Good morning from Paul & Graham.

Today's report is now finished.

I (Paul) recorded an interview with Paul Hill of Vox Markets yesterday afternoon, which should be published later today. So I'll insert a link to it here, when available. We run through the main shares that I've bought using my windfall from the takeover bid at Seraphine (BUMP), all previously mentioned here. It was a good back & forth discussion, with lots of interesting topics, although we ran over time at about 1hr 10m, so people might want to watch it in two sections instead of all the way through!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

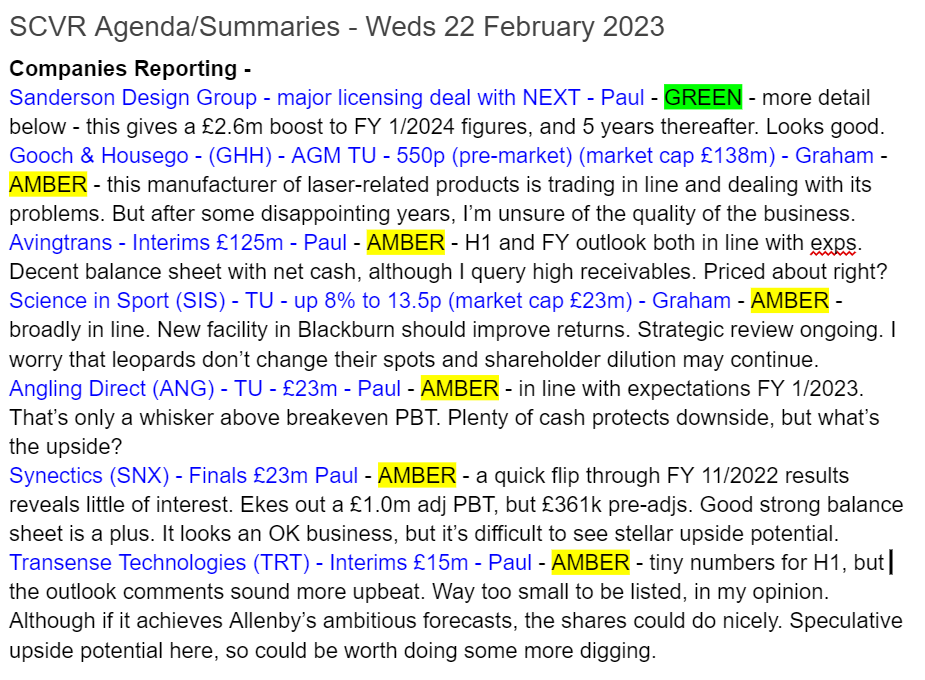

Sanderson Design (LON:SDG)

119p (pre market open)

Market cap £85m

Major licensing agreement with NEXT

There has already been licensing of designs from SDG to NEXT, but the relationship is now deepened to include SDG’s Clarke & Clarke brand -

… NEXT will hold a master agreement giving exclusive rights to produce a very broad range of Clarke & Clarke homeware products including bedding, towelling, tableware, furniture and lighting.

An initial £2.6m accelerated licensing income will be recognised this year, FY 1/2024. As licensing income is almost pure profit (but can be lumpy), this looks a material deal in the context of existing forecast from Singers being £12.0m PBT for FY 1/2024. Hence I imagine forecasts are likely to be raised at some stage.

The relationship with NEXT sounds as if it might make sense for NEXT to bid for SDG at some stage?

The new agreement marks the latest in a series of licensing agreements between NEXT and the Group's brands. These include a Morris & Co. womenswear agreement signed in May 2021, which has since been extended and will see the launch of a new range of NEXT Morris & Co. womenswear for autumn/winter this year.

My opinion - I imagine this could be worth a share price rise of c.10% today, maybe more, who knows? (I'm writing this pre-8:00 market open). As regulars might know here, SDG is one of my favourite value/GARP shares, and I was tremendously impressed with the strategy & ambition from CEO Lisa Montague - one of the most interesting & fun CEO interviews I did last year here (audio) and here (written version).

EDIT: an update note from Singers has just come through (many thanks), saying it's difficult to forecast the income from this deal, but estimating a value of 11-20p for the discounted cashflows. That's consistent with my guess of a 10% share price rise from this deal. Existing forecast for FY 1/2024 is unchanged from Singers, but with more solid underpinnings from this deal. End of edit.

Shares are good value still, maybe partly due to uncertainty over the short term macro uncertainty, and how this might impact the mid to high end furnishings market that SDG supplies.

If you’re prepared to take that macro risk, and think longer-term, I think the signs are that this share should do well - I imagine 200p+ looks a realistic target share price for patient investors. Also it has a lovely strong balance sheet, so there’s not any dilution/solvency risk to worry about, even if short term trading disappoints (which can always happen with any share).

Hence overall, a continuing thumbs up from me for SDG shares. Today’s announcement should give a decent boost to, and hence reduce risk, for FY 1/2024 performance. Also there should be ongoing licensing revenues (unknown size) for a 5-year period from product launch in spring/summer 2024 onwards.

I like the business model, of SDG specialising in designs, and its huge back catalogue as well, then licensing these to retailers & wholesalers, who can look after the product sourcing, and selling of the product.

Stockopedia also likes SDG shares, with a high StockRank -

Avingtrans (LON:AVG)

375p (down 3% at 09:09)

Market cap £121m

Avingtrans PLC (AIM: AVG), the international engineering group which designs, manufactures and supplies original equipment, systems and associated aftermarket services to the energy, medical and industrial sectors, today announces its interim results for the six months ended 30 November 2022.

H1 revenues of £50.0m are as expected.

Adj PBT was £4.0m (slightly up on H1 LY of £3.8m)

Good order book with over 90% of revenues secured for FY 5/2023.

Outlook - “cautiously confident” of achieving market expectations, which is 22.8p adj EPS, giving a PER of 16.4 - probably priced about right.

Balance sheet - is strong, with net cash of £17.3m. Although receivables stands out as very high, at £49.2m, which is at least double what I would expect to see for a business with £50m revenues in 6 months. Checking back to the 2022 Annual Report, note 18 reveals that trade receivables were only £17.8m (which is around the level I would expect), but that another £25.7m “contract assets” was included within receivables - as I understand it, this is where work has been carried out on contracts, booked as revenues, but not yet been invoiced. This seems an unusually large number, so I’m raising an amber flag here, that it needs more explanation, and investors need to be comfortable that this large asset is actually going to turn into cash. When? And why is there a considerable delay in invoicing for this work (which would move it into trade receivables, and then cash, once the customer pays). Large contracts with delayed cash receipts can introduce risk that something might go wrong.

My opinion - the numbers look OK (apart from high receivables on the balance sheet). It’s a difficult share to value, as the strategy is to buy businesses, turn them around, then sell them. Management seem pretty good at that, as evidenced by a strong long-term share price performance.

This creates a problem for investors, as to how to value AVG shares? Logically, it seems to me that a sum-of-the-parts basis might be best, which would involve having to analyse all the different companies within the group, and try to guess what each might be worth to an acquirer?

Or we can just treat it as one group, and apply a reasonable PER, which seems to be what the market is currently doing.

Overall, it looks priced about right for now, so I view it in a neutral way.

It would need a lot more research to find the upside, from the individual business units, what contracts they’re winning, etc.

The only thing I don’t like is excessive receivables, apart from that, everything looks OK. So it could be worth readers spending more time doing the more detailed work to properly assess it as an investment. I’ve heard that management is highly regarded, so together with decent long-term shareholder value creation that’s a good starting point for more digging.

Angling Direct (LON:ANG)

31p (up 5% at 10:50)

Market cap £24m

Angling Direct plc (AIM: ANG), the leading omni-channel specialist fishing tackle and equipment retailer, provides the following unaudited trading update in relation to the financial year ended 31 January 2023 ("FY23"), ahead of announcing its Final Results on 16 May 2023.

This looks an OK update, in line with expectations.

FY 1/2023 is expected to show revenues of £74.1m (up only 2.2% on the previous year, but up a much more impressive 58% on pre-pandemic). New store openings have helped growth.

European operation is small, but growing.

EBITDA of £2.2m, but this only translates into PBT of £0.6m, so this is effectively a business running lots of shops & an online business, at just above breakeven. Not very exciting at all, unless there’s a credible plan to increase margins, which doesn’t seem to be the case - the strategy seems to be chasing revenues (by offering low prices) & gain market share. Something might come of that long-term, if ANG ends up being a consolidator and competition withers away?

Net cash of £14.1m is a key investment positive for this share. The overall balance sheet position is better still, as it’s carrying a lot of inventories too.

My opinion - I very much like the balance sheet strength, but what is the point of this business existing? It’s trading a whisker above breakeven, and continuing to expand store numbers, and its European presence, but not generating any return from the deployment of a considerable amount of net assets.

I can’t see what’s going to change, to suddenly make this a great business, because it’s up against plenty of competition, and consumers are likely to shop around on price.

Shareholders have the downside protection of a lovely balance sheet, but what’s the upside excitement? I don’t see any particular upside. So I can only be neutral on ANG shares. The risk is that it could attract a revolving door of value investors, who could park their money in these shares, and then get bored after a year or two of nothing happening.

The top 7 shareholders own 82% of the shares, so it might cross their minds that the AIM listing brings little to no benefits (ANG is fully financed already, so doesn’t need to raise more cash from the market), and will cost several hundred £k in unnecessary costs. So I’d say de-listing risk here is probably too high for me.

It might be a decent trade though, betting on market sentiment improving, possibly?

Graham’s Section

Gooch & Housego (LON:GHH)

Share price: 550p (pre-market)

Market cap: £138m

Trading is in line with expectations at this manufacturer of laser components and systems, according to today’s AGM update.

It has a year-end in September, so we are now in the fifth month of the new financial year.

In August 2022, it issued a serious profit warning, which I covered here. Let’s see if the various issues at the company are being resolved.

Recruitment - UK production facilities are now “fully resourced” and “whilst we still have further roles to fill in some of our US facilities, the situation continues to improve”.

Supply chain - there are “persistent” supply chain constraints, but increased inventory continues to protect the company from this issue.

Order backlog - GHH is “making steady progress in lowering its lead-time for new orders received and reducing its overdue order book”.

The order book rises from £110m to £129m year-on-year, but it is down from the record level seen in September 2022.

Increased production has helped to reduce the backlog, and there has also been “a moderation of order intake” in some categories, “with evidence of overstocking by some of our customers”.

Inflation - because of the large order book, it’s going to take some time for GHH to pass input cost inflation onto its customers and for this to show up in revenues. It first needs to fulfil the historic orders!

My view

This strikes me as a comforting update for shareholders who have had to put up with a long list of problems and issues at this company.

However, I also note that the company’s adjusted PBT estimate for FY 2023, while unchanged today, is now just £9.3m (from finnCap). After what has been done to the FY 2023 estimates, I don’t think I can have any faith in the FY 2024 estimates. GHH’s profits are just too volatile.

The operating margin was weak even before the company turned unprofitable:

I’d like to be more positive on this stock. It is tackling its various issues and does, I believe, have some growth prospects. However, margins and returns have been disappointing in recent years and I think it’s reasonable to have doubts about the underlying quality at this point.

Science in Sport (LON:SIS)

Share price: 13.5p (+8%)

Market cap: £23m

Science in Sport, the premium performance nutrition company serving elite athletes, sports enthusiasts, and the active lifestyle community, is pleased to announce a pre-close trading update for the financial year ended 31 December 2022.

I’ve tracked this company for several years and unfortunately witnessed a stock that has been a money pit for shareholders:

The share count has jumped again, to 172 million, after the company printed another 33 million shares at 15p each in September 2022.

The market lost confidence in it last year, after temporarily allowing the market cap to exceed £100m during the 2021 post-Covid rally:

At the time of the September 2022 placing, it announced a “strategic review”, arguing that “the current market capitalisation of the Company fundamentally undervalues the Group and does not recognise the inherent value of its premium brands and market positioning”.

The review “may or may not result in a sale of the Company or of certain Group assets”, and has caused the stock to technically be in an “offer period” since then. This is why Stockopedia publishes the warning that “this security is involved in a takeover situation”. However, I am not aware of any evidence of any offers having been made up to this point.

All of which brings us back to today’s update. Let’s see what’s new.

Full-year performance was “broadly in line with expectations”.

Revenue growth 1.5% to £63.5m, and margins in line with expectations.

Operational developments - the company has a new Manufacturing and Logistics hub in Blackburn which, it is claimed, can grow SIS to £200m of revenue. Today’s update informs us that a new protein bar line has been commissioned this month at this site, and is now fully operational. This should lead to “a transformation in margin”.

Outlook - “optimistic” for 2023:

Macro factors including COVID-19 in China and Amazon global inventory reduction are alleviating. Retail in all regions is in line with our expectations for growth, and the UK had a strong start to the year. Margins are strongly improved due to initiatives including the above items, and a second wave of price increases beginning to contribute.

My view

I’ve always hoped that this company would succeed. When you review the company’s products (also here), it seems like the company should be able to enjoy some pricing power and should be able to generate profits. But it just never happens. At least not yet. The marketing budget and other costs always seem to make it impossible.

Could the new Blackburn facility be a gamechanger? I guess so. I also agree with the company that its current market cap is quite low. The price to sales multiple is now only around 0.33x, which would be far too low if it was performing reasonably well.

There is also the possibility that the company could receive a generous takeover bid during this offer period, and that shareholders could get out at a handsome premium to the current share price.

However, despite these factors, I can’t bring myself to take a positive view on these shares yet.

The company has had the same CEO for the past 12 years and he owns less than 1%. Perhaps if he had better alignment with other shareholders, they might not have been diluted so much during his tenure?

On the June 2022 balance sheet, the company reported net debt of £7m. It then raised £5m (gross) which will help to cover at least a portion of 2022’s losses, but I’d be surprised if the company didn’t have the begging bowl out again sooner or later.

In summary: the shares do have some speculative merit at this low valuation, but the balance sheet is probably still very light on cash. I would need to see proof of an improvement in performance before having any confidence in this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.