Good morning from Paul!

That's it for today, sorry my brain now needs a rest!

I caught up with my backlog of updates for my SCVR summary spreadsheet last night, it's now fully up-to-date. I'm pleased to say we've reported on 537 unique companies here so far in calendar 2024. That rises to almost 650 on a rolling 12-month basis, so really extensive coverage, and I'm always pushing harder to do more!

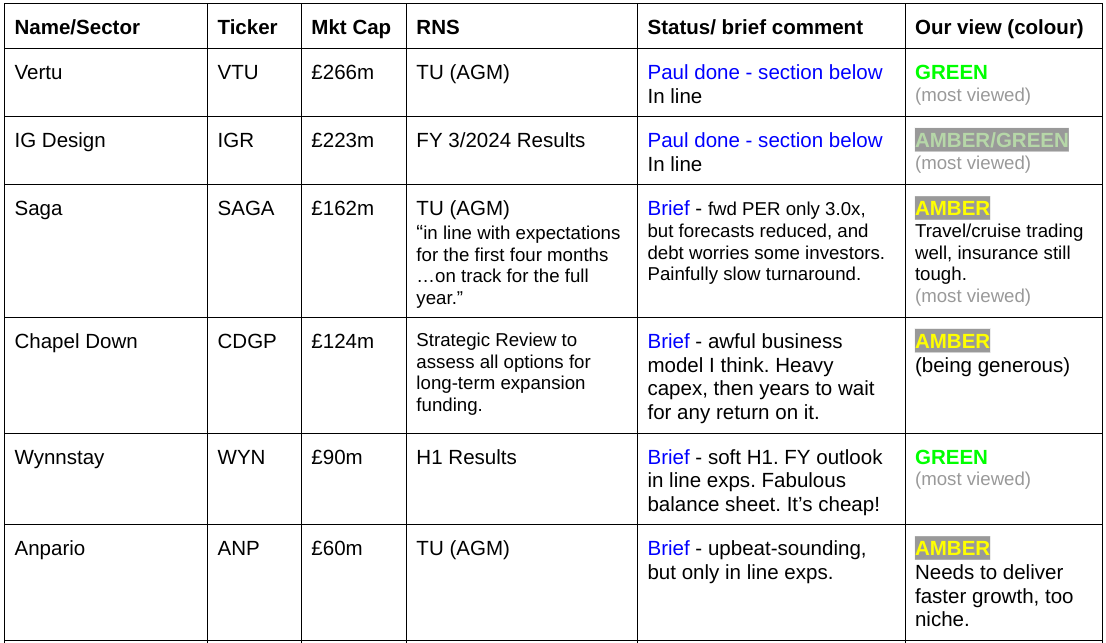

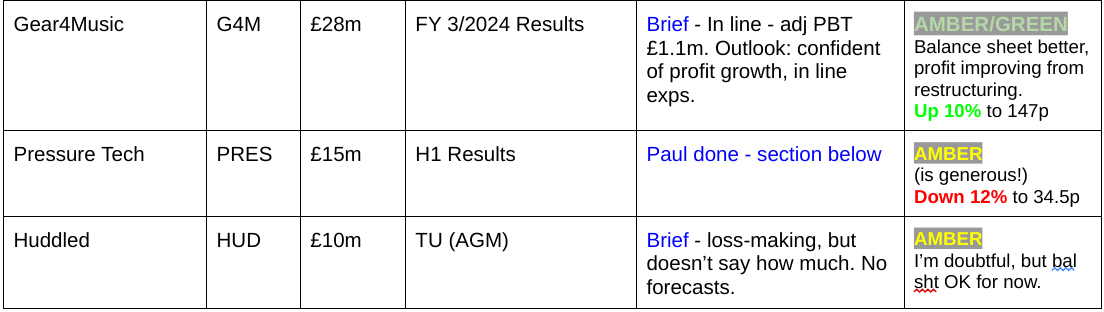

Here's a screenshot below, for about the last 6 weeks. It's notable how much takeover activity there is (I colour-code takeover approaches in PINK and put them on the left). Also not many profit warnings (in black), other than a recent flurry of five of them. Remember that on the Google Sheet you can hover over any cell and a pop up box appears giving a short summary of the SCVR comment on that company on that day. It's a very useful quick reference tool, to quickly get up to speed on any share we cover here, using CTRL+F and ticker.

[Note that for the colour-challenged, I now arrange the companies in a left to right, good to bad format. Also if you open the spreadsheet, hovering over each item shows text which includes the colour as a word. I hope that makes it accessible to almost everyone].

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

A manageable workload today, so I'm hoping (not promising!) to catch up on CMCX too - sorry, too tired now, so that will have to wait.

I'm taking my lead from the "most viewed" widget on the home page, so am planning on writing up sections in this order -

Other mid-morning movers (with news)

Funding Circle Holdings (LON:FCH) - up 10% to 93.4p (£327m) - The newswire says -

British small- and mid-sized enterprises lender agrees to sell its U.S. business for 33 mln pounds ($41.9 mln).

Confusingly it also says -

“The US business contributed losses of £(23)m to the overall Group in 2023, although reported a statutory profit before tax of £7m for the year ended 31 December 2023.”

Says UK ops on track to attain profitability in H2

“The UK business is on track to be profitable in H2, in line with our guidance. Over the medium term we expect net income growth of 15-20% CAGR with PBT margins of >15%.”

If those targets are hit, it would be a massive turnaround from heavily loss-making historical numbers. How credible is a >15% PBT margin?

Readers are discussing this in the comments below, noting that shrewd investors Harwood seem to like it.

Checking through the RNSs this year, its stated strategy is to focus on profitable UK business. It’s doing share buybacks almost every day (£25m total). Interesting balance sheet, with large amounts of net cash.

Paul’s view - it’s a special situation, so needs properly thorough research, but on a quick skim, I can see that this might be interesting to research in more detail, due to the big cash pile, disposing of the loss-making US business, and an indication that the UK business will be moving into profit shortly. So potentially worth you taking a closer look! Let me know what you think.

SIMEC Atlantis Energy (LON:SAE) - up a remarkable +107% to 2.2p (£15m) on publication of (quite late) FY 12/2023 results. A large profit has come entirely from upward revaluation of one of its renewable energy projects. Full accounts reveal accumulated losses of £190m, and a lot more debt (c.£50m) than is revealed in the shorter version issued on the RNS. Care needed here, it looks a special situation that needs thorough research. See reader comments below here.

Orchard Funding (LON:ORCH) - up 14% to 32p (£7m) - initial spike up to 36p this morning has moderated to 32p. Trading update today says;

“management now expect that earnings will exceed current market guidance by over 20%.”

That sounds good, but bear in mind this specialist financing company has a chequered history with various mishaps and a key RNS on 17/5/2024 stated that it intends to de-list because the costs & hassle outweigh the benefits. Shares trade at only a third of NTAV. It also stated in May that dividends would be stopped, so ignore the supposed 11% yield. Very unsatisfactory, looks like the majority shareholder wants to take it private on the cheap. There might be a tender offer, but not stated on what terms. Personally I’m steering clear, as there’s too much uncertainty, and a controlling shareholder at 54% can do whatever he wants.

Summaries

Vertu Motors (LON:VTU) - 79p (pre market) £265m - Trading Update (AGM) [in line] - Paul - GREEN

A reassuring update, in line with expectations so far in FY 2/2025, and for the full year outlook. Valuation remains reasonable, and the tangible asset backing (loads of freehold property) is a stand-out positive, that protects downside risk for investors. Takeover bid the likely outcome, but nothing so far.

IG Design (LON:IGR) - down 2% to 225p (£218m) - FY 3/2024 Results - Paul - AMBER/GREEN

Smashing figures, as expected as its turnaround gathers pace. Further margin improvement is anticipated, although I think the big rise in share price has now factored in a fair bit of the upside, so it might be more tricky for the bull run to continue, at least in the short term maybe? Super balance sheet with plenty of net cash. I'm shifting down from green to AMBER/GREEN, to reflect the very strong share price rise, so it's not as obviously undervalued now, as it was last year.

Pressure Technologies (LON:PRES) - down 13% to 34p (£13m) - Interim Results - Paul - AMBER

Underwhelming H1 results and outlook. Fund managers are trying to engineer a turnaround & restructuring, but it looks hard going. Balance sheet needs more liquidity I think. Risk:reward just doesn't appeal to me, as there's too much guesswork. Also I'm puzzled as to why they want to sell off the division that's performing better, and keep the problem bit?

Paul’s Section:

Vertu Motors (LON:VTU)

79p (pre market) £265m - Trading Update (AGM) [in line] - Paul - GREEN

Vertu Motors, a leading UK automotive retailer with a network of 189 sales and aftersales outlets, is pleased to announce the following update with regards to the three-month period to 31 May 2024 (the "Period"). The Board anticipates that full year results for FY25 will be in line with current market expectations.

I won’t regurgitate all the detail, see the RNS for that.

This bit below caught my eye, and is an interesting point, as it becomes increasingly clear that a lot of the public do not want electric vehicles (EVs), and the interesting unintended consequences that could boost used values of conventional cars maybe -

“The Board has been encouraged by the trading results for the Period. The Zero Emission Mandate to force the uptake of zero emission vehicles sold in the UK has the potential to create volatility in the new car market. This may include reduced supply of new petrol and diesel cars in the coming periods and would lead to a strengthening of petrol and diesel used car values.”

Aftersales (servicing and warranty repairs) stands out as the area management sound most upbeat about, eg -

“The Group's high margin aftersales businesses have strong growth potential due to additional resource levels and Group strategies around customer retention and increased average invoice value per customer.”

More acquisitions on the way, I wonder? -

“A number of growth opportunities are being evaluated against the Group's capital allocation metrics. The franchised retail market remains very fragmented with the Group representing around 5% of the sector.”

Stocking loans - are not mentioned in today’s update, but I always flag this point when talking about car dealers. Higher interest rates means everyone in the sector is now paying much more in finance costs, to fund their inventories through stocking loans. Eg this table below comes from VTU’s FY 2/2024 results, illustrating the point, with finance costs having more than doubled -

Paul’s opinion - this is a reassuring update. I’m amazed that nobody has bid for VTU, as so many others in the sector have been taken over. Investors have the added reassurance of a very strong balance sheet at VTU, it’s a property company as well as a car dealers, which should mean this share is strongly underpinned.

Management seem good, and on top of the detail, which is essential in a low margin, competitive sector. Although as with any company, none of us really know what's going on behind the scenes.

You can see from the graphs below how the pandemic distorted trading, but it looks as if we might now be back at a steady state where EPS is almost double pre-pandemic.

I can’t decide whether to stick with amber/green from last time, or just go with green? I think given the balance sheet strength, and a reassuring update today, combined with a fairly modest valuation and takeover bid potential, it should probably be GREEN.

Attractive valuation scores below, but this sector tends not to achieve valuations above a PER of c.10x most of the time -

Share price over 5 years has been resilient, given that 2021-23 in particular was a nasty bear market for small caps -

IG Design (LON:IGR)

Down 2% to 225p (£218m) - FY 3/2024 Results - Paul - AMBER/GREEN

IG Design Group plc, one of the world's leading designers, innovators and manufacturers across various celebration and creative categories announces its audited results for the year ended 31 March 2024.

Second successful year in the three-year turnaround journey, with improving operational efficiency and simplification of the business

Impressive adj profit growth, although note the adjustments to EPS seem very large, I’ll look into that - OK it’s due to a large taxation credit, so we need to adjust that out and hence ignore the 36.6c statutory EPS figure, since the 16.3c adj EPS is more realistic on a normalised tax charge -

Dividing the 16.3c by 1.27, to get from US dollars to sterling, gives 12.8p, so at 225p the PER is 17.6x, which looks up with events. Maybe that’s why the share price has slipped slightly so far this morning on a bit of profit-taking by the looks of it. Although not much volume has been printed so far today, only about £600k-worth of shares traded (plus whatever orders are being worked in the background - larger trades get printed later, with a delay).

Margin improvement is what the strategy is all about, and it’s working. Although this operating margin is still very low, and I imagine things like wrapping paper are never going to achieve good profit margins. Also as we’ve seen in the past with IGR, it doesn’t take much to go wrong (eg delays & costs in the supply chain) to cause havoc & ruin profitability - since seasonal products are worthless if they’re not delivered to customers well in advance of say Christmas, Easter, etc. So it’s not a very good business model in my opinion, so I would never pay a high PER for this share.

“Adjusted operating profit margin rose to 3.9%, up 210 bps on prior year”

Outlook - if IGR achieves the step up in operating margin set out here to 4.5%, then 6%, then I think this bull run in the shares could continue -

Crunching the numbers, for FY 3/2024 IGR achieved a 3.9% operating margin at $31m.

It’s guiding 4.5% for this year, FY 3/2025, so that would raise operating profit from $31m to $36m (assuming unchanged revenues).

The medium term guidance of $900m revenues and operating margin of at least 6% would be $54m adj operating profit, up 74% on FY 3/2024 actual - pretty good.

In EPS terms, I calculate it like this - $54m adj operating profit target, less say $5m finance charges = $49m adj PBT. Take off 25% corporation tax = $36.8m PAT target. Divide by 97m shares = 37.9 cents, divide by 1.27 = 29.8p. Put that on a PER of say 10-15, gives me a future share price target (if things go well, and targets are achieved) of 298p - 447p. That compares with a current share price of 225p. Hence I get an upside case of 32% to 99% over a two year period. Not bad, but I would want to discount that upside, to allow for any mishaps. There’s no guarantee it will get to 6% operating margin, as it’s struggled in the past to get to, let alone exceed, 5%.

Finance costs are below the operating profit line. Here, finance costs were $5.2m, fairly significant, as it has to use bank facilities to finance peak working capital periods.

Balance sheet - the considerable balance sheet strength, combined with the good chance of a trading turnaround, is why I chose IGR for my 2024 top 20 shares ideas list. IGR only uses bank debt at seasonal working capital peaks, and the year end 3/2024 position was a tremendous $95m net cash.

NAV was $369m at 3/2024, less intangible assets of $75m, gives a healthy NTAV of $294m.

Overall, I'm very happy with the balance sheet, and I reckon dilution or insolvency risks are very low.

Dividends - none declared. I think dividends could be reinstated, as IGR has the financial capacity to resume divis.

Sure enough, Canaccord is forecasting divis resuming this new year FY 3/2025, with 5p, rising to 10p by 3/2027.

That’s an OK yield nothing special, at 2.2% rising to 4.4%.

Cashflow statement - looks great at first sight, but remember there are hefty lease payments further down. The $43m increase in the cash pile has almost all come from a favourable reduction in inventories of $40m. That’s a one-off, and could even reverse a bit if revenues start rising again.

So I’m putting a question mark over cash generation, which doesn’t actually look as good as I was expecting.

Going concern statement is clean, as I would expect given the balance sheet strength.

Paul’s opinion - this is a good turnaround, and that’s been reflected in an excellent move up in the share price.

Outlook also looks good, with further increases in operating margins anticipated - which, if that is successfully achieved, could propel this share higher.

We’ve been green on this share on the previous 3 occasions it’s been reviewed here. However, given the big rise in share price, I feel the value is less compelling now. Hence I’m shifting down a gear to AMBER/GREEN due to the share price having gone up a lot. It feels to me as if the low-hanging fruit has now been enjoyed by shareholders, and further gains might require more patience, but who knows, anything could happen to share prices, as you know!

Looking at the 10-year chart below, it was de-rated from a growth company to a value share, when all the company-specific problems hit in late 2021. Now that recovery is well progressed, logically this share could have further to run upwards. Although I think supply chain problems in 2021 and 2022 showed the vulnerabilities in the business model. I'm not convinced it will get back to a growth company valuation any time soon. Also note that the number of shares in issue has steadily risen from c.66m in 2018 to 97m now, so that needs to be taken into account when looking at long-term charts.

Anyway, all told, I think there's probably more upside on this share over time, so I'm moderately positive at AMBER/GREEN. I might add it to my buy the dips list, if it drifts down to make risk:reward more attractive, possibly. Anyway, I'm glad we spotted the valuation anomaly last year, which has produced a good gain so far.

Pressure Technologies (LON:PRES)

Down 13% to 34p (£13m) - Interim Results - Paul - AMBER

This is another special situation, where Harwood, Schroders, and Peter Gyllenhammar combined control 57%. They rescued it financially, and are hoping to encourage a turnaround and disposal. Harwood have talked about this one in webinars, it’s quite interesting, and could have upside maybe. Although I always bear in mind that these guys are high & dry, with big illiquid positions, so they have to try and resolve the problems, whereas you and I can just hit the sell button any time we like (providing its not too large a position) and walk away. That’s a massive advantage for private investors vs fund managers, and it’s one of the reasons I never put money in small cap funds - because fund managers can’t ditch their mistakes, whereas on my own, I can. Also I get much better results than any small caps fund! (roughly 19% pa compounded since 2012). And I enjoy picking the stocks myself, and learning from the whole process continually. That said, I’m a great admirer of Harwood, who are seriously good at what they do, hence it’s always worth sitting up and paying attention to what they’re buying. Anyway, back to PRES.

H1 results to 3/2024 - the quick version is, not very good. Adj operating loss of £(0.7)m, worse by £200k than H1 LY. And they’ll be finance costs to come off that, of £238k, so the adj PBT in H1 is just over £(0.9)m.

Balance sheet looks tight for cash, I think it has too much tied up in inventories & receivables, and probably inadequate liquidity. It needs to be better funded, so I’d say dilution risk is probably quite high. Although on the plus side, it does own freehold property.

There’s potentially 5% dilution at 32p per share from warrants, which doesn’t worry me.

Outlook - sounds rather poor for the Chesterfield Cylinders business, better for the other part, which they’re trying to sell -

“During FY24, CSC expects to pass the peak of activity on current high-value defence contract milestones and will seek to re-balance its revenue profile across global defence programmes and the hydrogen energy market, with each of these markets presenting significant opportunities over the medium-term. During this transitional period, CSC revenue is expected to decline on FY23 levels with a consequent reduction in divisional profitability in FY24.

Whilst we expect significantly stronger performance from CSC in the second half of the year, the shortfall in first-half performance will not be fully recovered in the second half, while full-year performance will be further impacted by delayed order placement for new hydrogen storage contracts due to the UK general election, now expected later in FY24.

PMC continues to see increasing demand from its global OEM customers and improving operational performance. The strong first-half result and robust order book provides high confidence in a much-improved full-year FY24 performance for the division. As previously announced, this improved trading environment underpins the Board's decision to divest PMC.

Order books in CSC and PMC underpin the outlook for the Group in the second half of FY24. Given the current divisional trends and performance outlook, we now expect full-year FY24* Adjusted EBITDA to be not less than £1.0 million.

* FY24 outlook includes CSC and PMC, on the basis that PMC is not sold in FY24 and remains a continuing operation”

Paul’s opinion - for me, there’s too much guesswork in trying to assess the value of this share. There doesn’t seem to be anything particularly positive happening, indeed H1 figures look poor. It mentions £1m EBITDA for FY 9/2024, but bear in mind the physical assets depreciation charge is about £1.5m pa, and after interest costs, I reckon that could be a loss of c.£(1)m for FY 9/2024 at the PBT level.

The PMC division has now moved into a modest profit, so why are they trying to sell it? Surely PRES should be hanging on to the better-performing division, not selling it?!

For me this looks like a difficult turnaround, where fund managers are trying to get something done with deals, etc, to extricate themselves from a tricky situation. They might pull it off, and I certainly wouldn’t bet against them, but for me I want better risk:reward to put my own money into speculative turnarounds, and this doesn’t make the grade. As always good luck to holders, I hope it does well for you. The Chesterfield Cylinders business does look interesting, but its track record is so patchy, due to large lumpy contracts. There’s no reason for it to be listed now either.

Note the share count has doubled over this 5-year period below, so less upside on the share price -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.