Good morning from Paul & Graham!

** UK base rate cut today, from 5.25% to 5.0% ** MPC: 5 voted for a cut, 4 for a hold.

Excerpt -

In balancing these considerations, at this meeting, the Committee voted to reduce Bank Rate to 5%. It is now appropriate to reduce slightly the degree of policy restrictiveness. The impact from past external shocks has abated and there has been some progress in moderating risks of persistence in inflation. Although GDP has been stronger than expected, the restrictive stance of monetary policy continues to weigh on activity in the real economy, leading to a looser labour market and bearing down on inflationary pressures.

Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

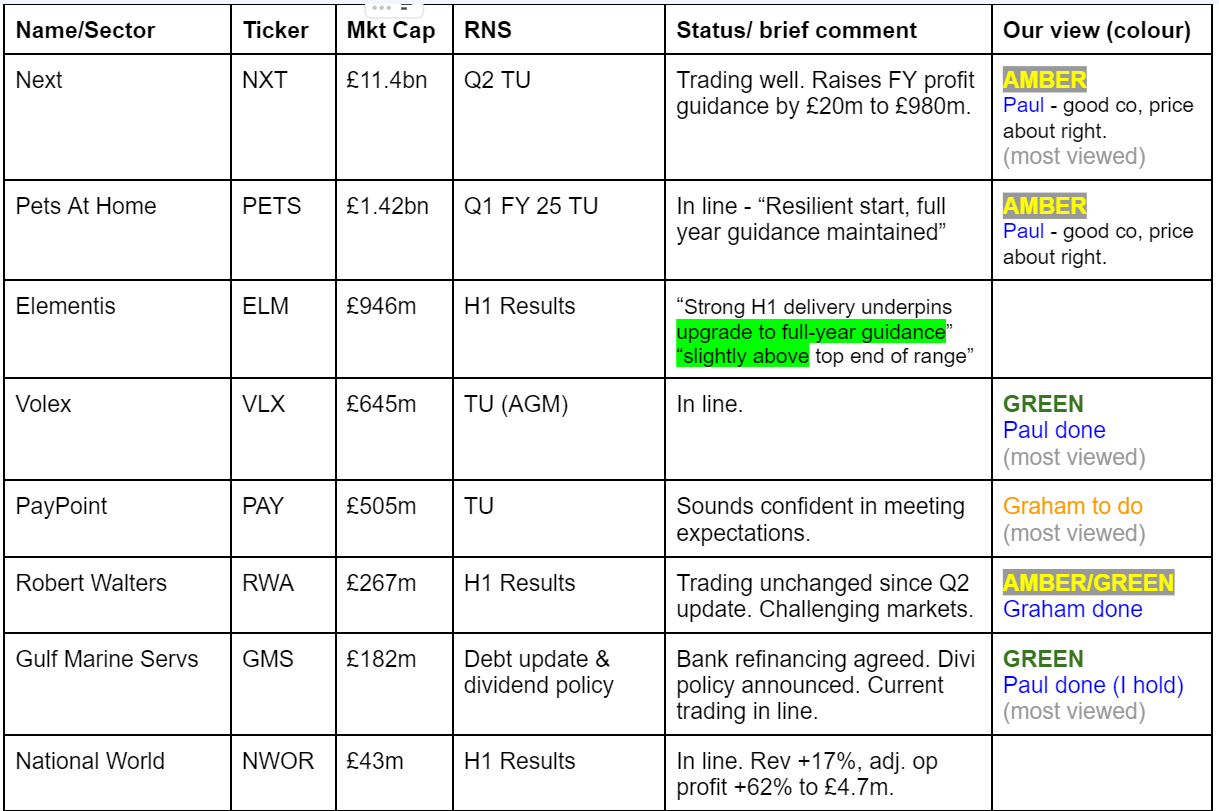

Companies Reporting

Other mid-morning movers (with news)

Rolls-Royce Holdings (LON:RR.) - up 11% to 498p (£42.4bn) - Half Year Results - Paul - No view

This is the movers section, so I’ll briefly flag anything interesting, regardless of market cap.

Up 11% today, on H1 results which have impressed the market. H1 adj PBT doubled to £1.04bn.

Raises FY 12/2024 guidance.

Reinstates divis, but they won’t be much by the looks of it.

Crystal clear guidance here - all companies need to do this -

It’s not just the products that fly at high speed, so have the shares - 7-bagging since the autumn 2022 lows! Remarkable stuff. No opinion from me.

Guild Esports (LON:GILD) - down 56% to 0.16p (£2m) - Company update & strategic review - Paul

We’ve never bothered covering this share in the SCVRs, as the figures always looked so grim.

Today’s update sounds bad, and it probably won’t be long until we’re waving this share a tearless goodbye.

It’s desperate for more cash, with just £25k remaining. It’s looking into various options.

David Beckham owns 3% I see, so he’ll be gutted.

The last balance sheet looks insolvent, so if management continue trading, then they could be breaking the law. Hence I think appointing administrators might be necessary. Brace for a zero here.

Coats (LON:COA) - up 8% to 96.7p (£1.53bn) - Half Year Results - Paul - AMBER/GREEN

“the world's leading industrial thread and footwear components manufacturer…”

Shares here hitting a fresh 5-year high, hence me flagging it briefly.

Nice figures, with adj EBIT up 24% to $133m in H1 - ahead of expectations.

Net debt still looks high, at $381m excl. leases, but that’s only 1.4x leverage it says.

Outlook -

“ the Board now expects a full year performance modestly above current market expectations

7 The current company compiled analyst consensus expectation for FY24 is for adjusted operating profit of $261.1m with a range of $256.3m-$266.5m

Paul’s view - looks quite interesting. I don’t like the balance sheet (debt, pensions, no NTAV), but it’s making nice profits, with decent margins, suggesting this is a good business with pricing power. Worth you checking out in more detail I’d say.

Summaries

Volex (LON:VLX) - 355p (pre-market) £644m - Trading Update (AGM) - Paul - GREEN

Reassuring, in line update. I remain bullish on this share, which seems undervalued, given the excellent track record.

Gulf Marine Services(LON:GMS) (I hold) - up 12% to 19.1p (£204m) - Debt Update & Dividend Policy - Paul - GREEN

Good news today that agreement has been reached on refinancing its bank facilities, at a slightly cheaper rate. A resumption of divis is also announced, with an intention to pay out 20-30% of future earnings, giving a c.4-5% yield, covered multiple times. It's all coming together nicely here, with impressive deleveraging being the key bull point, from large cash generation. Overhang from Seafox is an irritant, but has provided a good buying opportunity in my view.

Robert Walters (LON:RWA) - up 4% to 383.8p (£278m) - 2024 Half-Year Results - Graham - AMBER/GREEN

These results were well-flagged with a recent trading update and investors will have been braced for poor figures. Cost reductions have helped to minimise losses and this should be even more important in H2, according to today’s outlook statement. My overall impression of RWA is positive but I wonder how long investors might have to wait for profits to recover to former levels.

PayPoint (LON:PAY) - up 2% to 706p (£512m) - Trading update - Graham - GREEN

News flow at PayPoint has been heavier than usual - an investment in Yodel, an investment in an “open banking” platform, and a new distribution channel for Love2shop gift vouchers. At the same time the company has been busy buying back its own shares, and continues to trade at a modest multiple of about 10x. I’m as optimistic as ever about this one.

Paul’s Section:

Gulf Marine Services (LON:GMS)

(I hold) - up 12% to 19.1p (£204m) - Debt Update & Dividend Policy - Paul - GREEN

Gulf Marine Services (GMS), a leading provider of self-propelled and self-elevating support vessels for the offshore oil, gas, and renewables sectors…

I recently flagged up the improving risk:reward due to rapid deleveraging at this company, here on 1/7/2024 - where a major shareholder (Seafox) dumped some shares at 17p, a 15% discount at the time, in a secondary placing. To me that seemed a good buying opportunity, but some other investors worried that a major shareholder operating in the same sector knows the company better than any of us, so we should see their selling as a warning. Time will tell which view is correct but for me, people sell for all sorts of reasons, but primarily because they want cash for something else. It doesn’t necessarily follow that they have lost confidence in the shares they’re selling - it might be the only source they have to raise cash for some other project or investment.

The crux with GMS is that it’s rapidly paying off debt, so will soon have very large dividend paying capacity.

Today’s news is excellent confirmation of the bull case in my view.

Refinancing of bank debt. This was never really in any doubt, as the debt has reduced down to normal levels, whereas it was previously distressed. Previous RNSs from GMS had flagged that it was expecting to refinance debt on normal terms, but it’s great to have that confirmation today.

Lenders - two existing banks, plus an additional one joining the consortium.

Term loan of $250m (5 years, paying 16% pa capital, then a 20% bullet at end of the term), plus $50m working capital facility. The repayments look comfortably affordable, based on GMS’s prodigious cashflow from operations.

Current net debt is $234m (was $267.3m at 31/12/2023, a $33.3m reduction in 7 months, demonstrating just how cash generative GMS currently is).

Finance costs - look to be reducing slightly. Currently 300bps + SOFR (5.33%) = 8.33% pa. New costs: EIBOR (more volatile, but currently c.5.0%) + 250bps = 7.5%.

Liquidity - it says this deal provides “surplus liquidity” for dividends and potentially buying more ships - although it sounds as if there still might be some restrictions on dividends -

“It allows us to lease or to acquire new vessels to fuel the topline, and removes most restrictions related to direct payment to shareholders, either via share buyback or via dividend payment.”

Dividend policy - GMS has not been in a position to pay divis for many years, due to excessive debt. They stopped in 2017.

With debt now rapidly falling (despite higher interest rates), a resumption in divis has been on the cards.

Today’s news -

“GMS Board has also approved a dividend policy dedicating 20%-30% of annual adjusted net profit towards distributions to shareholders in the forms of dividends and potentially share buyback provided all bank covenants are met and other plans permit.”

Panmure Liberum says this could be a 0.9p dividend for FY 12/2025, which is a 4.6% yield at the current share price of 19.6p.

It has $47.8m PAT forecast for FY 12/2025, so 20-30% means a range of possible divis from $9.56m to $14.34m. Divide those by 1,055m (fully diluted) share count, arrives at estimated divis of 0.9c to 1.36c, converting into sterling that becomes 0.70p to 1.06p (yield between 3.6% to 5.4%). Not bad, and bear in mind that would be a yield covered between c.3-5 times by earnings. So considerable potential to further increase divis.

Pulling this together, it confirms that GMS does indeed now have considerable dividend paying capacity. Although management also talk about wanting to increase the fleet size further, which would mean diverting funds into capex. Let’s hope they don’t repeat the mistake made in the past, of taking on far too much gearing, and buying more vessels at the top of the cycle! That’s the main risk here. Although I’ll let long-term shareholders worry about that. Personally I want to see a 50-100% potential upside from this share with a say 2-3 year timeframe, then I’ll happily bank the profit and move on. That strikes me as a reasonable possible outcome. As the debt is rapidly reducing, then valuation upside flows straight to equity.

The cashflow figures really are astonishing actually given the market cap - that’s the key thing to focus on. Maintenance capex is not large, as GMS’s fleet is relatively young.

I should add that on Mello recently I flagged up GMS shares, and said that the net debt should all be cleared by end 2026. My apologies, I must have jumbled up the figures, as that looks wrong. The latest broker forecast today show net debt at end 2026 as $65m (Zeus), and a higher figure from Liberum Panmure, but they include leases. So I think it would have cleared all the debt by end 2027, not 2026, sorry about that.

Current trading - it confirms is in line -

“GMS is also taking this opportunity to confirm it is maintaining its adjusted EBITDA guidance for the 12 months ending December 2024 in the range of USD 92 million to USD 100 million, as first announced on 28 February 2024. We are also working on revisiting our EBITDA guidance for 2025 towards year end.”

Net debt is currently $234m, so that’s 2.54x to 2.34x EBITDA, depending on which end of the $92-100m EBITDA range you use. It will continue falling in the rest of 2024 of course, with Zeus forecasting $212m net debt by end 2024, taking leverage down to just over 2x.

I’m not sure what they mean by “revisiting” 2025 guidance? Does that mean it’s going up, or down, or staying the same?

Institutions - I assume this bit below must refer to the recent partial disposal by Seafox (down from 28.5% to 23.7%), in a discounted secondary placing at 17p. If Seafox want out, which a lock-in of only 75 days from 30/6/2024 suggests to me it probably does want to sell more, maybe even all of its shares, then more institutional demand would be needed to clear them out. We’re not talking huge numbers though, with Seafox’s remaining stake being worth c.£50m. That’s a trifle for many institutions, so personally I’m not worried about an overhang of this fairly modest size. Strong fundamentals and high yield potential could see plenty of investors checking out the figures here.

“GMS continues to monitor the positive changes to its shareholders register. We welcome our new investors and are pleased to see institutions showing increasing interest, higher than we've been seeing in a while.”

Paul’s opinion - I see this news today positively. This share is all about cashflow & rapid debt reduction.

Refinancing the bank debt was a formality really, but still good to have that confirmed.

Similarly, having confirmation of dividends starting probably in 2025 is a positive. Although it sounds to me management are keen to grow the business, so larger investors will have to bang the table to demand divis I suspect, instead of a fresh buying spree of new vessels.

It seems to me that the share price is lagging behind reality - possibly due to the selling overhang from Seafox? As we’ve recently seen with Card Factory (LON:CARD) a persistent overhang can clear in the blink of an eye, and if you’re not already in, then a re-rating can be very quick. Hence why personally I don’t tend to worry too much about overhangs - they can be giving us a nice buying opportunity, if we’re prepared to see the upside deferred for an uncertain length of time.

Another bear point is that the balance sheet values might be inflated, and need a writedown? That makes no sense at all to me. Since GMS is generating EBITDA of c.$100m pa from those assets, why would we worry about their values?! Surely if anything they would be worth a premium to the relatively modest book values?

Anyway, it’s an obvious GREEN from me again. I see good upside, but Seafox might torpedo that temporarily with another disposal maybe? I’m happy to look through that issue, fundamentals are what matter longer term, and they’re very good here. Longer term, it stands to reason that strong demand for these vessels means more are likely to be built, and it has been a boom & bust sector in the past. Hence why I don’t want to own these shares forever, it’s more a re-rating opportunity than a permanent buy & hold, in my opinion.

Volex (LON:VLX)

355p (pre-market) £644m - Trading Update (AGM) - Paul - GREEN

Volex plc (AIM: VLX), the specialist integrated manufacturer of critical power and data transmission products, is pleased to report a trading update for the three months ended 30 June 2024, ahead of the Company's annual general meeting, being held at 2.00 pm today.

“Positive start to the new financial year”

“The Group's trading performance in the first quarter of FY2025 has remained in line with management's expectations with the positive momentum outlined at the Group's FY2024 results continuing into the new financial year.”

Organic revenue growth (constant currency) looks impressive at +9% (although I wonder how they account for hyperinflation in Turkey, currently 71%?)

Sectors - strong performances in electric vehicles (EVs) and data centres are mentioned.

Acquisition of Murat Ticaret is “trading well”.

Site expansions & capex to increase capacity in Mexico, Indonesia, India, and Turkey.

Reshoring by customers is helping Volex (localising supply chains to reduce risk).

Outlook - also sounds in line, although simpler, more direct wording would have been better -

“The Group's encouraging performance in the first quarter, combined with the ongoing investment plans, improving market backdrop in key sectors and continued integration of Murat Ticaret, gives the Board confidence in Volex's ability to make further progress against its strategy during the year and deliver on its expectations.”

Paul’s opinion - I remain positive on this share, so it’s another GREEN.

It seems to me that VLX management have demonstrated they’re building an impressive group through well executed acquisitions. The financial track record looks superb to me. Yet shares remain relatively cheap, with a forward PER of only 12.7x. I think it deserves a re-rating up to maybe 15-20x, although we do have to take into account debt.

Volex got through multiple, serious macro problems (pandemic, supply chain, energy crisis) with barely a glancing blow. To me this proves that this is a decent business. I see good upside on this share, as macro conditions improve, providing nothing goes wrong.

Graham’s Section:

Robert Walters (LON:RWA)

Up 4% to 383.8p (£278m) - 2024 Half-Year Results - Graham - AMBER/GREEN

After all my work on SThree (LON:STEM) recently, I’ve been eager to cover some more recruitment companies, to give a more rounded view of the sector.

Here is the H1 results table from international recruiter Robert Walters:

SThree’s recent H1 results showed like-for-like net fees down by 7%. It was argued that this was a good performance in the circumstances, and I guess the 14% drop at Robert Walters serves to highlight this. As Paul noted last month, large recruiters have all announced large drops in fee income.

More damaging is the evaporation of operating profits at Robert Walters, and the slide into a pre-tax loss.

Note that 66% of fees at this company are from Permanent recruitment (not Contract), meaning that it is far more vulnerable to changes in overall hiring activity than the likes of SThree where only 16% of net fees are from Permanent recruitment.

Robert Walters describes what has happened as “the rebasing in hiring market conditions relative to the post-pandemic peak”. Hopefully it has reached a bottom, or it will soon?

Headcount is down 15% year-on-year, and £2m of redundancy costs are included in operating costs. Kudos to the company for not adjusting these out of the results.

Net cash of £49m should provide a sturdy foundation for the year ahead.

CEO comment:

"During the first half, the business continued to experience challenging hiring market conditions. This reflects the sustained period of lower client and candidate confidence impacting the sector since hiring markets reached their most recent peak in the second quarter of 2022. This had a marked impact on our financial performance during the first half.

Our near-term planning assumes that any material improvement in confidence levels will be gradual, and likely not occur before 2025, however 2024 is not a lost year. We are implementing the key elements of our medium-term plan to further strengthen the business…

Geographic segments: Asia-Pac is the biggest geographic segment (42% of net fee income) and it performed a little better than the group as a whole, with net fee income down 13% at constant currencies.

The segment that stands out is unfortunately the UK, where net fee income fell 18%. Conditions were particularly soft outside London, where professional recruitment fee income fell 25%.

Outlook: highlights progress on cost reduction to offset the reduction in fee income. There has been no change in trading since the Q2 update a few weeks ago.

Graham’s view

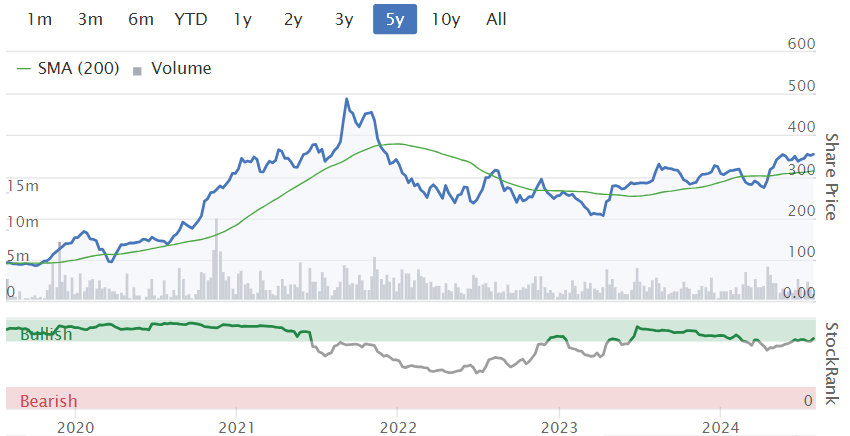

I’m surprised that the share price hasn’t fallen by more over the past two years, as trading has deteriorated:

Perhaps this is a case of markets being highly efficient, and investors correctly pricing in a recovery in profitability.

In the boom years pre- and post-Covid, Robert Walters was highly profitable indeed:

As noted above, the company doesn’t adjust out redundancies from its operating costs, so there will be an instant albeit small boost to its profits when it doesn’t need to further reduce headcount.

The cash balance is another attractive feature that should give it the flexibility to wait until conditions improve and invest in growth opportunities as they arise.

The operational leverage at play here is intense right now with £166.1m of net fee income offset by £165.9m of opex in H1. Small improvements in revenues and small cost reductions would immediately lead to large improvements in profitability.

My overall impression is positive, however I’m not sure that I can go fully GREEN on this one, as it seems to me that the £229m enterprise value (market cap minus cash) is already pricing in a recovery. While I do think that a recovery is more likely than not, and that investors should do well when that happens, some patience may be required. Time is money, and being early is the same thing as being wrong - apply whichever cliché you prefer!

As the timing of the recovery remains uncertain, I’m more comfortable with AMBER/GREEN here.

PayPoint (LON:PAY)

Up 2% to 706p (£512m) - Trading update - Graham - GREEN

This is a Q1 update to June 2024. PayPoint’s year-end is in March.

Revenue is up 9.5% to £39.2m.

Paypoint’s acquisition of Appreciate (now Love2shop) was more than a year ago and it hasn’t artificially boosted these % growth figures..

Checking each division in turn:

Shopping (largest division): net revenue up 3.8% to £16.4m. This division includes PayPoint’s flagship product, the PayPoint One shopping terminal.

Payments and Banking (second largest division): net revenue down 1.6% to £12.2m. This includes the legacy energy payments business, down 15.6%.

Love2shop: net revenue up 23% to £6.4m. The acquisition has gone well with highstreetvouchers.com performing ahead of expectations. Love2shop will soon be distributed in grocers and high street stores for the first time. This division also includes Park Christmas Savings where the news also sounds positive..

Ecommerce: net revenue up 75% to £4.2m. Excellent growth by Collect+. PayPoint has made a strategic investment into delivery company Yodel, alongside other partners. Yodel is a key user of Collect+.

Investment in obconnect: a separate RNS outlines this £10.5m investment, increasing PayPoint’s stake in the business to 59.3%. A put option has been granted, which I think means that the other shareholders have the option to sell out to PayPoint, if they wish. They will get paid up to £20m, depending on the future performance of Obconnect, and PayPoint will own up to 100% of Obconnect if this option is fully exercised.

Comment on the significance of obconnect:

This investment and partnership with obconnect have enabled PayPoint to leverage this technology platform and range of capabilities, offering Open Banking services to both new and existing clients. At a time when the number of applications for Open Banking is growing rapidly, this technology has been an important addition for PayPoint and its clients… obconnect as a standalone business has made significant progress, securing contracts with a number of banks and building societies, winning industry recognition at the Open Banking Expo Awards and is on track to achieve profitability in H2 2024.

CEO summary of the Q1 performance:

The strategic investments we have made in Yodel and obconnect, along with an expanded partnership with Incomm in Love2shop, underpin our confidence in a number of our key new opportunity building blocks, adding further momentum to meeting expectations for the current financial year and achieving our medium-term targets.

Net debt is £81m, a significant figure but PayPoint has been very cash generative over the years and I don’t blame it for using its cash flow in a variety of ways - both returning cash to shareholders, and making investments and acquisitions for the future..

Dividends are being increased “at a nominal rate” as the company seeks to grow dividend cover to over 2x by 2027, i.e. for less than half of EPS to be paid out in the form of dividends. In the meantime, excess cash can also be returned in the form of buybacks and a £20m buyback is underway.

The target leverage multiple is about 1x (net debt/EBITDA). For most companies this would be considered a conservative level of debt.

Graham’s view

I’ve been a fan of PayPoint for a long time, so there is absolutely no reason to change my view today.

The stock has traditionally been seen as an ex-growth financial utility. However, its ability to generate cash flow has always been excellent and I think recent results show that it has invested its cash well, and has found some avenues for growth in this way.

The share price has perked up:

But it still barely makes a PER of 10x.

The StockRank is an excellent 92, with Quality being the most important factor rather than Value.

The Appreciate/Love2shop acquisition is turning out better than I hoped it would (it wasn’t clear to me what the synergies and plans were). PayPoint is turning it into a nice standalone growth story.

Collect+ continues to go from strength to strength, while the company’s activities in Open Banking add another modern twist to an old company.

What’s not to like here? The debt position is unusual for a company that traditionally had net cash, but after-tax net income of over £50m is forecast this year. Perhaps it has earned the right to carry some debt after so many years of good profitability and cash flow?

PayPoint satisfies the requirements of my favourite checklist, the Greenblatt Magic Formula, and is on my best ideas list for 2024. We need to find some bears on this stock, to add some balance!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.