Good morning, it's Paul & Jack here with Wednesday's report.

Poor Jack messaged me at 05:45 to say that he's not got a wink of sleep due to an alarm going off all night. Plus I have to dash off for an investor lunch, which means I'll only have a couple of hours, so today's report might be a little sparse. We'll do our best!

Agenda -

Paul's Section:

Quiz (LON:QUIZ) (I hold) - interim results show a convincing turnaround, despite the impact of restrictions on social gatherings in the first couple of months. Balance sheet is strong, with growing net cash. Current trading excellent. There's lots to like here, on a tiny valuation. However, any renewed covid restrictions remain a risk for the sector.

Hostmore (LON:MORE) (I hold) - inaugural trading update comes across positively. This company looks far too cheap to me, due to an overhang of sellers from the badly handled demerger. Details also provided of new site roll-out accelerating, for both its brands. Quite exciting I think.

Jack's Section:

Equals (LON:EQLS) - strong update reporting accelerating growth trends, with FY revenue and EBITDA to be ahead of expectations. The share price fell dramatically in early 2020, but was also falling in H2 of 2019 (before Covid). However, a strategic pivot towards B2B opportunities appears to be paying dividends, so worth re-appraising the group’s prospects.

Dewhurst (LON:DWHT) - solid results with record adjusted operating profit but a more cautious outlook. Shares are illiquid and thinly traded, so it’s more appealing as a buy and hold candidate, though even then, building a position might take a while.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

Quiz (LON:QUIZ) (I hold)

19.5p (up c.8% at 08:14) - mkt cap £24m

I have to keep this brief due to time constraints today.

There’s a presentation from QUIZ today at 09:30, on InvestorMeetCompany, which should be well worth looking at.

Key points from today’s interim results -

Revenues strongly recovering at £36.0m in H1, up 109% on the more pandemic disrupted prior year comps. Note that QUIZ specialises in special occasionwear, so it was particularly hard hit by the pandemic, when parties/weddings etc dried up.

Trading in the first 3 months of H1 was disrupted by pandemic restrictions on social gatherings, which were only lifted fully in late June 2021. Hence there’s further upside on these numbers, providing there are no more Govt imposed restrictions on social gatherings, which remains uncertain. Here’s a handy timeline of pandemic restrictions, as it’s getting more difficult to remember exactly what happened.

Underlying EBITDA has returned to profitability, after the heavy losses of the previous year - at £0.7m (H1 LY: £(3.3)m

Statutory loss of £(1.3)m in H1, although I would expect this to have been profitable, if we take into account the restrictions which impacted the first few months

Online growth of +43% through own website, which is now the focus. Including third party websites, total online sales +27% - this is encouraging, as I think investors are more interested in online than physical stores

Store restructuring last year means that all stores are now on short (2-year at inception) leases, and rents are turnover rents, not fixed. This is a big competitive advantage, as it has roughly halved rents payable on a typical store. There’s also some benefit from reduced business rates.

Liquidity is fine - currently (7 Dec 2021) £4.6m net cash, plus £2.5m headroom on bank facility - cash has been growing each time it’s reported this year

Balance sheet - looks strong to me, no issues at all - this is a well-financed business, which might surprise many investors, who seem to think the company is a basket case, when actually it’s recovered very well

Broker forecasts - I understand Panmures has raised its forecasts this morning, and sees profitability of £0.9m next year (which starts in April 2022) and £1.8m the following year.

Current trading - looks excellent, back at pre-pandemic levels, and bear in mind this is now on a much reduced cost base (halved rents). Really good online growth could excite investors, although it’s obviously coming from a low base -

.

.

My opinion - this is panning out exactly as I hoped, with a strong turnaround underway.

The market cap of just £24m looks way too low, compared with other small online fashion retailers such as Sosandar (LON:SOS) (I hold) and In Style (LON:ITS) . I think QUIZ has potential to re-rate considerably, once more investors latch onto the excellent turnaround. Although the poor track record is bound to weigh on sentiment for some. Personally, I'm not interested in the past, it's the future that matters, and the previous problems have been fixed (mainly onerous leases). Plus QUIZ was unlucky with the demise of Debenhams, which was about a quarter of its revenues at the peak.

Obviously since QUIZ is one of my biggest positions, I'm talking my own book here, but nonetheless everything is (as always) my straightforward opinion. It's not the best business in the world, and I'm targeting an eventual exit at c.40-50p, to be completely transparent.

I’ll read the announcement again, more slowly, on the train to my investor lunch today, so might comment further if anything fresh crops up.

Downside risk in the short term is clearly that the Govt gets bounced into more lockdown measures, as seems possible given that the omicron variant appears to be highly transmissible (although so far, also appears milder). So still some uncertainty, although QUIZ is clearly strongly financed to weather any further storms, so not a major issue.

There's so much less competition now too, it's quite amazing that QUIZ survived, whilst Arcadia & Debenhams closed for good - who'd have thought?

.

.

Hostmore (LON:MORE) (I hold)

Trading Update

Its first since demerging from Electra Private Equity (LON:ELTA) (I hold).

Obviously share price performance has been very poor so far, but I think that presents an opportunity, with the market currently pricing it incorrectly due to forced sellers who can’t hold individual shares for technical reasons.

Key points -

Oct & Nov 2021 - trading ahead of pre-pandemic level EBITDA

Xmas bookings “remain encouraging”

Recruitment challenges are being “navigated well”

Electricity & gas costs have been hedged

Progress on rent concessions with landlords, and constructive way handled, means landlords favour MORE for new sites

New openings accelerating - now have 3 “63rd+1st” bars operating, and another 2 in the pipeline. “Potential for rapid expansion”. 4 new Fridays sites are in solicitors hands

Improvement in guest satisfaction scores (lots has been done to rejuvenate the product, and the customer experience)

Ending of rent moratorium in March 2022 should provide more opps for new sites

My opinion - I think MORE is a cracking business, and the shares seem woefully undervalued.

As more investors learn about the business, I suspect the current price could end up looking a tremendous bargain. We don’t know how long it’s likely to take, for the shareholder register to sort itself out. Personally I don’t mind waiting - it’s too cheap on fundamentals, and sooner or later that ends up reflected in the share price.

Jack’s section

Equals (LON:EQLS)

Share price: 69.9p (+10%)

Shares in issue: 179,341,807

Market cap: £125.4m

Apologies for the delay - the building’s fire alarm went off for about six hours’ with no way of turning it off, so a night to forget! Thankfully, we’re well-stocked for coffee.

Equals is a fintech company focused on the SME marketplace offering things like multi-currency cards and travel cash. Some might remember it as FairFX a few years ago (which is now Equals’ consumer related travel division).

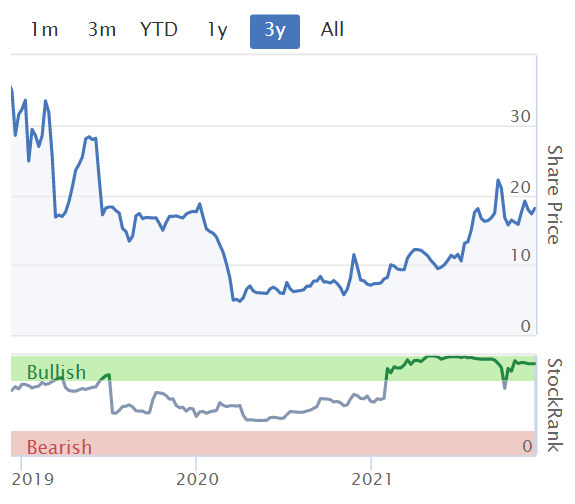

The StockRank is a middling 56, dragged upwards by strong momentum, but if we zoom out on the share price chart we can give a bit of context to that recent positive momentum.

Revenue has grown at an impressive 5y compound annual growth rate of 31.2%, but the company has so far struggled to translate this into cash generation. That picture has changed on a trailing twelve month basis though, and brokers are forecasting profitability in FY21E and FY22E.

Equals... is pleased to announce that is has significantly exceeded full-year expectations for both revenues and Adjusted EBITDA

This update covers most of the financial year ending 31 December, from 1 January through to 6 December. Revenue year-to-date was £40.4m, up 51% from £26.8m, and comfortably ahead of full-year forecasts.

It appears to be an accelerating trend too, as revenue from 1 October to 6 December (‘the period’) was £11.6m, up 105%.

These significant increases have been largely driven by strong demand for the 'Equals Solutions' proposition, which is a new multicurrency product aimed at larger businesses. This generated £3.1m in the year to date and £1.2m in the period alone. There’s also been ‘substantial’ growth in both Equals' Spend platform and its white-label business.

B2C travel-money products represented only 5% of total revenue in the period. This will rebound whenever travel normalises, presumably.

Importantly, ‘the group has now exceeded full-year profitability forecasts’. That goes some way to validating broker forecasts anticipating an inflection point in profits, and makes the stock much more interesting.

In order to drive further growth, Equals is re-investing and upgrading its sales functions, which will be reflected in higher staff costs in 2022.

Ian Strafford-Taylor, Chief Executive Officer, says:

I am delighted to be able to inform the market that the strong performance we saw in September and October has continued and allowed us to significantly surpass the market expectations for the full year in early December. Our results show the results of strategic steps we undertook three years ago to pivot the business to a B2B-focus and to invest into our platforms and connectivity.

Equals last reported a net tangible asset value of £7.4m after stripping out £34.1m of intangibles, with cash of £10.1m set against current liabilities of £16.2m. A little light, but then again this was never going to be an asset-intensive business. Hopefully the group is on the cusp of more dependable positive free cash flow generation. Net cash from operations has actually been positive for the past four years.

Conclusion

A great update for holders and one that suggests it’s time to reappraise the investment case here. Equals is well ahead of consensus estimates - with around three weeks to go it is reporting £40.4m of revenue - and the growth trend has been accelerating.

I tend to spend more time on profitable companies as this greatly reduces the risk in a single stroke, but it does mean I miss out on some promising turnarounds and aggressive growth stocks when they are valued most attractively. This could be a case in point.

Heading back three years to when Equals took ‘strategic steps… to pivot to a B2B-focus’ sounds like a good place to start in terms of re-familiarising myself with the company.

It’s the new multicurrency service for large corporates that is moving the dial, alongside white label partners and increased activity on the Spend platform.

The stock doesn’t look dangerously expensive even after today’s c10% rise to 69.9p given the growth rates. It could be that I’m missing some material risks, so I’d want to investigate the bear case too, and DYOR as always. The group has increased shares in issue over the years, and it looks as though the share price was starting to slide in 2019, before Covid, so H2 2019 is also worth looking into.

But on the basis of this update, Equals is worth spending some more time on in my opinion.

Dewhurst (LON:DWHT)

Share price: 1,464.1p (-0.4%)

Shares in issue: 8,081,398

Market cap: £118.3m

Looks like a fairly sensible company. Reliably profitable, good margins and returns on capital, solid cash generation. The thing that jumps out for now is: where is the growth coming from?

It’s not the kind of track record that deserves such a high rating as far as I can see, at least as far as growth is concerned. There are things to like about Dewhurst, however, and it’s worth monitoring due to its prudent nature and straightforward communication.

Back in July, the forecast PER was 31.4x, which was probably too high. Even now, at 18.4x, that’s affording a premium to the rest of the market. There has been a general expansion in multiples over the past few years, deserved to a degree, and you can appreciate the rerating in the long term share price chart.

So valuation and growth are my key questions here, although the company itself looks good. The shares are also illiquid - a 544bps spread and an EMS of 75 suggesting you can reliably trade around £1,100 worth of stock.

Highlights:

- Revenue +1.1% to £56.2m,

- Adjusted operating profit +6.8% to £9.2m,

- Profit before tax +41.9% to £9.6m, including £1.8m gain on disposal of property,

- Basic and diluted earnings per share +68% to 87p,

- Net cash from operating activities down from £9.3m to £5.5m (due to working capital changes).

Increased sales and record adjusted operating growth

Transport and Highways fell back 19% in the year after a strong year in 2020 supported by Government funded cycleway schemes in the UK. Keypad sales stabilised after the fall in 2020 and were broadly flat. The Lift division bounced back 4% from the fall in 2020 to achieve sales very similar to those in 2019. The recovery was primarily in the UK and Canada, which were the markets hardest hit in 2020.

Adjusted operating profit is before amortisation of acquired intangibles and pension GMP equalisation.

Further reflecting the long-term management focus is the completion of Dewhurst’s new facility:

The major project to build a new factory for Dupar Controls continued into this year. With some inevitable Covid-19 related delays, the completion of the building was a little later than planned, but we managed to move into the new premises during April. The sale of the old premises was completed in June. The total cost of the building (excluding land) was within expected parameters at a little over £5 million.

Outlook - sounds cautious, but I suspect a cautious tone might be par for the course at Dewhurst.

Sales in the first quarter of 2022 are expected to be lower than last year in most of our businesses, with the absence of the bounce back from lockdowns and lower demand for cycleway products. Market conditions are uncertain and difficult to predict further into the year.

Balance sheet - very strong, as you might expect from such a company. The current ratio (current assets / current liabilities) is 4.4x. Cash has increased from £18.1m to £20.5m, with no borrowings. Net tangible asset value of £43.1m.

The only real notable in Liabilities is the pension deficit, which has improved from £11.3m to £4.7m (with the discount rate raised from 1.6% to 2.05%). Dewhurst pays about £1.4m annually in contributions, which is manageable but a pain nonetheless.

Conclusion

Dewhurst comes across as a sensibly run, family owned industrials company. The valuation is more modest now than it was when I last covered it, and that was the real sticking point back then. Add to that the liquidity though, which remains a real issue.

This has some of the hallmarks of a good long-term buy and hold. I’m not dogmatically against debt but this is nevertheless good to see:

The Group is not subject to externally imposed capital requirements and the Group's philosophy is to have minimal or no borrowing where possible.

My sense is that it would take a lot to severely derail this enterprise, which suggests a stable and profitable base from which to continue operations. The key from here is to identify and quantify the group’s growth prospects. It stays on the watchlist.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.