Marine Services (LON:GMS) (Paul holds)

Down 6% to 15.7p (£168m) - H1 Results & Changes re Seafox - Paul - GREEN

GMS, a leading provider of advanced self-propelled, self-elevating support vessels serving the offshore oil, gas and renewables industries, is pleased to announce its interim results for the six months period ended 30 June 2024 (H1 2024).

There’s no company headline, it lets the key numbers (in US dollars) do the talking!

These below show an upward trend in EBITDA, a high EBITDA margin vs revenues, and impressive deleveraging at the last 3 years half year ends -

Key metrics -

Average daily hire rate - up 7% to $32.4k, reflecting strong demand and an industry shortage.

Utilisation rate - fell slightly from 93% to 91%, which reflects “planned downtime for maintenance”.

The large fall from $47.7m adj EBITDA to only $7.4m net profit is due to (as I would expect) heavy depreciation charges on a (still fairly new) fleet of capital equipment. Also there was $12.3m in H1 finance expenses, due to the still high debt load. Although note this is reducing well, down from $17.5m in H1 LY, and of course this will continue falling as GMS continues to quite rapidly deleverage, as well as having secured savings on the interest rates due to achieving more favourable leverage ratios.

Note there is also a $7.5m P&L charge for fair value of derivatives. Note 17 explains this. It’s warrants that GMS had to issue to lenders, as part of a deal in early 2023. The warrant holders could opt to subscribe for 137.1m new shares at only 5.75p (now a big discount to the 15.7p share price). The last date to exercise is 30 June 2025, and being well in the money, we should expect all the warrants to be exercised before the deadline.

The P&L charge is a non-cash amount that reflects the discount gained by the holder of the warrants when they’re exercised, with 53.5m shares having been issued in H1 out of the 137.1m total possible. It’s complicated by the fact that instead of being the usual 1 new share for 1 warrant, it’s 1.56 new shares per warrant here. Anyway remember to allow for further dilution at 5.75p when you value this share.

Outlook - this sounds good to me, in particular the growing secured backlog is 2-3 years revenue, nice visibility here -

“Given the Group's improved performance in H1 2024, we reaffirm our adjusted EBITDA guidance for 2024, projecting a range between US$ 92 million and US$ 100 million. This guidance is aligned with our current market conditions and expectations. We are also working on revisiting our EBITDA guidance for 2025 towards year end. Further, our secured backlog improved to US$ 426.8 million on 30 June 2024 (30 June 2023: US$ 301.4 million).”

More outlook detail - point 2 below particularly sounds significantly positive, as I worried about the risk of new vessels coming into the market. It sounds as if customers are locking in the use of GMS’s fleet for several years (at high rates), which should give it time to completely de-gear in c.3 years’ time, which I find highly positive. Longer term, there’s the obvious risk that rates and utilisation may drop back again, but since the debt should have been paid off by then, I don’t really care about that.

Balance sheet - is fine now I think. NAV $349m is nearly all tangible, apart from $14m of capitalised “dry docking expenditure”.

Note all the bank debt is shown within current liabilities, because renewed bank facilities (previously RNS’d) have been agreed but not yet finalised. Let’s hope nothing goes wrong there, but it shouldn’t do, as GMS is now a vanilla borrower with normal level of leverage, demonstrating prodigious cashflows which are enabling it to repay debt fast, and ahead of schedule. So I imagine plenty of lenders would be happy to lend on reasonable terms. I covered its refinancing here on 1/8/2024. Today it says -

“This potential transaction is commercially approved by all parties and the contractual arrangements, currently in progress, are expected to be finalised within the next couple of months. Management is confident that the deal will be signed consistent with the agreed term sheet.”

Going concern statement assumes that the bank facilities will renew, and will be sufficient.

Paul’s opinion - rightly or wrongly, I’m comfortable that the selling overhang is probably creating more of an opportunity than a threat in the medium term. There is a good argument though that Seafox are experts in this field, and want to exit, which could be a warning. However, there could be any number of reasons why Seafox want to move on, and handing over GMS shares to their own shareholders could create an overhang, or it might not, we don’t know.

For me the key point is that GMS is a deleveraging situation. It’s making excellent progress, and with such good (and growing visibility) on the order book, there’s a clear line of sight to it being debt-free in 2-3 years. I think that’s quite exciting, as the cashflows could then be used to start paying potentially big divis. There’s useful additional detail in a note from Zeus today, covering these points. A dividend policy of 20-30% of PAT plus buybacks is mooted.

Overall, I’ve no idea what the short-term share price will do (it could be choppy if the in specie holders try to sell), and my hunch is there’s probably not a great rush to buy more of these. That said at £168m market cap, any overhang of shares could be taken out in one fell swoop by an institution of even moderate size. Hence I don’t want to wait too long, to try to be too clever on price, before adding to my existing (small) position in GMS.

For me it’s clearly another GREEN. This is one of the best cashflow/deleveraging shares I’ve seen for a while.

In a separate announcement today -

Seafox changes - Seafox is the largest shareholder in GMS. It caused a problem when it did a secondary placing of 51m shares (about one sixth of its total holding, reducing from 28.5% to 23.7%) in late June 2024, which I reported on here. The problem was that it accepted a 15% discount, selling at 17p, when the share price was 20p. That, combined with a very short lock-in of only 75 days (from 30/6/2024) gave the distinct impression that the remaining Seafox holding was probably now best viewed as an overhang, casting a shadow over the share price. That could be viewed as a problem, putting downward pressure on the share price, or a buying opportunity given that GMS has been trading well and deleveraging.

Today’s news is that Seafox’ Chairman Hassan Heikal is stepping down as Seafox’ representative on GMS’s board (Deputy Chairman at GMS). There’s some interesting background about Seafox today -

“Mr Heikal's appointment to the Board followed a period of shareholder activism, commencing in 2019, during which Seafox became the Company's largest shareholder and which led to changes in the composition of the Board, including the appointment of Mansour Al Alami as Executive Chairman. These changes led to the financial restructuring of the Company. Seafox also participated in the June 2021 capital raise, maintaining its proportionate shareholding, which further enhanced the Company's capital base. As a result, EBITDA grew significantly, and the Company was able to substantially deleverage which has repositioned the Group to its current sustainability. “

Since this RNS has been written by MAnsour Al Alami, who was put in charge of GMS by Seafox, it’s not surprising that he speaks highly of Seafox, who for whatever reason now seem to be trying to further exit from their GMS position.

Seafox distribution - Seafox announces today it is giving 150m of its c.254m shares in GMS to its own shareholders as an in specie dividend. In specie means transferring an asset in its current form, ie not selling it for cash (as I’ve just been informed by google!) -

“distribute 150 million of the shares that it owns in the Company pro-rata in the form of an in specie dividend to Seafox's shareholders, which include prominent family offices, such distribution to take place on or after the 15th of September 2024”

The remaining 103.7m holding in GMS by Seafox is loosely retained -

“ retain (directly and through its subsidiaries) the remaining 103,686,385 shares in GMS (representing a 9.69% equity interest in the Company). Whilst acknowledging that circumstances can change, Seafox has confirmed that it has no current intention to make further disposals in the short-term, given the positive outlook for the Company.”

Those two changes suggest to me that there’s likely to be an ongoing overhang of sellers in the market, as it stands to reason that some of the new shareholders may not necessarily want to keep their GMS shares. Although an optimist might conclude that the new shareholders might like the obvious attractions of GMS shares, and be follow-on buyers in the market, we just don’t know. Long-term it won’t matter anyway, as short-term considerations like this give way to the company fundamentals longer term.

I reckon GMS shares would be much higher if it hadn't been for the clumsy selling by Seafox in late June. So GMS is one for patient, unflappable investors.

Graham’s Section:

Dalata Hotel (LON:DAL)

Down 4% to 351p (€930m) - H1 Results - Graham - AMBER/GREEN

Continuing the hotel theme we’ve been looking at recently, let’s take a look at the interim results from Dalata.

Dalata is “the largest hotel operator in Ireland, with a growing presence in the United Kingdom and Continental Europe”.

One of its brands, Maldron, hit the headlines a week ago when customers complained that their bookings for Manchester at the time of the Oasis concerts had been unfairly cancelled. Maldron said that a technical error resulted in more rooms being available for booking than were available, and denied any wrongdoing.

Let’s check out the interim results to June:

Revenue +6% to €302.3m

Profit after tax down 15% to €35.8m

RevPAR (revenue per available room): +1% to €110.77.

RevPAR is the combination of room rates and occupancy.

There’s an important difference between Dalata’s performance and PPHE Hotel (LON:PPH) (covered recently). PPHE has seen room rates (i.e. average prices) decline, but occupancy has increased.

Dalata has seen the opposite. Its room rates are up 2%, while its occupancy has reduced a little..

The result is that Dalata’s RevPAR has increased in H1. Again this is in contrast to PPHE, whose RevPAR was down marginally in H1.

Inflation in Ireland is higher than in the UK, so Dalata’s greater weighting in Ireland could be a factor in this. Which brings us to…

Profitability: the EBITDAR margin (EBITDA also excluding rents) falls from 40.6% to 39.4%, but Dalata says there has been “excellent progress made reducing the impact of payroll inflation through innovation and efficiency projects, in addition to reduced energy pricing”.

Profit after tax falls by €6.2m; of this €4.2m is adjusting items and the rest is underlying performance at like-for-like hotels.

So it’s important to put the company’s good revenue/RevPAR performance in the context of higher costs and lower profits.

Growth plans: four new UK Maldron hotels opened this summer. Three leaseholds, one freehold. Four other projects in progress. “Considerable financial firepower to fund plans for further expansion in the UK, large European cities as well as maintaining our market share in the larger Irish cities.”

Dividend/buyback: the company announces a small increase in the interim dividend, and a €30m buyback. This buyback is much larger than what we saw at PPHE Hotel (LON:PPH) recently, both on an absolute level and relative to Dalata’s market cap.

Balance sheet: there is official balance sheet equity of €1.4 billion (almost entirely tangible), a more than 40% premium to the market cap. The company is carrying financial net debt of €228m, plus leases.

Outlook contains some bad news. Trade was “lower than expected” in July/August, with RevPAR up by just 1%, due to “more measured consumer spending”.

Some of the detail:

Demand from corporate and international visitors remains strong but we are seeing a softening from more cost conscious domestic customers relative to last year. We continue to see periods of good leisure demand around events. As we look ahead to the balance of the year, we expect these recent trends to continue. The events calendar for the remainder of 2024 looks strong particularly in Dublin. In addition, the impact of the 4.5% Irish VAT rate increase will be fully absorbed from 1 September 2024.

Graham’s view

I have a generally favourable view of Dalata. One thing I’ve noticed is that leasehold assets are more important here at Dalata, compared to PPHE Hotel (LON:PPH). It’s just a slightly different business model, but I do prefer the PPHE emphasis on freeholds.

Also, the valuation at Dalata involves a smaller discount to balance sheet NAV, compared to PPHE which strikes me as more of a bargain.

At this stage, I’m most comfortable taking an AMBER/GREEN stance here. The company is managing the challenge of inflation and has well-known, mainstream hotel brands with good growth potential. So I think there’s a lot to like here.

Craneware (LON:CRW)

£21.96 (£788m) - Management Q&A - Graham - AMBER

I had the chance to catch up with Craneware management yesterday, following their full-year results (covered here). Huge thanks to CEO Keith Neilson and CFO Craig Preston for taking the time to speak with me.

We covered three topics, focusing on the company’s growth potential. I have little doubt that this is a high-quality business, but I wanted to explore if its growth prospects could justify the US-style valuation multiples it trades at.

A reminder of these multiples:

The StockRank has noticed that it trades expensively:

Q1. How important is the 3rd-party use of Craneware’s data when it comes to achieving double-digit revenue growth?

A. Craneware hasn’t emptied the tank yet in terms of revenue growth. When it comes to the 3rd-party use of Craneware data (that has jumped from $1m to nearly $14m over the past year), note that the users of this data have generated higher revenues on top of that, and the end-customers (hospitals) have generated much higher cost savings as a result of this activity. Under the “Shelter” programme, hospitals have enjoyed over $250m of benefit that can be reinvested into care. This is scalable, going forward.

An important change over the past six months is the hiring of an SVP of strategic partnerships. The person hired for this role has great relevant experience, e.g. with Oracle deals and with the NHS outsourcing of salaries.

Craneware’s underlying business is growing. c. 90% of revenue is recurring. Underlying sales growth is more than 10% and this will translate into ARR and ultimately revenue growth.

Q2. Can we have more detail on the relationship between Craneware and Microsoft, how you are working together and how this leads to development/innovation?

There are multiple layers to the relationship. Firstly, Craneware has a consumption commitment with Azure, meaning that it has a discount on the computing power it buys from Microsoft.

Secondly, customers are able to purchase Craneware software at a discount, when they use their own consumption commitment on Azure.

Thirdly, Azure is used as a platform for sales. Microsoft is bound to promote Craneware products and will promote it e.g. to the CIO of hospitals, opening up new partnership opportunities.

Fourthly, Craneware enjoys “unified support” from Azure. If there is ever a problem, Craneware products will see very little interruption due to the premium support provided by Microsoft under this plan. Furthermore, Craneware gets the best help when it comes to Microsoft architecture. This means they get product development proof-of-concept, a desktop review, and can understand if the use of AI will really work.

Q3. Can you talk a little about the importance of the Shelter programme?

Yes, the Shelter programme is an example of how our data can be leveraged for customers and for ourselves. The delta (or the difference it makes) is in the price hospitals pay for drugs. Craneware enables hospitals to understand the timing/quantity of needed drug deliveries and to most efficiently use their distributors, cutting down on waste and saving on storage costs. Drugs can be transported to the right place, at the right time.

An example was that in one hospital system in a disadvantaged area, Craneware enabled $30m of savings plus another $12-15m of annualised cost reductions.

A key differentiating factor between Craneware and other AI/software companies that might want to provide this type of service is that Craneware already has the data needed to do it.

Graham’s conclusion - huge thanks to Keith and Craig once again for talking me through their company’s achievements and plans. I remain a fan of their work and am comfortable with the stance on the stock that I took yesterday.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.