Good morning from Paul & Graham!

Today's report is now finished.

I've finally finished my half-year roundup of my 2023 top 20 watchlist of small cap ideas, so that article is here. I'm pleased with the performance, which is up 7% YTD (plus divis), in a market where the benchmark I use (AIM all-share) is down 10%. Not bad!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

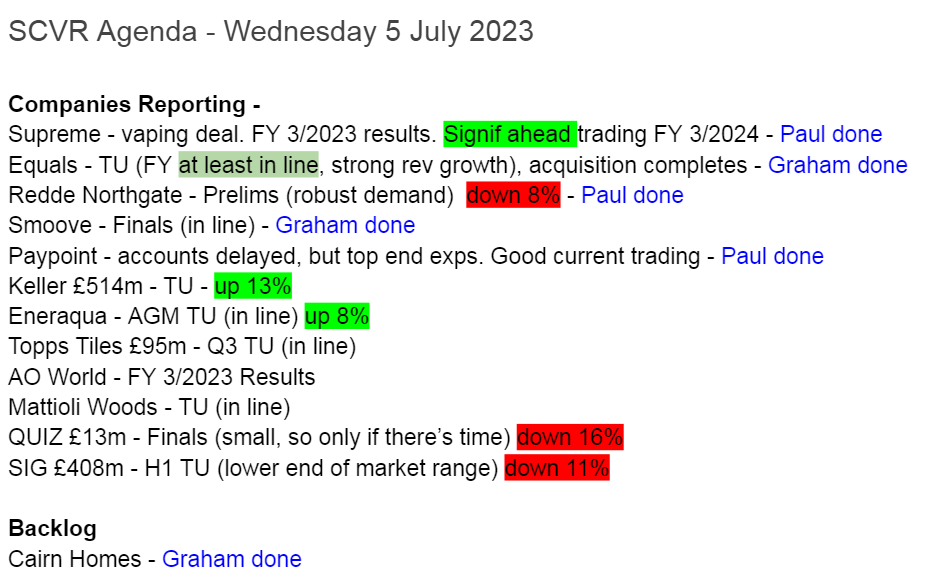

As usual, we'll focus first on the price sensitive announcements (above or below exps) -

Summaries of main sections

Cairn Homes (LON:CRN) - down 1% yesterday to 99p (£684m) (€799m) - H1 2023 update - Graham - GREEN

This Irish house builder reaffirmed and updated guidance for 2023. There is slight pressure on margins due to cost inflation but overall it’s an encouraging update. I’m intrigued by the company’s buyback policy. With macro tailwinds supporting it, I’ll give it the green light.

Smoove (LON:SMV) - unchanged at 36.5p (£21m) - Final Results - Graham - AMBER

Losses have widened and cash has halved at this company that helps make home buying easier. Remortgage activity is huge but low-margin. It will be very risky to continue as a standalone company so I would accept a reasonable takeover offer (talks continue).

Supreme (LON:SUP) - Up 12% to 117p (£138m) - Final Results - Paul - GREEN

I review FY 3/2023 results, but focus more on the "significantly ahead" outlook for FY 3/2024. The result is a modest fwd PER of under 10. Bal sht is OK. The only downsides are ethical considerations over vaping (its main products), and founder mgt controlling too much, at 57%. Otherwise, looks very good, hence my GREEN view.

Redde Northgate (LON:REDD) - Down 8% to 347p (£866m) - Preliminary Results - Paul - GREEN

In line results for FY 4/2023, and a reasonable-sounding outlook. So I can't fathom why it has fallen 8% today. PER of 6.2 is now below the 6.9% divi yield, plus buybacks. Looks very cheap. Maybe profit on disposal of vehicles may not be sustainable? Cheap debt lasts for several more years, and the bal sht is rock solid. Overall, there's lots to like here for value/income investors.

Equals (LON:EQLS) - up 3% to 99p (£180m) - TU (at least in line) - Graham - AMBER

There is “upside risk” to forecasts as revenue momentum continues to build at this diversified fintech/payments group. They have also announced a small acquisition in Belgium, opening up Eurozone markets. This one may be worth investigating further.

PayPoint (LON:PAY) - Down 2% to 458p (£332m) - Postponement of FY 3/2023 Results - Paul - GREEN

Reconfirms previous guidance, whilst also saying the audited results are delayed due to a technical matter re recent acquisition. Doesn't sound serious, assuming mgt are being honest. We've been positive on this value share 3 times before in 2023, and it still looks attractive, especially for income, to me.

Paul’s Section:

Supreme (LON:SUP)

Up 12% to 117p (£138m) - Final Results - Paul - GREEN

Significant Vaping Distribution Agreement - says it has been appointed distributor for 2 other vaping brands. This is expected to add £25-30m revenues, and £2m incremental adj EBITDA for FY 3/2024 - that’s about 10% additional EBITDA (actual FY 3/2023: £19.4m), so useful extra business.

This is quite an interesting development, for third party brands to use SUP as a distributor. I wonder if that opens up further growth potential, for other additional products to be bolted on to SUP’s distribution network to many retailers of various sizes?

Management at Supreme are clearly entrepreneurial, and seem capable at spotting niches to grow into.

Strong headlines here -

- Robust trading across FY23 and a particularly strong second half, underpinned by an outstanding performance from the Vaping category and earnings-enhancing acquisitions

- Record levels of cash generated from operations

- Very positive outlook, supported by a significant profit upgrade for FY24

The outlook is more important than the historic figures, so let’s focus on that -

5Company compiled analyst consensus for the year ending 31 March 2024 prior to the release of this announcement and the vaping distribution opportunity announcement (dated 5 July 2023) was revenue of £159 million and Adjusted EBITDA1 of £22.6 million.

I’m not keen on the focus on adj EBITDA. I prefer adj PBT, and EPS, as more meaningful profit measures.

Equity Development produced a research note in April 2023, forecasting as follows -

FY 3/2023: £19.4m adj EBITDA, becomes £14.0m adj PBT, and 9.4p adj diluted EPS.

FY 3/2024: £22.6m adj EBITDA, becomes £16.2m adj PBT, and 10.6p adj diluted EPS.

(NB. these figures are before today’s upgrade)

I haven’t seen an update from ED yet, but expect there is likely to be raised forecasts shortly. At a guess maybe 12-13p EPS looks on the cards for FY 3/2024 now?

At today’s increased share price of 117p, that’s a forecast PER of 9 to 9.8x - still very reasonable, cheap even - providing profits are sustainable. There have been negative surprises before with this company - eg the lighting division seemed to suffer from lumpy orders in the past, and I’m not sure that part of the business is any good. The share price is still barely more than half the 200p-level where it settled in the year after floating.

The bulk of revenues comes from vaping, which I personally wouldn’t invest in, as it’s doing so much damage to young people in particular, but that’s a choice for each investor to make, so it won’t affect my colour-coding of this share.

Bear in mind that FY 3/2023 adj profit did fall, to £15.2m, down 13% from £17.4m a year earlier. So the growth anticipated this year, FY 3/2024, is only getting profit back to where it was 2 years ago. Hence why I wouldn’t be inclined to chase this share too much higher.

Net debt has gone up, from £4.0m LY, to £11.8m at 3/2023. However, that includes £15.0m lease liabilities. So proper net (bank) debt is actually net cash of £3.2m, which looks fine. The cashflow is good, and has absorbed £11.6m capex & M&A costs this year.

Balance sheet - looks fairly healthy. NAV is £40m, less intangibles of £15m, gives NTAV of £25m, which is OK.

Paul’s opinion - a strong update today, combined with a reasonable valuation, means I have to see this as GREEN, consistent with our positive reviews of this share previously this year, in Jan, and April.

A negative is that management has too much skin in the game, at 57% shareholding.

Note the quality measures are good, which is quite unusual for a low PER share -

Redde Northgate (LON:REDD)

Down 8% to 347p (£866m) - Preliminary Results - Paul - GREEN

After doing a quick review of the numbers & outlook, I’m struggling to understand why the market has reacted negatively, and pushed the price down 8% this morning?

This group is a substantial business, owning about 130k vehicles, which it leases out (vans), and operates credit hire replacement vehicles for insurance companies (cars).

Key numbers today, for FY 4/2023 -

Underlying EPS 55.6p (slightly ahead exps), up 10% - low PER 6.2

Dividends total 24p - good yield 6.9%

Buybacks of £60m also done in the year, so this business is clearly a big cash cow.

Profit on disposal of vehicles is large, at over a quarter of total profit - this may not be sustainable, as REDD has probably benefited from vehicle supply restrictions which have inflated used values.

Net debt looks high at £544m (+£157m leases), but this is funding for vehicles with a book value of about £1.3bn, so in that context, debt is actually fine, not a problem at all.

Note that of the £544m debt, £330m of it is super-cheap loan notes charging only 1.3% interest, and repayable between 2027-31. So REDD will enjoy highly competitive funding for several more years, helping boost its profits.

Outlook sounds fine, although it doesn’t say much -

We continue to enjoy robust demand as we start FY2024 and our recent signing of a further multi-service outsourcing contract for Redde reflects our healthy new business pipeline. With exciting opportunities across the platform, we expect to continue to make strategic progress; together with good momentum in the business we are confident and are well-placed to continue to create long-term value for shareholders.

InvestorMeetCompany webinar is on 13 July.

StockRank is very high, at 96.

Paul’s opinion - I don’t know why the market is so gloomy about the valuation here. Possibly it’s factoring in a gradual decline in used vehicle disposal profits? Although broker consensus for FY 4/2024 is little changed from actual earnings in FY 4/2023.

A dividend yield of 6.9% that is above the PER (of 6.2), combined with most of the share price being tangible asset backed (NTAV is £753m) has got to be very tempting for value investors.

So I have to view this share positively, GREEN.

It does have major contract risk though - I recall a few years ago, it lost a big insurance company to a competitor, and the shares took a plunge, but later recovered.

The dividend track record at REDD has been superb, over many years. So providing nothing fundamentally changes for the worse, then this could be a nice income share to buy & forget.

I’m not keen on the credit hire side of the business though. This has been problematic in the past, when unexpected regulations change, or insurers change their approach. For that reason, personally I wouldn’t want to hold an over-sized position in this share, but rather hold it as a basket of higher yielding shares, to spread the risk.

Ownership is fragmented, so it could become a takeover bid target maybe?

Stockopedia likes the numbers too -

PayPoint (LON:PAY)

Down 2% to 458p (£332m) - Postponement of FY 3/2023 Results - Paul - GREEN

Auditors KPMG need more time to review a “technical accounting treatment” re the acquisition of Appreciate Group. That doesn’t sound serious.

No date is given for when the results will be ready.

Guidance for the figures is provided, and sounds positive - although this is just repeating what it said on 2 June (also saying at top end of expectations), and on 20 April, so it’s not new news (hence use of the word “reconfirms” -

The Board reconfirms that Group net revenue, excluding Appreciate Group, is expected to be around £125m (FY22: £115.1m) with accelerated revenue growth across all three business divisions.

The Group anticipates that profit before tax for the financial year ended 31 March 2023 will be at the top end of the range of market expectations, excluding exceptional items and Appreciate impacts since completion of the acquisition, driven by the strong momentum across the business.

Current trading - sounds OK -

Trading early in the current financial year has been positive, continuing the performance seen in FY23. We have detailed execution plans in place to capitalise on the positive momentum built up in our key growth areas of card processing, Open Banking, parcels, integrated payments and the new Love2shop division (previously Appreciate), delivering profitable growth in our retail and card estates, further enhancements to our proposition and positive new business growth in key target sectors.

Valuation - very attractive yield in particular, at 8.6%, which is above the PER of 8.4 (coincidentally similar to REDD also reviewed today).

Paul’s opinion - this looks an attractive value share, that we’ve discussed here many times. The question that always comes up is over the longevity of its core product, payment cards for utility meters. Hence why it’s trying to diversify. The Appreciate acquisition looked canny, and a nice bolt-on.

We’ve reviewed PAY 3 times earlier this year, and been GREEN each time, due to the value. I’m not worried by today’s audit delay, so will remain GREEN. That’s obviously making an assumption that management are trustworthy, and that there are not any hidden, undisclosed audit problems.

Graham’s Section:

Cairn Homes (LON:CRN)

Share price: 99p (-1% yesterday)

Market cap: £684m (€799m)

As far as homebuilders go, this is a young company, founded only in 2014. We haven’t discussed it before in this report. It is based in Ireland.

The stock started paying dividends in 2019, but capital appreciation has been limited:

Let’s catch up with their latest H1 trading update. The RNS does not include any of last year’s figures, so I’ve manually looked them up:

535 new home sales (last year: 547).

Total core revenue €215m (last year: €240m).

1100 homes went “sale agreed” (last year: 750)

Pipeline valued at €800 million (last year: €690m)

Pricing is “relatively flat in the period despite persistent, if moderating, build cost inflation” - should we be worried about margins?

Dividend: interim dividend will be set at 3.1 cents (2.65p).

Macro backdrop: housing is a controversial topic in Ireland, perhaps even more than in the UK, which is primarily due to a desperate situation in rentals (I cannot even bring myself to call it a rental market at this point!). Conditions for homebuyers are more reasonable and first-time buyers of new homes benefit from a range of policies including an extremely generous €30,000 tax refund (“Help to Buy”) - this in turn boosts the prices achieved by the likes of Cairn. However, the continued existence of Help to Buy is not guaranteed beyond 2024.

Here is what Cairn have to say about the macro backdrop:

Government surplus of €10 billion expected this year, with forecasts for large surplus until 2026

Housing policy is very supportive thanks to “Housing for All” strategy - includes various home builder rebates and a “cost rental subvention scheme” (GN note: this provides funding of up to €150k per unit to incentivise developers to produce cost rental housing).

Thanks to government support including Help to Buy and a shared equity scheme, 30k new homes have been completed for the first time in over a decade.

The mortgage market remains strong with first time buyer drawdowns up 7% in Q1 2023.

Guidance - full year guidance is “reaffirmed and updated”. Cairn expects “another year of growth across all key financial and operational metrics”.

Expected results:

Turnover in excess of €650m from 1750-1800 closed sales (total revenue last year: €617m).

Core gross margin c. 21 (gross margin last year: 21.7%).

Operating profit €105-110m (last year: €103m).

Their return on equity target is 15% - the StockReport suggests that they achieved 10.6% last year.

Graham’s view

My overall impression of Cairn is positive. Management seem to be credible and their developments are in prime locations or highly attractive commuter zones.

I also note the large buyback activity happening here. The company spent €75m buying back its shares last year, and is currently spending €40m on a new buyback. These are large numbers for a company of this size; the share count has reduced from a high of 771 million to a latest figure of 672 million.

The company is doing what I think most companies should probably do when they are on a humble single-digit P/E and they think their profits are sustainable: they should call the market’s bluff and start reducing their share count.

Are Cairn’s profits sustainable? It’s always just a matter of time until the housing market has its next hiccup, but I’m inclined to think that there is a growing consensus in Ireland that home construction needs to happen and that the government should not be standing in the way of it happening. It is remarkable to think that it has been a decade since 30,000 homes were built in a year - but at the same time, many people believe that the market could absorb 60,000 new homes annually. Bottlenecks around supply are the problem, not any shortage of demand.

This is not a buy-and-forget type of stock (I doubt that any house builder is), but I am willing to give it the green light primarily due to their aggressive reduction of the share count. Earnings per share could reach exciting levels if they can keep this up.

Smoove (LON:SMV)

Share price: 36.5p (unch.)

Market cap: £21m

As we learned in April, Smoove is the target of interest from a large Australian group providing similar property-related services.

We don’t yet have news of a firm offer, so Smoove shares remain in play. Here are the full-year results for FY March 2023:

Revenues +7% to £20.6m

Underlying EBITDA loss £4.8m

Statutory loss £5.8m

Cash falls by 50% to £10m (partly due to a return of capital to shareholders).

The loss reflects “investment in the core eConveyancer business and new product areas”. This service has a new user interface and “APIs deepening integration with introducers”.

I see that the company’s conveyancing completions grew by 44% for the year, but this was driven by a doubling of remortgages and a reduction of sales (reflecting broader issues in the housing market). As we have noted before, remortgages are low-margin work.

Post-period end, Smoove began a partnership with Mortgage Advice Bureau (Holdings) (LON:MAB1) and it does sound like a very useful bit of business: Smoove will “provide conveyancing comparison services to MAB's 2000+ Advisers through both Smoove's web platform and Connect APIs”.

Outlook - the current year starts “positively”; remortgages remain “buoyant” and sales are “stable”, thanks to contract wins with brokers.

Here’s an important bit:

The Board reaffirms the profit outlook announced in its trading update of 2 May 2023, which stated that the outlook for FY24 profit is in line with the Board's expectations, but with a different composition than previously expected. As previously announced, the Board expects the Company's cash burn to reduce significantly during the current financial year as a result of the initiatives it has put in place.

Discussions with PEXA around a possible takeover are ongoing. The current deadline for an offer (which may be extended) is 14 July.

Graham’s view

Management reassures us that cost reductions have been implemented and will be felt in the current year, so that cash burn can reduce.

I had high hopes for this stock when it popped up on my radar about a year ago, but the widening losses since then have dampened my expectations.

The company must be very confident that cash burn will reduce, as they were willing to send up to £5m back to shareholders in the tender offer. But it’s not hard for me to imagine that the company might end up wishing it had more cash in a few years - the forecast on Stockopedia is for a £4m loss in the current year (FY March 2024) and the current cash balance cannot survive three years at that rate. Hopefully conditions in the housing market can improve, and help to boost Smoove’s performance.

This is why I said that in the discussions with PEXA, it struck me that Smoove might currently be in a position of relative weakness. After all, if they don’t get taken out now, how confident can shareholders be that the company will make it to profitability as an independent company? I would not feel terribly confident about that.

If I were Smoove, I would bite PEXA’s hand off and take any reasonable offer.

Equals (LON:EQLS)

Share price: 99p (+3%)

Market cap: £180m

This “leading fintech payments group” provides an H1 2023 trading update:

Revenues +43% to £45m (or +21% if you compare to H2 2022).

Gross profit margin over 50% (last year: 47%)

Most of the growth is in the “SME” and “Solutions” segments.

Trading is “at least in line with expectations”, with adjusted EBITDA margins of c. 20%.

Separately announced, Equals buys Oonex for about £4m. Oonex is “a full service payment institution licensed in Belgium”, with regulatory licences, banking relationships, and the ability to issue IBANs in the Eurozone. The deal will “significantly expand the addressable market” for Equals, although it is likely to be loss-making in the short-term.

CEO comment:

"It is very pleasing to be able to report half-year revenues for 2023 that exceed those posted for the whole year in 2021. To have come so far in such a short period of time is testament to the incredible efforts of everyone who works for the Equals Group. Our trading performance clearly shows the success of our focus on the B2B customer segment and the continued growth of our Solutions business. With expanding distribution channels opening up increased addressable markets, we look forward with confidence."

Graham’s view

The growth here is impressive and hopefully it will translate to material profits in the current year: The StockReport suggests net income of £8m on revenues of £88m and that’s in line with the latest broker note from Canaccord Genuity, but revenues of over £90m look realistic. With the company expected to “at least” hit forecasts, I think it’s sensible for the market to start pricing in upgrades right away.

I’m not going to change my neutral view on this yet but if you like growth companies and the fintech/payments space then this one should be of interest.

Momentum has been building here for some time. They do have some B2C products which readers may be able to experiment with, to get a better feel for the company’s operations and any competitive advantages they may enjoy. The current valuation (PER c. 16x) may be justified and reasonable, given the growth prospects.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.