Good morning from Paul & Graham!

We've run out of time, so have to leave it there for today.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

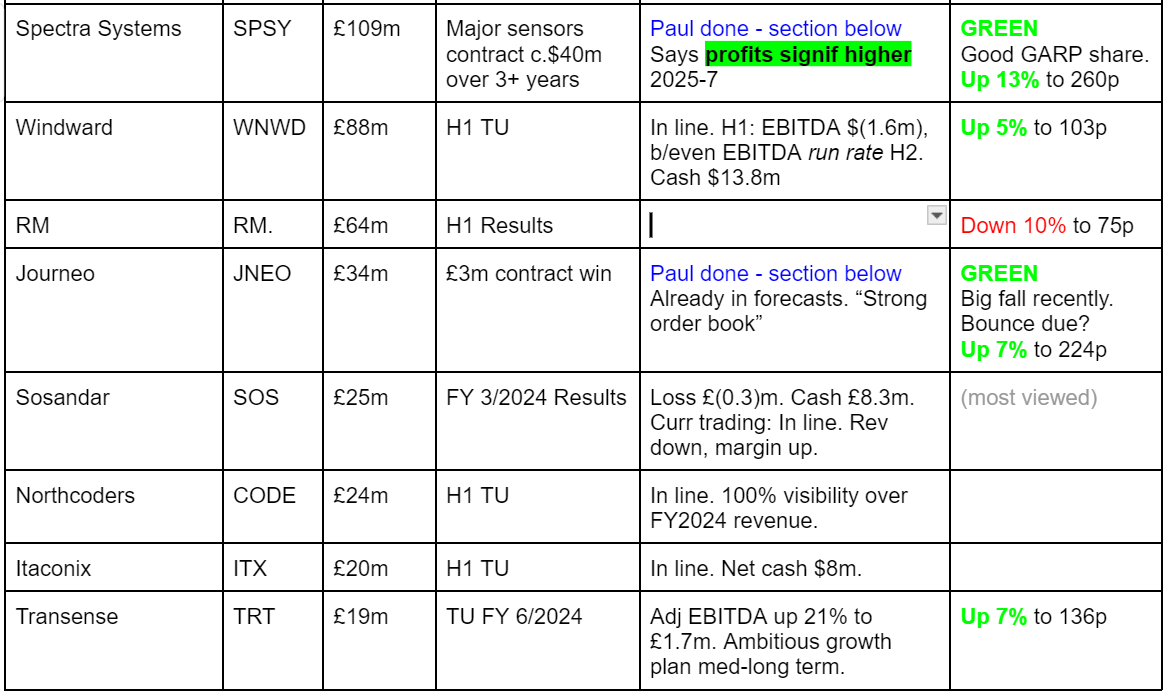

Companies Reporting

Other mid-morning movers (with news)

Trufin (LON:TRU) - down 32% to 52p (£54m) - Loss of customer - Paul - AMBER/RED

Its Satago division loses a significant customer (Lloyds Bank, which also had a NED on TRU’s Board, who steps down today).

Clearly this is a setback, but TRU tries to reassure -

“Based on the recent and continued strong performance of Playstack, which is trading ahead of expectations, the Board of TruFin confirms that the Group as a whole is trading in line with market expectations and remains on track to achieve EBITDA profitability in 2024. The Group also remains fully funded to profitability.”

Paul’s view - a quick look at the 2023 figures has put me off. EBITDA is meaningless, as it capitalised £5.5m into intangible assets. As yet no sign of this being a viable business. It’s trying to do too many things, and should maybe simplify to one core activity. I don’t see value here. Graham was RED last time on 4/1/2024, maybe a little harsh, so I’ll moderate to AMBER/RED due to the overall in line exps comment above, and the claim that it has enough funding. But I certainly wouldn’t want to get involved in this share, due to the very poor track record of continuous losses & cash burn.

Trustpilot (LON:TRST) - down 9% to 213p (£889m) - Secondary Placing - Paul - Graham is GREEN, Paul not so keen.

The curse of the secondary placing rears its ugly head again - where a major holder instructs a broker to flog a big block of shares, because there’s not enough market liquidity. Trafalgar Acquisitions is the seller, of 12.5m shares, 3.0% of TRST, and it’s taken a price of 220p, which looks to be a c.6% discount to the previous night’s closing price of 234.5p.

It now holds 9.5m shares, with a 45 day lockup that’s fairly clear that another sale is likely, which has put a 9% dampener on the share price today, to below the disposal price.

Paul’s view - if you like the company, then a clumsy seller might be providing you with a buying opportunity. Personally I’m not keen on this share, but it’s one of Graham’s favourites, so I won’t mess up his GREEN colour-coding by saying how I view it! (over-valued, and questionable business model). But the revenue & profit growth are impressive.

Summaries

Journeo (LON:JNEO) - 209p (£34m) - Contract Awards - Paul - GREEN

Two contracts totalling £3m with UK train companies are announced, but were already in the forecasts. It mentions a strong order book. Given the big share price sell-off (on no news), I think the company could have reassured more directly today, saying it's trading in line with expectations, but that wasn't done. Based on the information we have today, it looks a decent company at a fairly attractive valuation, so I see no reason to change from my previous GREEN view.

Spectra Systems (LON:SPSY) - up 13% to 260p (08:01) £125m - New $37.9m Contract - Paul - GREEN

Wins a big contract. This seems to have partly been in existing forecasts, but actual has come out much higher margin than planned, leading to a sharp upgrade in forecasts, but also re-phasing of the cashflows. I remain very positive on this interesting little company.

Bloomsbury Publishing (LON:BMY) - down 1% to 710p (£579m) - Trading Update (AGM) - Paul - AMBER/GREEN

A reassuring, in line with expectations update, and lovely clear profit guidance. One of our favourite shares here, but I reckon the big recent bull run has now re-rated BMY shares significantly, and are now looking up with events to me. So I'm moderating my view from green to AMBER/GREEN - still positive, but not the bargain it was when I picked it for my top 20 2024 share ideas.

Vanquis Banking (LON:VANQ) - down 14% to 45.5p (£133m) - Update ahead of interim results - Graham - AMBER

This credit card and vehicle finance bank announces it will need to write down some impaired loans, including their values on financial statements in prior years. Other balance sheet items will also see their values cut down. Current trading seems to be ok, but profitability and balance sheet targets won’t be met this year due to the writedowns. I see this as a highly risky bank share but already very cheap.

McBride (LON:MCB) - down 6% to 133p (£232m) - FY 12/2024 Trading Update - Paul - AMBER

A fantastic turnaround here, as we already knew. In line with expectations update today, reassures. Useful further reduction in the (still high) net debt. Have margins now peaked, I wonder? There could be a bit more upside on the share price, if it can maintain current profitability, but I think the major upward move has probably now mostly happened, so I'll shift down a notch to AMBER - which is a clean bill of health remember.

Brickability (LON:BRCK) - down 5% to 71p (£227m) - Unaudited preliminary results - Graham - GREEN

It was a tough year for Brickability, as expected, with revenues and profits done. However, the gross profit margin held firm due to price increases and the company still earned a profit that justifies an increased dividend. I’m happy to maintain our positive stance here, sharing in the company’s optimism for how it will perform whenever favourable conditions emerge again.

Journeo (LON:JNEO)

209p (£34m) - Contract Awards - Paul - GREEN

Here’s an interesting one. This widely followed share has gone into a nosedive recently, on no news. No idea why - someone must be selling clumsily? People obviously then start panicking, fearing bad news could be imminent.

Today’s RNS should reassure, and I imagine a bounce is likely today (writing this at 07:48).

Contract wins totalling £3.0m won, but were already in the forecasts, it says.

Contracts are for on board CCTV and passenger counting solutions for rail companies in UK.

It mentions a “strong order book”

Paul’s view - the broker consensus graph shows 22.4p EPS for FY 12/2024, which at 209p is a PER of 9.3x, which looks good value I’d say.

They could have stated that trading is in line with expectations, which wasn’t done today. So some uncertainty might persist maybe? But on balance I expect buyers are likely to reverse yesterday’s plunge. But that depends on whether the seller feeds more stock into the market today, who knows? It’s background noise for long-term holders, but price moves can be tricky with small, illiquid shares. Also it shows the risk of using stop losses, as moves like this can stop you out without good cause.

No broker updates recently, so we’re in the dark a bit.

I don’t see any reason to alter my previous positive view, so GREEN from me. See 26/3/2024 SCVR, when I reviewed its strong FY 12/2023 results.

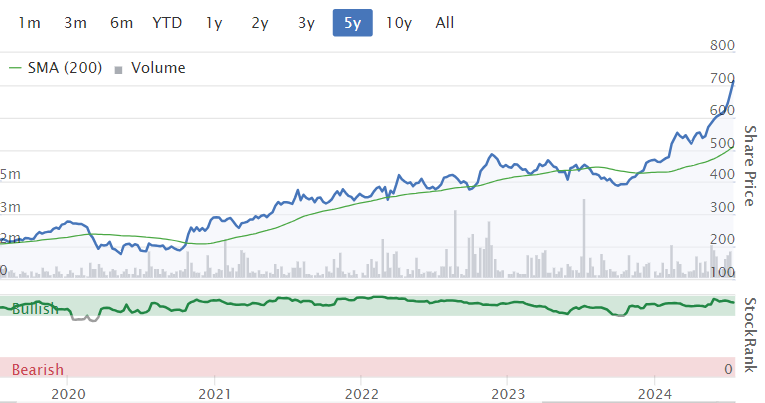

Spectra Systems (LON:SPSY)

Up 13% to 260p (08:01) £125m - New $37.9m Contract - Paul - GREEN

Spectra Systems Corporation, a leader in machine-readable high speed banknote authentication, brand protection technologies, security printing and gaming security software…

I like it when RNSs state the contract value in the title, as we can immediately see how material (or not) it is, helping prioritise our time in the crucial, manic 7-8am tidal wave of news.

SPSY is one of my favourite shares, we’ve reported at GREEN on it 3 times in the past year -

25/9/2023 - 166p - GREEN - Good H1 results. Strong cash, divis & outlook. Thumbs up from Paul.

12/10/2023 - 190p - GREEN - Large contract win. Paul likes it.

27/3/2024 - 218p - GREEN - OK results FY 12/2023. 4% yield. Exciting outlook section.

Unfortunately, it slipped through the net for my 2024 top 20 share ideas list, it should have been on that.

Today’s news is to manufacture sensors for an existing central bank customer.

Total contract value is expected to be $39.6m.

“Bulk of the revenues” receivable from Q1 2025 to Q4 2027, so spread over 3 years. With a smaller tail until 2029.

This is the best bit. Some element of the contract seems to have already been in the forecasts, but it’s much more profitable than originally assumed -

“ This manufacturing contract margin is expected to result in profits over its term that are significantly higher than previously estimated.”

This is another very interesting point - I’m a fan of customer-funded R&D, as it often results in big contracts at a later date (if all goes well), and is a good indicator that a company has strong IP & niche expertise -

“Dr. Nabil Lawandy, Chief Executive Officer, stated: "This long-awaited contract for the third generation of sensors follows after over $14.8 million of development funding by our customer and reflects both the continued need for banknotes as well as the trust our customer has in Spectra Systems."

Broker update - many thanks to Zeus, who provide additional colour, and up their forecasts significantly. In summary (I hope Zeus don’t mind me repeating this) - these are adjusted, fully diluted estimates below, in US$ cents -

FY 12/2024 - EPS forecast raised from 14.8c to 17.7c

FY 12/2025 - raised from 20.3c to 37.1c - good grief!

FY 12/2026 - lowered from 26.2c to 23.3c

It also brings in estimates for 2027 and 2028, but I think that’s way too far forward to be worthwhile trying to forecast, so I’ll ignore those figures.

Valuation - this is tricky, how do we value the shares? I think it would be a mistake to do a valuation based on growth, and a multiple of peak earnings in 2025.

We don’t know whether this big, obviously high margin contract is a one-off, or that start of a stream of contract wins. Hence there are a wide range of possible valuations here.

I’m leaning towards averaging the forecasts above, which gets me to 26c. Convert into sterling at 1.297, gets 20.0p EPS.

What PER to use? Given the highly impressive growth, I’m struggling to see why you wouldn’t rate it at between 15-20, hardly demanding.

That gets us to a crude valuation of 300-400p. Versus the current share price of 260p. Hence I remain GREEN on this share.

Paul’s opinion - I think there’s something special here. The valuation stacks up still ,even after today’s rise, although it’s not the easiest share to value due to the large lumpy contracts. Strangely, it comes up on a bearish screen, the James Montier “cooking the books” screen! I’ve never found anything untoward in SPSY’s accounts, so I think that’s probably a red herring, but it is a useful reminder to double-check everything in the annual report.

Remember that unusually for a growth share, SPSY also pays out nice divis, with the yield an attractive c.4%.

This looks very good, it has to be GREEN again. I’ll try to pick up a few personally if it drifts down in future.

Other SPSY news -

Lottery contract renewal - announced yesterday. Only $636k over 5 years. Talks about “renewed growth” of this business line.

Change of broker - Zeus has acquired WH Ireland’s capital markets division, taking its clients (including SPSY) with it, so broker notes will now be Zeus branded.

Bloomsbury Publishing (LON:BMY)

Down 1% to 710p (£579m) - Trading Update (AGM) - Paul - AMBER/GREEN

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, today announces its trading update for the four months ended 30 June 2024 ahead of the Company's Annual General Meeting ("AGM") at 12.00pm today.

A long-standing favourite here at the SCVR, and one of my top 20 share ideas for 2024, currently up c.50% YTD in 2024.

Trading continues to be good - and excellent, clear guidance - why can’t all companies do this?! -

“Bloomsbury's trading has been in line with recently upgraded expectations, including the acquisition of Rowman and Littlefield's academic publishing business,* following a strong performance in the first four months of its financial year.

*The Board considers current consensus market expectation for the year ending 28 February 2025 to be revenue of £319.3m and profit before taxation and highlighted items of £37.6m.

No broker notes available, so I have to go with the StockReport’s broker consensus number, which is £28.4m PAT, which is consistent with the company’s £37.6m PBT, after taking off 25% for corporation tax. Stockopedia has 34.3p EPS, so a PER of 20.7x FY 2/2025.

Next year forecast rises to 41.0p, so that PER is 17.3x

Dividend yield is quite modest now, at 2.2%, due to the big upward move in share price.

Also the cash pile has been spent on the latest “transformational” acquisition of Rowman & Littlefield’s academic publishing division.

Paul’s opinion - an excellent business, which deserves the re-rating the shares have achieved this year.

We have to take into account value, and given the valuation now looking up with events, I think it makes sense to moderate my positive view from green to AMBER/GREEN, to reflect the much higher valuation.

If I use the “PRINT” button on the StockReport to view the historical StockReport at end 2023, the forward PER then was 14.4x at 470p/share.

Forward PER is now 19.4x, so that’s a big re-rating, and hence I don’t see the same upside that was the case at the start of this year, because the re-rating has already happened. So further upside now would have to rely on more forecast increases only (not a higher PER).

For the avoidance of doubt, I still think BMY is an excellent company, just priced up with events now, instead of being cheap.

McBride (LON:MCB)

Down 6% to 133p (£232m) - FY 6/2024 Trading Update - Paul - AMBER

McBride plc (the "Group"), the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, today provides the following trading update for the twelve months ended 30 June 2024.

Confirmation that trading is in line with expectations -

“The Group therefore anticipates that adjusted operating profit will be in line with the recently upgraded current market expectations (*).

* Current market expectations refer to a Group compiled consensus of broker forecasts for FY24 of:

· Adjusted operating profit £66.4m

· Net debt £129.0m

MCB reported £30.5m adj operating profit in H1, so H2 must be a rise to £35.9m. Remarkable stuff, considering the company was financially on its knees and looked a candidate for potential insolvency or at least a highly dilutive placing just 2 years ago.

Although operating profit is not a good measure for companies with heavy finance charges. In H1 adj operating profit was £30.5m, and adj PBT was £22.4m, 27% lower. So really they should be quoting adj PBT in trading updates.

If I double the H1 finance charges, FY 6/2024 could be around £16m, hence I get adj PBT of c.£50m. Take off 25% tax, gives £37.5m PAT, divided by 174m shares, is adj EPS of 21.6p.

My estimate is almost bang on the 21.7p forecast shown on the StockReport, I love it when that happens and the numbers work! Strangely satisfying.

I try to work out my own figures when there aren’t any broker notes available.

PER is therefore 6.1x - which is obviously low, but that’s because MCB carries a lot of debt. Which is one reason why it hasn’t paid a divi since 2010. My previous notes show that the pension scheme was consuming £4m pa cash in deficit recovery payments.

Debt - is still high, but there’s further progress in reducing debt here -

“The Group's improved profitability and continued focus on net debt reduction resulted in net debt closing at £131.5m, a £14.2m reduction versus the half year end (31 December 2023: £145.7m) and a £35.0m reduction versus the prior year end (30 June 2023: £166.5m). The Group's closing liquidity of £98.3m (31 December 2023: £85.0m) continues to improve and is significantly higher than the minimum liquidity requirement of £15.0m applicable under the Group's financing arrangements.”

As mentioned before I don’t see debt as an emergency any more, because it’s falling nicely, and profits/cashflow are so much improved, that the lenders will clearly see that MCB now has the capability to repay it over time. In an ideal world, I would say net debt needs to fall to c.£50m to be comfortable, and preferably less. Companies should plan ahead for downturns, and unexpected events, not max out their borrowings (as MCB previously did). Let’s hope management have learned that lesson this time, and won’t risk the company going bust again. The bank was exceptionally lenient in the terms it gave MCB, which allowed it to survive, and avoid heavy dilution.

Checking my previous notes, I did flag the high risk (with AMBER/RED) on 16/7/2023, but also noted at the time that it could be an interesting high risk punt at 31p. Also I should give a hat tip to subscriber Yiannos01 who strongly flagged the turnaround potential here last year, and has gained a c.6-bagger. Nice work!

Looking back, the absolutely key announcement was when the bank gave it a lifeline, removing the covenants for I think c.2 years. That was the point to dive in, because it largely removed the insolvency risk, so I’ll remember that as an important lesson to look out for in the future.

As 2023 moved on, and bank debt began falling, and it kept beating expectations, we moved up to AMBER, then early this year to AMBER/GREEN. Remember our colour-coding just follows the facts, figures & forecasts, we’re not trying to predict the future - that's your job!

Paul’s opinion - drawing this to a conclusion, I reiterate that MCB has been an astonishing turnaround from near-insolvency, to highly profitable - now well ahead of its lacklustre performance pre-pandemic even.

How sustainable is it though? We know that MCB has benefitted from squeezed consumers moving down from branded products to supermarket own label. I wonder whether the big brands will take back some of that market share in future, with more advertising and consumers once again seeing real incomes rising?

There was also talk that supermarkets might have allowed MCB to make temporarily better margins to avoid it going bust, and that falling raw material prices and lower energy bills might have allowed bumper , but temporary profits? Supermarkets are notoriously tough negotiators, so I’m minded to assume the big profits in FY 6/2024 might be peak earnings that could be difficult to sustain (which is what the historical performance tells us). Remember that contract manufacturers have no pricing power.

Bulls reckon that MCB management took drastic and highly effective action to strip out costs and improve commercial negotiations, declining unprofitable business, etc. I certainly can’t argue with the numbers, as whatever they did, it’s been remarkably successful.

What happens next then? Broker consensus is assuming a fall in EPS from 21.7p FY 6/2024 (confirmed today) to 19.5p FY 6/2025. You’ve got to decide if you think that’s a low bar, deliberately set to be beaten, or whether profits have indeed peaked in FY 6/2024. I have no idea, hence don’t have a strong view either way.

With net debt now at c.£131m (and falling), and a market cap of £232m, we could see shares re-rate from a PER of c.6 to maybe 8x, as debt reduces. That’s not madly exciting though. How likely are further earnings beats? I suspect they’ve already bagged the low hanging fruit on margin improvement.

It’s difficult to say, but overall I can see modest further upside, but probably not another transformational multi-bagging move like the one we’ve already seen.

Shifting down to neutral feels about right, so I’ll go AMBER.

Graham’s Section:

Vanquis Banking (LON:VANQ)

Down 14% to 45.5p (£133m) - Update ahead of interim results - Graham - AMBER

We don’t cover this one too regularly in this report. I last studied it in Jan 2023, when it was still known as Provident Financial (PFC ticker).

At the time it seemed to me to be in decent shape, but the wheels have come off since then:

Paul covered the company’s most recent profit warning in April.

Today there is more bad news I’m afraid.

“One-off Items” - the headline for a section that outlines £40m of damage to the balance sheet.

First, there is a £29m “downward revaluation” of vehicle finance Stage 3 receivables, i.e. impaired car loans.

Most of this revaluation relates to prior years, meaning that Vanquis failed to get the values right in previous financial statements.

And that’s not all:

Management has now undertaken a full review of the balance sheet. This identified a further c.£11m of one-off items related to the write-down of development costs for a now redundant mobile app, property dilapidations and other sundry balances.

A reminder for all of us that financial statements aren’t a statement of fact - they are an expression of an opinion. £11m of value has just disappeared, as management decided to look again at the values on it.

Trading update: nothing terribly alarming here. Net interest income is stable compared to last year despite interest-earning customer balances falling 6% below December 2023.

£60m of cost savings are on track to be achieved by the end of 2024. A remarkable number given the market cap of £133m.

The costs of dealing with complaints “remain within previously guided levels”.

Outlook: will not meet its target of low single digit ROTE (return on tangible equity) and will end the year below its target capital ratio (Tier 1 ratio 19.5% - 20.5%). Looking on the bright side of things, the company says:

The Group's financial position is now clearer and more stable, with focus now on deploying capital for profitable receivables growth.

CEO comment:

"We have been carrying out a comprehensive review of our balance sheet and this has led to the revaluation of some historic balances. While finding these one-off items is disappointing, it does mean that our financial position is now clearer and more stable. Our trading performance towards the end of the first half of 2024 was encouraging, with year-to-date growth in customer numbers, at better margins, and a return to growth in receivables in June."

Graham’s view

I can’t express a strong view here due to the uncertainty around the numbers, but here are some observations on the company’s 2023 full-year results.

Adjusted ROTE was 3.2%, before any restatement that may be required. That figure is too low to get me interested in investing here, and the company’s target of low single digit ROTE in 2024 (which it is not going to hit) is also too low to get me interested..

2023 balance sheet equity was £583m vs. total assets £3.2 billion. Tangible equity c. £435m. Restatements will affect these numbers.

Clearly there is a large business available here for a market cap of c. £130m. The price to tangible book ratio based on unrevised numbers is about 30%, i.e. there is a discount of up to about 70% to book. And with £60m of cost savings being delivered, you would think that the outlook for the equity would be quite good.

But there are good reasons to stay away:

Higher leverage vs. other alternative lenders we could invest in.

A high volume of complaints. Even if they are spurious, they are an unwelcome distraction.

Weak profitability in the short-term. How long will shareholders have to wait for recovery?

Today’s revaluations are a reminder that the balance sheet doesn’t tell the whole story, as the numbers can and will be revised, sometimes in surprising ways.

There is also the problem of profit warnings and negative earnings momentum:

For me personally, I consider the risks here to be uncomfortably high.

For someone with a highly diversified portfolio, who could afford to see this go to zero, maybe the risk/reward here could be acceptable, given the 70% discount to tangible book value (before any restatements)?

Since there is “value”, I’m inclined to take a neutral stance on this share. I imagine that some readers (and perhaps my co-writer?) will see this as an overly generous position to take.

Last year, there was a debate around Metro Bank Holdings (LON:MTRO) where I also took a neutral stance, due to the apparent value. Bank shares do have a tendency to look extremely risky, and they frequently disappoint - but in today’s markets when they are already trading for peanuts, and when they appear to be solvent, I prefer not to take a bearish view!

Even if VANQ’s tier 1 capital ratio falls below 19.5%, it should still remain at levels generally considered safe, e.g. still well above 10%.

Brickability (LON:BRCK)

Down 5% to 71p (£227m) - Unaudited preliminary results - Graham - GREEN

Brickability Group PLC (AIM: BRCK), a leading distributor and provider of specialist products and services to the UK construction industry, is pleased to announce its unaudited preliminary results for the twelve-month period ended 31 March 2024.

It was a tough year. But despite most metrics moving in the wrong direction, the dividend here still gets a raise. It is well covered by EPS:

This is described as a “resilient” performance, given the challenging environment.

Outlook - currently trading in line. New CEO as of April. They are “well positioned to recover strongly as market conditions improve”.

However, there is also an acknowledgement later in the statement that “activity levels in the housebuilding sector remain subdued”.

The Chairman’s comment emphasises the company’s expansion into new product categories:

"Over the past year there have been a number of well-documented challenges impacting the housebuilding and RMI markets. Against this macro backdrop, the Group has continued to demonstrate resilience and deliver a robust financial performance. It is particularly pleasing to see the Group's strategic focus on diversification of products and end markets yielding benefits…

Indeed, it’s not just a brick company - it also sells cladding (boosted by an acquisition), pavers, blocks, balconies and other building materials.

Quick overview of divisions:

Bricks/building materials (68% of revenues): brick volumes down 28%, in line with the market. Like-for-like revenue declined 19% with price increases helping to offset the volume decline.

Importing (16% of revenues): like-for-like revenue down 34%. This division is extra sensitive to market conditions as weak demand means that there are more domestic bricks available to satisfy customers, and less need for imports.

Distribution (11% of revenues): marginally down on last year.

Contracting (10% of revenues): boosted by acquisitions that are performing as expected. This division includes various cladding companies.

Adjusting items: there is a £14m gap between adj. PBT (£35m) and statutory PBT (£21m). The biggest numbers here are amortisation and earn-outs relating to acquisitions. So the usual disclaimers apply - if you are happy to ignore them, you can give a greater weight to the adj. PBT figure.

The adjusting items also include £1.5m of share-based remuneration - I don’t think it’s controversial here to say that this should not be adjusted out.

Net debt of £56m is after paying out £43m for acquisitions and £5m of deferred consideration for previous acquisitions.

Graham’s view

I don’t have a strong view on this one, so I am happy to defer to the GREEN stance which Paul took in April, in anticipation of a cyclical recovery.

According to the company, conditions still remain soft, but they seem to be maintaining their optimism for how they will perform whenever things pick up.

In the meantime, the shares trade at a modest multiple and pay a yield that is covered by earnings even after a bad year:

Can things get worse? Of course, but the company seems to be able to grind out margins and profits even in bad conditions.

The net debt figure stands out as having increased greatly, but with diversifying acquisitions being the main reason for this, I think investors can be reasonably relaxed about this for now. Of course it’s something that we’ll need to keep an eye on in future updates.

In summary: while this is a low-conviction stance for me, I’m happy to maintain the continuity of a GREEN stance on this share.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.