Good morning from Paul & Graham!

Today's report is now finished.

Inflation data

Has come out today from the ONS (Office for National Statistics). Here's the link to the report. Key points seem to me -

CPI inflation rate is 6.8% in July, down from 7.9% in July - good news.

Not so good news -

"Core CPI (excluding energy, food, alcohol and tobacco) rose by 6.9% in the 12 months to July 2023, unchanged from June."

Commentators seem to think that stubborn core inflation, combined with accelerating wages growth reported by the ONS yesterday, could mean the Bank of England keeps going with even more interest rate rises. It seems crazy to me that they're doing this, when we don't even know what economic impact the large increases already implemented will have. Anyway, everyone's got their own view.

It seems to me that hurting people in their 30-40s who mainly have mortgages, is likely to increase demands for higher pay from key staff. And push up rents. Thus fuelling more wage growth, and higher inflation. Do the people making these decisions really know what they're doing? Judging by central banks' long-term track records, I'd say vehemently no! Accusations of "groupthink" have come from some eminent sources, eg Mervyn King, and Andy Haldane.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections

Gattaca (LON:GATC) - up 6% to 102p (£32.5m) - Trading Update (profit warning) - Graham - GREEN

An unusual situation with this STEM recruitment firm as the shares edge higher on a profit warning. Perhaps like others, I’m enthused by the company’s willingness to pay dividends, having already bought back some shares. The cheapness on offer here is hard to ignore.

Restore (LON:RST) - 126p (pre market) £173m - Interim Results - Paul - AMBER/GREEN

The share price of this group has really crashed this year, on a profit warning. I was expecting more bad news, given the precipitous fall of late, but today's update generally reassures me that things haven't got any worse. Forecasts reiterated. Crucially, the debt situation looks under control I think. Could be a trade for a bounce, I reckon. Possibly!

Essentra (LON:ESNT) - down 0.3% to 154.8p (£453m) - Interim Results (in line) - Graham - AMBER

This former mid-cap has dropped into small-cap territory following some disposals that cleaned up its balance sheet and have enabled special dividends and a buyback. It’s an international component manufacturer and distributor and looks fairly valued to me.

Calnex Solutions (LON:CLX) - Unch 137p (£119m) - AGM Statement - Paul - AMBER

It's in line with expectations, but remember these were halved only a few months ago. Rating looks very expensive now, I can't see why shares are so expensive, given that a poor year is expected. Nice balance sheet though, and historically it's made fat margins. Price looks way too high to me, so bulls need to be very sure that profits recover strongly from the weak level expected this year.

Marshalls (LON:MSLH) - Down 4% to 247p (£625m) - Interim Results - Paul - AMBER/RED

We've had 2 profit warnings from this building supplies group previously this year. Today it says markets remain challenging, and no recovery expected until 2024. It dodges the question of performance vs market expectations. Together with considerable debt from an ill-timed acquisition, I'm giving this one the miss for now.

Paul’s Section;

Restore (LON:RST)

126p (pre market) £173m - Interim Results - Paul - AMBER/GREEN

Appoints an Interim CFO today (previously notified that the existing CFO was bowing out). The RNS is signed off by the Interim CEO, the previous one having fallen on his sword after a profit warning, and what looks like a failure of the whole strategy to diversify by acquisition.

Now we make it a hat-trick, with Interim results!

I’m keen to look at this one before 8am if I can, to see if there’s a trading opportunity here (for a possible bounce). It has been on my watchlist for a few weeks, given the calamitous share price performance this year, on what was previously a quite highly-rated growth stock -

Restore plc (AIM: RST), the UK's leading provider of digital and information management and secure lifecycle services, today announces its unaudited results for the six months ended 30 June 2023 ("H1", or "the period").

Not a great start, with an unclear self-description above of what it actually does (the core business is document storage).

However, going through the rest of the statement, I’m quite encouraged by it. Crucially there’s no more bad news. Maybe the last profit warning could be the last one for this year ? -

Current trading remains in line with the Board's revised expectations to achieve an adjusted profit before tax of £31m for the full year.

Balance sheet - is weak, with NAV of £238m being dominated by goodwill on acquisitions of £294m. Erase that, and the £30m deferred tax liabilities (which is usually connected with goodwill), and I get NTAV negative £(26)m - not a disaster, but not ideal.

The other stand-out item is non-current bank debt of £123m, which is too high for comfort, partly offset by £25m cash, so net bank debt is £98m, which has come down slightly by nearly £6m compared with 6, and 12 months earlier. Banks and investors often focus on the direction of travel, as well as the actual amount of net debt, and are more tolerant when they can see it coming down.

As RST mentions in the commentary today, the business is still nicely cash generative (which I can confirm from the cashflow statement), so if it stops making more acquisitions, and limits divis & capex, then I could see it being able to reduce bank debt. Also, the key covenant measure of 1.8x EBITDA disclosed today is not into danger territory, and “well within” covenant levels.

So maybe the market shouldn’t be seeing this as a distressed debt situation, which was what I was beginning to worry about (and judging by the share price, so were investors in this).

Note that bank debt has been reduced by £35m (RCF), mostly funded by a fresh drawdown on US private placement notes (bonds) of £25m - note 10 doesn’t split these out, just calling the total “bank loans”. I’d like to know what the terms of the debt are, as it’s getting more costly each month as the Bank of England raises interest rates relentlessly, and the latest wage growth data suggests they might keep going with more increases, until they’ve succeeded in trashing the economy and impoverishing households with mortgages. Plus of course, the higher rates go, the riskier highly leveraged companies become, as just the interest cost alone is becoming onerous for many.

Overall, I’m still a bit worried about how much debt RST has, but it’s not at a level where I’d be ringing the alarm bells - particularly given that trading seems to have stabilised at a level where the business probably could reduce debt steadily in future.

Valuation - thanks to Canaccord for an update note today. They’ve pencilled in adj/dil EPS of 17.1p for FY 12/2023, down from 24.1p in 2022. If the business is now ex-growth, then I would only apply a PER of about 10 to that (also taking into account the heavy debt), so I get a valuation of c.171p/share. That compares with the market price of 126p currently, so possibility of a trade here for a bounce? I think maybe so.

Although that depends on who is selling in the market, and why? If institutions have lost faith in it, and want it off the books, the selling could continue. Or if they’re facing redemptions, and are forced sellers? Who knows.

My opinion - this is just a quick initial review. I think there are some positive signs here -

- Reiterating reduced guidance for 2023, so no more bad news.

- Maintaining a (29% reduced) divi suggests that it’s not panic stations.

- Sensible measures being taken to cut costs.

- Profit drop in 2023 is disappointing, but it’s not horrendous.

- Bank debt reducing, and whilst too high, doesn’t look dangerous.

Given the scale of the share price crash, maybe we’re due a bounce? It’s not a business I would want to hold long-term, but as a shorter term trade, this might be a buying opportunity? So it’s going on my watchlist as a possible trade.

EDIT: I'm tempted to go AMBER/GREEN for valuation reasons (could be a bargain trade), but think it's probably safest to stick to AMBER for now, as this is supposed to be a value report! Or maybe that means I should be more bullish, as I think it might be cheap now? I see it dipped in early trade this morning, but now seems to be edging up on a flurry of retail buyers. Actually, yes let's go with AMBER/GREEN, as I do think this looks a potentially interesting trade. I've just re-read the results, and it mentions that a lot of revenue is recurring, which helps.

Calnex Solutions (LON:CLX)

Unch 137p (£119m) - AGM Statement - Paul - AMBER

Calnex Solutions plc (AIM: CLX), a leading provider of test and measurement solutions for the global telecommunications sector, provides an update on trading ahead of its Annual General Meeting ("AGM") taking place at 9am today.

The current year is FY 3/2024.

It’s rare for the SCVR writers to completely disagree on any share, but that’s case with our recent comments on Calnex, as follows -

8/3/2023 - Paul viewed it RED at 117p, mainly on valuation grounds, as it looked much too expensive after a profit warning. On reflection, maybe that was a bit too harsh?

23/5/2023 - at 109p Roland viewed it GREEN after seeing excellent cash generation and a strong balance sheet in the historic FY 3/2023 results.

Much more important than our views, is that the market as a whole has been positive, taking the shares up to 137p in a nice rebound lately.

I wonder if this rise will stick, and puncture the moving average, or whether traders will bank their profits and move on (which is happening a lot right now with rebounds - sell the rally behaviour, typical of a bear market).

Today’s update at the AGM - this sounds a bit mixed, but reassures me that things haven’t worsened, and there might be some signs of a recovery possibly? This needs to be seen in the context of a sharp reduction in forecasts previously -

While customers continue to adopt a cautious approach to investment decisions, engagement levels remain high and there are signs of optimism with regard to the pipeline for H2 FY24, although the precise timing of orders remains unclear. Indicators across the wider industry also point to a cautiously improving outlook. The Board remains confident in the delivery of results for the year in line with current market expectations.

Cenkos (many thanks) was forecasting a drop in adEPS (adjusted, diluted earnings per share) from 6.8p FY 3/2023 actual, to only 3.6p this year - that’s from a note dated 23/5/2023. Assuming that’s still valid, since today confirms in line with expectations, gives us a PER of 38x the 137p current share price. That’s pause for thought. The way I look at it, shareholders holding this must be assuming that profits can roughly double in future, to get it onto a (still expensive) PER of 19x.

Supply chain - it says procurement issues are easing, which is what we’re hearing generally from many companies right now, which is helpful.

Balance sheet - I’ve just checked the last one, and it’s good, with plenty of net cash. No issues here.

Paul’s opinion - on reflection, I was indeed too harsh viewing this as red when it warned on profit in May 2023. Although as stated at the time, the main reasons were excessive valuation, and a nasty profit warning. It was being priced like a growth company, which is justified by the historic numbers, but not any more given that it halved guidance back in May, for FY 3/2024.

If you think profits are likely to double or more, then the valuation makes sense. If not, then it’s too expensive. An in line update isn’t good enough for me.

I think AMBER is a sensible view - nice company with good margins, but very expensive given that FY 3/2024 forecasts show a serious drop in profitability. Holders need to be very sure that this year is just a glitch!

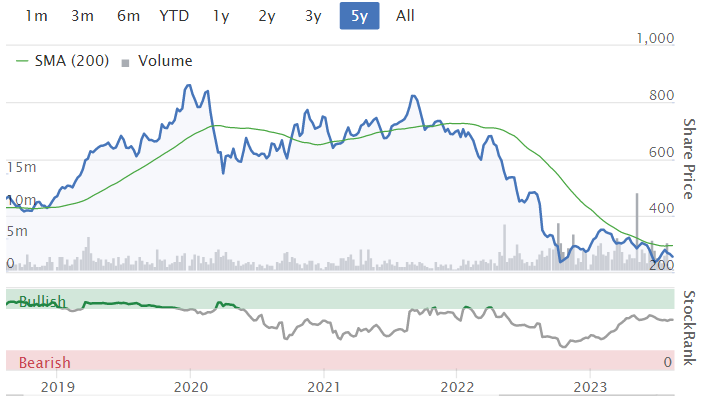

Marshalls (LON:MSLH)

Down 4% to 247p (£625m) - Interim Results - Paul - AMBER/RED

We’ve mentioned this building supplies company twice recently, with profit warnings on both 9 May 2023, and 31 July 2023. It strikes me that the share price seemed to shrug off the bad news surprisingly well. I've only done a quick review of the figures today.

Interim results today aren’t great: adj PBT is down 26% to £33.2m, but the underlying picture is worse, due to the figures being boosted by a full H1 contribution from a big acquisition. You can see the bigger picture from the reported segmental analysis.

There are some fairly big adjustments too, including restructuring costs.

Net debt is a bit of a worry, at £185m (pre-IFRS 16). This is also costly now, consuming over 20% of operating profit with finance costs.

Balance sheet isn’t great, but just about tolerable, providing trading doesn’t significantly worsen again, in which case things could get a bit tight.

Interim divi cut 54% to 2.6p.

Outlook - this sums it up well - but dodges saying anything about performance vs market expectations, and I don't have access to any updated broker notes either. This makes me speculate that we could see broker forecasts quietly dropped further this year maybe?

Paul’s opinion - this is only brief, as I can’t see much point in digging deeper into the shares of a company that I wouldn’t be interested in investing in at this stage.

Bull case - profits should improve when current tough market conditions improve. Shares peaked at about 800p not long ago.

Bear case - consensus broker forecasts seem to be in a declining trend still, and the outlook today suggests recovery isn’t likely an time soon. Not cheap, on fwd PER of 12.7x, and there’s all that bank debt to consider too. Is it wise to be paying divis at all, given the uncertainty?

The share price is now back down to where it was 20 years ago. Is that an opportunity (for a big rebound in future?), or evidence of a not very good business? I don’t have a strong view either way.

It’s a pity the group geared up with a big acquisition at the wrong point in the cycle.

I think there could be better risk:reward situations in the sector, so this one’s not of interest to me.

Hence I think AMBER/RED, to reflect the wobbly outlook, and the bank debt.

It wouldn't surprise me for this share to have another leg down, to a new low, given that talk of recovery now seems some way off. This is a similar reason as to why I've cooled on the housebuilders too, as discussed here last week after an update from Bellway (LON:BWY) showing the order book massively down.

Graham’s Section:

Gattaca (LON:GATC)

Share price: 102p (+6%)

Market cap: £32.5m

Gattaca plc, the specialist staffing business, today provides the following unaudited trading update for the financial year ended 31 July 2023 ("FY23").

This isn’t one I usually cover but it should make for a nice company to compare with SThree (LON:STEM) (a share I usually write positively about!)

Here are the full-year highlights:

Net fee income down 1% to £43.6m. This is below estimates (not stated in the RNS).

Slightly heavier weighting in contract vs. permanent recruitment than last year. Contract 72%, permanent 28%.

“Continuing underlying PBT of £2.5m” is ahead of expectations due to “cost rebalancing programme and exit from low margin contracts”.

Contract recruitment: net fee income is broadly flat due to “exiting some low margin contracts”.

Permanent recruitment: net fee income fell 4% due to “industry-wide client and candidate challenges”.

Net cash is flat over the past six months at £21m, but is up compared to last year.

Outlook:

In light of the ongoing macroeconomic headwinds, particularly the uncertainty over the timing of any recovery in the wider economy and the Group's focus on sustainable contract growth, the Board currently expects profit before tax for FY24 to show marginal growth on FY23.

Estimates: Liberum have cut their adjusted PBT estimate by 25% to £3.0m.

Return of capital: the company plans to pay out a 2.5p full-year dividend, and a 2.5p special dividend. The EPS estimate for FY July 2023 is 5.6p, so this should be covered by earnings.

The company recently completed a £0.5m share buyback. With so much of its earnings flowing back to its investors, this seems like a very shareholder-oriented company!

CEO comment excerpt:

"The continued improvements in culture, staff retention and productivity are good signs that we are becoming a stronger business. Our progress has been impacted by the decline in the wider market, and although that is frustrating, I am pleased that we were able to continue to simplify and improve the business throughout the year and manage our cost base so as to report an improvement in profitability in the second half of the year."

Graham’s view

I wrote very harshly about this company in February, on the day of a profit warning. The company’s failure to generate statutory profits since 2018 was a red flag for me:

Despite my misgivings, I gave the stock a neutral rating, as it was only trading at a small premium to the company’s cash balance.

That remains the case today.

Despite the profit warning, the shares seem to actually be up this morning. That could be classic market inefficiency but I don’t think so. I think it’s because people understand that when a company is trading at an enterprise value of only around £10m-£12m, the real expectations for the business are already extremely low.

Much will depend on management’s intentions with the cash balance. Are they going to use it wisely? I don’t know.

As I write this, Gattaca’s enterprise value is c. £12m. At a 25% corporate tax rate, the expected £3m of adjusted PBT in the current financial year (FY24) translates to £2.25m of adjusted net income.

So I think the cash-adjusted PER here is about 5x (£12m divided by £2.25m).

Maybe this is good value? I think it could be. If management can do something reasonable with their cash pile, then it should be. I’ll tentatively give this stock the thumbs up today, on valuation grounds.

Management have shown shareholder orientation by returning cash to shareholders this year, so I want to give them the benefit of the doubt.

Essentra (LON:ESNT)

Share price: 154.8p (-0.3%)

Market cap: £453m

Paul covered this stock for the first time in January. It was previously too big to be in a small-cap report:

The great and the good are on the shareholder register: Soros, MFS, Fidelity, Invesco, etc.

Company description: “We are global manufacturers and distributors of vital component parts for hundreds of markets and thousands of products”.

They are focused on “injection moulded, vinyl dip moulded and metal items”.

H1 results: in line with expectations, and full-year expectations are unchanged.

There is a revenue decline, but a nice improvement in profitability:

Note that the above numbers are not like-for-like, as there was an acquisition in December 2022. The like-for-like revenue decline is 10.4%.

Net debt improves from £310m (!) to only £8m, following two disposals.

The company is now looking to expand again, as a “bolt-on acquisition pipeline is actively being managed”.

A special dividend of £90m has already been paid.

There is also a £60m share buyback programme, with only 27% completed in H1. So I guess the company will have to increase its net debt by another c. £44m in order to complete this?

Outlook excerpt:

The business remains resilient and has the ability to manage volume impacts, through implementation of pricing actions, and careful cost management.

CEO comment excerpt:

"Essentra has shown financial and operational resilience in its first half year as a pure-play Components business, making further progress towards our medium-term targets, despite the macro-economic backdrop.

We continue to demonstrate the strength of our business model, which is underpinned by our global footprint, the breadth of our offer across a wide range of end-markets and our focus on our hassle-free customer proposition.

Geographic breakdown: revenues from APAC were very weak, down 18.3% at constant FX. The large “Americas” segment was also down 12.6% at constant FX.

Medium-term targets:

Organic revenue >5% CAGR

Total revenue >10% CAGR

Adjusted operating margin c.18%

Operating cash conversion >85%

Net debt to EBITDA <1.5x

These aren’t bad targets to have but I note that there is no reference to return on capital. Manufacturers should have a ROCE target, in my view.

Also, the 5% organic revenue growth target makes sense if inflation is 2%, but what if inflation is 10%?

Graham’s view

This is another special situation, where disposals have created a very different investment proposition: it’s now a “pure-play” business rather than a diversified group, and its balance sheet is far less leveraged.

These situations can sometimes throw out interesting investment opportunities. For example, if the large fund managers who own most of this company were to lose interest in it after the disposals, its shares might get sold down to an irrationally low price.

There is little evidence of that happening, however, based on the movements shown on Stockopedia’s shareholder page.

As for the company itself, I’m only mildly enthused by its medium-term plans and targets. 5% organic revenue growth wouldn’t really be anything to write home about, although an adjusted operating margin of 18% would be a good achievement.

I’ve not seen enough here to get me excited about these shares, which on face value appear to be fairly valued. Let me know if I’ve missed anything important!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.