Good morning, it's Paul & Jack here, with the SCVR for Wednesday (first few sections prepared last night by Paul).

Agenda -

Paul's Section:

Universe (LON:UNG) - bumper payday for shareholders here, with a >100% premium cash takeover bid, from a trade buyer.

Ao World (LON:AO.) - very poor interim numbers, with growth low, and fleeting profitability during the pandemic having vanished. This is a very poor business model, in my opinion, as the figures clearly show. I also have concerns about the heavy reliance on commissions from extended warranties, etc.

M&c Saatchi (LON:SAA) (I hold) - another upgrade to expectations. Not cheap, but forecasts keep rising, so is the company now in an "upgrade cycle"?

Intercede (LON:IGP) (I hold) - nothing spectacular in these interim results, but it's tracking in line with full year expectations. The balance sheet has been transformed, with net cash now 18% of the market cap. It has the best blue chip client list I've ever seen for a micro cap, and under the surface a lot has been done to (hopefully) lay the groundwork for fast growth, in this 3-year turnaround. The valuation can be justified on a PER basis too, very unusual for this type of company.

Appreciate (LON:APP) - I'm still quite sceptical about this gift voucher company. But we'll keep it on the radar, as there's a possibility of a turnaround with the digital strategy. I need to see more evidence though, nothing doing so far.

Harland & Wolff Group (LON:HARL) - a blast from the past, for those of us old enough to remember the industrial strife of the 1970s. Can this Belfast shipbuilder rebuild profitability with wind farms, and apparently tightening capacity constraints at competitors? You can be the judge of that, I have no idea!

Jack's section:

Wynnstay (LON:WYN) - trading ahead of expectations and managing inflation well. Reasonably valued with a great dividend track record, so worth considering for longer term investors, although the shares are very illiquid and the company's fortunes depend upon farmgate prices.

Mulberry (LON:MUL) - turnaround of British luxury lifestyle brand could be gaining traction. The share price remains down on historical levels and there has been no equity dilution. But the group has struggled to generate revenue growth and decent operating margins in the past. If management can address this then there could be an interesting opportunity, although the free float is, unfortunately, very small at just over 5%.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Universe (LON:UNG)

11.7p (up 123% yesterday) - mkt cap £31m

An outstanding, and very lucky outcome for shareholders here -

Recommended Acquisition

It’s a 12p cash bid, a remarkable 129% bid premium.

Holders of 51.2% of the company have given indications of support, so this looks a done deal - as you would expect with such a generous premium being offered.

Clearly the bidder sees value in Universe, which is far from obvious in the published accounts - where Universe has disappointed for many years.

The bidder (called PDI) seems to be a much larger software business -

PDI is a leader in enterprise management software for the convenience retail and petroleum wholesale markets.

Therefore, UNG looks a good fit, since it also specialises in areas relevant to this.

So this looks like a case where the business is worth more to a trade buyer than as a standalone listed micro cap.

My opinion - given UNG’s long-term under-performance, this bid seems an exceptionally good outcome for shareholders. Also coming at a good time, since there are many bargains around currently in UK small caps, so the cash windfall can be deployed much more effectively than a few months ago when prices were higher.

Ao World (LON:AO.)

106p (down 14% yesterday) - mkt cap £509m

This online only electricals retailer issued a profit warning, which I covered here on 1 Oct 2021.

I’ve long been bearish about this company, since the business model seems poor to me (very low margins, shifting other people’s brands, with high costs). The valuation has seemed excessively high for a long time. The last profit warning made it clear that the boom from lockdown was a one-off, so the share price has now given up nearly all the boom it enjoyed when the pandemic began.

We’ve seen very severe downward moves across most of the eCommerce sector, not just in the UK, but also internationally, in the last year, as the whole sector de-rates due to concerns about growth, increased competition, and supply chain delays/costs.

.

AO World plc ("the Group" or "AO"), a leading European online electrical retailer, today announces its unaudited financial results for the six months ended 30 September 2021 ("HY22").

This table below is a good way of showing that the negligible growth in H1 this year, comes on top of very strong growth in H1 last year. So the 2-year growth rate is still very good. That’s fine, but the big problem for me, is that the decent rise in EBITDA last year, has not been maintained - it’s actually disappeared. Which suggests to me that they’re back to square one, with a business model that doesn’t really work. Margins, and costs must be under pressure, for EBITDA to have wilted back to just above breakeven.

.

Increased digital marketing costs & recruitment of lorry drivers (500 new drivers recruited) are mentioned as increased costs. Trouble is, AO makes such a low profit margin, that it hasn’t got scope to absorb increased costs.

Outlook - this is the whole of the outlook section, as it’s all interesting -

At the start of our financial year in April, we planned for continued revenue growth and built up our cost base accordingly. However, since then, growth in the UK has been impacted by the nationwide shortage of delivery drivers and the ongoing disruption in the global supply chain, and the German online market has seen significantly increased competition.

As we now look to the second half, we continue to see meaningful supply chain challenges with poor availability in certain categories, particularly in our newer products where we have less scale, experience and leverage. In addition, shipping costs, material input prices and consumer price inflation remain challenging uncertainties.

As a result of these factors, the all-important current peak trading period is significantly softer than we anticipated only eight weeks ago. As a result, we now expect full year Group revenue to be flat to minus 5% year on year, with Group Adjusted EBITDA in the range of £10m to £20m.

While a substantial amount of short-term uncertainty remains, we are taking decisive action to address and mitigate the issues and are confident in our ability to trade our way resiliently through this period. In the medium-term, our international expansion ambitions remain entirely unchanged. We remain confident about AO's future prospects, based on the strength of our business model, the quality of our customer proposition, and the ongoing structural shift online.

Net debt - alarm bells rang in my head when I saw that net debt is reported at £102.2m which would be a problem, given that the company is now loss-making.

However, it turns out that this includes £93.3m in lease liabilities. Most companies report net debt excluding lease liabilities, or provide both numbers in the headlines. So AO has scored an own goal here, by quoting the artificially high IFRS 16 net debt figure. The real world net debt (under IAS 17) is modest, at £8.9m, which is not a concern. So we can reset the alarm bells!

Balance sheet - overall looks adequate, with NTAV of £47.3m, and only modest bank debt.

However, there are a number of large items which concern me - in particular receivables seem extremely high for a retailer (where customers pay up-front, so receivables should be very low).

Tracing things through to note 8, the reason is “Contract assets” of £173.6m, sitting in receivables. The note explains -

Contract assets

Contract assets represent the expected future commission receivable in respect of product protection plans and mobile phone connections. The Group recognises revenue in relation to these plans and connections when it obtains the right to consideration as a result of performance of its contractual obligations (acting as an agent for a third party). Revenue in any one year therefore represents the estimate of the commission due on the plans sold or connections made.

The cash for this seems to be received over c.1-2 years, with £73.7m cash received in H1 - that’s a huge number. It seems to suggest that AO is effectively selling goods at a loss, once its overheads are taken into account, but makes money on extended warranties, product protection plans, etc. Even after those revenues, it’s still managed to be loss-making in H1.

This strikes me as a very poor business model. What happens if this is the next area to attract mis-selling, or other regulatory attacks? Something adverse happening in that regard could cripple AO. Hence I think this share could be quite high risk.

My opinion - this company looks very poor to me. It’s got a low margin, and now a loss-making business model. I’m concerned about how heavily reliant it seems on profits from extended warranties, and other add-ons - the huge receivables balances on the balance sheet demonstrate how material this income is. We’ve now had 2 profit warnings in 2 months.

There’s only been one year where it made a significant profit, due to lockdowns. Now we’re back into losses (at the operating & profit before tax levels - i.e. real profitability!)

We’ve seen several other eCommerce companies complain that digital marketing has become more expensive, as competition for advertising & search words increases. AO also mentions this in its commentary today.

All of this leads to me viewing AO very negatively. I think this is a marginal business, that is not likely to ever generate significant and sustainable profits. The space it’s in is too competitive, with low margins, and AO has adverse costs (e.g. 2-person deliveries).

Hence even though the shares have now lost three-quarters of the peak price in Jan 2021, I still see absolutely no attraction to this share whatsoever. The £509m market cap still seems far too high, given that there’s little growth, and no profitability now.

I suppose the upside story is that growth might resume, and excess costs could moderate in future, but why would I want to gamble on that happening? The only other hope, is that the stock market has previously valued this share at irrationally high valuations, so that could happen again, which is speculation rather than investment.

If you really want to invest in an online electricals retailer, there’s now another option - much smaller, but more profitable (as a % of revenue) competitor Marks Electrical, which floated on AIM on 5 Nov 2021. I’ve had a quick skim through its admission document here, and my main concern is that it looks an opportunistic float, on the back of stellar growth in profits in the pandemic year FY 3/2021. That may not be sustainable, as we’re finding out from lots of other eCommerce businesses.

Interim results from Marks Electrical cover the same period as AO World’s interims above, but show continued very strong growth, and a much better EBITDA margin than AO. So perhaps smaller is better, in this sector? AO’s figures look bloated & inefficient, in comparison. I really don't want to own either AO or Marks Electrical, it's just not a sector that interests me.

M&c Saatchi (LON:SAA) (I hold)

166p (up 1.2% yesterday) - mkt cap £203m

The Company is pleased to announce a further trading upgrade for 2021.

Since the last trading update on 21 September 2021, the Company has continued to trade well.

As a result of the continued strong performance, management now believes the Company's headline profit before tax for FY21 will be ahead of consensus expectations, with both revenue and operating profit margin ahead of market forecast.

New business continues to be strong with new client assignments including projects for Apple and Mars. We extended relationships with Commonwealth Bank, Whoop and TikTok, and 'Icelandverse' became one of the most talked about campaigns of the year.

Going through the archive here, I can see my previous comments gradually turning positive earlier this year, as the company resolved previous problems (of potentially bad dilution), and issued increasingly positive trading updates. Getting another positive update today (albeit with no numbers, frustratingly) strengthen my view that this PR/marketing group seems to be on a roll.

Broker forecasts - many thanks to Liberum who update us today. Forecasts are -

FY 12/2021 - eps 5.6p = PER of 29.6

FY 12/2022 - eps fc 6.5p = PER of 25.5

Hmmm, that doesn’t look good value. The assumption must be that SAA continues to out-perform. Indeed, the Liberum analyst Ciaran Donnelly does talk about a potential "upgrade cycle", which has been happening already -

I wish I could remember more about why I bought these shares, and can only remember that at the time they looked reasonable value, and the company was out-performing, so likely to upgrade more. Today seems to confirm that, although the valuation doesn’t look a bargain.

The long-term chart suggests there may be more upside, but remember that the share count has increased a fair bit since the previous highs.

Also with this type of business, where by far the largest cost is staff, who want a slice of the action when things are going well, so that might limit the upside for shareholders possibly?

.

.

Intercede (LON:IGP) (I hold)

83p (down 3% yesterday) - mkt cap £47m

Intercede, the leading specialist in digital identity, credential management and secure mobility, today announces its interim results for the six months ended 30 September 2021.

Revenues of £4.9m in H1, up only 2%, but up a more respectable 9% on constant currency basis (most revenues are earned in USA, but costs are mostly UK).

The most notable item on the P&L is that finance costs in H1 fell from £295k last time, to £53k this time, due to the convertible loan notes having converted into shares - this is the first period to benefit from this reduced interest cost, which is material to profitability.

Taxation is negative, due to R&D tax credits, and again is material.

H1 profit after tax is £539k, up slightly on £441k last time. Note there’s an H2 weighting to profits, due to contract renewals at the year end.

Balance sheet - is absolutely transformed for the better, now that the £4.8m loan notes have converted into equity. Therefore all previous concerns about this issue have completely gone. For the size of business, we now have a strong balance sheet - £5.2m NTAV (there are no intangibles, the accounting is very conservative, writing off all development spend, capitalising nothing, which I like).

There’s £8.5m net cash, which is 18% of the market cap - a very comfortable position. Management started to talk about the possibility of bolt on acquisitions in future, when they last presented to investors. Although costs have been suppressed for several years now, hence it should be expected (and welcomed) that some staff pay rises and bonuses have been implemented.

Many staff are very long-serving - a point which came across strongly when I was delighted to be invited to join a short section of Intercede's staff Zoom conference some time ago, to give my perspective as a small shareholder. What a great initiative, connecting staff and a small shareholder, more companies should do this.

What came out of it was that many staff are very long-serving, and are also small shareholders. I emphasised that the stock market really values growth above all else - so accelerating the growth rate is key to a higher share price. Plus I emphasised that as a small shareholder, I'm just a back seat passenger, so thanked the team for everything they do, and expressed my confidence in the company and its prospects, whilst also emphasising that I'm only speaking for myself, and other shareholders may have different views.

Commentary - there’s always a lot of interesting information in Intercede’s results commentary, so I’ll pick out items which I think are worth flagging -

Record new customer wins of 8 in H1 - the business model has been changed to focus on partnerships, which I hope could accelerate growth. The investing opportunity as I see it with IGP, is that it has very sticky long-term client recurring revenues, so if it can accelerate new client wins, then the operational gearing from an already profitable base position, could be exciting, and give us a multibagger. Easier said than done, of course.

The key point with IGP is its astonishingly high quality client base - UG Govt Depts, major aerospace multinationals (Boeing, Airbus, etc), international banks, etc. Once installed, these relationships can last 10-20+ years, with recurring revenues, support revenue, and hardly anything goes wrong with the software, so new clients can be easily supported due to the low level of support tickets, I understand.

M&A - I think IGP could be a target for a larger software group. However, it is also considering its own deals -

Phase 2 of the Intercede turnaround plan is underway to push scalability and accelerate revenue growth. The Company is building an M&A pipeline to expand its footprint across the authentication pyramid and to address adjacent market segments.

I’m a bit nervous about this. The last thing I want, is for management to be distracted by deal-making. That said, the CEO has established a track record of being shrewd, and cost-conscious. So I’m confident they’re not likely to let egos run wild, and destroy shareholder value. The CEO strikes me very much as a man who would walk away from a deal, rather than doing a bad deal. That’s obviously subjective though.

Another key point on M&A, is that personally I would only want to see deals done, if the story could be sold to enthusiastic institutions, prepared to fund any placing at the current share price, or even a premium. I think it’s important that small shareholders like us are protected, as we don’t usually get access to placings. Also that adviser fees are kept under control, as we’ve seen some utterly ludicrous deal fees recently.

Ultimately, one of the key advantages to being a listed company, is access to fresh capital. If there are good M&A opportunities, executed well, then this could build into a bigger group.

Outlook - plenty of interesting stuff in here -

Whilst the nature of Intercede's business and customer profile is such that the precise timing of orders is difficult to predict, the first half of this year gives us several reasons to be cautiously optimistic. We have continued to demonstrate the strength of our product suite in our core market (PKI), which offers our Blue Chip client base the highest levels of authentication technology available. We are encouraged by the long-term nature of these customer relationships, which remain sticky and grow incrementally over time and provide us with a solid sales pipeline to support management's revenue target.

At the same time, Intercede has ambitions to generate further top line growth and we have identified various avenues to achieve this in the medium-term. We have expanded our TAM (Total Addressable Market) by moving into the FIDO space, which requires a rigorous but lower level of authentication technology and makes our products more relevant to a wider customer base.

Initial indications from the proof of concept phase are promising and we look forward to rolling this new solution out to both existing and new customers. With a renewed focus on growth, we have also implemented an M&A strategy which will concentrate on gaining exposure to adjacent and attractive markets.

With various positive structural growth drivers in play and expansion into new markets, the Board remains positive about the medium and long-term prospects for Intercede. As a such, whilst we remain cautious of the effects of COVID-19, the Board can confirm that the outlook for the second half of FY22 continues to remain in line with management's expectations.

My opinion - I remain astonished that Intercede is only valued at £47m, yet provides vital cybersecurity software for some of the world’s largest organisations, including various USA Govt Depts. The commentary explains how recent cybersecurity attacks are driving legislation in the USA to require more controls in this area.

Usually, small software companies like this trade at a hefty loss, and bleed cash, needing repeated fundraisings. Yet Intercede is already profitable, cash generative, and sitting on a cash pile that’s 18% of its market cap.

As I always say, if it can accelerate growth, then there’s a chance the market cap could really take off, and become a multibagger. I’m not saying that’s definite, because nobody can predict the future. But in terms or risk:reward, the company is reasonably priced as things stand now without any new contract wins, so accelerated growth would be a game-changer that we’re not having to pay for up-front.

Broker consensus is EPS of 2.6p for FY 3/2022, and 3.6p for FY 3/2023.

At 83p per share, those are PERs of 31.9, and 23.1 - which doesn’t include any adjustment for the £8.5m net cash pile. We would be looking at a PER just under 20 for next year, if we adjust out the cash. I find that an appealing valuation for a business in such a relevant, growth sector as cybersecurity. Which is already profitable & world-renowned.

What’s not to like? In terms of risk, the main one would be if the software fell over & customers abandoned it. Given that it has a 20-year record of serving major organisations, and many long-serving staff (so expertise retained), hopefully that’s very unlikely.

Other risks could be if the biggest clients which renew year after year, suddenly sprung a surprise and decided to cancel instead of renewing. Again probably not likely, but nobody outside the company really knows.

To conclude then, I think risk:reward for Intercede shareholders looks excellent. The way I see things, the current valuation of £47m seems tiny, considering this business provides vital software for so many major organisations.

The PER is reasonable on the existing level of profits, and there’s no dilution risk because it’s securely funded - although acquisitions could involve a placing - introducing risk, but also opportunity. Ultimately we have to trust management to get it right.

Then we have the potential upside from increased contract wins through the recently widened product range, and the partnership programmes which have already begun to bear fruit (8 new customers in H1).

Not a share for traders, I think IGP remains an excellent, and reasonably priced long-term investment. I’ve been in since 2018, and am very happy to remain on board. Can you imagine what it would be valued at, as a fresh IPO? Probably multiples of the current valuation. That’s one of the things I like about turnarounds - it takes the market a while to realise that the outlook has improved. Whereas IPOs are usually over-priced on hype. I'd much rather buy the cheap, overlooked turnaround, than an over-hyped newcomer. Then we have to just sit back & wait. Some do well, some don't.

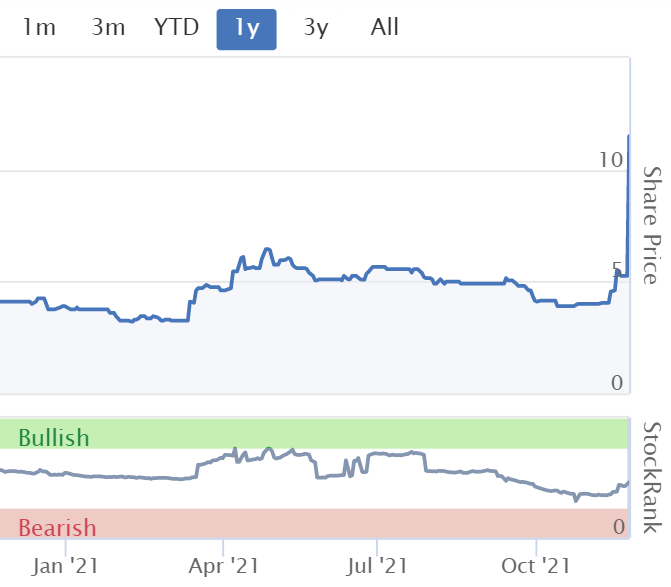

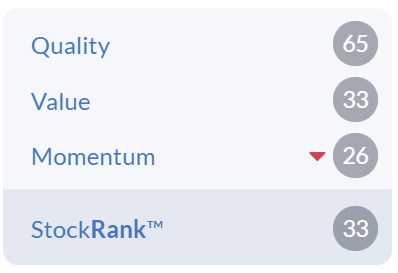

Stockopedia's computers don't really share my positive view, with a disparaging StockRank. A low StockRank makes me pause, and reconsider - is there anything I've missed?

.

Comments from Andy Hornby of Restaurant (LON:RTN)

Many thanks to the superb Propel Newsletter, which is essential reading.

I read its daily newsletter, if I can find the time, alongside the always superb & amusing daily updates from Langton Capital - both are hospitality sector experts.

I find hospitality interesting, because it’s so similar to my own sector specialism (where I was a CFO for 8 years in ladieswear retail, for those that don’t already know me here) - the dynamics of multi-site operations targeting consumers, are really very similar, except that in fashion retail, the customers are usually sober.

The reason I mention this, is that Propel recently published an excellent article with RTN’s CEO sector comments, which I summarise as follows -

VAT support ends 1 April 2022

Rent moratorium also ends at same time - so landlords can kick out tenants who are refusing to, or cannot pay rent

Net living wage also rises, about 6.5% I think

90% of staffing problems are back of house (i.e. kitchen). This got me thinking - why do most chains actually need chefs? If they simplify menus, and give proper training, they could employ (much more cheaply) cooks, not chefs. Millions of people know how to fry an egg, or a steak, etc. Most mass market casual dining food does not actually need a chef, who are notoriously difficult, and always want to do things their own way. My own restaurant startup was a disaster, I’ll tell you all the awful details when we have more time, but basically I threw away about £200k because I thought it would be fun to own some pubs & start up a restaurant. BIG mistake! It took years to get out of the personal guarantees on the rents (£2m over 10 years - what on earth was I thinking?!)

Launching apprenticeship scheme (good! Train up people, rather than exploiting cheap labour from abroad, which strips other countries of their best/trained people, so a form of negative foreign aid - deeply unethical, if you think about it)

Reviewing policy on sharing of tips (again - good. After all, why should the waiters get the tips, when the main driver of customer satisfaction is the quality of the food? Share the tips with the kitchen staff, at least 50%, I reckon)

Supply chain - it’s all about price rises, more than shortages.

Quick comments -

Appreciate (LON:APP)

Interim results - this company provides gift cards. The bull case is that it’s shifting online, hence might have good upside.

I’m not convinced, but am happy to keep an open mind. Numbers today show a reduced H1 loss on H1 last year. It’s an H2 seasonal biased business.

Lots of cash on the balance sheet, but it’s in trust, belonging to customers. Net tangible assets are negligible.

I’ve got 2 problems with Appreciate -

To be blunt, I don’t rate management - the last presentation was poor.

I don’t rate the business model - most people would love a £10 M&S voucher, but would not rate a £10 voucher from this company.

Poor customer journey - someone, I think it was the ONS, sent me a £10 “Lovetoshop” voucher from Appreciate, and it turned out to be worthless - I had to register on its website, and give an intrusive level of personal data (including date of birth) and then I forgot to redeem the voucher, and found it had expired when I did a very unusual removal of debris from my workstation. In my experience, and talking very generally, any business that leaves a tail of unhappy customers in its wake (e.g. Purplebricks) , is probably going to struggle to maintain profits, or even survive. I try to avoid investing in anything like that.

My opinion - based on everything I’ve seen to date, Appreciate could be a dud. Not something I would want to own, but we could be pleasantly surprised, who knows? I’ll keep an eye on it, because when the market cap gets this low, the potential upside can be quite nice if things improve. Some of my best profits have come from buying shares that everyone else hates & dismisses, where I’ve spotted a turnaround.

Well known investor, Richard Crow is very good at this, often spotting good turnarounds early. They don’t always work, obviously. I think the trick with turnarounds is to make 100%+ on the good ones, and to ditch the losers early, hence incurring a loss of under 50%. As always, easier said than done!

.

.

Harland & Wolff

Down 31% to 19.75p

Reason - equity fundraising for £7.7m after fees, including a Primary Bid element (flippers?)

The name “Harland & Wolff” rings multiple bells in my mind. The loudest are probably for strikes, and inefficiency in the 1970s & 1980s, then Mrs Thatcher losing patience, and withdrawing taxpayer support for old-fashioned, moribund operations like this.

But there’s more - they made the Titanic! Here’s the Wikipedia page.

Imagine millions of rivets, of possibly inadequate tensile strength, being banged into place, and occasional episodes of men plunging to their deaths from creaking platforms - it’s barely imaginable to think how cheap life was back then. People complain about elf n safety, but personally I think it’s a damned good thing we do value human life now. That should not be controversial at all.

My opinion - totally uninformed, as I’ve only just started looking at the numbers.

My first point is that a c.30% discount on a small £7m placing, means the institutions aren’t interested. A few are just taking a punt on it, with play money (for them), and want to dilute other shareholders, on a put up or shut up basis.

Secondly, on reading the most recent update from this company, I notice it has 250 acres of dockside land. Has this been sold & leased back I wonder? If it’s freehold, it could be worth a bob or two to someone else, I don’t know.

Thirdly, H&W seems to be pivoting to wind farms & stuff like that. As well as shipbuilding. It talks about £500m p.a. Revenues which seems very ambitious.

Overall, I wish them well, but it sounds a total punt, good luck to all involved. The commentary makes good points about a strategic need to revitalise the UK’s shipbuilding capacity. I couldn’t agree more. Maybe there’s a high risk opportunity here? If I was groaning with cash, I’d probably have a small punt, but … sadly not. South Korea & places like that seem to trounce the UK with shipbuilding.

.

Jack’s section

Wynnstay (LON:WYN)

Share price: 571.2p (+7.77%)

Shares in issue: 20,298,868

Market cap: £115.9m

A short ‘trading ahead’ update from this agricultural supplies group today. Wynnstay shares are illiquid, and the company itself can be seen as boring, but that can often be a positive for those not chasing lottery-type returns.

It’s a sensibly managed, dividend-paying enterprise that has been operating for more than a century now, and a solid long term hold candidate for those who can afford the liquidity and cyclical risks.

Trading since June, and for the key trading month of October in particular, has been strong across all core activities.

Certain areas have outperformed the Board's expectations especially fertilizer blending activities, which experienced certain one-off benefits, and joint venture activities. As a result, the Board now expects that underlying Group pre-tax profit* for FY 2021 will be significantly ahead of current market forecasts.

The group is experiencing strong farmgate prices across almost all categories, which has continued to buoy farmer confidence and farm re-investment. Tonnages and yields have reverted to more normalised levels following a poor harvest last year, boosting arable activities in the important final quarter of the financial year, and grain prices remain strong, while the Specialist Agricultural Merchanting Division experienced strong demand from farmer customers across all major categories.

The group has so far avoided significant disruption due to inflationary and supply chain pressures, and ‘expects to be able to continue to manage these operational and cost challenges effectively, although some imported product lines have experienced delays and this may continue.’

Outlook - The board believes that the short and medium term outlook for agriculture and farm commodities in the UK remains positive.

Conclusion

A short update to confirm that trading is ahead of expectations. Agricultural commodity prices can be cyclical, but Wynnstay has a fairly low risk expansion plan revolving around organic growth and bolt-on acquisitions to build out its presence across the UK.

It’s got a great dividend track record and is prudently run.

While margins are low, they are resilient, and the group is reliably cash generative. Returns on capital employed are also fairly low, but the group has good asset backing and shares trade at around 1.35x net tangible book value.

The valuation is returning to the higher points of its historical range and has recovered strongly since 2020. It’s also likely that, at some point in the future, Wynnstay will be forced to navigate less favourable farmgate conditions. But the conditions are currently positive and, as a long term hold, this continues to strike me as a good candidate. Unfortunately, building up a meaningful stake can be tricky.

Mulberry (LON:MUL)

Share price: 340p (+12.58%)

Shares in issue: 60,077,458

Market cap: £204.3m

Mulberry is a British luxury lifestyle brand famous for its iconic bags. The shares bombed a couple of years ago after poor trading exposed its hefty cost base. Today, the share price is up significantly but still well down on levels seen four years ago, and commercial leasing dynamics have changed for the better.

Looking at the historical results, revenue held up reasonably well until FY20 while profits deteriorated, so perhaps it’s been more of a cost base issue than fading popularity? Checking back through the Mulberry archives, Graham covered a poor trading update and exposure to the House of Fraser collapse back in 2018.

Turnarounds can be very lucrative when successful, and Mulberry has the same number of shares in issue as it did back in 2017/18, but a lot here will depend on the quality and popularity of Mulberry’s products. So if anyone has any insights there as a customer then please do share.

Highlights:

- Group revenue +34% to £65.7m,

- Profit before tax of £10.2m, up from a loss of £2.4m (including £5.7m profit on disposal of Paris lease),

- Gross margin of 69%, up from 59%, ‘due to a strategic focus on full-price sales and increased volume efficiencies’

- Period end net cash of £30.3m (2020: £8.6m) and deferred liabilities of £5.0m (2020: £4.6m)

Breaking down the group revenue, UK retail sales were up 36% to £38m, Asia Pacific sales grew by 23% to £11.8m (helped by China, up 38%), and US retail sales increased by 57% to £3.3m. International retail sales in total represented 40% of group revenue. Franchise and wholesale sales jumped 67% to £10.1m. Meanwhile, digital sales were 29% of total - down on last year but up 20% on 2019 ‘reflecting the ongoing strength of this channel’.

Supply chain challenges have been managed:

The combination of our UK factories, careful planning and agile supply chains has enabled us to successfully navigate the well-publicised difficulties in global logistics, with no impact on fulfilment to our sales channels.

Current trading - Retail revenue in the 8 weeks to 20 November 2021 increased 35% compared to the same period last year. Gross margin in the second half is expected to be similar to, or slightly higher than, the 67% achieved in the second half of last year. The Group is expected to continue generating cash from operations in the second half and, with its deferred liabilities expected to unwind, the Group will maintain a strong cash position at the year end

Sales are expected to continue to grow in the second half, and retail revenue in the 8 weeks to 20 November increased 35% compared to the same period last year. Gross margin in the second half is expected to be similar to, or slightly higher than, the 67% achieved in the second half last year.

In view of the strong performance in the first half and the Group's substantial cash reserves, a progressive increase in marketing expenditure is planned in the second half to continue building brand awareness worldwide.

Projects are in place to move the group's legacy systems forward, and to develop the next generation of digital and omni-channel platforms. This is expected to lead to increased capital expenditure next year and beyond.

Longer term, Mulberry hopes to become the leading responsible British luxury brand ‘and a pioneer in sustainability’, which sounds promising from both ethical and marketing perspectives. The group says:

We believe the opportunity is substantial and we have taken a progressive leadership position in this space, investing in products that are made to last, and offering customers circular repair and buy back options through the Mulberry Exchange.

The balance sheet could do with more work and lease liabilities remain significant at £70.9m, although this is down from £88.2m. The current ratio is solid at 1.7x and the cash balance has improved, so the direction of travel appears to be positive.

Conclusion

It should be noted that the outlook continues to be subject to a degree of uncertainty as the important festive period commences. Lockdowns over these key trading months would materially change the prospects in the short term.

That aside, it looks like the turnaround is worth digging into here:

The reduction in lease liabilities (current and non-current) by £17.3m to £70.9m (2020: £88.2m) is primarily due to the renegotiation and termination of certain leases.

That’s an encouraging reduction in the lease cost base. Meanwhile, the company is confident of ending the year in a strong cash position.

Store sales are roaring back post-lockdowns and the group is gearing up to invest in marketing and systems. The latter brings disruption risk if anything goes wrong while updating legacy systems, but assuming there are no issues then this should make for a more efficient operation.

No equity dilution, either, unlike Ted Baker (LON:TED) for example. The shares have more or less trebled since the 2020 low, but remain well down on the 1,000p+ range they were trading at a few years ago.

It would be good to see more director buys and institutional interest, but the free float is so small that there’s really not much liquidity for statement purchases. It’s a tiny free float, just 5.7%, meaning the amount of shares you are able to trade is again a consideration.

Can the brand reclaim its former glory? The company is confident, as you would expect, and the results suggest signs of life. Oddly though for a luxury lifestyle brand, Mulberry has really struggled to generate good margins in the past, so with a market cap now north of £200m, the company has to prove its profitability.

Mulberry operating margin

Compare that to Burberry (LON:BRBY) , for example (below). I wonder why this huge gap in margins existed even when Mulberry was more favourably perceived by the market. The group’s H1 2021 operating margin is a much improved 18%.

Burberry operating margin

Signs of meaningful revenue growth could be a strong catalyst, given the group has struggled here in the past.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.