Good morning from Paul & Graham!

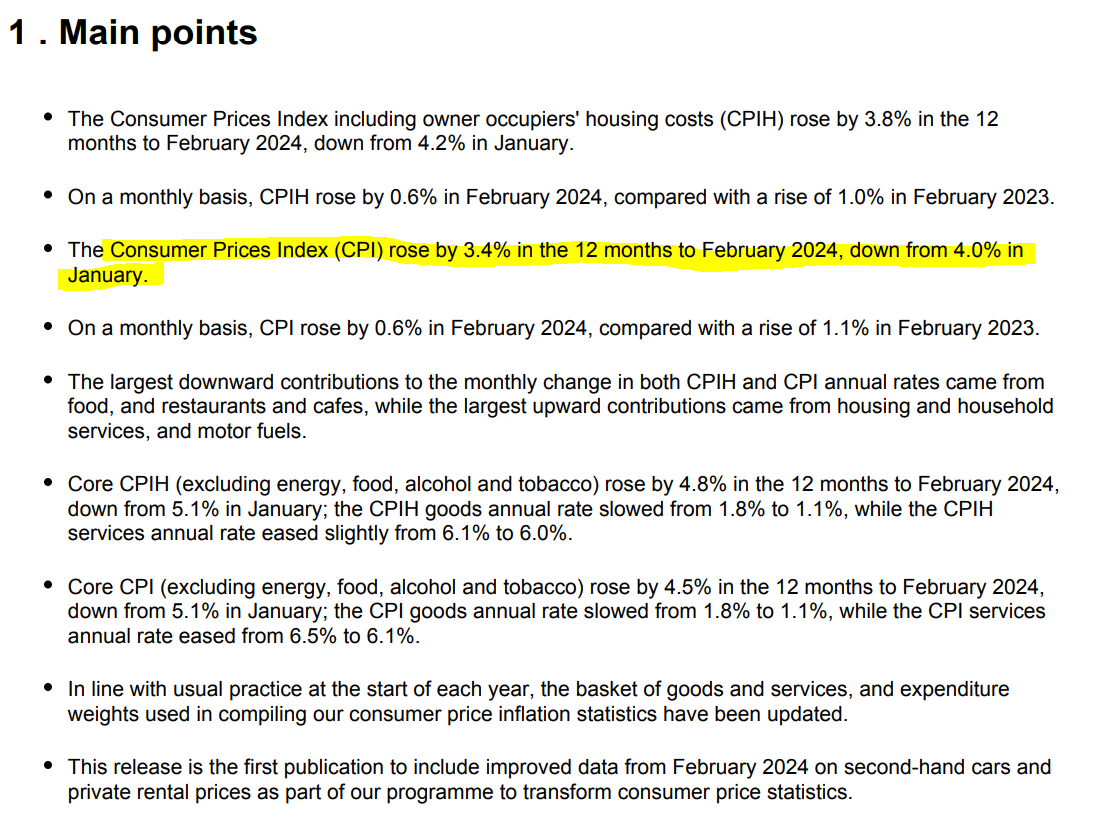

Inflation data

Is just out from the ONS at 07:00 - this looks encouraging, I see readers were discussing the forecasts of c.3.5% for CPI yesterday, it's come in slightly below -

(excerpt above: with thanks to the ONS pdf release at 07:00 today)

Paul's comment - surely this now makes the case for interest rate cuts stronger? Although the Bank of England looks into a lot more data than just the headline inflation figures. Conventional wisdom is that central banks need to raise interest rates to curtail economic activity, when inflation rears its ugly head. However in this case, I think the inflation was mostly caused by supply chain problems during and in the aftermath of the pandemic, and the energy crisis, so inflation would have fallen by now anyway.

There's also a persuasive argument that interest rate hikes in the UK might actually be fuelling inflation. Why? Because the impact on borrowers is mostly deferred, due to mortgages being fixed for a year or two, sometimes more. Meanwhile savers are feasting on interest income for the first time in c.15 years. In the short term anyway, higher interest rates have surely pumped money into the economy, not removed it? Although I don't have any reliable figures on this.

Also higher interest rates are fuelling private rent increases. I'm in exactly that situation with a buy to let, and I've been relaxed about the rent, not increasing it for years in order to keep good tenants. However, now the mortgage is set to more than double, I've had to tell the tenants it has to go up to full market rent, and even that won't cover the increased mortgage. That must be happening throughout the economy, with private rents and mortgage payments gradually rising, creating a hotch-potch of different effects on different households.

The sooner they get interest rates down to something more sensible, say 3.5%, the better. After years of being too low, they've overshot the other way now. This always seems to happen in most economic cycles, nobody making the decisions ever seems to learn, do they? Mind you, economists seem to have little to no ability to predict or plan the economy, so why do we take any notice of them at all?! I think policy is little more than educated guesswork, and very prone to group-think (as Mervyn King has emphasised in his interesting comments on the current situation).

NB. I should add that I'm not an expert in economics, but do understand the basics. It's fun to discuss anyway. In my network I often find that people with basic common sense and business experience can be excellent readers of the economic tea leaves. This was confirmed in the book Superforecasting, which I haven't mentioned for a while, a fascinating read. So don't let supposed experts shout you down, your opinion could be more accurate than theirs!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

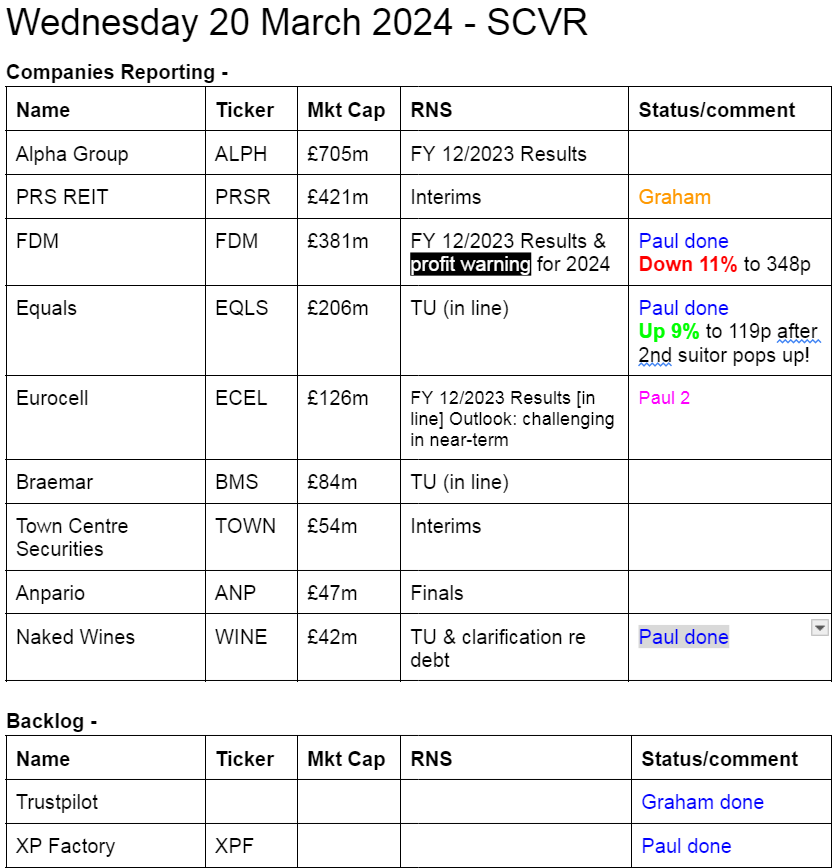

It seems like there might be a problem with the RNS this morning, with several people reporting that expected results for some companies have not yet come through.

Other mid-morning movers (with news) -

Johnson Matthey (LON:JMAT) - up 8% to 1837p (£3.37bn) - positive market reaction to disposal news (medical device components business) for $700m cash to Montagu Private Equity. Doing a $318m share buyback with some of the proceeds (c.7.4% of its shares). Not a company I’m familiar with, but the value metrics on the StockReport look quite attractive, and it might be worth a closer look maybe?

Abingdon Health (LON:ABDX) - up 24% to 10.5p (£13m) - Launching self-testing products for iron & vit D deficiency, being launched in Boots. Provided by ABDX in partnership with Crest Medical. No financial details, so I can’t add anything here. ABDX has been a serial loss-maker historically, and looks like an opportunistic pandemic IPO in Dec 2020 that’s c.90% down since then. H1 to Dec 2023 showed doubling of revenues to £2.4m, and reduced losses. I suspect it will need another fundraise, as net cash reduced to £1.3m at Dec 2023. So the usual pattern of positive news, then a placing into the spike, looks likely here, a cynic might say. Interim results mentioned it had orders in place from retailers, but didn’t name Boots.

Computacenter (LON:CCC) - down 5% to 2,788p (£3.42bn) - FY 12/2023 Results - PAUL - AMBER.

Adj PBT up 5% to £278m. Adj dil EPS up 3% to 174.8p (PER 15.9x). Outlook - expects an H2 weighting to 2024, due to “challenging” last year comparatives in H1. Bal sht looks OK, NTAV £627m, including “adjusted net funds” of £459m.

Paul’s quick view - good long-term track record, soundly financed, looks like earnings growth is taking a breather. Valuation seems reasonable. StockRank 96. On a very quick review, I can’t see anything wrong with it, other than the update today introduces the risk of a profit warning, given it says expect an H2 weighting. I’ll go AMBER.

Summaries of main sections

Equals (LON:EQLS) - 110p (£205m) - Trading/Strategic Update, PUSU deadline [in line] - Paul - AMBER

A reassuring trading update showing continuing strong revenue growth. Overall it says trading is in line with expectations. PUSU deadline extended yet again! UPDATE: Sky News says EQLS has been approached by Railsr with a proposed merger. Equals rushed out a response, confirming it has received "an indicative non-binding proposal" from a consortium including Railsr and (more importantly) TowerBrook Capital, regarding a "possible offer" for EQLS - so a takeover rather than a merger. Things are getting more interesting!

XP Factory (LON:XPF) - 14.75p (£26m) - Interim Results - Paul - AMBER/GREEN

A previous favourite of mine, but the forecast profits have failed to turn up! Highly misleading presentation of these lacklustre results (a small loss before tax) has undermined my trust in the company. That said, these are good formats, and it could power into decent profits in a consumer recovery, possibly? So on balance I remain moderately positive, but I also flag the downside risks below.

EDIT: See company's response to my article, clarifying the position with lease entries on balance sheet, which I have added below.

Trustpilot (LON:TRST) - 190p (£787m) - Results for 2023 - Graham - GREEN

Great results from Trustpilot as the company moved into statutory profitability for the first time after expectations had been raised during 2023. Another dose of operating leverage should provide a strong tailwind to profit growth in 2024. A share buyback is ongoing.

FDM (Holdings) (LON:FDM) - down 11% to 348p (£381m) - Preliminary Results - Paul - BLACK (profit warning), AMBER on fundamentals.

I have a quick look below at FY 12/2023 results, and its latest profit warning (last one Nov 2023). Business is still slow, and it's maintaining staffing capacity in anticipation of a recovery at some point. Balance sheet is fine, generous divis maintained. I've not yet seen any revised broker forecasts, so we'll have to wait to see what the damage is when consensus forecasts update. UPDATE: Shore Capital (many thanks) has updated, and it's nasty. - FY 12/2024 forecast EPS down from 26.6p to 21.1p, down 21% on already soft forecasts. So the 2024 forecast PER is now 16.5x - not looking bargain unless you factor in a considerable improvement in future earnings. So shareholders have to hope 2024 is a one-off bad year, and not the new normal.

Naked Wines (LON:WINE) - up 10% to 56p (£41m) - Trading & Refinancing Updates - Paul - RED

A clarification update today has helped stem the panic caused by Sky's report on Monday. Delving into the detail below, I'm far from convinced that WINE is out of the woods. Although there is a wide range of possible outcomes I think, good and bad, discussed below. Too much guesswork for my liking.

PRS Reit (LON:PRSR) - up 3% to 78.7p (£432m) - Interim Results - Graham - GREEN

PRSR has the largest portfolio of single-family rented homes in the UK, which continues to grow. Interim results show strong growth in LfL rents (11%) and excellent performance in both occupancy and rent collection. At a big discount to its official NAV, I like this one.

Yu (LON:YU.). - 1480p (£248m) - Final Results (out y’day) - Paul - AMBER

Fantastic 2023 results and a positive outlook for another good year in 2024, so I can see why bulls like this share and keep chasing it higher. As mentioned before, it's whether bumper profits are sustainable in the long run that I doubt. But for now, it's been a terrific share, well done to holders.

Paul’s Section:

Equals (LON:EQLS)

110p (£205m) - Trading/Strategic Update, PUSU deadline [in line] - Paul - AMBER

This is one of the payment services/forex companies, which has moved into meaningful profitability in the last couple of years, after a patchy history previously.

What is the point in the PUSU deadlines that the takeover rules require, when they just get extended over & over again? They’re not really deadlines are they!

This potential bid situation has been ongoing since 1/11/2023. As far as we know, Madison Dearborn seems to be the only party involved, and today EQLS says -

Whilst the Board recognises the time elapsed since the commencement of the Strategic Review, it considers it to be in the best interests of shareholders that the Strategic Review remains ongoing to allow further time for it to reach its conclusion.

As part of the Strategic Review, discussions are ongoing between Equals and Madison Dearborn Partners LLC and, to allow further time for these discussions to take place, the Board of Equals has requested that the Panel on Takeovers and Mergers (the "Panel") extends the PUSU Deadline further.

It will be interesting to see what happens, but as mentioned last time, in my experience the longer things take, the increased likelihood of a deal falling through. However, given talks still seem ongoing, there must be something going on, so maybe a deal might be reached? We don’t know, without inside information, which would mean we couldn’t trade the shares.

More interestingly, we also get an update on trading - which is in line -

The Board is pleased to provide an update on the Company's current trading, which continues to be in line with the Board's expectations. Trading in the first quarter of FY-2024 up to 15 March 2024 (the "Period") has continued the strong growth trajectory of FY-2023 with Revenues in the Period reaching £22.2 million, up from £17.4 million in the same period in FY-2023, representing an increase of 28%. In keeping with recent trends, trading has been robust across the business with particularly strong growth from Solutions.

Paul’s opinion - this sounds reassuring that trading is in line with expectations.

Based on the StockReport, the valuation of 18.6x forward earnings looks fair to me.

It’s a good story, but I’d personally want to see a longer track record of profitability, to be sure that profits are sustainable. Hence why I’ve not invested in EQLS. The story sounds good though, and I’ve been impressed with several webinars done by management. This sector is really all about the crumbs falling from the table of the major banks, who don’t seem to want low margin business, creating an opening for challenger companies who do well out of it. EQLS says that it has created an impressive IT platform, and is used by some larger clients too. Mind you, they all say that.

Overall, I don’t have a strong view either way, and can see merit in the bull arguments. So I’m happy to stick at AMBER. It might make sense to keep some powder dry to buy any dip in case bid talks are called off. Although that would then mean missing out on any bid premium, so it’s a tricky one!

UPDATE at 10:10: Sky News says EQLS has been approached by Railsr with a proposed merger. Equals rushed out a response, confirming it has received "an indicative non-binding proposal" from a consortium including Railsr and (more importantly) TowerBrook Capital, regarding a "possible offer" for EQLS - so a takeover rather than a merger. Things are getting more interesting!

This one has been all about timing -

XP Factory (LON:XPF)

14.75p (£26m) - Interim Results - Paul - AMBER/GREEN

XP Factory plc (AIM: XPF), one of the UK's pre-eminent experiential leisure businesses operating the Escape Hunt® and Boom Battle Bar® brands, is pleased to announce its unaudited interim results for the twelve months ended 31 December 2023 ("2023").

(sorry this was meant to be a quick section, but it turned into a full review!)

Note this is a 12-month period, with the old year end of 31 Dec 2023. The current period is being extended to 15-months, in order to move the year end to a more convenient date, as previously reported.

Background - last night I listened to an extremely bullish-sounding interview from Vox, with the CEO (who’s a very nice guy, but that doesn’t matter for our purposes here) on my headphones whilst going for a walk. On returning, I felt highly motivated to look at the numbers. It turned out the figures were far from being a cause for celebration as the interviewer in this company-funded interview presented it. So this is a useful reminder that if the company has paid to be interviewed, it is not necessarily honest or accurate commentary, and in this case I felt it went as far as being highly misleading (more the host than the CEO, to be fair).

In contrast, remember nobody pays for our views here at the SCVR, they can’t be bought. Our duty is to you, the subscribers.

Disclosure on my own position - I was previously much more enthusiastic about the potential for XPF, but the forecasts were surreptitiously lowered, and it doesn’t actually make any real world profit currently. As the facts had changed, I changed my opinion. Although I’ve kept a tiny placeholder position, so it’s on my screen as a company that is potentially interesting, if the facts improve then I would buy back a proper position size. So technically I’m holding some shares personally, but it’s so small as to be insignificant.

Results for the year-ended 31 Dec 2023 -

Very rapid revenue growth +96% to £44.8m, due to annualising the large site opening programme in late 2022, new sites in 2023, LFL growth from maturing new sites, and buying back some previously franchised sites.

Adj EBITDA is complete nonsense, but it’s £8.0m (up 103%)

Operating profit of £1.8m is also nonsense, as it doesn’t include part of the site rental costs, with £1.8m “lease finance charges” being below this line.

Actual profits? It’s a loss of £(535)k. That is not a good performance, although in tough macro, and after a rapid site opening programme, it’s not a disaster.

Balance sheet - shows a large deficit on the lease entries, suggesting BOOM must have a significant number of loss-making sites, but the company has previously denied this. RoU assets is £20.3m. The lease liabilities total £29.3m. That’s a £9.0m deficit, and significant as RoU assets are only 69% of the rent liabilities. So I don’t care what management says, it clearly has some problem, loss-making sites, I’ll go by the numbers.

Cash of £4.4m looks adequate, as the site opening programme has now slowed right down. Maybe the cash figure might have been window-dressed for the year end, as current assets of £7.9m is a lot lower than £16.5m current liabilities.

NAV is £25.5m, but taking off intangibles of £23.7m, NTAV is modest at £1.8m.

However, I could also reverse out the lease entries, which would boost adj NTAV to £10.8m, which isn’t bad actually.

Overall, I think the balance sheet looks stretched, which explains why the new site opening programme has now slowed to a trickle. I think it needs another fundraise of c.£5-10m, to be able to accelerate site openings.

Cashflow statement - does actually look quite good, to be fair. Although working capital has been squeezed, boosting cashflow, and remember that a lot of the rents now appear in finance costs further down, rendering operating cashflow meaningless.

That said, it has funded £6.75m of capex without an equity fundraise. So if expansion capex was switched off (always an option with roll-out businesses) then XPF would generate positive cashflow.

Therefore the way I see it, management are not in an emergency, but are in a difficult position where they need to raise more equity if they want to more rapidly expand the business. Yet the share price is low, so there would be a fair bit of dilution from any meaningful fundraise.

Paul’s opinion - I really dislike the over-promotion of this share, where investors are only told the positives, yet have to look more closely ourselves to find the negatives - the most obvious one being that it doesn’t make any real world profit.

That said, conditions are incredibly tough for bar operators, and I imagine lots of competitors are likely to disappear after the big April 2024 increase in Living Wage, with in my view listed competition Revolution Bars (LON:RBG) and Nightcap (LON:NGHT) at significant risk of insolvency. Mind you, not many bars close forever, usually they’re taken on by a new operator, at a lower rent.

With many younger people now apparently teetotal, and the cost of drinking out being prohibitively expensive, we’ve just got far too many pubs and restaurants now - serious over-capacity.

The good thing is that XPF is offering something superior to conventional bars - the game-playing experience is excellent, and they’re also pulling in punters at other times with large sporting screens. The food & drink offerings are OK, nothing special.

Competition? There are other operators growing in the same experiential leisure space, although XPF has secured some very good sites in prime locations, on reasonable rents, due to the timing of its site opening programme mainly in 2022. First mover advantage maybe?

Could it benefit from a consumer recovery later in 2024? I would say so, yes. Also corporates are getting people back into their offices, and need to do team-building - XPF is ideal for that. If you mystery shop a Boom site, you can see that people are really enjoying the experience, it’s a very good format I think.

Overall, I’m torn between amber and amber/green. Last time I was amber/green, and nothing much has changed, so I’m happy to stick with AMBER/GREEN - moderately positive, but with some reservations (mainly the stretched balance sheet, limiting site roll-outs, and the over-promotion of the shares which I find misleading). If I had to pick a recovery share in the small cap hospitality sector, XPF would be it. Everything else just seems too risky to me (e.g. RBG, NGHT, MORE, TAST, VARE all spring to mind as things I'm avoiding).

Right to reply - XP Factory (LON:XPF) - we're always happy to talk to companies if they think we've got something wrong in the SCVRs. I had a call yesterday from a rather miffed CEO of this experiential leisure company. He said that the deficit on the lease entries on its balance sheet was due to netting off landlord contributions (creditors - for rent-free periods and reverse premiums) against the Right of Use Asset. That sounds plausible, so I've asked for more information, and will publish that here when it comes through. Just wanted to flag it straight away.

Here we are, XPF's CFO explains the lease entries - many thanks for this - it certainly puts a much better picture on the lease entries on XPF's balance sheet. So my apologies for jumping to an incorrect assumption about these entries in yesterday's report. I think we're all learning as we go along re IFRS 16, which almost everyone agrees is a terrible accounting standard, a big backward step!

Subject: Response to Paul Scott's comment

Whilst I will leave you to form you own opinions on the XP Factory performance, there is at least one factual inaccuracy in your comment which I believe is misleading. You state that the “balance sheet shows a large deficit on the lease entries, suggesting BOOM must have a significant number of loss-making sites”. The company has been the beneficiary of significant cash contributions from landlords on the majority of its Boom sites and on some Escape Hunt sites. Under IFRS 16, these landlord incentives are netted off against the Right of Use asset. Ordinarily, at the lease inception, the right of use asset would exactly set off the leasehold liability. However, when a landlord contribution is received, the Right of Use Asset is reduced by the contribution, meaning it will be smaller than the lease liability. Once the lease commences, the lease and the right of use asset will amortise down and slightly different rates, depending on the rental payment profile, which will lead to a further mismatch. However, the substantial majority of the difference in the case of XP Factory is due the cash benefit from landlord contributions – ie a benefit to the company. It has nothing to do with the performance of the individual sites, which within Boom generated an 18% EBITDA margin – 23% in H2 - after fully accounted rent charges as set out in the statement.

FDM (Holdings) (LON:FDM)

Down 11% to 348p (£381m) - Preliminary Results - Paul - BLACK (profit warning), AMBER on fundamentals.

We last reported on a profit warning here on 13/11/2023, which said its IT consultant numbers hired out were down 18%, so it reduced outlook for FY 12/2024.

FY 12/2023 figures are out today, with adj PBT down 3% to £50.2m (a v good margin on £334m revenues). Adj EPS is down 12% to 32.9p, so a PER of 10.6x. Dividend held at 36p, so not quite covered by EPS, but sending a strong message by maintaining it. Balance sheet is healthy, with ample cash of £47m and no debt.

Outlook - this is the problem bit. Market conditions “remain soft”. FY 12/2024 performance now “likely to be materially below its earlier expectations”. Difficult to predict recovery, and it’s maintaining staff capacity ready for a recovery.

Paul’s view - no strong view either way, but I could see this share being a decent recovery play, if/once it starts reporting a recovery in business. So I’ll stick at AMBER on fundamentals. UPDATE: Shore Capital (many thanks) has updated, and it's nasty. - FY 12/2024 forecast EPS down from 26.6p to 21.1p, down 21% on already soft forecasts. So the 2024 forecast PER is now 16.5x - not looking bargain unless you factor in a considerable improvement in future earnings. So shareholders have to hope 2024 is a one-off bad year, and not the new normal. Maybe the share price needs to sell off a bit more to get risk:reward into better balance?

Naked Wines (LON:WINE)

Up 10% to 56p (£41m) - Trading & Refinancing Updates - Paul - RED

Sky News upset the applecart on Monday with a piece saying that WINE had appointed debt advisers Interpath, which I commented on here.

Today WINE retorts that it had previously advised on 15 Dec 2023 (Interims) that it was working with an adviser to look at debt options. Whilst that is true, it was contained within a going concern statement that concluded with a “material uncertainty”, which specifically mentions the risk of breaching banking covenants. Anyone getting bullish after today’s update needs to re-read the going concern statements carefully, I suggest.

Today it says further -

The existing credit facility expires in April 2025 and as such the Company is running a typical replacement review well in advance of that date. The Company is targeting a facility of similar scale with additional financial and operational flexibility, providing more capacity to pursue the actions being undertaken to return the company to profitable growth. Constructive discussions are being held with a number of parties to secure this.

Again that’s true, but I’m more worried about possible covenant breaches, rather than the April 2025 expiry date. Remember facilities become technically repayable on demand if covenants are breached (although lenders usually agree a waiver for listed companies), raising the risk of an emergency equity fundraise and big dilution.

Trading update - Q4 (to Mar 2024) revenues have continued to be in line with expectations (nothing said about profitability though). Net cash has improved to £17m from £3m at end Q3 - that is good news. Anticipated net cash for Mar 2024 year end now at top end of previous range (£0-15m). Remember though that it should be sitting on a large cash pile belonging to customers, but it’s spent that on buying huge amounts of wine - which could be a big problem is customers close their accounts and ask for their cash back.

Paul’s view - I think this clarification today improves things somewhat. I can foresee a very wide range of possible outcomes here. If trading genuinely starts to improve strongly, then this share could be a multibagger. How likely is that though? It still seems to me that the company is in a downward spiral, struggling to afford the marketing spend it so badly needs to replenish the customer churn that all businesses of this type are bound to have. The issue of massive over-stocking with wine really worries me, as there could be anything in those numbers. Downside case a multi-million write-off of unsaleable wines? It’s already had to make some provisions against inventories, and you often later find out that such impairments are the tip of the iceberg. Hence I remain very wary, but good luck to people punting on it. I’m prepared to miss out on a big potential gainer when there’s this level of uncertainty, and a business model that has never made any reliable, repeating profits.

The other question is whether the brand is worth anything to an acquirer? That’s a possibility - look at what happened with Hotel Chocolat out of the blue. Bids can sometimes come for the most unlikely seeming companies, as acquirers sometimes see something that may not be obvious to us.

Anyway, there’s just too much guesswork involved for my tastes, so I’ll stick with RED to flag up the risk and uncertainty.

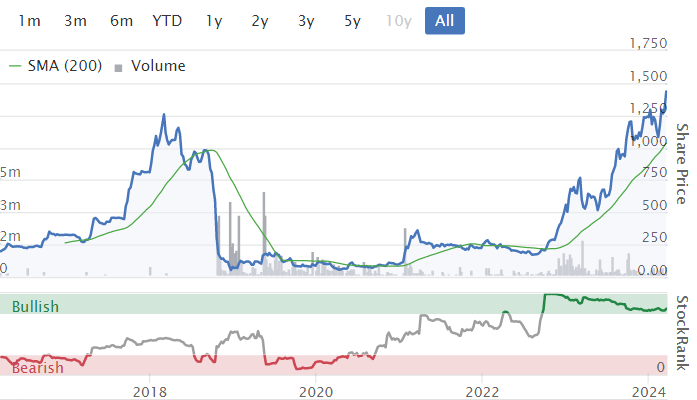

Yu (LON:YU.)

1480p (£248m) - Final Results (out y’day) - Paul - AMBER

Stunning 2023 results from this utilities supplier came out yesterday. I don’t think we can add anything in terms of analysis, other than to repeat that it all depends whether the huge rise in profits is sustainable or not? YU reckons it is, saying -

The Board expects to continue to deliver sustainable and profitable growth as the significant market opportunity available is seized by the Group's differentiated position and digital capabilities.

Revenues up 65% to £460m

PBT up 580% to £39.7m

Adj diluted EPS 182p (up 507%) - PER of 8.1x

Divis 40p

Net cash £32.1m

I liked the new collateral arrangement which we covered here on 23/2/2024, unlocking a lot of cash.

Outlook - sounds like 2024 is going to be another bonanza year -

Paul’s opinion - fantastic figures, and outlook. It seems obvious to me that these are super-normal profits, caused by short-medium term opportunities provided by the energy crisis. YU management seem to have played a blinder with their hedging, and contracts with customers.

Once energy markets normalise, and people can shop around again for supplies, then it will be interesting to see if profits remain this high? Big Director selling would be a warning sign worth heeding I think, but there's not been anything of significance yet. Note founder/CEO Baljit Kalar owns 51.8% of the company.

Another bull case is that lots of smaller, badly managed energy suppliers went bust during the energy crisis. So as a survivor (which has prospered, not just survived), then maybe YU could have less competition to contend with in future?

There’s also the regulatory framework to consider, which might change if the Govt changes maybe?

I can see why people like these numbers/outlook though, they’re fantastic!

Note that the share price crash in 2018 was caused by accounting problems - overstated profit. Let's hope the accounting is more prudent now.

Graham’s Section:

Trustpilot (LON:TRST)

Share price: 190p (-9% today, results were out yday)

Market cap: £787m / $999m

The market reacted very positively to these results from Trustpilot yesterday - the shares were up 9% at one point, before dropping back lower again.

Momentum has been remarkable here for some time:

Here are the full-year highlights:

Revenue +18% to $176m (+17% at constant currency)

Annual recurring revenue +22% to $197m

Adj. EBITDA $16m (previous year: $4m loss)

Net income $7m (previous year: $15m loss)

The bull thesis played out as intended, as the company moved from losses into profitability. Indeed, it did this earlier and more impressively than the City originally expected. See the trend in EPS estimates:

Net income was boosted by some accounting effects which investors might justifiably treat with caution, e.g. $4m of sales commissions could be capitalised in 2023 under the accounting rules, whereas previously they would have been expensed and dragged on the year’s profits.

On top of that, the company was able to recognise some deferred tax assets. This is normal when a loss-making company becomes profitable, and it has the benefit of reducing future taxes paid. But, in the case of Trustpilot, the benefit is extraordinary: they recognised over $12m of tax assets and if I’m reading the footnotes correctly, they have another $24m they might recognise in future, depending on the evolution of their profitability.

Just another reminder to treat net income with care - it can be highly volatile, and there are often some strange accounting effects involved.

Net cash is an objective number and finished the year at $91m (previous year: $73m). Greatly improved free cash flow, as the company made the transition from losses into profitability, enabled the commencement of a $25m share buyback in January 2024.

Strategic highlights show the continuation of strong growth metrics:

Monthly unique users +30% to 57 million

Total reviews +25% to 267m

Number of reviewed domains +22% to 1.1m

Outlook is for more of the same, but allowing a wide range of possibilities:

The bookings growth we achieved in 2023 and the ongoing momentum in the business underpins our confidence in continuing to deliver mid-teens constant currency revenue growth, and we also expect to achieve further operating leverage in the current financial year. The Board is confident in the Company's ability to deliver sustainable growth and long-term margin improvement, as we expand to capture the significant global opportunity ahead.

“Mid-teens” revenue growth combined with more operating leverage could lead to a wide range of outcomes but most of them are very positive as top-line growth should produce another very dramatic improvement in the bottom line.

This is why I haven’t been terribly concerned about Trustpilot’s PE Ratio; it’s not relevant in cases where earnings this year and next year are not representative of earnings a few years from now:

For what it’s worth, I see that Trustpilot’s PEG Ratio according to Stockopedia is quite normal at less than 2x: this ratio is much wiser than the PE Ratio, I think!

CEO comment:

“In my first six months at Trustpilot, I have witnessed first-hand just how powerful our platform is for consumers and businesses worldwide. We made strong strategic progress in 2023, building on robust foundations to grow our network of consumers and businesses and deliver profitability and positive cash flow ahead of expectations. By driving consumer adoption and delivering ever greater value to businesses through innovation, we are confident of delivering sustainable growth and long term margin improvement.”

Low customer growth?

One of the bear points I’ve seen raised (here and elsewhere) is a low increase in the number of active paying business customers at Trustpilot.

That argument remains intact in the sense that the company reports 26,000 paying customers at the end of 2023. At the end of 2022, the company reported 25,000 paying customers.

These numbers have been rounded but nevertheless the number of active paying customers is still only increasing by c. 4%.

When a company leaves out a percentage growth rate, it’s often because the percentage growth rate isn’t very impressive.

Last year, Trustpilot saw 9% growth in the number of active customers.

This year, it could not bring itself to mention the 4% growth rate. Instead, it makes an argument as to why the 4% growth rate isn’t relevant:

Importantly, our strategy is to increase the revenue opportunity within our installed base, principally by focusing our direct selling into the enterprise market, typified by larger deal sizes and lower churn, whilst addressing the smaller business market via self-service channels. Therefore, we do not see growth in the absolute number of paying customers as a critical data point per se; instead, we believe we should focus on increasing average contract values and increasing retention over time.

Graham’s view

Clearly, I’m a believer in this stock: I’ve left it on my best ideas list for two years in a row, despite a soaring share price in 2023. Yes, I did consider taking it off the 2024 list, but I still believe that there is a story worth backing here.

Let’s consider some possible risks:

Reduced growth - with growth in the absolute number of customers having slowed down to a crawl (c.4%), there is a risk that this starts to drag on revenue growth sooner or later, as existing customers may reach the limit of what they are willing to pay. Company guidance for “mid-teen” revenue growth could mean 13%-14% at the lower end of the range. It becomes harder to justify a racy valuation multiple at that sort of growth rate.

Increased competition - Trustpilot’s success is likely to attract competition. There are already alternatives such as Bazaarvoice, Feefo and Reviews.io. (Perhaps this is inevitable, but all three of these competitors have terrible ratings on Trustpilot! 1 2 3)

Valuation - At a price to sales multiple of about 7x and without a level of earnings that can justify the current market cap, perhaps the stock has entered overvalued territory? The ValueRank from Stockopedia is only 4.

Personally, I remain bullish even though the stock has doubled compared to where I originally took a positive stance.

With regard to competition, I do not view the existing alternatives as offering serious competition. They don’t have the consumer brand recognition, and I don’t see any evidence that they are on track to anything comparable to Trustpilot’s brand recognition.

With regard to valuation, I’ll value it on a pre-buyback basis. So we have $91m of cash deducted from the USD market cap, giving a market cap of $908m.

ARR has reached $197m, so we have an EV/ARR multiple of 4.6x. I would say again that in my view, this is not particularly high for a company with good prospects and a strong competitive position (not to mention the fact that it is already profitable and cash flow positive). Maybe compare it to some US-listed software companies and then reconsider if it still seems expensive!

(Paul adds: I read with interest previous reader comments about concerns over TRST's business model, and have to say I found some of those views alarming. So for me personally, whilst I admire Graham's impressive performance on this share, I'm more sceptical - not just on valuation, but also the actual business model too).

PRS Reit (LON:PRSR)

Share price: 78.7p (+3%)

Market cap: £432m

This isn’t one we normally cover, but let’s check in and see how the property market is treating the private rented sector. PRS Reit has the largest portfolio of single-family rental homes in the UK, spread out across all major regions along with Scotland and Wales but excluding London.

These interim results show lots of movement in the right direction:

The improvement in profitability “mainly reflected the difference in gains from fair value adjustments on investment property”, i.e. £20.5m of property value gains were recognised in H1, versus only £6m in H1 last year.

Net assets are up 3% to £679m. The market clearly doesn’t trust this figure, given the latest market cap of only c. £430m. Net asset value per share is 123.6p.

The number of homes in the portfolio continues to grow and reached 5,264 at the end of December, having an estimated rental value of £60.3m (£11.5k p.a. for each home).

Operational metrics are immaculate:

Rent collection has improved from 98% to 99%. Average rent as a proportion of gross household income is only 23%.

Occupancy is unchanged at 97%, or even higher if you include tenants who have paid deposits and passed referencing checks.

Like-for-like rental growth of 11.1% (9% for renewals, 16% for new tenants).

Dividend target for the year is 4p. That means a yield of 5%+ on the current share price.

Recent dividends have not been fully covered by earnings in recent times, but the situation is improving, as the company explains:

Dividend cover has continued to increase as home completions and lettings have advanced, and as we exit March 2024, earnings have reached a level on an annualised run-rate basis that fully covers the target dividend.

Analysis of NAV: this very useful table shows how the latest NAV has been derived.

This table confirms that earnings (excluding valuation gains) have not quite been sufficient to pay the dividends (e.g. 1.8p vs. 2.0p in H1).

Outlook:

Between 1 January and 8 March 2024, 42 new homes were added to the portfolio… A further 270 homes with an ERV of £2.5m were under construction at 8 March 2024

Rental demand for high-quality family homes remains very strong nationally and is expected to grow against a background of structural under supply, higher interest rates and continued cost-of-living pressures.

Balance sheet and debt

PRSR has £460m of available facilities; it has drawn £415m of them and expects to use the remaining amount over the next 12 months “as we finish the current phase of construction, completion and letting activity”.

The lenders are all mainstream (Scottish Widows, L&G, RBS, Barclays) and most of the debt is classified as “long-term investment debt” with an attractive average cost of only 3.8%.

Graham’s view

I met the CEO/Co-founder of PRSR’s management company some years ago and was impressed by the story; all of this time later I’m pleased to see that the company continues to go from strength to strength.

Dividends per share have fluctuated but I think the prospects should be good from the current level, given the upward movement in rents:

Investing in REITs isn’t for everyone; they tend to suit those who are happy with a moderate long-term return and are looking for less risk than you get with a typical equity investment. The PRSR share price illustrates this:

My personal view is that the rental sector will remain in high demand. Even if lower interest rates improve mortgage affordability next year, which in theory would cool the demand for rentals, there is still a widely acknowledged lack of housing supply. And perhaps one of the long-term effects of the cost of living crisis could be sustained high demand for affordable rentals, which PRSR is ideally positioned to provide.

This stock is unlikely to “multi-bag” but I like what it’s doing, how it’s positioned and the valuation at a hefty (36%) discount to NAV. There is some financial risk given £400m+ of net debt, but according to the footnotes of today’s report, most of this debt is locked in at fixed rates until 2033-2038.

Plenty to like here, in my view, and this stock should be of great interest to REIT investors.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.