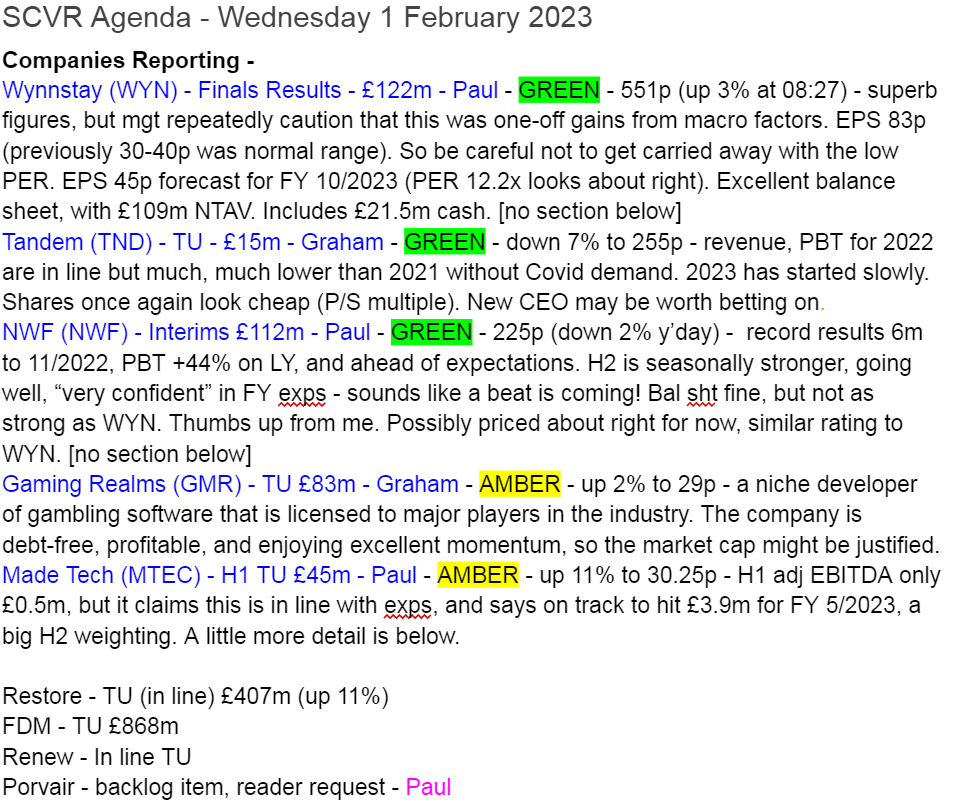

Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Thankfully a bit quieter for news today. This all looks a bit boring, and in-liney, so I might start with Porvair (LON:PRV) from the backlog -

Paul's Section:

First, some short sections left over from yesterday, which I did last night -

DX (Group) (LON:DX.) - Trading Update - £173m - Paul - GREEN - 29p (down 2%) - H1 trading in line with expectations. Confident in FY 6/2023 outlook. Net cash £36.4m. Good pipeline & new business. My view - looks a convincing turnaround, and valuation seems attractive value.

Ricardo (LON:RCDO) - Trading Update - £339m (in line) - Paul - AMBER - 517p (down 5%) - H1 to Dec 2022 traded in line with expectations. FY 6/2023 guidance unchanged. Strong order intake & closing order book. Net debt £31m. My view - shares have a had a great run, and now look sensibly valued (fwd PER 15x) instead of cheap.

Wickes (LON:WIX) - Trading Update - £395m - Paul - GREEN - 152p (down 4%) - FY 12/2022 in line with expectations (£72-76m adj PBT). Impressive 3-year LFL sales growth of +23%. Cost headwinds - bringing forward staff pay rise will cost extra £3.5m. Also energy will be £10m more in 2023 than 2022. Not clear if those costs are in existing forecasts or not. My view - an attractive value share, with reasonable PER, good yield, and nice balance sheet.

Instem (LON:INS) - Trading Update (in line) £143m - Paul - GREEN - 630p (up 7%) - FY 12/2022 says profit was “materially in line” with consensus adj PBT forecast of £7.9m (H1 was £3.2m, incl £0.9m forex gain). Strong growth, helped by 3 acquisitions. Salary inflation hit H1, but recouped in H2 from price rises & contract wins. Closing cash £13.7m. Last bal sht looks adequate - relying on up-front cash from customers (like many software cos). Outlook upbeat, further growth, strong order book. My view - this looks good, worth a closer look I think.

Northcoders (LON:CODE) - Trading Update £24m - Paul - AMBER - FY 12/2022 in line with expectations. Tiny IT training company. Small recent placing at 300p done. Going for rapid growth, and good visibility for 2023. Might be worth a look, but £24m mkt cap seems steep for the early stage, and small size.

Belvoir (LON:BLV) - Trading Update - £69m - Paul - GREEN - 183p (down 2%) - Reports that profit (PBT) for FY 12/2022 is expected to be slightly ahead of management expectations. Finncap lowers 2023 forecast by 13%.

Net cash of £1.1m at Dec 2022.

H1 2023 expected to be impacted by more expensive & tighter availability of mortgages.

Signs of a recovery starting in Jan 2023, expected to “build slowly over the year”.

Lead times of up to 5 months mean improved performance not expected until H2 of 2023.

Overall guidance is for FY 12/2023 profit “to be slightly below 2022”, then return to growth in 2024.

My opinion - this is absolutely fine, I think, given well-known macro problems. Finncap’s revised forecast is 18.2p EPS for 2023 (PER 10.1x), with a 9.5p divi (5.2% yield). I think that’s an attractive entry price, for long-term holders. A softer H1 in 2023 won't matter longer-term, so I see it as a buying opportunity rather than a threat. Plus you collect in a >5% yield whilst you wait for earnings & the share price to recover.

RBG Holdings (LON:RBGP)

58p (yesterday's close, down 12%) - mkt cap £55m

Trading Update & Board changes

This is very unusual indeed - a CEO (also major shareholder) being fired, acrimoniously -

The Board has lost confidence in its Chief Executive, Nicola Foulston, as a result of cultural concerns and the execution of the Group's strategy; her employment contract has been terminated with immediate effect.

“Cultural concerns”? What on earth does that mean? It annoys me in situations like this, that private investors are in the dark, but behind the scenes no doubt word is spreading about what’s actually been going on.

It wasn’t long ago that the (now former) CEO was being lauded by everyone (including me!) as seeming impressive, and having a strong track record. She came across really well on webinars for example. Although I know there were objections to excessive Board remuneration amongst some shareholders.

Moving on from this shock, the trading update for FY 12/2022 strikes me as pretty solid.

Key points being -

Trading in line with expectations, and a footnote gives the numbers (very helpful) -

(1) RBG understands that consensus market expectations for the year ended 31 December 2022 are for revenues of £49.5 million, Adj. EBITDA of £11.2 million and Adj. PBT of £6.9 million (Source: FactSet)

It says the balance sheet is strong, which it isn’t by my calculations. NTAV is only about £7m. Given that a lot is tied up in receivables, normal for lawyers, that leaves the business dependent on bank debt.

We’re not given a figure today on what net debt is now. Just that it is within facility agreements. Net debt was £17.3m at 30 June 2022, and at a guess I imagine it’s probably higher now, hence not being disclosed today! Confirmation that a second interim divi will be paid suggests that there’s probably not a problem with debt (or the divi would have been pulled).

Divisional performance seems to be saying that the main legal services businesses are doing OK. The problem division is litigation finance, called LionFish, which we already knew was problematic. The news today sounds upbeat on that, saying that a number of potential offers are being assessed for its disposal. Potential upside there, I wonder, although we don’t know the terms of any potential deals, which might have to come with a dowry, who knows?

My opinion - it’s a shock to see the CEO being booted out on obviously a big falling out. Although things were looking a bit wobbly after the previous bombshell announcements about the LionFish subsidiary going wrong, which we already knew about.

At this stage it’s just guesswork whether more bad news is lurking.

If the balance sheet were more solid, I’d be tempted to have a little flutter here, as a speculative recovery situation, but don’t feel I’ve got enough information to make a rational decision at the moment. The main thing is that the core business seems to be trading OK, which could make it worth considering. Hence I’ll go amber on it.

What do readers think? Is the glass half empty, or half full? I'm not sure.

I'm not keen on the whole sector - as mentioned many times before, there's a conflict of interest between the big fee earners, and outside shareholders. Generally the lawyers who floated have not been good investments for outside shareholders. The main purpose of the floats, is for the partners to cash out, in part, or on a deferred basis. They'd be better off remaining private businesses, I think, as traditional partnerships or LLPs.

Made Tech (LON:MTEC)

30.25p (up 11% at 11:58) - mkt cap £45m

H1 adj EBITDA only £0.5m, but it claims this is in line with exps, and says on track to hit £3.9m for FY 5/2023, a big H2 weighting.

Recent large contract wins from public sector.

Record contracted backlog of £48m.

Balance sheet is indeed strong (I’ve checked!), with net cash of £9.0m (down from £12.3m in May 2022).

FY 5/2022 accounts - I’ve briefly reviewed - big share options charge of £2.4m LY, and no divis. Capitalised £1.8m of payroll into intangibles last year, which inflated EBITDA.

My view - investing here is a leap of faith that it will be able to start making genuine profits. That didn’t happen in H1, so there’s a heavy reliance on H2 delivering better performance. Growing this fast, things are bound to go wrong along the way.

The over-priced Sept 2021 float was mainly to allow existing shareholders to sell shares, banking £70m. CEO & COO are still the 2 largest shareholders, might they be tempted to buy it back on the cheap? (as Mayfair Capital is doing with £BUMP , at one tenth of the IPO price)

I quite like some aspects of this share, but as we’ve recently seen with Tpximpact Holdings (LON:TPX) the wheels can come off quite easily with these high growth, hyped up IT contractors, when things go wrong. MTEC looks a lot safer though, as it has sensibly avoided taking on debt, which is what has killed TFX’s share price. Speculative flutter might have some attractions, but on balance it's too speculative for me, and risk:reward doesn't seem that great. I’ll go amber on this one.

Stockopedia isn't impressed, with a low StockRank -

Graham’s Section:

Tandem (LON:TND)

Share price: 275p

Market cap: £15m

This is a small company, even by the standards of this report. But I know that many micro-cap value investors, including myself, have previously bet on it. At one stage this was the largest position in my portfolio. I’ve owned it twice, but currently have no position in it.

What is it: it’s a designer, developer, distributor and retailer of sports, leisure and mobility products.

When I think of Tandem I immediately think of the classic bike brands Claud Butler and Dawes, but there are many other bike labels in the group.

There’s also the classic golf equipment company Ben Sayers, the outdoor equipment company Hedstrom, and a wide range of licences for children’s toys and bikes:

The group’s share price has calmed down after a Covid-related surge:

My first experience owning Tandem was traumatic. Not just because of the losses I experienced, but because things always seemed to go wrong for them. They were the unluckiest company I ever came across. Then at some point I started comparing the value of the dividends to the value of management remuneration, and decided I’d had enough.

The second time I owned TND shares, things went much better. It was the 2019-2021 period, when they started treating shareholders properly. I managed to sell out during the Covid spike, thereby recouping most of my earlier losses (see comments in the archive, e.g. here).

Let’s check in on today’s trading update for the full-year 2022.

Key points:

Revenue at £26.7m is in line with market expectations but note that this is down 35% versus 2021. Stockopedia reports that the consensus revenue forecast was £27m.

PBT is also in line with expectations (according to Cenkos, 2022 PBT is expected to be £0.9m).

Stock inventory levels closed the year down by 40% compared to 2021, so that should at least provide a cash flow boost. Cenkos expects that net debt is £2.7m.

Toy, Sports & Leisure - this division had a strong December but full-year revenues were still down 11%.

Bicycles - revenues fell 52% as Covid-related demand evaporated.

Home & Garden - revenues down 55%, as people no longer have to spend so much time at home or in their garden!

eMobility - this division includes eBikes and eScooters. Sales rebounded and were very strong in November and December. Perhaps Tandem are right that this division has good long-term potential. But full-year sales are down 46%.

Outlook

As we expected, 2023 has begun slowly for the Group with a slowdown in our Free-on-Board (FOB) sales as a result of an early Chinese New Year, and as consumers remain cautious with their purchasing. However, we expect to see a different trading pattern this year, and will be targeting between 8% and 12% like for like growth on the full year.

In case you haven’t heard it before, Free-on-Board is a term in shipping - Tandem’s products are typically manufactured in China and shipping arrangements/distribution are a key element of Tandem’s expertise.

Reading further, children’s licences sound promising this year. Gabby’s Dollhouse has been added to the portfolio (I’m familiar with this show, unfortunately). Also:

“...there are several high-profile movie launches based on our existing license agreements such as Barbie, Spider-Man, Paw Patrol, Trolls, Transformers and Baby Shark, all of which will provide additional sales opportunities.

Other initiatives:

New e-bike models being launched

The Jack Stonehouse website has been modernised

They are finally making a real effort to use social media (Facebook, Instagram).

The new warehouse in Birmingham will be ready “within the next few weeks”.

My view

I am going to have to very reluctantly take a positive view on this share.

For a company that has been around for so long, and had so many false dawns, it feels wrong to take an optimistic view on it.

However, there are three reasons I’m going to take this positive view:

They shook up the management team with a new CEO in 2022.

Using websites and social media to their full potential is a no-brainer and has the potential to transform performance over time.

Valuation: they aren’t cheap against FY 2022 earnings, and formal FY 2023 estimates are unavailable. But if you consider the price/sales multiple and historic profit margins, I think it once again looks like a bargain.

Price to sales and price to book, according to Stockopedia:

Historic profitability:

Don’t be fooled by its cheapness, however - holding TND shares can be a stressful way to live, and any profits made by shareholders are hard-earned!

Gaming Realms (LON:GMR)

Share price: 28.9p (+2%)

Market cap: £84m

This is a “developer and licensor of mobile focused gaming content”, and it also brings us a trading update for 2022:

The Company is pleased to confirm that it expects to report FY22 revenue of c.£18.7 million and adjusted EBITDA* of c.£7.7 million, up 27% and 36% respectively year-on-year.

What it does: Gaming Realms owns Slingo, a cross between slots and bingo, that is licensed by a wide range of partners in the gambling industry.

The impressive growth rates are explained by its expansion into new markets across the US, with partners such as Draftkings, Caesars and 888 (in which I have a long position).

It’s also expanding in Europe, e.g. with Pokerstars (owned by Flutter Entertainment (LON:FLTR) ).

Board changes - the CFO becomes CEO, and the young FD becomes CFO.

Comment by Exec Chair:

The Company has delivered another strong, full-year performance with growth coming from both existing and new markets… with the release of new Slingo formats during the period, which have proven to be very popular. We are seeing good momentum, and backed by an exciting commercial pipeline and new games, we are confident that we will achieve further progress in 2023.

With respect to the outlook, note that “the Group’s expansion into further new markets during Q4 FY22… has continued into Q1 FY23”.

My view

This strikes me as interesting. The company appears to have turned the corner to profitability, and has paid off an outstanding loan with cash so that it is now debt-free.

The abbreviated income statement numbers from Stocko are copied below. Note that the revenue number announced today is below Stocko’s consensus revenue forecast, so perhaps it came in below expectations. But the RNS does not make any reference to prior expectations, so I’m not sure.

I should also remind readers that we can expect an enormous gap between adj. EBITDA and reported net income, as is the case with many companies

But I think the key point is that Slingo, GMR’s primary asset, appears to be growing in popularity and is in very strong demand from major players in the betting industry. That’s what really matters here.

The price tag of £84m for the company’s market cap does look like a stretch at first glance, but I’m open to the possibility that it’s justified by possible earnings momentum over the next few years. So I’m going to take a neutral view on this stock for the time being, pending further information and research. Could have potential.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.