Good morning from Paul & Graham.

Today's report is now finished, at 13:44

(for any new subscribers, we first post a blank "placeholder" article at 07:00 every weekday, so that readers can add your initial comments on the day's announcements, which we encourage, especially if you add your own insights to any news. The main article then gradually builds throughout the morning, until usual finish time of 13:00, when the SCVR email goes out)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Summaries

(more detail in sections below)

Persimmon (LON:PSN) - 1289p (up 4% at 08:42) - mkt cap £4.1bn - Paul - GREEN

This Q1 trading update caught my eye, and has read-across for lots of smaller caps that are dependent on a healthy housing market. Q1 traded as expected, but the outlook comments sound rather encouraging for a housing market recovery. Hence I think the whole sector is worth a fresh look.

Nichols (LON:NICL) - £10.90 (pre-market) (£398m) - Graham - GREEN

Q1 update for AGM is in line. Out of Home business struggles, blamed on cost of living issues. CFO leaves. Adj. PBT of £25m is forecast for 2023. I like this company and hope for improvement in subsequent years.

Brickability (LON:BRCK) - up 4% to 68p (at 10:08) (£205m) - Paul - GREEN

Given uncertain macro conditions, I find this ahead of expectations update a positive surprise. The forward PER of only 5.9x is clearly factoring in a significant cyclical downturn in profit - but there's no sign of it happening so far. Although outlook comments imply some softening may happen short term maybe? Very good value in my view, so it has to be green.

Elementis (LON:ELM) - down 1% to 117.8p (£689m) - Graham - AMBER

Another Q1 AGM update. Trading and outlook are in line with expectations. Market conditions are said to be affecting demand but the company is also showing signs of pricing power. Could be worth a closer look.

Learning Technologies (LON:LTG) - down 16% to 109p (£861m) - Graham - AMBER

Final results in line but the outlook is a profit warning due to a forecast EBIT growth rate for 2023 of only “high single digits”. It would be nice if profit warnings were delivered in a more straightforward manner.

Warpaint London (LON:W7L) - up 7% to 210p (£161m) - Paul - GREEN

Slightly ahead of expectations FY 12/2022 results. Together with an even better Q1 performance than was indicated about a month ago. Lovely balance sheet, and decent cash generation (funding organic growth and reasonable divis). It's not often I find strong organic growth, at a still-reasonable valuation. Thumbs up from me.

Quick Comments (from Paul)

(no additional detail below)

Touchstar (LON:TST) - this minnow software company confirms it has reduced the share premium account by £1.2m, which enables it to legalls pay divis or do share buybacks. Recent results showed it had 41p/share in net cash. There might be some potential with this share, I've been following it for years, but progress has been quite slow so far. Only £422k PBT (although that doubled from LY) recently reported.

Polarean Imaging (LON:POLX) - a very strange one, where investors were excited about FDA approval for its imaging technique/product, which happened and the shares subsequently collapsed in price. With hindsight, a good example of too many people chasing up the price on the rumour, but then seeing the price crash on the actual fact. At only about a quarter of the hyped-up previous price, maybe it's worth a fresh look now? Today's news is I think the first commercial sale of its specialist gas blend for MRI scanners.

Eagle Eye Solutions (LON:EYE) (Paul holds) - good newsflow continues, with yesterday's announcement of a new 5-year contract with John Lewis & Waitrose. It seems to be an existing client, but has signed up for a new product with EYE, if I'm reading the RNS correctly. I should add that I bought a starter position in EYE (we clearly disclose all personal holdings here) earlier in April, after listening to webinars on PIWorld. This share is more expensive on traditional metrics than I would normally tolerate, but it does seem to have genuine expertise in a niche, serving big clients internationally. Hence it strikes me as something with genuinely exciting growth potential. It's moved into profit now. Concerns are over valuation, and management greed that other investors have flagged.

Paul's Section -

Persimmon (LON:PSN)

1236p pre-market (£4.0bn) - Q1 Trading Statement - Paul - GREEN

A mid-cap housebuilder, which is relevant here for read-across to lots of small caps - as so much hinges on a healthy property market. There’s lots of info in this update - Q1 trading was as expected (weak, due to the macro chaos last autumn) - Q1 completions down 42% on LY, build rate 30% lower, but this is reflected in forecasts that have already been slashed across the sector.

So this issue really is, are there signs of life in the outlook comments? Yes, is the short version. This reads well I think - e.g.

- Selling prices holding firm (+10% Y-on-Y, surprisingly), so no signs of having to discount heavily to get sales agreed.

- Recent weeks have seen “some encouraging signs” re customer activity.

- Current trend suggests FY 12/2023 volumes will be at top end of previous guidance of 8-9k properties sold.

Building cost inflation stabilised at 8-9%, with “limited signs” of that easing. - Customer confidence improving, but less so with first-time buyers, who are finding affordability stretched, and harder to secure mortgages.

FY 12/2024 outlook sound positive - expecting a recovery in both volumes and margins (this is currently not reflected in forecasts, so there could be upside here).

Paul’s opinion - I think this is very encouraging, and am flagging up the whole housebuilder sector to SCVR readers as possibly being worth a fresh look. PSN’s share price is back down to barely above the chaotic time last autumn. Whereas some other housebuilders have seen a good recent bounce, so maybe this one could be an interesting one to look at? Or maybe there are specific factors affecting PSN that investors are wary of?

Strong balance sheets across the sector mean that there’s not really any solvency or dilution risk, even if the macro picture were to worsen due to unforeseen events.

You do have to also take into account remediation costs re cladding, and the additional rate of Corporation Tax that housebuilders will be subjected to in future.

Brickability (LON:BRCK)

68p (up 4% at 08:50)

Market cap £205m

Following on nicely from a housebuilder, is this distributor of bricks.

I last reviewed its positive update here in Feb 2023, which was ahead of expectations - surprising plenty of us I think, given that housebuilders have slowed down their pace of construction, as mentioned above in my review of PSN.

It’s obvious from the low share price that investors must be expecting a slowdown from BRCK, given that its forward PER is only 6.3. There’s also an attractive dividend yield of c.5.2%, but no asset backing (unlike the housebuilders).

On to -

Brickability Group plc (AIM: BRCK), the leading construction materials distributor, is pleased to provide the following update on trading for the year ended 31 March 2023.

Continued robust performance, record Adjusted EBITDA of >£50m and strong acquisition pipeline

Q4 “remained resilient”, despite macro uncertainty.

FY 3/2023 is ahead of expectations again (following an upward revision in Feb 2023).

Revised guidance now is £50m+ adj EBITDA (consensus previously £47.1m)

Revenue of £681m is up an impressive 31%, but most of the increase has come from acquisitions, since only +4% is like-for-like (LFL).

Note that the exceptional performance last year from timber has been a headwind this year. This is important, because the other divisions achieved +15% LFL revenue growth, much more impressive than the +4% overall growth including timber.

Net bank debt is insignificant now at only £8m.

Acquisition pipeline strong, and I think it can probably make more acquisitions without dilution, given modest debt.

Outlook comments sound a little cautious, with mention of challenging conditions in some sectors, and robust long-term demand (which I always think is softening us up for shorter term weakness!)

Broker update - many thanks to Cenkos for publishing an update on Research Tree. £50m EBITDA becomes £43.1m adj PBT, and 11.6p EPS - so at 68p/share, I make the PER only 5.9 - which leaves plenty of scope for a downturn in demand (that hasn’t actually happened as yet, but might do).

Forecast for FY 3/2024 assumes a small slowdown in EPS to 10.2p.

Paul’s opinion - this update strikes me as remarkably good in the circumstances. Maybe price rises are obscuring volume shrinking, possibly? Ultimately, I don’t care where growth comes from (price, volume, or a combination), all that matters is what’s happening to profit - and it’s going up here.

It’s getting very tempting to throw caution to the wind and buy BRCK, given that the 68p share price already effectively prices in a halving of future earnings. Maybe that’s too cautious, providing possible upside on the share price?

Warpaint London (LON:W7L)

210p (up 7% at 12:09)

Market cap £161m

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands is pleased to announce its audited results for the year ended 31 December 2022.

Record sales and significant profitability reflect strong full year performance; positive start to 2023

This is one of my favourite GARP (growth at reasonable price) shares, so let’s see if its FY 12/2022 results stand up to scrutiny.

Key numbers, with my comments -

Revenue £64.1m, with over half now being international (+48% growth).

Gross margin up to 36.4% (LY: 33.8%) - I’m impressed, given that input cost inflation would have been a headwind.

Adj operating profit £10.3m (LY: £7.0m)

Adj EPS up 44% to 11.2p (giving a PER of 18.75) - this is a slight beat against a forecast of 11.2p from Shore Capital (many thanks).

Current trading - I last reported on Warpaint here on 24 March 2023 when it gave a positive view of FY 12/2022, after a strong Q4, and indicated that strong trading had continued into Q1 2023.

Q1 has turned out better than imagined, with £18.5m sales (I deduced c.£17m in my last report here), giving Q1 growth of 40% (and note that the Q1 2022 comparator was strong, so beating it by 40% really is impressive). This is all organic growth remember, there have not been acquisitions of other businesses.

Gross margin is also said to be up in Q1.

Outlook - sounds confident, and I think we can clearly expect more organic growth, from W7L’s simple but effective strategy - increasing its presence, and range sizes, in large retailers, globally.

Inflation & gross margins - this is interesting, and I think could apply to many more companies providing consumer products -

The currency options we have for the current year, the falling container rates, new product development, sourcing, and growing sales in the USA, will all help to protect our margin in 2023…

In addition, the increased scale of the business has given the Group increased buying power.

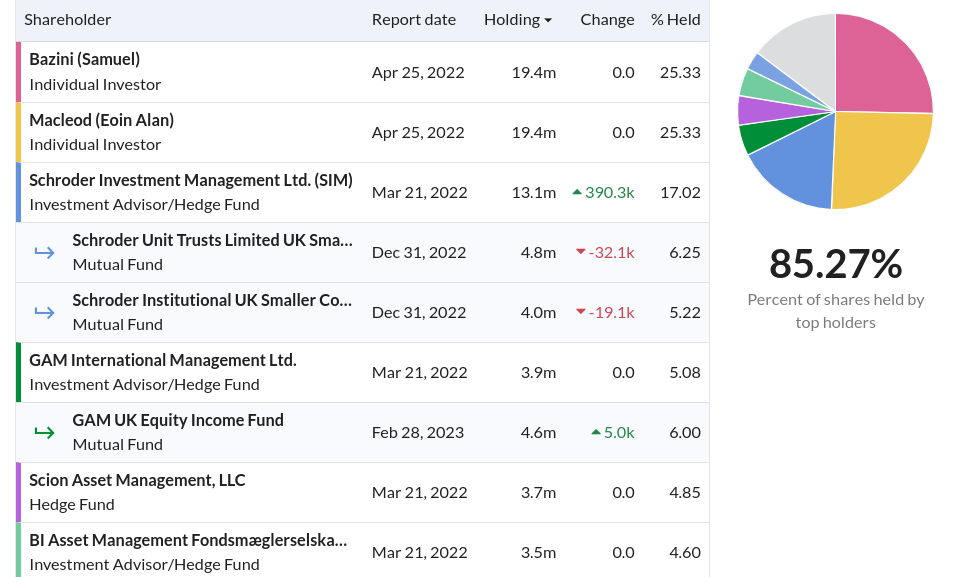

Ownership structure -

Share options charge is modest, at only £0.2m in both 2022 and 2021, bravo for that.

The owners’ eye here - founder management own 50%, so we have to decide if we trust them. Personally, I do trust management here. There has been no dilution in the last 5 years.

Balance sheet - is excellent. NAV is £37.8m, which becomes NTAV of £30.3m once I write off intangibles. Note that of the intangibles, £7.3m is goodwill that is not amortised, and the other intangibles assets (brands and customer lists which is goodwill in all but name) have now been practically eliminated in 2022. So the amortisation charge will almost completely disappear in 2023, which means the statutory and adjusted numbers should become almost the same in future - a plus point for people who like clean accounts, with no adjustments. Interesting only to accounting geeks!

This is a capital-light business, with hardly any fixed assets - only £1.4m PPE.

Inventories of £18.7m have hardly increased, despite much larger revenues, which is good to see. Receivables look fine. Note that trade payables is hardly anything, which suggests to me that W7L must be paying cash on delivery for purchases, probably to get the keenest prices & get the best service from suppliers (who generally focus on making sure customers who pay promptly are at the front of the queue for production slots).

Cash of £5.9m is healthy. There are no bank borrowings. I suggest the company splits this out on the balance sheet, instead of lumping together lease liabilities under the same heading as bank borrowings.

Cash generation is good, and as with the balance sheet, these look clean numbers with nothing unusual in them. The cashflows are real, and have enabled the company to self-fund its growth (which is just a little extra working capital), and pay decent divis too. So shareholders benefit from the company growing, with a reasonable income stream from divis on top. Very pleasing.

All 122 staff given a £1k cost of living bonus, on top of usual salaries, is a nice touch.

Forex is hedged, with details given. This means 2023 gross margins should be safe, even if currencies move a lot.

Paul’s opinion - regulars here will already know that I view Warpaint very positively. It was meant to be on my 2023 top 20 watchlist, for unfortunately I forgot to include it, and can’t change it retrospectively.

These numbers, and confident commentary reinforce my positive view of the company. Brokers have upgraded 2023 expectations today, and I'm expecting more out perform trading updates later this year.

It’s one of the simplest investing concepts I’ve ever seen - the company sells products that customers like and repeat purchase, at good margins, and is growing strongly by signing contracts with more retailers to stock its products. That’s it!

I suspect we’ll probably see an undulating but continuing upward trend in share price. I suspect the share price is likely to be up to about 300p by this time next year, if the strong organic growth continues. That’s an attractive proposition I think, assuming nothing goes wrong of course, as always.

Graham’s Section:

Nichols (LON:NICL)

Share price: £10.90 (pre-market)

Market cap: £398m

This is an old name in beverages where I’ve been positive, thinking that margins can normalise with the passing of time.

Today we get a short Q1 trading update on the day of the company’s AGM. Key points:

Revenues +4.2% year-on-year to £41.2m. It needs to do a little better, to keep up with inflation!

“Packaged” business +7.7% to £32m led by growth in Africa. UK revenue was only “marginally” ahead of prior year.

“Out of Home” business continues to struggle:

As expected, the Group's Out of Home ("OoH") business has seen a slower start to 2023 than in the prior year, with revenues down 7.8% to £9.2m, as continued significant cost of living pressures are being experienced.

Between Covid lockdowns and the cost-of-living crisis, it has been a difficult few years in which to sell drinks for consumption out of home. These beverage businesses were once considered to be almost bulletproof, but it turns out that they have vulnerabilities after all!

I see that Roland has been rooting around for value in the sector, and has found a few candidates (including Nichols).

Turning back to today’s Q1 update:

Cash remains strong at £57m

The outlook is unchanged (thanks to the company for confirming that market expectations are for adjusted PBT of £25.3m in FY 2023)

We also get some management-related news. John Nichols, the grandson of the founder of the company, will remain on the Board as a NED after stepping down as Chair. The great-grandson of the founder is also a NED. It’s nice to see this continuation of family influence.

Less positively, the CFO has resigned after three years with the company. No reasons are given. It doesn’t look particularly well-planned as the search for a new CFO seems to have only just begun.

Graham's view

We all have our biases and in my case, I like this sector (soft drinks) and I like this stock. I like the heritage at Nichols and its long-term financial results, even if recent years have been more difficult.

That’s why I’m going to continue to give this stock the thumbs up, thinking that it can only be a matter of time before margins are restored as inflation feeds through the economy, and before out-of-home consumption returns to its previous popularity.

I could be wrong, of course. Or I could be too early, which is the same thing!

Turning to the chart, I am reminded that it has been a “lost decade” for Nichols shareholders, as the shares have made no progress since mid-2013:

Revenues in 2013 were £105m, versus £167m forecast in 2023. So progress has certainly been made since then! Profit growth simply hasn’t lived up to expectations yet - but I still think there is a good chance of improvement in the years ahead.

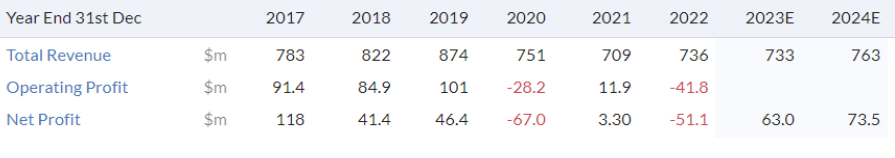

Elementis (LON:ELM)

Share price: 117.8p (-1%)

Market cap: £689m

This is a specialty chemicals company that rarely (if ever?) gets mentioned in these reports. Perhaps we should give it a chance?

It’s an international company with leadership in New Jersey, Amsterdam and London. According to his LinkedIn, the CEO seems to be based in New York.

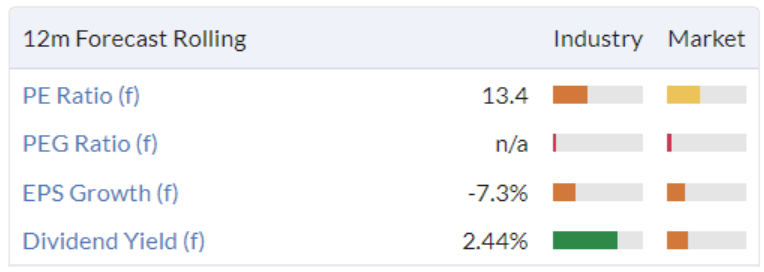

Earnings have been very volatile over the years, but it’s currently offering some value on a PER basis:

Today we have a Q1 update:

Trading is “resilient against continued subdued market demand conditions”, in line with expectations.

Revenue is “flat on an underlying basis against a strong prior year period”

Performance Specialties: performance is weaker due to “continued challenging demand conditions”.

Personal Care: performance has improved, thanks to higher margins on stable volumes. Comments suggest good pricing power here.

Outlook:

The year has started as expected with the benefits from self-help and pricing actions offsetting market related volume softness in Coatings. For the full year, we are confident that further strategic progress will drive improved financial performance and a further reduction in leverage, in line with expectations.

Let’s check how leveraged they are. According to the full-year results for December 2022, they had net debt of $367m (plus some lease liabilities). But they also sold a subsidiary for $119m in January 2023, with “pro forma” net debt to EBITDA falling to 1.9x. So their leverage appears to be under control, so long as earnings remain solid.

My view

Chemistry was my least favourite subject in school, and perhaps it’s no surprise that I can find the chemicals sector to be a little dull!

I’ve been dimly aware of this stock for a long time, without ever examining it in too much detail. But it’s been a respectable FTSE-350 member for many years and if you’ve got any interest in the chemicals sector, it could be worth a closer look.

Last year’s $51m loss involved a $103 goodwill impairment. Hopefully better days ahead.

Learning Technologies (LON:LTG)

Share price: 109p (-16%)

Market cap: £861m

Learning Technologies Group plc, a global market leader in digital learning and talent management, announces results for the year ended 31 December 2022.

I thought I would add a few words on this one, as it has suffered a significant fall in its share price despite reporting “revenues and profit ahead of expectations, as previously announced” for 2022.

Revenues have more than doubled to nearly £600m, and adjusted EBIT is over £100m (actual PBT is £40.5m).

The problem is with the outlook statement:

Despite a more challenging macro environment, we have seen moderate revenue growth in Q1 and continue to expect to deliver high single-digit adjusted EBIT growth in 2023, supported by a strong pipeline

They reiterate that they are on track to meet 2025 goals, but the market can’t look past a disappointing outlook for the year ahead.

According to prior broker forecasts, adjusted EBIT was supposed to grow by c. 16% in the current year.

Instead, investors can only look forward to a “high single-digit” rate of growth, i.e. 7%-9%.

So when the company says that they “continue to expect to deliver high single-digit adjusted EBIT growth”, they are actually delivering a profit warning, because this is worse than prior expectations.

Graham’s view - I haven’t got a strong opinion on the merits of LTG. It appears to be a varied mix of businesses, some of which might be decent quality, I’m not sure. I just wanted to clarify that today’s announcement is a fully-fledged profit warning, in case anyone was wondering.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.