Good morning! Paul & Graham are here with you today. Today's report is now finished.

This is turning out to be a busy time, what with all the half year updates being issued. Busy, and confusing too, given how uncertain the macro picture (and hence company earnings & outlook) are.

Agenda -

Paul's Section:

Victoria (LON:VCP) - I looked at these results for FY 3/2022 last night. The share price has scrubbed off about £1bn in market cap, with its two-thirds decline this year. Results beat expectations and are strongly up on last year's numbers. The PER in single digits now does look attractive, although a big debt pile is equal to the market cap, so cannot be ignored for valuation purposes. I think it's starting to look interesting. EDIT: although on closer inspection of the notes, I'm not so sure. The preferred equity arrangements look costly & complicated.

Norcros (LON:NXR) - a reassuring trading update accompanied yesterday's AGM. No sign of a downturn in bathroom fittings. Or rather a small downturn in the UK has been more than offset by strong growth in S.Africa. Looks dirt cheap now, but that depends on how macro develops. Don't forget the big pension scheme!

Finsbury Food (LON:FIF) - a very reassuring trading update for FY 6/2022. The key issue, is that FIF is successfully passing on price rises to customers, and enjoying volume increases too, as its end markets recover. A huge new bank facility has been agreed for acquisitions. I check out the balance sheet too. This share looks very good value now, after the recent 30% fall, given that we now know it can cope with higher inflation, and supply chain problems, which are likely to get worse later this year for food manufacturers.

Costain (LON:COST) - H1 trading update provides a lot of reassurance, especially on its ability to pass on inflation to customers, which is apparently built into contracts. Trading in line with expectations. Plenty of cash. Looks very cheap, but beware the cash hungry pension scheme. Tiny margins, so profit/loss can swing wildly. Might be worth considering though, at a modest valuation.

Netcall (LON:NET) - another positive trading update, for FY 6/2022. This software company is on a roll, and FY 6/2023 forecasts have been rising significantly in the last year. I think it looks very interesting. Expensive, mind you.

Graham's Section:

PayPoint (LON:PAY) (£416m) - an encouraging update from this provider of services to small retailers. Q1 revenues are up 6% and all divisions are showing nominal revenue growth, even the “Payments & Banking” division which includes services in structural decline. The company’s debt burden has reduced compared to a year ago, and dividends will be paid both this month and in September. I continue to admire the quality characteristics of this share and believe that PayPoint maintains a lucrative quasi-monopoly in its niche.

Pendragon (LON:PDG) (£300m) - this group of car dealerships provides an H1 update that looks to have reassured the market. Underlying PBT is only down by 6% (from £35.1m to £33m) compared to the extraordinary result seen in H1 2021. This is despite underlying operating costs increasing by £20m! Eye-watering price increases are being passed on to customers in this era of tight vehicle supply, and PDG shares are priced for normality to resume before too long. If normality does not resume, the positive share price momentum here should continue.

Samuel Heath and Sons (LON:HSM) (£16m) (+8.5%) [no section below] - This is a small bathroom fittings company but it has been listed since 1994 and reliably earns a small profit and pays a dividend every year.

Today’s FY March 2022 results show revenue slightly lower than the last pre-Covid year, but profits up sharply (operating profit £2.15m) due to a reduction in sales and marketing spending. This spending has been reinstated in the current year, “as being essential for the future growth of the business”. The outlook for FY March 2023 is mixed - good sales momentum is offset by product development spending, inflationary margin pressures and supply chain concerns. The company has cash of £4.4m and remains a family business. It might be that rare thing: a low-risk micro-cap.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Victoria (LON:VCP)

404p (down 6% yesterday)

Market cap £472m

Victoria PLC (LSE: VCP) the international designers, manufacturers and distributors of innovative floorcoverings, is pleased to announce its preliminary results for the year ended 2 April 2022.

I’ll call that FY 3/2022, as it’s only 2 days into April.

This is one of many mid caps that have come back into my small cap universe, due to the general market sell-off. This is providing us with some marvellous long-term buying opportunities I think, for good quality businesses, that have sold off too much, unreasonably. Remember we’re buying all the company’s future earnings, not just this, or next year’s earnings, and earnings always recover after downturns, for decent companies. Then the shares go back up again, so we should be excited about market falls, not despondent. That doesn’t apply to all shares of course. Many were over-priced last year, so are just coming back down to more realistic valuations.

Is VCP a bargain then?

Here are my notes for the FY 3/2022 results -

Share price has dropped by two thirds from the peak of c.1200p last year, that’s almost a £billion of market cap reduction!

Highly acquisitive floor-coverings manufacturing group, with mid to high end products.

Revenues £1,020m, up 54%, of which +19% is organic growth - impressive.

Underlying PBT £73.8m (up 47%) - note this is stated after a hefty £34.1m finance charge, due to high debt - so any deterioration in trading would be geared by finance charges remaining unchanged, but operating profit falling.

Net debt is very high at £407m, but this is secure, fixed rate, covenant-lite bonds - much safer than risky bank debt.

Diluted EPS 40.2p (up 40%) - PER of 10.0 - might seem cheap, but remember that net debt is about the same as the market cap, so the PER would be in the high teens if debt were replaced by equity (you have to remember to adjust out the debt finance charges if recalculating the PER on a debt-free basis, so it wouldn’t be as straightforward as just doubling the PER).

Supply chain constraints & “significant inflationary pressures” are mentioned.

5 acquisitions made in the year.

Special relationship with Koch Equity Development, who provide convertible debt, £150m more was drawn down in the year. Note there are some warrants, causing modest dilution. VCP says it intends to repay this debt before it is available for conversion.

Senior debt - is large, but all fixed rate, covenant-lite bonds, repayable in Aug 2026 and Mar 2028 - so the high level of debt should not cause panic for equity holders, this looks a much lower risk strategy than bank borrowings.

Liquidity - over £200m available at year end, sounds fine.

Outlook - main points are -

- Q1 (Apr-Jun 2022) revenues & earnings in line with original budget expectations - strange wording - why not just say consistent with full year market expectations, which would have been clearer?

- Geographic diversity helps, as some markets stronger than others.

- Mindful of macro headwinds, but “numerous actions” have been taken to mitigate.

- Well positioned overall.

- Commercial demand returning, after pandemic downturn. Early in the cycle.

- Lower demand for a time cannot be ruled out.

- Low operational gearing - i.e. most costs are variable with revenues - the benefit of this was demonstrated in the pandemic - remained EBITDA positive, even when revenues were down 80% temporarily - this is a really good point.

Net debt - is £407m, rather high, but as mentioned above, is secure long-term, fixed rate bonds. Made up of - £258m cash, £632m senior debt, £32m unsecured debt.

Balance sheet - NAV £203m, less intangibles of £504m, gives NTAV of £(301)m - normally I would run a mile from a balance sheet this negative, but the long-term, secure nature of the bonds, means it’s more tolerable, and of course gives nice gearing to equity when things are going well - and reverse gearing when things are going badly.

But of course we do have to adjust the valuation to include the large debt pile.

My opinion - I like this group. Chairman Geoff Wilding has worked wonders with what was originally a sleepy little UK micro cap, and is now a >£1bn revenues international group. The acquisition strategy seems to have worked very well, although picking up a lot of debt along the way. It’s long-term, and fixed rate though, which means it doesn’t particularly worry me. Similar to Saga (LON:SAGA) actually, in that respect. I wish more companies would finance themselves with bonds, rather than risky bank debt that is so vulnerable to covenant breaches & nervous bank managers, in an economic downturn. Whereas companies funded by bonds can breeze through recessions usually.

Overall, at just over 400p, I think VCP shares are starting to look potentially interesting. That's tempered by the uncertain macro outlook, which could trigger a downturn from current strong levels of trading, possibly. For that reason, I'll add it to my watch list, but it feels too early to buy.

EDIT - many thanks for shipoffrogs, who points out in the comments below the large difference between the underlying profit, and the statutory loss. This is a very good point. On doing some further digging, I'm less comfortable with this share, because the preferred equity funding looks expensive, and complicated (see note 6). End of edit.

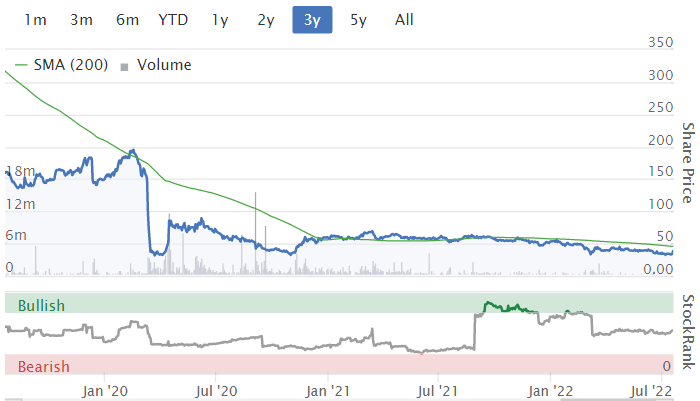

Note that it's given up almost all of the vaccines bull run from autumn 2020 through last year.

.

.

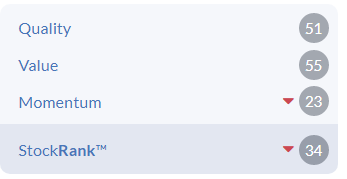

Stockopedia's emotionless computers wave a hand dismissively at this share -

.

Norcros (LON:NXR)

222p (up 2% yesterday)

Market cap £198m

Norcros plc ("Norcros" or the "Group"), a market leading supplier of high quality and innovative bathroom and kitchen products, issues the following trading update covering the 13 week trading period to 3 July 2022…

We might have expected a bathroom fittings group to be seeing a slowdown, now that the pandemic-driven home improvements boom seems to have fizzled out. That’s certainly what the share price has been anticipating.

Hence this is a pleasant surprise (very clearly worded too) -

The Group's overall trading for the first quarter was robust, with the Board's expectations for the full year remaining unchanged.

This is even more impressive, given that broker consensus expectations have been rising, not falling -

.

UK revenues in Q1 were slightly down, -2.2% vs LY, but 20.2% ahead of pre-pandemic, so most of that growth has stuck.

Some customer destocking in larger retail accounts is mentioned - destocking is worrying me a lot at the moment, as we’ve seen several companies (e.g. Luceco (LON:LUCE) & Supreme (LON:SUP) lighting division) taken by surprise at reduced demand, due to customers having over-ordered last year, and now winding down those excess inventories, as supply chains start to normalise. So it’s good to see NXR mention this, but it’s been absorbed without derailing the overall company performance.

South Africa (a big part of NXR) is storming ahead, at revenues +9% vs LY.

Outlook - this sounds upbeat, and I think NXR has established a good track record of telling it how it is -

"We have delivered a resilient first quarter performance against a backdrop of an uncertain economic and political environment. The Grant Westfield business is being integrated and continues to trade strongly. The Board remains confident that the Group's proven business model, leading brands, excellent service proposition and its commitment to new product introductions will continue to offer strong differentiation and deliver further progress and share gains, in line with its expectations, for the year to 31 March 2023."

My opinion - the valuation metrics (see below) look really attractive. As with everything, it depends on how the macro picture develops. A prolonged recession would no doubt reduce demand, and see shares fall further.

Two big factors to consider when valuing this share - large pension scheme deficit recovery payments, and political risk from having material operations in South Africa.

After a steep fall in share price, combined with solid trading & outlook, this share looks attractive to me. It’s also proven adept at making good acquisitions, at reasonable prices.

.

Stockopedia’s computers smile in an avuncular way on this share -

.

.

Finsbury Food (LON:FIF)

68p (before market open)

Market cap £89m

Finsbury Food Group Plc (AIM: FIF), a leading UK speciality bakery manufacturer of cake, bread and morning goods for both the retail and foodservice channels, is today providing an update on trading for the financial year, ended 2 July 2022, prior to entering its close period.

Let’s call that FY 6/2022. I don’t know why it used such a small font, I’ve had to zoom my screen to 150% to read it.

This sounds encouraging -

The Group delivered a robust full year performance in line with market expectations whilst having to manage and adapt the business under exceptional macroeconomic and inflationary headwinds.

FY 6/2022 revenues are up 13.9% to £357m.

It says 8.7% of the increase is higher volumes. The rest is due to price rises, which my workings suggest is +4.8% price rises. That’s encouraging, as it shows an ability to pass on cost increases, but we’re not told specifically what the cost increases are. Although since the overall result is in line with expectations, then clearly things have turned out as budgeted for, so that’s fine.

H2 was stronger than H1, with H2 revenues up 18.7% (volume +10.0%, the rest is price rises).

Cost inflation & passing on to customers - this is the key message to me, and I like it -

The Company has continued to be challenged by the persistent pressure from input cost inflation, staff shortages and other supply chain disruptions.

Pleasingly, it was able to mostly mitigate the impact of these pressures through revised commercial arrangements, operational improvements and other supply chain initiatives.

It will continue in the same vein as further inflationary cost pressures are expected in the new financial year.

That's the sort of thing well-managed businesses say. Badly managed businesses are taken by surprise by negatives, and put out profit warnings. We're really finding out now which are the well-managed companies, and which aren't. Hence I think I'll focus my share purchases on those that are successfully navigating these choppy waters, and avoid the ones that are struggling, no matter how cheap they look.

As we already know, food is a key area of higher inflation, along with energy, both of which are vital for FIF. Therefore, its reassurance today that it has been able to pass on these higher costs to customers, is tremendously reassuring.

New credit facility - I’m taken aback at the large size of this new borrowing facility, relative to the size of FIF. It strikes me as verging on excessive -

The Group also successfully negotiated a new four + one year £120m credit facility (£60m core + £60m accordion) effective as of 27 June 2022. As relayed in the February 2022 Interim Results announcement, the Board continues to explore opportunities to accelerate the growth of the Group through targeted acquisitions. Whilst the current stock market conditions persist and lower ratings of food manufacturers become a feature, these new credit facilities provide financial flexibility for the Group to pursue its significant growth ambitions.

Is this the right time to embark on a debt-fuelled acquisition spree? I would need some convincing. There again, FIF is trading well, and if it can buy up competitors on the cheap, then why not? Although it would increase the risk of something going wrong. Time to check back at what management track record is re previous acquisitions? If they've had to write off goodwill previously, then that would be a worry.

People who have done successful acquisitions in the past, and have a logical framework for what to buy, and what to pay, in a sector where they know the competition well, can work out well. Providing they can manage a larger group tightly.

Banks being willing to extend a large facility, in current conditions, demonstrates they have considerable confidence in the company & management, so that in itself is a positive.

CEO comments -

"To have delivered a record revenue performance this year that is in line with market expectations despite the challenging backdrop is testament to the hard work of our teams and the resilience of our model. Our Retail business performed well, we continued to see a bounce back in foodservice, and our Overseas division continued to see strong growth.

In recent years, we have experienced unprecedented challenges first triggered by the Covid crisis and now by significant input cost inflation and falling consumer confidence. While headwinds are expected to persist, we have a strong balance sheet and a successful track record of navigating challenging market conditions. I remain confident in Finsbury's ability to deliver on its long-term growth ambitions."

Uh-oh, he says they have a strong balance sheet, so I’ll have to check now.

Balance sheet - when last reported as at 25 Dec 2021 looks OK, adequate I’d say, not particularly strong. Once the £87.5m intangible assets are written off, NTAV is quite modest, at £26.4m, and remember this is a capital-intensive business, with £57.3m in fixed assets (PPE).

Note there is a pension deficit, on the last balance sheet at £14.5m.

The last annual report shows (note 12) that land & buildings are on the balance sheet at a NBV of £26.6m. That’s at cost. So there could be upside on the valuation of this property? The bank being prepared to lend £120m suggests to me that the property might be worth more than book value maybe? I'm assuming this is freehold property. The word "freehold" only appears once in the last annual report, in the depreciation policy note. I would have liked more details on this important asset.

So if there’s hidden property value here, it’s possible the balance sheet might be stronger than it looks.

If they do a webinar, I suggest asking: what is the current market value of the freehold property, would be a good question.

My opinion - I previously held a small position in FIF, but sold a while ago due to concerns over inflation.

Today’s update reassures me completely on this issue, and given that the share price has fallen about 30%, for as it turns out, no good reason, I think this share should go back on my personal buy list. Now that we know it can pass on higher costs successfully, then the downside risk on this share has greatly receded, in my view.

Look how cheap it is -

.

Stockopedia quite likes it too -

.

Costain (LON:COST)

38p (up 10% at 09:15)

Market cap £105m

Trading in line with expectations with strong cash performance

This is unusual - they’ve made the PR summary the actual title of the RNS. Why not? Quite a good idea, providing it’s accurate, which this is.

Costain is an infrastructure contractor, specialising in: transport, water, energy, and defence - all of which strike me as probably good sectors to be targeting at the moment.

Costain announces a trading update for the six months ended 30 June 2022, ahead of its interim results scheduled for 24 August 2022.

Inflation - very much like FIF above, COST addresses the main worry many investors have right now - the ability pass on inflation to customers. This sounds reassuring -

The Group has delivered a good performance in the first half, with revenue ahead of market expectations1, reflecting the inflation recovery mechanisms built into contracts as we passed through increased costs with higher prices, together with increased volumes delivering revenue growth in Transportation and Natural Resources. We expect revenue for the full year to be ahead of market expectations.

Particularly for a business like this, which operates on wafer-thin profit margins, being able to contractually pass on higher costs is not just nice to have, it’s essential for survival right now, I imagine.

Profitability - more important than revenues, and this is in line, not ahead -

Adj operating profit in H1 Is in line with management expectations.

FY 12/2022 - profit expectations are unchanged (but no footnote to say what they actually are).

Net cash - c.£95m at end June 2022, or 90% of the market cap! Ahead of market expectations, it says, due to “efficient working capital management”.

Good outlook for cash in H2 too -

...and we expect to deliver further positive net cash during the second half of the year.

Outlook - sounds good -

Our continued progress, supported by a strong order book and pipeline, gives us confidence for the remainder of the year and beyond."

My opinion - I don’t tend to invest in this sector, but the cheapness of Costain shares does make me wonder whether an exception should be made?

Looking through last year’s full accounts, the pension scheme seems to be consuming about £10m cash, that’s almost half of profits. So properly researching the pension scheme is of great importance before jumping in and buying this share blind. It’s shown as an asset of £67m on the last balance sheet - a very strange asset, that requires £10m p.a. cash outflows! Pension scheme accounting is just so rubbish, and highly misleading, it's a disgrace actually. Yet the accounting standards people don't seem to care. Same with the IFRS 16 nonsense. If people need to manually adjust accounts, then it means the accounting standards are no good, as a reader here correctly pointed out recently.

Lots of companies in this sector go bust, when big contracts go wrong. So checking for any contract disputes is another key point.

The last balance sheet looks fairly robust, with £146.5m NTAV, although that includes the false pension scheme “asset” of £67.2m, which I would delete (and should arguably be replaced by a liability for the real world cash outflows), which brings adj NTAV down to £79m.

Overall, the balance sheet looks OK, and it seems that COST receives cash up-front from customers, so it maintains a very nice cash pile.

The valuation metrics look ridiculously cheap, which is often because there’s a problem. Pension scheme cash outflows, super thin profit margins, high risk from big contracts, are the main reasons why. That said, there comes a point where even low quality businesses are too cheap. Given Costain’s reassurance today on contracts & inflation, its shares might be worth people taking a closer look, possibly?

Be careful with drawing lines on the chart, because the share count has gone up from 114m to 275m in the last 3 years. So 200p in old money, is only really about 60p in new money -

.

.

Netcall (LON:NET)

89p (up 1% today)

Market cap £133m

This software company caught my eye here on 10 June, when it announced a major contract win. It seems to be on a roll, and whilst the shares look expensive, I think the high valuation could be justified.

Netcall plc (AIM: NET), a leading provider of intelligent automation and customer engagement software, is pleased to provide the following update on trading for the year ended 30 June 2022.

Trading is ahead of expectations -

Following a strong trading period with good demand across our product portfolio, the Board expects full year results to be ahead of market expectations(1).

(1) Netcall believes that consensus market expectations for the year ending 30 June 2022 is revenue of £29.8m, adjusted EBITDA of £6.0m and Net cash of £8.0m.

Revised guidance provided today is -

Revenues £30.5m

Adj EBITDA £6.4m

Most of revenues looks to be recurring, with Annual Contract Value of £24.2m.

Net cash is £13.4m, which seems to be way ahead of the £8.0m forecast previously.

Outlook comments sound positive. The big contract win announced in June led to FY 6/2023 forecasts being raised significantly (see below, the lighter dotted line), to 2.55p EPS - a forward PER of 35 times - expensive for sure, but it seems to me something interesting is going on here, with growth accelerating.

.

Balance sheet check - this might surprise you, but it’s quite weak. At end Dec 2021, NAV was £26.1m, but that includes £30.0m intangible assets. Get rid of that, and NTAV is negative, at £(3.9)m.

Current assets of £17.9m (included £10.7m in cash) is less than current liabilities of £19.7m.

Does any of this matter? Not really, like many other software companies, NET gets paid up-front, before delivering the services. That means it can operate fine with a negative balance sheet, and has cash in the bank in advance.

But don’t let the talk of a big cash pile lull you into a false sense of security, because it’s customers' cash, paid up-front, not the company’s own surplus cash.

It’s not a criticism, I’m just flagging the facts.

My opinion - this looks terrific, although that’s been reflected in a high valuation on the shares.

Therefore the decision to make is whether to hold fire for a pullback, or throw caution to the wind, in the hope that the contract wins continue, leading to forecasts getting upgraded repeatedly again. With so much recurring revenue, the risk of a downgrade is probably fairly low.

Overall, I can see the appeal here, Netcall looks good to me. But expensive.

This video is 2 years old, but it shows a Doctor using the Netcall system, which is widely used in the NHS.

.

Graham's Section:

PayPoint (LON:PAY)

Share price: 603.6p

Market cap: £416m

Judging by the limited commentary on this share over the years, I’ve developed the impression that few private investors are interested in this one. But I’ve always thought that it has some interesting and attractive characteristics.

For example, how many UK small/mid-caps have paid a dividend every year since 2005, and continue to offer a generous yield? The yield on offer currently is 6.7%, according to Stocko.

The traditional PayPoint business revolved around helping customers to pay their bills, by visiting their local newsagent.

That business is naturally in decline. In general, people with good banking services who can use the internet do not need to pay their bills this way.

I think the strong association of PayPoint with this service helps to explain why its shares receive so little attention. If it was a shiny new fintech brand without any of its legacy activities, perhaps it would get a higher rating!

PayPoint’s services have broadened over the years. The company now provides “everything a modern convenience store needs”, including an electronic Point of Sale, a contactless payment device, parcel collection and ATMs. (link)

Let’s catch up with this morning’s trading update for April to June (Q1).

- Quarterly revenue +6% to £29.9m

- Largest division, “Shopping” is +8%, while the second largest division, “Payments & Banking” is +1.8%.

Note that Payments & Banking includes the services in structural decline (bill payments and mobile top-ups).

- Ecommerce division revenue £1.4m (2021: £1.1m).

This is the parcel delivery service Collect+. There has been “a resurgence in the clothing category”.

Analysis

PayPoint wants to be an all-in-one payments service provider to small shops, by offering a wide range of complementary functions available to every site. They appear to be succeeding in this mission.

In parcel delivery, they are starting from a small base. But they have potential, I think - they have a new partnership with wish.com, and have rolled out Amazon returns capability to 2,000 sites.

The Payments & Banking division is a mixed bag. PayPoint is very busy modernising it, as their traditional services dry up. But it’s not easy to guess at the future size of this division. Maybe they can tread water, and prevent it from shrinking at least?

Net debt reduces to £38m.

My view

I continue to have the impression that PayPoint enjoys a lot of pricing power over its customers.

Roland noted in his 2019 SIF article that PayPoint’s store network covers more than half the addressable market. PayPoint is the de facto standard solution for small shops.

And you can see the effects of this when PayPoint decides how much to charge, and when it changes its rates.

Earlier this year, PayPoint changed its service fee by half the RPI. The Federation of Independent Retailers wasn’t happy about this, and yet it had little choice but to accept it.

Indeed, the relationship between PayPoint and retailers hasn’t always been a very happy one. But again, I think a lot of this comes down to the fact that PayPoint has a lot of freedom to set its prices, and the retailers often feel like they have limited alternatives.

So for a company with this much pricing power, I find it curious that it has a P/E of only around 11x (adjust it higher for the debt load if you like)

To me, it’s a fintech company with a quasi-monopoly in its sector. Its operating margin and ROCE statistics are always excellent, and it generates lots of cash.

So does it not deserve to be rated higher than this?

Pendragon (LON:PDG)

Share price: 21.5p

Market cap: £300m

This car dealership group updates with another “strong” performance in H1 2022, but there is a reduction in underlying PBT from £35.1m to c. £33m.

The exceptional profits of recent times could not last forever and a decline will have been expected. Judging by PDG’s share price reaction today, investors are cheered by this PBT number.

The company reports that the wider market for new cars was down by 11.9% in H1, as supply constraints continue to bite:

As a result, the Group's focus has continued to be on maximising the level of margin achieved per unit, and strengthening the already robust order bank. New gross profit per unit is higher year on year and more than outperformed the volume shortfalls.

I’ve been impressed by the ability of car dealerships to earn large profits during a car shortage. I suppose this is what happens when you have an inflationary environment and very strong consumer demand: higher prices can offset lower volumes!

Having said that, there has been a softening of prices in used vehicles:

Used vehicle volumes were also down year on year as supply constraints from lower new car production continued to have a knock-on impact on used car availability. Used gross profit per unit also remained strong; although, as anticipated, this has been lower than the exceptional levels seen in H2 FY21.

Higher gross profits are offset by £20m of increased costs - the removal of government support, marketing campaigns, and higher labour/utility costs.

There’s not much else of interest in this update. In the outlook section, the company cautions that vehicle supply will be a problem for the rest of 2022, at least, and that consumer sentiment could soften in H2.

My view

I like to read how the car dealerships are doing as a check on economic conditions, but I’m not sure if I'd ever want to buy their shares. They are often good solid performers, but I find it hard to differentiate between them.

PDG shares might be seen as a bet on current conditions prevailing for longer than expected: low vehicle supply, and extraordinary margins for dealers.

You can see this in the StockRank: PDG shares offer both high momentum and high value. If only things stay as they are for another year or two, then PDG can enjoy these bumper profits for longer, and these “cheap” shares can continue on their upward trajectory.

The adjusted PBT forecast for this year was only around £55m, according to the most recent broker note that I can find. Pendragon is already 60% of the way there…

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.