Good morning from Paul & Graham!

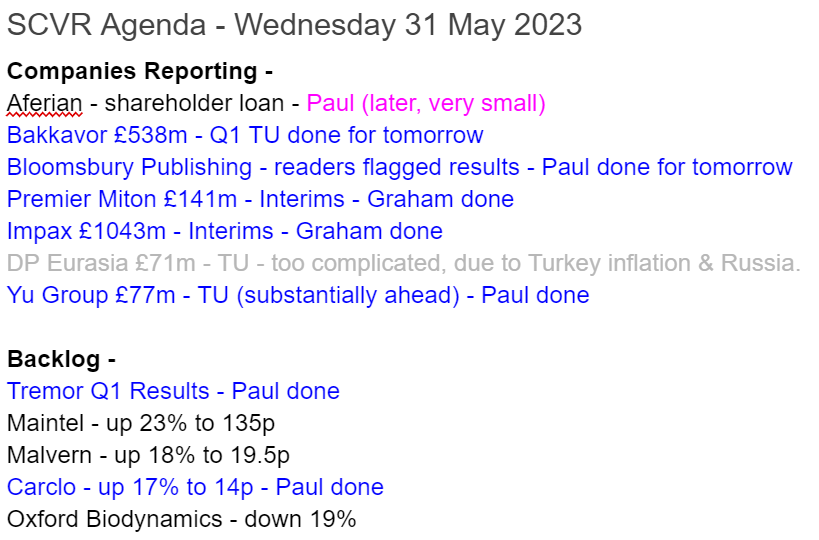

Incidentally, I was looking through the pages under "BROWSE" on the left menu here over the long weekend. It transpires that the FTSE 250 (mid caps) market caps run from £309m to up c.£5bn (with one outlier above that). As we are now covering shares up to £1bn here in the SCVRs, not all of them obviously, our market size remit now actually covers about 40% of mid caps, as well as most small caps! So maybe we should rename this the Small & Mid Caps Value Report? or SAMCVR?

We've covered 518 unique companies here since 1 July 2022, according to my summary spreadsheet. Not bad going for 2 people, I'd say! And certainly providing plenty of share ideas for readers to research further, if our initial reviews float your boat.

As I constantly have to remind people, we can't predict the future. So our views will only ever reflect the facts, figures, and forecasts on the day the reports are written. Then things begin to change literally with each day that passes, often in highly unpredictable ways. I think that's the exciting bit about stock-picking - trying to anticipate what might happen in future, and getting ahead of the curve.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections

Carclo (LON:CAR) - up 17% to 14p y’day (£10m) - Update re contract - Paul - RED

Announced a positive conclusion to negotiations with a major customer, over a cancelled framework agreement. No details, but deal "largely offsets" its losses, which sounds OK. I remind readers of the very high risk of this company, due to bank debt, and heavy pension repair contributions. Freehold property assets could save the day, who knows?! Downside risk is that HSBC could pull the plug, or insist on a dilutive equity raise. A wide range of potential outcomes here, from a wipe-out, to a multibagger.

Tremor International (LON:TRMR) - up 8% to 280p y’day (£400m) - Q1 Results - Paul - AMBER

I don't invest in this sector, online advertising, as in the past many of them have gone wrong, when profits suddenly disappear. However, TRMR has an OK balance sheet, has done big share buybacks, and is on a low PER. So if you can reassure yourself that profits are sustainable, then maybe it's cheap on a fwd PER of 7.4x? Usually, shares in this sector are cheap for good reasons though, so be careful, this needs careful scrutiny I think.

Premier Miton (LON:PMI) - down 8% to 82.35p (£130m) - Interims - Graham - GREEN

Very poor profit figures in H1 as this fund manager sees continued equity outflows. Flows into US equities and fixed income soften the blow. I think PMI could do more to prove its differentiation and conviction but on value grounds I have to give it the thumbs up here.

Yu (LON:YU.) - Up 22% to 560p (£94m) - Trading Update - Paul - AMBER/RED

A sparkling trading update today, "substantially ahead" of mkt exps. That comes on top of a big increase in 2022 profits. All looks good then? I'm not so sure. I rummage through the 2022 accounts, and find a lot of risk. So I'm wondering whether maybe the current big profit growth might be a temporary benefit from the energy crisis, rather than the company itself being particularly good? Who knows, time will tell! Risky, but it's got strong positive momentum behind it for now.

Impax Asset Management (LON:IPX) - down 10% to 710p (£941m) - Interims - Graham - GREEN

This fund manager also sees a reduced performance in H1 compared to last year, but inflows remain impressive at over £1 billion (£2.5 billion last year). Valuation here is in a different league to the likes of Premier Miton (LON:PMI) but still offers an opportunity if positive flows continue.

Paul's Section:

Tremor International (LON:TRMR)

Up 8% to 280p y’day (£400m) - Q1 Results - Paul - AMBER

A very strange market reaction to Q1 results yesterday - it opened down about 9% at 235p, but recovered to up 8% at 280p by the close of play - not something we see often!

I've had a quick look through the Q1 results, and noted down these points (not comprehensive) -

Similar to CNIC, TRMR reports a large cash pile of $191m, whilst having $100m of long-term debt. Why?

Aggressive share buybacks, with c.13% of the shares (19.4m) bought back in the year to Mar 2023, costing $95m.

Outlook mentions challenging macro conditions weighing on customers advertising revenues. But despite this, it sounds optimistic, and guides $140-145m adj EBITDA for FY 12/2023.

Stock based compensation looks excessive, at $7.1m in Q1. There seems to be a pattern of Director selling after exercising options, but that looks like possible partial selling to fund tax liabilities, as the Director dealings page shows here.

Q1 adj EBITDA of $8.9m becomes a $17.3m total comprehensive loss, the biggest adjusting item being $17.0m depreciation & amortisation.

Balance sheet - NAV of $533m contains $392m of intangible assets, resulting in NTAV of $141m, which looks OK to me.

Paul’s opinion - these numbers remind me a lot of CentralNic (LON:CNIC) - seemingly very cheap, but a big question mark over how sustainable profits are? TRMR has a much better balance sheet than CNIC. Both have large gross cash, but also large gross bank debt - why? That doesn’t make sense to me, and is surely wasting millions in finance costs?

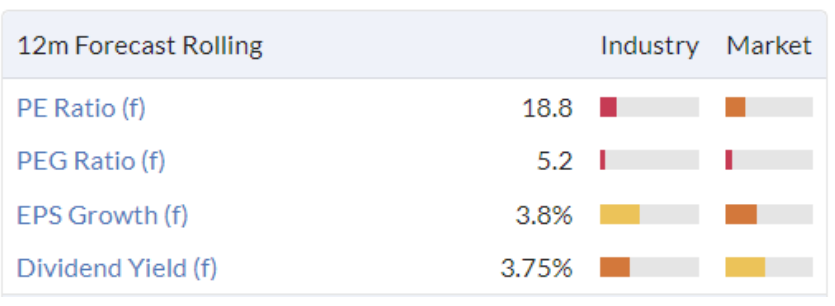

If you think profits are sustainable, then TRMR looks great value on a fwd PER of 7.4. It seems to be doing big share buybacks instead of paying divis - which would make sense if the shares are indeed too cheap.

Personally, I don’t understand the business model, so have no idea if profits are sustainable or not. Hence it’s impossible for me to value, and I’ll steer clear for that reason.

But if you think you understand the business model, and the numbers, then you might be more (or less!) bullish.

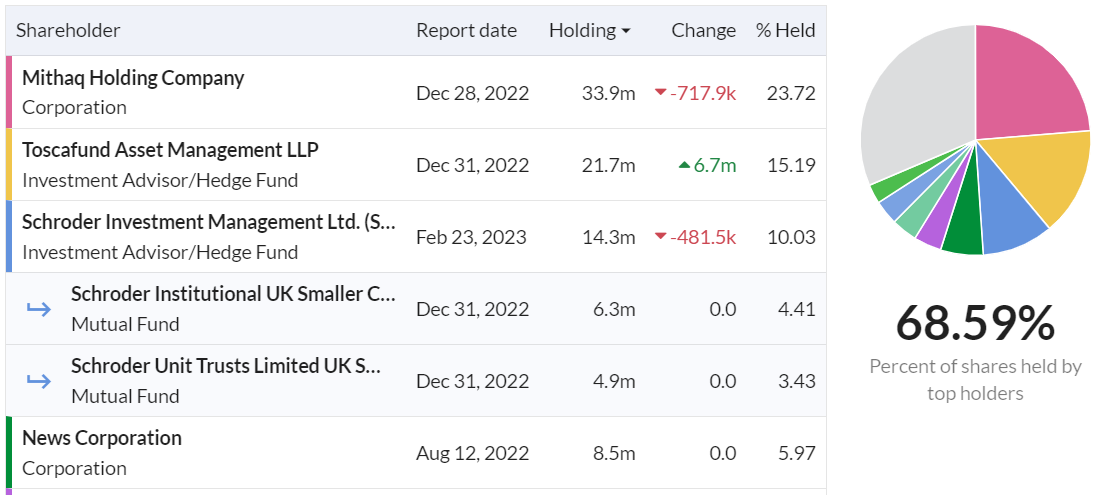

Some interesting shareholders here, and quite concentrated -

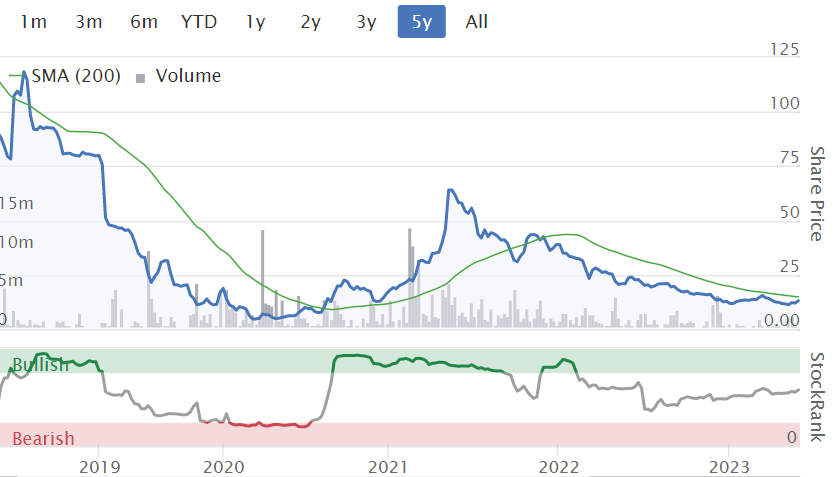

Is the rollercoaster (below) getting ready for another surge, or coasting to a halt? Who knows?! -

Carclo (LON:CAR)

Up 17% to 14p yesterday

Market cap £10m

A major 10-year framework agreement was cancelled in Dec 2022. Yesterday, Carclo announced that it had reached a “positive conclusion” with the customer, for compensation. No terms are disclosed due to confidentiality, but it does say this, which sounds satisfactory -

“...it is expected to largely offset the Group's financial exposure arising from the early termination of the contract.”

Paul’s opinion - CAR is still very high risk. The scale of its financial problems dwarfs the market cap. E.g. £35m gross bank debt (£24m net debt) in last accounts (interims to Sept 2022), and a gigantic pension deficit (actuarial basis, which drives the recovery payments) of £83m at March 2021. Deficit recovery payments are scheduled at £3.5m - £4.0m p.a. The problem is that the business doesn’t generate enough cash to fund the pension scheme, let alone reduce bank debt. It’s also breaching bank covenants, which the bank waived at 31 March 2023. A revised strategy is now focused on cash generation to reduce debt - better late than never. It’s very difficult to see any value at all in the equity. Although the balance sheet does contain £27m freehold property, which could be why HSBC have been prepared to give the company more time, maybe? Banks like the security of freehold property. I see that CAR did a sale & leaseback of a small property in Arizona last year. Could more such deals follow, to ease the financial pressure maybe?

What happens next? Who knows. A miraculous turnaround is what bulls are hoping for. More likely I’d say is an equity raise to reduce debt, diluting existing holders badly, if the terms are punishing.

If you do want to gamble on a good outcome here, then that’s your choice, but just be aware you’re taking a big risk, of losing a large part, or all of your money. Also, the higher interest rates go, the more expensive the bank debt is likely to be getting. Note that the interest cover covenant on debt is a problem, and caused a “material uncertainty” going concern statement in the last interim results, flagged up in the audit report.

Note that it avoided dilution and insolvency in 2021, producing a spectacular multibag, which has since fizzled out. Really a share for gamblers only, I'd say!

Yu (LON:YU.)

Up 22% to 560p (£94m) - Trading Update - Paul - AMBER/RED (performing well, but high risk)

We stopped covering YU in 2019, because its 2018 accounts were terrible (heavy losses), and there were some accounting irregularities I see from checking an old SCVR.

It’s a supplier of gas/electric to commercial customers - so not really a sector we would normally cover, and have no expertise in.

However, the share price has been on quite a journey, which seems to have kicked off when the mini budget in Oct 2022 launched Govt support for energy bills (both residential and corporate) -

I wish I’d never started this, but might as well finish.

Today YU updates us positively -

Yü Group PLC (AIM: YU.), the independent supplier of gas, electricity, meter asset owner and installer of smart meters to the UK corporate sector, provides the following update on trading.

I like the umlaut over the letter u, which gives it a rather attractive, exotic look. If my O-level German serves me well (highly unlikely given the passage of time), I think this means we pronounce "Yu" with what would sound like a heavy Glaswegian accent? Any linguists here can possibly correct me if that's wrong (highly possible/likely).

Following a detailed review by management, revenue, margins and cashflow for the year to 31 December 2023 are now expected to be substantially ahead of current market expectations.

The Group is pleased to announce continued strong trading momentum, with key performance indicators of revenue, profitability and cash generation all showing very strong growth.

The run rate growth of average monthly bookings achieved in Q4 2022 has continued into 2023. Pent-up demand from softening commodity markets has seen an increase in customers contracting with Yü providing additional revenue visibility for FY 2023 and beyond.

There’s more detail, but those are the key points. Very encouraging, we’re not seeing many (if any!) “substantially ahead” of expectations updates right now.

Broker updates - many thanks to the 2 brokers who have published updates via Research Tree, very useful. Liberum upgrades FY 12/2023 by a whopping +42%, to 61.1p EPS (fully diluted), giving an attractively low PER, even after this morning’s big rise in share price. This is slightly over double the 30p EPS achieved in FY 12/2022 - really impressive!

2022 Results - the above good news prompted me to review the FY 12/2022 accounts, which also show very strong revenue & profit growth.

These points do concern me however -

Low margins: revenue of £279m only turned into £5.8m PBT

Note 16 shows a massive £21.4m cost for bad debt provisions - that’s 7.7% of all its revenues in the year, and results in only £5.8m remaining profit after this huge charge. What’s going on? Clearly there’s a big problem with not properly ensuring customers can actually pay for the electricity being supplied. It says in today’s update that rolling out smart meters helps reduce bad debts.

Balance sheet - is fairly weak, so there’s no asset-backing here to speak of. The £19.0m cash pile at Dec 2022 looks nice, but that’s almost fully offset by trade creditors that will need paying. Overall working capital is £75m current assets, and £74m current liabilities. So the cash pile just looks to be temporary timing differences on balance sheet dates, rather than genuinely surplus cash. A good question to ask management at any company, is what the monthly peak, and trough (and the average) are for net cash/debt.

Overall, NTAV was £11.7m at Dec 2022, not much asset backing for a £94m market cap, but also not an immediate concern.

Paul’s opinion - the key question for investing in any company is: “Are profits sustainable?” My concern with YU is that pre-energy crisis, in most years it made losses. We then have the current energy crisis, and YU’s profits soar, yet most of those profits have to be written off as bad debts. Leaving only £5.8m remaining profit in 2022, a very low margin of 2.1% of revenues. So credit risk is my main concern, that seems to be handled very badly. Supplying electricity to companies that can’t pay for it, is not good business. Maybe that’s an improvement opportunity, if you want to see the glass half full?

Secondly, I worry about the volatility of energy prices, and the contract risk of agreeing fixed prices with customers, and what hedging is necessary? The figures suggest to me that this business is very high risk, and could go bust if management make serious errors over their hedging strategy. Why would I want to take that investment risk? So investors here need to be all over that issue, and to strongly believe that management are safe hands to hedge safely in any possible scenario. It’s good to see that the Chairman’s statement focuses strongly on this point -

CHAIRMAN'S STATEMENT

Delivering high growth, shareholder returns, innovation and expert risk management.

· Maintaining a steadfast commitment to "best-in-class" corporate governance as we scale the business to meet our highly ambitious targets in a £50bn+ market.

· An experienced, seasoned board and a highly resolute, expert management team have continued to thrive and continued to deliver impressive results in the face of multiple "Black Swan" challenges.

Overall then this share looks high risk to me, and I don’t know enough about the sector to want to get involved. The large bad debt provision suggests to me that management are not very good at risk management actually.

The bumper profits are probably due to the chaos in energy markets, which has worked out well for YU so far. Can we guarantee that will continue? Will profits evaporate back to breakeven again, when energy markets return to normal (which will happen, we just don’t know when)? Although it sounds like YU has a pretty good outlook for 2023, and maybe 2024, what about after that though? Nobody knows what energy markets are likely to do, and the good luck it's had so far, could reverse, who knows?

Maybe it’s best to see this as a speculative share, and bank some profits on any future big share price rises? It looks risky, and a bit one-offy (recent profit growth fundamentally due to a temporary energy crisis) to me. But as always, good luck to holders, and let’s hope you do well on it. Do we have any sector experts in the house, who can give a more informed appraisal of YU? My conclusion is purely that I don't like the risks, and I'm not making any predictions on how it might perform in future, because I don't know.

Graham’s Section:

Premier Miton (LON:PMI)

Share price: 82.35p (-8%)

Market cap: £130m

This company is the product of the 2019 merger between Miton and Premier Asset Management. It has produced some interesting commentary this morning, as investors continue to exit the UK and European equity markets.

Here are the major points from their interim results:

£11 billion AUM (a year ago: £12.8 billion)

Net outflows £32m (H1 last year: £400 million of outflows)

Adjusted PBT £7.9 million (H1 last year: £24.3 million)

Adjusted PBT doesn’t tell the whole story: there is also some amortisation and some share-based payments, so the final reported PBT is a paltry £2.4 million (H1 last year: £14.9 million.

It’s obviously a massive deterioration in performance, which results from the fact that fund managers tend to have mostly fixed cost bases. Great when AUM is rising, but not so good when AUM is falling!

Premier Miton did manage to reduce its administrative expenses by a few million pounds, with a reduction in staff bonuses.

Chairman comment - a lengthy comment outlining the challenges facing the business and their confidence in getting through this difficult time. The dividend is up for discussion, with a debate around what the final dividend should be. The Board is “highly reluctant to pay an uncovered dividend except in exceptional circumstances”.

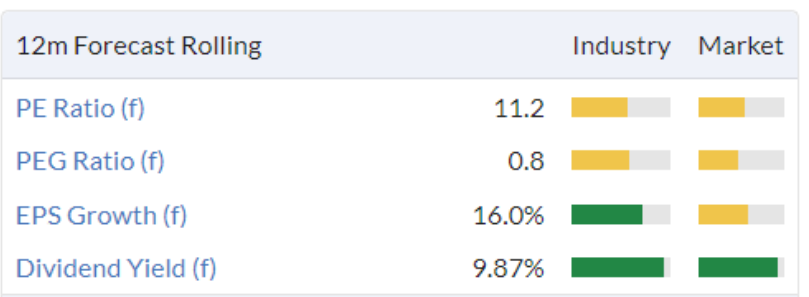

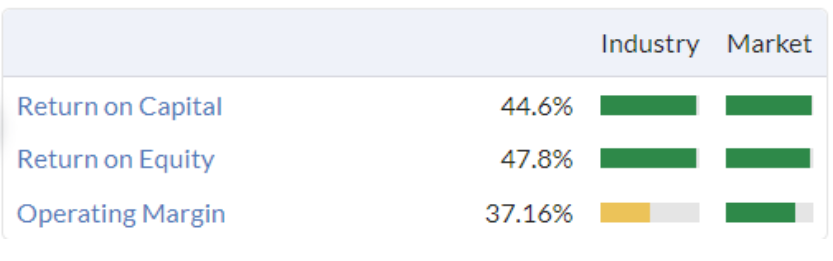

Stockopedia calculates value metrics as follows:

In prior years, PMI’s final dividend was significantly larger than the interim payment, but the Chair warns that this may not happen in the current year. The interim divi is 3p - so maybe the final dividend could be at least 4p? The yield might not fully reach 10% but it’s not far off it at the current share price.

The Chair also leaves a mysterious comment on “strategic ideas”:

We have also been active in reviewing several strategic ideas which have the potential to materially advance our business, contributing to shareholder value. We have an experienced team and focussed approach as to how we assess these strategic ideas and we will need to continue to apply this focus as the industry is going through a period of potentially deep change.

CEO comment - notes the “uptick” in demand for fixed income products. It makes sense that higher rates would send conservative investors back to the fixed income market, but I think it also speaks to the enormous opportunity in equities! PMI saw nearly £400m flow out of equities, and nearly £400m flow into fixed income.

He notes that their US equity strategy did see inflows - a reminder that US equity investors remain as confident as ever, with sturdy S&P performance keeping them bullish. To me, there are signs that strong US performance has become a self-fulfilling prophecy, as money continues to pour into the US almost because it has performed well. And meanwhile, valuations elsewhere are on the floor.

Profitability - the margin earned on AUM (“net management fee margin”) falls from 65 basis points to 62.5 basis points, which “primarily reflects the change in the Group’s product mix” - I assume this refers to a higher weighting in fixed income.

Balance sheet - balance sheet equity is £121 million, though this includes £90 million of goodwill and other intangibles. So the level of asset backing is moderate.

My view

I’m naturally going to be interested in this one, thinking that it could be near the bottom of its cycle:

Reviewing and reminding myself of their range of equity funds, I’m neutral when it comes to PMI’s competitive positioning and differentiation. They’ve never stood out to me in the same way that the likes of Fundsmith or Lindsell Train have done. Those fund managers have really high levels of conviction and a well-defined, quality approach. On the other hand, I’ve never had any major concerns about PMI’s strategies. They do need to prove that it makes sense to choose them over a simple index, and that is an ongoing challenge.

At the end of the day, I’m going to have to give this stock the thumbs up on valuation grounds. It looks like you’re getting about £85 of AUM for every £1 invested in these shares, which in my experience is an extraordinary reading and makes little sense. The corresponding metric at Jupiter Fund Management (LON:JUP) is currently c. £87, and I’ve been very bullish on that one too.

The endgame might be that all of these conventional fund managers get merged into each other, but why not? It might not be such a bad outcome - eliminate their duplicated costs, run them for cash and simply pay out massive dividends to shareholders.

Impax Asset Management (LON:IPX)

Share price: 710p (-10%)

Market cap: £941m

This fund manager has a well-defined theme: sustainability. Given that investments are increasingly under pressure to be “sustainable”, a fund manager dedicated entirely to this theme is sitting in a sweet spot.

Impax shares have been multi-baggers for long-term investors, though they are down by 50% since the end of 2021:

With the environment-focused Inflation Reduction Act of 2022 in the US, and the EU’s “Green Deal”, it doesn’t seem like governments are going to step back from policies related to climate action any time soon. The policy backdrop for environmental investing simply couldn’t be any better.

Here are the main points from the interim results at Impax:

AUM £40 billion (up from £38 billion a year ago and up from £35.7 billion six months ago).

Net inflows of £1.1 billion (inflows in H1 last year were £2.5 billion).

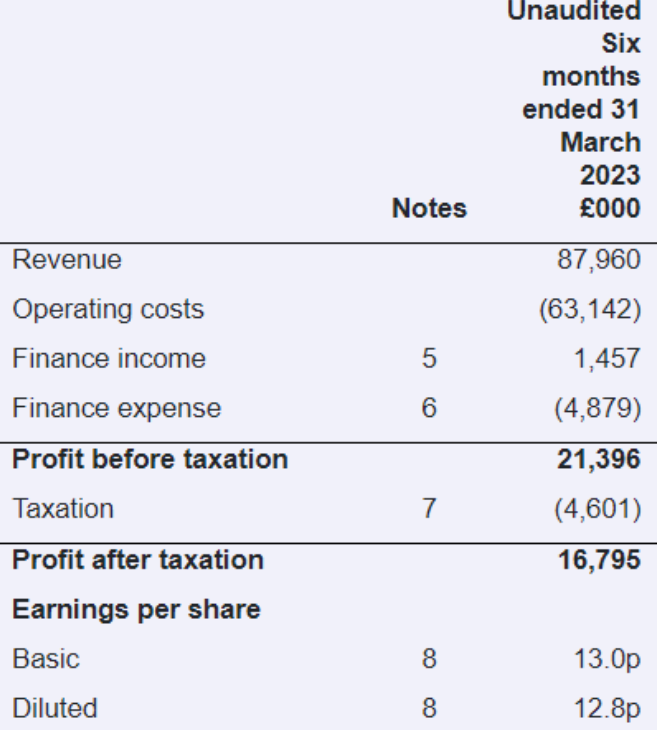

Revenue £88m, slightly lower than last year.

Adjusted operating profit £27m (last year: £34m).

CEO comment:

"Thanks to positive net flows and rising equities markets, our revenue grew compared to the second half of 2022, while adjusted operating profit fell, reflecting our investment in people and systems to support our growth strategy and to increase our operational resilience. We continue to carefully manage our costs in line with external market conditions and at the end of the Period, our run-rate adjusted operating margin was 31.8%, only slightly lower than the equivalent figure at the start of the Period (32.6%).

Note the very high reported margins, despite a tough year. Impax shows what a successful fund manager can do with its quality metrics:

The unadjusted accounts are simple, clean, and demonstrate the company’s excellent margins:

Performance has helped, with eight out of Impax’s ten largest strategies, representing 90% of AUM, outperforming benchmarks over five years.

The company has opened a new office in Japan and has an established fund range in the United States. H1 saw net inflows of £750 million into the US Large Cap Strategy at Impax, helping to illustrate the point I’ve already made this morning about the very high level of confidence in US equities.

Outlook - nothing too concrete in this statement from the CEO, although he does mention that there is some pushback in the US against “ESG investing”:

Our experience to date is that this criticism is largely limited to states in which Impax is not active and that our focus on economic transition and mainstream fundamentals rather than "ESG" has wide appeal.

My view

I’ve just reviewed my notes from July 2022 , the last time I covered Impax here. As I said then, I don’t know how long the popularity of “sustainability” will last - but it’s clearly a major theme, and will be with us for the foreseeable future.

I also had the impression that Impax chose reasonable stocks, with decent StockRanks, which gave me some reassurance that the funds could survive a bear market. It seems that their funds are continuing to perform well.

So my overall impression of Impax as a business remains positive.

Valuation also remains more interesting than it was before - I was priced out at £14 per share in 2021, but £7 per share in 2023 is much more interesting.

For every £1 you invest in Impax, I calculate that you get about £42 of AUM. So it is twice the price of Premier Miton or Jupiter according to this metric. This I believe reflects the market’s view that Impax operates in a niche and has a theme with a very bright future, while the others are conventional and arguably undifferentiated fund managers.

I think I’ll give Impax the thumbs up, too. It is far more highly priced than Premier Miton. But I think the quality and the outlook are strong enough to justify a closer inspection.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.