Good morning from Paul & Graham!

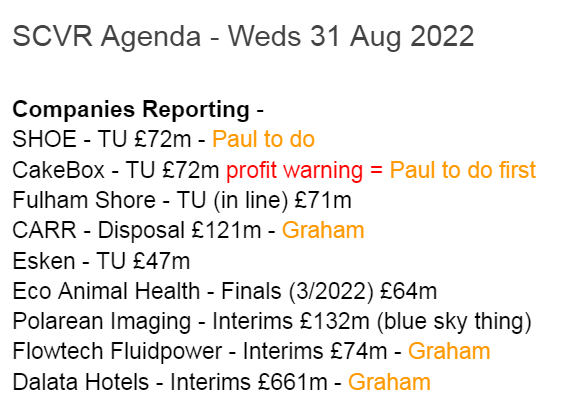

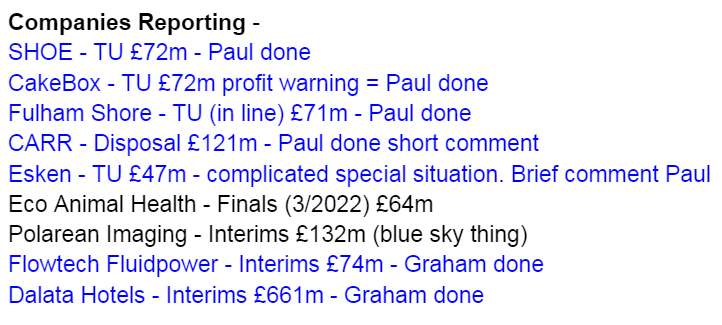

Agenda - this is today's to do list, hopefully we can get through this lot -

Update: How did we do? Most companies covered, I'm pleased to report!

Paul's Section:

Cake Box Holdings (LON:CBOX) - profit warning, which looks mainly due to cost increases. So why has CBOX been slow to pass these on to franchisees? I think the share price is inevitably heading for a steep fall - I can't see anything above 100p looking justified right now. A franchise model was supposed to prevent this kind of nasty surprise, so what's going on?!

Shoe Zone (LON:SHOE) - at the opposite end of the spectrum, value shoe retailer SHOE produces another positive trading update, and ups profit guidance again for FY 10/2022. I have a look through the latest Zeus update (many thanks for that), and I ramble completely off the point, with some more pondering of energy costs. Soft targets for FY 10/2023 mean that (hopefully) SHOE should be at lower risk of a profit warning than other retailers. Also its focus on the value end of the market, where purchases are essential not luxuries, should help it weather the current economic storm, hopefully. So it looks a sensible investment.

Fulham Shore (LON:FUL) - a robust, in line with expectations update from this restaurant chain. Surprising? It's offering nice, differentiated product, at value pricing, which seems to be key at the moment. Rapid expansion, and it's getting amazing deals from landlords. Long-term, I see this share as a winner, but have no idea what will happen shorter term.

Brief comments from Paul (no sections below):

Esken (ESKN) - TU £47m - complicated special situation. Material uncertainty in last accounts going concern statement. Looks financially distressed, very high debt (some convertible). Cargo operations at Southend Airport being wound down by customer. Small amount of passenger flights operating, hoping for more (given congestion in airports elsewhere). Renewables division doing well: EBITDA >£22m FY23. In discussions over funding requirements. Overall - looks risky to me, so make sure you know what you're doing, and do thorough research, if you want to punt on this.

Carr's (LON:CARR) - a material disposal for £44.5m (compare with £121m market cap) of its agricultural supplies division. This leaves it to focus on remaining 2, higher margin divisions. Sale multiple is only 6.4x 2021 adj EBITDA, so doesn’t seem a compelling disposal valuation, and of course group profits will correspondingly drop. It does take the group into a net cash position though. Wants to invest more in remaining divisions. Revised forecasts from Edison (i.e. the company!) shows revs dropping by 71% to £138m next year, and EPS dropping by about a third from 12.7p to 8.8p. PER goes up from 10.2 to 14.8. So at first glance, I’m questioning whether this is a good move or not, and it doesn’t look compelling to me. What do readers think?

Graham's Section:

Flowtech Fluidpower (LON:FLO) (£74m) - H1 results confirm much of what we expected to hear from this company dealing in hydraulic and pneumatic equipment, and providing related services. The outlook section is cautious as visibility beyond the short-term remains limited. There are some key industry headwinds beyond its control but it is dealing well with the challenge posed by inflation and now needs to work on reversing the £11m increase in inventory that it built up in response to the supply chain challenges of the past year.

Dalata Hotel (LON:DAL) (£691m) - solid results from this hotel owner and operator as it emerged from the era of Covid restrictions after Winter 2021/2022. The company generates strong PBT and cash flow for the first time since H1 2019. Overall, I’m a fan of this stock as it trades at a discount to book value and I like the Clayton and Maldron hotel brands (I’ve probably met many of you at a Clayton Hotel!). The balance sheet is stronger than most hotel groups and there is more to look forward to as additional hotel openings are planned and the sector finally moves on from the effects of Covid. Inflation is going to have an impact but Dalata’s balance sheet should see it through any difficulties.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Cake Box Holdings (LON:CBOX)

179p (pre market open)

Market cap £72m

Trading Update (profit warning)

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, announces an update on current trading and outlook.

We last looked at this franchise cake shop business here on 27 June, when it published sparkling results for FY 3/2022. The outlook comments indicated that Q1 (Apr-Jun 2022) had “remained robust”. My overall impression was positive, although with some reservations.

This is the latest update today (my summary) -

Overall -

Accordingly, due to the worsening outlook and increasing cost of living pressures on the consumer, the Group now expects full year profitability to be significantly below current market forecasts.

Detail -

Since Q1, trading has “become significantly more challenging”.

Cost inflation worse than expected.

Cost pressures not likely to ease before year end (FY 3/2023).

Recent price rise has passed on “some of the cost increases”.

Full year gross margin will be impacted.

Weaker than expected sales in franchised stores in July & August (LFL sales down 2.8% in H1 to date - so Q2 must be well down, offsetting a strong Q1?) - blames lower footfall due to heatwave.

Action being taken, mentions price rises again, but nothing else specific.

Cash at 30 Aug 2022 was £6.7m (but £2.0m of that is earmarked for divi payment shortly).

Expansion continues, with “strong pipeline” of new franchises & deposits (from franchisees?) for new sites.

Longer term outlook - this seems to be admitting that financial controls are still not up to scratch -

Looking further ahead, the Board remains confident in the Cake Box's future growth prospects, underpinned by the increased investment in professionalising the Group's functions and the pipeline of new store openings across the country, with levels of franchisee deposits remaining at good levels.

Broker update - as is so often the case, this is a frustratingly vague profit warning. All we can really latch onto is “significantly below current market forecasts”, which could mean anything!

Thankfully Shore helps us out with an update note, lowering FY 3/2023 PBT from £7.2m to £5.5m, a drop of 24%. This new forecast is also well below last year’s actual adj PBT of £7.0m, which was a record. Forecast has already been lowered once, from £7.8m, so this is now a 29% drop in forecast for the current year.

Forecast EPS is now 10.9p.

Given the risk of another profit warning, as economic conditions worsen, it’s difficult to see why anyone would now pay a PER of over 10.

That implies a big potential drop in share price from 179p to maybe nearer 100p? I’m writing this at 07:47, so we’ll see what happens, but I think this could be a nasty drop today, and then not much reason to see a recovery in share price any time soon.

My opinion - remember there were previous accounting problems here, with the auditor resigning and leaving behind a nasty public note which called into question management ability and trustworthiness. Since then, some changes have been made, to be fair. But it seems budgeting is still sub-par, because surely they should have allowed for cost increases in forecasts, and passed them on to franchisees?

The whole point of a franchise business is that the structure is meant to cushion the central company from economic woes, with a fairly reliable stream of income still coming from the franchisees (providing they don’t go bust).

So the fact that CBOX has warned on profits, after only a couple of months of tougher trading, perplexes me.

In particular, the delay to passing on cost increases seems bizarre. Which calls into question how the franchise contracts are set up? Surely if input prices for ingredients goes up, then CBOX should immediately pass on those price rises to its franchisees? Why the delay?

On the upside, the balance sheet at CBOX is strong, and there are no issues concerning solvency, and hence dilution should also not be an issue. It’s got plenty of cash, and the divi yield should increase as the share price likely plummets today.

A drop of 2.8% in franchise level sales is not particularly damaging, so this profit warning seems to be mainly due to a failure to budget for, and pass on increased costs - financial mismanagement basically. Again. I think the new CFO has been in place for long enough to have done more to prevent this problem, so questions need to be asked there.

Overall - this has got to be the first of many profit warnings from consumer-facing shares, as the economy tightens. That’s why they’re cheap, but they still plunge further when the profit warnings come out. It’s an absolute minefield at the moment, isn’t it. So I completely understand why many investors are completely avoiding the sector. Maybe the time to pick up bargains is still some way into the future, maybe next year, when we have more idea who the winners & losers will be.

Update at 09:07 - the market agrees, and has savagely cut CBOX to 100p. There's probably no point in selling now, since the reduced profit is now baked in -

Shoe Zone (LON:SHOE)

160p (up 10% at 08:15)

Market cap £79m

It seems that consumers are spending their cream cake money on cheap shoes instead, maybe there’s a lesson there from today’s RNSs?

SHOE once again delights us with another positive upgrade -

Shoe Zone is pleased to announce that since the publication of its trading update on 26 July 2022, trading has continued to exceed expectations due to continued strong demand for summer and back to school products throughout August. The Company also continues to benefit from the margin improvements as outlined in recent trading updates.

As a result, the Company now expects adjusted1 profit before tax for the financial year ending 2 October 2022 to be not less than £10.5m.

1 Adjusted to exclude the profit on the sale of freehold property and foreign exchange revaluations

Checking my notes here on 26 July 2022, triggered by the last positive update, it raised guidance from £8.5m to £9.5m. So today it’s being raised by another million, to £10.5m.

It’s great when companies provide such clear guidance isn’t it? Apparently some brokers tell their clients that they’re not allowed to publish profit guidance, which is demonstrably untrue! Investors want, and need profit guidance. So if your broker won’t let you, just fire them and get a new broker that actually wants to help investors buy your shares by giving us the information we need!

I see that Zeus is the broker & NOMAD to SHOE, so many thanks to them for being investor-friendly, also with research notes being provided to us via Research Tree. This is the way it should be done.

Broker update - Zeus ups forecast EPS by 11% to 16.8p for FY 10/2022.

That’s a PER of only 9.5, although bear in mind that the consumer is retrenching, and that’s likely to continue. Plus retailers/hospitality enjoyed a boost from the tail end of the Govt support measures earlier this year (e.g. business rates relief, which will be a big number for multi-site operators).

Even so, the Zeus forecast for FY 10/2023 is a big drop in EPS from 16.8p to 11.1p, which seems to provide plenty of scope for out-performance. I'd much rather invest in things where the forecasts are set low, rather than overly ambitious targets and then a profit warning.

My opinion - so far, SHOE seems to be performing particularly well. Here's its website, to see the product for yourself.

So I remain keen on this share.

Although if I’d been the CFO, I probably would have made some prudent provisions on the balance sheet, to mop up the surplus profit, and provide a buffer for next year, rather than out-performing profit at this late stage of the year.

If (as expected now) Govt support measures for energy bills (for households) are likely to be substantial, this could prevent consumer spending from really plummeting. Whatever our views on this, we have to think about what’s most likely to happen, as that will be what drives share prices.

As mentioned in last weekend’s podcast, I see big interventions as being highly likely from Liz Truss. Govts & the civil service are now used to being highly interventionist, which they were in 2008 and 2020-21. So why would they do nothing in this latest emergency? That’s not likely, the only question is how big the energy cost support measures will be. As we’ve seen with other emergencies, the worst case scenario is usually avoided, and share prices mostly recover over time.

We also had some good news yesterday, that Europe is now 80% stocked up with gas, ahead of schedule, and the EU (and UK) are planning big interventions to try to get the price of gas down, and break the link between gas, and the price of electricity. But it’s all so volatile, who knows what will happen, I’m just following the news and trying to think up a range of possible scenarios, which forms the basis for my decisions on whether to hold, or bail out, of existing positions.

Obviously SHOE also has the issue of utility bills itself, for lots of (increasingly large) shops. Generally, utility bills were not a big consideration for multi-site retailers, but the recent increases (without the benefit of a cap) are of such a scale that utilities might rise from say 1-2% of revenues (which is what I remember them typically being a while ago) to more like 5-10% of revenues - enough to wipe out profits altogether. Companies which have got long-term contractual arrangements at lower prices, will be laughing, providing their provider doesn’t go bust.

Hence one of several key questions to ask management on webinars, is whether they have affordable, fixed prices on energy, and who the provider is - i.e. are they likely to go bust or not?

Govt support might come, but it’s usually channelled to small businesses, as that’s where the votes are - e.g. pubs were on the news last night, saying they won’t be able to open over the winter, as it will be too costly to heat. Or they’re planning to use open fires more, if they have them. At least the beer will be cold though, and I quite like the idea of sitting round a roaring fire in our winter coats, peering at each other by candlelight - nostalgic for those of us who remember the 3-day week in the 1970s (although I wasn't going into pubs back then, due to only being about 6 years old). Hence I imagine a package of smaller company grants (like in covid) is probably being considered. But whether the larger chains will get Govt support, who knows?

Sorry, I’ve rambled way off the point. Getting back to SHOE then, it looks really good - out-performing repeatedly against forecasts this year, despite a worsening macro picture. Margins rising is also positive, as supply chains improve. Plus investors look protected since the forecasts for next year are set prudently low - hence the risk of a CBOX style profit warning is probably quite low at SHOE.

There’s also a decent yield on SHOE shares.

I think people holding SHOE shares need to be very comfortable that it can continue trading well, and not serve up a profit warning. So far, that appears to be a sensible stance, but in these highly uncertain times, it’s probably best not to get too confident about any share.

A bright spot in a dismal sector. Note also the StockRank is jammed on maximum -

.

Fulham Shore (LON:FUL)

11.25p (flat on the day, at 10:16)

Market cap £71m

Trading Update (AGM)

Fulham Shore owns and operates "The Real Greek" ( www.therealgreek.com ) and "Franco Manca" ( www.francomanca.co.uk ) restaurants.

The current financial year is FY 3/2023.

Current trading - is good -

Despite the turmoil in the UK economy and the recent sporadic train and tube disruption, Group trading is resilient and running in line with management expectations.

New openings -

All new restaurant openings are being well received and are also performing in line with expectations.

As mentioned in last weekend’s podcast, this is a great time to be expanding successful bar/restaurant/retail businesses, because they’re getting stunningly good deals from landlords. I’ve heard of good sites being re-let at just a third of the pre-pandemic rents. That locks in very positive economics for the best operators. Obviously there’s a hurdle to get over with the current energy crisis, but like all crises, it will pass in time. And inflation means that fixed rents will get cheaper in real terms every year, although other costs do rise as we know.

The stock market doesn’t yet seem willing to look beyond the current crisis, but it’s laying the groundwork for some excellent future rebounds, in my opinion - as always happens in bear markets. Hence why I think this niche of expanding hospitality chains, is a promising area to be at least doing our research and creating a buy list, to action at some point, whenever we’re ready. Remember that, once we’re comfortable with everything, then the best share price gains will have probably already happened.

FUL is expanding fast right now, not being cautious. That’s because it’s headed by an experienced operator, who knows good rental deals when he sees them.

FUL has opened 10 new sites in the first 5 months of this year, taking the total to 90. Seven more sites are fitting out now. So this is a strikingly fast roll-out, with a total of 18 news sites expected this year, which is largely done, or imminent.

Net cash of £4.7m at 30 Aug 2022, so there’s clearly little to no solvency risk there, also £15.9m undrawn bank facilities are available. Dilution risk should be small, as this rapid expansion is being funded without calling on shareholders. Bear in mind that landlords are probably paying the bulk of the fit-out costs, with hefty reverse premiums, and probably long rent-free periods too. Hence rapid expansion which would normally consume a lot of cash, is probably being done with very little cash from the company itself. Plus the existing sites are trading well, and will be generating positive cashflows.

My opinion - this looks very good. A theme is possibly emerging now, of businesses that offer a clear value for money offering, and are well managed by entrepreneurial management, doing well (or at least OK). That’s true of SHOE and FUL, of the companies reporting today.

Swathes of competitors are likely to go bust in the next year (especially independents), leaving more market share for the successful operators that are expanding on low rents, like FUL.

For these reasons, long-term, I think FUL shares should do well, and the risk of a profit warning seems relatively low.

I remember reading an article in the Telegraph here in late July, with David Page of FUL, and a couple of points jumped out, especially this -

Fulham Shore secretly put wages up 25pc late last year, after having struggled to open all its restaurants in the autumn. “Guess what, within a month or two, we had enough people and we’d made our competitors really cross. We pinched all their best staff,” Page grins.

That’s an astonishing revelation. If you can do that, then the business should be a long-term winner, as competitors disappear.

How do we value FUL right now though? As Graham commented here back in July, it’s difficult to value, and doesn’t look cheap. So I’ve no idea what the share price is likely to do short-term.

One final point, I think FUL slipped through a stealth 10% rise in selling prices. When I last visited, there was an “optional” 10% or 12% (can’t remember which) service charge on the bill. Mum huffed, “Well, it’s not optional then, is it?!”. We proceeded to vigorously debate the point (I'm a chip off the old block!), with me arguing that you could ask for it to be removed, but in practice only an unreasonable person would do so, or if the food was awful. I’m fairly sure that, pre-pandemic, it just said service charge is optional, but was not added to the bill. So plenty of people would have just paid without adding a service charge. I'm pretty sure the service charge is paid to staff, but that in itself would take the pressure off the company.

Anyway, as a long-term investment, I think FUL looks good. Short-term, no idea.

Graham’s Section:

Flowtech Fluidpower (LON:FLO)

Share price: 121p (pre-market)

Market cap: £74m

We already saw the H1 trading update from this company. It was a slight miss compared to broker expectations for revenues, but margin improvements made up the difference.

Today we get confirmation in the form of the H1 report. Here are the highlights:

- Revenues +4.8% on a like-for-like basis

- Gross margin +89 basis points to 36.3%

- Underlying EBIT +£0.9m to £4.3m

- Net debt rises to £19.7m

There will be an investor presentation at 9am (link).

This is a group of related businesses dealing in hydraulic and pneumatic products. They trade as Flowtech and as Primary Fluid Power. In total, there are about a dozen separate businesses.

There was a big divergence in H1 between the Flowtech performance and the Fluidpower performance:

Flowtech: H1 revenues flat, H1 profits down 6%.

Fluidpower Group Solutions: H1 revenues up 5.5%, H1 profits up 44%.

See table below. Flowtech is still the main source of profits, but Fluidpower Solutions is catching up:

The company has hit its target of a 10% margin (“return on revenue”) from Fluidpower Solutions.

The target of a 15% margin in Flowtech is still a work in progress, but the company is confident that it can hit it.

According to the commentary, much of the divergence in performance during the period was caused by differences in the industry focus of each division: Flowtech is biased towards pneumatics (air flow) while Fluidpower is biased towards hydraulics (liquid flow).

Net debt: as previously discussed in this report, the headroom at this company doesn’t look too comfortable at just £5.3m as of the end of June. It built up a huge pile of inventory, which I wouldn’t normally criticise a company for doing. However, I do think it needs to either increase its debt facility or unwind the inventory position.

Shareholders can look forward to “a degree of unwind”:

…we expect a degree of unwind of this position in the remainder of the year as we benefit from a more predictable supply chain environment, and which will reduce the Group's net debt position.

Trading Review & Outlook

A few worrying comments here.

In hydraulics, the situation remains positive, “albeit there are some signs of the rate of demand beginning to flatten”.

But in pneumatics and the broader industry, “there has been a noticeable decline in demand in Q2”.

On top of that, post-Brexit arrangements with Irish customers have led to “a more challenging market for our Flowtech division as the year has progressed”. (I’m not sure why Brexit would suddenly prove to be a challenge in mid-2022?)

Inflation - the company is navigating the inflationary environment with price increases passed onto customers to offset increased costs. So far, this one is not a victim of inflation.

Outlook - “visibility beyond the short term is limited”, particularly at Flowtech. Overall, there is still confidence in the company’s ability to grow and increase market share.

My view

There’s not much here to make me change my mind about FLO.

Some things I like about it:

- It’s good at passing costs onto customers (so far). Much of what it does is distribution, and there is not much wiggle room for customers when product prices are rising.

- Accounts are always presented in a no-nonsense way. There’s not one mention of EBITDA in today’s RNS. The adjustments to create “underlying” profits aren’t as large as you find at many other companies.

- Simple, clear targets for “return on revenue” help to demonstrate the company’s focus on profitability, not growth for the sake of growth.

Some things I don’t like about it:

- If inventory unwinds very slowly, then the company will have this limited debt headroom situation for an extended period of time. Not ideal.

- There is probably little to write home about in terms of the company having any proprietary technology or other IP.

- As you might expect from a company with limited IP, the quality metrics are unimpressive:

Overall, I still think this a solid company, and I think it’s fairly priced here.

Dalata Hotel (LON:DAL)

Share price: 309p (+4.6%)

Market cap: £691m (€800m)

It’s very rare that we cover this one - it was last mentioned by Paul in 2018.

It’s Ireland’s largest hotel operator, owning the Maldron and Clayton brands, plus a few one-off hotels. Most hotels are 4-star properties in major cities.

David Stredder’s Mello events have in recent years been held at Clayton Hotel Chiswick - one of Dalata’s London properties.

The entire Clayton portfolio can be viewed here. The Maldron portfolio can be viewed here.

So let’s dig into these interim results for H1 2022.

Note that H1 2021 was impacted by very strict Covid restrictions, so I won’t bother with any comparisons against that period. The company helpfully includes H1 2019 numbers:

- Revenue €220.2m (H1 2019: €201.9m)

- PBT €52m (H1 2019: €37.8m)

- Free cash flow €56.6m (H1 2019: €45.2m)

The KPIs are: room occupancy 69.8%, average room rate €126.89, and RevPAR €88.61 (revenue per available room).

Compared to 2019 the business is now bigger, and charging much more per room, so that even at a materially lower occupancy rate it’s earning more per available room.

In October it will open Clayton Hotel Glasgow, its 50th hotel.

Outlook - current trading sounds good, with RevPAR in July/August 25% higher than 2019.

The company is “cautiously optimistic” (bold added):

The trading environment remains challenging with global inflationary cost pressures around food supply, payroll and particularly energy. Although we have not seen any impact on demand to date, inflationary costs may impact consumer discretionary spending in the future. In the face of these challenges, Dalata continues to focus on its sales and dynamic pricing strategies to optimise revenue and apply its normal cost disciplines including driving new initiatives to reduce costs.

Importantly, 75% of Dalata’s electricity and 65% of its gas is now fixed pricing for H2. But gas and electricity expenses are still set to rise by €8m versus H1 - that’s a significant chunk of PBT.

Balance sheet - total assets of €2.2 billion, including PPE of €1.3 billion (the balance sheet value of the owned hotels). There is only €276m under “loans and borrowings”, and €628m of lease liabilities. As far as hotel groups go, this is a tidy balance sheet.

Balance sheet equity officially stands at €1,084m.

My view

Occupancy of below 70% still feels light but there was a lingering Covid impact around the beginning of the year. Restrictions weren’t actually lifted until the end of January. In other words, these results don’t fully reflect a post-Covid environment.

And what will a post-Covid environment look like? Dalata says “most US multinational corporates have not yet returned to pre-pandemic travel levels”.

Similarly, conference and banqueting events are described as “not yet having returned to pre-pandemic levels in the period”.

With so much economic hardship right now, including the impact of inflation, and with Zoom/remote working being so cheap and convenient, maybe business travel and hotel events are going to be a bit subdued for the foreseeable future? I hope not! Pre-Covid, I was constantly hopping on the plane to a business event, and I loved it!

Finally, it’s also worth mentioning that a reduced VAT rate of 9% is temporarily boosting the Irish hospitality sector. This rate will return to 13.5% in March 2023.

Overall, I think there are more positives than negatives here.

At the current market cap, Dalata is available at a meaningful discount to book value. It offers some decent hotel brands with a mix of geographical exposure across Ireland and the UK. Future periods should benefit from the effects of Covid finally being eliminated, although that needs to be balanced against the likelihood of seeing recessionary and inflationary impacts.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.