Litigation financing specialist Burford Capital has been one of the most successful stock market performers of recent times. The AIM-listed firm’s share price has risen by about 1,200% in just four years. It now commands a market cap that would place it near the top of the FTSE 250.

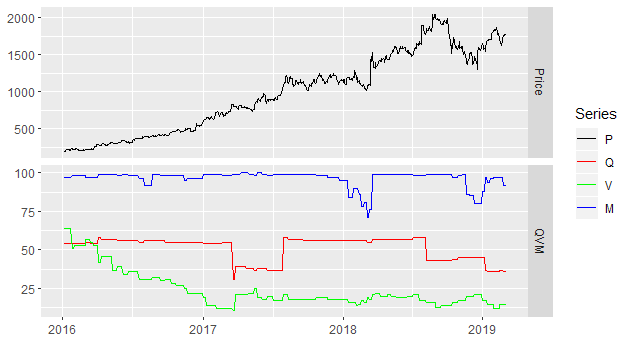

However, Stockopedia’s algorithms have recently flagged up this stock as a potential Momentum Trap, a losing style that suggests valuation has risen far ahead of fundamentals.

There are no new stocks to add to my SIF fund this week, so instead I’ve decided to take a closer look at Burford Capital’s performance to date. I’ll be asking whether now might be a good time to take profits -- or whether this is actually the kind of stock I should be buying.

Litigation finance is hot

There seems to be no limit to the current market appetite for litigation finance. Investors seem happy to provide increasing amounts of money to firms such as Burford Capital, in the hope that its legal expertise and skilled due diligence will result in a profitable settlement in a few years’ time.

Burford remains the standout success on the UK market, but it’s growth has triggered a string of me-too flotations on AIM over the last year:

Manolete Partners (LON:MANO) - specialises in insolvency cases, which are said to be quicker to resolve than some other types

Rosenblatt (LON:RBGP) - this established law firm plans to use IPO proceeds to seed a new litigation finance division

Litigation Capital Management (LON:LIT) - an Australian firm that listed in December 2018

A fourth firm, Vannin Capital, planned to float in October 2018 but cancelled its IPO due to market volatility

It’s too soon to judge the track records of these recent arrivals. But Burford has been listed since 2009 and now commands a £3.9bn market cap. I think we should be able to learn something interesting from its numbers.

How are profits calculated?

Burford’s annual profits are based largely on estimates of the likely outcome of the legal cases in which it has invested. IFRS accounting rules specify that litigation financiers can book non-cash gains on cases, based on an independent review of the likelihood of success and the potential value of any settlement.

The problem is that these cases often take many years to resolve. So while money floods…