Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

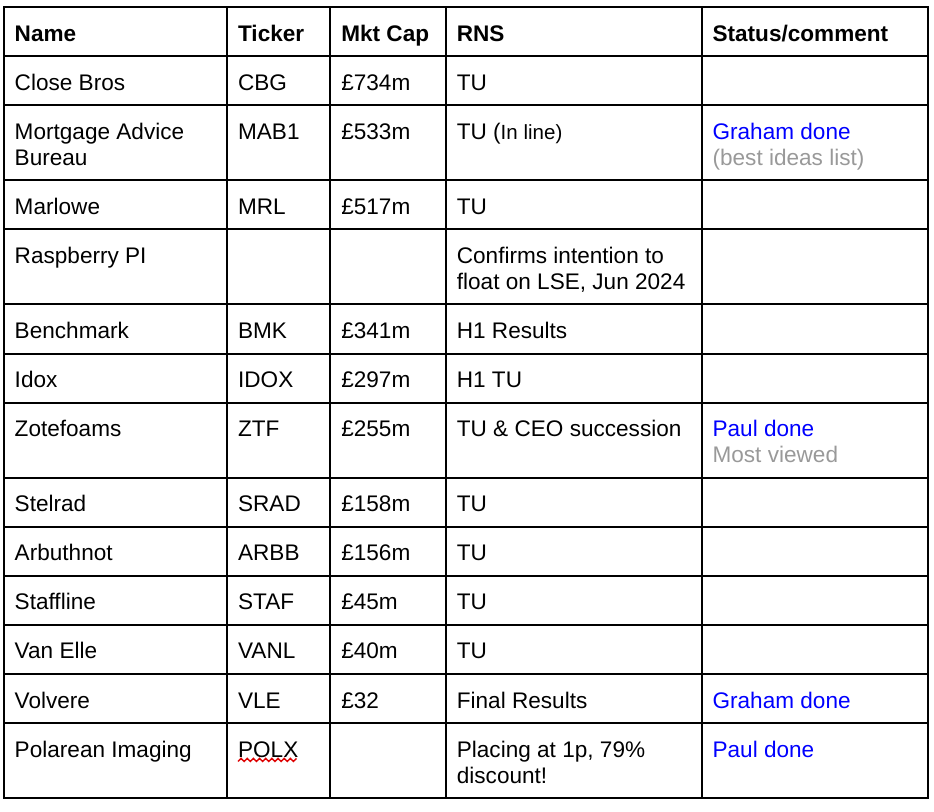

Companies Reporting Today

Other mid-morning movers (with news) -

Nightcap (LON:NGHT) - up 10% to 4.25p (£10m) - Fundraise for £3.5m at 5p/share - Paul - RED

Another fundraise (it raised £1m at 6p in Feb 2024) - presented as if it’s for expansion, but I think it’s more likely to keep the lights on. It admits there could be further fundraises. Highly ambitious management (who greedily draw excessive remuneration for themselves), talk as if they’re a sector consolidator, but a quick glance at their last accounts (Dec 2023) shows a loss-making ragtag of bars, with a weak balance sheet, negative NTAV of £(6)m, and net bank debt of £5.6m. So this latest £3.5m raise (if successful, only £750k is firm) would still leave it with net debt. There was a bad profit warning in Feb 2024 too.

Paul’s view - management strike me as greedy, and delusional. Rather than being a consolidator, I think this fundraise prevents them from joining the list of unremarkable bars groups going bust. It’s just a horrible sector, where very few operators make any money. Maybe they’ll pick up some of Revolution’s old loss-making sites at cheap rents and with long rent-frees?

Zenova (LON:ZED) (I hold) - up 22% to 2.2p (£3m) - Sells fire extinguishers to 2 hospitals - Paul - speculative nanocap

I can’t really give this a colour code, as it’s so small & speculative. Interesting products & newsflow, but as I mentioned here on 29/4/2024, I think it will need another fundraise. It’s one of an alarming number of low quality nanocaps that seem to have found their way into my personal portfolio. I’ve renamed the RNS title above to make it more accurate. The fire extinguishers have been extensively tested by the NHS it says, and Zenova is now an official supplier, and expects “significant sales to follow in the coming months”.

I see that the auditor was recently changed, suggesting they fell out with the old one I imagine, as it was well after the year-end, when companies don't usually change auditors. FY 11/2023 results don’t seem to have been published yet. Hence I imagine ZED shares are likely to be suspended by 31 May 2024 (next week!) since AIM companies have 6 months to publish accounts. So personally I’ve already assumed the brace position for a bumpy ride in the coming weeks. The RNS is full of exciting-sounding product news, but nothing of any substance in terms of the financial performance. H1 figures were lamentable, showing negligible revenues. What possessed me to buy some of these?!

Mitchells & Butlers (LON:MAB) - up 13% to 300p (£1.81bn) - Half Year Results - Paul - no colour.

Another mid-cap producing a superb recent rise in share price. Strong H1 results, and positive outlook - “Full year outturn expected to be at the top end of consensus, with momentum into FY 2025”. Large balance sheet, with £2.2bn NTAV (above market cap), with lots of property, plant & equipment at over £4bn, about 4x net borrowings (excl leases) of £1,037m. So needs a very careful look in particular at property valuations, and debt terms. I don’t have time to do that today, so won’t give a colour code. Looks potentially interesting though - although it’s almost tripled in share price from the Oct 2022 low, so I wonder if the gains have now been made?

PCI- PAL (LON:PCIP) - up 13% to 66.5p (£48m) - Victory for PCI-Pal in Court of Appeal - Paul - AMBER/GREEN

Good news today -

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, is pleased to announce that the Court of Appeal for England & Wales has ruled in its favour in the unfounded patent litigation case brought by its competitor Sycurio Limited. The Court of Appeal dismissed the appeal after just one day of the two day hearing, upholding the original ruling of the High Court announced by the Company on 25 September 2023.

Further good news, in that £1.1m held in escrow will be released to PCIP, as an interim award of costs. Could there be more to follow, I wonder? Ah yes, PCIP mentions that further on, saying more details about further costs it is seeking from the other side will be released shortly.

Paul’s view - clearly this is good news. I think there’s still a patent dispute in the USA yet to be decided though? I imagine a resounding success in the UK court might improve the odds of a similar victory in the USA, but who knows? Looking at the fundamentals for PCIP, it’s been a long and frustrating road for shareholders, with long periods of drift in between spikes up. Organic revenue growth has been superb in recent years, and multi-year losses are now finally set to turn into profits. However, the latest Cavendish forecasts only suggest barely above breakeven at adj PBT level for both FY 6/2024 and FY 6/2025, which does raise the question, what’s the point? All that hard slog, and multiple fundraises, just to get to breakeven. Hence I think the bull case only makes sense if investors think these forecasts can be significantly beaten, which might well be the case, I have no idea.

Just to emphasise, we only look at the facts, figures, and forecasts on the day here in the SCVR. It’s your job to do the fortune-telling about what the future holds! Also different investors buy/hold/sell with a whole range of strategies - a popular method is following the chart, which seems to be turning up at PCIP. Momentum can be very powerful in an early stage bull market, which I think we’re in. Also tech investors often value things differently, on sometimes aggressive multiples of revenue and EBITDA. Each to their own. Anyway, for me, I think the positives of patent risk receding, and strong organic growth, just about offset my scepticism about modest profitability. Let's hope we see upgrades in future. So I’ll stick with AMBER/GREEN for now.

Polarean Imaging (LON:POLX) - down 62% to 1.4p (£3m before, £17m after dilution) - Deeply discounted fundraise at 1p (£3m before dilution) - Paul - AMBER

We’ve been resolutely RED on this interesting, but under-funded company, all the way down, most recently on 7/9/2023, 7/12/2023, 29/2/204 and 10/5/2024, warning that dilution was obviously coming and that it could be on potentially ruinous terms for existing shareholders. That’s exactly what has happened, with a 1p raise today increasing the share count from 216m to 1,207m if full uptake of the £2m open offer (9 new shares for every 10 existing) . It reminds me a bit of Surface Transforms (LON:SCE) - promising sounding tech, but constantly running out of cash. It just isn’t worth the risk holding shares in anything speculative, unless the cash runway is c.2 years+ in my opinion. Although no two situations are exactly the same. Key question now, is it worth backing now at just over 1p? Maybe, but I would remind you that previously POLX said it needed to raise $10m, which is has done today. But that a further $20-25m would be required in due course.

Paul’s view - now that the cash runway is extended, I’ll temporarily go up to AMBER for a few months probably, and we’ll see what if any commercial progress it makes, before probably going back down to red when it’s close to running out of cash again next time. We are coming into a new bull market though, hence why there might be speculative upside here for a punt? Personally I wouldn’t pay 1.4p though, as I decline to hand a 40% profit on a plate to holders of about 83% of the new total number of shares bought at only 1.0p.

Summaries of Main Sections

Zotefoams (LON:ZTF) (I hold) - up 1% to 524p (£256m) - Trading Update & CEO Succession - Paul - GREEN

Revenue growth in Jan-Apr 2024 is up 14%, ahead of +11% in the forecast. It reiterates trading in line with full year expectations, so I suspect they might be in a comfortable position, maybe a bit ahead of expectations? The tone about its ReZorce development project has been noticeable more positive lately, including a recent press launch, so I suspect the odds are moving in our favour for a good outcome there, but that's just guesswork mainly. Not cheap, and it is capital-intensive, but I remain positive on Zotefoams shares, and hold personally. EDIT: my notes from InvestorMeetCompany webinar added below.

Mortgage Advice Bureau (Holdings) (LON:MAB1) - down 4% to 893p (£510m) - AGM Statement - Graham - AMBER/GREEN

A good update from MAB; the market may have gotten ahead of itself. SP is still 15% higher vs. when I covered the full-year results. Some growth is expected later this year, then normal growth from next year. I moderate my view to AMBER/GREEN to reflect the high valuation now attached to these shares.

Volvere (LON:VLE) - up 5% to £14.11 (£32m) - Final Results - Graham - GREEN

Good results showing continued progress at Shire Foods. The Chairman includes in his remarks an acknowledgement that the Volvere share price is not matching up with the company’s asset values; the directors are considering how to “unlock” this value. I am happy to hold and look forward to their ideas.

Paul’s Section:

Zotefoams (LON:ZTF) (I hold)

Up 1% to 524p (£256m) - Trading Update & CEO Succession - Paul - GREEN

22 May 2024 - Zotefoams, a world leader in cellular materials technology, provides a positive trading update for the four months ended 30 April 2024 (the "period"), ahead of its Annual General Meeting to be held today.

Revenue growth looks good so far in FY 12/2024 -

“Trading in the period has been strong, with the Group sustaining the positive momentum seen in FY23 to deliver overall sales growth of 14% and record revenue…”

That’s ahead of the +11% revenue growth in Singers 2024 forecast.

Overall trading is in line with expectations -

“Performance in the first four months of the year has been strong and provides a solid platform from which to deliver further financial and strategic progress in 2024. While being mindful of remaining macroeconomic volatility, the Board's full year expectations remain unchanged, and it is confident about the long-term prospects of the business.”

Helpful footnote, all companies need to include this in trading updates please -

“Note. The Board understands that current market expectations for the year ended 31 December 2024, prior to release of this trading statement, are revenue of £138.5m and adjusted profit before tax of £14.9m.”

ReZorce - there was an upbeat update on this fully recyclable drinks carton development project recently, here on 15 May 2024. There was also a very helpful note from Singers (many thanks) on 16 May 2024, available on Research Tree, which gives more colour on the opportunity with ReZorce. I don’t know any more than anyone else, but it seems to me subjectively that the messaging on ReZorce has become noticeably more enthusiastic, and by doing a press launch on it, I’m taking from that ZTF must be confident the product works, and can be launched. Although that’s still subject to quality & performance testing in bigger trial batches. Note that ZTF is talking about getting external investment in to scale up ReZorce, so my main worry is they don’t give away too much of the upside to partners. Let’s have a placing here, and fund it ourselves, would be my preference. Investors are usually happy to put up fresh cash in a placing if it’s for a viable expansion, not to prop up a failing business model (where valuations are brutal, as seen again today with the disaster Polarean Imaging (LON:POLX) )

Shincell - a partnership was announced previously, but I don’t understand the implications of this, so welcome receiving a more detailed update on what this entails with the August publication of H1 results. Sounds like ZTF might be licensing some new technology or products?

CEO succession - all planned, so nothing to worry about, as very long-serving CEO David Stirling retires. New CEO Designate is Ronan Cox.

Outlook - with the first 4 months ahead of forecast (for revenue) and a fairly upbeat commentary below, it feels to me as if the risk of a profit warning should be quite low here -

Performance in the first four months of the year has been strong and provides a solid platform from which to deliver further financial and strategic progress in 2024. While being mindful of remaining macroeconomic volatility, the Board's full year expectations remain unchanged, and it is confident about the long-term prospects of the business.

Paul’s opinion - as regulars will know, I’ve been keen on this share for some time. My rationale has been that the core business is decent, riding out both the pandemic and energy crisis with aplomb. The various products & divisions seem to balance each other nicely, with any downturn in one area being offset by growth elsewhere, which is again demonstrated in the detail of today’s update.

Critics point out that the business is quite capital-intensive, which is true. However it generates a decent enough ROCE of 12.2%, and note it owns the freeholds on properties which I like, even though it might suppress ROCE a bit compared with leasing properties (depending on the lease terms).

Singers has 22.3p pencilled in for FY 12/2024, so a far from cheap PER of 23.5x. However, FY 12/2025 sees a big forecast rise to 30.8p, which if achieved would make anything under 600p/share look a fair price, in my view. I’m not sure if Singers have factored in an income for ReZorce in future, or not. If anyone knows, please could you post a comment below.

ReZorce sounds as if it’s increasingly credible, and the potential could be enormous longer-term. Although I imagine ZTF would become a bid target if it takes off, and there are not any blocking founder/management stakes unfortunately, just a bunch of fund managers who would probably grab the money if someone offers a big enough premium in a takeover bid.

Overall then, despite the big recent rise, I still find the opportunity here fairly compelling - a good core business, and potentially big upside from a late-stage development project. So I’ll remain at GREEN. For full disclosure, I am required to disclose that I hold personally. ZTF is also on my top 20 share ideas for 2024, (now up 25.7% YTD, with Graham remaining stubbornly ahead of me at +28.6% YTD!) so it’s good to see ZTF developing nicely.

Hopefully we might get some guidance about the potential financial benefits from ReZorce with the next set of results? We’re in the dark so far, just guessing - so a rising share price needs more certainty of at least the range of possible outcomes. I hate relying on the “this could be huge!” type of comments, as that can allow expectations to get well ahead of likely reality, but we don’t know at this stage.

EDIT: I listened in to the IMC webinar today from ZTF, and enjoyed it. The new CEO Ronan Cox led it. LinkedIn says he spent most of his career at Coats (LON:COA rising to President of Performance Materials, which sounds like relevant experience for ZTF. Also present on the call was the CFO, and the outgoing CEO David Stirling. There was a pleasing dynamic between them all I thought, and Stirling is staying on until Oct 2024 to gradually handover the reins on key growth areas of Shincell, and ReZorce.

Shincell - paying this Chinese company £9m over 5 years, in order to use (licence?) its tech for use in new products & markets. Some exclusivityin "strategic markets". "Greatly accelerates innovation" in mixed gas technology that ZTF has been working on.

ReZorce - "very exciting project" for 100% recyclable drinks cartons. "Large response" from the industry, despite no marketing done yet. "Huge market", "massive opportunity" (CFO). Tailwinds coming from legislation for drinks companies to improve recyclability of packagaing. Strong IP. Seeking investment partners, as ZTF is not a packaging company, and needs "considerable funding" and expertise from a large industry partner. ReZorce is "World's first, and only fully recyclable drinks carton". Can be scaled up "pretty quickly". Going through testing for sterility. Don't anticipate any problems with testing.

End of Edit.

Very strong recent move might attract some profit-takers perhaps?

Graham’s Section:

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Down 4% to 893p (£510m) - AGM Statement - Graham - GREEN

This AGM statement is in line with expectations.

Key points in relation to the wider market:

Completions: there has been a 13% reduction in new mortgage lending for Q1 2024, due to a low pipeline being carried into the year.

All purchase-related activity has picked up

Remortgaging is slightly down

As for MAB itself, they have “performed well in these conditions”, growing market share. Their own mortgage completions in Q1 were £5.7 billion, only slightly down on Q1 last year (£5.8 billion) (this figure includes both new mortgages and product transfers).

Adviser numbers: a slight fall in the number of advisers to 2,110. I was hoping to see a slight increase here, but on checking my notes from the recent full-year results, the company did warn that “we do not see normal growth in organic adviser numbers resuming until 2025”.

Here is the latest update on the growth outlook:

The momentum in our new Appointed Representative ("AR") recruitment activity continues to be strong, and consequently we expect a high number of new firms and advisers to join MAB over the next few months. Our pipeline of incoming new ARs has also continued to grow strongly over the last few months…

"We expect our existing AR firms to start growing their adviser numbers again later in the year, most likely as consumer confidence improves when there is more certainty around the outlook for mortgage interest rates and our firms can plan with a greater degree of certainty.

(GN Note: “Appointed Representatives” are the mortgage intermediary firms in the MAB network.)

So a little more patience is needed before adviser numbers start to grow again.

CEO comment:

Our performance once again demonstrates MAB's ability to continue winning market share in all market conditions.

Boardroom changes: the company has a new Chair and new CFO. But importantly the founder-CEO (who is also a major shareholder) remains in place.

Graham’s view

I don’t see any reason to change my view on this: a high-quality franchise-based business that performed well even in the very difficult housing market conditions seen in 2023.

Admittedly, the shares have had a great run up and they do price in an improvement in the company’s performance in the years ahead:

Compared to when I covered MAB in March, the shares are up by a further 15% since then.

That’s the context for today’s slight drop in the share price:

Having checked the best ideas spreadsheet that is shared by myself and Paul, I see that MAB shares are up 9% year-to-date, after having gained a mighty 60% last year.

With “normal” organic growth still not expected until next year, I’m therefore going to moderate my view on MAB to AMBER/GREEN. To be clear: I still rate it very, very highly as a high-quality long-term investment. And I’m glad I put it on my best ideas list for this year. But perhaps the company does need to grow into this valuation now, before any further share price gains will be justified.

Personally, I am optimistic when it comes to the potential for a strong recovery in the mortgage market, but of course nobody can be sure about these things.

Volvere (LON:VLE)

Up 5% to £14.11 (£32m) - Final Results - Graham - GREEN

(At the time of writing, Graham has a long position in this share.)

Even though this is a big holding for me personally, I tend not to cover it too often in the SCVR, as it’s rather illiquid and something of a niche interest.

It’s a turnaround investment vehicle founded by the late Jonathan Lander and his brother Nick Lander.

It came as a great shock when Jonathan Lander passed away in August 2023.

Nick Lander is now running things.

Today we have results to December 2023. I’ll break it down into the key points of interest.

Shire Foods: this is Volvere’s only operating subsidiary. It manufactures pies and pastries for a variety of customers but the headline customers would be supermarkets such as Iceland.

Up until the death of the former CEO, a key talking point was the lack of M&A activity which left Volvere only holding a single business. But more on that later.

Shire Foods has been a successful investment for Volvere. They initially invested £500k back in 2011, to buy 54% of the equity. They also provided working capital.

Today they own 80% of the business. Shire’s 2023 results are as follows:

Revenues £43m (2022: £38m)

Profit before Volvere’s charges (interest and management fees): £3.9m (2022: £2.8m)

PBT: £3.5m (2022: £2.4m).

The way I look at it, Volvere’s stake in Shire Foods should be valued based on 80% (reflecting Volvere’s ownership stake) of the profit before Volvere’s charges.

So for 2023, I would use an earnings multiple of £3.9m * 80% = £3.1m.

Let’s apply 25% corporate tax on that for after-tax net income of £2.3m.

A buyer of Shire might also need to inject some cash into the business but I don’t think the amounts involved would be very large. It should also be pointed out that Shire owns a freehold property (valued at £3.75m in 2021) along with substantial plant and machinery assets.

If a small but successful food manufacturing business, that owned its own properties, could fetch an earnings multiple of ten times trailing after-tax net income, Shire might be worth c. £23m.

Of course I’d be delighted if it could achieve a higher value than that - its growth over the past five years has been superb and perhaps a buyer might give credit for that. Although there has been no indication from Volvere up to this point that they have any interest in selling Shire.

I should add a risk warning that Shire’s revenues are highly concentrated in its top customers. One customer is responsible for nearly half of revenues, and the top four customers generate over 90% of its revenues.

Some commentary on the performance and the outlook at Shire:

In recent months we have found the recruitment market easing somewhat and have been able to recruit for additional shift requirements that are needed to support growth, particularly for the second half of the year when our volumes are traditionally higher. Labour and energy costs are expected to increase this year and, whilst we will endeavour to recover these through increased gross margins, there is no certainty that these will be mitigated in full. Increases in raw materials' costs have, however, largely stabilised and this is expected to remain the norm in 2024.

Overall not a bad outlook - I would hope for another solid performance from Shire this year.

Indulgence Patisserie: no point dwelling on this for too long. It was an acquisition that didn’t work out, and it has been shut down. However, I note that Volvere sold Indulgence’s properties for £2.25m (purchased in 2020 for £0.95m).

Investments and central costs: Shire’s central functions generate investment returns on the group’s liquid financial assets, but also have to pay the Directors.

This year, investment returns improved from £0.7m to £0.8m.

The amount paid by Volvere to the company owned by the Lander brothers reduced from £650k to £549k, and I expect this number to reduce further.

The balance sheet now has cash and available-for-sale (liquid) investments of £23.7m (2022: £20.8m).

Total balance sheet equity for Volvere shareholders is £34.5m.

Future plans?

The big question since last year has been the direction that Nick and the other directors wish to take the company in now. Will they carry on the mission of investing in turnaround companies, and start investing Volvere’s cash, or is now a good time to think about winding up?

Here are most of the top shareholders who might want to have some influence on the decision:

The Chairman has this to say today:

The Board is conscious of the Group's share price, which it does not believe reflects the underlying value of the Group's assets. These are principally cash, liquid investments and the investment in Shire Foods. We are considering a number of ways through which to unlock this value for shareholders and will update investors on these developments at the appropriate time.

Graham’s view

Firstly, in terms of current value, I believe that Volvere is likely to be worth in the region of £47m (80% of Shire valued at ten times trailing earnings, plus cash and liquid investments). Let’s call it £46m, as there are borrowings of £1m associated with Shire. This equates to a share price of about £20.50.

How to achieve this? My own vote would be that Volvere should now look for ways to wind up in an orderly manner. I would return most of the cash currently on the balance sheet to shareholders and I would sell Shire: not in a hurry, but I would start to look for a suitable buyer who is willing to pay a fair price for it.

If none of this happens, then I am not in any huge rush to sell my Volvere shares, but I’m also unlikely to hold them forever.

At the end of the day, the company does need to make a decision - to either put its cash to productive use and invest it, or to return it to shareholders.

Investing will be the more demanding option, and will necessitate a fresh appraisal of their investment strategy.

If they do choose to call it a day, they can do so with their heads held high, having achieved terrific returns for their shareholders over many years.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.