Good morning, it's Paul and Roland today - welcome back Roland!

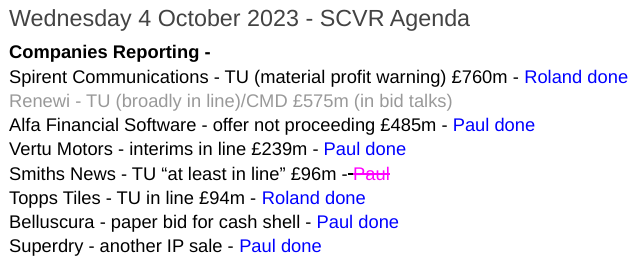

All done for today!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Superdry (LON:SDRY) - up 27% to 55p (at 09:36), mkt cap £54m - Paul - AMBER/RED

Another IP sale, netting £28m. Clearly there is some value in the brand, internationally. This buys it time I think, to see if it can turn the loss-making core business around. For that reason I've relented, from RED to AMBER/RED, to recognise that this is a significant cash injection.

Alfa Financial Software Holdings (LON:ALFA) - down 11% y’day to 165p (£486m) - Paul - AMBER

Announced yesterday that early stage bid talks are off. Shares don't look very interesting to me, as detailed below.

Belluscura (LON:BELL) - 35p (£47m) - Fundraise - Paul - AMBER/RED

Some interesting elements to this fundraising for this jam tomorrow company. Including the acquisition of a listed cash shell with £4.7m cash in it, so a backdoor fundraise that reminds me of the 2001-3 bear market, so I reminisce below about my 5 shareholder action groups targeting cash shells.

Spirent Communications (LON:SPT) - down 32% to 89p (£508m) - Q3 TU (profit warning) - Roland - AMBER

A “material” profit warning from this FTSE 250 engineering group, which says Q3 order intake fell well below expectations. My sums suggest earnings could halve this year, but I think Spirent could be worth further research as a recovery/value play.

Topps Tiles (LON:TPT) - up 3.7% to 50p (£98m) - Q4 trading update (in line) - Roland - GREEN

This tile retailer has issued a reassuring full-year update, confirming that profitability improved as expected during the second half of the year. There’s some risk from reduced homeowner spending, but I think the 7% dividend yield looks relatively safe and remain positive.

Vertu Motors (LON:VTU) - up 2% to 71.5p (£244m) - Interim Results - Paul - GREEN

Solid H1 numbers, and an in line with expectations full year outlook. Balance sheet remains very good, with loads of freehold property, although note that net debt has risen following acquisition of Helston. More acquisitions are planned. Divis & buybacks combined are equivalent to a c.7% yield. Outlook sounds fine. Potential bid target, as whole sector is in play. Plenty to like here, for value investors.

Paul's Section:

Superdry (LON:SDRY)

Up 27% to 55p (at 09:36), mkt cap £54m - Paul - AMBER/RED

Sky news reports that it is about to announce another IP sale, to a partner in India, for £25m. SDRY had previously indicated that more IP sales were in the pipeline, on top of the net £34m supposedly received post year end from its Far East IP sale. These amounts are surprisingly large, and do clearly show that the brand does have value still. If this deal completes, it gives management more time to turn around the loss-making core business. Potentially interesting, maybe we’ve been premature in writing it off? Could go either way, I think.

SDRY confirms with an RNS this morning - it’s set to receive a net £28.3m from the sale of IP to a JV in which it will hold 24%. This is significant I think - we could see a pop in the share price today - whether it holds though, is another question - as we’re seeing at many companies, rallies can often be rapid, but short-lived, depending on the circumstances. Good examples of that recently were Videndum (LON:VID) and Victoria (LON:VCP) which plunged on bad news, then furiously rallied, but have since fallen back again. In both cases the prices looked to me like they were being manipulated by persons unknown. One that hasn’t rallied yet, on recent bad news, is XP Power (LON:XPP) . This bear market shows no sign of letting up right now, really tough conditions, especially for overly-indebted companies that encounter harsher trading conditions - these are the things to carefully avoid, I think. Debt is now expensive, and equity is hard to raise if companies get into trouble with too much debt.

Alfa Financial Software Holdings (LON:ALFA)

Down 11% y’day to 165p (£486m) - Paul - AMBER

Announced on 27/9/2023 (after leaks to the press) that it was in preliminary talks following an unsolicited possible offer from THL. It now says that talks have been terminated.

Interesting comments ALFA says it has “an exceptionally strong late-stage pipeline”, and “strong confidence in the outlook for the business”.

Paul’s view - I’m not familiar with this company, but on reviewing the StockReport it’s difficult to see any attractions from the historic numbers - profit has only really gone sideways for the last 6 years, there’s only a 1% divi yield, and we’re being asked to pay 22x forecast earnings. Negligible asset backing too, with a price to NTAV of 33x.

There might be more to it than those numbers suggest, but I have to see something attractive in the figures to make me want to research it more, which is not the case here.

Belluscura (LON:BELL)

35p (£47m) - Fundraise - Paul - AMBER/RED

A flurry of announcements from this jam tomorrow Adam Reynolds company. There’s no track record, so the market cap is based entirely on contracts for its oxygen enrichment technology, which sound exciting, but as yet unproven.

Quite a creative (or desperate?!) refinancing, containing 3 elements -

Placing of £0.6m at 32p, so minimal dilution from this.

Convertible (at 40p) loan notes (10% coupon) raising £2.7m, and

Acquisition of a listed cash shell ( Tmt Acquisition (LON:TMTA) ) with £4.7m cash in it, using BELL paper. This reminds me of the 2001-3 bear market, where a lot of failing internet startups had large cash piles of 2-3 times their entire market caps. I ran 5 shareholder action groups targeting these, all of which achieved 100%+ profits for shareholders (Expocentric, Protagona, Actinic, PPL Therapeutics, Teamtalk Media). The reason I mention it here, is because several of the successful outcomes of my action groups, were all-paper takeover bids by other listed companies which needed the cash piles of the target companies, and didn’t have any other way to raise fresh cash. The Belluscura takeover approach for TMTA is exactly the same - shareholders in TMTA holding a dormant cash shell, swap their shares for a jam tomorrow project in the shape of BELL, which may or may not work out, depending on what happens.

The devil is in the detail, so it's always worth carefully reading fundraise announcements, in case there are dilutive elements like warrants buried in the detail.

Paul’s opinion - I’m keeping an open mind on BELL, although it’s not the sort of thing I’d want to get involved in at this stage. I’d rather pay more, once the business is actually generating cash, rather than taking a punt on a startup project. Why? Because hardly any of them actually deliver what they promise, so things like this are usually terrible investments! There's the odd rare exception though, and often even failing projects can be temporary multibaggers when people believe the hype.

Anyway, I just thought BELL’s unusual refinancing was interesting. Maybe we’ll see more similar deals (backdoor fundraisings) from cash-rich companies being taken over primarily for their cash piles? I’m not sure how many cash shells there are currently listed? Not as many as there used to be, because the rules were tightened up, so they have to do something with the cash pile, or face delisting, after a certain period of time.

Vertu Motors (LON:VTU)

Up 2% to 71.5p (£244m) - Interim Results - Paul - GREEN

Vertu Motors plc, the automotive retailer with a network of 190 sales and aftersales outlets across the UK and with sector leading brands, announces its interim results for the six months ended 31 August 2023

Company’s headline -

"Record revenues, year-on-year profit and dividend growth"

A long-standing SCVR favourite value share, this car dealers. It’s been a safe port in the small cap storm of the last 2 years, being around a 5-year high presently, despite not managing to catch a takeover bid, unlike several of its peers.

Here are my notes from reviewing the H1 results -

H1 revenue £2,423m (up 21%, helped by large acquisition of Helston, included for the full 6-month period after being acquired in Dec 2022)

Adj PBT £31.5m (up 12%) - very low profit margin, as much of the revenue is the full value of new & used cars, so really I see the gross profit figure as being more meaningful than revenues.

Note that adjustments both this year and last, are very small.

There seems to be an H1-weighting to profits, judging from last year’s numbers.

Finance charges - have tripled, reflecting higher interest rates and the fresh debt to buy Helston. Finance charges now consume a quarter of operating profit.

Corporation tax is also now biting at most companies, VTU shows that its effective rate has gone up from 20% last year, to 25% H1 this year, taking quite a bite out of earnings (PAT).

Net debt has risen considerably, to £90.7m (was net cash of £17.8m a year earlier. This is due to the Helston acquisition). Not a problem, but of course servicing debt comes at a price.

NTAV by the company’s calculations is 70.9p, so about par with the share price, mainly being freehold property, so this share remains full tangible asset backed, very nice.

Share buybacks - notable as having bought back 14% of the whole company in 7 years, and ongoing.

Outlook comments seem generally positive -

FY 2/2024 is proceeding in line with market expectations. VTU has a pretty good track record of setting expectations at a reasonable level, then upgrading/beating expectations, helped by favourable market conditions in recent years.

Strong September (registration plate change month, so important)

New & used vehicle supply improving.

More acquisitions identified.

Agency model - closely monitoring - do any readers have an expert view on this change to car dealer/manufacturers relationships?

Cautious about customer confidence.

Balance sheet -

Pension scheme is fully funded.

NAV strong at £356m. I’ll deduct £130m intangibles (growing, due to acquisitions), and also cancel the (usually related) £21m deferred tax creditor, giving NTAV £247m, which is healthy, and is mostly freehold property, with large working capital debits and credits roughly offsetting each other and continuously rotating, so that’s as I would expect.

Note long-term borrowings has risen to £122m from £55m a year earlier.

Overall, it’s a strong & healthy balance sheet, I reckon.

Cashflow statement - all looks straightforward. Note that working capital increased a fair bit in H1. Also note that divis and share buybacks are similar £ amounts, so the overall yield is a lot better than the 3.5% headline divi yield would suggest.

Broker update - Zeus (many thanks!) updates us, only slightly tweaking figures to reflect share buybacks (hence slightly higher EPS). It reckons 10.0p for FY 2/2024, rising to 10.6p next year.

That puts VTU on a PER of only 7.2x, which continues to look cheap I think. Especially with bidders sniffing around and pouncing in the sector.

Paul’s opinion - I remain positive, so it’s GREEN again.

What we like about Vertu -

Sector is in play, so could attract a premium takeover bid?

Low forward PER

Forecasts have been rising (helped by a largeish acquisition too)

Rock solid balance sheet, with price to NTAV only about 1x

Dividend yield of 3.5% is covered 4x, plus similar amount of buybacks on top.

Management come across well on webinars, as hands-on and energetic, with sensible strategy (subjective).

Downside risks -

Higher profit margins on used cars may diminish over time.

Threat from direct to customer supply of EVs?

Unknown impact of changes to agency business model.

Suggestion that EVs may require less servicing, although contrary indications also suggest there may be more going wrong with them, and harder to fix, maybe?

Higher cost of borrowings, and vehicle stocking loans.

Low margins overall.

Energy costs from multiple large premises - although this is only 2.2% of total overheads, so immaterial really..

Cost of living rises for staff, and shortages of suitably trained mechanics.

Nice high StockRank too -

Roland’s Section:

Spirent Communications (LON:SPT)

Share price: 89p (-32% at 08.30)

Market cap: £508m

Trading impacted by very challenging telecommunications market conditions

Today’s trading update from this FTSE 250 network testing and assurance specialist is unfortunately a material profit warning. A shortfall in Q3 orders means that the order book no longer supports expectations for full-year trading.

Spirent shares have fallen into our market cap range thanks to a share price decline that had already seen the stock halve this year, prior to today’s slump.

Let’s take a closer look at today’s news.

Order shortfall: Spirent says that improved order intake momentum in the second quarter did not continue into the third quarter.

The company says order intake for the first nine months of the year was down 24% compared to the same period last year. This is blamed on key telecommunications customers “delaying their investment plans”.

The Chinese market is said to represent “a large proportion” of the revenue shortfall, due to a reduction in Chinese government spending plans.

Revenue for the nine months is expected to be down by c.20%, consistent with the first half of this year. Full-year revenue is also expected to be c.20% lower than last year.

Management says that gross margins are tracking “to plan” and cost savings are underway. However, they warn that the group’s fixed cost base will result in a material hit to operating profit:

negative operating leverage will impact operating profit very materially

I don’t have access to any updated broker forecasts for Spirent and today’s update doesn’t provide any revised profit guidance for investors. However, I think we can gauge the likely scale of the damage using the information provided.

FY22 revenue was $607.5m. This year’s result is expected to be down by 20%, suggesting a figure of around $486m.

Gross margins were 72% in H1, so I’ll assume a similar result in H2. That would give a full-year gross profit of c.$350m.

Checking back to last year’s accounts, adjusted operating costs were $308m in 2022 and $306m in 2021. The figure for H1 2023 was $149m.

Given this consistency, it seems reasonable to suggest that adjusted operating costs for 2023 could be c.$300m, less any short-term cost savings that can be made.

This suggests an adjusted operating profit for the full year of around $50m, compared to a 2022 figure of $129.5m.

Statutory operating profit will be lower, due to the inclusion of adjusting items including amortisation and share-based payments. Last year, these totalled $17m.

Based on an adjusted operating profit figure of $50m, I estimate full-year adjusted earnings might drop out at about 8 cents per share. This is roughly half the consensus estimate shown in Stockopedia prior to today’s results:

Balance sheet: Fortunately, Spirent had a net cash balance sheet position at the end of June 2023. Management says that the balance sheet “remains strong”, although today’s update does not confirm whether Spirent still has a net cash position.

Share buybacks: the company has spent $72m buying back shares this year. Given the uncertainty in its underlying markets, I would have preferred a more cautious approach to preserving cash. But to be fair, Spirent has been highly profitable and cash generative in recent years.

Outlook: management remains confident that the rollout of 5G networks will be “an enduring growth driver” and believe that “core network spending” is also “poised to increase through to at least 2027”.

Stronger activity is expected in 2024, but order intake does not yet reflect this and Spirent warns of “the lack of certainty in the timing of our customers’ technology roadmaps”.

Today’s trading update did not include any new guidance for 2024.

Roland’s view

Today’s profit warning should probably be seen in the context of the company’s updates throughout 2023. In January, Spirent warned of a greater second-half weighting than usual – always a risk.

In March, the company noted “delays to some of our customers’ decision making”.

Full-year expectations were left unchanged when the half-year results were issued in August, but with revenue down by 20%, it was clear that Spirent was placing a heavy dependence on a stronger second half.

The question now for investors is whether this is a temporary setback, or a sign of deeper problems within this business.

Spirent’s progress has been good in recent years and the company’s quality metrics have been excellent, in my view:

A track record of net cash is also reassuring, as it should give the company breathing space and allow time for it to return to growth:

On balance, I think there’s a reasonable chance Spirent shares could offer decent recovery potential from current levels. However, I’m a little concerned by the group’s apparent reliance on Chinese government spending.

I’d also want to do a little more research into the company’s product offerings and competition before forming a strong view.

Despite its long history, Spirent’s business model has changed several times over the years. I’m not entirely convinced this business has the long-term pedigree of some other UK-listed engineering groups.

On balance, I’m going to stay neutral on this. As far as I can see, Spirent’s previously strong balance sheet should mean the company can avoid financial difficulties. If profits recover in 2024, the shares could be cheap at current levels.

On the other hand, the near-term outlook clearly remains very uncertain.

I think it probably makes sense to stay on the sidelines and await the full-year results.

Topps Tiles (LON:TPT)

Share price: 50p (+3.7% at 09.45)

Market cap: £98m

Third consecutive year of record sales; FY23 profits in line with market expectations

Tile retailer Topps Tiles has issued a confident Q4 update, reporting record sales and confirming that full-year profits (y/e 30 Sept) should be in line with previous expectations.

Today’s update is clear and nicely consistent with previous updates this year, allowing us to track progress against previous management commentary.

Trading summary: sales results for the year look positive to me and suggest the company is maintaining its position as a market leader:

Group sales up 6.4% to “approximately £263m”

Third consecutive year of record turnover

Expect to report “a strong increase” in market share from 19% reported last year

The company says that sales growth moderated during the final quarter, mainly due to a reduction in residential RMI spend (Repair, Maintenance, and Improvement). In other words, squeezed homeowners are spending less on their properties.

However, performance across the group’s businesses appears to have remained on track:

Topps Tiles: like-for-like sales rose by 3.1% last year in the core business, with average sales per store up 30% vs FY19. Gross margins improved through the year as shipping and product cost inflation eased.

Pro Tiler Tools & Tile Warehouse: these online-only operations delivered 40% sales growth last year.

Parkside: this commercial brand suffered problems earlier this year but returned to profitability during the fourth quarter, thanks to a 35% reduction (!) in operating costs.

Profitability: Topps’ half-year results included guidance for improved profitability during the second half of the year. Today’s Q4 update confirms this:

Profitability improved in H2 as expected and adjusted profit before tax for the 52 weeks ended 30 September 2023 is expected to be in line with market expectations4. Our cash flow and balance sheet are also in line with our expectations.

The company helpfully includes a footnote specifying a consensus pre-tax profit estimate of £11.8m for FY23.

However, it’s worth viewing this in context. Profits are expected to fall sharply this year:

FY22 pre-tax profit £15.6m / adjusted earnings: 6.14p

FY23 forecast pre-tax profit £11.8m / adjusted earnings: 4.14p

Unsurprisingly, Topps’ profit margins over the last 12 months have come under pressure from inflation. Reassuringly though, today’s update suggests to me that the worst may be over and that profitability could continue to recover next year.

Roland’s view

Topps Tiles looks quite reasonably priced to me, based on the full-year guidance that’s been confirmed today. Assuming the dividend is maintained, the shares offer a tempting 7%+ dividend yield:

When I last looked at Topps Tiles in April, I noted that cover for the dividend was starting to look slim, with expected earnings covering the dividend around 1.2x.

That still seems to be true, but if profits start to recover next year as now seems likely to me, then cover could improve without requiring a cut. Free cash flow cover for the payout also looks reasonable to me.

The main risk that seems to be flagged up in today’s commentary is the possibility that spending by homeowners could suffer a longer and deeper slump than expected.

That’s certainly a possibility potential investors should consider, in my view.

However, today’s update seems to confirm my previous view that Topps Tiles is a well-run retailer with good market share and growing online operations. With the shares still trading well below pre-pandemic levels, I’m going to stay positive on this stock.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.