Good morning from Paul!

All done for today, sorry for some sections being slow to gestate.

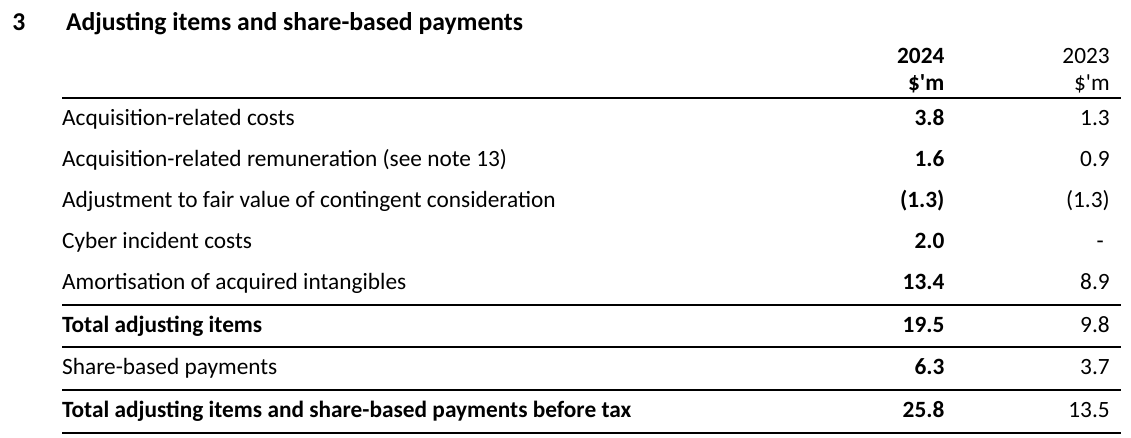

Starting off with my delayed review of CMC Markets (LON:CMCX) below, mine and Graham's star performer from our 2024 shares ideas lists, up 200% YTD - is it time to take profits, or has it got further to run? Who knows, that's for the market to decide.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

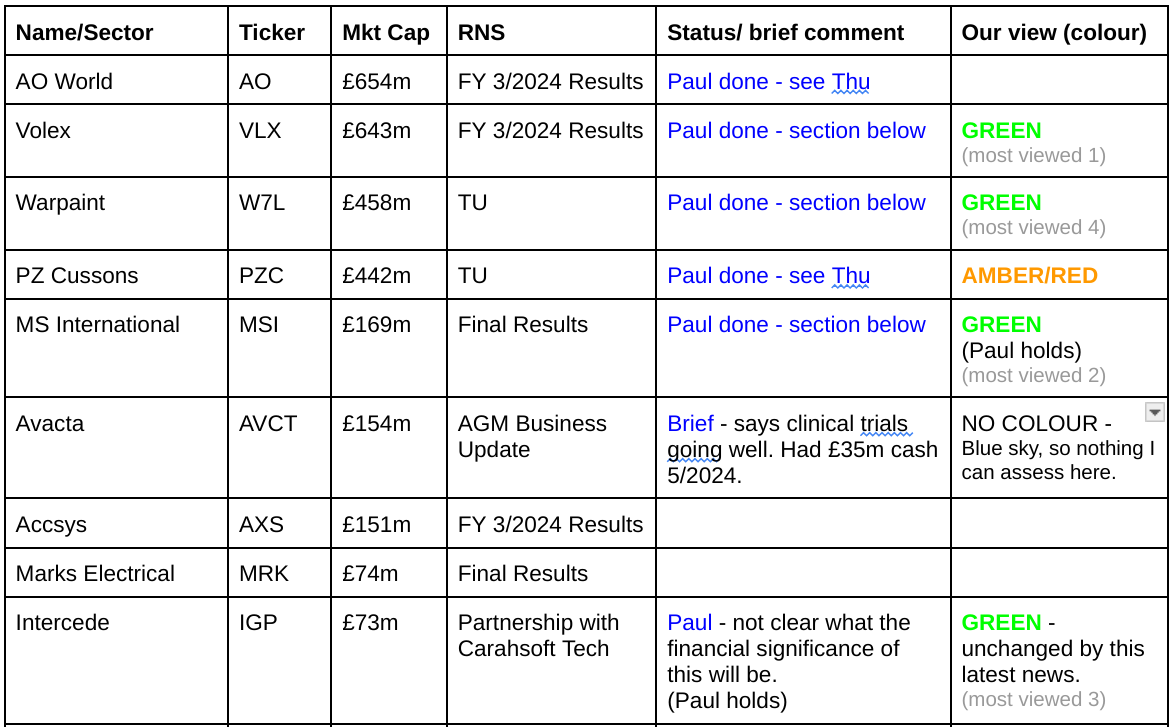

Companies Reporting

Summaries

CMC Markets (LON:CMCX) - 314p (£878m) - FY 3/2024 Results (ann. 20 Jun 2024) - Paul - GREEN

Our star pick here at the SCVR, coincidentally chosen independently by both Graham and I for our top 2024 share ideas lists. Now up more than 200%. Has it peaked now? I have no idea, shares can do anything, as we know. Although crunching the numbers, I feel the 3x higher valuation does indeed stack up, so I'm sticking with GREEN.

Tortilla Mexican Grill(LON:MEX) - up 10% y'day to 57p (£22m) - Acquisition - Paul - AMBER/GREEN

Announces an interesting deal to acquire an established French burrito chain. It dents short-term profitability, but management reckon they can turn it around in 2 years, and use this as a springboard for European expansion. I discuss the bull & bear points, concluding moderately positively - the valuation seems too cheap, but I'd prefer a more robust balance sheet.

Volex (LON:VLX) - down 6% to 334p (£604m) - FY 3/2024 Results - Paul - GREEN

Good results for FY 3/2024, slightly ahead of broker consensus. I run through the detail below, and come away happy. This share strikes me as good value, so I'm very happy with GREEN.

MS International (LON:MSI) - up 7% to 1,100p (£180m) - FY 4/2024 Results - Paul (I hold personally) - GREEN

Fabulous results, with profit tripling. Defence division generates almost all the profit. Order book up again. Balance sheet strong. Ageing owner-managers likely to sell the business at some stage I suspect. With such good figures, and "excellent prospects" for the defence division FY 4/2025, I'm inclined to let my winner run.

Warpaint London (LON:W7L) - unch 588p (£458m) - Trading Update (AGM) - Paul - GREEN

Strong growth continues at this makeup company. It doesn't refer to performance vs market expectations, but does say H1 revenue is rising faster than forecast. H2 weighting as usual, due to Xmas. Share price looks up with events, but with a positive outlook and tendency to beat forecasts, I'm inclined to remain positive on W7L, although top-slicing after a 6-bag rise also looks prudent, but that's up to you!

Paul’s Section:

CMC Markets (LON:CMCX)

314p (£878m) - FY 3/2024 Results (ann. 20 Jun 2024) - Paul - GREEN

This financial trading platform has put in a remarkable turnaround.

“Net operating income at a post-COVID high. Adjusted profit before tax up 52%.

Cost efficiency programme in place to drive profit margin expansion.”

Adj PBT rose an impressive 52% to £80m.

“...consistently strong performance throughout H2”

...in both institutional and retail divisions.

“several major client wins during the year and a strong pipeline of potential clients.”

Higher interest rates boosted profit by £22m.

Dividends total 8.3p for the year (up 12%), a yield of 2.6%

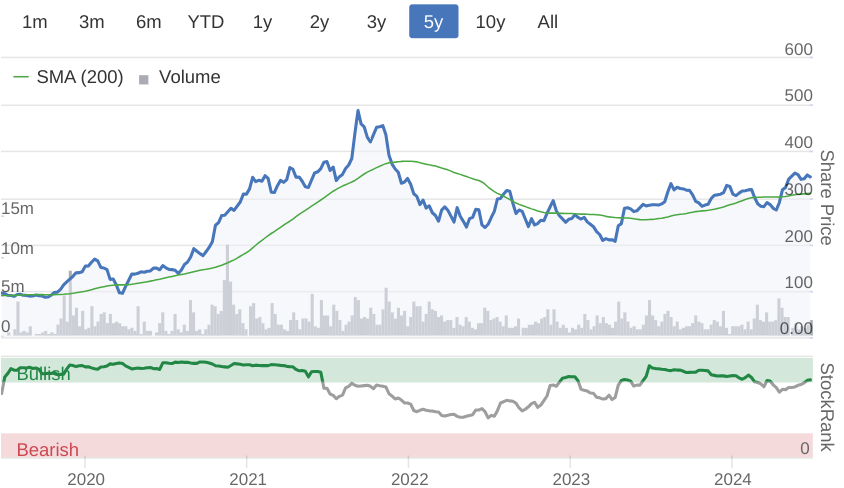

No broker notes available to us. But broker consensus forecast has been on a strongly positive trend, more than doubling from peak gloom in Nov 2023 -

I wish they would give simpler guidance just saying what they think the range of PBT outcomes is likely to be, rather than providing some elements and then leaving it up to us to put them together.

Net operating income was £333m in FY 3/2024. So the forecast range of £320-360m is quite wide, from a bit below, to almost 10% above.

The cost base (excl variable remuneration) seems to have been £250m in FY 3/2024. So the guidance of £225m above looks to be a £25m cost saving. That ties in with an announcement on 5/2/2024 that it was slashing costs, including 17% of its staff.

Variable remuneration was c.£17m in both of the last two years.

So if I’ve got this right, then they seem to be saying PBT could be between £78m and £118m.

Assuming corporation tax of 25%, gives PAT of £59m to £89m, divided by 280m shares = 21p to 32p forecast EPS.

At 314p the forecast PER for FY 3/2025 is between 9.8x to 15x.

So assuming my figures are roughly correct, then the current share price seems to stack up, and looks about right. Hence my conclusion is that the big bull run from c.100p to over 3 times that price now, this year alone, seems fully justified by the fundamentals.

Balance sheet - was very strong, and this was a key reason both Graham and I picked CMCX for our top 10 & top 20 share ideas for 2024. The rationale being that the share price of 105p at end 2023 was more than fully backed by CMCX’s own liquid assets. So the business was literally in for free. Looking back it was a bizarrely positive value opportunity. Although we didn’t predict it would recover profitability so quickly.

NTAV is now £375m, and it’s a remarkably good balance sheet, groaning with liquid assets. Fixed assets are small, which will just be some office fit-outs and equipment. There are no significant long-term liabilities, other than £12m lease liabilities (future operating rents). So the main assets and liabilities are within working capital, which was £648m receivables and cash combined, less £298m current liabilities. Hence £350m net current assets, and a current ratio of a very healthy 2.18. Remember there are no inventories either, being a service business. The narrative says it’s way over the regulatory minimums for balance sheet strength.

Altogether this is a superb balance sheet. Although NTAV is now only 43% of the market cap, whereas at the start of 2024 the market cap was actually below the NTAV of £326m, which was just a crazy, and obvious valuation anomaly.

Paul’s opinion- something remarkable seems to be happening at CMC. This snippet reinforces that -

“"This strategy, based on continuous product launches and multiple application connectivity through the CMC Markets Connect brand, means we are making great strides in a huge market segment of B2B and institutional business, with limited competition from our peers.”

As demonstrated above, I think the tripling of share price this year stacks up on fundamentals. It’s not even expensive based on the latest guidance.

It’s always tempting to bank some profits after a spectacular run, but I can’t help feeling that something very interesting and exciting seems to be happening here, and the price is far from stretched (providing nothing goes wrong).

I was intending to reduce from my GREEN view, but after going through the numbers and outlook, I’m more inclined to run with it. Sadly I didn’t buy any personally, because I didn’t anticipate that the trading turnaround would be so rapid or sizeable. Never mind.

"Institutional, B2B and multi-asset, multi-currency platforms, across all brands is the future, and ours. We have built the infrastructure which will allow us to significantly increase our growth potential whilst improving profit margins through scale.

"It is going to be an exciting couple of years."

This looks & feels like a winner, so I’m sticking with GREEN.

Tortilla Mexican Grill (LON:MEX)

Up 10% to 57p y'day (£22m) - Acquisition - Paul - AMBER/GREEN

Interesting news yesterday from the UK’s largest Mexican-style burritos chain, Tortilla - it’s bought a small French chain called “Fresh Burritos” for 4m Euros - a mixture of cash (2.7m euros) , and assuming debt (1.2m euros). The target has 13 company sites, and 19 franchises.

Fresh Burritos seems to be operating at a small loss, but MEX sees ways to improve performance -

“expected to contribute £2.5m of additional annual adjusted EBITDA (pre-IFRS 16) at 24 months maturation.”

We’re reassured about bank covenants - important, as MEX is not well capitalised. I’d like to see it raise more equity once the share price has recovered to a more sensible price (say 100p+) -

“The cash payment has been funded from Tortilla's existing committed financial facilities with net debt remaining well within the Group's covenant headroom ensuring flexibility to continue to fund its plans.”

For full disclosure, I’m not currently holding, as I sold mine a little while ago to raise funds to buy more Zotefoams (LON:ZTF) and Intercede (LON:IGP) . I still like this share though, and it’s on my top 20 share ideas for 2024, because I think it’s a good brand, and there should be upside on future profits once energy and food costs recede, and consumer demand recovers after the disposable income squeeze of the last two years.

This acquisition is likely to weigh on short term profitability a bit.

UK trading update - useful, and sounds OK -

“The core UK business is trading in line with the Board's full year expectations. The Company will provide a market update on its H1 2024 performance in July.”

Paul’s opinion - it strikes me that buying an established operator for a modest price is more sensible (and cheaper) than trying to start from scratch.

Former CFO turned CEO, Andy Naylor seems to be fizzing with ideas, and is getting things done. There was an IMC webinar yesterday to explain the deal in more detail, which I've just watched. There sound credible reasons for the deal (eg well invested sites in good locations), and fairly simple improvements to raise margins (eg central kitchen planned for a fitted out 15k sq.f.t site in Lille), springboard for further European expansion & franchising. My main question is whether the acquired sites have workable rents, or could be too expensive? Also, there will be additional overheads from managing a new French division, and extra costs, whilst it's sub-scale.

Many thanks to Liberum for revised forecasts, which does clobber profits down to breakeven in FY 12/2024, and a 35% drop in 2025 forecast PBT. Although the longer term upside kicks in from 2026. I think this reinforces the reality that MEX shares will probably require patience to see a meaningful re-rating. It depends though, in bull markets, investors are happy to pay up for future upside. Not so much in bear markets. Imagine if this share was a new IPO. I reckon it would get people excited about the growth, and upside potential, and probably list at 100p. So buying now at c.56p includes a discount for disappointment mainly due to tough macro in recent years. That could be an opportunity, time will tell.

Overall I’m probably neutral on this French deal. It might have been better to focus on developing scale and profitability in the UK market, before venturing into Europe? That said, I continue to see this share as under-priced on the recovery potential, so am happy to stick at AMBER/GREEN - positive overall.

Four Directors combined have just spent over £100k buying shares, including the founder, interestingly.

There's not been any dilution since it listed, 39m shares in issue. Some interesting names joined the shareholder list recently, in a clear out of a stale bull holding. I'm anticipating more dilution, but not ruinous - say a £5m placing at 100p in 2025, would be my optimistic guess? Although MEX has confounded the critics by operating fine without any additional equity so far - so I see dilution as being something the company can control, rather than an emergency. That changes the outlook for the shares considerably. As we move from bear market into bull market, it's important to change our thinking, otherwise we'll miss some good opportunities from unfounded fears.

Volex (LON:VLX)

Down 6% to 334p (£604m) - FY 3/2024 Results - Paul - GREEN

Volex plc (AIM: VLX), the specialist integrated manufacturer of critical power and data transmission products, announces its preliminary results for the 52 weeks ended 31 March 2024 ("FY2024").

Record profits delivered; accelerating strategic investments in growth opportunities

The highlights table shows impressive profit growth, helped by acquisitions (with a corresponding increase in net debt) -

Valuation? EPS of 33.7c (slightly ahead of the StockReport’s broker consensus number of 32.6c) converts into sterling of 26.6p = PER 12.6x which strikes me as a modest valuation for a growing group that is executing a successful acquisitions strategy.

Broker consensus is a further increase in EPS to 36.1c this year FY 3/2025.

Adj PBT growth of 30.5% becomes only 11.6% growth in adj EPS, which seems to be due to an increased share count (179.9m average shares in issue, vs 158.7m last year, a 13.3% increase) and a higher taxation charge.

End markets have once again been mixed, with data centres being the best performer, offsetting some weakness in EVs and consumer electricals. Macro conditions have been tough, and VLX seems to have coped well with supply chain, and customer destocking issues, plus issues re hyperinflation in Turkey, where VLX has made some large acquisitions.

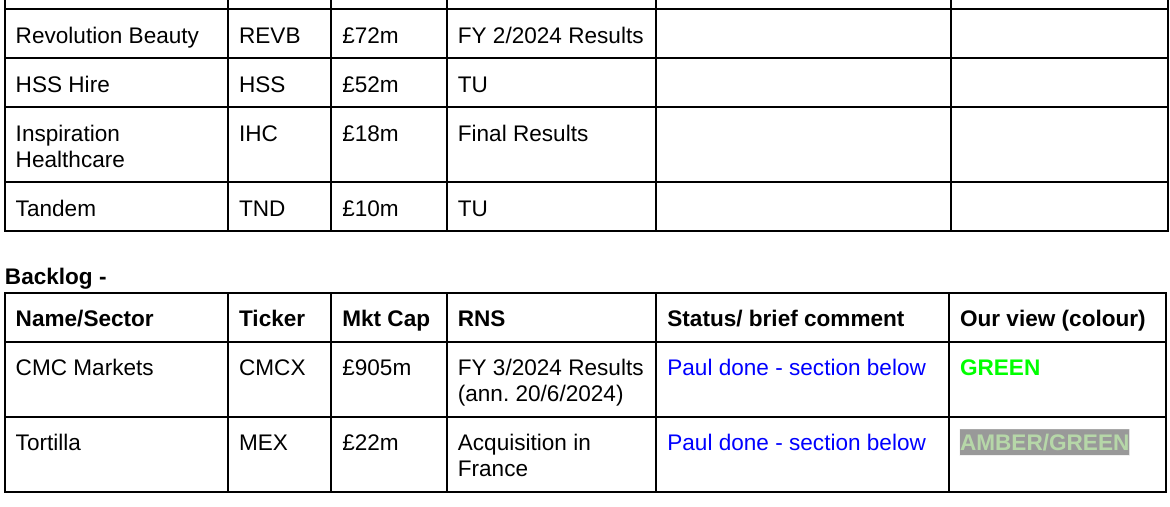

Are adjustments reasonable? I can live with these (table below) although note the share options charge is a fair chunk of the year's profit -

Outlook - some interesting bits below. Overall I think it reads a bit mixed. I would have preferred a shorter, more precise outlook statement, just telling us if they’re trading in line with expectations or not.

“The improvement in demand from our Electric Vehicles and Consumer Electricals customers towards the end of FY2024 and the beginning of FY2025 is encouraging, indicating a reduction in the impact of destocking in these areas. The significant growth in Medical and Complex Industrial Technology included some one-off catch-up due to better component availability, which is not expected to repeat in FY2025. However, we continue to secure new projects in these sectors, demonstrating how our global capabilities and manufacturing footprint support our growth objectives.

There is a significant opportunity to accelerate our growth in the Off-Highway sector outside of existing geographies served by the Group. Based on customer feedback and requests, we are therefore expediting our plans to launch an Off-Highway business in North America. This initiative will underpin our growth strategy in this sector.

With a clear strategy and execution plan for each of our markets, we are accelerating our investment programme to achieve long-term growth. This includes broadly doubling operational investments and raising capital expenditure to around 5% of revenue for the next year. We enter FY2025 with the business in excellent shape, positioning us to meet our five-year plan targets and deliver sustained growth and value for shareholders.”

Exec Chairman Nat Rothschild’s comments seem upbeat -

“Our strategic investments in FY2024 and those planned for FY2025 will expand capacity at key locations to meet anticipated future customer demand, positioning Volex for further growth by leveraging our dominant positions in attractive sectors. With leading positions in our end markets, strong cash flow and robust financial position, we are ideally positioned to capitalise on the significant growth opportunities available to us.

"Our acquisition pipeline remains promising, alongside incremental organic initiatives, underscoring our commitment to achieving our strategic goals. Having started the new fiscal year with strong customer demand, we are confident of making further progress in FY2025 and we are firmly on track to achieve our five-year revenue target of $1.2 billion by the end of FY2027."

Balance sheet - looks OK to me. As it makes more acquisitions, intangible assets (goodwill) are increasing, to a substantial $253m. However, NTAV is still positive if we eliminate intangible assets, at $83m, or £65m. That’s only 11% of the market cap supported by NTAV, so investors need to be aware that there’s little asset backing here.

Bank facilities have grown, but it’s leverage multiple at year end is reasonable at 1.0x.

A new facility of a whopping $600m, unsecured and on improved terms, for 4 years, was agreed in June 2024, so clearly the banks are very relaxed about Volex as a borrower, which is encouraging. Although I hope management don’t over-gear, as we’ve seen with say Victoria (LON:VCP) and the corresponding damage to its share price, and possibly even its solvency.

It probably wouldn’t be appropriate for a humble small caps commentator like me, to lecture someone called Nat Rothschild about banking!

Cashflow statement - looks healthy, with growing operating cashflows. The big item is $134m spent on acquisitions. This was financed through $72m raised from new equity issued, and a $51m increase in bank borrowings drawn down.

Going concern statement is clean, no issues there.

Results webinar details -

A live presentation will be held online at 10.00 a.m. BST on Friday 28 June 2024 on the Investor Meet Company ("IMC") platform.

Broker forecasts - nothing available unfortunately.

Paul’s opinion - this all looks fine to me. I’m surprised shares fell c.6% today on these sturdy results & reasonable outlook. Maybe the talk of short term costs being incurred to increase capacity might have led some investors to trim their short term profit expectations? It will be interesting to see if the broker forecasts dip slightly over the coming days?

I look at things the other way - to my mind, VLX spending money in the short-term to expand capacity and go into new markets where it sees opportunities, is a positive thing, and should result in a larger & more profitable group in the medium term.

Overall, I remain enthusiastic about this share as a long-term holding, being a successful GARP share. So it’s another GREEN from me. I see good upside on this share, for patient investors, and it should attract a more generous PER once we’re more established in a bull market. Could it be a bid target? Anything is possible, but I suspect Nat Rothschild (26%) wouldn’t sell the company unless the price paid was generous. He’s mentioned before in webinars that he sees the share price as under-priced.

Volex is one my top 20 share ideas for 2024. It's only up 1% YTD, but I cannot see anything wrong with the original share idea, quite the opposite actually, it's performed well on fundamentals, but for unknown reasons demand and supply for the shares seem to be in balance. Maybe there's an institutional overhang, who knows?

Buying the dips looks a good strategy on this share -

MS International (LON:MSI)

Up 7% to 1,100p (£180m) - FY 4/2024 Results - Paul (I hold personally) - GREEN

One of our favourite value/GARP shares, MSI was another share that I put on my 2024 top 20 shares ideas list. It’s up about 27% YTD.

Graham likes it too, and in the last year we’ve favourably covered it 3 times -

10/7/2023 - Paul - GREEN - 540p - FY 4/2023 results subdued, due to large order slipping past year end. But large order book suggests FY 4/2024 should be excellent.

3/10/2023 - Paul - GREEN - 780p - Flurry of large military contracts won. Mgt say “significant upwards step change” in performance underway. Exciting.

12/12/2023 - Graham - GREEN - 882p - Strong H1 results. Not overvalued despite big price rise.

So this was a good company, with strong prospects, hiding in plain sight! One reason it could have been overlooked is because owner-managers don’t seem very shareholder friendly, and there are no broker forecasts, so it wouldn’t come up on any screens for broker upgrades. Investors who did their own research, or just read our reports, have done nicely on this one so far.

The company has several seemingly unconnected niche divisions -

Defence - the most exciting bit with large US, Royal Navy & German navy orders (>£100m intake in the year). This division generated nearly all of the group profit, at £13.0m operating profit (vs only £2.0m LY). Group total operating profit was £14.8m.

“...will make MSI the current primary supplier of small calibre naval weapon systems to three of the major 'NATO' navies.”

“All told, we perceive that the excellent prospects for the division bode well for the current year.”

Forgings - has had a softer year.

Petrol Station Superstructures - difficult year, impacted by Ukraine war, but achieved breakeven.

“Looking forward, the outlook for the petrol station forecourt industry in the UK looks promising. In eastern Europe much depends on what happens in reaction to the ongoing war in Ukraine.”

Corporate Branding - has restructured, after disappointing performance.

“We are confident that the UK based operation will continue to flourish as we invest further to grow its capability. The restructuring programme, to re-align the Netherlands and Germany based businesses to a more sustainable level, is progressing to plan.”

Some numbers for FY 4/2024 -

Revenue up 31% to £110m

PBT up 209% to £15.7m, an outstanding result.

Diluted EPS is up 179% to 67.5p = PER of 16.3x

Balance sheet is healthy. NAV £50.8m, less £2.4m intangible assets = NTAV £48.4m

Cash has shot up from £12.3m to £35.5m, but I would treat this as partly a red herring, since contract liabilities have also shot up, so it looks as if some of the cash is up-front payments by customers, confirmed in the cashflow statement.

Overall the balance sheet is comfortable, and low risk.

Dividends are fairly insignificant at total 19.5p for the year, yield of 1.8%. I think the business has the capacity to pay more in divis in future, providing performance continues to be strong.

Paul’s opinion - beware of my unconscious bias, as I own shares in MSI.

These results are obviously superb, but reinforce to me that it’s now a bit of a one-trick pony. Almost all profits come from the defence division, so that’s the area to focus on in your further research. If this was just a one-off good year, then the shares could be overvalued now. If however, this bumper year is the start of a new era of high performance, then shares could continue rising. The naval guns have been ordered by 3 NATO navies, which tells me MSI has something special on offer. Also its anti-drone guns seem to be very topical, and attracting interest.

What we really need is more detailed information from the company, via broker notes.

The order book growth is of key importance, and this gives me confidence -

“The Group's order book has, once again, risen substantially to a record value of £162m (2023 - £115m) at the year-end”

The other divisions are a sideshow. Maybe MSI should sell-off these, and become a defence pure play share, probably achieving a higher rating, and possible takeover bid activity (since owner-managers are getting on a bit, that’s the likely exit route I imagine).

I’ll stick with GREEN, although I don’t have enough detailed information about the company to make me totally confident about the outlook, there is an element of guesswork in my view.

Warpaint London (LON:W7L)

Unch 588p (£458m) - Trading Update (AGM) - Paul - GREEN

Warpaint London plc (AIM: W7L; OTCQX: WPNTF), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands…

This is another of our long-term favourite GARP shares here at the SCVR.

Good growth in revenues again, up 25%, and margins improved -

"The Group continues to trade strongly with sales for the six months to 30 June 2024 expected to be approximately £46 million (six months to 30 June 2023: £36.7 million), with margins continuing to be robust and ahead of those achieved in 2023. Consistent with previous years, due to Christmas gifting orders and the Group's momentum, sales are expected to again be second half weighted.”

Outlook - its growth strategy of focusing on larger retailers globally, seems likely to continue delivering more growth -

"Further progress continues to be made with expanding the Group's presence in larger retailers globally and the Group has significant further opportunities to grow sales, both with new and existing customers. The Group has a number of planned product roll outs to additional stores in the second half of the year and remains in active discussions with a number of UK and overseas retailers about stocking the Group's products.

Valuation - shares have been a remarkable gainer, and congratulations to the many subscribers here who hold W7L shares -

I think the valuation looks fully justified, because EPS forecasts have tended to be much too low previously, so the forward PER of 24.3x will probably turn out to be a good bit lower than that, since earnings tend to beat forecast.

Paul’s opinion - it would obviously be tempting to bank some profits with a top-slice after any share has 6-bagged, which I think would be sensible.

That said, the fundamentals continue to power ahead, and I’m happy to run with it, at GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.