Good morning, Paul & Graham here today. Today's report is now finished.

Agenda -

Paul’s Section:

4imprint (LON:FOUR) (£941m @ 3350p) (no section below) - FOUR sells promotional goods to companies, for marketing purposes. Its operations are almost all in USA. It briefly popped into our universe in June, but has since risen c.50%, pity as I had it on my agenda to take a look just before the shares soared. Interim results today look very strong, with a major bounce back in profits post pandemic. 118.9c EPS in H1 looks like it’s heading to smash full year forecast of 179c, because I checked back and pre-pandemic it had a seasonal weighting to H2. Hence if that pattern plays out again, we could be looking at 250c+ for FY 12/2022. Liberum has just raised to 216c forecast for FY 12/2022, expect that to be beaten I think. Outlook comments are vague, but positive. Balance sheet looks fine to me. Well-covered divis, scope to increase. Smashing company, performing really well, but there is US recession risk of course. What a pity I missed the irrational sell-off earlier this year, would have been a lovely buy in that panic sell-off.

Hostelworld (LON:HSW) - interim results are poor, due to only a partial recovery in travel, but heavily increased marketing spending. The cash pile is more than offset by high cost debt from a US investment firm, and large payroll tax arrears owed to the Irish Govt. HSW was declining before the pandemic, and I cannot see the point in its business model of chasing low value customers, with heavy marketing spend, against major global competitors. I wouldn't go near this share, and the >£100m market cap looks irrationally high to me. Terrible risk:reward in my view. There must be much better opportunities elsewhere in the bombed out travel sector.

CML Microsystems (LON:CML) a positive, if somewhat vague in places, trading update at its AGM. I have a rummage to see if I can put a value on the surplus property. Also there's a very large cash pile, even after the 50p special divi paid last autumn. This is a hybrid investment - being about half backed by surplus cash/property, and the rest being the business itself. So copper-bottomed for assets, but that also dilutes the upside if the business out-performs, since the business is only about half the valuation.

Graham's Section:

S&U (LON:SUS) (£273m) - an ahead of expectations update from this motor and property lender. S&U is a family enterprise owned and managed by the Coombs family, and the current business combines both a long-standing business (founded 1999) and a newer venture (founded 2017). Both are performing extremely well and this is a stock that I would back to survive a recession, based partly on my understanding of the company’s financials but also to a large degree on the character of the Chairman and the culture of the business. After rising today, the stock now trades at a more meaningful premium to book value (around 32%), which I consider to be easily justified by the attractiveness of the stock.

Digitalbox (LON:DBOX) (£13m) - This trading update has been interpreted as a profit warning, even though the directors are confident that market expectations for the year will be met. The problem is that H1 is very strong, while H2 requires caution. Digitalbox owns three entertainment websites, and is soon to complete the purchase of tvguide.co.uk. It has over £2m in the bank and has earned nearly £2m in revenues over the past six months. The websites have impressive numbers on Facebook although we can’t value them purely based on that success. Corporate advertising budgets are likely to pose a headwind in the short-term but I’m open to the possibility that this company could turn into a success story for shareholders.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Hostelworld (LON:HSW)

91.5p (down 4% at 08:51)

Market cap £107m

Hostelworld, a leading global Online Travel Agent (OTA) focused on the hostel market, is pleased to announce its interim results for the six-month period ended 30 June 2022

The H1 numbers reflect partial resumption of travel.

HSW reports in Euros, and is based in Dublin.

H1 revenues E28.0m (almost 10-fold increase on H1 LY, which was hit by lockdowns)

Steadily improving revenues trend, but still well below 2019 pre-pandemic comparatives.

Heavily loss-making in H1, with the best view (adj EBITDA) of E(5.2)m loss, and the worst view being E(14.7)m PBT unadjusted loss.

Note 4 shows the culprit is a large increase in marketing spend, at E20.1m in H1. I understand that they’re effectively re-starting a travel business, but heavy marketing spend seems to be the achilles heel of many eCommerce businesses at the moment. Online marketing costs having risen so much, I wonder if they are viable, having to spend big now, to generate new business, or even stand still? The winners are likely to be the companies which can drive the best results from their marketing budgets, and not run out of cash, as competitors fall by the wayside. Maybe marketing rates could drop again, if things continue to be this tough?

Average booking value is strikingly small, at just E15.82, is it worth chasing this business? Especially when marketing spend per booking was E9.46.

Balance sheet - looks very weak to me. If we write off E76.4m intangible assets, then NAV of E54.0m positive, turns into NTAV of negative E(22.4)m.

The depleting cash pile is E22.6m, but that’s more than offset by borrowings of E29.8m - note 9 gives the detail, it’s provided by HPS Investment Partners LLC, and is expensive at 9.0% p.a + EURIBOR. It looks like some interest cost is being rolled up, thus increasing the debt.

The lender, HPS, is a very substantial US-based investment firm, seeking high returns from “creative capital solutions”. There’s a clear risk here that, if terms of the borrowings are breached in some way (e.g. covenants), then it could hand control of the business to this lender. Or they could force HSW into heavy dilution, to raise fresh equity. I don’t like this arrangement one bit. It looks desperate, so I would want HSW to refinance in some way to eliminate this debt at some stage before I’d want to invest.

Payroll tax arrears - the Irish Govt has been very helpful, in allowing E9.4m in payroll taxes to be deferred - see note 12. This is in non-current creditors, as the company says it doesn’t have to be repaid in the next 12 months. But it will have to then be repaid, which would bring the cash pile down from E22.6m to E13.2m. That’s before we take into account further trading losses too. Hence I reckon the cash pile is probably spoken for, and HSW then has to worry about how it’s going to repay the expensive HPS debt.

Outlook - the way I read this, as long as nothing bad happens, we might scrape into breakeven in H2 (before interest costs) -

The Board remains confident in the long-term resilience of our business model and the potential of our differentiated growth strategy. The trends in H1 2022 are encouraging and indicate that where markets open up for travel, demand will recover to 2019 levels and that we can gain our share of that growth. In the absence of any further deterioration in the macro-economic climate, disruption to airline schedules, or escalation of the conflict in the Ukraine, we expect to be EBITDA positive in H2 2022."

My opinion - as you’ve probably gathered, I’m not at all keen on this share. The market cap of £107m looks over-valued to me, because it’s blowing the cash pile on marketing spend, to chase after an unattractive, low spending niche in travel. Against major global competition.

Remember that HSW was declining before the pandemic hit too. Since then, marketing spending has become a lot more expensive, and travel generally is taking longer than I expected to recover, due to lingering impact of the pandemic on infrastructure like airports. Plus it looks as if we might be going into a recession, although that's not necessarily certain.

Then there’s the high interest debt, and the tax arrears to repay.

So for me, the bear case is overwhelming here, and I’d say the equity could end up being worth little to nothing. It would need a stellar improvement in performance to justify anywhere near the current share price - it could happen, but why take the risk of betting on a low probability outcome? And over-paying at the starting point for an unlikely outcome. Thumbs down from me, I’m afraid.

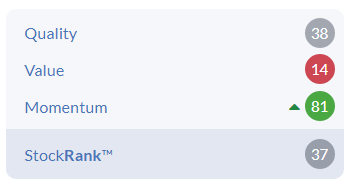

Stockopedia isn't keen either, with a lowish StockRank, propped up by a high momentum score that could easily wither away -

.

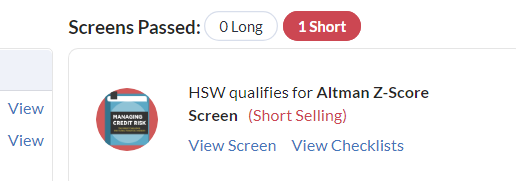

The only screen passed is for a short -

.

The only uncertainty here is why the share price has held up so well? There must be buyers, otherwise it would have tanked along with the rest of the travel sector, so maybe I've got something wrong?

.

CML Microsystems (LON:CML)

421p (up 5% at 10:27)

Market cap £67m

AGM Statement (trading update)

CML Microsystems Plc, which develops mixed-signal, RF and microwave semiconductors for global communications markets…

The current year is FY 3/2023.

Trading is up on last year, but it doesn’t say anything about market expectations, which is the more usual (and useful) reference point that we need, to judge for ourselves how it’s performing -

We entered the new financial year with a healthy order book and a strong pipeline of future opportunities. We have made good progress so far, with trading for the opening four months comfortably ahead of the prior year comparable period.

This bit below is also a bit too vague for me - “firm improvement” against what? Last year, or market expectations? It should be more precise -

After experiencing an encouraging start, the Board remains of the view that full year trading to 31 March 2023 will show a firm improvement, both operationally and financially.

Strategy -

Our enhanced strategy to widen the addressable market is gathering pace and activities to capture share of new market application areas remains a priority focus. In support of this, several new product releases are scheduled across the coming months that are projected to start contributing to revenues during the following year.

Property - we already knew about surplus property. It would be useful if the company could give an indication of the likely size of this windfall. Again, “significant cash inflow” is far too vague. There should be specific numbers, even if it’s a range of possible outcomes -

As expected, planning applications have now been submitted for the commercial development of excess land at the Group's 28-acre Essex headquarters site and, if successful, this could generate a significant cash inflow for the Group.

With things like this, scrutinising broker notes can often provide more detail. There are 2 out today, from Shore, and Progressive. They don’t say anything on property, other than there could be material upside.

I’ve done some googling, and this seems to be CML’s existing site below, called Oval Park, looks very nice (from google maps), and mostly surrounded by countryside, with a small village nearby. It’s about 5-10 miles from Chelmsford, Essex -

Next, I stumbled across a relevant article in the famous Maldon & Burnham Standard, which refers to a planning application for Oval Park, to create 60 new homes, and new “employment space”, which looks like 6 new offices/units, in a ring around the existing oval shaped road. This is said to be 7,100 sq.m, so fairly smallish units, not big warehouses. It’s definitely the same site, due to the name, and the recognisable shape -

.

Further googling provides other articles, saying that CML has been trying to get planning permission on this site for many years (e.g. planning application in 2012 was rejected, and an appeal in 2014 also rejected).

Given that we know the planning system is slow, then it’s probably best to see upside from the property as a long-term benefit to shareholders. Problems with infrastructure are also mentioned in another article.

How much profit could CML make on this? No idea, but if it’s say £100-200k overall profit on each of the 60 houses, then that would be £6-12m. Plus whatever the profit would be on the industrial/office units. This would be split somehow, as it’s being done in conjunction with a local developer called Aquila.

All quite interesting, and it’s reasonable to add a bit on to CML’s valuation to account for this property upside potential.

Broker forecasts - Progressive leaves forecasts unchanged, but reckons that the next move could be upwards - a key thing we need to see right now, to avoid profit warnings.

Balance sheet & divis - CML has a lovely habit of accumulating cash! It paid out a 50p special divi in Aug 2021 (£9m cost) but still ended FY 3/2022 with £25.1m in net cash, which is way too much. Although perhaps management might be retaining this big cash pile to help fund the property development work?

Overall, the balance sheet looks remarkable, e.g. current assets £31.9m (incl. Cash & deposits of £25.1m), whilst current liabilities are just £3.1m!

There is a £2.4m accounting pension deficit, but the last results show that the actuarial valuation was better, in a small surplus. So aside from admin costs, it sounds as if the pension scheme shouldn’t need much funding from the company.

My opinion - what an interesting little company, I’ve enjoyed digging into this, it’s like doing a puzzle!

The logical way to value a share with material surplus capital, is to adjust the market cap down, to take into account a big pile of surplus cash (at least £20m is surplus I think), and surplus property - no idea how to value that, maybe £5-10m, we’d need more detail, and would need to discount it to reflect that this could take years to turn into cash, given the history of rejected planning applications.

Even so, the cash and surplus property are probably adding up to around half the market cap. Therefore the apparently high PER (Stockopedia is showing 27.1 times, blended between this year & next year). Progressive is showing a PER of 33.3x this year, and 27.0x next year, but also saying there’s potential upside on its current year forecast.

I would halve those PERs, to take into account the cash & property, taking us down into the mid-teens for the PER - which looks reasonable value to me.

The challenge will be to grow revenues and hence profits - which are currently still a long way below 2016-18, when the business made c.£4m p.a. profits.

The next step for people to research would I think be looking into its products, including the pipeline, with the big question being are there any potential blockbusters in there? That’s beyond my pay grade, I just look at the numbers, which overall I think look good.

I quite like these hybrid shares, where you have a good business, plus a great pile of surplus assets. It’s nice to get the assets in for free though, which is not the case here.

CML has been remarkably resilient in the recent small caps bear market. Nice high StockRank too -

Graham’s Section:

S&U (LON:SUS)

- Share price: £22.46 (+8%)

- Market cap: £273m

This is a family business with a history stretching back to 1938. Its activities have changed over the years, but the family remains very proud of their traditions. In addition to being heavily represented on the Board, they have meaningful stakes in the business.

In 1999, S&U launched Advantage Finance, a non-prime car lender. In 2017, it launched Aspen Bridging, a specialist property lender. S&U borrows at 4%, and lends at 25% (see the 2021 Annual Report, footnote 21!).

I’ve interviewed Chairman Anthony Coombs in the past, and this cemented my view of the company as having a strong culture of stewardship. That’s always highly reassuring from an investor point of view - and particularly in this case. We are talking about a subprime/non-prime lender, after all.

Some great news in this update:

Although it is only just over two months since our last trading update, S&U is pleased to report that both its motor and property bridging divisions continue to outperform its expectations, both in transactions growth, and in the quality of its book and the new business it is writing

Growth is being achieved without any signs of excessive risk-taking by S&U: “debt quality is reflected in strong collection rates and supported by low levels of default” at both subsidiaries.

Anthony Coombs is an excellent writer (I’d guess that he wrote this update with little PR input) and offers some remarks on the weak economic prospects - including inflation, rising interest rates, low consumer confidence and a technical recession. He says there is now a “manically depressed view of the future, particularly in the UK equity markets”.

The conclusion from Mr. Coombs is that underwriting standards must remain infused with caution; there have been some “adjustments” to take into account the possible pressure on household incomes later this year.

Changes include “a revised scorecard and the introduction of further credit reference information, as well as strengthened buffers on customer affordability”.

In property bridging, which is still a very young business in the context of S&U’s history, net receivables are up by more than 50% compared to last year and now stand at £90m.

The company is building its track record in the market, which bodes well for the future:

Aspen's growing reputation and the introduction of new products mean that it is attracting more experienced and expert borrowers, which have seen average gross loan size increase to around £875,000 so far this year, helping both the receivables and revenue growth.

Gearing and borrowings

A brief look at S&U’s January balance sheet shows the company with £207m of equity supporting total assets of £327m (with no intangible assets).

Putting it differently, S&U’s equity accounts for 63% of its assets. In mortgage terms, the LTV is 37%. The LTV at something like Lloyds Banking (LON:LLOY) is 94%.

So we can understand what Mr. Coombs refers to, when he talks about S&U’s “low level of gearing”.

The large equity cushion provides comfort that S&U would survive a historically unprecedented wave of defaults.

If I had any concern on the balance sheet, it would be a growth-oriented concern: the company has used up most of its medium-term banking facilities. Net borrowings are £154m, while the facilities only stretch to £180m. S&U claims there is still “ample headroom” for growth, but surely it will want to increase the amount it can borrow before too long?

The 2021 Annual Report said that the facilities “may be augmented within the next financial year as further growth occurs, and the macroeconomic landscape becomes clearer” - perhaps the fact that the facility has not increased yet has as much to do with the risk appetite of S&U, as it does with the risk appetite of the bankers.

My view

I’m a big fan of this company, and I’m very interested by the fact that the share price has made such little progress in recent years:

This is a company with a terrific track record when it comes to growing book value (and also book value per share, because the share count barely moves):

As of the last balance sheet (January 2022), book value per share was £17. At this morning’s share price, the shares are trading on a 32% premium to this amount.

For a company which usually earns double-digit ROCE and double-digit ROE, that still strikes me as potentially offering good value. The S&U Chairman naturally agrees, saying:

S&U's performance and its prudently planned prospects for the future, are inadequately reflected in stock market commentary and valuations dominated by uncertainty and pessimism.

I’m as much of a bear on the economy as anyone else, but I’m still perfectly happy to back good companies to get through what’s coming.

And if S&U’s bank facilities were ever withdrawn, I suspect that there would be more important and urgent things to worry about than share prices!

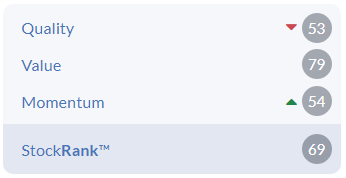

The StockRanks really like this one, too: Edited to correct error, our apologies. The correct StockRank is now below, as you can see it's upper-middle -

Digitalbox (LON:DBOX)

- Share price: 11.4p (-5%)

- Market cap: £13m

This is a collection of consumer websites: Entertainment Daily, The Daily Mash and The Tab.

I’ve occasionally seen The Daily Mash pop up on my Twitter feed. Having a closer look today, it is clearly a British version of The Onion. It has 1 million Facebook followers.

Entertainment Daily offers celebrity and TV news and has 2.4 million Facebook followers.

The Tab is pitched as a student publication and has 300,000 Facebook followers.

So each website has had a lot of success on Facebook, assuming that we can trust the numbers (unfortunately we can’t trust these numbers in every case).

Websites like these depend on the advertising budgets of larger companies, which are of course very sensitive to economic conditions.

For example, the advertisers listed on digitalbox.com include various travel companies, along with the likes of John Lewis, M&S, and Sky:

- P&O Cruises

- Thomas Cook (!)

- Jet2holidays

H1 trading update

Here are the key points from today’s update, which initially reads positively.

- Revenues are up 40% on last year, rising to £1.9m.

- Net cash rises £600k to £2.4m.

Explanation:

The performance is a result of exceptionally strong traffic for Entertainment Daily, and ongoing improvements in the monetisation of The Tab and is significantly ahead of the Company's expectations for the Period.

In H2, the company will complete the purchase of tvguide.co.uk (price: £550k), and more acquisitions are being studied.

Then at the very end of the statement, we get this warning around prospects, which explains why the stock is trading lower today:

The Board anticipates that the challenging macro-economic conditions are likely to adversely impact advertising revenues in the second half of FY 2022, but given the exceptional performance in H1 2022 the Board remains confident of meeting market expectations for the full year FY 2022.

It makes for an unusual profit warning: H1 was better than expected, but H2 will probably be worse. Net it out and the Board thinks that expectations will be met.

Estimates

The market expectations, according to Stocko, are for revenues of £4.1m and net profit of slightly less than £1m:

The estimates have been unchanged for several months, and at no point were they revised lower:

Shareholders must have been hoping that a strong H2 would enable the company to hit these estimates, but they weren’t promised it. Instead, they’ve been given a strong H1, which they are probably less interested in!

However, when the market cap and the free float are this small (the free float is 59%, according to Stocko), it might be best not to read too much into share price movements.

In this sector, everybody knows that advertising budgets suffer in tough economic conditions. For most large corporations, advertising is a type of luxury purchase, and it gets scaled back quickly whenever cash is tight.

So at the end of the day, it is not major news to hear that advertising revenues might be impacted in H2, given the economic backdrop.

My view

Overall, I find this an interesting little company. This is a sector (websites/online media) I feel comfortable analysing, and I’m open-minded as to whether or not these websites could turn out to be worth something substantial.

The purchase of tvguide.co.uk looks like a great deal, at this price. Search “tv guide uk” and see what comes out at #1 on Google.

Whether or not these websites are worth £13m together, I’m unsure: the price to sales multiple (after subtracting the cash balance) is about 2.5x, which is not too high. I’m most comfortable when this multiple is in the range of 1x-2x. There is the possibility that Digitalbox could build synergies and systems to make them worth more than the sum of their parts, but that’s far from certain!

Unfortunately, content creation is expensive and audiences can be fickle. The audience can also simply grow up: if you have a website targeted at students, for example, like Digitalbox does, how many of the readers will still want to read the same student publication in five years? You constantly need to find new eyeballs, and that’s not so easy.

On top of that, you are always vulnerable to the decisions and the policies of Google, Facebook and Twitter (full disclosure: I own shares in Alphabet ($GOOGL)). So there are big investment risks that you don’t suffer if you simply buy one of the tech giants instead.

In conclusion: I’m not certain that these shares are overvalued, but I also wouldn’t be in a rush to buy them here. At a price to sales multiple somewhere below 2x, I’d reconsider it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.