Good morning from Paul (now back in the UK after a wonderful trip to Washington DC - a fantastic place to visit, highly recommended!). Graham's having a well deserved holiday.

I've added some extra links below, at the bottom of the explanatory notes (that nobody ever reads lol!), as I noticed that there were several requests for those links. This way they're available in every report from now on.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

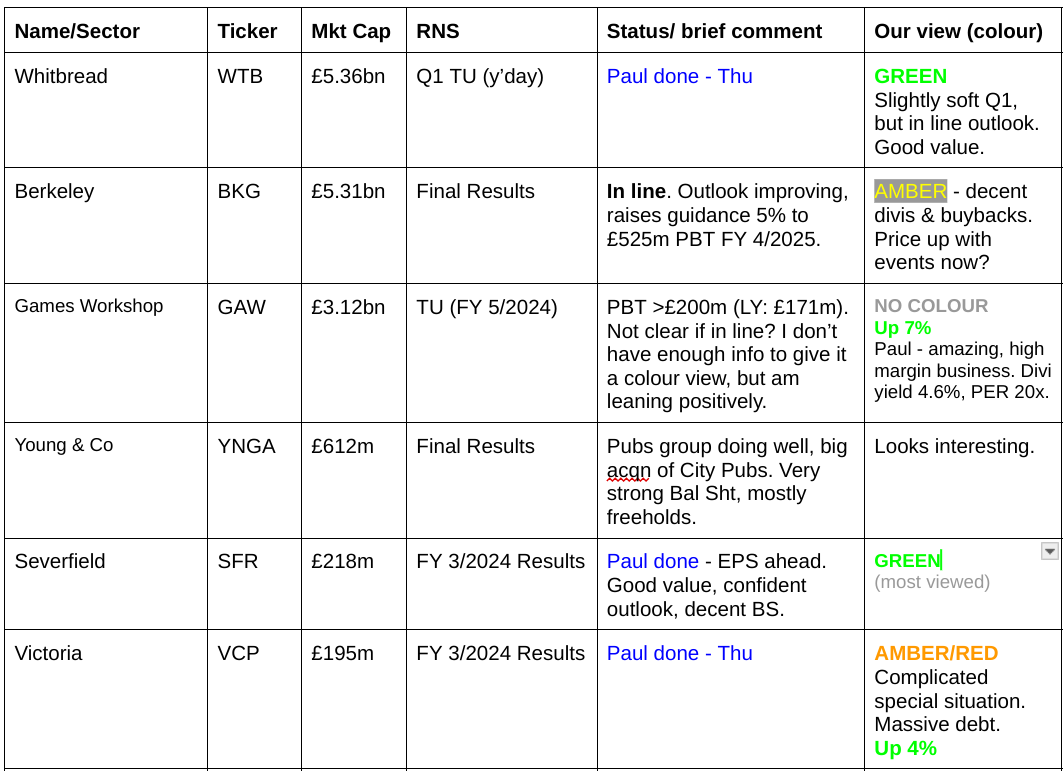

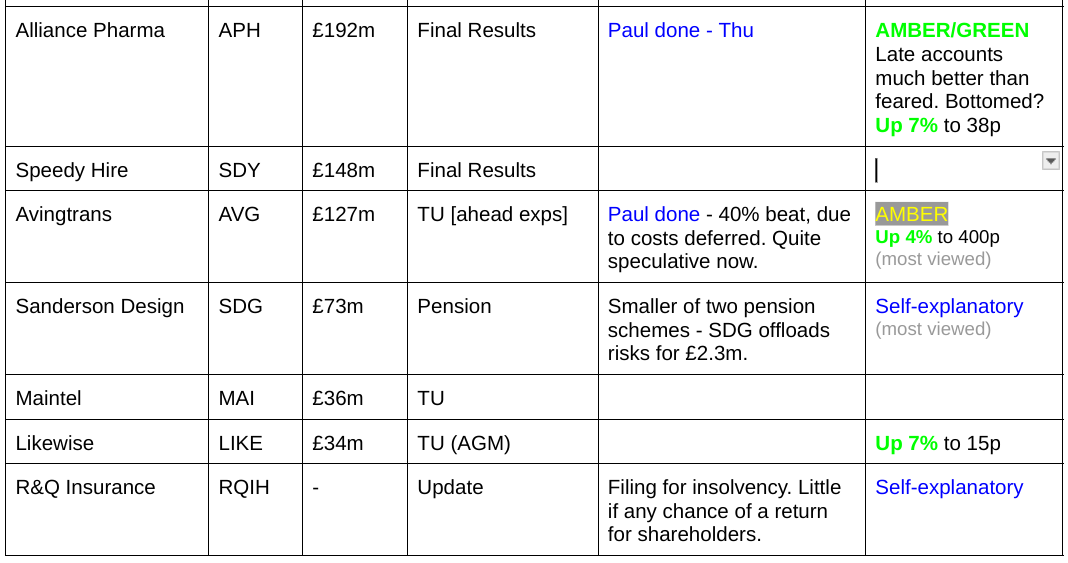

Companies Reporting

Other mid-morning movers (with news)

Alpha Financial Markets Consulting (LON:AFM) - up 21% to 475p (£541m) - Indicative Offer - Paul - PINK (takeover)

AFM is a specialist consulting/staffing company. It previously announced on 1/5/2024 that private equity giants Bridgepoint and Cinven were both considering making offers for AFM. This caused a vertical move up in share price, which had been withering away somewhat in May & June. Today we get another vertical move up to 475p, on fresh news that Bridgepoint has tabled an indicative bid (ie not yet a formal bid) as follows -

Type - indicative bid (not yet a formal proposal, but nearly there)

Bidder - Bridgepoint (private equity)

Price - 505p cash

Premium - 29% to last night’s close. 51% to the undisturbed price before 1/5/2024.

Recommended? - AFM says its independent Directors would unanimously recommend this bid if it becomes formal.

Status? - “advanced” stage of finalising discussions and documentation.

Shareholders support? - not known at this stage.

Paul’s view - this price looks fair to me. By my calculations the 505p bid is a PER of 21.9x forecast FY 3/2024 earnings, and 20.0x forecast FY 3/2025. That seems a decent exit valuation. There’s little in the way of tangible asset backing in AFM’s accounts. The bid is just above previous highs for AFM shares.

Overall AFM has been a successful investment for shareholders, floating in late 2017, with an exit now at about 3x the original price, plus a stream of divis received in between. It’s a pity to see another decent quality growth company leave the London market, but I can’t argue with the price being offered, which is 50% higher than the stock market was valuing it at before 1/5/2024 announcement of bid talks.

Summaries

Severfield (LON:SFR) - down 1% to 71.5p (£219m) - Results FY 3/2024 - Paul - GREEN

I'm surprised at how positively the FY 3/2024 results come across. I think there could be quite nice upside on this, which is looking a decent GARP share. The PER of 8 looks too low, and you get a c.5% yield, which is easily affordable, plus buybacks on top. Well worth considering, for value/GARP investors to research in more depth.

Avingtrans (LON:AVG) - Up 4% to 400p (£132m) - Trading Update FY 5/2024 [ahead exps] - Paul - AMBER

EBITDA guidance for FY 5/2024 is significantly raised (c.40%), but due to deferring some costs into next year. Despite this I'm perturbed by the strongly downward trend in forecast earnings, which makes AVG difficult to value. It's more speculative than I realised, with the valuation hinging considerably on the outcome for 2 new medical products in development. Might be suited to a sum of the parts type of valuation. Too difficult for me to assess, so I moved down to don't know, AMBER.

Paul’s Section:

Severfield (LON:SFR)

Down 1% to 71.5p (£219m) - Results FY 3/2024 - Paul - GREEN

Severfield plc, the market leading structural steel group, announces its results for the year ended 30 March 2024.

A strong headline, but so far (at 08:36) it hasn’t done anything for the share price -

Profits ahead of expectations, strong order books, further strategic progress in Europe

Revenue down, but profit measures up, so this is a case of margin improvement, which I find impressive given tough macro -

The 8.9p EPS is a PER of 8.0x at 71.5p/share.

Dividends are good, with a strong statement here -

Total dividend increased by 9% to 3.7p per share (2023: 3.4p per share), includes proposed final dividend of 2.3p per share (2023: 2.1p per share) - ten consecutive years of progressive dividends

That gives us a (now historic) yield of a healthy 5.2%.

Note also a £10m share buyback began in April 2024, which is about 5% of the market cap.

Graph 5 below shows that the dividend yield has been rising, and is a good reason to buy this share, alongside good trends in all the graphs - performance improving, but PER going down, is a good combination -

Order book - hasn’t changed much, and is c.1 years revenues - so decent visibility -

High-quality, diversified UK and Europe order book of £478m at 1 June 2024 (1 November 2023: £482m), includes higher proportion of European orders

Encouraging points above. The key line says -

“On track to deliver a result for 2025 which is in line with our expectations”

CEO comments are also positive, including -

“Looking ahead, we have strong order books in the UK, Europe and India which are providing us with good earnings visibility through 2025 and beyond. With market conditions showing signs of improvement and with our businesses well-placed in markets that are expected to benefit from positive long term growth trends, which are unlikely to be impacted by the result of the upcoming UK general election, we are confident in the outlook for the business."

A new note from Progressive shows a slight increase to 9.2p EPS for FY 3/2025. A combination of modestly set forecasts, an upbeat outlook commentary, improving macro, plus an acquisition, suggests to me there’s a good chance it might beat forecasts in FY 3/2025.

Balance sheet - looks healthy to me. NAV £221m, less intangible assets of £104m (mainly goodwill on previous acquisitions), gives NTAV of £117m. That’s just over half the market cap, so there’s reasonably good asset backing here.

Note there’s a small pension deficit of £11.5m. There’s little in net debt, at only £9.4m (excl leases). For a business that’s reporting adj EPS of nearly £37m, that bank debt is insignificant, and there’s scope to take on a little more, eg for acquisitions, in my view.

The Indian JV is accounted for like an associate, with its net assets shown as a single line on the balance sheet, of £37m. On the P&L, SFR’s share of the profits of £2m is shown as a single line. The Indian operation looks quite interesting actually, with good growth, and upbeat outlook. It has bought some land to expand, but note it seems highly geared, with half the operating profit being consumed in finance charges.

Overall, it gets a thumbs up from me for a healthy balance sheet.

Cashflow statement - healthy cash generation of £45m was mostly spent on capex of £11m, and acquisitions & investment in the JV totalling £25m.

Dividends and share buybacks total £14m, which arguably have been financed through increased debt (up by £11m). But that’s fine, as debt is negligible.

Overall, it looks a healthy, cash generative business to me, both this year and last.

Paul’s opinion - on a quick review, I’ve seen enough to be comfortable giving SFR a thumbs up, continuing Graham’s positive view last time, so we’re both GREEN.

Previously we’ve been worried about macro risks, but I don’t see that as a problem any more, given the positive outlook comments and slowly improving macro in the UK and elsewhere. India could grow into a decent part of the business too.

You get this for a PER of 8x, and whilst you wait you’ll get paid a dividend yield of just over 5%. Plus it’s buying back shares too, thus enhancing EPS and the yield. I like buybacks in situations like this - when the shares are cheap, and the balance sheet robust enough to make it easily affordable.

This share probably won’t be a multibagger, but I think it’s a good business, with a decent operating margin, at a very reasonable price. Yes, I’m keen on this share actually, it ticks all my value investor boxes, and it could be seen as a GARP share. There should be decent long-term upside, and maybe even a short-medium term profit of say 25% if it re-rates from a PER of 8 to something more appropriate of 10. Even that would still be quite cheap. So I reckon with a bit of patience, and providing nothing goes wrong, you could see 100p+ out of this share.

Avingtrans (LON:AVG)

Up 4% to 400p (£132m) - Trading Update FY 5/2024 [ahead exps] - Paul - AMBER

Avingtrans PLC (AIM: AVG), which designs, manufactures and supplies critical components, modules, systems and associated services to the energy, medical and industrial sectors, announces a positive trading update in respect of the financial year ended 31 May 2024.

I’ve loosely followed Avingtrans for many years, and my impression is that management are active in buying & selling companies, trying to add value in between. Management seem highly regarded.

Shares have done well over the last 20 years, as you can see below, tending to do good bull runs, then trade sideways for several years after each one -

We’re due a fresh look, as last time I reviewed it here was 13/7/2023, on an in line trading update for FY 5/2023, and news of an acquisition, strong order book and confident outlook. I concluded that it wasn’t a bargain at 425p, but a high valuation was justified given the decent long-term track record. Almost a year later, the share price is about 6% lower at 400p. The published spread looks wide, 390/410p, although as I’m sure you know, the actual trades are usually within the quoted spread, but it’s fairly thinly traded most days, hence more a share to buy & hold, rather than trade in & out of.

Today it says for FY 5/2024 -

Revenue in line exps (no figure given).

EBITDA - note that this is not a reliable profit measure, being way higher than adj PBT -

“Adjusted EBITDA from continuing operations is materially ahead of market expectations* and is expected to be in the range of £13-14m

*Prior to today's announcement, the Company understands that market expectations were: Adjusted EBITDA of £10.0m and Net Debt (exc. IFRS 16) of £7.1m”

That’s a 30-40% beat at EBITDA level. Shares have not reacted much to this beat, perhaps because some (not stated how much) costs have just been deferred into the following year, which is obviously not a very good reason for beating profit expectations.

Net debt is £1m below expectations, at £6.1m, which is neither here nor there really.

Engineering division commentary sounds positive, with acquisitions doing well.

Imaging division - mixed comments, including FDA delay and slower sales build up for new products. This bit has interesting positive read-across for cybersecurity companies -

“the increased cyber security scrutiny required by the FDA in the USA has required additional time and effort.”

Outlook - vague, but says they’re confident.

The trouble is, deferring costs from FY 5/2024 into FY 5/2025 flatters the results for FY 5/2024, but now means a growth headwind trying to beat those increased profits in FY 5/2025.

Broker updates - thanks to both Cavendish and Singer for putting out helpful updates today. Looking at Cavendish, it raised adj EBITDA to nearly the top of the new guided range, at £13.9m. This becomes a lot lower figure, adj PBT of £7.0m, well below the last 3 years’ despite a big forecast increase today. That’s forecast to halve to only £3.5m adj PBT next year, FY 5/2025, making the £132m mkt cap look considerably stretched on a conventional valuation basis.

In EPS terms, we have 15.4p almost actual for FY 5/2024, and only 6.0p forecast for FY 5/2025. Hence at 400p the share price is showing a sky-high PER, and on earnings trending significantly downwards. So bulls have to be very comfortable that these forecasts are significantly too cautious, otherwise you’re heading for trouble.

Reading through more of the commentary, this share seems to mainly hinge on new product launches, so it’s a lot more speculative than I previously thought. Forming an informed view on the prospects for new products looks to be the key thing to research further here.

Balance sheet - I’ve had a quick look at the last reported balance sheet at 30 Nov 2023, and it looks strong. My only reservation is that receivables seem much too high, so I suggest that needs to be part of your deeper research to find out why. If anyone already knows why, please do leave a comment below.

Paul’s opinion - this share is more speculative than I realised. I think the best way to value it would be on a sum of the parts basis, assessing each subsidiary as a separate entity, as it sounds like there could be parts of the business that are profitable, and other bits that are not, or are spending a lot on development projects anyway. If those work, they could be valuable, but it’s beyond the scope of these reports to delve into the new products and try to assess (or rather guess) how they might work out.

Overall then, I’m moving down from green to AMBER, as I don’t like the way profitability is set to drop sharply according to broker forecasts, and I have no way of knowing if the new products will be good or not. Maybe it’s best to see AVG as a combination of some existing profitable companies, with some blue sky stuff added on, and value those two parts of the group separately, rather than on a PER basis for the combination? Cavendish flags its MRI and 3D X-ray new products as having potential upside, if they sell well.

It doesn’t interest me at this stage, but good luck to holders. Management have done a good job in the past, so that’s always a good starting point.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.