Good morning! It's Paul here with the SCVR. As there's not much company news this week, I'm trying to handle the SCVRs solo, to give Jack more time for other duties.

Agenda -

Paul's Section:

D4t4 Solutions (LON:D4T4) (I hold) - 2 large contract wins are announced, but seem to be in the forecasts already. They company reassures that it should achieve its FY 3/2022 expectations. I'm struck by the size of these contracts, which will contribute 37% of the entire year's forecast revenues. Even after the recent c.30% correction in share price, it's still not cheap on a PER basis. However, I continue to be impressed by the potential for this company to scale up in future, possibly, which could transform its valuation if they succeed in winning more large contracts. No guarantees about that of course, so it requires a bit of a leap of faith.

Parsley Box (LON:MEAL) - a trading update that tries to sound upbeat, being in line with lowered market expectations. However, on doing a little digging, it's clear that this company is burning through cash at a prodigious rate, and has nearly run out. It says more funding is needed in early 2022. Very high risk, I think this share is probably heading to zero unfortunately. Bargepole I'm afraid, due to the high risk of insolvency, based on these numbers. I hope punters manage to salvage something from this bad investment. I think anyone holding this is crazy, because it looks highly likely to end up at zero, given the very high cash burn.

Camellia (LON:CAM) - my first ever look at this overseas agricultural group. I like the strong balance sheet, and good track record of dividends. Today's update is ambiguously worded/punctuated, and I can't find any broker notes, so can't take it any further. Developing country , and exposure to volatile agricultural prices, turns me off.

Corero Network Security (LON:CNS) - issues a positive trading update during market hours. Has this cyber-security company finally turned a corner, after years of heavy losses? I don't know, but there do seem to be some encouraging signs.

K3 Business Technology (LON:KBT) - issues an in line with expectations update for FY 11/2021. The balance sheet has been fixed now, with some non-core disposals businesses sold. My view: neutral.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

D4t4 Solutions (LON:D4T4) (I hold)

285p (pre market open) - mkt cap £115m

D4t4 Solutions Plc (AIM: D4t4, "the Group", "D4t4"), the AIM-listed data solutions provider…

This is effectively a trading update, with the key part saying -

These multi-year contract wins add over £3 million per annum to the Group's ARR as well as over £9 million to the current year's revenues.

Along with existing contracted H2 ARR and continued good visibility of the pipeline for the remainder of this financial year, the new wins underpin the Group's confidence in achieving board expectations for the full year.

I’m struck by the new contracts adding >£9m to this year’s (FY 3/2022) revenues - that’s 37% of the whole year’s revenues, a huge number. It’s very good news, but also reminds me that D4T4 still seems to be dependent on lumpy licence revenues (which are often almost 100% gross margin for software companies). Some of that £9m might be implementation fees, and support, it doesn't say.

Seasonality - D4T4 has a very heavy H2 bias to results historically, and often scares investors with a poor H1, but then seems to deliver the goods in H2.

EDIT: thanks to davidjhill who points out in the comments section below that D4T4 has large contract renewals that fall into H2 each year, which is what creates the H2 weighting to results. End of edit.

I wonder if the company is setting itself up for a beat against expectations nearer the year end? It feels like that might be the case, let’s see what brokers say in any update notes later today.

Note that H1 revenues this year were £7.6m, and the FY 3/2022 revenue target is £24.3m, hence £16.7m revenue is needed in H2 to hit Finncap’s revenue forecast. Today’s contract wins bank >£9m of that £16.7m H2 target, plus there will be recurring revenues already in the bag. So it’s looking promising.

My opinion - there’s more detail in the announcement, all of which sounds encouraging, including the first sale of its new Fraud Data Platform software.

Both Jack and I had concerns about valuation, with the price looking toppy at the peak of c.400p earlier this year. The price yesterday was 285p, so a fairly hefty c.30% fall from its recent highs - although that’s similar to many other small caps which have sold off heavily in the last 3 months in particular. So I don’t see the fall back in price as being anything company-specific, it seems more about nervous holders trimming back or selling out. Probably.

Generally, I think it needs a company to issue a reassuring trading update, confirming market expectations, to stop the selling, and trigger some fresh buying, in depressed market like we're experiencing now for UK small caps. That’s what has happened here, so I expect this share could recoup some of the recent losses.

The valuation still looks high, a forward PER of 32.4, but I continue to believe there’s something special going on at this company. If it can scale up, and as we see today these are big contracts with large organisations. So the figures could look a lot more interesting in the future.

In the meantime, it’s already nicely profitable, so investors need not worry about cash burn, or equity fundraisings, as it’s sitting on a decent cash pile already.

Overall then, I think with a lower share price, and a reassuring trading update today, risk:reward for investors seems a lot better than it was earlier this year.

.

.

Parsley Box (LON:MEAL)

38.5p (down 12% at 08:25) - mkt cap £16m

Trading Update & MD appointment

Parsley Box Group plc (AIM: MEAL), the direct to consumer provider of ready meals focused on the Baby Boomer+ demographic, today issues an update on trading.

Recent trading has been in line with the last update - a profit warning on 30 Sept 2021, which I reviewed here.

Revenue is “on track to deliver full year revenue marginally over the £25m forecast, representing modest year on year growth.”

H1 revenue was £14.0m, so H2 is lower at £11m.

Cash - £2.2m is expected to be left in the kitty at 31 Dec 2021 year end. That’s way down on the £6.5m reported at 30 June 2021, so an alarming rate of cash burn, despite marketing spending being reduced in H2.

Inventory levels improving, after (previously reported) problems with outsourced production

Marketing spending reduced by a third in H2 vs H1 - “whilst stock availability was significantly constrained, resulting in approximately 20% lower order numbers and therefore revenue in H2 compared to H1.”

Product ranges improved & extended - 50% relaunched with new recipes - good, as some of the previous ones were absolutely awful, and the product looks nothing like the photos in the brochure/website, which I found misleading and caused disappointment when my order arrived. Successful companies surprise & delight customers with their products, which is what drives repeat business.

A new MD (20 years at John Lewis) has been appointed, to free up the CEO’s time on business development, “and in particular strategic growth opportunities.” - what does that mean? Acquisitions, partnerships, who knows?

Funding - the biggest issue - it’s running out of cash, and needs to do a fundraise (from a position of weakness I would say, so there’s a risk of heavy dilution) -

In order to support its investment plan, Parsley Box intends to raise further funding during Q1. Certain members of the Board together with their associates have indicated their intention to invest, demonstrating their strong support for the Company.

My opinion - this looks really bad.

I’ve managed to successfully resist the urge to buy this share, thank goodness. The trouble is, it’s become clear that the float price was excessive, and unjustified given poor performance in 2021.

It’s still not clear if MEAL has a viable business model at all. Actually, it looks clear the business model is not viable. Just because something has dropped in price by c.75%, doesn’t mean it’s cheap, if the starting price was wrong.

If the product had wowed me, then I might have been prepared to have a punt. The trouble is, I tried a box of these meals, and thought they were pretty awful. Although it’s true I’m not the target market.

The company has burned through £4.3m in H2 (cash down from £6.5m in June 2021, to £2.2m just 6 months later) - that is really bad, and calls into question if the company is going to be able to survive. It’s certainly dependent on another fundraise, without which I believe the company could go bust in 2022.

With the high risk of a 100% loss here for investors, and no signs of MEAL being a viable business, so little potential upside, I think risk:reward looks awful. I hope they manage to turn things around, but if I held this share, I’d get out while I can, and salvage something from a bad investment.

.

Camellia (LON:CAM)

6875p (up 4% at 10:13) - mkt cap £190m

This share seemed to peak in 2018, and has been drifting down since.

Something seems to have gone badly wrong in March 2021, with broker forecasts being slashed in the following 5 months, as you can see -

.

.

We don’t seem to have ever covered this share before in the SCVRs, I don’t know why, there must have been something I didn’t like about it. I’m not keen on UK listed companies with mainly overseas operations, particularly if they operate in developing countries, because I've seen so many of those shares go (often very badly) wrong in the last 25 years or so that I've been in the market.

Many (particularly AIM-listed) overseas companies ended up being scams, or having something seriously wrong with them. For that reason, I almost always avoid AIM companies with overseas operations. Somero Enterprises Inc (LON:SOM) is an exception.

If I do consider an AIM company with overseas operations, then I look for 2 key things to reassure me -

- Stock market listed for a long time, and

- Paying decent dividends over 5+ years

Camellia passes these 2 tests, since it listed 20 years ago, and has a good track record of paying divis. So it looks OK, let’s have a closer look.

Here’s an investor presentation (only 6 slides) which explains what the company does. It claims to be the world’s largest private producer of tea. Also other crops being produced are avocado, and macadamia. Agriculture makes up 85% of group revenue. Smaller divisions are Engineering, and Food Service.

Running through previous results, some key points -

H2 seasonal weighting to profitability - when majority of harvesting of agricultural products occurs

Developing country risk

Cash pile & investment portfolio look significant to the valuation

Refocusing operations - diversification & non-core disposals

Volatility of prices for agricultural products - interim report mentions over-supply of tea (which makes up most of CAM’s revenues), and significantly lower avocado volumes from Kenya

Bought Bardsley England - the UK’s second largest apple grower (850 hectares in Kent)

2 aerospace interests sold

Net cash of £62.1m at 30 June 2021 (which is a third of the market cap)

Balance sheet looks complicated, but strong, including nice cash pile - it would be important to consider where the cash actually is though - as developing countries can have restrictions on sending cash abroad.

OK, that’s given me a rough idea of what the company does, so let’s look at today’s update.

This is rather ambiguous -

…These changes have resulted in improved margins for a number of our agriculture businesses which coupled with the rigorous cost-saving measures implemented across the Group, leads the Board to believe that the underlying profit before tax* for the year is likely to be substantially above market forecasts in the range of £7-9 million on revenue which is now expected to be 4-5% below market expectations.

* Underlying profit before tax seeks to present an indication of the underlying performance which is not impacted by exceptional items or items considered non-operational in nature and for example excludes impairment charges, gains/losses on disposal of assets and restructuring costs.

Are they saying market forecasts are £7-9m profit and they’re “substantially above” this figure? Or that they’re going to achieve £7-9m profit, which is substantially above (lower) market forecasts? I’m leaning towards thinking that £7-9m profit might be the outcome, and market forecasts are lower? How do readers interpret the above? Improved punctuation & wording would have made this clearer - I’m surprised the broker & PR didn’t pick up on that.

I can’t find any broker notes.

My opinion - this is an unclear update, and with no broker notes available, I can’t take this idea any further, due to lack of information.

On a first, superficial review, this looks quite an interesting, sprawling group.

Developing nation risk is not something I generally take on, so it’s not for me.

The share price is back to where it was 15 years ago. Although the total shareholder return would be better, including divis. Wouldn't it be great if we had a chart showing total shareholder returns, not just the share price?!

.

.

Corero Network Security (LON:CNS)

13.15p (up 16% at 12:02) - mkt cap £65m

Pre-close update regarding market expectations

Issued at 10:35 today - grrr, it’s so annoying when companies do this - issuing updates when the stock market is open, thus giving an advantage to professionals who are glued to a screen all day, and disadvantageous to everyone else who is busy doing something else.

Corero Network Security plc (AIM: CNS), a leading provider of real-time, high-performance, automatic Distributed Denial of Service (DDoS) cyber defense solutions, today issues a pre-close update for the year ended 31 December 2021 ("the year").

Here’s today’s update in full -

Subject to year-end close and external audit finalisation, the Board anticipates revenue to be broadly in line with market expectations and EBITDA to be significantly ahead of market expectations for the year and positive.

The increase in EBITDA is a result of a better than expected gross margins coupled with lower operating expenses.

The scale of the profitability is linked to the remaining sales opportunities to be closed before the end of the year.

A more comprehensive trading update will be provided as soon as available to the market in January 2022.

That sounds fairly good, although a profit rise from cost-cutting is not as positive as revenues beating target. Improved gross margins is good.

Corero has a poor track record, with many years of heavy losses, and dilution from fundraisings. The current share count is 495m, up from 133m in 2015. So I would need fairly heavy duty evidence that the business is improving, before wanting to buy.

Having a look at its website, Corero seems to operate in an interesting growth area, of preventing Denial of Service attacks on customers’ websites -

We are a global leader in real-time, high-performance, automatic DDoS defense solutions. Both Service and Hosting providers, alongside digital enterprises across the globe rely on Corero’s award winning cybersecurity technology to eliminate the threat of Distributed Denial of Service (DDoS) to their digital environment through automatic attack detection and mitigation, coupled with network visibility, analytics and reporting…

Quick review of H1 results (published 14 Sept 2021, for 6 months to 30 June 2021) -

Corero achieved a negligible $0.1m EBITDA profit in H1.

This was a loss before tax in H1 of $(1.2)m (which benefited from what looks like one-off “other income” of $637k - forgiveness of PPP loan)

Net cash was $5.1m at 30 June 2021

NTAV weakish at $(0.6)m, but as with most software companies, it benefits from favourable working capital (customers paying up-front), so this balance sheet is probably OK

Capitalised R&D of $938k in H1

My opinion - I can’t get madly excited about today’s update. It’s OK, but the company is still loss-making once you take into account capitalised development spending. EBITDA isn’t a real-world profit figure for this type of business.

So from a value/GARP investor point of view, the mkt cap of £65m can’t be justified.

However, from a growth investor point of view, in a bull market for tech companies, the valuation could be seen as quite reasonable. Cannacord points out in a previous research note that Corero’s peers are valued at 3x its rating (on an EV/Sales basis, which seems crazy to me, but that seems to be the current fashion for growth investors).

Corero has some big name US partners, including Juniper Networks. I wonder if there’s a possibility that it might become a bid target from the US? Juniper already owns 10% of Corero. There’s only a small free float, which can be great when really good news comes out, as there are hardly any shares to be bought, so people have to chase up the price to get any.

The Chairman, Jens Montanana owns a 38% stake, so he’s in the driving seat.

Overall, it’s not my usual type of share, and the long track record of poor performance and heavy losses does bother me. That said, I’d be inclined to have a small speculative punt on this, if I were swimming in cash (sadly not the case right now!)

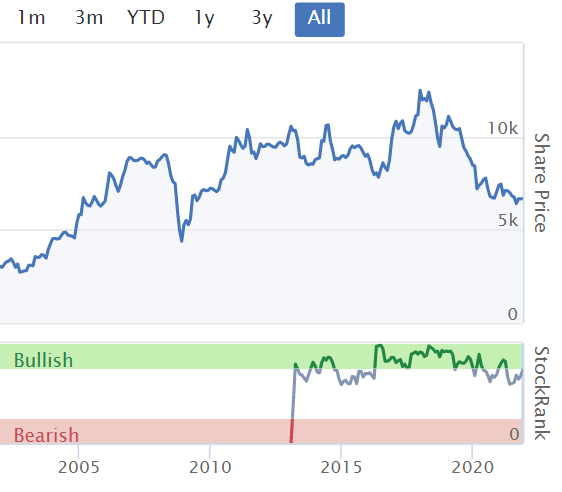

As you can see below, this share has been a lousy performer, and the share count has risen a lot over this period too.

.

.

K3 Business Technology (LON:KBT)

179p (up 4% at 13:16) - mkt cap £80m

This is a software group. I’ve not looked at it for a while, and in the past its weak balance sheet ruled it out for me. Checking its H1 results though, the good news is that the balance sheet was fixed earlier this year, with some disposals. NTAV is now positive, at c.£3m, after writing off £25.7m goodwill and £8.4m other intangible assets. So it is now within my investable universe.

The company seems to now have a much tighter sector focus, on fashion & apparel brands, and sells both third party, and its own software.

Interim results to 31 May 2021 look ropey to me, with it still being loss-making.

Trading update today - FY 11/2021 has been in line with management expectations. We have to assume this is the same as market expectations - why couldn’t they just have said so?

Adj EBITDA expected to be higher than LY (continuing ops, i.e. ignoring disposals)

Stronger operational cash generation

No figures provided on either of the above

Net cash of £9.0m - which is a comfortable position I think

New clients mentioned (but no brand names provided)

2 non-core businesses sold for £16.4m in total during the year, which has transformed the balance sheet, so looks a good move to me

New CEO has reorganised the “go-to-market team”

My opinion - used to be negative, due to balance sheet weakness. Now that’s fixed, I’m neutral on this share. It seems to be undergoing a turnaround plan, but I can’t see any evidence yet that there’s an exciting investment opportunity here.

Software for the apparel sector doesn’t strike me as a particularly exciting niche, with so many participants under competitive & structural pressure, even the online companies now.

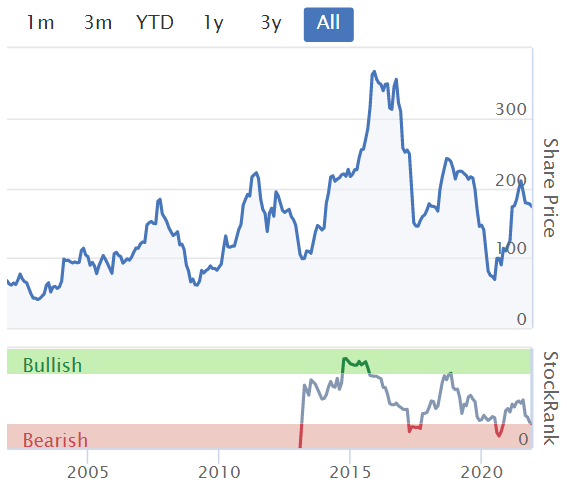

A long-term chart like the one below, suggests to me that this share might be better for traders, not long-term investors possibly?

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.