Good morning, Paul & Graham here!

It's a clean sweep today, we covered everything, and mostly interesting companies too. So we'll sign off.

Let's hope the IT problem that caused so many problems globally on Friday has now been resolved, with prompt RNSs at 7am hopefully. Update: so far, so good!

Mello Monday starts 17:00 later today - details here. One of my favourite shares over the last couple of years, Cohort (LON:CHRT) is presenting. Having done so well, do the shares have further upside? I believe Richard Crow is on the BASH panel, he's always worth listening to. Also Vin Murria of AdvancedAdvT (LON:ADVT) is on!

Begbies Traynor (LON:BEG) - it's the quarterly Red Flag Alert Report - which is particularly gloomy this time, even by Begbies standards! There's been a considerable increase in companies classified as being in "significant financial distress". Especially in travel & tourism, hotels, health & education, and bar/restaurants. "Serious concerns" remain in construction, real estate, and support services sectors.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Some interesting stuff here! First published at 07:49, then updated throughout the morning.

Other mid-morning movers (with news)

Ryanair - thank you to readers who have pointed this out. Not a share I follow, but the newswire says shares have “tumbled” 18% in New York, on missing profit targets for April- June, and warning that fares for the key summer months would be “materially lower” than last year.

This has caused shockwaves in other travel shares today. No view from me, as I haven’t properly looked into it, just flagging the news.

Summaries

Beeks Financial Cloud (LON:BKS) [Paul holds] - down 6% to 190p (08:11) £125m - Trading Update - Paul - GREEN

FY 6/2024 trading in line (although a revenue miss). Claims to now be cash generative. Outlook comments strike me as encouraging, but the market seems to have done a bit of profit-taking this morning. I remain a bull - this seems an unusual high organic growth niche company with exciting prospects.

Tristel (LON:TSTL) - up 6% to 478.55p (£228m) - Trading Update - Graham - AMBER/GREEN

A very nice update as Tristel beats management and sell-side expectations on revenues, profits and cash. I take a few minutes to explore ways a company might be able to justify a very high valuation such as the one that Tristel has. I think Tristel might be able to do it, so I’m comfortable with AMBER/GREEN.

Fonix Mobile (LON:FNX) - up 7% to 261p (£258m) - FY 6/2024 Trading Update - Paul [ahead] - GREEN

Ahead of expectations flourish to end FY 6/2024. Cavendish raises 2025 forecasts a little, but says they're being conservative. Punchy rating, but I think this share is worth it. Intriguing possibilities from further international expansion, and a broadening of its UK services. A continuing thumbs up from me - I think it's worth the premium valuation.

Arcontech (LON:ARC) - up 5% to 93p (£12m) - Trading Update - Graham - AMBER

Customers have been using products more intensely than expected, giving a 4% boost to revenues and a 20% boost to adjusted PBT. However, there is no change to FY 2025 expectations so it may just be a temporary boost. With a cash pile covering about half the market cap, this may be worth studying.

AdvancedAdvT (LON:ADVT) - down 2% to 143p (£189m) - Accounts for 8 months to 29/2/2024 - Paul - AMBER

Quite complicated, due to acquisitions, a disposal, big cash pile, owning 9.8% of M&C Saatchi (LON:SAA), and a change of year end, so plenty to unpack there! I think it looks quite interesting, and more than half the market cap is backed by cash & SAA shares. We'll have to see what further acquisitions the forceful and experienced Vin Murria makes!

Croma Security Solutions (LON:CSSG) - unch 72.5p (£10m) - Trading Update [in line] - Paul - AMBER

Updating myself on the particulars here, I think risk has reduced (after a nice lump sum of cash received from the highly material disposal receivable), and rolling out a modestly profitable (but very small) operating business does have some attractions. I'm teetering on the brink of moving up to amber/green, but let's monitor events for a little while.

Paul’s Section:

Beeks Financial Cloud (LON:BKS) (Paul holds)

Down 6% to 190p (08:11) £125m - Trading Update - Paul - GREEN

Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, provides an update on trading for the year ended 30 June 2024 (FY24).

I could be biased here, as for full disclosure, I have a small position in BKS personally (<1% of my portfolio, as I was hoping to buy more cheaper, but it went up instead of down!) and so far it’s a very good performer (up 90% YTD) on my top 20 share ideas for 2024.

Today’s update strikes me as reassuring, but not price sensitive either way. Key points -

FY 6/2024 trading has been in line -

“FY24 results are expected to be in line with consensus expectations, with Beeks having delivered significant double-digit growth on the prior year, driven by a strong performance across Beeks' Private, Proximity and Exchange Cloud offerings.

Growth - why do they give the percentages, but not the actual numbers? This wastes everyone’s time, having to look up and calculate the numbers -

“Beeks exited FY24 with approximately 18% growth in ACMRR in the year to £28.0m (30 June 2023: £23.8m). Revenue for FY24 is expected to be approximately 27% higher than FY23, delivering underlying EBITDA1 growth of over 27% and underlying profit before tax2 growth of approximately 67% versus FY23. “

Broker update - many thanks to Canaccord, whose note this morning fills in the gaps. EDIT - previous glitch with Research Tree has now been resolved.

Canaccord says for FY 6/2024 revenue was £28.4m (up 27%, and slightly faster growth in H2 than H1). However, this is £1.6m below Canaccord’s estimate of £30.0m revenues. So revenue looks a miss against Canaccord forecast.

EBITDA is a nonsense number here, so I’ll ignore that.

Underlying PBT is said to be up 67% vs FY 6/2023, which Canaccord says is £3.9m, slightly below its estimate of £4.1m.

Overall then, BKS says it’s in line with broker consensus, but it looks c.£0.2m below Canaccord’s estimated adj PBT.

That’s about 20 minutes wasted trying to piece that together. Clearer reporting is needed in future please, Beeks!

Accelerating growth - obviously the historical profit numbers at BKS are unexciting, but it’s a rapid growth company, so sceptical value investors are looking at all the wrong things! The excitement with Beeks is that its lengthy process of winning large contracts subsequently delivers increased revenues (“land and expand”), and a long-term, growing stream of recurring revenues. I particularly like the word “accelerated” in this paragraph -

“Significant wins secured in H2 FY24, including (as announced in March) the Johannesburg Stock Exchange's (JSE) Exchange Cloud Contract Extension and a Proximity Cloud Win with one of the world's largest banking groups, have contributed to Beeks' increasing levels of contracted, multi-year, recurring revenue, providing a strong basis for accelerated growth”

For a company that’s just grown revenue by 27% (organically), to be talking about accelerated future growth seems remarkable.

Cashflow - a question mark and food for the bears, has been BKS previous inability to generate free cashflow. I’m more relaxed about that, because many tech-based companies have to spend up-front, to then generate a long stream of recurring revenues. They need to reach a tipping point where increased scale means cashflow turns positive, and can then grow rapidly due to high growth, high margins, and a largely fixed infrastructure. That’s the hope here, and maybe hope is starting to turn into reality? Although I’d like to see the full numbers before drawing a firm conclusion. Today it says -

“In the second half of the year, Beeks continued to achieve a positive free cash flow position in line with management's previously stated strategy, with unaudited net cash of £6.58m at the period end, (H1 24: net cash of £5.44m; FY23: net cash of £4.41m) notwithstanding continued investment in Beeks' product offering.”

Big contract - this was already known, and is a key reason why BKS shares have done so well this year. I think investors are anticipating at least some of the upside from a large contract win, still in regulatory approvals stage. Rumour has it that this is related to New York’s stock exchanges. As I understand it, the figures for this contract have not yet been included in broker forecasts, and there could therefore be big upside if/when regulatory approval is achieved -

“As announced on 6 February 2024, Beeks conditionally secured a third Exchange Cloud contract with one of the largest exchanges globally (the "Exchange"). Completion of the contract with the Exchange is subject to regulatory approval, following which deployment of services and recognition of revenue will commence. Advanced progress has been made on this approval process, in line with expectations, and Beeks looks forward to updating shareholders on the outcome shortly.”

“shortly” is tantalising there!

Outlook - I think this bit below is quite bullish, but at the moment the market disagrees! -

“The Exchange Cloud pipeline continues to build, with advanced discussions taking place with other major Exchanges across the globe. Having signed a contract extension during FY24 to meet stronger than anticipated customer demand for the solution, the JSE is providing strong references to other potential customers of Exchange Cloud.

The conversion of Beeks' record pipeline across each of its offerings remains a core focus for FY25 and the new financial year has started promisingly, including the contracts already signed in FY24 for delivery and revenue in FY25.”

Paul’s opinion - I’m a little surprised shares have eased off today, dunno why - traders taking profits maybe? It seems to me this update is pretty good. BKS shares are difficult to value at this stage, as it’s rapidly growing, and we don’t know for sure what the numbers will look like when it reaches maturity. Growing revenues at close to 30%, organically, and with a major new contract going through regulatory checks (which is not yet baked into the forecasts) sounds an exciting set up to me.

It’s a mistake to value rapid growth companies on a PER basis, in my opinion. If you do that, you won’t invest in any of the fastest growing, and best companies! PER is for mature companies.

My view is that £125m market cap here looks good value for a rapid growth company that is building sticky recurring revenues globally, in an interesting niche.

Management has been open about their plan to rapidly grow the company, then sell it in due course.

So it’s a continuing thumbs up from me, but I have no idea what the shares should be valued at, the valuation methods used by the public and private markets for growth companies are a bit of mystery to me!

Can it punch through that 200p barrier in due course? I think it's possible if/when the big new contract gets regulatory approval. Downside risk obviously that regulators don't approve it.

Fonix Mobile (LON:FNX)

Up 7% to 261p (£258m) - FY 6/2024 Trading Update - Paul [ahead] - GREEN

Fonix Mobile plc, the mobile payments and messaging provider, is pleased to provide an update on trading for the year ended 30 June 2024 (the "Year").

The niche that Fonix seems to dominate in the UK (and growing in Ireland) is for phone/text/messaging for interactive TV shows - so think charity, reality TV, talent shows, competitions, etc, where audience participation is encouraged to either vote or donate. Fonix takes a fee from those revenues. Its systems have to be 100% reliable, as they have to cope with a deluge of transactions when a TV opens voting. Hence to clients, the fact that Fonix never goes wrong, means they stick with it, rather than shopping around for a better deal. That looks like a moat to me! But also brings risk if its systems ever were to be hacked or broken in some way.

One of my favourite companies, it’s another one that usually looks a bit too expensive, but it keeps performing well, so I’ve remained positive on the fundamentals.

Previously -

14/11/2023 - GREEN at 193p. Positive TU. Podcast mystery share!

24/01/2024 - GREEN at 225p. H1 TU marginal ahead exps.

1904/2024 - GREEN at 232p. I remain positive, despite Director selling.

FNX floated in Oct 2020, and hasn’t put a foot wrong, developing into a reliable growth company, high margin, sticky repeating revenues, cash generative, capital-light so it reliably pays out about ¾ of earnings as divis.

An impressive (organic) growth company - lots to like here -

Today’s update - is good news -

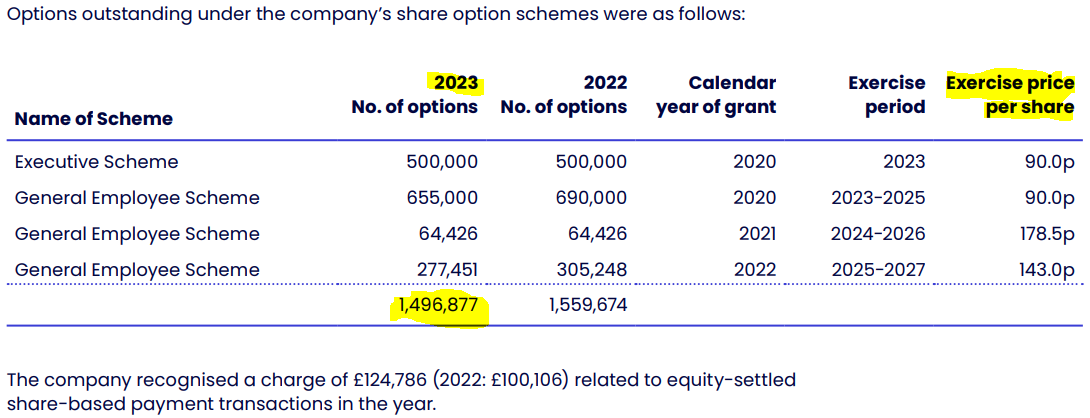

I like share buybacks at companies with no debt, and surplus cash. However, generally I’m only keen on buybacks when the shares are obviously cheap. That doesn’t seem the case here. Also buybacks can be a cover for generous share options. I’ll check that now actually. Rummaging through the RNS, it seems that FNX has indeed awarded shares from exercised share options from its treasury shares. However, the quantities of share options issued looks very reasonable to me -

“ the Company has now issued 1,904,174 options over shares since the Company's admission to the AIM in October 2020, of which 192,797 have subsequently lapsed, 127,557 have been exercised and 1,583,820 remain outstanding. The outstanding options represent 1.58 per cent. of the Company's issued share capital.”

Also note that the options are not nil cost. They seem to be issued with an exercise price set at the market price of the shares at the time of issue. So options only reward additional share price value created from the point of issue. This seems exemplary to me, if I've understood it correctly. From the 2023 Annual Report - modest dilution (on 100m existing shares), and at market value at time of issue -

Broker update - see Cavendish’s very helpful note today, they’ve upped FY 6/2025 adj diluted EPS from 10.2p to 10.6p, a punchy rating of 24.6x, but it says the upgrade is conservative, ie likely to be beaten, hence the actual PER might end up somewhat lower.

Outlook - I would have preferred a more specific confirmation about meeting market expectations for the new year FY 6/2025, especially since FNX enjoys reliable, repeating revenues.

Still, this all sounds interesting below, especially the bit about entering a new European market - does anyone know which country this is?

“The Board remains confident in Fonix's growth potential for FY25 and beyond, supported by high levels of recurring revenue with a strong run-rate, an expanded commercial offering, and significant opportunities for further international expansion…

"We are pleased to announce another year of robust profitable growth across our core markets and segments. We have continued to see strong underlying growth from our long-standing customers, alongside new income streams from recent client wins such as ITV and RTÉ, and new adjacent product offerings including live broadcast voting and online payment portals. Our expanded client base and product suite has not only generated new income sources but also enhanced our credibility and competitive edge in the market.

Looking ahead, we are making steady progress on our plans to enter a new territory in mainland Europe, with several TV and radio broadcasters lined up to trial services once we launch in the region. We are optimistic about starting to transact in this new market during FY25 and we hope to be able to give further details at the full results in September."

Paul’s opinion - it’s the same message as previously from me - terrific company, and shares are a bit pricey, but I do think the valuation is justified.

Further international expansion is potentially exciting too.

So yes, it’s a thumbs up from me. This just has that look of a company which is on a roll, and seems likely to keep delivering. That’s worth a premium price, in my view. The same message from all 3 of our main sections today, coincidentally.

A good listing, and with generous divis paid too -

AdvancedAdvT (LON:ADVT)

Down 2% to 143p (£189m) - Accounts for 8 months to 29/2/2024 - Paul - AMBER

“AdvancedAdvT Limited (LSE: ADVT, "AdvT", the "Group"), the international software solutions provider for the business solutions, healthcare compliance, and human capital management sectors, has published its period end results for the eight months to 29 February 2024. “

This is a shortened year, due to a previously announced change of year end to Feb 2024.

It’s a special situation, being Vin Murria’s acquisition vehicle.

There are 4 elements to its valuation in my mind -

- Businesses already acquired,

- Another acquisition after the 2/2024 year end,

- Substantial cash pile, and

- 9.8% shareholding in M&C Saatchi (LON:SAA)

For our purposes here, it would take too long to plough through those various elements in detail.

Briefly though, the main things are £82.1m cash pile (and no debt) at 29/2/2024, c.43% of the current market cap, so highly material.

A small acquisition of £5m net cash cost was completed c.3 weeks ago, reducing cash to £77m.

It’s earning interest on the cash pile, with net finance income of £2.3m in the 8 months to 29/2/2024.

SAA shares have done well in the last year, rising from a low of 125p to 205p now. ADVT tried unsuccessfully to buy it, so the increased share price should have recouped the losses from wasted deal fees. That market price of ADVT’s holding in SAA is now £24.8m. Add that to the net cash, and it’s effectively got about £102m of cash and marketable shares in SAA combined. So you’re paying £87m for everything else - the operating companies bought so far. I’m not convinced that’s a bargain, but time will tell once we have a clearer picture of how trading is likely to progress. Investors are also arguably paying a Vin Murria premium, given her track record and high esteem.

It’s too early to analyse the trading numbers, since it’s had acquisitions, disposals, a £2.6m gain on the SAA shares, etc, so a lot of moving parts.

Outlook - in line -

"Current trading and outlook

Despite the significant macroeconomic uncertainty and disruption, we believe that the current environment will present numerous opportunities to develop the Group, both organically and by acquisition.

In the current financial year, which started on 1 March 2024, the Group has continued to make good progress and has secured a number of large, long-term contracts across both public sector and private sector customers. The improvement in performance of the four units has also continued. Overall, the Group is trading in line with the Board's expectation.

Paul’s opinion - too early to judge, but I’ll follow it with interest. It all depends what acquisitions are made using the cash pile.

Very nice asset backing for over half the share price, so it’s a comfortable AMBER for now. I definitely wouldn’t be betting against Vin Murria, that’s for sure!

EDIT: I've just seen that Vin Murria is presenting on Mello Monday tonight at 18:40, talking about ADVT!

Relatively early days so far, and shares have recovered from earlier mis-steps and bear market -

Croma Security Solutions (LON:CSSG)

Unch 72.5p (£10m) - Trading Update [in line] - Paul - AMBER

Croma Security Solutions Group plc (AIM:CSSG) is pleased to announce the following update on trading for the twelve months to 30 June 2024.

Trading in line, but it doesn’t say what expectations are -

“During this period, the Company has traded well and continues to develop its security centre network, add new commercial clients and expand the security solutions the Group provides. As a result, Croma expects to report FY2024 results in-line with market expectations.”

Zeus helpfully shares their model with us, which has forecast £0.8m adj PBT for FY 6/2024, double the prior year. Sounds promising, but note all the increase has come from changes to the finance charge line. The adj operating profit (EBIT) line is unchanged Y-on-Y at £0.5m. So you need to avoid running away with a misconception that profit is soaring! (because it isn’t based on any change in operating profit)

This is a very small business, which offer fire & security, and locksmiths services. Only £8.6m forecast revenue in FY 6/2024, but at least it’s profitable, albeit very small for a listed business - is the listing really worth the hassle and cost? If they’ve got something good to roll-out, then maybe it could be? I’ve got an open mind.

This reminds me a little of React (LON:REAT) - a small business that is trying to expand, but struggling because it can’t get a high enough rating on its shares to be able to issue more for acquisitions. I put that question to REAT in a Mello webinar, and the reaction from management was priceless - the body language clearly showed I touched a raw nerve, whatever came out of their mouths in answering my question! But the fact REAT didn’t try to conceal their frustration is actually a positive to me.

Anyway, back to CSSG - what I like here is that it doesn’t need to issue new shares. There’s a sound balance sheet, and it can roll out these small locksmith & other services through its existing cash. Could be interesting. Although is there a big profit opportunity here? Surely these are usually one or two man bands, who enjoy being independent? What value can a group add? Or is this the next Timpsons in the making? Who can say?

Going back to my previous (brief) notes on CSSG here on 21/2/2024, the main issue was the highly material disposal, where the terms were payable in cash instalments by a startup - which in my experience frequently fail midway through the payment plan, after the first few payments have been made.

Today’s update reassures -

“In June 2023, the Group sold its manned guarding business Vigilant for £6.5 million, in order to focus on the Company's core businesses, Croma Locksmiths and Croma Fire & Security. As reported earlier this month, the Company received a cash payment of £1.76 million as part of the consideration for the sale of Vigilant with a further £3.48 million including interest to be received over the next 8 quarters. As at the date of this announcement, the Company has no borrowings and a cash position of £4.0 million.”

It’s moving in the right direction, but personally I would still put a hefty discount on the expected receivable, and plan for a default, so I can see how things work out if there is a default. 40% of the market cap is now net cash, that’s a nice position, no arguments over that! Risk is not prediction, remember, we have to think about all possible scenarios, and weight the valuation accordingly.

Outlook - sounds interesting -

“Croma's strategy remains focused on driving the core business as well as acquiring traditional locksmith stores and transforming them into modern security centres with stronger in-store product ranges and much greater profit potential. The Group boasts a strong balance sheet and there is a good pipeline of store acquisition opportunities to support the Group's ambitions to roll out its security centre network nationwide.

Roberto Fiorentino, Chief Executive Officer, commented: "We are pleased to have completed a successful year in what has been a challenging market environment. Looking ahead, we have a clear strategy together with the financial resources and management expertise to execute it. As a management team, we are therefore very focused on expanding our store presence and benefitting from the resulting growing economies of scale."

Paul’s opinion - not something I can get madly excited about, as rolling out a stores-based format takes a long time, and plenty can go wrong. That said, it’s starting from a good point - already profitable, and with a good balance sheet.

Probably priced about right for now, but as a long-term investment idea, I’ve seen many far worse ideas.

I’ll stick with AMBER for now, but if a few more instalments come in, and they can demonstrate good returns from new sites, then could see myself moving up a notch to amber/green in future. Let’s keep an eye on it - I know we have some bulls here already.

Have management done any webinars? If so, I'd be interested in observing the cut of their metaphorical jib. Overall best summed up as: I'm getting slightly interested!

Graham’s Section:

Tristel (LON:TSTL)

Up 6% to 478.55p (£228m) - Trading Update - Graham - AMBER/GREEN

Pleasant news:

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products, announces a trading update for the year ended 30 June 2024, having delivered a strong trading performance ahead of market expectations and the Company's own performance targets.

I’m always a little paranoid now that a company might be referring to a previous beat of expectations, rather than a new beat of expectations.

However, that’s not the case here. There hasn’t been a trading update from Tristel since the half-year report published in February. The broker note from Cavendish confirms the extent of the outperformance:

Revenues up 16.4% to £41.9m (estimate: £40m)

Adj. PBT at least £8m (estimate: £7.6m) [this excludes the impact of share-based payments]

Cash £11.6m (estimate: £10.1m)

Share-based payments had a cost of over £1m in FY2023 so it will be worth checking their cost in FY2024.

CEO comment describes the company’s evolution:

"This is my last trading update before I hand over the reins to our incoming CEO…

"In June last year we achieved the major milestone of obtaining approval from the US Food and Drug Administration for our Tristel ULT disinfectant for ultrasound instruments. During the first half of FY 2024 we set up manufacture of the product with our North American partner…

“Tristel has become a leading global player in a specific niche of the global infection prevention industry: the decontamination of non-lumened heat sensitive medical devices. The niche sweeps up many of the diagnostic tools used in hospitals ranging from ultrasound probes to small endoscopes. Looking to the future, we are confident that we will also become a leading player in the hospital surface disinfection market with our unique chlorine dioxide chemistry. We are all very excited for the Company's future prospects."

Graham’s view

Congratulations to long-term holders. If you’ve been in this for the long haul, you’ve probably earned a fine return on your investment:

As we’ve said many times here - most recently from Paul in February - it might be tricky for value investors to justify the price here.

How to justify it? Well, I think it does require a bit more work than with the average stock.

For example, here’s how I would begin my Tristel studies.

To justify a high PE multiple, we’re going to need either a financial reason (e.g. operational leverage kicking in to boost profits in future years) or what we might call an economic reason (e.g. the company having a very strong competitive advantage.

Looking at Tristel, it seems plausible to me that there could be both financial and economic reasons to justify a high P/E multiple for it.

Financially, it earns a gross margin of 80%. And yet it currently converts over £40m of sales into just £8m of adj. PBT. Its profit margins have been steadily improving year-on-year, as more and more sales and gross profits get converted into bottom-line profits. If this continues, there is the potential for the bottom line to keep growing at a much faster rate than planned top-line growth of 10-15%.

Economically, the company claims to already be a leading player in one niche, and to have the potential for a similar achievement in another one.

This is where an investor benefits from industry knowledge, and this can also be the hardest part of investing.

If I run a search for “decontaminate heat sensitive medical devices”, Tristel doesn’t show up for me until page 4 on Google.

(If you do an even more specific search, “decontaminate non-lumened heat sensitive medical devices”, Tristel is the #1 result for me in Google.)

Most of the search results are non-commercial. Others are specific to dental devices. A company that does show up for me and that may be a genuine competitor is STERIS.

A little bit more googling on STERIS provides me with a list of companies active in ultrasound probe disinfection, including both STERIS and Tristel.

In this way, little by little, we can build up our knowledge of an industry. Who are the competitors, and on what basis do they compete?

One sign of a company with a competitive advantage is a high market share - and I love to find and to invest in companies with a high market share (e.g. I own the likes of IGG and RMV). Does anyone know if Tristel has published market share numbers for any of its products?

Overall, I’m happy to leave our AMBER/GREEN stance on Tristel due to its long track record of profitability and seemingly excellent prospects for the future. I wouldn’t personally be willing to pay this rating for it, but I also think it deserves something more than a neutral stance. So I’m glad we expanded our colour coding system!

The StockRank system also notices the quality and the momentum here, while being wary of the limited value on offer:

Arcontech (LON:ARC)

Up 5% to 93p (£12m) - Trading Update - Graham - AMBER

We don’t very often see companies at this market cap that are consistently profitable but that is the case with Arcontech:

It even pays a rising dividend:

Today’s update is short and sweet.

Arcontech (AIM: ARC), the provider of products and services for real-time financial market data processing and trading announces that for the year ended 30 June 2024 (FY24) turnover is expected to be ahead of market expectations by approximately 4% as result of increased use of product by certain customers, whilst adjusted profit before tax is expected to be ahead by approximately 20%, as a result of the aforementioned increased product usage and certain planned staff costs only being incurred at the end of the financial year (FY24).

Expectations for the current financial year (FY25) remain unchanged.

So investors can get excited, but not too excited: the company is not extrapolating increased customer activity out to future years.

Graham’s view

Paul gave Arcontech’s interim results a quick review in February, noting that the company had net cash of £5.7m. That leaves a tiny enterprise value but it’s also fair to point out that the company has seen very limited growth over the years. For a software company, that’s a worry - the phrase “if you’re not growing, you’re dying” often applies.

According to the StockReport, revenues were only supposed to grow by 2.5% this year, prior to today’s update. With a 4% beat on expectations, that suggests we still have a single-digit growth rate - not bad, but investors often look for more.

At the same time, I don’t want to downplay the company’s 20% beat on profitability. And it’s no mean feat to achieve profitability for so many years at this end of the nano-cap market.

As you can tell, I can’t quite make my mind up on this one. Perhaps I could go AMBER/GREEN, but the £12m market cap is also a worry; anything below £10m I now consider to be high-risk due to illiquidity and the delisting risk. Arcontech is almost at the limit of market cap respectability.

I acknowledge that this is paradoxical. We should be getting more interested in companies as they get cheaper, not less interested! But I do think that listing costs and liquidity become factors at certain levels.

I’m leaving a neutral stance on this one: an interesting value play with some impressive features, but there are also some reasonable grounds for concern.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.