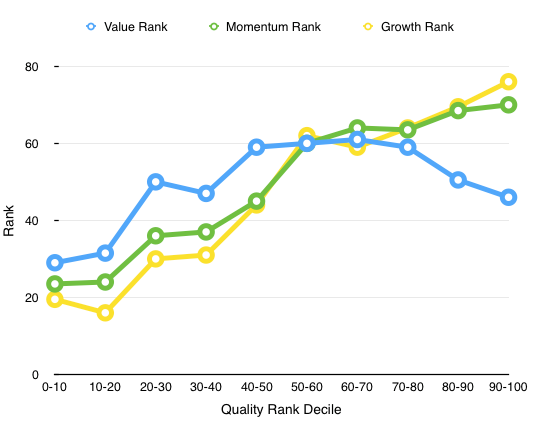

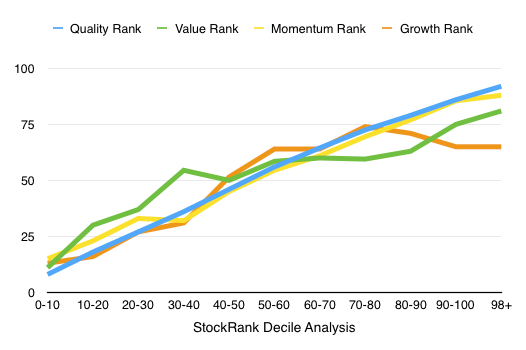

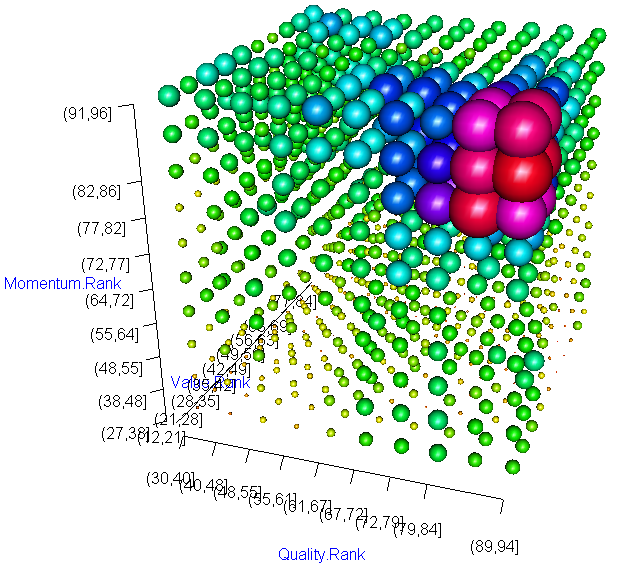

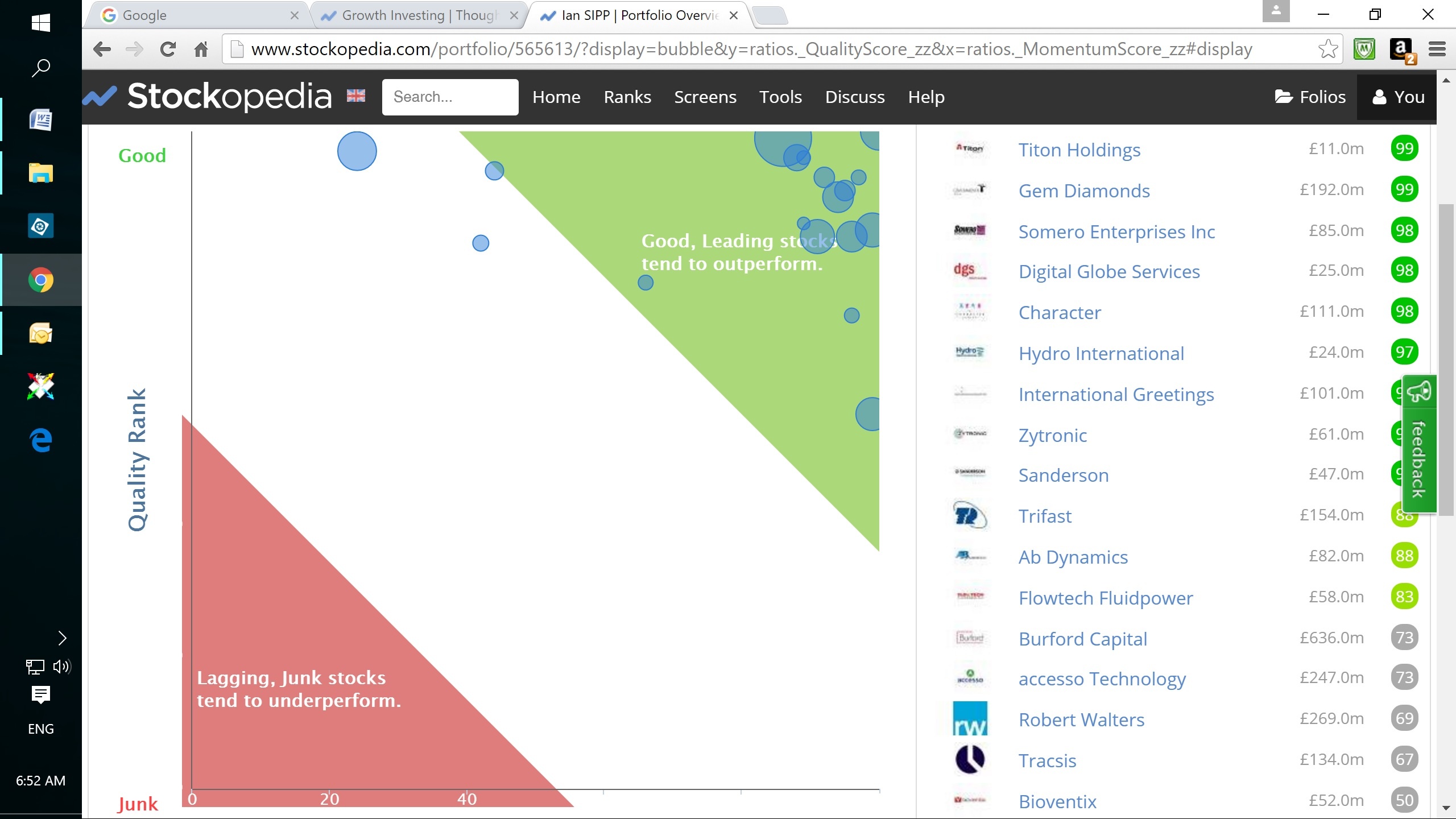

This website provides a very useful summary of a stock's performance in terms of three numbers: the Quality rank, Value rank and Momentum rank. However my testing suggests that the Value rank needs to be treated with caution.

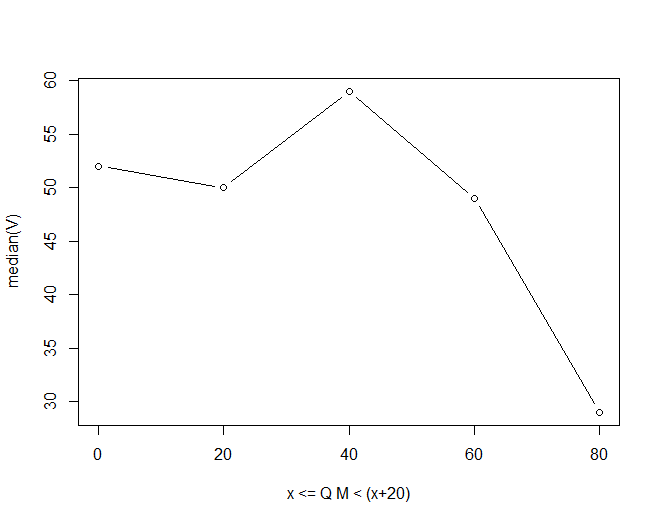

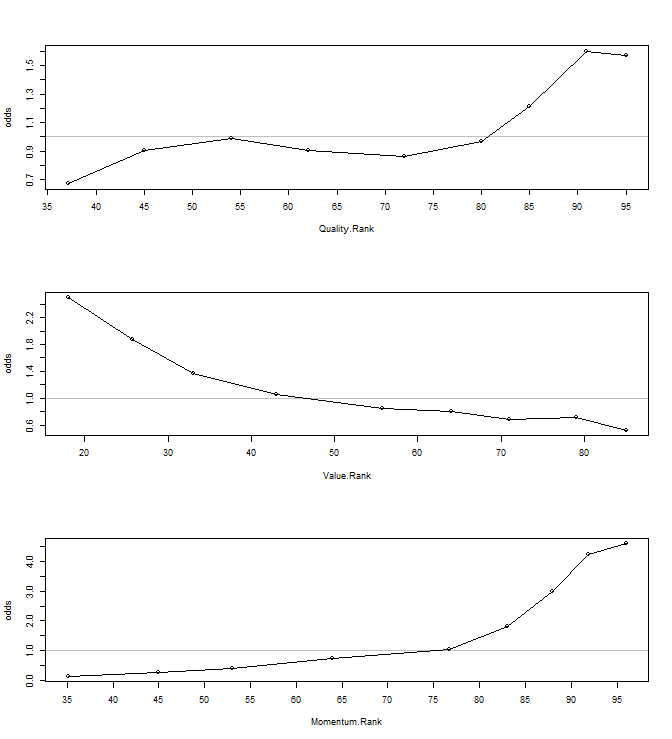

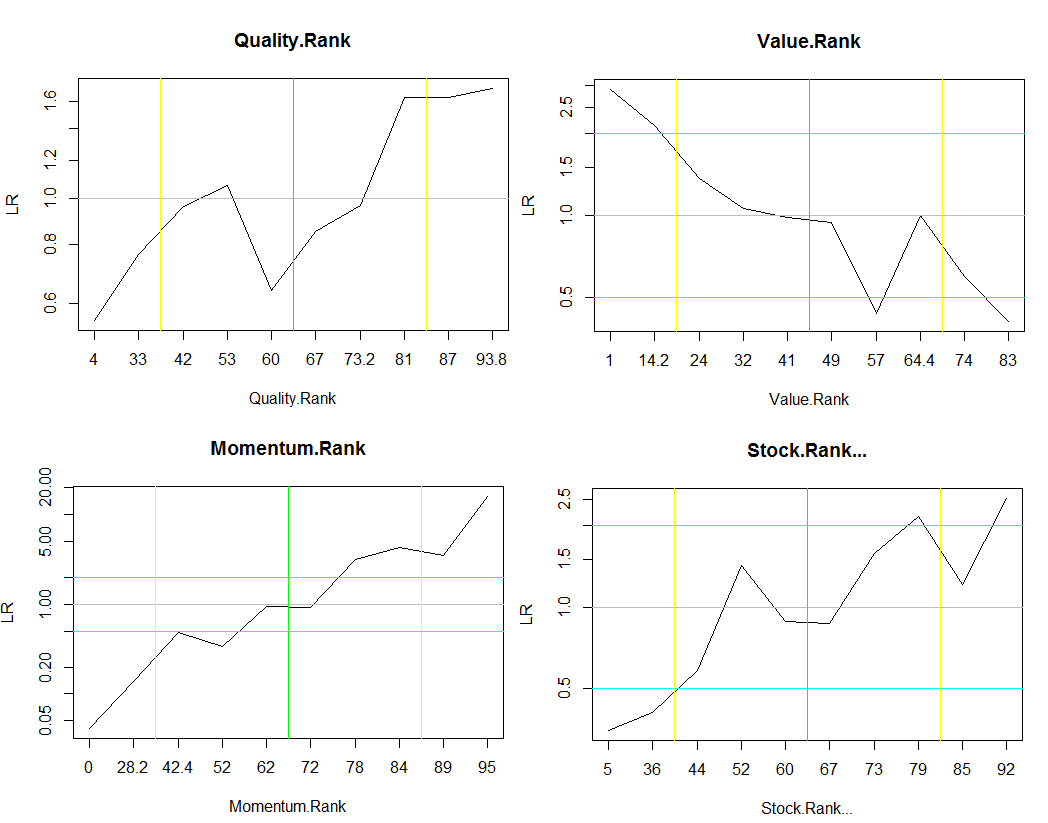

These plots show LR (Likelihood Ratio) against rank. Values of LR greater than 1 indicate a probability greater than 0.5 that the stock will have a positive return over one year. (The data is quite noisy and limited and so only rough trends can be taken from it.)

On the basis of this data, a screen which selects Q>=80, M>=80 but V<=20 seems to be more likely to select well-performing stocks than a screen which instead selects V>=80 and this seems to be my experience to date. You can see the selection using this screen QVM Screen and compare the stocks it chooses compared with its choices if V>=80.

Now clearly the philosophy behind why a high Value (i.e. "cheap" stock) should be desirable makes sense. But it does not seem to be borne out in practice. Stocks which the market "expects" to continue to perform well become more expensive, and therefore a low Value (expensive) rank can be a leading indicator of expected continued good performance.

But surely eventually even a good quality stock will become too expensive? Of course it does and perhaps you get in a local peak, but over a year the stock's growth will pick up the upward trend again.

If you understand Bayes Theorem and the ideas behind likelihood ratios, you will recognise that each separate metric (Quality, Value or Momentum rank, as well as all the other ratios) acts to confirm or reinforce the verdict of the others. So the best way to screen is to always AND together all the conditions (as the Stockopedia screener does) but to use multiple conditions which individually are not too strict.

So I would recommend that rather than choose stocks with the absolute highest Q and M and absolute lowest V value, it is better to stay around the >=80, <=20 mark, and if desired add more conditions (maybe based on yield, ROCE, Mkt Cap, sector diversification, etc) to refine the selection. (The more conditions you add the more you can widen the tolerance on any individual condition.)