Good morning! I'm back after a week's holiday, bright-tailed and bushy-eyed! It was my first week off since starting this column in 2012, so it felt strange not having to compose my thoughts every morning and type them out into an article. It's good to be back though, so here goes.

Plus500 (LON:PLUS)

If you thought there was an odd smell in the air this morning, you've probably detected the smell of burning bears! Yes the shorters have taken a spanking on this controversial CFD provider (CFDs are a leveraged way to buy shares, a bit like spread bets, but taxable), since very surprisingly a bidder has appeared.

400p cash takeover bid - Playtech is the bidder, and they are paying 400p per share, all in cash. The deal is expected to complete by the end of Sep 2015, subject to a shareholder vote, and regulatory approval.

PLUS shares are currently 385p in the market, so there's a potential 15p profit to be had, 3.9%, by holding the shares for four months. However, set against that is the risk of the deal falling through (e.g. if Playtech find more skeletons in the cupboard), so if I still held, I'd have gratefully taken the 385p that is currently on offer, in order to have certainty.

Sadly, I sold my shares for about 302p last week, as various comments made at the AGM sounded disingenuous to me. Pity, but never mind.

This has been a fascinating share to follow - and a good example of how bear raids are carried out. Bears (shorters) are generally shrewd and experienced investors, so they find companies with some sort of serious weaknesses, open short positions, then shout from the rooftop about all the things that are wrong with the share.

The latest method of doing this is by posting a dossier of allegations and revelations online. An individual calling himself Gotham City did this last year, with a devastating dossier revealing the many shortcomings at Quindell. He wiped £1bn off its market cap in one day, and the shares never recovered to anything like their previous highs of over 600p.

In the case of PLUS500, the usual suspects (UK bloggers such as Evil Knievil) posted alarmist comments about the company. I think there was a grain of truth in some of the comments, although they seemed to be wildly exaggerating the downside case, and wrongly suggesting that the company was an elaborate fraud/hoax.

An outfit called Cable Car released a damaging dossier, although when I ploughed through the detail, there was virtually nothing of any substance in it, so personally I carried on buying stock in the market right the way from over 500p down to 200p, and ended up getting most of my money back - it would have been a profit if I'd stayed in bed last week, instead of getting up and fretting about the stock market!

This brings up some interesting issues. Namely that bear raids are designed to create maximum panic, so as in this case, the time of maximum panic, when the shares went into freefall to 200p, was actually the best time to buy. It also confirms my view that stop losses are best avoided. If you've done your research properly, then a deep drop is actually a buying opportunity, not a time to sell. Having said that, stop losses are beneficial when your research later turns out to have been wrong! All investors get some investments wrong, it's unavoidable.

I maintained a civilised discussion with bears (by email) throughout this PLUS500 bear raid. Even though I was long, I think it's essential to listen to, and think about, the opposite point of view. IF you can pull apart the bear case fairly easily, as was the case here, then that gives you more conviction to continue being long, and even add to the position.

Although fighting bears is often very dangerous - they tend to be more right than wrong, in my experience. They choose their targets carefully, and based on there being something badly wrong with the company. One of Gotham City's targets, a Spanish telecoms company called Gowex, admitted that the company was an elaborate fraud, shortly after Gotham published its dossier, so Gotham's reputation is understandably high. Although I think Gotham's Tweets have been poor of late - clearly designed to create panic amongst longs, rather than informing people of facts.

All fascinating stuff. So generally if a stock is being widely shorted (the information is available on a spreadsheet on the FCA's website) then be aware that you're in dangerous territory - so I would say it's best to either use a stop loss (to mitigate losses if an online dossier against the share is published), or if you don't use a stop loss then be prepared for a big potential % loss.

What I did with PLUS, was to buy in small tranches, prepared for losses, as it's impossible to time the exact low point. With hindsight, I started buying far too early, but since I was only buying in smallish chunks, this left me plenty of firepower to continue buying the lower it went, and in the end I bought 9 times at lower & lower prices, with the last two being close to the bottom.

So although it's a risky strategy sometimes, if you're sure there is value in a share, then averaging down can be a very successful strategy. If you're wrong though, then it can be a ruinous strategy! My biggest investing successes and failures have been where I averaged down heavily.

Position sizing is everything in my view. It's a balance between making sure you make a decent gain on your best investing ideas, whilst protecting yourself against losses if you've got it wrong. I always try to work out what the worst case scenario is with a company - e.g. a 30-50% loss on a bad profit warning. Then I calculate how much in £ I would lose. If that figure scares me, then I cut the position size back until the worst case scenario would be unpleasant, but not disastrous.

Overall, with PLUS500, I think the bears can claim a partial victory, in that they correctly identified there was something badly wrong with the company (it ran into serious regulatory problems in the UK market, half its total business). However, bulls can also point to the fact that the bear case was exaggerated, and a bidder has come along who is prepared to pay 400p. So the sell off to 200p was overdone, and turned out to be a great buying opportunity.

All good fun!

For me, dividends are the key. In my experience, companies which throw off large amounts of cash, and have a track record of say two years' generous & growing dividends, are not likely to be frauds. Fraudsters usually don't like paying out anything in dividends. Or if they do. it will tend to be designed to pump up the share price, and when that fails, the dividends soon stop - as has happened with several dodgy Chinese companies on AIM.

PLUS however, threw off lots of cash, and paid generous divis. I never liked the company, as the profits looked too good to be true, so there was a big question mark over the sustainability of the profits. It now looks as if that question mark was valid - in that perhaps the company played fast & loose with the regulatory side of things? However, the profits do appear to have been real.

Playtech seem to like it anyway, although as mentioned above, I think there must be above average risk of this deal falling through, so personally I would take the money and run, and let someone else carry the deal risk in return for the last 3.9% profit.

Also, it has to be reinforced that this is YET ANOTHER overseas company listed on AIM, where something turned out to be wrong. So my golden rule on never buying overseas companies listed on AIM needs to be stressed over & over again. Even I broke my own golden rule in this case, bottom-fishing on the fall, which was a mistake, although it turned out alright in the end.

Tribal (LON:TRB)

Share price: 153p

No. shares: 94.8m

Market Cap: £145.0m

Contract win - I don't normally comment on contract wins unless they are material to the company's results. In this case it's a contract win of "at least 6m NZD". The exchange rate is currently £1 = 2.14 NZD, so that works out at £2.8m.

Broker forecast is currently for £11.9m net profit this year, which is equivalent to 12.8p EPS. Therefore whether this contract win is material or not, depends on how much of that £2.8m is licence revenue (effectively 100% profit), and how much is for other services.

I last reported on Tribal (a provider of software & services for educational establishments such as Universities) here on 15 May 2015, when it issued a mild profit warning, causing the shares to dip to 139p. Market confidence has strengthened somewhat since then, with the shares now at 153p.

My opinion - this one is not for me, as I don't like the weak balance sheet, with negative net tangible assets, and a little more debt than I am comfortable with.

However, with the reassurance of a contract win today, and a chart which looks as if it's bottomed out for the time being, it might be worth a look. The divi yield is poor at only 1.4%, and note that the AGM statement indicated 2015 would be an H2-weighted year - suggesting that interims may look disappointing when they are released.

The shares have under-performed the FTSE Small Caps Index quite badly in the last two years, and the StockRank is very low, at 26. However, making money from the markets is all about buying low, and selling high (in my opinion), so if the company's performance is now improving, then this could possibly be a good entry point? Overall I'm leaning towards a possible purchase at 153p, but probably don't have enough conviction to go ahead with it - especially as we're now entering the traditionally slower summer months, when small caps can become much more illiquid, and hence vulnerable to sudden sell-offs. Hence why I'm not really looking to open any new positions at the moment unless I find a massive bargain.

Molins (LON:MLIN)

Share price: 89p

No. shares: 20.2m

Market Cap: £18.0m

Disposal - this is an interesting announcement. It looks as if Molins (a maker of machinery for the tobacco industry) has disposed of a problem subsidiary, its US-based company called Arista Laboratories Inc, to a buyer called Enthalpy Analytical Inc, for £0.3m, received in cash. Molins has also agreed to pay Enthalpy £0.4m in monthly instalments over the next 18 months, to subsidise an onerous lease. Therefore netting the two off, Molins has basically given away this subsidiary, along with a dowry of £0.1m.

These numbers are not of interest, but what is, is that Arista made an operating loss of £2.0m in 2014, which is clearly very negative for Molins as a group. So eliminating a heavily loss-making part of the group, is clearly a significant positive for Molins overall.

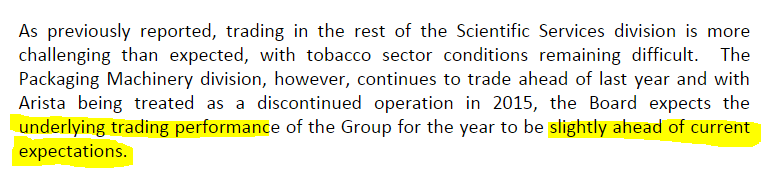

Trading update - There is then a trading update in the final paragraph of today's announcement, which starts off sounding like a profit warning, but is actually a modest profit improvement;

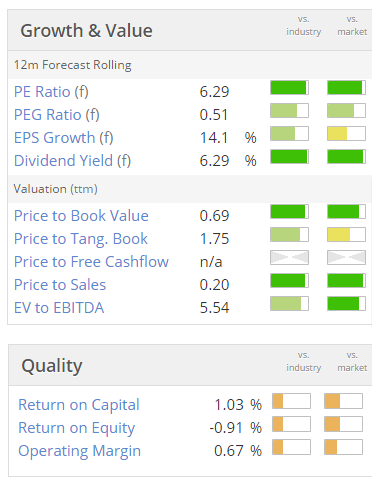

Valuation - as you can see from the usual Stockopedia graphics below, Molins looks strikingly good value on a PER and divi yield basis;

Pension deficit - the elephant in the room is the pension fund deficit. This is consuming a lot of the company's cashflow, and dividend increases are linked to overpayments into the fund - so this is an essential are to research properly before diving into an apparently cheap share - it could turn out to be a value trap.

My opinion - Ethical considerations also come into play here. Do I really want to own shares in a company which makes tobacco machinery? In a word, no. However, if you are untroubled by such concerns, then this share is starting to look potentially interesting in my opinion, now that a loss-making subsidiary has been jettisoned, and current trading is looking up, then potentially this could be a good time to buy? Although don't forget to properly research the position with the pension deficit!

GB (LON:GBG)

Share price: 205p

No. shares: 120.7m

Market Cap: £247.4m

Results for y/e 31 Mar 2015 - these figures look good. The company reports 15% organic turnover growth, which is boosted by acquisition(s) made in the year, to give total revenue growth of 37% to £57.3m.

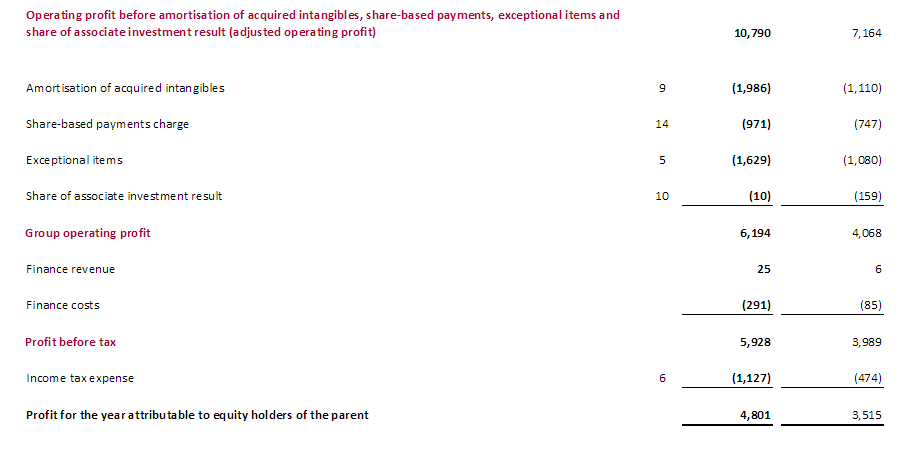

Profitability is a little more complicated. Reported profit (i.e. on the face of the P&L) comes in at £5.9m at the pre-tax level (up from £3.0m last year).

However, the company makes a lot of adjustments to the reported profit figure, so at the adjusted level, they reverse out a lot of costs which are deemed to be non-underlying, and have managed to get the profit figure up to £10.8m this year (compared with £7.2m last year).

Note the large gap of about £4-5m each year, between adjusted, and reported profits. That makes me uncomfortable, so one really needs to dig into the detail to see what the reconciling items are. Here is the relevant excerpt from the RNS today;

Taking each item in turn from the above;

Amortisation of acquired intangibles - I've looked into this, and it's a book entry relating to acquisitions, so I'm happy to disregard this item.

Share based payments charge - as I always say, this is just a form of remuneration to employees & Directors, therefore it is completely wrong (in my opinion) to disregard it.

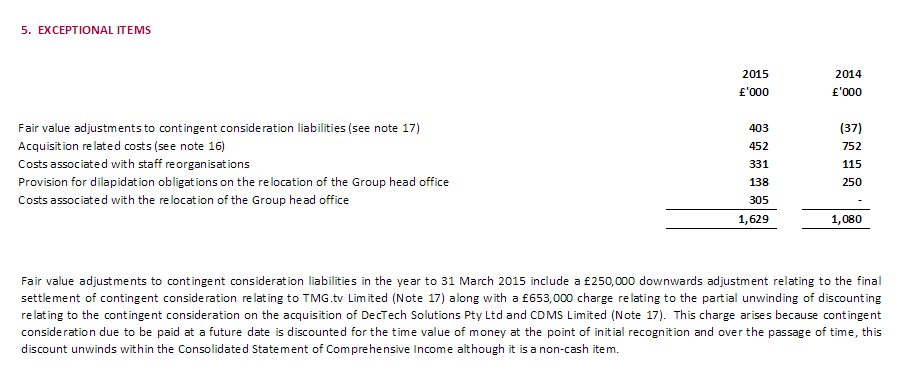

Exceptional items - what concerns me here is that the figures are material in both years. That makes me wonder whether exceptional items really are exceptional? More detail is given in note 5;

Why do they have to use such a small font?! Legibility guys! Not all investors have perfect eyesight, in fact since most of us are over-40s, then it's safe to say most of us would appreciate a little help from GB Group using a bigger font size next time.

Since four out of five of these one-off items occurred in both years, then I'm leaning towards adding back in the exceptional costs, in terms of the profit figure I use to value the company. It's always sensible to be prudent anyway, since you're building in a little extra safety margin that way.

Valuation - the company focuses on 8.8p adjusted EPS, whilst after all costs, the basic EPS figure is much lower, at 4.0p (or 3.9p after taking into account dilution from share options).

My own back of the envelope calculations come to a figure of 5.3p EPS which I would be happy to value the company on - which I've calculated as ignoring the amortisation charge, but including the exceptional items (which are not really exceptional in my view, and there will always be something in this category every year), and share-based payments.

So I might be prepared to value it on a PER of about 15, so that gets me to a theoretical valuation of 79.5p. The actual share price is 205p, so for me this share is prohibitively expensive.

Growth - clearly this is a fashionable share, and the market is prepared to pay up for growth. In the operational highlights, some interesting-sounding contract wins are noted;

Outlook - the Directorspeak is confident;

There is another outlook section too, which makes similarly positive noises, and refers to a "robust pipeline".

My opinion - I'm wary of highly rated companies growing by acquisition, as it's a bit of a conjuring trick in accounting terms - i.e. it creates the illusion of faster growth, and the acquired companies are often bought at low prices, then valued more highly once bolted on to an existing group. Synergies very rarely live up to what management expect.

This company would have to grow its profits considerably to make the current valuation stack up, so investors are being asked to pay up-front for several years' future growth. People have to make up their own minds whether that is a reasonable request or not! We're in a bull market, so it might keep going up, who knows? For me though, the valuation is way too high.

All done for today, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.