Halloween may have passed this year, but there’s still fear in parts of the market of sudden shocks and blood curdling drawdowns. A long bull run for equities has left some wondering whether prices could be slashed if confidence were to suddenly disappear.

Last week I wrote about how the present conditions are in some ways reminiscent of the run up to the nightmare crash of 1987. But while it’s easy to get spooked by uncertainty, there are ways to feel your way through the market and find shares that may offer better protection from the unknown. The latest data on dividend payments from UK companies, for example, is one area where there are reasons to be optimistic.

On the hunt for income

Dividends appeal to different investors for different reasons. For some, they’re a welcome bonus but not the priority. Take, for example, Robbie Burns who is well known for his ‘Naked Trader’ approach to buying growth stocks, but who sees dividends as simply a good way of offsetting tradings costs.

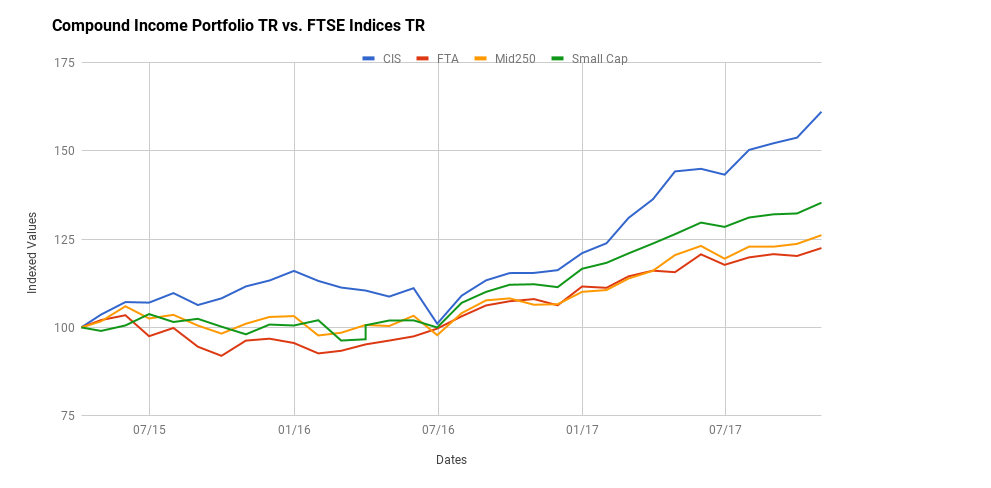

But more typically, dividend income is the hallmark of the classic ‘Owner’ persona, that Ed talked about in his article here. For this type of investor, dividends are a clear route to compounding wealth over long periods. While the exact strategies differ, and dividend folios can be built in various ways, the objective is generally the same - to find stable income.

Since the EU referendum in June 2016 - and the devaluation of the pound that followed - dividend payouts have been in an interesting phase. That’s because a big chunk of them are either made in dollars and euros or paid by companies that make large profits in those currencies. With the pound falling in value, those payouts were worth a lot more to UK investors.

But this exchange rate effect couldn’t last. The issue that was always coming was that after 12 months of supercharged growth caused by weak sterling, the effect would disappear. Year-on-year comparisons wouldn’t pick it up any more because the rates have been stable for so long. And that’s exactly what we’ve seen in the latest payout figures for the third quarter - exchange rates made hardly any difference.

The predictions were that dividends would drift as things started to normalise. But that didn’t happen, and dividend payouts actually broke records over the autumn.

…