Good morning it's Paul & Graham here!

We're exhausted now, that's going to have to be it!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

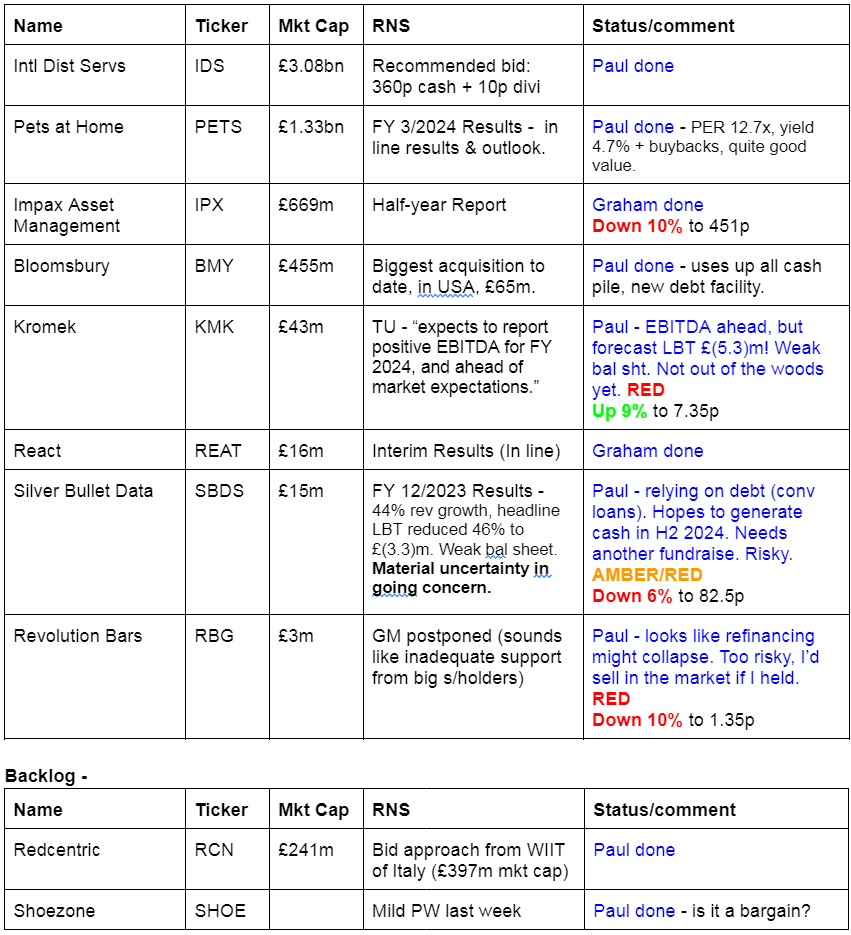

Companies Reporting

Other mid-morning movers (with news)

SysGroup (LON:SYS) - up 13% to 35p (£18m) - Strategic Partnership - Paul - AMBER/RED

I can’t tell from this announcement whether it’s significant or not. My hunch is that it doesn’t sound particularly important, with SYS becoming a “Preferred Partner” with £3.4bn IT group Softcat (LON:SCT) . Perhaps any subscribers here who work in IT could confirm if it’s a game-changer, or just a typical supplier arrangement - I imagine Softcat will have lots of partner/reseller type arrangements with small companies like SYS? There’s the almost obligatory smattering of AI and ML (machine learning) references in today’s statement.

Paul’s view - I was AMBER/RED when reviewing SYS’s finances recently here on 30/4/2024, with specific concerns being a weak balance sheet, NTAV negative at £(7)m. So the risk is that the rampy-sounding announcements might be designed to get the share price up before holders are clobbered with a discounted fundraise? There’s a lot of that about at the moment, I don’t want to be cannon fodder, so I’ll pass on this one. I imagine institutional holders would quite like an exit here, as shares have been drifting down for the last 10 years. New management claim to be transforming things though, so we’ll keep an eye on it.

Foresight Sustainable Forestry (LON:FSF) - up 29% to 94p (£162m) - Recommended takeover - Paul - PINK

I can barely keep up with all these bid approaches!

Buyer - Averon Park Ltd - an investment company in wind, solar, forestry, etc, with £1.16bn in net assets at 3/2023 (accounts here). Seems to be connected to Blackmead Infrastructure, which already owns 29.9% of FSF.

Price - 97p in cash (33% premium to last night’s close)

Discount of 5% to unaudited NAV at 31/3/2024 of 102.2p

Alternative offer in B shares.

Rationale for the deal is that the public market values assets at a discount, so they can’t raise more money. Private markets prepared to pay close to NAV. It’s difficult to argue with that! This deal raises the obvious question of what other listed infrastructure companies there are which trade at a big discount to NAV? Could be further bargains to be found, for people who know what you're doing investing in this area.

Summaries

Redcentric (LON:RCN) - 152p (£241m) - Possible takeover approach from WiiT - Paul - PINK

Originally announced on 24/5/2024 that it was in possible takeover talks with Italian cloud services group WiiT. This was confirmed yesterday by WiiT. Early stage talks for a possible cash takeover bid. Not clear how WiiT would finance this. Note concentrated big 5 shareholders include Kestrel & Harwood, both known for agitating for exits. I can't see any obvious appeal to RCN shares.

International Distributions Services (LON:IDS) - up 3% to 332p (£3.19bn) - Recommended Cash Offer - Paul - PINK

Another takeover situation we've been following. Recommended bid at 360p cash + 10p divis is announced. Regulatory hurdles are the next challenge, hence the share price discount to the bid.

Impax Asset Management (LON:IPX) - down 8% to 462p (£612m) - Half-Year Report - Graham - GREEN

These interim results show Impax suffering from weak sentiment in some parts of their sales channel. Additionally, future dividend payments may be lower in light of a new dividend policy, but the yield remains over 5% currently. Overall, I view this as a robust half-year report from a high-class fund manager.

Bloomsbury Publishing (LON:BMY) - up 2% to 568p (£464m) - Acquisition - Paul - GREEN

This book publishing group announces its biggest ever acquisition, spending the entire cash pile, and taking on some new debt. That does change risk:reward somewhat, although on balance I think it looks OK.

Pets at Home (LON:PETS) - up 4% to 294p (£1.38bn) - FY 3/2024 Results - Paul - AMBER

I see these results as resilient, given tough macro. A big chunk of profits come from its vets operations, and with the CMA enquiry ongoing, I feel the current valuation does not build in enough margin of safety. Nice business though, but it has to be amber until we know what the CMA decides.

React (LON:REAT) - up 2% to 77.5p (£17m) - Interim Results - Graham - AMBER

Good results from this cleaning group with confidence in hitting FY24 expectations. I study its amortisation charges in detail, and do not find any simple conclusions to the question of its earnings adjustments. This looks like a solid business, but I’m not yet convinced of its attractiveness as a potential investment.

Shoe Zone (LON:SHOE) - 165p (£76m) - Interim Results - Paul - AMBER/GREEN

I check out last week's H1 results, and the mild profit warning that saw it reduce FY 10/2024 guidance a little. Shares now look pretty good value, I reckon. Although the question mark remains, why is it now missing forecasts, when it used to beat them?

Paul’s Section:

Redcentric (LON:RCN)

152p (£241m) - Possible takeover approach from WiiT - Paul - PINK

Another potential takeover. RCN had previously announced here on 24 May 2024 that it was in “early stages” of discussing a possible offer for RCN from Italian cloud computing services group WiiT. It’s listed in Milan, and according to the StockReport here (European subs required) has a market cap of £397m, only 65% greater than RCN’s, and seems to have hefty existing net debt, so it’s not clear how WiiT would fund any takeover approach of RCN? Would it involve a fundraise and/or have an element of paper as part of the offer?

WiiT yesterday confirmed it has held “preliminary” talks with RCN, re a possible offer, which it says “would likely be in cash”.

Interestingly, note the biggest shareholder in RCN is Kestrel at 20.7% - who seem to be encouraging their large holdings to put themselves up for sale, in order to achieve liquidity events at premiums.Note who is also there - Harwood! (with 10.8%), who also agitate for deals. Five big holders will be making the decision here, so if the price is right (and even if it isn’t), I suspect they’re likely to wave through a deal in order to exit.

Paul’s opinion - I tend not to cover RCN very often here, and there’s not any obvious appeal from glancing at the StockReport - value metrics seem unremarkable with a forward PER of 17.5x, yield of 2.4%, and negative NTAV. Although shares are now at or around a 5-year high . The StockRank is a middling 50. Broker forecasts are in a declining trend. So it looks an unremarkable company, where a premium priced takeover bid would be a useful way to exit maybe? Do any subscribers here hold RCN, if so I’d be interested in your thoughts.

International Distributions Services (LON:IDS)

Up 3% to 332p (£3.19bn) - Recommended Cash Offer - Paul - PINK

No great surprise, as we’ve been covering this story for a while.

“The Czech’s in the post” (yes I can re-use that joke!) - Czech billionaire Daniel Kretinsky has been circling IDS for a while, and has now reached agreement with IDS’s Board for a cash offer at 360p + 10p dividends (2p final, 8p special).

He already holds 27.6%.

Premium is good, at 73% above the undisturbed share price on 16/4/2024.

Given that the share price is about 10% below the offer price, suggests to me that some investors would rather bank the gains now, and leave some on the table for other investors to take the regulatory, and deal risk. Negotiations with the Govt and opposition leaders presumably now intensify, to see whether they’re prepared to accept the legally binding (time limited) assurances detailed in today’s announcement for loss-making Royal Mail. The main deal is obviously for the profitable German business.

Bloomsbury Publishing (LON:BMY)

Up 2% to 568p (£464m) - Acquisition - Paul - GREEN

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, today announces the acquisition of The Rowman & Littlefield Publishing Group's academic publishing business. It is the biggest acquisition by Bloomsbury to date, and significantly accelerates and strengthens Bloomsbury's academic publishing in North America and Bloomsbury Digital Resources ("BDR").

Key points -

Biggest acquisition to date.

Strategic rationale is to make BMY “a leading US academic publisher”

Price is £60m initial cash, plus up to £5m post completion (I’m guessing for working capital adjustments?)

Performance of target company - revenue £28m and £5m PBT in FY 12/2023 (implying purchase price of 13x PBT - not cheap)

Earnings accretive - I suppose this means the earnings multiple is lower than the interest receivable on the existing cash pile -

“The acquisition is expected to be earnings accretive, before highlighted items and amortisation, in the current year and significantly earnings accretive, before highlighted items and amortisation, in 2025/26, the first full year. Additionally, there are potential cost synergies from the scale of the combined business and operational improvements.”

Financing -

“Bloomsbury has financed this acquisition from its own cash resources and a new $38m (£30m) three year term loan with Lloyds Bank Plc.”

As luck would have it, I reviewed FY 2/2024 results last week, here. NTAV was £122m, and included a cash pile (with no borrowings) of £66m. The big acquisition today is £65m, so that’s all but £1m of the cash pile spent. Also if we assume that almost all the purchase price is goodwill, since little in gross assets are mentioned (and nothing about liabilities), then we’re likely to see group NTAV drop by about half, from £122m to c.£60m. So this deal does make the balance sheet significantly less strong. It’s still OK though I think, given that profits and cash generation should rise from this acquisition.

Paul’s opinion - let’s hope BMY has found a good home for its entire cash pile, as this deal removes the comfort of excess cash, and means it’s got the additional risk (and cost) of a £30m three year term loan. This also removes the potential for greatly increased divis which I flagged last week.

The rationale for the deal sounds sensible, and BMY has a long-established track record of making good acquisitions, so I’m happy to trust management here, given their previous successes. Also it knows what it’s buying, this is not a diversification.

I don’t see this news as particularly price sensitive in the short term. BMY shares came off the boil recently because a gap in the Sarah J Maas publishing pipeline means forecast for FY 2/2025 is currently showing a -19% drop from the bumper FY 2/2024 earnings.

I’m happy to stay GREEN on the fundamentals for BMY on a medium to long-term view. However, as mentioned last week, after a very strong run it looks probably priced up with events for the time being.

Some value investors may not be quite as comfortable now the big cash pile has gone, as that downside protection was a lovely feature of this share previously.

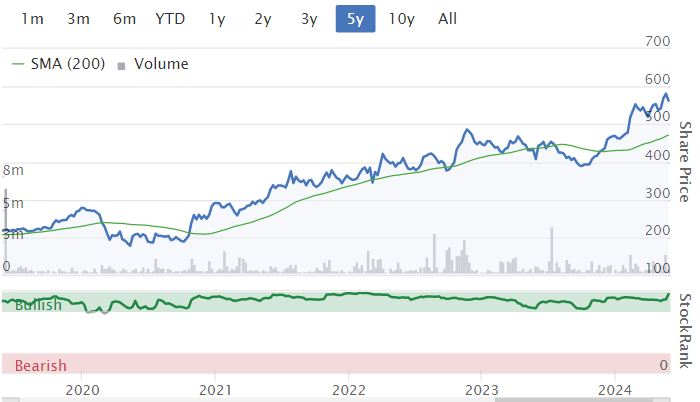

A lovely 5-year chart below, what bear market?! Also note the consistently high StockRank, so I remain positive too -

Pets at Home (LON:PETS)

Up 4% to 294p (£1.38bn) - FY 3/2024 Results - Paul - AMBER

The valuation metrics on the StockReport look quite attractive - PER 12.7x, and yield of 4.7% plus buybacks. I have in the back of my mind that PETS has looked a decent business when I’ve checked it out before. The CMA investigation into vets has badly damaged CVS (LON:CVSG) but only dealt a glancing blow to PETS shares.

Vet services is still a very important part of the group though, generating £62m underlying PBT versus £87m PBT from retail. So that’s 42% of total profit (before £17m central costs) coming from its vet activities. Hence I’d want to know more as to why PETS doesn’t see the CMA investigation as a threat. If they’re wrong about that, then there could be a potentially nasty hit to profits.

Key numbers for FY 3/2024 -

Revenue up 5.2% to £1,477m

(note that the vets revenue looks like a franchise type arrangement, or JVs, as total consumer revenue is larger at £1,906m)

Like-for-like (same store) revenue growth looks quite healthy at +5.1%

Number of stores has barely changed.

Underlying PBT £132m (down 3.2% - that seems fine to me, considering the inflationary impact of wages, and a consumer downturn, this seems resilient I think)

Underlying basic EPS is down more, -9% to 20.7p (PER 14.2x)

Dividends flat at 12.8p, a generous 62% of earnings, and a yield of 4.4% (plus it’s done buybacks)

Overall results seem to be as expected -

“Performance in Q4 was in line with our expectations and as previously guided.”

Adjustments - see note 3, are quite hefty at £26m, and mainly relate to a new distribution centre, which I think is stretching the definition of non-underlying a bit.

Balance sheet is thin for the size of business, with only £9m NTAV, but with no significant borrowings. That’s possible because it has low inventories and receivables (being a retail business), and gets paid by customers in cash, before it has to pay suppliers. So a nice business model.

Cashflow statement - nicely cash generative, which it uses mainly to pay generous divis and buybacks.

Outlook - not exactly glittering, but the StockReport shows broker consensus of +11% EPS growth to 22.4p in FY 3/2025, which sounds OK to me -

Paul’s opinion - I think PETS is clearly a good business, generating not bad margins, plenty of cash, and with little requirement for use in the business, this is mostly distributed to shareholders in divis & buybacks.

The attraction of pet-related businesses is obviously that revenues repeat a lot, and are largely recession-proof since we love our pets and will sacrifice plenty of other spending before even considering switching to eg a cheaper brand of dog food or whatever. My last remaining dog (that’s the little scamp below), Seamus (he’s 17!), makes his disdain for cheaper dog food readily apparent 24 hours later, with a significant additional cost in carpet cleaner more than offsetting any savings. So we leave him on Caesar now, despite it having doubled in price during the pandemic.

As regards PETS shares, personally I wouldn’t want to take the risk of buying before the CMA results on its vets enquiry are known. Why take the risk, when it’s a significant part of profit at PETS?

(he will never look at the camera)

Shoe Zone (LON:SHOE)

165p (£76m) - Interim Results - Paul - AMBER/GREEN

Investors have fallen out of love with this retailer of cheap Chinese-made shoes. Is it a bargain now?

Nearly all the profit is made in H2, so H1 numbers matter less than the FY outlook.

For the record though, H1 to 3/2024 looked like this -

Revenue slightly up +1.5% to £76.5m

Adj PBT unch at £2.5m (hardly any adjs this year)

H1 divi flat at 2.5p

Balance sheet is good I think, ungeared, and £29m NAV (no intangibles)

Cash pile down heavily to £4.1m, mainly due to quite heavy capex of £5.2m in H1 (opening bigger stores), £6.9m final divis from last year paid in H1 this year, £1.9m in corporation tax paid in H1, and some adverse working capital movements (reversing from last year). The much more cash generative H2 should increase the cash pile again I reckon, so I am not ringing any alarm bells.

Outlook - is admirably precise, why can’t all companies do this? -

Our original full year profit before tax forecast was £15.2m, which has been revised down to £13.8m, a reduction of £1.4m. At the point at which the original forecast was prepared the consensus was that the National Living Wage would increase to £11.08, but when announced, the increase was to £11.44 which adds £0.4m of cost in our second half. The continuing disruption in the Middle East has increased shipping times and container prices which adds a minimum of £0.5m of cost and due to the large number of stores we have closed, particularly in Scotland, we have provided for an additional £0.5m of dilapidations.

None of those above points relate to a demand shortfall, although perhaps in better times these issues might have been absorbed within the original forecasts?

Paul’s opinion - I don’t think there’s anything serious going wrong here. Thanks to Zeus for their detailed forecasts, which now say 22.4p adj EPS for FY 10/2024. I would personally think it’s fair to value that at maybe 8-10x, giving me 179p - 224p target share price. Hence the current share price of 165p being below my range, looks moderately attractive. For that reason, I’m happy to go with AMBER/GREEN.

Although the sheen has really come off SHOE shares, since it wasn’t long ago it kept beating forecasts, but now seems in a cycle where it misses, we’ve had a couple of profit warnings so far in 2024. Is there some underlying malaise? I hope not, but as mentioned before, the Chinese are now selling direct to consumers, and even if this only takes a low single digit off SHOE’s sales, the operationally geared impact would be noticeable. Maybe it’s already happening? After all, something has changed, as it’s now missing forecasts (not by much, mind) when previously it used to beat them.

Graham’s Section:

Impax Asset Management (LON:IPX)

Down 8% to 462p (£612m) - Half-Year Report - Graham - GREEN

This is “the specialist investor focused on the transition to a more sustainable global economy”.

We covered its Q2 AuM update in April.

I’ve been positive on this since it fell to a fraction of its former levels, offering much better value relative to its AuM:

The PE Ratio also got out of control for a while, before coming back to “normal” levels:

There is a catch, of course. Impax is currently experiencing outflows, and we can’t be sure when these might end.

Let’s review the company’s interim results for the six months to March 2024.

Key points:

AuM +5.9% to £39.6 billion.

Net outflows £2.7 billion.

Revenues down to £86.2m (H1 last year: £88m).

New fixed income capabilities and new listed equities strategies launched.

Profitability/dividend

Even though AuM increased during the six months, average AuM during the period was lower than H1 last year, and therefore revenues declined.

Fees earned as a percentage of AuM (the “revenue margin”) were unchanged.

Costs increased marginally and were “carefully managed”.

The end result is that adj. operating profit comes in slightly lower at £25.8m (H1 last year: £27.3m).

Operating margin is 30% (H1 last year: 31%).

Interim dividend is unchanged from last year (4.7p).

New dividend policy is more geared towards growth and reinvestment in the business, as it will now pay out “at least 55%” of adj. profit after tax. The previous policy was to pay “between 55% and 80%” of adj. profit after tax.

CEO comment from founder Ian Simm, explaining the net outflows:

"The rise in our AUM was driven by the positive impact of £4.9 billion from investment performance, market movement, and foreign exchange. This was partially offset by net outflows of £2.7 billion, following asset allocation decisions by clients primarily within our wholesale channel in Europe, who rotated to a more 'risk-off' stance amid a higher interest rate environment…

A hot topic for Impax right now is distribution, as it pins recent outflows on the “wholesale” channel, i.e. on the decisions of intermediaries on behalf of retail customers. BNP Paribas Asset Management is specifically mentioned as a source of outflows.

In contrast, the “institutional” channel is still thought to be strong: the number of institutional accounts at Impax continues to grow, and they have a “healthy” new business pipeline.

This helps to explain the company’s current focus on direct distribution: selling direct to professional and institutional investors reduces the company’s exposure to decisions by intermediaries, although of course the sales and marketing effort can be expensive.

This is not an area that I’ve put much focus on before. I’ve tended to trust that if a fund manager has a differentiated product offering that generates good returns, then it shouldn’t be too difficult to sell it, and analysing the sales channels is unnecessary. But perhaps I should look at this more closely in future?

And looking ahead, Ian Simm says:

"Following nearly two years of relative headwinds, asset owner sentiment around the transition to a more sustainable economy and associated areas of Impax expertise has improved in recent months.

Forecasts: thanks to Paul Bryant at Equity Development for reiterating his forecasts for FY Sep 2024. These include revenues of £180.5m and net income £40.3m (rising to £198.6m and £48.6m respectively for FY Sep 2025).

Graham’s view

There may not be a whole lot for investors to get excited about in these results, but I would argue that’s because we are accustomed to Impax consistently pumping out very healthy profit numbers, even in more difficult periods.

The key points for me:

a) AuM isn’t shrinking, thanks to market returns/investment performance offsetting the outflows.

b) revenue margin is unchanged, i.e. there’s little evidence of fee compression.

Therefore, I believe the company remains well-positioned for when sentiment improves.

With £65 of AuM available for every £1 invested in Impax stock, I continue to believe this represents unusually good value.

For income investors, the prospective yield remains over 5%.

React (LON:REAT)

Up 2% to 77.5p (£17m) - Interim Results - Graham - AMBER

REACT Group plc (AIM:REAT.L), the leading specialist cleaning and soft facilities management services company is pleased to announce its unaudited interim results for the six-month period ended 31 March 2024.

Paul looked at REACT’s full-year results in February.

Here we go with interim results:

Revenue +13% to £10.6m (86% of this was “repeat/recurring revenue”).

Slight increase in gross profit margin to 27.1%

Adj. EBITDA +35% to £1.3m

Operating profit improves from around breakeven to £300k.

The major difference between adj. EBITDA and operating profit, as discussed by Paul in February, is the exclusion of a large amortisation charge from adj. EBITDA.

Getting into the weeds: amortisation

Checking the 2023 annual report, I see that there is only one category of intangible asset being amortised at REACT: customer lists.

In simple English: when REACT makes an acquisition, part of the cost of the acquisition goes on its balance sheet to represent the fair value of the customer lists being acquired.

In subsequent years, REACT has to write down the value of these lists, as the accounting assumption is that their value does not last forever. This loss of value is the amortisation charge.

Is it an accounting fiction, or does it reflect reality? Many people are happy to ignore amortisation charges completely. I like to do a little digging and try to see for myself if the assumptions behind amortisation might be realistic.

In the case of REACT, their acquired customer lists had a balance sheet value of £5.7 million at the start of the most recent financial year. That’s a big number for a company with a market cap of only £17m!

The company took a £1.6m amortisation charge last year, and then another £0.8m in H1 of the new financial year.

At this rate, I think the acquired customer lists will be written down to zero by March 2026.

Most of the value in customer lists was acquired when REACT bought the LaddersFree cleaning company for £8.5m in May 2022.

If I’ve analysed it correctly, the accounting assumption is that these lists have a useful life of c. four years, but after that point, the lists will not be assumed to have any value. After four years, maybe most of the customers will have shopped around and looked for new suppliers?

Examples of LaddersFree customers can be found here.

It seems to me that the four-year assumption might be a reasonable one, which is often the case. I often do a little digging, find that the accounting is reasonable, and then I want to use the statutory (unadjusted) numbers!

But (this is important) if Laddersfree is able to command tremendous customer loyalty, such that there isn’t much customer churn even over four years, then they will have proven that the accounting assumption was too pessimistic, and that there was no need to amortise the customer list so quickly.

If you browse the page I linked to above, you’ll see that some national customers have been with LaddersFree for much longer than four years.

This is why I like to take a neutral stance in the debate between adjusted and unadjusted numbers: there are no easy answers!

Balance sheet: REACH has balance sheet equity of £8.6m but it’s zero if you strip out the value of intangibles. That’s pretty normal for an acquisitive company: its value depends on the success of previous M&A!

Cash is £1.5m, loans and borrowings are £0.8m.

Highlights: various new contracts and contract renewals. LadderFree digitalisation project to go live later in the year. Banking facilities moving to one consolidated relationship with HSBC.

Outlook

Trading in the second half of the year has remained robust, continuing the strong momentum from the first half. The improved mix of recurring revenue and higher margins gives the business increased visibility and a more reliable revenue stream. The pipeline for the rest of the year continues to be strong, providing the Board with significant confidence in the ability to meet full year consensus market expectations. The Group is confident that the strategic investments and diversified contract wins position the Business well for continued success.

Forecasts are helpfully included in the RNS: FY 2024 revenue £21.25m, adj. EBITDA £2.5m.

Graham’s view

I’m a little more cautious on this than Paul, as it seems fairly valued to me:

Even if we ignore the amortisation charge completely, we can’t ignore taxes. Looking ahead to FY 2025, if we apply corporate tax to the adj. PBT forecast, we get adj. PAT of £1.9m. That puts the shares on a forward PER of about 9x. More acquisitions could juice the numbers but as Paul rightly points out, these deals will have to be paid for and the company is not sitting on a mountain of cash, so more dilution could be on the cards.

The long-term progression in the share count doesn’t fill me with confidence:

Therefore I’m going to take a neutral stance on this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.