Good morning!

It's B-day (no, nothing to do with bathrooms!) today, the last Budget before the next general election, widely expected to be focused on popular giveaways. This is despite the fact that the Govt is already running substantial annual spending deficits already. NI cuts cost less than Income tax cuts, because pensioners and many self-employed (if operating through a limited company) pay little to no NI.

Keelan will be reporting on the Budget on Stockopedia, and has already started with an article here - Spring Budget 2024: What to look out for.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

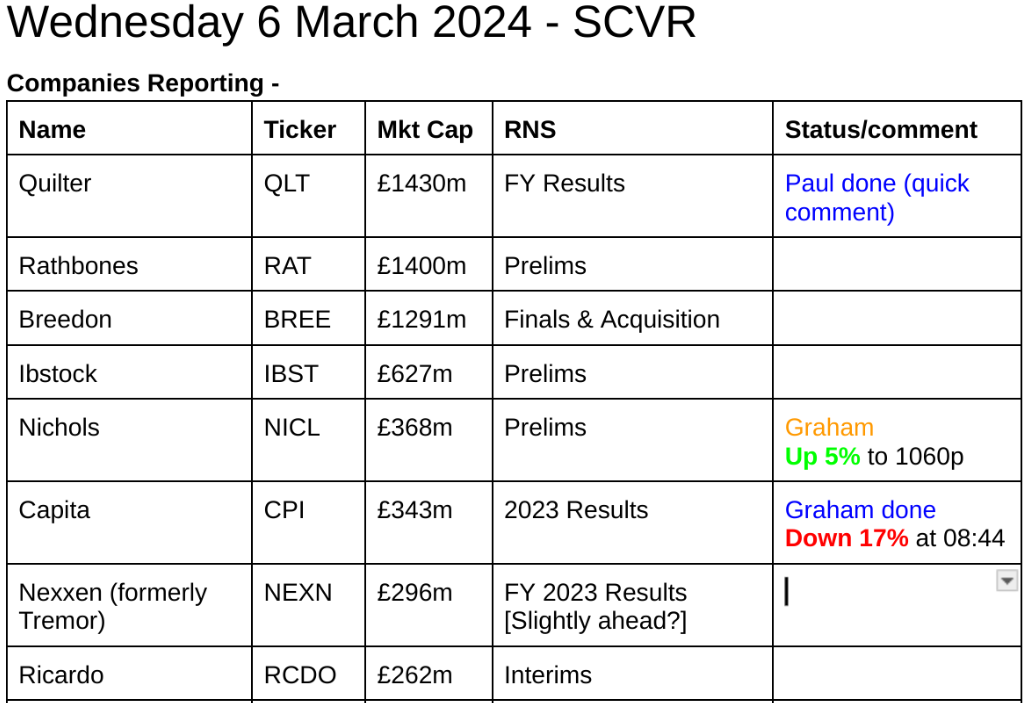

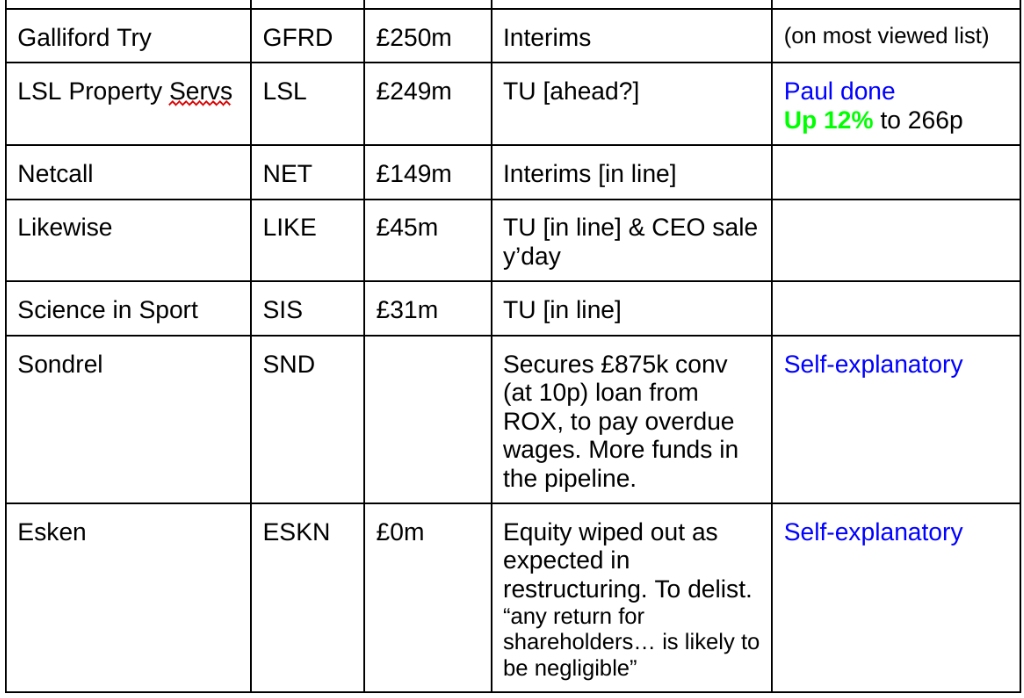

Companies Reporting

We collate a list of all companies reporting each day, but please bear in mind we cannot cover everything. So we'll pick the items that are ahead/below expectations as a first priority, then shares which have moved in price. Plus we consult the widget on the home page that shows what subscribers are most looking at, and we try to cover those too, within the timescale available (report out by 1pm).

Other mid-morning movers (with news) -

Premier Foods (LON:PFD) - up 13% to 157p (£1.37bn) - Suspension of pension deficit payments - PAUL - AMBER/GREEN

“£33m increased free cash flow for the financial year ending 29 March 2025, and subject to the results of the next triennial valuation, the Group anticipates no further contributions to be payable after this date.2 Administration costs associated with running the pension scheme of c.£5m per annum and the dividend match6 mechanism are currently unchanged. “

Paul’s view - this share looks quite interesting. EPS forecasts have been rising, and the shares have made a decisive move upwards, quadrupling from the sideways range 2014-19. Good profit margins for a food company. Fwd PER c.11x, but miserly divi yield of 1.5%. Could this good news on pension funding lay the ground for more generous divis in future maybe? Worth a closer look. I’ve only done a very quick review today.

ImmuPharma (LON:IMM) - up 64% to 1.54p (£7m) - Update - PAUL

I normally run a mile from speculative, cash burning jam tomorrow shares. However this one caught my eye as a top mover today, and I quite like aspects of its rambling update today. In particular this bit -

“ImmuPharma would firstly like to confirm that the financing position of the Company is sufficient for its immediate requirements and it has no current plans to raise equity through the capital markets.”

Although you could argue that wording above gives wiggle room to do an equity raise later this year! The business model has been changed to reduce cash burn, and seek licensing deals.

“Future cash requirements are fully expected to be met through non-dilutive income derived from the Company's portfolio of assets”

Paul's view - It’s still very much jam tomorrow, but I’m tempted to have a little flutter with my speculative money. With so many discounted placings going on for poorly financed micro caps, destroying shareholder value, it's a powerful & positive message telling the market that you don't need to raise any more cash. Although whether IMM sticks to that in reality, is still open to question. It raised money last autumn, and is burning through it as we speak. So if no licensing deals raise money, then inevitably it will have to come back to investors for more cash. So I'm not entirely convinced by today's update!

Summaries of main sections below

Capita (LON:CPI) - down 21% to 15.9p (£271m) - Full Year Results - Graham - AMBER

This sprawling support services group reports a nasty loss if you don’t exclude its adjusting items. Each individual adjusting item might be a one-off but in aggregate they point to a company with structural problems. Further cost cuts now needed to improve performance.

LSL Property Services (LON:LSL) - up 11% to 265p (08:17) £263m - Trading Update [ahead] - Paul - AMBER/GREEN

A smashing update for the first 2 months of 2024 - ahead of expectations, but bear in mind last year's comparatives are weak. Healthy cash position. Valuation is probably up with events, but I imagine there could be further upside as the property market recovers, so I'm moderately positive on this share now.

Quilter (LON:QLT) - down 1% to 101p (£1.42bn) - FY 12/2023 Results - Paul - AMBER

A quick review of its results below, showing a nice rise in profits, an OK outlook for 2024. However, it also mentions a review of historical advice, which is the issue that clobbered STJ shares recently. That uncertainty puts me off wanting to delve any deeper here. Nice 4.9% yield though, and AuM are rising.

Nichols (LON:NICL) - up 5% to £10.60 (£387m) - Preliminary Results - Graham - GREEN

The Vimto maker reports that 2024 has started well; brokers have left forecasts unchanged. The company is successfully restructuring to boost profitability but still reports very clean accounts with few adjustments needed. At a PER of 17x I continue to view this as attractive.

Paul’s Section:

LSL Property Services (LON:LSL)

Up 11% to 265p (08:17) £263m - Trading Update [ahead] - Paul - AMBER/GREEN

LSL is one of the largest providers of services to mortgage intermediaries and estate agent franchisees.

It switched to a franchise model in estate agency last year, which I like, as it should in theory mean earnings are less cyclical, and might attract a higher rating from investors, possibly?

In advance of the 2023 Preliminary results, LSL issues a trading update for the first two months of 2024.

This is confusing, what do they mean by “previous”? It’s ambiguous -

At the end of February 2024, Group Underlying Operating Profit1 was materially ahead of the Board's previous expectations and around £7.5m ahead of the same period in 2023 and around £2.5m above 2022, reflecting in particular very strong trading in the Surveying & Valuation Division.

1. Group Underlying Operating Profit is including discontinued operations, before exceptional costs, contingent consideration assets & liabilities, amortisation of intangible assets and share-based payments

Profit being £7.5m ahead of prior year in just 2 months sounds great, but we don’t have sight of last year’s first 2 months management accounts, so we can’t put this into context.

Last year comparatives are no doubt soft, since early 2023 was the aftermath of the mini budget debacle, and rapid increases in interest rates which clobbered the housing market.

Cash position sounds fine -

Net Cash at 29 February 2024 was c.£28m (31 December 2023: £34.9m) with the reduction reflecting the acquisition of the TenetLime mortgage network which completed at the beginning of February.

Outlook - I imagine shareholders will be happy with this -

Whilst commentators have pointed to improving conditions in the mortgage and housing markets, it remains difficult to predict the future path of these with confidence. However, early trading reaffirms the Board's confidence that profits in 2024 will be materially ahead of 2023. The earlier than expected recovery means that even at this stage of the year, the Board's expectations for the full year have increased.

Broker update - thanks to Zeus for crunching the numbers, which is especially helpful when company updates are unclear.

Zeus today raises profit & EPS for FY 12/2024 by +15% - the share price reaction this morning is similar, which makes sense to me.

Adj EPS forecast is now 16.3p, coincidentally also making the PER 16.3x at 265p/share - I’d say that looks priced about right. Although Zeus makes the point that net cash of £28m could be viewed separately for valuation purposes, I calculate that stripping it out (104m shares in issue) is 27p per share. Although now companies earn interest on cash, this would be included within earnings, so I don’t think we should strip out cash for that reason. It was different when cash didn’t earn any interest between 2008 and 2022.

Paul’s opinion - this looks very good, and once earnings recover sharply like this, it often starts a trend of upgrades.

The 4.8% yield is an attractive reason to hold this share.

Overall, as property markets recover, I think LSL could be an obvious beneficiary. That said, its long-term track record is unimpressive (10-year chart below). For that reason, I’d probably only be interested in trying to play the economic cycle with this share, and then selling it once it’s done a sizeable increase. There seems a pretty firm floor under this share at about 200p, and there’s not been any change in the share count over the last 6 years, so I can see more upside than downside on LSL. For that reason, I’ll move up from amber/red (7/8/2023 profit warning), to AMBER/GREEN, to reflect very much improved performance now coming through in 2024.

Quilter (LON:QLT)

Down 1% to 101p (£1.42bn) - FY 12/2023 Results - Paul - AMBER

Decent rise in profit & margin (it’s targeting a 30% operating margin in future) -

Quilter delivers a 25% increase in adjusted profit to £167 million and a five percentage point improvement in the operating margin to 27%

This bit below puts me off, and is increasingly making me wary of the whole sector after the recent problems at St James's Place (LON:STJ) -

Subsequent to the year-end, on 15 February 2024, the FCA wrote to around 20 advice firms, including Quilter, requesting information regarding ongoing servicing. Consistent with our focus on delivering good customer outcomes, we are commencing a review of historical data and practices across our network to determine what, if any, further action may be required. This may lead to remedial costs but it is too early to quantify.

Outlook for 2024 it is expecting -

…modest year-on-year increase in Adjusted Profit, excluding any potential costs associated with the aforementioned review of historical advice.

Paul’s quick view - my first time looking at this company, and unfortunately it doesn’t interest me. The accounts look complicated, and I wouldn’t want to be worrying about the outcome of its review of historical things, given what happened recently to STJ. The 4.9% dividend yield is pretty good though.

Graham’s Section:

Capita (LON:CPI)

- Share price: 15.9p (-21%)

- Market cap: £271m

I still find it odd that Capita is a small-cap. I always think of it as a FTSE-100 member, but those days are long ago!

Today’s full-year results headline is designed to inspire confidence:

Stable revenue underpinned by strong contract wins, further accelerated efficiency measures to drive growth and improve cash flow

The company has a new CEO (started in January) who says:

Our 2023 financial results have demonstrated some progress. However, we have yet to deliver the operational excellence that will enable us to create the right platform for future growth or achieve our full potential for the benefit of shareholders…

"We need to deliver a rapid reduction in our cost base and are on track to deliver the net £60m annualised cost savings, from Q1 2024 as announced in November. Today we are announcing further material efficiency improvements of £100m to improve our competitive position.

“Efficiency improvements” of £100m sounds very large for a company with a market cap of £340m! And that’s on top of £60m of savings already announced.

Here are the financial highlights for 2023:

Adjusted revenue +1.3% to £2.6 billion

Adjusted PBT +14% to £56.5m, but this includes a one-off £20m “commercial settlement”

Pre-tax loss £107m “reflecting business exits, cost reduction programme expenses and 2023 cyber incident costs”.

The fact that the company makes over £150m of adjustments, but does not adjust out the one-off £20m gain that is in its favour, instantly stands out to me!

Adjustments

With over £150m of adjustments - more than half the current market cap - I need to take a closer look, to see what is going on.

£54m cost reduction programme costs - it seems reasonable to adjust these out as one-off costs with future benefits.

£36m loss from business exits - also reasonable in my view.

£42m goodwill impairment - arguably reasonable, but we should check to see how vulnerable the balance sheet might be to more impairments.

£25m cost of cyber incident - presumably a one-off event.

So looking at each of the adjustments in isolation, they all seem reasonable.

The previous year (2022), the company adjusted out a goodwill impairment of £169m, and that was the main adjustment to the 2022 results.

So I’m comfortable with the adjustments, but I would presume that any remaining goodwill is highly vulnerable to impairment.

Balance sheet

The December 2023 balance sheet shows total assets of £2 billion, and total liabilities nearly £1.9 billion.

Unfortunately there is still nearly half a billion pounds of goodwill on the balance sheet, along with other intangible assets of £90m.

Strip them out and the company is firmly in the red, with negative tangible asset value.

Outlook

2024 revenue to be “broadly in line” with 2023.

“Modest improvement in operating margin”

Free cash outflow £70m to £90m which includes £50m expected cost of efficiency programmes.

The cash performance has really been dire, with a free cash outflow of £115m already seen in 2023. That follows an outflow of £42m in 2022.

Net debt has risen to £545m, double the current market cap. But this does include property leases which many investors would be happy to leave out of the calculation.

Without leases, net debt is £182m, which is up £100m year-on-year.

The leverage multiple (net debt to EBITDA) is 1.2x, which would normally be considered manageable, and would only be 0.9x if one of Capita’s disposals had completed before the end of the year.

The company’s long-term target is for net debt to EBITDA of less than 1.0x, so perhaps it has already achieved this goal?

But remember that EBITDA is only a proxy for operating cash flow and doesn’t measure a company’s actual cash performance. With another large free cash outflow expected in 2024, I am not too optimistic about the company’s future debt profile.

Graham’s view

These results are even more complicated than I expected, with lots of moving parts.

My overall impression of Capita is that it’s a large, sprawling group of mostly low-margin support services businesses. Many of the revenues are likely to be “sticky” (think of long-term government contracts) but at the same time the prospects for growth are limited.

The shares are “cheap” but the true enterprise value is probably around £450m (adding £180m net debt to £270m market cap). With another large free cash outflow expected this year, I expect debt to rise again.

So then it becomes a bet on what the company will look like in 2025, with the hope that performance will be transformed by all of the business disposals and cost cuts.

I’m taking a neutral stance on this share.

I can’t take a bullish stance because the hole in the balance sheet (in terms of negative tangible value of minus nearly £500m) suggests to me that it could take several years of good performance before the company is on a truly sound footing.

I don’t want to take a bearish stance because the leverage multiple of 0.9x or 1.2x, depending on how you look at it, is not currently distressed. Although it could become distressed this year, depending on how bad the outflows are.

I also don’t want to take a bearish stance because I’d like to think that the £160m of total planned efficiency savings will transform the company’s financial performance, and that the new CEO will simplify and improve the overall structure of the group. Given these possibilities, this is not a stock that I would want to short.

Overall, therefore, neutral seems to be the safest and most sensible option.

Nichols (LON:NICL)

- Share price: £10.60 (+5%)

- Market cap: £387m

I left this soft drinks group on my top ideas list for 2024, so I’m eager to see progress in today’s full-year results!

The Nichols share price didn’t make much progress last year:

We did already cover the full-year trading update in January.

Here are the results highlights:

Revenue +3.5% to £171m (GN note: this reflects inflationary price increases, volumes are falling)

Adjusted PBT +8.7% to £27m

Actual PBT +75% to £24m

My investment thesis here has been for margin improvement as inflation feeds through the system, rather than fast revenue growth. In that regard we have the following trend:

Adjusted PBT margin increases from 15.1% to 15.9%

Actual PBT margin increases from 8.4% to 14.2%

Clean accounts: in the previous year (2022), Nichols recognised a £9m impairment charge, and total exceptional items for the year were £11m.

For 2023, exceptional items are only £3m. This reduction in exceptional items has enabled the significant increase in the company’s PBT margin.

I’d also observe that for a company of this size (and note that its market cap is larger than Capita’s), these are very clean results.

Return on Capital Employed: the company calculates and reports its ROCE for investors as a KPI, a practice which I view as a green flag.

It also doesn’t hurt that the ROCE is very good. Adjusted ROCE falls slightly to 26%, while actual ROCE improves to 23%.

Cash balance rises to £67m, covering a chunk of the market cap.

Performance breakdown

Nichols is divided into a “Packaged” segment and an “Out of Home” (OoH) segment.

The OoH segment has been a problem in recent years with unprofitable contracts dragging on performance.

Today’s results show a 3.4% decline in OoH revenue (to £43.6m) as the company has been restructuring this segment following a strategic review. This restructuring of the OoH segment has also fed through to overhead cost savings that have helped to boost profitability.

Overall, OoH contributed an adjusted operating profit for 2023 of £5.1m, up from £3.5m in 2022. More progress should be seen this year.

The larger Packaged business sees 6% overall revenue growth (to £127m), with a remarkable divergence between international (+17%) and UK (+1%) growth trends. Adjusted operating profit for this segment grew to £36m.

There’s some useful commentary on the company’s strategy:

We raised prices to recover significantly higher material input costs early in the year where we were unable to mitigate these costs, with the expectation that we would lose some volume in the UK as a result of our decision to protect our gross margins. The price increase was designed to recover higher costs rather than to increase profitability and was consistent with our long-term strategic positioning.

Gross margin fell from 43.1% to 42.3%, reflecting “a change in sales mix within our operating units and our decision to pass on cost inflation only”.

Outlook: 2024 has started well, in line with expectations.

Estimates from Singer are virtually unchanged. They see modest revenue growth feeding through to adjusted PBT of £28.7m in 2024, and then £30.3m in 2025.

CEO comment:

2023 was a year of strong progress and execution for Nichols, as the Packaged business delivered another year of growth underpinned by the Vimto brand, and benefits from the newly streamlined OoH business were delivered earlier than anticipated. The Group delivered a very strong performance in international markets driven by strong market penetration across existing and new territories in Africa and the Middle East. Innovation remained a critical growth driver and we have an exciting pipeline of new products planned for 2024.

Graham’s view

Of course I’d love to see the adjusted profit margin increase even faster, but I can’t complain about the progress made so far.

The unsatisfactory performance of OoH is being addressed and has already yielded an improvement in profitability.

Long-term, I’d love to see volumes picking up again. For now investors must make do with inflation-driven revenue growth.

Stockopedia’s systems share my appreciation for Nichols:

It continues to trade at a premium earnings multiple (in the context of today’s small-cap market) but I view this as justified for a high-quality family business.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.