Good morning, it's Paul & Jack here with the SCVR for Wednesday.

Agenda -

Paul's Section:

Goodwin (LON:GDWN) (I hold) - interim results show improved profit vs LY. Strong balance sheet. Looks priced about right for now, but there's interesting potential upside from new contracts kicking in.

M&c Saatchi (LON:SAA) - another positive trading update from this PR group. It looks good to me, so am regretting having sold out recently!

In Style (LON:ITS) - interim results from this fast fashion eCommerce (and wholesaling) business aren't bad considering the sector-wide impact from supply chain costs/problems. ITS eked out a small (albeit reduced) profit, and has a strong balance sheet with plenty of cash.

Cineworld (LON:CINE) - terrible news today, as this hugely indebted cinema chain has now lost a big legal case. It looked insolvent even before the adverse judgement, and by my calculations doesn't have enough cash on hand to pay the legal damages. With over $5bn in gross interest-bearing debt, equity holders look very vulnerable to being wiped out either completely, or through a discounted equity raise. Massively risky, I think the equity is worth nothing. Bargepole. That said, it was propped up by the lenders last year, and 4-bagged from the lows (a surge that has since dissipated). So who knows? A share only for reckless gamblers, not investors.

Jack's Section:

Midwich (LON:MIDW) - full year profits to be materially ahead but also notes ‘ongoing product shortages’. Resellers tend to have low margins and struggle to create enduring value, although some do break free and act as larger-scale consolidators. I’m neutral here - good trading, but I'm not sure the company deserves too high an earnings multiple.

Avon Protection (LON:AVON) - another fall for the troubled former High Flyer. Winding down the body armour business is not Avon’s finest moment, but the share price reaction has been extreme, while brokers are forecasting a fairly swift rebound. Ongoing supply chain issues are a concern. It’s worth keeping tabs on, but management has made some big errors and not much has been done to explain these or convince me that lessons have been learned.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Goodwin (LON:GDWN) (I hold)

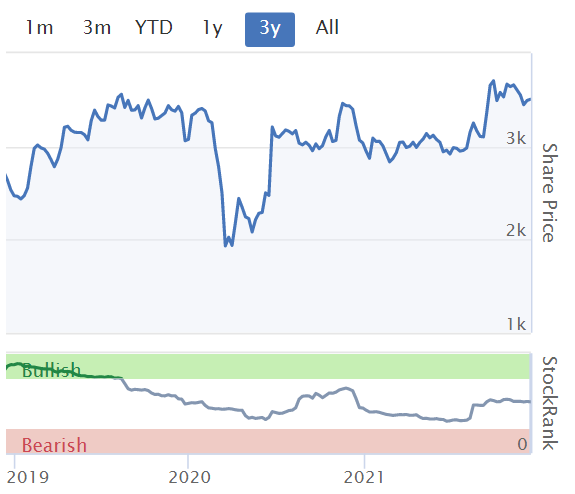

3200p (down 7.5% at 08:10) - mkt cap £253m

Goodwin is a family-controlled engineering group. It used to rely on the oil & gas sector, but has been diversifying in recent years. The investment case has been explained to me by several shrewd investors, who point to large, long-term contracts (e.g. nuclear waste storage containers) which are coming on stream in the future. Hence it’s all about the future potential for earnings to grow. In the meantime, the business has proven resilient during the pandemic, and is conservatively financed & run.

H1 revenue up 10% vs H1 LY at £68.9m, and is flat vs H2 LY

Profit before tax of £7.7m shows a decent profit margin of 11.2%, and is up 33% on H1 LY

Profits are reported simply, with no adjustments, which emphasises that this is a traditional, conservative company (as we often find with family-controlled businesses - they tend to take less risk than companies run by hired hands trying to maximise their personal gains from share options, and who can walk away if it all goes wrong)

Diluted EPS in H1 is 72.12p, up 30% on H1 LY - which seems a decent result, although I can’t find any broker forecasts, so don’t know what was expected.

Note the significant minority interests (called “Non-controlling interests”) which accounts for £458k of retained profit, or 7.6% of total profit (this relates to minority shareholders in subsidiaries whose entire profits are consolidated into the group accounts). This is adjusted for in the EPS calculations, so it’s best to always use EPS when doing a valuation.

Balance sheet - looks good. NAV of £114.6m, less £24.5m intangible assets, results in NTAV of £90.1m, which is more than adequate. It’s a fairly capital-intensive business, with fixed assets of £82.9m.

Working capital looks very healthy, with a current ratio of 2.37 - helped by bank loans moving down from current, to non-current liabilities last year - which must have been due to extending the maturity of bank facilities.

I’ve checked the last annual report, which shows £32.8m of freehold property, which are on the balance sheet at cost (see note 11), hence could be under-valued compared with current market value. Family-owned businesses like this can sometimes be a treasure trove of hidden property assets, which lowers risk for investors, often without us even being aware of it.

Net debt is £34.8m (ignoring lease liabilities), which seems OK to me. The going concern note refers to this as “modest”, which I don’t entirely agree with. I would say it’s acceptable, or not excessive, rather than modest. Banking headroom is described as “acceptable”.

I've searched for the word "pension", which doesn't appear, so hopefully that means no legacy issues?

Overall, no issues with the balance sheet - this is a solidly financed business.

Cashflow statement - working capital increases have absorbed most of H1 cash generation.

Capex was quite heavy at £9.2m in H1.

Outlook - generally sounds positive -

At the half year the Group's workload remains steady at £156 million and does not yet contain some of the major projects that the Mechanical Engineering Division has confidently been pursuing within the military, nuclear waste re-processing and surveillance markets.

Even with the expectation of an increased order input over the next six months, we expect the second half year pre-tax profits of this financial year to be possibly slightly better than the first half and for the benefit of increased activity and profitability to be realised over the next eighteen months.

This improvement is a feature of the strategic transformation of the foundry and its progress in creating an efficient environment to deliver high volume, high quality products for nuclear waste and cast naval components for its new customer base following the decline of its traditional oil and gas business. Furthermore, whilst we continue to experience inflationary pressures, the offsetting benefit of increased selling prices will be recognised within the next financial year.

The momentum within the Refractory Engineering Division shows no signs of slowing and the Group's eight companies supplying consumables to the jewellery casting, fire protection and construction sectors are well placed moving forward to continue to deliver strong results subject to raw material availability and consumer demand.

Valuation - is tricky, with no broker forecasts available to me.

Taking a stab at it, H1 was 72.1p, and the outlook comments say H2 could be “slightly better”, so maybe 80p? That gives c.152p for the full year, a PER of 21 times - not an obvious bargain, but not excessive either.

Given the upside from large, long-term contracts, alluded to in the outlook comments, I think this valuation seems reasonable, with medium term upside perhaps?

My opinion - for long-term holders, this looks a reassuring update.

There’s probably not enough excitement to attract new investors at the moment, especially given how strangely bearish & short-termist the small caps market seems to have become in recent months.

The share is extremely illiquid, with few traded, as it seems to mainly be held by long-term investors. I like it - it’s good to have some really solid, traditional companies in a portfolio, to provide stability and dividend income. There’s also interesting growth potential with GDWN from its diversification strategy away from oil & gas.

.

.

GDWN has an upper-medium StockRank, although with no forecasts available, the algorithms don't have key forward-looking data to assess -

M&c Saatchi (LON:SAA)

155p (up c.3% at 08:51) - mkt cap £189m

This PR/marketing group has been putting out positive updates for a while now, and we get another good one today -

Further to the last trading update on 23 November 2021, the Company is pleased to announce that trading has continued to be strong and, as a result, management now believes full year 2021 operating profit will be materially ahead of expectations.

Activity in the final quarter has been strong across the group, particularly in the Performance Media and Global and Social Issues divisions and the UK Agency. The strong performance was largely driven by new assignments from existing clients, and we expect this continued trend to be reflected in the December results.

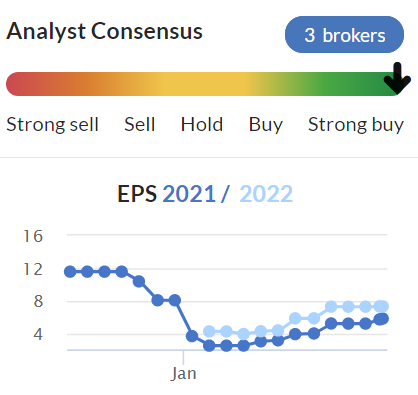

Valuation - as you can see, the broker estimates are on a recovering trend, and today’s update will see a further rise in forecasts.

Should we be valuing the share on the old forecasts of 12p earnings maybe, since the group seems to be recovering towards pre-pandemic trading? That would drop the PER to about 13, which is good value.

My opinion - I dipped my toe in here with a small starter sized position a few months ago, but it didn’t survive a recent portfolio trim. Maybe that was a mistake to sell them, given the continuing positive newsflow? This share does look quite good, with historic problems seemingly now resolved, and a strong recovery in earnings underway.

.

.

In Style (LON:ITS)

91.5p (down 9%, at 09:25) - mkt cap £48m

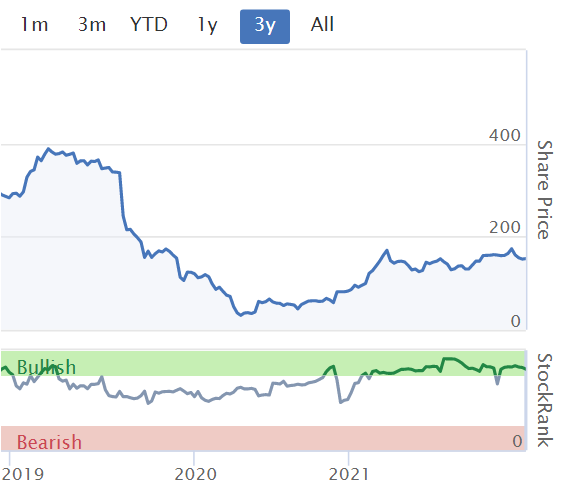

Checking our archive, I reported on a profit warning from this fast fashion eCommerce business here on 24 Sept 2021. That set off a steep fall in the share price, which has continued with today’s update. There were some positive elements in the last update, but overall I was inclined to sit on the sidelines because ITS did not give enough factual information on the key problem areas - supply chain freight costs & delays (no surprise there), and a much higher customer returns rate.

Moving on to today’s update, we have -

In The Style, the fast-growing digital womenswear fashion brand with an innovative influencer collaboration model, announces its results for the six months to 30 September 2021 (the "Period"). Financial highlights in this report are provided on both a year-on-year basis and two-year basis, reflecting the exceptional trading performance and growth in the prior year period:

A period of very strong revenue growth across all channels against an exceptional prior period

H1 revenue £29.8m (up 39% on H1 LY, and up 246% vs 2 year comparative pre-pandemic)

Growth was strongest in the relatively smaller wholesale channel, up 139% to £6.9m (23% of total revenues)

Profit before tax halved to £890k in H1 - but to be making any profit at all, as a small player in a highly competitive sector, is not too shabby.

Supply chain disruption and a higher customer returns rate are mentioned as adverse factors, previously flagged in the 24 Sept update. Action has been taken to try to reduce returns rate -

Since the Period end, return rates have reduced in line with expectations reflecting the seasonal change in the product mix, and we are confident of achieving a lower underlying returns rate over the medium term.

Supply chain - sounds under control, and at some point the stock market should start to anticipate upside on profits from supply chains improving, and shipping rates normalising -

As previously indicated by the Group, industry-wide global supply chain disruption and increased associated costs are expected to continue through at least the second half of the year. We continue to actively manage these external challenges as far as is possible and, so far, have successfully amended collection launch timings and deliveries into wholesale partners to minimise disruption. Detailed plans are in place to mitigate the longer-term cost impact of these external headwinds through both sourcing and product pricing initiatives.

Current trading & outlook - sounds OK to me, overall -

● | Since the end of the Period and through the important Black Friday and December trading period so far, the business has continued to perform well with direct-to-consumer sales continuing their strong growth trajectory. |

● | As anticipated, sales to wholesale partners have been lower than the prior year since the period end reflecting the phasing of orders, however the Group remains confident in achieving continued progress through this channel in the second half. |

● | Notwithstanding the industry-wide supply chain disruption that is expected to continue into the second half, the Board remains very confident in achieving the Group's growth plans and the brand's very exciting potential. This is underpinned by the strength of In The Style's differentiated business model and distinctive brand as well as the investments made in the Group's leadership team and infrastructure in recent periods. |

Balance sheet - looks good. £12.1m NAV, less £1.6m intangible assets = NTAV of £10.5m, including £9.9m of net cash.

Trade receivables looks very high at £6.0m, which suggests to me that ASDA and other wholesale customers might be using ITS like a bank - paying ITS invoices very late?

Overall, there are lots of very similar companies competing in this space, some of which are precariously financed (e.g. Missguided). Therefore having plenty of cash in the bank, and operating at a (modest) profit gives ITS a good chance of survival, where others may fall by the wayside.

My opinion - I was expecting to completely dismiss ITS as a potential investment, but at £48m market cap, and with reasonable numbers published today (considering the sector headwinds), risk:reward actually doesn’t look too bad.

My main problem with fast fashion eCommerce, is that the sector is so competitive, a small player like ITS just doesn’t have the marketing budget to take on the bigger competitors.

Also, with investor sentiment currently so negative towards this sector (e.g. Boohoo (LON:BOO) and Asos (LON:ASC) - both of which I hold), then I can’t see any reason to pick a small, me-too competitor, over the much more dominant (and now much cheaper), larger companies in the sector.

Some investors are worried about the impact of Chinese competitor Shein, which could keep the sector under a cloud for a while, who knows? I think it all depends what growth these companies can deliver going forwards, once the effect of the pandemic has washed through.

Overall then, on ITS I’m neutral. There are some attractions to the share, but I see larger competitors as probably having more upside potential on current bombed out share prices.

A disappointing IPO, but to be fair, the whole sector has de-rated massively since ITS floated -

.

Cineworld (LON:CINE)

33.0p (down 27%, at 10:44) - mkt cap £461m

This cinema group embarked on an extremely reckless, debt-fuelled acquisition spree, and ended up with an insolvent balance sheet, just as the pandemic struck last year.

My review of it here on 12 March 2020 pointed out that with NTAV negative at $(3.1)bn, there was an extremely high risk of insolvency. As it turned out, the shares bottomed out in Oct 2020, then annoyingly went on to 4-bag by spring 2021, as people gambled on it surviving. It just shows, that market sentiment can be wildly wrong, both on the upside and the downside sometimes. Fundamentals have reasserted their dominance, with CINE shares crashing back down again, having lost the speculative froth.

I remain of the view that the equity is worth nothing, because the company is in such dire straits with the balance sheet debt. Not to mention on-off restrictions with covid hurting cinemas, but also stoking pent-up demand when they can re-open maybe? The last trading update showed a steadily improving trend in attendances.

Maybe the banks want to keep the equity afloat, to provide a route to refinance the company with fresh equity in due course, thus reducing the risk for the lenders? Who would want to put in more equity though, and at what price? Even if CINE survives, there’s a big risk of a highly dilutive equity fundraising being forced on the company - giving existing holders that awful quandary of whether to accept massive dilution and write off your investment, or to stand your corner and put more money into a bad investment in the fundraising.

More bad news today, Cineworld has lost a big legal action against it regarding an aborted takeover deal -

On 6 July 2020 Cineworld confirmed that Cineplex had initiated proceedings against Cineworld in relation to Cineworld's termination on 12 June 2020 of the Arrangement Agreement relating to its proposed acquisition of Cineplex (the "Acquisition"). The proceedings alleged that Cineworld breached its obligations under the Arrangement Agreement and/or duty of good faith and claimed damages of up to C$2.18 billion less the value of Cineplex shares retained by Cineplex shareholders.

Cineworld defended these proceedings on the basis that it had terminated the Arrangement Agreement because Cineplex breached a number of its covenants and counter-claimed against Cineplex for damages and losses suffered as a result of these breaches and the Acquisition not proceeding, including Cineworld's financing costs, advisory fees and other costs.

The Ontario Superior Court of Justice has now handed down its judgment. It granted Cineplex's claim, dismissed Cineworld's counter-claim and awarded Cineplex damages of C$1.23 billion for lost synergies to Cineplex and C$5.5 million for lost transaction costs. Cineworld disagrees with this judgment and will appeal the decision. Cineworld does not expect damages to be payable whilst any appeal is ongoing.

My opinion - Google tells me that 1 Canadian Dollar is worth 59p, so C$1.23bn damages payable by Cineworld is about £730m - considerably more than CINE’s current market cap, so this is a seriously big deal. Is this liability enough to sink the company?

I’ve checked through the RNSs, and the last reported liquidity position was on 12 August 2021, with the interim results. This showed cash of $436.5m at end June 2021, plus another $200m term loan raised in July 2021, so $636.5m in total, or £482m in sterling. That’s not enough to pay the £730m damages, so I think CINE would need to raise yet more debt, and/or equity, to pay this fine.

The scale of its existing debt is mind-boggling. It had $4.86m gross borrowings at end June, so with the $200m new loan in July 2021, the total interest-bearing debt will now be over $5bn.

How much are its assets worth? There’s only $395m shown on the last balance sheet as land & buildings. The rest is leased. Plant & machinery of $861m probably doesn’t have that much resale value secondhand. So it’s a hopelessly insolvent balance sheet, with the only value coming from hope that cinemas can trade normally (and profitably) again at some point in the future, when the pandemic’s over. Or maybe some cinemas could be sold, to raise cash?

All in all, a dire situation. Therefore the equity is a pure gamble on CINE somehow surviving (maybe its appeal against the judgement might succeed)? Even if it does survive, at some stage this horrendous balance sheet will need to be refinanced.

I wouldn’t touch it with a bargepole, because the risk of a 100% loss is so high.

.

Jack’s section

Midwich (LON:MIDW)

Share price: 635.50p (+9.57%)

Shares in issue: 88,735,612

Market cap: £563.9m

Midwich distributes audiovisual (AV) tech to the trade market, with operations across EMEA, North America, and Asia Pacific. It was founded in 1976, specialising in computer distribution, before shifting to AV in 1995, and since 2006 it has been acquiring smaller distributors at pace.

Shares are roughly double the IPO price but have only just recovered to pre-pandemic highs (but note the softer share price in 2019, before Covid).

The group’s strategy has seen the top line grow at a good rate, while the operating margin has remained around the 4% mark. Understandably, Midwich made a loss in 2020 but EPS are forecast to bounce back more or less immediately.

This is a short update so I’ll quote the bulk of it.

Despite ongoing product shortages, the Group's trading performance has been stronger than expected since the Interim Results, published on 7 September 2021, with the UK & Ireland and EMEA performing particularly well. As a result, the Board expects that adjusted profit before tax for the year ending 31 December 2021 will be not less than £30 million, which is materially ahead of its previous expectations.

The group expects to make its scheduled trading update on 19 January 2022.

Conclusion

Distribution and reselling tends to be a low margin business and is not typically where the real value accrues in the food chain. That said, there are some good operators that have proven themselves over longer periods of time. Typically those that are well-run and have reached a large enough scale to begin acquiring smaller players.

For these companies, their economies of scale allows for a higher level of reinvestment, financial security, and the ability to consolidate fragmented markets. Given Midwich’s history here, it seems as though it might fit into this camp.

And the group is materially ahead of expectations - perhaps, in a tough market, this is an operator that has managed to take share and stands to benefit more from a recovery in demand.

That’s just a hypothesis though, and “supply chain disruption” is the phrase on most investors’ lips. Midwich is not immune here. It’s a dynamic situation so, while it’s not having an impact right now, that can always change.

There have been some significant director sells over the past couple of months too, coinciding with the recovered share price. I’m not about to draw a link between these sales and the short term outlook just yet, but it’s understandable if management thinks this is an opportune time to crystallise some value.

This isn’t the kind of business model I’m focusing on in the current conditions, so I’m neutral despite the ‘trading ahead’ announcement. I’m looking for higher margins and more obvious pricing power.

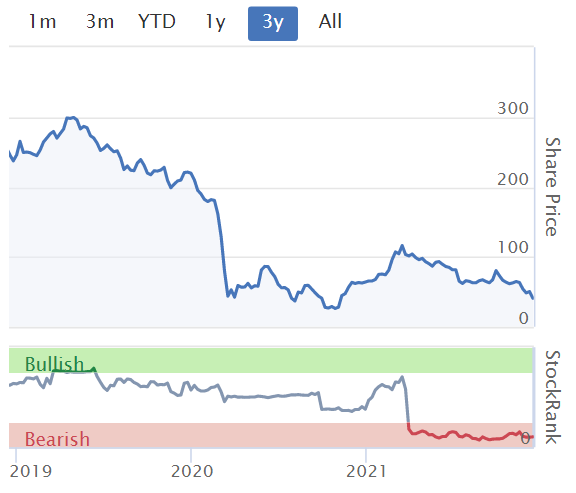

Avon Protection (LON:AVON)

Share price: 931.5p (-13.59%)

Shares in issue: 31,023,292

Market cap: £289m

This is one of the more intriguing situations around at the minute - previously viewed as a very high quality (and highly rated) but the story has come undone quite dramatically due to a concerningly fundamental aspect of its recently-acquired body armour business.

The market reaction has been brutal.

Highlights:

- Orders received +34.9% to $282.7m and closing order book +40.6% to $143.1m,

- Revenue +16.2% to $248.3m,

- Adjusted operating profit -42.9% to $22m, reported operating profit down from $8.9m to -$29m,

- Adjusted basic earnings per share of 60.6 cents (-38.5%) and a reported basic loss per share of 79.9 cents,

- Net debt has grown to $55.9m ($26.8 ex-leases), from a net cash position of $118.7m.

Armour

Having conducted an in-depth strategic review of our armor business, we have concluded that an orderly wind-down of the body and flat armor business over the next two years to fulfil our existing body and flat armor customer commitments is in the best interest of our stakeholders as a whole.

Expected net cash costs of closure and right sizing the continuing operations of between $3 and $5m in total across FY22 and FY23.

A wind down suggests Avon has not even contemplated a sale. They're closing down a recently acquired business, which is never a good look. This division was supposed to be central to the group’s future, so how has it all unwound so quickly? When you talk about management’s capital allocation skills as a key driver of future growth, this is an example of pretty dire misallocation.

No surprise, then, to see a capital allocation policy review:

Given the strong financial position, expected cash generation in our 2022 financial year and the Board's intention not to initiate any further major merger and acquisition activity until after our 2022 financial year the Board is undertaking a review of the Group's capital allocation policy.

Interestingly, this might include a share buyback programme.

Net exceptional non-cash costs of $31.1m consist of asset impairments of $46.8m, partially offset by a $15.7m contingent consideration provision release. This does not fully explain the substantial $51m difference between adjusted and reported operating profit. Other charges include $14.2m of amortisation of acquired intangibles and $5m of acquisition and integration costs related to Team Wendy and Ceradyne.

Respiratory and head protection

Respiratory protection remains well invested and is a ‘growing business with strong profitability and cash generation’.

The ramp-up of NATO framework contract for FM50 is a key growth driver and there are further opportunities with the U.S. Department of Defence (DOD), Rest of World Military, and First Responder customers.

Outlook

Growth expectations for FY22 and beyond are underpinned by long-term contracts in respiratory and head protection; opening order book excluding armor of $116.5m.

We are continuing to experience the impact of disruption in global supply chains and customer order pattern volatility, which we are actively working to mitigate, Given the ongoing challenges, we are taking a cautious view on the anticipated rate of growth for FY22 at this stage in the year. As such, the Board is guiding to revenues excluding armor, in FY22 of between $260 and 290 million, being growth of between c. 8 and 20%, with further revenue of up to $25 million from the armor business depending on the timing of DLA ESAPI product approvals

We expect our adjusted EBITDA margin to recover materially in FY22 given operational leverage and the actions to address overheads.

Conclusion

Avon has fallen from a High Flyer to a potential turnaround. That typically attracts a different crowd of investors. With sentiment shot and likely some churn in the shareholder base, my assumption is that there is no rush to make a decision just yet.

Brokers have reduced their earnings per share forecasts for the current year from 134.44p at the start of the year to just 54.64p, with the company figure coming out at 60.6c - quite a change, and I’d be surprised if anybody has a firm handle yet on the group’s revised prospects, although forecasts do assume a swift rebound.

The recent director buys at 2,000p-3,000p are perplexing. I listened to the investor call this morning and the tone did not encourage me - not much time at all spent on past mistakes, but there has been a profound misjudgement here which needs to be addressed. Otherwise, why should we provide capital?

There could be value at these levels - there was a lot of growth priced in just a few months ago - but credibility and market sentiment have taken a big knock. It’s a bad time for turning around, too, with ongoing supply chain issues, so it could be that the bad news is not over.

I’m keeping it on the watchlist given the revised valuation and remaining healthy business lines, but I don’t feel the need to rush in and call the bottom, and I’m not convinced at present.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.