Good morning from Paul & Roland!

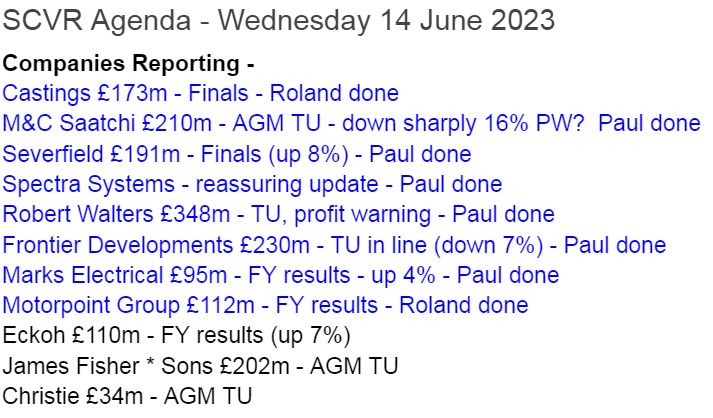

Today's report is now finished.

Terrific reader comments today, thank you! Keep them coming, we need more discussion!!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Lots of interesting companies for us to look at today! We've run out of time now.

Summaries

Robert Walters (LON:RWA)

Down 14% to 402p (pre market) (£301m) - Trading Update - Paul - AMBER/GREEN (edited from GREEN originally)

It's a profit warning I'm afraid, bad luck to holders. I run through the numbers below, hampered by a lack of broker forecasts. Short-term the shares are likely to plunge today, but it's a fundamentally sound business, so they should recover in time. Annoying for traders, but not a big deal for medium-long-term shareholders. Very strong balance sheet with plenty of net cash, and generous divis, so no concerns over solvency/dilution. I'm staying green on this, as I see profit warnings from quality companies as potential buying opportunities, for longer term investors. EDIT: after reader comments below, I think editing this to AMBER/GREEN makes more sense. Thanks for your input!

Motorpoint (LON:MOTR)

Down 4% to 120p (£109m) - FY 03/2023 results - Roland - AMBER

Profits collapsed last year, due to a mix of one-off and persistent factors. But the balance sheet looks okay and I think the business could be well-positioned for a recovery. While risks remain, I’m cautiously optimistic about the outlook for this car supermarket group.

Castings (LON:CGS)

+5% to 428p (£178m) - FY03/2023 results - Roland - GREEN

This engineering group delivered a sharp rise in volumes last year as its customers opened the floodgates to clear production backlogs caused by semiconductor shortages. Demand is said to remain strong and I rate the quality and management of this business highly.

Marks Electrical (LON:MRK)

Up 4% to 95p (£99m) - Preliminary Results - Paul - AMBER

Decent revenue growth for FY 3/2023 results, but profit is slightly down. Good balance sheet & cashflow. I like the business, but online electrical retailing is so competitive, with no pricing power, so everything is all about being the most efficient operator, which MRK does seem to be. Founders 74% stake is too high. Valuation is too high for me, hence why I remain AMBER. Sub-70p would tip me into green!

Quick Comments

(no additional detail below)

Spectra Systems (LON:SPSY)

166p (pre market) (£74m) - Update on development contracts - Paul - GREEN

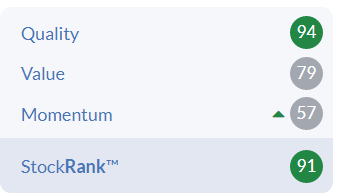

I’m following this share, and it’s been a previous podcast “mystery share”. In recent years it has displayed good growth, high profitability, and has plenty of cash, and pays generous divis. Plus some excitement from potential new contracts. So it’s well worth a closer look I think. The StockRank is high, at 92.

Today’s update says it has won a new contract, and achieved milestone payments on another. These were as planned, so it’s not changed the outlook -

"We are pleased to make this announcement today. These developments and payments were included in our financial projections for the 2023 fiscal year and solidify our expectations for the full year results."

Paul’s opinion - a reassuring update. This is an interesting, niche company, I like it.

M&C Saatchi (LON:SAA)

Down 9% to 158p (£193m) - AGM Trading Update - Paul - AMBER

It’s quite short, so here it is in full - I’ve bolded the most important bits -

The more challenging trading environment, as widely reported across the sector and previously referenced in the Company's 2022 full year results announcement, has continued, and has impacted the pace of business into the second quarter, particularly in the Advertising and Media specialisms.

However, the Company is benefiting from its diverse range of businesses, with the Passions, Consultancy and Issues specialisms continuing to perform strongly.

Whilst we expect a small decline in like-for-like net revenue for the full year, we remain confident in delivering year-on-year Headline PBT growth and Headline operating margin improvement. This will be achieved through a combination of the high operational gearing inherent in the business model, targeted cost savings and the global cost efficiency programme.

As a result, Headline PBT is expected to be significantly weighted towards the second half, although net revenue is expected to be more evenly spread.

The Board remains confident in its strategy and the medium-term growth targets set out at the Capital Markets Day held in February 2023, driven by the quality of its diverse set of businesses.

Paul’s opinion - this doesn’t look too bad actually. It's recovered a lot of the initial drop this morning to 140p, being 158p now at 12:39. We know macro conditions are tightening, so it’s to be expected that cyclical sectors like marketing might see a slowdown, which has been reflected in a falling share price since it peaked in Feb 2023, when conditions were looking more benign.

The most important bit is that SAA seems to be coping alright, through improving margins, and cost cutting.

I haven’t yet seen any broker updates, so can’t comment on valuation until we have more information.

Overall, I’m quite intrigued by SAA shares. There are some interesting reader comments below, talking about the takeover approaches. There were some big historical problems, but I seem to recall those have now been resolved.

Quite interesting, and definitely one to add to the watchlist for a cyclical recovery in due course, I think.

Severfield (LON:SFR)

Up 9% to 67p (£207m) - FY 4/2023 Results - Paul - AMBER

Excellent results today from this structural steel group.

Revenue up 22% to £492m, and adj PBT up 20% to £32.5m, underlying EPS 8.5p = PER of 7.9x. Cheap, if profits are sustainable? Divis 3.4p for the year, up 10% = yield of 5.1%.

Big order book of £510m at 1 June 2023. Outlook sounds upbeat about its chosen markets, including India. In line with expectations for FY 4/2023.

Balance sheet solid, with NTAV £129m, net debt eliminated in the year, now holding £2.7m net cash. So should be able to weather a recession, if we have one, and a lot of revenues are overseas.

Paul’s opinion - this intrigued me when last looking at it in March. So far, it doesn’t seem to have any macro problems, and the big order book seems to provide about a year’s worth of forward orders. What happens after that? I’ve no idea, but personally I wouldn’t want to invest in a very cyclical business like this, at this stage in the cycle. Look back to what happened to the share price in 2007-8, and it’s never really recovered. Even post-crisis, the last 10 years have only seen a sideways share price. So yes the shares look attractive value, with a low PER, and good yield, plus the reassurance of a nice balance sheet. It looks a much better business now, than 10 years ago too. So some merit, but not for me at this stage.

.

Frontier Developments (LON:FDEV)

Down 8% to 537p (£212m) - FY 5/2023 Trading Update - Paul - AMBER

Graham covered the big profit warning from this computer games publisher in Jan 2023. Today it says performance has been in line with guidance provided in Jan. It selectively picks some profit measures, but I’d need to see the full accounts for clarity. Cash of £28m. Foundry games label launched in 2019 hasn’t worked, so it’s not seeking any new third-party business, being wound-down it sounds.

Guidance doesn’t sound very good, but it is in line with expectations, let’s hope there’s upside on this -

The Board is therefore comfortable with current analyst forecasts for FY24, with consensus revenue at around £108 million and the majority of analysts projecting an Adjusted EBITDA loss in the range of £5-10 million.

Paul’s opinion - I don’t generally invest in the computer games sector, where the smaller ones in particular are so dependent on individual game releases doing well. That said, the repeating “franchises” can be very valuable to acquirers, look at the previous takeover activity in the sector. So not for me, but might be worth readers doing some more research on it. Graham reckoned it was interesting value in January, and today’s update reiterates that profit guidance.

Note that FDEV is due to launch a Warhammer game, which is Games Workshop (LON:GAW) ‘s brand. That share has been a stunning performer, pity I sold mine at 1200p, as it’s 8-bagged since then! So it will be interesting to see how the customer passion for GAW’s products will (or won’t) translate into computer games. Incidentally, I see GAW itself has risen to a new YTD high today on a positive update.

Paul’s Section:

Robert Walters (LON:RWA)

466p (pre market) (£348m) - Trading Update - Paul - AMBER/GREEN

Robert Walters plc (LSE: RWA), the leading international recruitment group, today provides an update on current trading.

The current year is FY 12/2023.

April & May 2023 saw net fee income down by 10% at constant currency, 9% reported.

That’s triggered a full year profit warning -

It is now considered likely that profit for the full year ending 31 December 2023 will be significantly lower than current market expectations.

I don’t know if you can make sense of this next bit, but it seems contradictory to me - the market’s weak, but also strong is how this reads to me! -

Reduced levels of candidate confidence and lengthening time to hire were signalled in the second half of 2022 and, contrary to the Board's prior expectations, are not yet showing sustained improvement. Conversely, recruitment market fundamentals such as job flow, candidate shortages and wage inflation remain solid, suggesting that when market confidence recovers there will likely be a return to meaningful growth.

Costs - looks like it might have ramped up overheads at the wrong point in the cycle, perhaps? (easy to say with hindsight) -

The Group has invested significantly in both headcount and its global infrastructure over the last two years, and whilst appropriate cost reduction is central to the management of the current short-term pressure, we will protect our strategic core to ensure we can fully benefit from future growth opportunities as they arise.

Next trading update will be on 6 July, for the whole of Q2.

Broker updates - there’s nothing on Research Tree since 2019, so unfortunately private investors will now be at an informational disadvantage compared with the preferred clients of the brokers who will be sent a broker note detailing how much the profit miss is likely to be. We’re kept in the dark. This is highly unsatisfactory and unfair. Information is supposed to be released to all investors at the same time, that’s a core requirement of company law. So giving some investors privileged information (because the brokers have privileged access to the company, and broker forecasts are basically the company’s forecasts) seems to break that principle.

Current forecast consensus is 49.8p, so at 466p/share the PER is 9.4x.

If revised EPS drops 20% to 40p, then the PER would be 11.7x

If revised EPS drops 40% to 30p, then the PER would be 15.5x

The share price found support around 400p at recent lows, but depending on how bad the forecast reductions are, then it seems likely to me that the share price is more likely to be starting with a 3, than a 4, later today. We’ll soon find out.

An interesting long-term chart, showing that buying after previous disappointments is a good strategy -

Paul’s opinion - shareholders don't like profit warnings, but for medium to long-term holders, this shouldn’t be too much of a worry, as earnings & hence the share price are likely to recover once economies are back on track. Plus it gives long-term watchers (like me) a potential buying opportunity.

The medium-term track record is good, with an obvious spike down for covid, but either side of that, earnings look quite reliable. This is a high quality business in my opinion -

Balance sheet - I’ve checked the last set of accounts, and it’s important to note a very healthy balance sheet, with NTAV of £155m, including net cash of £97m. So there’s no issue at all with dilution or insolvency risk, despite a profit warning shareholders can still sleep soundly at night (well, once this heatwave has passed anyway!).

Dividends are well-covered too - it looks like the policy is to pay out about half earnings as divis. So it’s possible divis for this year might be cut, but given its balance sheet strength, the dividend paying capacity is still intact.

My opinion - clearly a disappointing update, and shareholders are likely to take a bath today. However, I don’t mind profit warnings from fundamentally strong businesses, as they recover in time. For that reason, I’m leaning towards seeing today’s news as more of a potential buying opportunity, than a cause for alarm. There doesn’t seem to be anything fundamentally wrong with RWA, it’s just entered a period of softer trading probably due to macro factors. Most of its operations are overseas (Europe & Asia), with UK relatively small.

Is this a precursor to a recession? Who knows. It does make me a little more wary about the macro picture though, as labour markets were supposedly strong.

Anyway, for long-term holders I don’t think there’s anything to panic over. Yes the shares are likely to fall, but in time they’ll recover. Probable read-across to other staffing companies too, so it might be an idea to review any other holdings you have in this sector, and consider selling a few perhaps?

Note that the StockRank is high, confirming the quality of the business. Although I imagine the Momentum score is likely to drop after today's profit warning -

Marks Electrical (LON:MRK)

Up 4% to 95p (£99m) - Preliminary Results - Paul - AMBER

Marks Electrical Group plc ("Marks Electrical", "the Company" or "the Group"), a fast-growing online electrical retailer, today announces its unaudited preliminary results for the year ended 31 March 2023 ("the year" or "FY23").

We previously reported (here on 13 April 2023) MRK’s FY 3/2023 year end trading update, with the key points being: revenues £97.8m (up 21.5%), net cash £10.0m, aEBITDA >£7.5m, positive start to April, Canaccord forecast 4.7p EPS.

Let’s see how the actual results compare…

Actual results for FY 3/2023 -

Revenues £97.8m (exactly in line), up 21.5%

Adj EBITDA £7.5m (again, exactly in line), up 4%

Adj EPS 4.82p (ahead of 4.7p forecast)

The more meaningful profit measures are actually down a little, eg. adj EBIT £6.24m, down 2% vs LY.

Net cash £10.0m (exactly in line)

So no surprises in the above, it’s as expected.

What about outlook & current trading - this sounds encouraging for FY 3/2024, and sounds in line (without directly saying so) -

Webinar - tomorrow at 14:30, organised by Equity Development, sign up link is here. Mgt came across very well on previous webinars, in my opinion. Definitely backable people - hands-on entrepreneurs (from any background, I don’t care about that), which is the main thing I look for in small caps.

Other sundry things I spotted in the accounts -

Finance income has gone up from nil, to £71k, suggesting that net cash is now earning some interest, and is not just a window-dressed year end balance, good to see.

“Fair value gains” of £481k (£195k LY) helps boost profits. Does anyone know what this relates to? I can’t find an explanation in the commentary.

Balance sheet - looks good to me, and is building nicely year-on-year, with NAV at £13.8m (LY: £9.4m). Inventories look well controlled, and has fallen slightly to £14.2m, despite strong revenue growth. That’s an important indicator, that MRK is operating efficiently, getting stock in, then turning it around quite fast, essential in this sector.

Lease liabilities are very small, again suggesting an efficient operation.

Receivables are small, likely to be payments in transit from card processors I imagine, and maybe some commissions from selling warranties?

Overall, the balance sheet is good, so there’s nothing to worry about re dilution or insolvency.

Cashflow statement - looks healthy, nice clean numbers. Helped by favourable working capital movements (keeping tight control of inventories, whilst trade payables rose £3.5m).

Modest capex of £1.0m in the year, and nothing capitalised into intangibles.

Dividends paid only modest at £1.0m, so I’d say MRK has considerably higher future dividend paying capacity. Hence the modest 1.2% dividend yield should improve as the years go by, potentially quite a lot - I think this share could end up paying a yield of 3-4% without stretching itself.

Ownership structure - the founder owns 73.6%, which is uncomfortably high for an AIM stock. We like the owner’s eye here at the SCVRs, but are not so keen on the owner having complete control. iEnergiser spooked many of us.

Paul’s opinion - an interesting challenger in the electrical retail sector (online only), which I think is a much better business than AO World (LON:AO.) - MRK makes a superior operating margin, has much more % growth potential (as it’s starting off small), a better, simpler balance sheet, and importantly does not have extended warranty liabilities on its balance sheet (unlike AO, which has big potential exposure there).

So it’s a thumbs up from me for the business itself.

However, as mentioned before here on 16 Jan, and 13 April, I’ll only go AMBER on the shares, because they’re over-priced for my purposes. Canaccord reckons 5.1p EPS for FY 3/2024, which will mean no overall profit growth in 3 years. At 95p per share, we’re being asked to pay 18.6x, which is just too high, considering this is such a competitive sector, with absolutely no pricing power - quite the opposite, it’s a race to the bottom to win orders by offering the lowest price, which people compare online.

There are some economies of scale as it grows (more buying power, and more efficient deliveries with shorter routes serving more drop-offs. However, I think there are also dis-economies of scale, as warehouses could become too large & unwieldy.

So what it boils down to is probably this -

- Do you want to invest in a low margin, highly competitive sector?

- Are you prepared to pay a full price for future growth?

I’m leaning towards no, on both questions.

That said, MRK has really impressed me, and I would pick this share ahead of AO and Currys, which both have significant issues in my view.

Could MRK end up beating forecasts? That looks quite possible, given the strong trading in Q1 to date. So the bull points are quite good, and if the shares were 70p or less, I'd go green. Also I'd like to see the free float increased, with the founder reducing to under 50%, ideally. AIM rules need to change, so that nothing can float unless there's a 50%+ free float. The current rules are ludicrous.

Roland’s Section:

Motorpoint (LON:MOTR)

Share price: Down 4% to 120p

Market cap: £108m

Final results - Roland - AMBER

The Group expects to emerge in a normalised market as a leaner and more valuable business ready to seize a significant opportunity.

Motorpoint’s high operational gearing is a consistent theme of commentary on the stock – for good reason. The company’s low margins and fixed cost base mean that profits can swing wildly given small variations in margin and revenue.

Today’s results highlight why it’s important to understand this. Motorpoint’s revenue rose by nearly 10% last year, but operating profit fell by almost 75%.

The firm’s shares have now also fallen by 75% from the record highs seen in 2021:

Let’s take a look at the numbers to understand more. Does this business offer a turnaround opportunity, or is it now at risk of failure?

Results summary: today’s results cover the year ended 31 March 2023. They show record revenue but a significant fall in profits, due to higher finance costs and a reduction in gross margin on used cars due to stock shortages.

Revenue up 8.9% to £1,440.2m

Gross profit down 19.4% to £85.7m

Gross margin: 6.0% (FY22: 8.0%)

Operating profit down 72.8% to £6.8m

Operating margin: 0.5% (FY22: 1.9%)

Finance expense up 103% to £7.1m (FY22: £3.5m)

Pre-tax profit (loss): £(0.3m) (FY22: £21.5m)

That’s the bad news. There was also some good news.

Motorpoint has strengthened its balance sheet somewhat by reducing stock levels to 51 days (FY22: 54 days) and carrying out sale and leaseback deals on two properties. The group ended the year with net cash of £5.6m (excluding stocking facilities), versus a FY22 net debt of £21.2m.

Market share also continued to improve:

Market share (0-4 years old): 3.5% (FY22: 3.1%)

Avg mkt share within 30 min drive of store: 8.9% (FY22: 7.7%)

These metrics suggest to me that Motorpoint is maintaining its record with customers for competitive pricing and good stock availability. This reflects management’s deliberate strategy to give up some margin last year, in particular on finance commissions.

As a result of this, retail gross profit per unit fell to £1,300 (FY22: £1,466).

The number of vehicles sold last year fell despite market share gains. This implies a significant reduction in used-car sales across the UK:

Retail vehicles sold down 8.9% to 57.3k (FY22: 62.9k)

Wholesale vehicles sold down 6.9% to 32.4k (FY22: 34.8k) - wholesale sales are customer part-ex vehicles sold through Motorpoint’s B2B auction service

Motorpoint opened two new locations last year, taking its total to 19, but the company has now paused its expansion programme. However, online sales have continued to grow, even as the pandemic effect passed:

Ecommerce revenue up 5.7% to £660.5m

Electric vehicle: today’s results mention the “widely-documented fall in value of Electric Vehicles” as one reason for the drop in margin. The company says that in the latter part of FY23 (i.e. Sept ‘22 - Mar ‘23) stock values fell by as much as 30% over a four month period.

We aren’t told what the profit/loss impact of this was, but it highlights the risk the company faces if it’s caught out by market moves in used car pricing and valuations.

However, when I look at Motorpoint’s website today, the company only lists 128 electric cars for sale out of a total stock list of 4,965. I don’t expect any further impact from EV pricing falls.

Finance costs: the impact of rising interest rates was also significant and will be longer-lasting, in my view. Borrowing costs affected Motorpoint’s results in two ways last year:

interest rates on the group’s stock financing facility rose, so it cost more to hold vehicles in stock. This may have been one reason why the number of days’ stock held was reduced.

Rates on car purchase finance also rose. Motorpoint says it sacrificed some of its finance commission to reduce the impact of higher finance charges on customers.

Higher borrowing costs are here to stay, in my view. But once rates level out, then I’d imagine the impact of this will be much less significant – prices will simply have to adjust.

Outlook: trading in FY24 will continue to be impacted by higher interest rates and inflation. But CEO Mark Carpenter says that recent growth in new car registrations should mean that used vehicle supply improves over time.

Meanwhile, Carpenter is confident that last year’s market share gains should also help to drive future growth and improved profitability.

There isn’t any specific financial guidance for FY24, perhaps unsurprisingly.

Consensus forecasts on Stockopedia prior to today suggest that adjusted earnings are expected to recover to 8.4p per share this year. That would price Motorpoint at 15x forecast earnings – not expensive if you believe that earnings can eventually recover to pre-pandemic levels of c.15p per share.

Roland’s view: it’s probably worth remembering that this business is 25 years old and has weathered previous slowdowns.

Another positive, for me, is that CEO Mark Carpenter has a 9.9% shareholding, so his interests should be aligned with those of shareholders. Founder Mark Morris has retired from the board, but also retained a 4.7% shareholding.

I’ve admired this business in the past. I think it’s well-run, with good scale and an attractive customer offer. However, I have to admit that I started this review thinking that I might have to go red on this stock.

However, after looking at today’s results I feel more positive. I think Motorpoint remains in reasonable financial health and could recover strongly over the next couple of years. Risks remain, but I’m happy to go amber on this stock.

Castings (LON:CGS)

Share price: 427p (+5% at 09.50)

Market cap: £177m

Final results y/e 31 March 2023 - GREEN

Our customers continue to increase schedules with the demand for heavy trucks in particular remaining very strong.

Today’s results provide straightforward commentary and clear, unadjusted accounts. Reading these makes a refreshing change from the opaque jargon and adjustments used by many firms.

Castings’ main business is producing cast iron and machined parts for truck manufacturers. The group is also expanding into areas such as wind energy.

This business had a frustrating time in 2021 and 2022, when it was forced to hold back production because its customers could not get the computer chips they needed to build new vehicles.

Automotive supply chain issues now seem to have been largely resolved and Casting has had a strong year. Shareholders are now set to receive a special dividend in addition to the ordinary payout, which has not been cut for over 30 years.

Results summary: turnover rose by 35% last year, lifting operating profit by 36%. The company says its despatch weight – an indicator of volume – was at the highest level since 2014 (although I note that operating profit was 24% below 2014 levels):

Revenue up by 35% to £201m

Operating margin: 8.2% (FY22: 8.1%)

Pre-tax profit up 38% to £16.4m

Basic earnings up 61.5% to 31.66p per share

Ordinary dividend up 6.9% to 17.35p per share

Special dividend of 15p per share declared

Net cash: £35.6m (FY22: £35.8m)

Return on capital employed: 11.9%

Castings’ financial performance was strong last year and the balance sheet looks bulletproof to me. Net cash of £35.6m is equivalent to nearly 18 months’ operating expenses.

The total dividend of 32.4p gives a trailing yield of 7.6% at current levels – nice to have.

Trading commentary: last year’s rapid increase in customers’ build schedules supported higher profits, but the company says this was skewed towards “certain production lines”. Rebalancing activity in the firm’s foundries “caused some inefficiencies” but this is now said to be “behind us”.

My reading of this is that experienced operational management handled the challenges well. Margins were unchanged last year despite this sudden increase in volumes. In my experience, some less accomplished manufacturers would have taken a hit to margins in order to fulfil the surge in orders.

Castings reports its results under two segments, foundry operations and machining.

Foundry: output increased by 6.6% to 53,100 tonnes last year. External sales revenue rose by 36.7% to £199m, mirroring the growth in group revenue. Segmental profit was £16.3m (FY22: £13.1m).

Higher costs have been passed through, but with some disruption due to production rebalancing.

Machining: this is the CNC Speedwell business. Revenue rose to £27.7m last year, (FY22: £22.5m) but only 7% of revenue came from external customers.

Segmental profit for the year was £0.2m (FY22: a loss of £0.9m).

Management say that £1.4m has been invested in this business during the year, including £0.4m on automation and £0.5m in a more power-efficient cooling plant.

These productivity and engineering improvements are said to have driven an improved profit performance in the final quarter.

It would be easy to look at the segmental results and suggest the disposal of the machining business. But the small proportion of external revenue implies that the majority of machining activity serves the needs of the foundry business.

Keeping CNC Speedwell in house seems prudent and in keeping with the company’s focus on providing a quality service to its (much larger) clients. I think it’s a sensible strategy.

Outlook: Castings says its customers “continue to increase schedules” and that demand for heavy trucks is particularly strong. Demand from other sectors such as the US market, trailer braking and coupling systems and wind energy is also said to be growing.

Broker forecasts suggest earnings will remain at a similar level this year, putting the shares on c.14x forecast earnings.

Roland’s view: one risk often mentioned in connection with this business is that the adoption of electric vehicles could render the core foundry business redundant.

I think this is unlikely for the foreseeable future. It seems likely that heavy trucks will be among the last to make a wholesale switch to electric power, if indeed they do. I suspect that alternative solutions such as hydrogen may be more successful in this market, due to the power and range required.

In my view, Castings is a well-run and high quality business. However, the capital-intensive nature of the business means that returns on capital will probably always be relatively modest – last year’s figure of 11.9% was the highest since 2017, according to Stockopedia data.

Given this, this isn’t a business I’d pay too much of a premium for. However, Castings shares still remain below historic highs, despite recent gains.

Given the positive momentum in the business, I’m going to go green on this stock. I think there’s scope for profit margins to improve further this year as recent price rises fall through to profits.

Assuming demand remains stable, I think Castings continues to look fairly priced at current levels.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.