Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

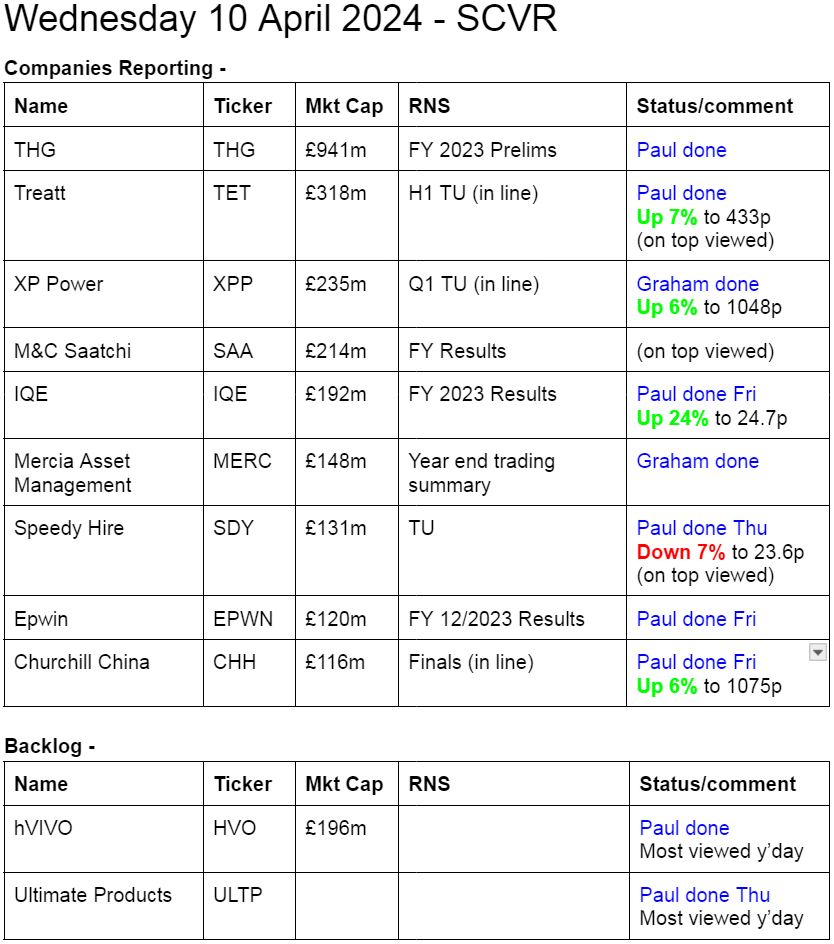

Summaries of main sections

hVIVO (LON:HVO) - 29p (£196m) - Final Results - Paul - GREEN

As this share is popular with readers, I've circled back to its impressive 2023 results, published yesterday. Strong growth, as expected, a reassuring outlook section, and sound balance sheet & cashflows - all pass my testing! Valuation still looks reasonable to me, and there could be further upside if it continues the trend of beating expectations with positive trading updates. So I remain positive on HVO shares.

Mercia Asset Management (LON:MERC) - up 6% to 35.95p (£157m) - Year end trading summary - Graham - GREEN

A good update shows Mercia hitting and possibly exceeding its targets and estimates: FY March 2024 saw £0.5 billion of organic fund inflows and zero redemptions. A subsidiary has hit its two-year target with eight months to spare. NAV per share should still be around 45p.

Treatt (LON:TET) - up 8% to 436p (£265m) - H1 Trading Update [in line] - Paul - AMBER/GREEN

An in line H1 trading update, shows a return to growth in Q2, after a tough Q1 due to customer destocking. On balance, I take a moderately positive view.

THG (LON:THG) - down 1% to 66.8p (£930m) - FY 12/2023 Results - Paul - RED

Terrible numbers for 2023, with another hefty loss. It dresses up the results by focusing on meaningless adj EBITDA. The valuation looks nuts to me. Although the leverage on £2bn revenues is such that if margins do improve in future, then it might become a viable business possibly.

XP Power (LON:XPP) - up 13% to £11.20 (£265m) - Q1 Trading Update - Graham - AMBER

An in-line update, after a nasty profit warning earlier this year. The market is relieved but I’m still concerned by the lack of stabilisation in the company’s trading trajectory. The company suggests that Q2 orders will tell us whether the customer “destocking” trend has ended.

Paul’s Section:

hVIVO (LON:HVO)

29p (£196m) - Final Results - Paul - GREEN

Results were published yesterday, and most viewed by readers here.

hVIVO plc (AIM & Euronext: HVO), a rapidly growing specialist contract research organisation (CRO) and world leader in testing infectious and respiratory disease products using human challenge clinical trials, announces its audited results for the year ended 31 December 2023.

Company’s summary -

A record year across all financial and operational metrics

On track to deliver future growth targets

Initiating annual dividend policy

Impressive headlines, including good revenue & profit growth, large order book, big cash pile (from up-front client payments), and commencement of (modest) annual dividend (note it did pay a special divi in 2023) -

Profit before tax is missing from the bullet points above. It was £11.1m in 2023, up 69% from £6.6m in 2022 - very impressive.

Note the growing cash pile is providing a helpful income now interest rates are higher - net finance income rose from £617k in 2022 to £1,055k in 2023.

Tax - note there is a large tax credit of £5.0m, turning PBT of £11.1m into PAT of £16.1m, with a corresponding boost to EPS which is 2.35p (diluted), but adjusted EPS is 1.25p - with the main adjustment being to normalise the tax (£8.1m adjustment - see note 11). So obviously it’s the adjusted EPS we should be using to value the shares - a PER of 23.2x - which strikes me as about the right price for an impressive growth company.

It depends on where you see future growth heading - it might still be cheap if revenues/profits grow faster than forecast. Note that HVO has surprised on the upside quite significantly in the last year or two, and often companies that out-perform continue to out-perform - and brokers are often too cautious with successful growth companies (as we saw y’day with W7L) -

Broker update - Cavendish says the 2023 results are in line.

It has 1.6p forecast for FY 12/2024, which would bring the 2024 PER down to 18.1x, which seems reasonable to me.

Outlook -

…Q1 2024 trading in line with expectations and the Company remains confident that 2024 will be another year of significant growth.

Detailed guidance below is useful. I’m not sure what, if any significance there is for the cancelled trial? -

Balance sheet - looks good. NAV of £34m becomes NTAV of £29m, which is plenty for a company that gets paid up-front by customers, hence doesn't need a lot of capital.

Note the big jump in lease entries, which must relate to its new facility at Canary Wharf which is coming on stream around now - and presumably the additional capacity should help further revenue increases, but with some extra costs too.

Cash of £37m is ample, although remember it’s come from getting paid up-front, so if there was an unexpected slowdown in order intake (eg another pandemic lockdown, or a competitor winning new business), then the cash pile would reduce - always worth bearing in mind. Bulls always like me to point out that the customer deposits are not refundable. That’s true, but it’s still getting paid up-front, which means a lot of the costs of providing the service have not yet been incurred.

Overall, it’s a very comfortable financial position, so no issues here.

Cashflow statement - note the £2.4m benefit from R&D tax credits, which is material to the overall profit, let’s hope this generous scheme remains in place.

Note the £5.2m in 2023 (and £11.2m in 2022) boost to cashflow from increased payables - this is recording the benefit of up-front customer payments.

Capex rose from £1.3m to £5.2m, presumably for fitting out the new facility in Canary Wharf, which is fine, this is not excessive at all.

Overall this all looks good - it’s a genuinely cash generative business, albeit with most of the cash increase coming from increased receipts up-front from customers. Don’t shoot the messenger in the comments section please! I’m just pointing out the facts.

Paul’s opinion - I remain positive on this share, it’s been a remarkable turnaround in the last few years, and now seems to be exploiting a lucrative niche. I’m still perplexed as to why there doesn’t seem to be much competition? Does HVO have any long-term moat? So increased competition (which tends to happen when other people also spot the lucrative niche) is probably my main downside worry.

Valuation stacks up, and still looks reasonable, especially if HVO continues its track record of beating expectations.

So based on how things stand now (I can’t predict the future remember!) it has to be a continued GREEN view from me. Well done to bulls, it’s been a star performer - tripling in price since the late 2022 lows.

Shares have been very volatile, but the business fundamentals are now far better than at any time in the past, so I think the recent bull run has been justified -

Treatt (LON:TET)

Up 8% to 436p (£265m) - H1 Trading Update - Paul - AMBER/GREEN

The financial year ends 9/2024.

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, announces the following trading update for the half year ended 31 March 2024 (the "Period").

Company summary -

Solid performance in H1 2024, with sales accelerating in the second quarter and year-on-year profit growth

H1 revenue down 5% to £72.1m, but within that the trend is positive - a weak Q1 due to customer de-stocking (previously indicated), then a rebound to +5.1% in Q2.

Profit before tax slightly up in H1 to £7.5m (LY H1: £7.3m) - not bad considering revenues were down 5%, suggests to me that margins are OK and overheads under control.

Outlook - seems reassuring -

Valuation - no broker research is available.

Broker consensus on the StockReport shows 24.0p for FY 9/2024, up c.9% on LY. That’s a PER of 18.2x, which strikes me as generous considering TET’s lacklustre track record. Although it does now have a spangly new factory in the UK, so hopefully the additional capacity and efficiency might see performance improve?

Paul’s opinion - the bull case for TET seems to rest on its European competitors being highly valued, so TET should be as well. TET is capital-intensive - it’s spent a lot on capex in recent years, but as yet there’s not been any increase in profit.

On the upside, it’s now showing an improving trend in Q2, so looks as if customer destocking has ended. The valuation seems more reasonable than in the past, and there’s little debt.

On balance then, I’m happy to stick with a moderately positive view of AMBER/GREEN.

Sentiment has really plunged, so I wonder if a turnaround might be on the cards? -

THG (LON:THG)

Down 1% to 66.8p (£930m) - FY 12/2023 Results - Paul - RED

Very quick notes, due to time constraints today. If you want an example of how adj EBITDA can be used as smoke & mirrors, then these accounts are a great example.

There’s no growth (revenue is down).

Adj EBITDA us up 48% to £120m.

However, the operating loss is £(185)m, and the loss before tax is £(252)m!

Why such a huge difference? It’s due to heavy capitalisation of development spending (£79m), large depreciation charges on its expensive automated warehouses, massive finance costs (remember it has c.£650m of expensive bank debt, although partially offset with cash, so net debt was £218m) - I’d like to know the average daily net debt.

Weak balance sheet with negative NTAV of £(185)m.

Paul’s view - I don’t see any sign of a viable business here. Unless it can drastically improve performance, then I think THG could end up going bust. So quite why it’s still valued at almost £1bn, I have no idea. The figures are awful, although not quite as awful as last year.

Obviously I don’t know what the future holds, and on big revenues of c.£2bn pa, it doesn’t take much of an improvement to transform profit & cashflow for the better. That must be what bulls are hoping for, but there’s no evidence at all so far that this is actually happening. Management worry me greatly too, I wouldn’t have any confidence backing the current team, who I think got wildly carried away with tech mania, and would be better suited working in the USA.

Graham’s Section:

Mercia Asset Management (LON:MERC)

Up 6% to 35.95p (£157m) - Year end trading summary - Graham - GREEN

Mercia Asset Management PLC (AIM: MERC), the proactive, regionally focused specialist asset manager with over £1.5billion of assets under management, is pleased to provide a trading summary for the financial year ended 31 March 2024 ("FY24").

This one has made it onto my best ideas list for two years running. Share price performance has been OK overall:

Today’s short trading update is as follows:

Organic fund inflows for FY24 as a whole exceeded £0.5billion, which is a record for Mercia and represents a c.40% increase in Mercia's third-party funds under management, since the beginning of the financial year. There were no redemptions. As a result of these substantial inflows, Mercia has begun the new financial year in a strong position.

There is no shortage of doom and gloom in the fund management industry. But Mercia is one of those rare fund managers seeing inflows and zero outflows. Granted that it’s starting from a low base, but in my view it is clearly offering something different and attractive to fund investors, and deserves its success.

Other key points:

Frontier Development Capital (link) (acquired by Mercia in late 2022) has raised over £100m of institutional 3rd party funds. This two-year target has been reached with eight months to spare, triggering defcon payments.

Mercia’s direct investment portfolio “continues to make overall technical and commercial progress”.

Cash at the end of March 2024 is £47m.

Although not mentioned in today’s update, the company has been buying back its own shares since the announcement of a £5m buyback last November. So far, it has bought back around 11 million shares (this still leaves 435 million shares outstanding).

CEO comment excerpt:

Mercia's record year of organic fund inflows for FY24, which exceeded £0.5billion, is testament to our investment performance, together with the operational teamwork of everyone in our Group. It also reflects Mercia's ability to effectively deploy equity and debt funding across the UK, through our established regional footprint..

"Our significant closing debt free cash position as at 31 March 2024 of c.£47million, means that Mercia enters the new financial year in a strong financial and liquidity position, across both its managed funds and balance sheet…

Graham’s view

As a fan of this business for some time now, today’s update is unlikely to change my mind! Mercia is in rude health and appears to be going from strength to strength as a manager of third-party funds.

One point that is worth a mention is that the majority of the new flows have been sourced from the State-owned British Business Bank. I’d like to see more diversity in the sources of new flows: maybe that’s something for the company to work on in the new year.

Estimates: an excellent note from Canaccord Genuity this morning suggests that the new financial year (FY March 2025) will see AUM hit £2 billion and revenues increase from £30m to £34m. They haven’t changed their estimates today, but they do see upside risk to forecasts as the company appears to have beaten their AUM estimate for FY March 2024.

Please note that the profit result here tends to be volatile:

This company does tend to look expensive relative to earnings, but remember that it’s carrying a large cash balance and a direct investment portfolio. NAV per share is still likely to be in the region of 45p.

XP Power (LON:XPP)

Up 13% to £11.20 (£265m) - Q1 Trading Update - Graham - AMBER

This is an “in line” update.

XP Power, one of the world's leading developers and manufacturers of critical power control components to the electronics industry, is today issuing a trading update for the first quarter ended 31 March 2024.

The company’s numbers continue to move in the wrong direction.

The “book-to-bill” ratio stands out to me: it’s not often that you ever see a reading as low as this one.

At 0.68x, it means that for every £100 of billings (or revenue), the company only took in £68 of new orders. This doesn’t augur well for future revenues:

However, this 0.68x level is actually a slight improvement on the book-to-bill in the most recent quarters.

The reason? It’s not because orders have picked up in recent months, but because revenues started to fall faster.

Falling revenues are another way for the book-to-bill ratio to stabilise or improve:

XPP’s Quarterly orders: fell from £54.5m (Q2 2023) to £43.7m (Q1 2024)

XPP’s Quarterly revenues: fell from £82.3m (Q2 2023) to £64.6m (Q1 2024)

Divisions: sales and orders from the Semiconductor manufacturing equipment sector are similar to H2 2023. But the Healthcare and Industrial Technology sectors have “slowed as customers continued to destock” (the dreaded word!).

Net debt fell by £9m in the quarter to £103m.

Outlook: expectations unchanged.

As expected, revenue in Q2 is likely to be slightly lower than Q1 due to ongoing customer destocking, and we continue to expect trading to improve during 2024 as channel stock levels reach equilibrium and as demand for Semiconductor Manufacturing Equipment begins to increase. Order intake in Q2 will provide greater clarity on the timing and trajectory of this improvement.

We are confident that our market positions remain strong and that the Group is well positioned to prosper as our key markets resume their trajectory of healthy long-term growth.

Graham’s view

This company still appears troubled. We have extensive coverage in the archives, including a recent profit warning, interim results and a fundraising last November.

Today’s news shows the company’s downward trajectory continues. Even if the market likes today’s update, I can’t say with confidence that XPP has stabilised. It would be great if we could make the argument that at least visibility has improved, but I don’t think that’s true either as the company itself acknowledges that order intake in Q2 is needed to provide clarity.

Net debt remains high, although probably not distressed: net debt/EBITDA is probably somewhere around 2.5x.

Paul has been putting this at AMBER/RED. I’ll maintain my AMBER stance on this one: hopeful for an improvement in trading soon, but not expecting it. Some bravery is required to get involved here, I think.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.