Good morning, it's Paul here!

Please see above the companies which have caught my eye this morning.

Market conditions for small caps still feel very depressed. The UK small caps space seemed to have a nice bounce in January, but a lot have slid back again. Bad, even only slightly bad, news continues to be punished severely. I think that's mainly because there's a buyer's strike, until we know what's happening with Brexit. So some prices are falling too far, below what makes sense.

Selectively, I see some obvious & compelling value. Today's buyer's strike could well be tomorrow's buying stampede. It's market conditions like we have currently, which lay the groundwork for some big future profits, in my experience. I could trot out that Buffett quote about fear & greed, but everybody already knows it, I'm sure.

It all depends though, on where we are in the economic cycle? This recovery from 2008 looks very long in the tooth now. Is a global recession coming? The recent major recovery in the US stock market suggests otherwise.

We've had 10 years of ultra low interest rates, which has supported equities. What's to stop us having another 10 years of low rates? Will they ever normalise? It's really difficult to know where things are heading, which in turn makes it difficult to value shares.

EDIT: a friend has emailed me several articles, showing that housing enquiries in London are up, and that there is very positive data on construction of high rise buildings planned, especially in London. This is strengthening my growing conviction that we could, perhaps, be on the cusp of a post-Brexit boom. Even if it's a complete muddle (looking very likely), the removal of uncertainty could unleash a backlog of investment. Hence I'm back in buying mode, in terms of my small caps portfolio.

Headlam (LON:HEAD)

Share price: 420p (up 0.5% today, at 09:43)

No. shares: 84.6m

Market cap: £355.3m

Headlam Group plc (LSE: HEAD), Europe's leading distributor of floorcoverings, is pleased to announce its final results for the year ended 31 December 2018.

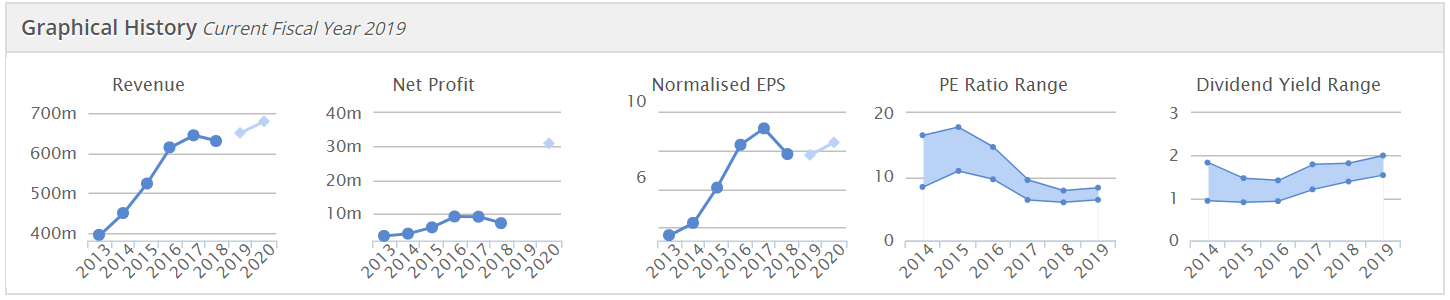

This looks a mature business (i.e. little growth in profit), and is priced accordingly, so it's a value share. It has grown historically by making lots of acquisitions, funded from cashflow - quite a nice business model.

Underlying profit before tax is basically flat at £43.4m (vs. £43.1m in 2017)

Gross margin was up, which together with growth from acquisitions, offset the LFL decline in revenues (worse in the UK than Europe).

Balance sheet - is excellent, and includes £36.7m in net cash

Dividends - up slightly, to 25p - giving an excellent yield of 6.0%

Current trading - looks good, but not quantified, so probably only slightly up;

Positive start to the year, with both the UK and Continental Europe up on a like-for-like revenue basis...

Outlook - I like that the group has already set up the market to have modest expectations for 2019. This reduces the likelihood of a plunge on a profit warning;

As advised in January 2019, we have taken a prudent view of 2019 and expect revenue to be in-line with 2018 due to the anticipated further general weakness in the UK market, and as a consequence it is anticipated that underlying profit before tax will be lower than 2018 due to a number of factors. These include the anticipated movement in revenue mix and associated margin, the year-on-year inflationary pressure on distribution costs and administrative expenses, and the efficiency initiatives being predominately at an early stage and not yet sufficiently material in their contribution to offset the current weak market backdrop and increases in overheads.

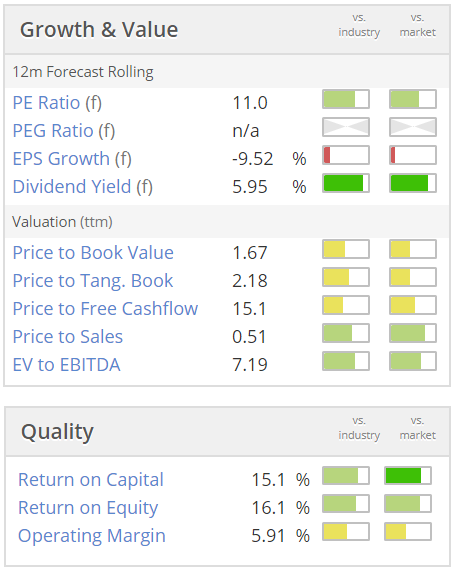

Valuation - as you can see below, this looks a classic value share - a reasonable PER, very good divi yield (and the strong balance sheet makes this look sustainable), plus decent asset backing.

My opinion - this share looks worthy of consideration for a long-term income portfolio, e.g. a SIPP. The divis seem safe, and the company is prudently financed.

Given very wobbly market conditions, and Brexit uncertainty, I'm not convinced this is the right time to rush out and buy it though. I'd probably want a PER of around 8, to tempt me in.

Cambria Automobiles (LON:CAMB)

Share price: 64.5p (down 0.8% today, at 10:41)

No. shares: 100.0m

Market cap: £64.5m

This is a chain of car dealerships.

The Board of Cambria provides the following update on its franchising developments and trading for the five months to 31 January 2019...

Perhaps surprisingly, performance has been good;

The Group's trading performance in the first five months of the current financial year to January 2019 has been ahead of the corresponding period in 2018, both on a total and like-for-like basis.

Quite steep falls in new car registrations seem to have been offset by improved margins. Cambrian seems to be focusing more on high end brands these days.

Aftersales (an important part of profits) are doing well.

Outlook - reasonably upbeat;

Whilst challenges remain given the ongoing uncertainty around Brexit and the terms of the UK's departure from the EU, the Group's ongoing franchising and property development activities have enhanced Cambria's excellent dealership portfolio mix and the changes made in the prior year have further benefitted the Group. These new businesses are still in their infancy, though as they mature, their potential is exciting.

My opinion - I continue to see good value in this sector. It seems to me that any supply difficulties re Brexit are probably being exaggerated, and would only be temporary anyway, which could provide nice opportunities for a post-Brexit bounce, which is the theme of today's report. There again, I am a glass half full person, so some readers may think I'm being too sanguine?

Cambrian's move up-market seems to be working well. See how the rating has come down considerably in recent years. This sector is not only cheap on an earnings basis, but most also have excellent balance sheets with loads of freehold property.

For value investors then, this is an interesting sector to investigate.

One area to look into is the possibility of mis-selling of finance. I read somewhere yesterday that the FCA is investigating car finance. Apparently some dealers or brokers have been given flexibility to change interest rates charged to different customers. That sounds potentially ominous, given the possibility of fines being levied. I'm just flagging this as a risk which readers would need to consider, if buying shares in this sector.

Anpario (LON:ANP)

Share price: 330p (down 2.9% today, at 11:39)

No. shares: 23.2m

Market cap: £76.6m

Anpario plc (AIM:ANP), the international producer and distributor of natural animal feed additives for animal health, nutrition and biosecurity is pleased to announce its full year results for the twelve months to 31 December 2018.

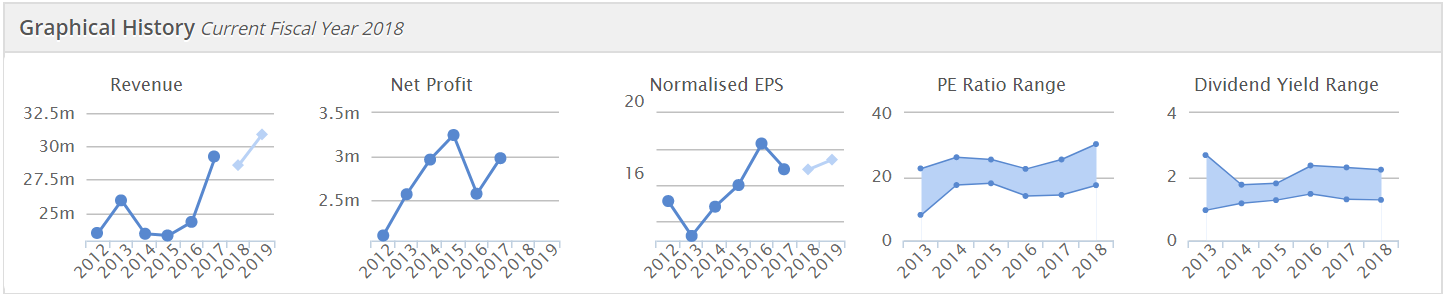

The financial highlights bullet points seem rather misleading. The first two points trumpet profit & EPS growth of over 30%. However, when you adjust for the fact that 2017 included £627k of exceptional costs, and 2018 had none, then the more meaningful adjusted EPS rose from 16.74p in 2017, to 18.9p in 2018, a rise of 12.9%.

This is the figure that should have been presented in the highlights section. I don't like it when companies cherry-pick favourable figures, and gloss over the more meaningful numbers.

Broker forecasts - the 18.9p adj EPS announced today for 2018 seems to be usefully ahead of the 16.9p broker consensus forecast shown on Stockopedia. Although with very limited broker coverage, Peel Hunt, and N+1 Singer, it's difficult to tell exactly. Peel Hunt is closed to private investors, unless you're prepared to pay them about £20k per year to get their superb research (and even then I expect they would say no!).

I note from Research Tree that N+1 withdrew its Anpario forecasts last autumn, due to a change in analyst. Hopefully there might be an update from N+1 fairly soon. So I'm in the dark as to what the future holders, unfortunately.

The PER is 17.5, based on 18.9p EPS

Revenues - actually fell, from £29.2m in 2017 to £28.3m in 2018. I'm not usually interested in companies where revenues are going backwards, even if profit has risen.

Outlook - not madly exciting;

Trading in the current year is ahead of the same point in 2018. However, we remain vigilant as there may be obstacles ahead due to Brexit and African Swine Fever, in particular. Our strong balance sheet and cash generation capability provide Anpario with a firm platform from which to invest in new products and to develop the exciting Anpario Direct opportunity.

Expanding profitable sales and distribution channels around the world remains our priority and the initiatives already implemented are gaining traction. This gives me confidence that we will return to sales growth as 2019 progresses.

Is that positive enough to justify a PER of 17.5? Probably not, in my view, given that we're in a sceptical stock market right now.

Cashflow - deteriorated in 2018, due to adverse working capital movements - although these can be swings & roundabouts. Net cashflow from operating activities fell from £5.6m in 2017, to £3.2m in 2018.

Also, note that capitalised intangibles rose from £624k in 2017, to £1.1m in 2018, flattering profitability in 2018.

Balance sheet - outstandingly good, with a bulletproof working capital position. There is cash of £12.9m, and no interest-bearing debt. Therefore this group has the firepower, if it wanted to, to make acquisition(s) up to about, say £20m - assuming it would be prepared to use all its cash, and take on a bit of debt. That could provide an important boost to future profits (and hence the share price), if thee cash pile is spent wisely.

I'm not keen on profitable companies sitting on cash piles which are far larger than needed, as in this case. Much better to put it to use with a decent acquisition, or give it to shareholders in a special divi or tender offer.

My opinion - I can't make a judgement about the company's future prospects, as it's not a sector I understand. Therefore, it's almost impossible to value the share (for me). This historical track record is not madly exciting;

Growth appears rather pedestrian, which raises the question of why the stock is still on a growth company rating?

As you can see from the 2-year chart below, this share has de-rated considerably, in the indiscriminate market sell-off. Maybe there is scope for a bounce? Although it doesn't look compelling value to me, it's possible that improved market sentiment could add perhaps 10-30% to the current price? Who knows?

To interest me, I'd want to see better growth prospects, and/or the cash pile being put to good use in a decent quality acquisition. Also I would need to understand what its products are like. Are they any good? How are they better than the competition? Is there any moat surrounding its products, etc? If they're good, then why are revenues so small?

Revolution Bars (LON:RBG)

Share price: 63.5p (up 2.4% today, at 14:23)

No. shares: 50.0m

Market cap: £31.8m

(at the time of writing, I hold a long position in this share)

Interim results - meeting with management

I met with the new CEO, Rob Pitcher, and the CFO, Mike Foster, on Monday this week, in London.

... we'll have to come back to this another time, I got side-tracked talking to a supporter about what we could do about the situation in Zimbabwe

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.