Good morning, it's Paul & Graham here!

Today's report is now finished. Sorry we didn't get all the stragglers done in the time available.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Rather a large wish list today of things we'd like to look at, so we'll do our best to cover as many as we can, but it won't be everything -

Summaries of main sections

Hargreaves Services (LON:HSP) - down 0.4% to 458p (£149m) - Preliminary Results - Graham - GREEN

This diversified group publishes a good set of results. Raw material profits are lower after commodity prices eased, but investors can celebrate a 12p special dividend on top of a 9p ordinary dividend. Management here strikes me as shareholder-oriented. Cheap valuation.

D4t4 Solutions (LON:D4T4) - Up 8% to 210p (£84m) - AGM trading update & contract win - Paul - AMBER

A low margin delayed contract has now been won, moderately reassuring. Outlook comments are vague, but sound confident, mentioning a strong pipeline. Overall, I think this company looks potentially interesting, but there's not enough to tempt me into buying any shares just at the moment.

RM (LON:RM.) - Down 30% to 49.5p (£41m) - Interim Results - Paul - RED

Sorry to any holders of this share, but the 30% drop today looks fully justified. It's a worrying profit warning, combined with a very weak, overly geared balance sheet, and a going concern warning of "material uncertainty". I'd steer well clear, this looks way too risky.

£PCIP Down 1% to 51p (£33m) - Trading Update - Paul - AMBER

~A reassuring trading update for FY 6/2023, in line with expectations, but still loss-making. The ongoing patent case is consuming a lot of the cash, but a UK judgement is due shortly (the case being held in June). I like the good organic growth, and closeness to underlying breakeven, but I can't judge the shares until the Judge has spoken, and patent case is behind it.

Paul’s Section:

Some quick comments first -

Bellway (LON:BWY)

(mkt cap £2.7bn)

For read-across to other housebuilders, suppliers, and the economy generally. Key points in today’s trading update -

- Current trading impacted by higher mortgage rates.

- June & July - reservations fell back to similar levels as last autumn (28% down on LY)

- Pricing robust.

- Accelerating building of social housing, to partly offset weakness in private.

- Cancellation rate has risen from 13% LY to 18% now, rising trend.

- Good availability of mortgages, but problems with higher loan to value (LTV).

- Forward order book is down a lot, at £1194m, vs £2114m LY, down 44%.

- FY 7/2024 results, expect “material decrease” in completions.

Paul’s opinion - the market knows about these factors, and has priced-in weaker performance, which is why Bellway is one of several housebuilders now trading significantly below its own balance sheet NTAV. I’m taken aback by the 44% fall in closing order book though, which seems worse than the broker consensus of a 19% drop in revenue for FY 7/2024. So I’m worried there could be another round of downgrades for housebuilders, which might mean the recent rally could be short-lived perhaps? I’ve not seen any updated broker notes yet though.

It’s starting to feel as if a sustained recovery in housebuilding shares is looking premature, so I’ll continue to sit on the sidelines for now.

Lookers (LON:LOOK)

Another update today on the level of support for the 130p recommended takeover bid. It’s at 24.8% now, following further sales in the market by J O Hambro. The market price of 128.6p again looks attractive as a point to consider following Hambros and bank some profits, since the level of acceptances isn’t high enough to make this a done deal. As we saw last time, the downside risk is c.20p+ if the deal falls through, but there’s only 1.4p upside from hanging on for the full 130p payout. Is another, higher bid likely? Who knows.

I’m cooling a bit on the car dealers sector, because the impact of higher interest rates can in some cases be quite serious for profits. The stated net debt is usually not high, but in some cases they rely on large additional borrowings for funding inventories (vehicle stocking borrowing facilities), which could become a lot more expensive perhaps? Also freeholds have probably fallen in value a fair bit. Disclosure: in this sector I hold Vertu Motors (LON:VTU) personally.

D4t4 Solutions (LON:D4T4)

Up 8% to 210p (£84m) - AGM trading update & contract win - Paul - AMBER

D4t4 Solutions Plc (AIM: D4t4, "the Group", the "Company", "D4t4"), the AIM-listed data solutions provider, is pleased to announce a contract win with an existing banking customer.

The contract was one of the two contracts previously mentioned which were expected to have closed in FY23, and includes a high proportion of low margin hardware which is expected to be substantially delivered in the first half of FY24. This contract win accounts for a large proportion of the revenue shortfall from FY23.

That’s reassuring rather than exciting, I think. I like it when delayed contracts are announced, as then you know it was indeed just a delay, and not an undisclosed cancellation.

It’s a March year end, so FY 3/2024 currently. I wish everyone would use the month and the year when referring to financial years, it’s so much easier and clearer, and would save us having to remember them all, or look them up every time.

Outlook - too vague to place any reliance on this, I think -

At the Company's AGM at 9am this morning, the Chairman will confirm the Group has a strong pipeline and is highly confident in the Group's strategy to deliver growth and create significant shareholder value in the coming years.

It would be interesting to go back and compare the tone of the above with previous outlook comments.

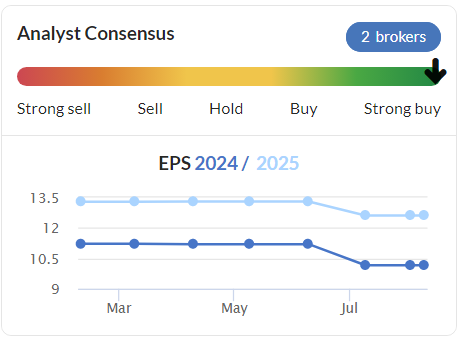

Paul’s opinion - as we’ve commented here before, D4T4 does look an interesting company, prudently financed with plenty of cash, interesting-sounding services, churning out good profits most years.

The problem is the rather erratic performance, and it’s not clear if the company is able to generate structural growth or not. So how do we value it? D4T4 always strikes me as having a lot of potential, but leaves me uncertain about what’s likely to happen in future. I’d need to consult someone who knows the sector, uses the product, and understands how it works vs competitors. Without that detailed knowledge, investing in this is little more than guesswork. Nothing wrong with that, with a portfolio approach of similar shares, the odd one could be a big winner, and if we only pick things with solid balance sheets including net cash, then there shouldn’t be any complete disasters.

I see forecasts have been nudged down this summer, which doesn’t seem to suggest any immediate excitement. Forward PER of high teens doesn’t seem demanding for a tech company with plenty of cash. Could it become a takeover target perhaps? That’s possible I think.

There’s been a strong recent rebound since July. For me, I don’t see enough here to want to get involved at this stage, the moment might have passed to pick up a bargain for now?

New management from 2021 seem to have negligible shareholdings. I prefer entrepreneurial, founder management, with big stakes.

RM (LON:RM.)

Down 30% to 49.5p (£41m) - Interim Results - Paul - RED

RM plc (“RM”), a leading supplier of technology and resources to the education sector, reports its half year results for the six months ended 31 May 2023.

I don’t really want to spend too long on this one, as it’s not very interesting.

Previously in the SCVRs here we commented -

29/12/2022 - AMBER - Asset disposals announced, helps lower debt. Worth a closer look?

29/3/2023 - AMBER - up 8% to 70p - FY 11/2022 prelims, profit down 65%. Wobbly balance sheet. Disposals. Possible turnaround? Special situation, quite risky.

H1 key numbers, for 6 months to end May 2023 -

Revenue £87.6m (down 10.5%)

Adj loss before tax of £(6.7)m, very much worse than a profit of £3.7m in H1 LY.

** Red flag ** Going concern statement indicates “material uncertainty” over banking arrangements.

Balance sheet looks awful to me. Take off the £74m intangible assets, and NTAV is negative £(13)m. Although it has raised useful cash from some disposals of intangible assets, so maybe we should include some value for these?

NAV also includes a supposed pension surplus asset of £19m, which note 14 indicates is an actuarial deficit, requiring £3.2m pa cash overpayments until end 2024. So we really should be manually adjusting the balance sheet further into the red, for the commercial reality as opposed to the nonsensical required accounting treatment that shows a liability as an asset!

The long-term bank loan of £53m is way too high, and increasing. Expensive now, too, given higher interest rates.

Outlook - the problems seem to be mainly in its “Consortium” business -

As we work to recover sales and win back the trust of our customers, we expect Consortium trading to continue to be below where we would expect it to be, impacting our expectations for the Group’s full year adjusted operating profit.

We now expect to deliver Group adjusted operating profit on or around breakeven for the full year, and in excess of £10million of identified annualised cost savings to benefit in FY24.

That’s a huge amount of cost savings, which makes me wonder what that money was being spent on, and why wasn’t it cut earlier?

Paul’s opinion - this looks a real mess to me. Turnarounds are fine when there’s a sound balance sheet with plenty of net cash. However, in this case, the bank is clearly breathing down their necks, and that puts equity in a very high risk position. At some point, I imagine a placing is going to be necessary, but on what terms, if they can get one away at all? Banks aren’t so accommodating, now that interest rates are higher.

This is a bright RED situation to me, I wouldn’t go near it, at any price - it looks far too risky. Institutions are high & dry, unable to sell, but private investors can get out - you may not like the price though, but sometimes it’s worth bailing out even if you have to take a few % points haircut on price. This would be one such situation I think.

PCI- PAL (LON:PCIP)

Down 1% to 51p (£33m) - Trading Update - Paul - AMBER

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, is pleased to announce a trading update for the year ended 30 June 2023 ("FY2023").

PCIP is only small, and has a significant (in terms of cost) patent infringement case ongoing. However, I keep an eye on it because I’ve been impressed with the decent organic growth, finally making inroads into reducing its annual losses - it could be near the tipping point where it becomes profitable, perhaps?

This is the latest today - the company’s headlines say -

Strong growth momentum continues - driven by excellent H2 new business

sales performance and continued high retention rates

My summary of the other points -

FY 6/2023 results expected to be in line with the Board’s expectations.

Revenue growth c.25% to £14.9m.

“Significant sales momentum” noted in the USA.

Still loss-making though, guided today at £(2.3m) at the adjusted PBT level, a tad smaller than £(2.9)m LY.

H2 was “very strong” for new contract signings.

Net cash looking tight at £1.2m (down from £4.9m a year earlier), with £2.0m of that due to the patent case - that’s a big financial burden, so a material issue.

Bank facility of £3.0m is undrawn, giving hopefully adequate headroom, although a small top-up placing of say £3-5m wouldn’t surprise me, at 10-15% dilution that wouldn’t be a disaster, but I would allow for that possibility when valuing this share.

Patent case - described as “unfounded”. UK trial happened in June, and now waiting for the judge’s ruling. Fingers crossed! I can’t remember whether there’s a USA patent trial too? Let me know if you’re more up-to-speed on this than me!

"We remain highly confident in our position on the unfounded patent claim being brought against us by a competitor, and we look forward to the UK court's ruling in the near future.

Paul’s opinion - I like the business, but don’t want to speculate on what might happen with the costly patent infringement case. As it’s a material issue potentially, I’m forced to remain at AMBER, as we have been the previous 4 times I’ve looked at PCIP this year. So investors buying or holding, are by implication taking a favourable view of the likely outcome of the patent case. The rest of us will be asked to pay more for the shares if a favourable patent case outcome is announced, or might get them cheaper if an unfavourable outcome arises.

Graham's Section

TI Fluid Systems (LON:TIFS)

Share price: 151.1p (+1%)

Market cap: £785m (€912m)

TI Fluid Systems plc ("The Group"), a global industry leader in highly engineered automotive fluid storage, carrying and delivery systems and thermal management products and systems for light vehicles, announces its results for the six-month period ended 30 June 2023 (the "period").

This large automotive parts manufacturer has been listed since 2017, starting life in mid-cap territory before dropping back to small-cap land:

I’ve been positive on it (see articles in May and last November), arguing that its price to sales multiple was unusually low and that it had the potential for margins to recover. It had fallen into unprofitability during the Covid-related car production slowdown:

Here are the highlights from yesterday’s interim results:

Revenue +15% at constant FX to €1.8 billion

Adj. EBIT +58% to €132m

Actual operating profit almost doubles to €95m

After-tax net income €33m (H1 last year: breakeven)

So we have a modest increase in revenue plus an improvement in margins resulting in substantial profits.

As it has done before, the company says its revenue growth is outperforming wider trends in light vehicle production.

Cost recovery agreements were achieved with “a significant majority of customers”.

Cash/debt

One of the factors I identified as possibly dragging on the share price here was the substantial net debt being carried.

The company finished H1 with €440m of cash and €1.1 billion of borrowings.

But it has now made some very confident announcements regarding its financial plans:

1) it plans to pay €35m in dividends, similar to what it paid to shareholders pre-Covid;

2) it also wants to repurchase €40m of its own shares;

3) it plans to reduce gross borrowings by making a €100 loan prepayment, which will help to take a small bite out of its large interest bill.

It does have the cash to do these things, but is it wise?

Checking the latest cash flow statement, there is little sign of any free cash flow being generated.

However, the company must be feeling confident if it’s willing to take the three actions mentioned above. It says that it expects adj. free cash flow “to increase significantly as automotive markets recover and the Group's margin expands towards its medium-term target level”.

The outlook statement is bearish on global vehicle production, but is positive on the company’s ability to outperform the wider market and to generate cash:

We now expect full year adjusted EBIT margins to be above 7%, benefiting from operational improvements, ongoing cost recoveries and volume enhancements, notwithstanding continued cost pressures, especially from labour inflation. Adjusted free cash flow conversion is expected to be at the rate of approximately 30% of adjusted EBITDA.

Electric Vehicles - a key question mark for the company is how it responds to the transition to EVs. It maintains that it’s “well positioned to be a leader in the transition to electrification”. It is opening “e-Mobility Innovation Centres” across Asia and winning large deals, especially in China, relating to BEV/PHEVs (Battery Electric Vehicles, and Plug-in Hybrid Electric Vehicles).

I suspect that the risks around electrification are still substantial for this company, but it doesn’t sound like it is shying away from the challenge!

Graham’s view

I’m going to remain positive on these shares, as I think the bull thesis is playing out.

Revenues are recovering as vehicle production stabilises and price increases have been passed on with acceptance by customers. During this inflation, it has been a key theme that profit margins can be depressed in the short term, but can recover on a lagged basis as prices later adjust. That seems to be what is happening here.

The balance sheet could be healthier and perhaps it’s a leap of faith to believe the company’s claims that free cash flow will improve. But again, the bull thesis is not really looking for anything more speculative than a pre-Covid performance level.

The move to electric vehicles is a complicating factor and could be researched in greater detail.

On balance, I’m going to remain positive on these as I continue to suspect that the risk/reward on offer could be attractive. Worthy of further research.

Stockopedia puts it on a PER of only 7x and a price to sales multiple of 0.28x. I think it’s reasonable to hope that this could get back to its 255p IPO price.

Hargreaves Services (LON:HSP)

Share price: 458p (-0.4%)

Market cap: £149m

Roland gave this one a comprehensive overview in January. It’s a group of many businesses - “Services” (earthmoving/construction), “Land” (brownfield regeneration) and “European Raw Materials”.

Today it has published full year results: revenues are up, but profits are lower. Last year’s results were boosted by very high commodity prices for the Raw Materials division.

Here’s the divisional breakdown, with the result at Raw Materials (“HRMS”) highlighted in yellow:

The table above shows profit growth in both the Services and Land division, despite a reduction in revenues at Land.

Delays have been experienced in this division, which are “reflective of the wider slowdown in the housebuilding market and therefore will only represent a timing delay”. Its flagship project has exchanged contracts and will generate £18.5m of revenues over three years.

Growth in Services is “due in the most part to the increase in activity on the HS2 contract”. This division has also signed various term and framework contracts with customers, giving it some visibility over future revenues while also protecting it from fuel inflation.

Comment by the Acting Chair (excerpt):

The growth of a robust recurring revenue base in Services is particularly pleasing and has provided the bedrock of performance for the Group. The outlook for the Group's operations for the coming year and beyond is strong with over 60 term and framework contracts and 70% of revenue for the year already secured.

Presentation: there is a presentation on Investor Meet Company at 4.30pm today. Here’s the link.

Undervalued land: land on the balance sheet suitable for wind farming and solar farming has a historic value of £6m, but has been valued by Jones Lang Lasalle at around £22m-£23m.

Balance sheet: the company is asset-rich with NAV of £201m, before adding on any gain from the undervalued land. Cash is comfortable at £22m. However, £15m may be needed to sell its pension scheme liabilities to an insurer.

HSP’s financial condition is neatly summed up by the Acting Chair:

“The Balance Sheet remains free from bank debt and third party security and continues to provide a strong and stable platform for growth.”

Dividend: the full-year dividend is 9p (last year: 8.4p). Thanks to cash coming back from the Raw Materials division, there will also be an “additional dividend” (why not call it a special dividend?) of 12p.

Graham’s view

This isn’t a company I look at very often (for sector reasons). It’s also not very straightforward to analyse, given the range of different activities in which it’s involved.

Nevertheless, I am coming away from these full-year results with a positive view of the company and its management. They strike me as shareholder-oriented, e.g. by sending surplus cash back to shareholders in the form of a special dividend, after temporary profits were generated by the raw materials division.

The CEO owns 8% of the company, so that might help to explain why it’s being run for the benefit of its shareholders: safely, without leverage, and with a focus on paying dividends.

The stock is also quantitatively very cheap, with a ValueRank of 90:

It passes five stock screens, including two which I really like: the Ben Graham Enterprising Investor Screen and the Neglected Firms Screen.

Are there any reasons for concern? Well, I would go back and consider the sectors it operates in. The HS2 project will not last forever. Raw material prices will rise and fall. House prices will remain volatile. The company itself might be high-quality in its approach, but the earnings it generates aren’t particularly high-quality, in my view.

Overall, I’m going to give this stock the thumbs up because I think it probably is worth a second look at this valuation, considering both the earnings multiple and the discount to tangible book value.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.