How to Analyse Potential Multibaggers

This is our second series on Multibaggers, where you will learn about the qualitative factors that drove the top ten best performing stocks in the UK market over the last decade.

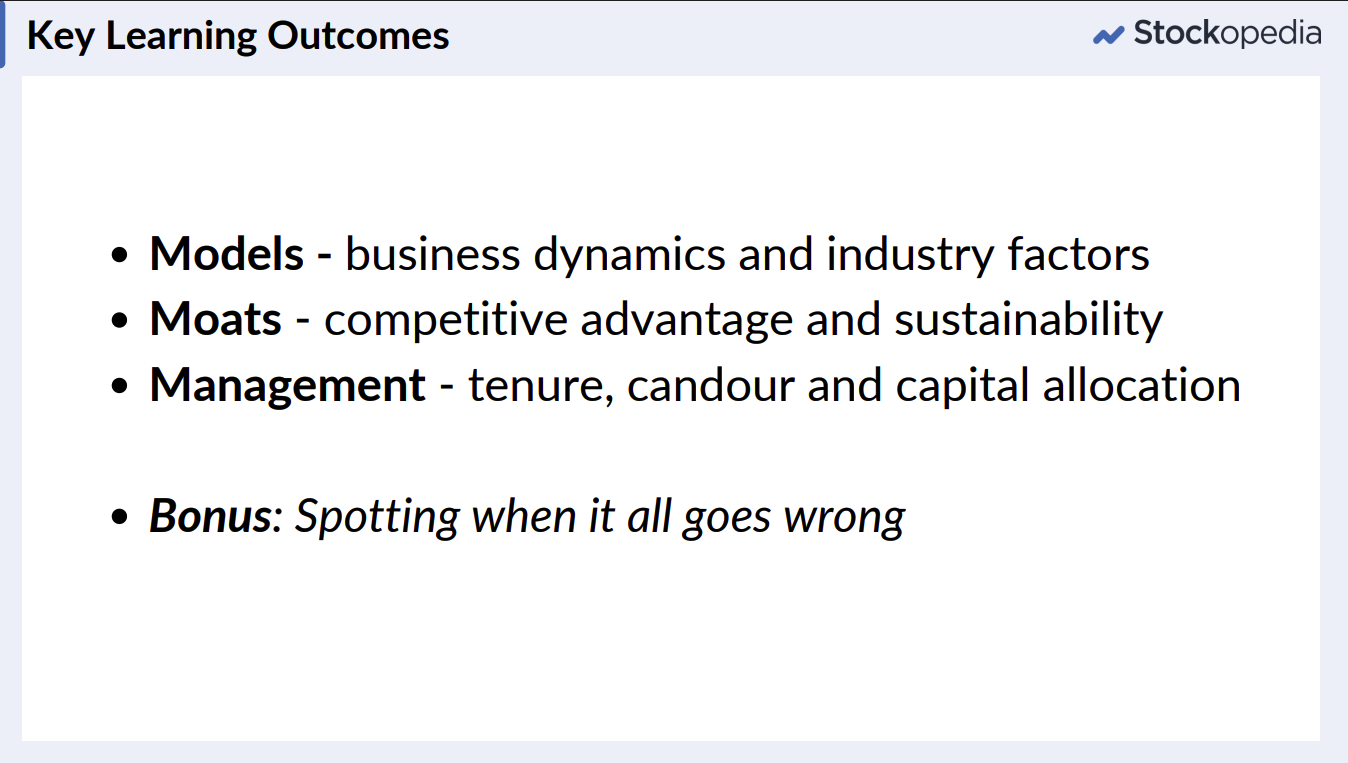

Working through this series, the key learning outcomes will be:

You will recognise the business models of multibaggers and their industry characteristics, as well as the factors that can extend their sales growth for many years.

You’ll learn the concept of moats, and the 7 ‘powers’ that businesses use to maintain competitive advantage and sustain the compounding of profits and share price gains.

You’ll learn about the qualities of good management: the tenure, candor and capital allocation skills required by management to drive multibagger businesses.

Finally, there is a bonus section on how it can all go wrong.

We have previously written an article series on the financial engines of a Multibagger, so we highly recommend you read this as well. The qualitative factors of companies are more discrete than 'screenable' financial data, but they are just as important to look out for when hunting the next multibagger.

This article will guide you through what to look for when assessing annual and interim reports, company announcements and presentations. Understanding the qualitative factors of a business will give you a greater understanding of a company's strategy, operations and management, as well as, where it potentially is going. There may be glaring issues that a screen just cannot see!

Completing this series will give you an understanding of how to judge any potential multibagger using qualitative analysis. You can either read through this article series, or watch our video below which covers the same material.