Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

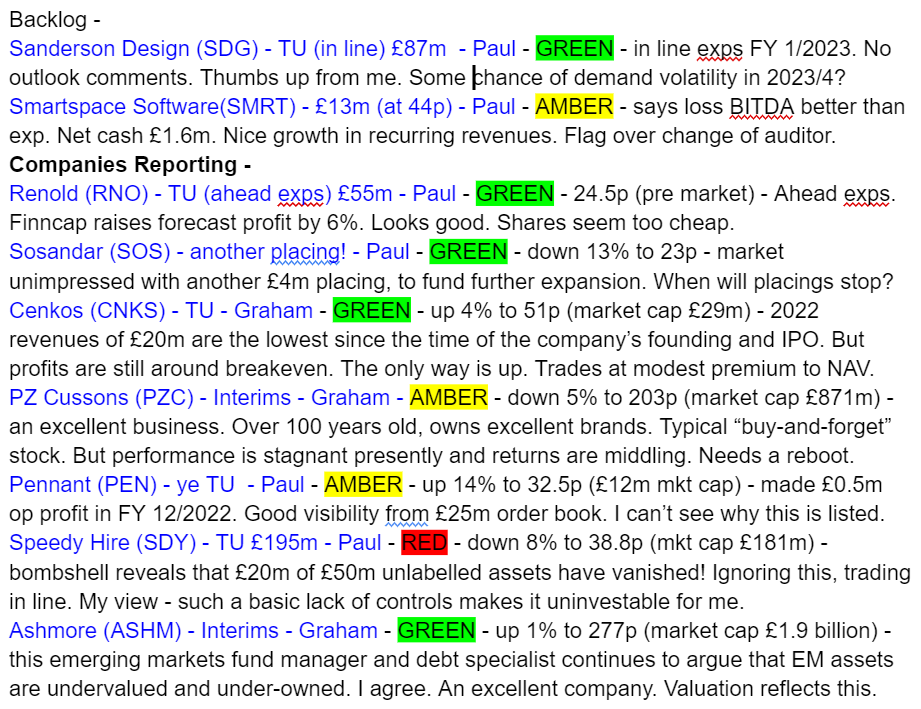

Agenda / Summaries -

Paul’s Section:

Renold (LON:RNO)

24.5p (pre market)

Market cap £55m

Good news for shareholders of this industrial chains manufacturer/distributor today -

The Group has traded strongly since announcing its interim results in November 2022, with order intake running ahead of sales. Supported by the positive market outlook, the Board now anticipates that underlying operating profit for the full year will be above current market forecasts.

Other points -

Revenues up an impressive 25% for the 10 months to end Jan 2023 (helped by forex)

Order intake up 19%

N.America “particularly strong”

Order book at record high, of £104m, so good visibility.

YUK acquisition going well.

Net debt “comfortably below” 1.5x EBITDA

Revised forecasts - thanks to Finncap for an update note this morning. It raises forecast profit by about 6%, to 4.8p EPS (LY actual was 4.0p, so healthy profit growth).

This gives us a PER of just 5.1x at 24.5p per share.

Although the reason the PER is so low, is because you need to adjust for the now increased level of net debt (after a recent big acquisition), and of course the hefty pension deficit, which is a consistent drain on cashflow every year. Which also explains why there are no divis.

Forecast free cashflow for this year is negligible, as capex is quite hefty too, and a lot has been absorbed into increased working capital - an inevitable consequence of higher inflation, that we’re seeing affect lots of companies, as the value of their inventories and receivables go up. I’m not too worried about that though, as the money hasn’t disappeared, it’s just temporarily tied up in assets which turn into cash later.

My opinion - Renold is a much better business now, than it was a few years ago. There’s been a slow, but effective turnaround, improving margins. Also it has demonstrated that demand remained robust through both the pandemic, and through the recent spike in inflation, where RNO also showed it can raise prices effectively.

As the business, and its profits grow, that helps dilute the negative aspect of its pension deficit. Higher interest rates also seems to be taking the edge off pension deficits, so maybe the market is now being too gloomy with the valuation of RNO shares?

It’s only had a modest bounce since the everything rally began in Oct 2022, so it strikes me that RNO shares seem a bargain hiding in plain sight. Hence a thumbs up from me.

Note that it comes up on a negative Z-score screen, so you need to be sure you're comfortable with the financial position.

Good StockRank, I see below -

Sosandar (LON:SOS)

26.4p (pre market open)

Market cap £58m

I’m probably not the only person surprised that SOS has yet again passed around the hat to raise more cash from investors. Now it’s reached profitability, I had assumed that the direction of cash would reverse, and investors might start to get something back in divis, rather than pouring more cash into the company.

Details as follows -

Raising £4m (before fees) in a placing, plus up to £0.5m in a retail offer.

Priced at 22p (a c.17% discount)

About 20.4m new shares, if retail offer taken up fully.

New shares represent 9.2% of the existing 221.4m shares in issue, so dilution isn’t excessive.

Reasons given for this latest fundraise are to accelerate growth.

Trading update - continues to trade in line with market expectations for FY 3/2023.

My opinion - it’s must be getting a bit tiresome for shareholders to be asked yet again to pump more money into Sosandar. There again, it’s now profitable, so this cash is not being burned, it’s going into the larger working capital needed to drive sales & profits further.

I think growth companies can get addicted to raising money from the market, and there needs to come a point where they become self-supporting, and start paying divis to shareholders.

That said, Sosandar is delivering stunning growth, and clearly has established itself as a credible mid-market brand, and is shrugging off the consumer downturn. So I can see the argument for maximising that growth with more funding. I'm expecting today's announcement to take maybe 10% off the price of SOS shares, but we'll see. Update at 09:12: down about 13% to 23.0p, snuffing out the recent rally, this latest fundraising has not gone down well with investors. I'm remaining green on this share, due to the excellent growth, and move into profit this year FY 3/2023, but the latest fundraise is stretching my patience, so it's borderline between amber & green now.

Sanderson Design (LON:SDG)

121p

Market cap £87m

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group, is pleased to announce its trading update for the financial year ended 31 January 2023.

This looks OK to me -

Underlying profit in line with Board’s expectations.

Revenue £112m for FY 1/2023 (flat vs LY)

Good bits - Morris & Co, N.America, licensing.

Bad bits - withdrawal from Russia, manufacturing revs down slightly.

Net cash remains very healthy at £15.2m- this is a sleep soundly at night share for investors, with a lovely strong balance sheet. Note that SDG didn't dilute shareholders during the pandemic, as it was adequately funded already.

Outlook - nothing said, we have to wait until April 2023 for the full accounts.

Inflation - raised its selling prices twice, in Feb & Aug 2022 (as opposed to more usual once per year price rise). So given that revenue is static, this must mean volumes are down.

Forecasts - thanks to Singers for updating us. It’s forecasting 13.9p EPS for FY 1/2023, and a fall to 12.7p in FY 1/2024. At this stage, with macro uncertainty, I’m happy with soft targets for future years. As rival Colefax (LON:CFX) recently warned, high end furnishings tends to lag a slowdown in the high end property market by 6-12 months, so it’s possible that SDG could see a downturn in demand in 2023/4.

The PER is only 8.7x based on 121p share price, and 13.9p EPS for FY 1/2023.

That’s an attractively modest valuation.

Plus of course, as with everything, we’re not just buying this year’s earnings, we’re buying all future earnings, which should rise in the next economic cycle.

My opinion - no change. I’m positive about this share, which looks attractively cheap. There could of course be bumps in the road in 2023/4, that’s unknown at this stage. However, as it’s well-financed, and well-managed (I think), then this would be a share to just hold regardless of short term performance. OR, one to keep on the watchlist, to grab a bargain on any future trading disappointments. Anyway, it's another thumbs up from me.

Graham’s Section:

Cenkos Securities (LON:CNKS)

Share price: 51p

Market cap: £29m

Following on from the larger investment bank Numis yesterday, today we get a full-year update from smaller rival Cenkos:

Revenue for the full year is expected to be approximately £20m and the Board expects to break even at underlying profit level. This has been achieved against a backdrop of significantly depressed market conditions for 2022, with the overall level of money raised on AIM at its lowest since 2003 and new money at its lowest level since launch in 1995.

Among the brokers, Cenkos stands out to me as a company that has always managed to make a small profit, even in vicious bear markets (it has been listed since 2006).

This is because, over the years, they have always radically reduced variable pay (i.e. bonuses) when market conditions have deteriorated.

Mark Simpson’s excellent recent article notes that over the past two years, revenues and staff costs have moved hand in hand.

However, during bull markets of the past, there have been some occasions when revenues have far exceeded costs and significant wealth has been returned to shareholders. For example, here’s an excerpt from the 2015 annual report, showing fabulous results and shareholder returns:

But Neil Woodford, their most important investor client, has no more large business to offer them. The small-cap market has been ruptured by a collapse in investor sentiment, and very few companies are willing to IPO into this environment. Annual revenues for Cenkos of just £20m are the lowest they have achieved since around the time of their founding and IPO.

So where do they go from here - surely the only way is up? Here’s the outlook:

Conditions remain challenging and the outlook uncertain but markets have made a more encouraging start to 2023. We have made a solid start to the year with revenue for January ahead of the average run rate for H2 2022. We have already completed four placings and one M&A transaction this year, with a growing pipeline of future transactions and clients continuing to engage on both capital raising and M&A opportunities.

My view

I think the variable pay structure at Cenkos is brilliant - up until now they have never made a loss, and I’ll forgive them if net income is slightly negative in 2022.

As of June 2022, they had net assets of £24m (equivalent to 42p per share). This included cash of £16m (equivalent to 28p per share), financial assets related to their market-making activities, and options taken from companies in lieu of fees.

Would I pay a small premium over net assets for Cenkos? Yes, I think this represents decent value. Of course a discount would be even better. Stockopedia currently gives a ValueRank of 87.

However, a word of caution.

While I do expect Cenkos to do well in the next bull market, I don’t think anyone could view it as a stock that can compound higher for investors over the long-term. It is fundamentally cyclical.

However, there is a cheat code for investors that could help the compounding process: diligently reinvesting Cenkos dividends back into the company every year.

Reinvesting 3p-4p per share every year, assuming that Cenkos remains capable of this payout in future years, could seriously help to boost returns:

PZ Cussons (LON:PZC)

Share price: 203p (-5%)

Market cap: £871m

We don’t usually cover this one but on a lighter news day it’s worth a look. This one is a member of the FTSE-250 (i.e. outside the FTSE-100 but within the top 350 UK-listed stocks). It owns a variety of brands including Carex, Imperial Leather, Original Source and St. Tropez.

The shares have been range-bound for several years now:

Today brings H1 results for the period from June to November (inclusive). Technically, H1 ended on 3rd December 2022.

Key points:

H1 performance in line with expectations and full-year outlook unchanged

LfL revenue growth 6.1% driven by price/mix (i.e. selling more valuable items at higher prices, passing inflation onto consumers).

Volumes declined 5.4%. Demand for Carex products is lower post-Covid, and one of their Nigerian businesses is deliberately choosing price and margin over volume.

Reduction in adjusted operating profit margin from 11.6% to 9.9%.

Unchanged interim dividend of 2.67p.

Inflation is being managed, as you can see from the above, although not quite enough to keep the adjusted profit margin where it was. Carex and St. Tropez are high-margin brands, and their sales are now lower than they were during Covid.

There was also a reduction in adjusted EPS by 8.5% due to a higher tax charge on pre-tax profits, and minority interests - the other shareholders in PZC’s subsidiaries - taking a larger bite out of results.

CEO comments - the commentary in this report is very cautious, pointing to the “challenging macro environment, with ongoing high cost inflation and reduced consumer confidence”. The reference to “near-term headwinds” may partially help to explain this morning’s share price weakness, despite the full-year outlook having been reiterated.

Simplification - the company made a profit of nearly £12m by selling residential properties in Nigeria (!), as part of a simplification strategy. This helps to explain why PZC’s statutory results (which include those profits) are far more flattering than the adjusted numbers they voluntarily present.

Outlook

They are looking for an improvement in H2:

…we expect a stronger operating margin performance in the second half of the year driven by improved trends in our Europe and Americas business, more benign cost inflation and the full impact of price increases implemented part way through the first half. We remain mindful of significant macro-economic uncertainty, including the continued depreciation of the Nigerian naira, but expect to report FY23 adjusted profit before tax in line with current market estimates.

Despite no change to the PBT target, they do now expect a higher tax charge of 26-27% (22-24% previously), due to geographic mix.

Adjusted net debt is modest at £35.7m. Lease liabilities are low. There is an additional c. £100m headroom on their primary credit facility.

My view

This is a “buy and forget” type of stock. Even if management were incompetent, they should still be able to make some money out of these brands.

I’m a long-term fan of this business but I do acknowledge that they have failed to grow in recent years and that ROE has been less than stellar.

Therefore, while I want to be bullish on this one, I can’t until there is stronger evidence of improving performance, that will help to get the stock out of its current holding pattern.

Ashmore (LON:ASHM)

Share price: 277p (+1%)

Market cap: £1.9bn

Let’s briefly review the interim results from this emerging markets asset manager. Mark Coombs, founder and 31% shareholder, remains CEO here.

The fall in average AUM compared to H1 last year is something to behold, down by over a third:

During H1, Ashmore experienced net outflows of $7.6 billion, far outweighing the positive investment performance of $0.8 billion.

Emerging markets, like micro-caps, see little interest from nervous investors in times like these.

Ashmore is primarily a debt investor, rather than an equities investor (only about 10% of its AUM is invested in equities). However, I imagine that the long-term underperformance of emerging market equities relative to the S&P must be a factor that weighs on sentiment for prospective investors.

Ever since about 2010, the S&P 500 has trounced emerging market indices. The strength of the US dollar has been remarkable, too. People have been saying for years that the performance discrepancy will be corrected. But it never has.

That is the context in which Ashmore makes the following observations:

Emerging Markets valuations remain at attractive levels, significant discounts to Developed Markets assets

Light investor positioning in Emerging Markets after a period of global risk aversion

Continuing market recovery supports Emerging Markets outperforming in coming periods

My own instincts, for what it’s worth, are to agree with Ashmore that emerging markets are due and deserve to have a substantial period of outperformance. But I have been thinking that for a long time, so I’m probably wrong!

I did a poll on my Twitter recently, asking people which type of ETF they might invest in. Less than 30% chose an ETF that included emerging markets. That might be partly due to the higher fees that go with investing in these markets, but I think it also reflects the knowledge that developed markets have performed better, and a belief that this is likely to continue.

And when you look at the outflows experienced by Ashmore, I think you can start to piece together an argument that emerging markets are “under-owned”. At least, that is the bullish argument for emerging markets - that they are neglected by investors, because they have performed so poorly for so long.

Ashmore’s outlook statement includes a reference to the IMF’s forecast that EM GDP growth will return to a premium of 3% over developed markets in 2023 and 2024. While this growth will be bumpy, it’s easy to forget about the very rapid development of GDP in so many non-Western and developing countries, especially China.

My view

Ashmore’s income statement (for the six month period) shows net revenue of £103m (excluding FX gains), and personnel and other expenses of £47m. There are other moving parts but these are the most important ones, in my mind. So there’s about £55m in “underlying” pre-tax profits.

According to the forecasts in the market, Ashmore is trending towards c. £100m in annual after-tax profits at its current AUM:

The high PER reflects the likelihood that profits will bounce back:

When the EM bull market returns, which I acknowledge could take a few years, these shares will look great value. I consider Ashmore to be another very good share to buy and hold for the long-term.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.