Good morning! It's Paul here with the SCVR for Weds.

Agenda -

Concurrent Technologies (LON:CNC) - "slightly ahead" trading update for FY 12/2021. I like the numbers - a reasonable PER, good reliable divis, and a superb balance sheet. That provides a decent base for further research by readers on the company's products, markets, and prospects. Outlook mentions an exciting pipeline of new products. Potentially interesting, and worthy of further research, I reckon.

Facilities By Adf (LON:ADF) - a new float on AIM today from Cenkos. I rummage through the Admission Document, and much to my surprise, think this looks quite good. Most of the money being raised at 50p, is to fund expansion, due to strong demand. Founders retain nearly 50% of the business. It has a fleet of specialist outside broadcasting vehicles for the TV/film industry, with 35% market share in the UK. It plans to expand into Europe through acquisitions. Current trading looks good. Just an initial view, but I like

Industry data - Propel newsletter (which I find interesting & useful) provided sector data yesterday from the hospitality sector - based on widely used software. December trade was obviously well down on 2019, but not as bad as I had feared, especially outside of hardest-hit London. It's a useful reminder that there is price-sensitive industry & macro data out there, which we can often access freely to improve our investing. Hence relying solely on the RNS for company specific data could mean we miss a trick. An excerpt -

Hospitality sales last month were down 12% compared to December 2019, according to the latest data from S4labour, the online labour-scheduling management system from Catton Hospitality. London sites’ sales were hit the hardest as like-for-likes fell by 23% on 2019 levels. Non-London sites also saw downfalls, however by a lesser figure of 10%.

[Source: Morning briefing email (4 Jan 2022) from Propel Info]

Hospitality sector experts Langton Capital also provide a wonderful (and often hilarious) free daily email - there's a signup box here (scroll down, on the left).

I mystery shopped the Bournemouth branch of TGI Fridays (owned by Hostmore (LON:MORE) - I hold) last night, and was surprised at how busy it was. If anyone's interested, I can post some pictures & comments.

This reminds me that a friend told me, before the profit warning, that he monitored website data for Boohoo (LON:BOO) (I hold) and reckoned it was down 20% at one point in the autumn, for the legacy brands (Boohoo and PrettyLittleThing). I don't know how accurate that is, but it correctly predicted the direction of travel anyway, so maybe I should pay more attention to this? Although in the past, when I have checked website data, for various companies, it didn't seem to correlate with subsequent trading updates, hence why I stopped.

Maybe the community here could pool our resources, and start a new thread on industry/macro data, and share any useful industry/macro data with each other?

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Concurrent Technologies (LON:CNC)

80p (pre market open) - mkt cap £57m

Concurrent Technologies Plc (AIM: CNC), a world leading specialist in high-end embedded computer products for critical applications, announces a trading update for the year ending 31 December 2021.

This sounds fairly good -

Based on its unaudited management accounts for 2021, the Company expects to report revenues and profitability slightly ahead of market expectations despite the ongoing challenges that the worldwide component supply chain is experiencing. Whilst the component issues are ongoing, the Company enters 2022 with a robust order book and an exciting pipeline of innovative product releases to grow our customer base and revenues in 2022 and beyond.

The Company also expects to pay a final dividend to shareholders and to pay this after the final results for 2021 are announced.

There’s no footnote provided unfortunately, to inform us what market expectations are. This wastes our time, having to look up forecasts, and we can’t always access them.

An old forecast from Cenkos on Research Tree indicates adj EPS of 4.68p for FY 12/2021.

Stockopedia has the same 4.68p EPS figure on the StockReport, so it looks safe to rely on that number.

“Slightly ahead” today could mean perhaps 4.75p EPS for 2021? That gives a PER of 16.8 - which looks about right, or maybe even slightly warm, given that the company looks ex-growth (no increase in EPS over the last 6 years) -

.

As you can see from the graphs above, the company has a decent profit margin, making £3-4m profit annually, on revenues ranging between £16-21m p.a.

Also note the regular divis, providing a reasonable yield of about 3.3% currently.

Balance sheet - nothing is said today, but I’ve checked the last balance sheet, as at 30 June 2021, and it’s fabulous - very strong, with net cash of £12.4m. Hence there’s clear scope to fund acquisitions, or a special divi or buybacks. This looks a safe, conservatively financed company.

Cashflow statement - again from the interim results, the only thing to note is that CNC capitalises a lot of development spending by the looks of it - £0.9m in H1, and £1.9m in FY 12/2020. The amortisation charge is in that ballpark too, so there’s no artificial boosting of profits. Also, the company doesn’t quote EBITDA (which of course is a meaningless number when companies capitalise their development costs).

My opinion - this company looks quite interesting.

The numbers stack up, it’s almost a value share - reasonable PER, decent & reliable divis, and a bulletproof balance sheet.

The question is, where’s the growth going to come from, and are existing profits sustainable? The trouble with small caps, is that profitability can sometimes be based on one, or a handful, of decent contracts. If they expire, then profits can collapse. Whereas with large caps there’s usually more business spread over a large number of contracts & subsidiaries.

Hence I think a key point to research for CNC, is client/contract concentration - there’s usually information about this in the Annual Report.

Today’s update mentions an exciting pipeline of new products. That could be a potential catalyst for the shares to re-rate, if new products drive growth in revenues & profit, perhaps?

The current share price seems well underpinned by existing profits & assets, assuming they’re sustainable. So any growth could be the icing on top in future, if it happens.

Overall, this share could be worth readers having a closer look at, it gets a thumbs up from me on the basics.

As always, remember I’m only giving a quick review of the numbers here, so more detailed research is needed by you, to assess the company’s products, competition, and outlook - which is what ultimately drives the share price up or down in future.

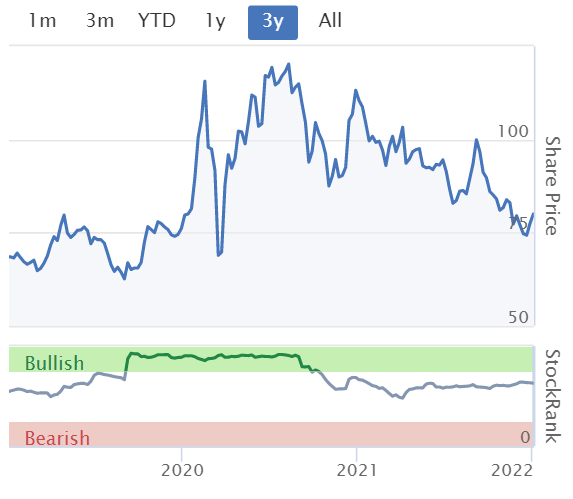

Share price performance in the last 3 years has been lacklustre, reflecting the lack of earnings growth -

.

Facilities By Adf (LON:ADF)

Admission to AIM and First Day of Dealings

It’s quiet for other news, so my attention was diverted to this new listing on AIM, floating today. I’ve had a skim through the Admission Document, and think it looks potentially interesting, and worth following.

In the last couple of years, too many new floats have proven to be over-priced, over-hyped, and opportunistic (e.g. short term pandemic beneficiaries), with management and/or private equity owners using the float as a way to bank a profit. All too often brokers & other promoters don’t seem to care about their own firm’s reputation, it’s just all about greed, in trousering ludicrously high fees.

Against that backdrop, it’s quite refreshing to see this new float, ADF, looking reasonably priced. Also, it’s what I see as a good float - i.e. most of the placing money is being raised for expansion of the business, with only a relatively small amount withdrawn by founder shareholders trimming their holdings, but retaining a large amount of skin in the game. So far so good.

The £2m fees unfortunately do not pass the reasonableness test, and seem very high for a £38m market cap float. One of the post-Brexit aims is to make the London market more competitive. Surely this could best be achieved by slashing the red tape, and therefore adviser fees?! Although there is a counter-argument that a really thorough scrutiny at time of listing is a one-off, and provides a wealth of information in the admission document. Not that many people read them. Although when companies fail, there were often warning signs lurking in the admission document, usually near the back, so it’s worth a read, which takes me about an hour typically as there are lots of parts you can skim over.

Incidentally, I carefully read the “risk factors” sections now, for all accounts, as there are often important warnings in there.

Numbers -

Placing of 30m new shares at 50p each, raising £15m (£13m after fees!) fresh cash for the company, to be used for expansion, due to strong demand.

Selling shareholders (Directors) are reducing from 40m to 35.3m shares, but holding a substantial 46.8% of the enlarged equity.

Total share count on listing will be 75.5m, so at 50p placing price, the market cap is £38m

What does it do? ADF hires out specialist trailers (towed by articulated trucks) for the TV/film industry. Here’s the fleet, from page 18 of the AIM AD (Admission Document) -

.

.

The fleet seems to be mostly leased, so the balance sheet shows large entries for lease right of use assets, and lease liabilities.

The company is experiencing strong demand, and is booked up for 2022, so it’s raising more money to expand the fleet. That sounds ideal, I like that a lot as an investment proposition.

Historic numbers - are not bad, with the pre-pandemic year of FY 12/2019 showing £15.9m revenues, and £2.1m profit before tax (see page 41). However, I would caution that, as a listed company, this would be a good bit lower. Why?

Listing & adviser fees, non-execs, audit fee (of £11k in 2020!) etc, all could add maybe £250-500k p.a. in additional costs, and

Director remuneration - is typical for a private company, with salaries c.£100k (above which the marginal income tax rate goes to something ridiculous like 60%, due to tapering of personal allowances), then the rest is paid via dividends. That’s likely to change, so we could see Director remuneration as a listed company moving to £200k+ salaries, and share options. Thus I reckon that could add £500k+ p.a. to the overheads.

Put that together, and I reckon we could be looking at profits roughly halving, on the FY 12/2019 figures, as a listed company. Hence caution is needed when valuing this share on the historic numbers.

Interim figures for 2021 - this is where it gets interesting! See Section C of the AD - unaudited results for the six months ended 30 June 2021.

The restarting of TV/film production meant revenues soared to £11.5m (up 385% on lockdown 1 hit prior year comps) Profit before tax rose to £2.8m, in just 6 months remember. Whether profits are sustainable at that level, is another question though. Still, it’s not bad for a float priced at £38m market cap, and with £13m in new cash within that valuation.

Balance sheet at 30 June 2021 (unaudited) looks OK, with NTAV positive at £4.8m. It was nicely cash generative over this 6 month period, with cash rising from £1.25m to £3.1m.

Client concentration - see page 51 - is very high. The top 2 customers (which includes Netflix, I believe) make up 65% of total revenues in FY 12/2020, although that year was heavily impacted by the pandemic, with revenue roughly halving. Losses were minimised due to Govt support of about £1.8m.

Clearly the big companies (Netflix, BBC, Sky, and others) are absolutely critical relationships for ADF to nurture, and that is a risk. Although it’s also an opportunity, as if ADF gives top notch service, then that could lock out competitors, and maintain high margins.

Market size & expansion - I originally dismissed ADF as a potential investment, because it says on page 15 that ADF already has 35% market share (it’s UK only at the moment). So what’s the point in investing here, given that it’s probably not far from saturation in its niche? Although good organic growth is expected, as so much more original content is being made, due to newer creators like Netflix, focusing on original content (which they seem to be very good at, I have to say).

Page 22 of the AD explains that European expansion, through acquisitions, initially targeting Spain, France, and E.Europe is the plan. That makes sense to me, because I’ve heard that post-Brexit it can currently be difficult for musicians & other creatives to get visas for tours. Although that may not be so difficult for the TV/film sector, I don’t know. So buying (potentially distressed) European companies in this niche, looks a good way to instantly bolt on the people & equipment needed.

Acquisition risk is therefore a big potential issue here. I’d want to know more about the Directors and their experience. Even if they haven’t done acquisitions themselves before, some solid NEDs with plentiful acquisition experience would be very necessary, in my view. So many companies come unstuck with bad acquisitions. Plus of course there could be dilution from any future fundraisings, although mgt have too much skin in the game to do anything reckless or highly dilutive.

My opinion - I think this looks quite good, and reasonably priced, based on an initial skim of the AD.

I’ll keep an eye out for its future trading updates and accounts, which should gradually build my knowledge of the company.

On a first view though, unusually for a new listing, I’ve formed a positive early impression.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.