Good morning from Paul & Graham!

We've run out of time for today. I might circle back to some of the other companies reporting today, with short comments tomorrow possibly.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

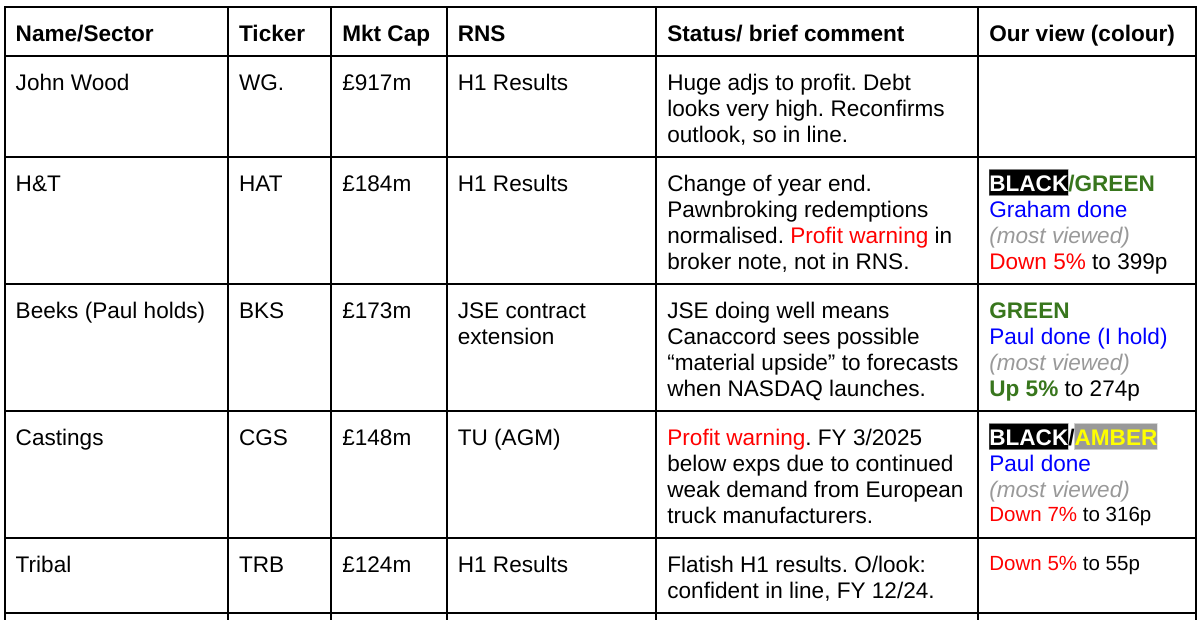

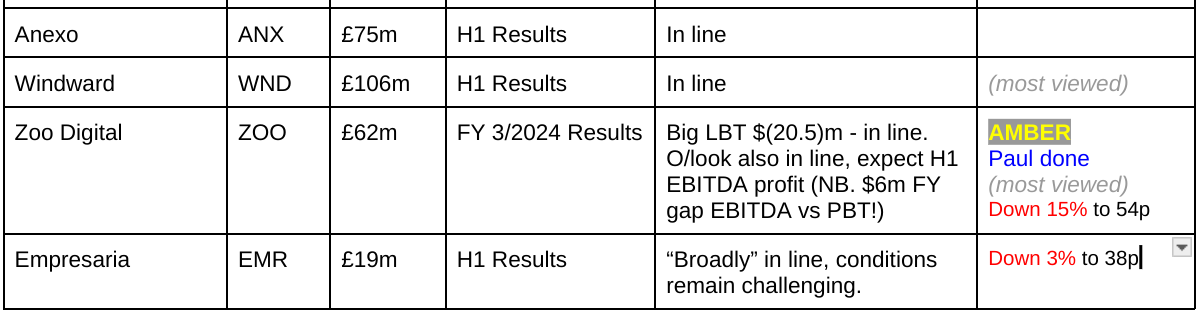

Companies Reporting

Summaries

Beeks Financial Cloud (LON:BKS) (Paul holds) - 260p (pre-market) £173m - Extension of JSE contract - Paul (I hold) - GREEN

More food for the bulls this morning, with the large Johannesburg Stock Exchange contract once again being extended to a second data centre location (for backup/security I think). No financial details are given. Canaccord flags that if NASDAQ launch goes well there could be "material upside" to forecasts. I remain very bullish, but as the price rises it becomes more difficult to value the shares, and there's bound to be some profit-taking at some stage.

Castings (LON:CGS) - down 5% to 322p (£141m) - AGM Trading Update [profit warning] - Paul - BLACK / AMBER

Continued soft demand means a fairly hefty 32% reduction in forecast profit for FY 3/2025, which can't be ignored. Hence I'm dropping a notch from Graham's amber/green on the last profit warning in June. Shares have fallen a fair bit before today, but don't look good value yet. That could change if trading improves, so it depends on your view of where we are in the earnings cycle. For now, I'm sitting on the fence because forecast earnings have now more than halved this year, which is a lot! Superb balance sheet is a considerable comfort.

H & T (LON:HAT) - down 4% to 402.4p (£177m) - Interim Results - Graham - BLACK/GREEN

I’m a little frustrated with H&T today for two reasons. Firstly, their house broker has cut EPS forecasts by 10%+ but there is no acknowledgement of reduced forecasts or a profit warning in today’s RNS. Secondly, they are changing their accounting reference date which is something I almost never welcome but H&T says it is needed to address increased seasonality. Despite these annoyances, I still like the stock at a PER of about 7x and with medium-term prospects which I still regard as very good.

Zoo Digital (LON:ZOO) - down 10% to 56.5p (£56m) - FY 3/2024 Results - Paul - AMBER

Terrible results for FY 3/2024, but as expected, due to the Hollywood strikes. Outlook comments strike me as lacklustre. Cash looks adequate, and going concern is clean. Recovery could take longer than expected, as the broker points out long lead times. Personally I don't see any attraction at all, it's just a punt on hoped-for industry recovery. Forecast is only for breakeven in FY 3/2025 - I point out below why EBITDA figures are nonsense here.

Paul’s Section:

Zoo Digital (LON:ZOO)

Down 10% to 56.5p (£56m) - FY 3/2024 Results - Paul - AMBER

ZOO Digital Group plc (AIM: ZOO), the leading provider of end-to-end ("E2E") cloud-based localisation and media services to the global entertainment industry, today announces its audited financial results for the year ended 31 March 2024.

Diabolical numbers for FY 3/2024, as expected, since this period was greatly disrupted by the Hollywood strikes.

Revenue down 55% to $40.6m

Massive loss before tax of $20.5m, versus a LY PBT of $7.9m.

Net cash fell from $11.8m at 3/2023 to $5.3m at 3/2024. However, that includes the disappearance of $15.5m equity raised during the year supposedly for an acquisition (that hasn’t happened, sorry it’s “postponed”). Instead all that cash (and more) has been squandered on operating losses. Why didn’t they slash their overheads when the strikes started? That’s what good management does in a downturn - act quickly to slash costs. Instead this lot burned through their cash pile before belatedly cutting costs once the cash looked like it was running out. This is why I flagged it as AMBER/RED back on 28/3/2024, as at that point in time the risk of cash running out looked high, although there were also some early signs of trading improving after the strikes ended.

Graham took a fresh look on 13/5/2024, where he shifted up a notch to AMBER, because the news had improved - bank facility extended for another year, giving more cash headroom, and broker upgraded EBITDA forecasts. Strong Q1 and good visibility. So when the facts change, we reflect that - which to clarify yet again for any slow learners, is what our colour-coding is all about - it’s a snapshot view on that specific day, of the facts, figures, and forecasts. It’s not a prediction of what is going to happen in the future. So when the facts, figures & forecasts improve, we up our view, and vice versa.

Anyway, back to today’s FY 3/2024 accounts, they’re awful, but in line with expectations, so no surprises on the enormous loss and cash burn.

Let's move on to the outlook comments, some excerpts here -

“Most recently, in Q1 2025, our order book expanded by 35% over the prior quarter as work delayed from 2023 was eventually completed and we were profitable at EBITDA level as the improvement in revenue coupled with the cost reductions implemented in FY24 came through. With a stronger year-end cash position than previous market expectations combined with its renewed debt facilities, the Company has sufficient working capital for FY25.”

Full year guidance sounds in line -

“Our major customers have not yet provided full order schedules for Q3 onwards; however, the Board expects further revenue growth and an EBITDA profit in H1 2025, putting us on track to meet market guidance for the full year.”

Further detail is given in the bullet points below, which sound lacklustre to me (reminder: $6m EBITDA is PBT of zero) -

Broker forecasts - many thanks to Singers for its FY 3/2025 estimates, which are a 50% recovery in revenues to $60m, $6.5m adj EBITDA, and adj PBT of err, nothing! Or rather a $(0.1)m loss.

The company reckons industry recovery should mean further improvements, which is vital to justify anything near the current market cap of £56m.

I don’t have any particular view on whether or not ZOO will be able to move into sustainable profits or not, that’s up to you to predict.

The broker reckons that AI isn’t a threat. Again that’s up to you to have a think about, but personally I would have thought that as language models get better & better, it’s bound to have some impact, but I have no idea how much. Why get involved in a share where you have to make that type of guess about the future?

Going concern - is clean, saying that the $3m invoice discounting facility (to 31/8/2025) gives enough cash headroom, and that they could take mitigating actions if necessary if trading disappoints. Let’s hope they act much more quickly than last time.

Balance sheet - what they call “borrowings” are actually lease liabilities, see note 7. A presentational own-goal there, which I think we’ve mentioned before.

NAV is $27.7m, including $15.1m intangibles, and $3.1m in “equity accounted investments”, which I’m inclined to write off leaving NTAV of $9.5m - not a great deal.

It’s worth noting from the reserves part of the balance sheet (that records numbers since the company first started), where shareholders have injected $72m in share capital, and the company has burned through almost all of it, with retained losses of $67m. This reminds us that ZOO has not yet established itself as a reliably profitable business. Although this should mean it won’t be paying corporation tax for some time if it does move into profit in future.

Cashflow statement - is obviously awful for FY 3/2024, due to the industry effectively being partially shut down due to the strikes.

Some numbers to note - it capitalised $2.7m of development spending, which renders EBITDA meaningless of course.

There was also $2.2m of physical capex, a reminder that to do what it does, ZOO needs a fair bit of kit which isn’t cheap. Again, making EBITDA a nonsense number.

The equity raise of $15.0m net of costs saved the day, and without that, I think ZOO would have gone bust.

Paul’s opinion - I have no idea why some investors get so excited about this share. It just strikes me as very ordinary. The only decent profit it has ever made was in FY 3/2023 when streaming services were spending big on international expansion. We can’t blame ZOO for the collapse of profitability in FY 3/2024, as the Hollywood strikes caused that.

However, even with the forecast 50% recovery in revenues this year FY 3/2025, it only gets ZOO back to breakeven at PBT.

To get to a market cap of £56m, you’re guessing that performance will improve strongly beyond the recovery already factored in this year. Management say they can get back to previous peak profits - which if achieved, would probably make this share double or triple. That's the bull case.

With rather lacklustre outlook comments, it seems to me that ZOO is struggling to gain traction, and as Singers points out, the recovery timescales for new films from being written and produced, to requiring ZOO’s services, is long.

It wouldn’t surprise me if ZOO warns again on profit in Q3 or Q4. Cash could get tight by then if a more convincing recovery hasn’t started.

So for me, risk:reward is not at all attractive at this stage, and I see this share as a complete punt.

Good luck to holders, but for a £56m market cap you can get much better quality companies with dependable, consistent performance, and decent divis. So why get involved in this, where you’re hoping for a recovery to happen before it runs out of cash?

That said, management talk a good story in the commentary today, and if you believe it’s likely to pan out as bullishly as they suggest, then this share could do well.

I’ll go with AMBER, because I don’t know what the future holds, but I remain sceptical about ZOO, so am happy to sit on the sidelines. Good luck to holders, let’s hope the facts improve and you do well on the shares.

Castings (LON:CGS)

Down 5% to 322p (£141m) - AGM Trading Update [profit warning] - Paul - BLACK / AMBER

Castings PLC ("Castings" or "the company"), the leading iron casting and machining group primarily focused on the European heavy truck market, announces a trading update..

This year is FY 3/2025.

Profit warning - an admirably clear explanation of what’s gone wrong, but what’s missing is quantifying how much of a profit miss this is likely to be -

“We previously reported in June that demand from our commercial vehicle customers (80% of group revenue) was at a lower level, relative to the elevated demand in the year ended 31 March 2024, with the potential for a slight increase in the autumn.

Demand has remained at lower levels and our customers have now indicated that there is unlikely to be any improvement before at least early 2025. The OEMs are citing caution in the end customer buying decisions, particularly in Europe. In the light of this, the result for the full year to 31 March 2025 is anticipated to be below market expectations.”

Broker updates - both Zeus and Canaccord have issued updates, thanks to them for sharing these with us via Research Tree, which I find very helpful.

This is a hefty miss, with Zeus lowering FY 3/2025 forecast adj PBT by 32% to £10.1m = 17.3p adj EPS = PER 18.6x (hardly a bargain).

The City seems to use EV/EBITDA multiples for valuation purposes these days, so in this case forecast adj EBITDA is down 20% to £18.3m. Forecast EV I will calculate as today’s mkt cap £141m minus forecast y/end net cash of £18.7m = EV 122.3m

So I make EV/EBITDA 6.7x - a fairly modest level, but possibly in the right ballpark for an ex-growth business that is overly dependent on one specific sector (with question marks over the longevity of its market for diesel truck engines).

Vvaluation depends on whether future earnings might recover. This share would look cheaper if an operationally geared recovery were to happen in FY 3/2026.

It’s quite tricky to know what the settled level of profitability is likely to be, as we’ve had so much disruption over the last 4 years from pandemic, stocking up, destocking, energy crisis, supply chain issues, etc.

Balance sheet - CGS has a strikingly strong balance sheet, with NTAV of £134m at 3/2024. I feel that my EV calculation above doesn’t fully capture the surplus capital on the balance sheet by just including forecast cash.

Paul’s opinion - Graham eased us down a notch from green to amber/green with his review on 12/6/2024, when soft demand was mentioned, and forecasts were reduced. With forecasts sharply reduced again today, likely performance for FY 3/2025 is now less than half the EPS that was originally forecast.

So the key question is to what extent do you expect earnings to recover next year & beyond? It needs a recovery in earnings to justify a higher share price, as the valuation is not cheap on a PER of 18.6x the current year’s forecast earnings. Divis are likely to be cut I imagine.

On the basis of the above, I would normally be inclined to go down another notch to amber. However in this case the balance sheet is so strong, and the long-term track record is impressive, plus some recovery in earnings next year seems likely, that I was minded to stick at amber/green.

Shares had already sold off a fair bit before today, and a modest 5% share price fall today on a 32% forecast PBT reduction, suggests that shareholders here are not easily spooked. Or maybe sellers can’t sell, given the lack of liquidity in this tightly held share?

I don’t feel at all motivated to buy any of these shares myself, so maybe I should be amber after all, given the steep fall in forecasts this year, and that we don’t know if/when a recovery will happen. Yes, I think I’ve made up my mind, to reduce a notch to AMBER - which is not bad remember - it’s just saying I’m not sure what will happen next, and I can’t ignore another 32% drop in forecast earnings. The fall in shares of only 5% today is a clear mismatch with that 32% forecast fall, so I feel that a better buying price would be something nearer 250p than the current 322p. The difference of 72p is people factoring in a future earnings recovery, but personally I'm not keen on being asked to pay up-front for that.

Shares haven't gone anywhere in the last 10 years, but it has paid decent divis over that period - which was great in a 0% interest rate environment. But now you can earn close to 5% on cash, why get involved with shares in ex-growth companies paying a similar dividend yield? Things have changed.

Beeks Financial Cloud (LON:BKS) (Paul holds)

260p (pre-market) £173m - Extension of JSE contract - Paul (I hold) - GREEN

Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce that the Johannesburg Stock Exchange (JSE) has signed a further significant contract extension for the provision of Beeks' Exchange Cloud, to a second data centre location. The multi-year contract extension further supports the Board's confidence in its financial expectations…

It’s encouraging to hear this important, large contract with the Johannesburg Stock Exchange is going well, and has been extended again (in terms of scope, rather than duration).

It’s good to get third-party comments, this is from the JSE itself -

“Tebalo Tsoaeli, Chief Innovation Officer at the JSE, commented: "Since the launch of Colo 2.0 in September 2023, JSE has seen significant adoption of the Colo 2.0 service by customers, demonstrating a clear demand for the product offering. This has resulted in additional demand for a secondary solution aimed at addressing the redundancy and Disaster Recovery requirements of existing customers. Through our partnership with Beeks and IPC, JSE seeks to power a truly cloud-based marketplace infrastructure that is modern, hyper-scalable, ultra-resilient, highly performant, and accessible to all market participants."

Beeks comments once again mention that more exchange deals are in the pipeline, so I think we’re likely to have continuing exciting newsflow from Beeks for some time to come (which is necessary, to back up the strongly rising share price) -

“Gordon McArthur, CEO at Beeks, commented: "We are delighted to announce this further expansion with the JSE to meet the growing demand for the Colo 2.0 service from the JSE's customers. Exchange Cloud continues to be a unique offering in the market, and the success of the solution at the JSE is supporting our discussions with other global exchanges, underpinning our confidence in continued momentum."

Paul’s opinion - given that JSE is clearly going very well, and NASDAQ is the next project to start, having just achieved regulatory approval, Beeks is clearly on a roll.

Thanks to Canaccord for a brief note this morning which has one line which caught my eye in particular, saying that successful implementation and customer uptake of the new, large contract (which is NASDAQ, but can’t be disclosed due to an NDA),

“could create material upside to our forecasts”.

My view remains that BKS is a very exciting situation, but it’s difficult to value the shares right now. There are bound to be bouts of profit taking along the way. Personally there’s no way I’m selling, as the NASDAQ contract could (pretty obviously!) be a monster, if there’s big customer uptake of the service. The fact that much smaller JSE is clearly working well, and has been extended twice now further reinforces my confidence that the upside potential here is not a moonshot, but actually seems quite likely - providing nothing unforeseen goes wrong.

We’re also reminded today that there are advanced discussions with other exchanges globally too. Another reason to sit tight I think.

The bear case is basically that it’s overpriced, and that cashflow has been unimpressive. It’s up to you which side of the fence you’re more comfortable on!

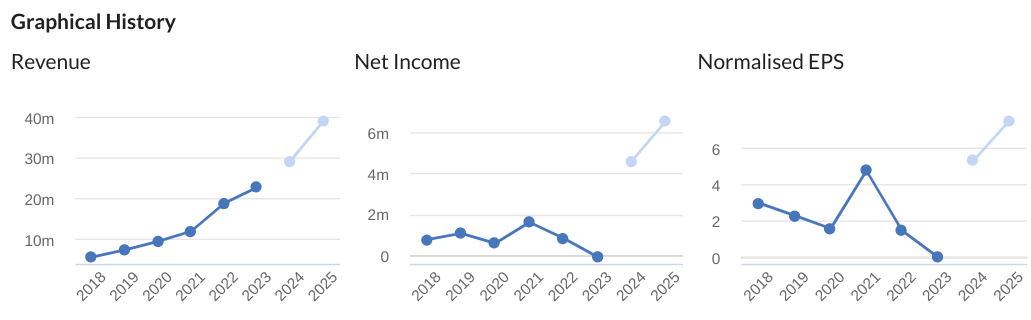

Here's the BKS chart since it listed in late 2017 -

Look at the progress that has been made on fundamentals though, and I would argue it was overpriced between 2017 and 2023, and is now actually quite reasonably priced in comparison, since highly impressive compound growth has been achieved, with a lot more to come now the NASDAQ contract is limbering up for implementation - which isn't in the forecasts yet remember, so expect serious upgrades if that goes ahead without a hitch -

Graham’s Section:

H & T (LON:HAT)

Down 4% to 402.4p (£177m) - Interim Results - Graham - BLACK/ GREEN

We covered the H1 trading update here in July, when high redemptions (i.e. customers ending their loans quickly, to get their items back) were the hot topic.

Today we have confirmation that redemptions are back to normal, “albeit later than anticipated”.

As a reminder, the pawnbroking pledge book here has a capital value (excluding accrued interest etc.) of £105m, by far the largest in the industry. This capital value is up since December 2023, but that’s with the help of an acquisition. Excluding the acquisition, the capital value of the pledge book would be slightly lower than it was six months previously.

The boom period in pawnbroking may be on hiatus, perhaps to return again before too long?

Estimates: the house broker Shore Capital has published a research note today, in which they reduce all of their EPS estimates (for 2024, 2025 and 2026) by 10%+. This is attributed to the “increased seasonality” in pawnbroking.

We therefore have an effective profit warning, but you have to read the broker note to see it! There is no profit warning in H&T’s RNS today.

Change in accounting reference date: this is never something I look forward to.

Following consultation with a number of shareholders and after careful consideration, the Board has made the decision to change the Group's financial year end from 31 December to 30 September with effect from September 2025. This will result in financial performance being more evenly spread across the two half year reporting periods.

Changing the accounting reference date creates complexity for historical analysis, makes a mess of financial statements during the transition period, and what does it really accomplish?

H&T says that financial performance will be more evenly spread across the two halves, but the split wasn’t too uneven last year. I guess that seasonality has become more pronounced in 2024.

The most worrying aspect of a change in accounting reference date is the suspicion that it’s being done because the regular results aren’t too inspiring, and the confusion caused by the change suits the company.

However, I normally associate that tactic with junk companies, not with reputable firms like H&T! So I can only assume that the motivation for this change is legitimate and is purely to do with increased seasonality.

Let’s get back to today’s results and highlight some of the key points.

H1 PBT £9.9m (no adjustments), up 12.5%.

Diluted EPS 17.7p, up 8.6%.

Interim dividend: 7p (last year: 6.5p).

Maxcroft acquisition: H&T acquired a “posh” pawnbroker earlier this year. Its integration is “proceeding as planned, with valuable insights being applied in other stores”.

CEO comment (emphasis added):

"I am pleased to report that we have continued to make positive progress in the first half of 2024.

Our core pawnbroking business continues to attract increasing numbers of new and returning customers, for whom alternative sources of small sum regulated lending are much constrained. Retail sales have also been encouraging, with margins on all product categories improving in the second quarter and expected to further improve through the remainder of 2024. This performance has been supported by growing demand for our foreign currency service and improved margins on over-the-counter gold purchase.

Maxcroft has performed well since the acquisition in February. We have begun to apply our learnings from their foreign currency business to selected H&T stores, and we have seen an increase in footfall and sales as a result.

Readers may remember that there was volatility in the 2nd-hand watch market last year. Thankfully, that problem seems to have gone away as prices have stabilised. The issue is mentioned today with an acknowledgement that H&T reduced its exposure to watches last year. However, with the volatility of watch prices having “abated”, they are now ready “to cautiously increase activity in this asset class once again”.

Compared to other items, watches are associated with larger loans to customers and lower redemption rates (i.e. H&T are left in possession of watches more often than they are left holding other customer items). So it’s a tricky asset class. Fortunately, H&T are the experts as they own Swiss Time Services, “the UK’s largest independent watch servicing centre”.

Here’s an interesting YouTube video published recently by a watch collector, discussing the H&T offering - link.

Net debt has increased since Dec 2023, from £32m to £49m. The Maxcroft acquisition (£11m price tag) occurred during this period. I generally like it when H&T’s net debt increases, because it means that they are growing!

Outlook - very confident in the medium term. They remain interested in opening new stores, in refreshing existing stores (50 store refreshes per annum), and in acquiring stores from independent operators. 8 to 12 new stores to be added in 2024. I’m comfortable with that rate of expansion.

In pawnbroking, they want to target business owners who can pledge valuable personal assets for business purposes. The Maxcroft acquisition makes sense in terms of making a quick start in this strategy.

In costs, payroll is the major expense and the minimum wage is a key factor. We’ve discussed this before in relation to Ramsdens Holdings (LON:RFX).

I would have appreciated it if the company had acknowledged in today’s outlook statement that they needed to reduce forecasts, instead of leaving it up to the brokers to reveal that.

Graham’s view

As usual, there are a lot of moving parts here, and macro-economic forces at play. Foreign travel boosts FX revenues. The gold price boosts (or hurts) scrappage prices. The (shortage of) supply of alternative credit boosts demand for pawnbroking loans. Minimum wage determines payroll costs. Et cetera, et cetera.

The investment thesis here is ultimately unchanged: this business has been around since 1897 and despite the occasional hiccup, it continues to go from strength to strength.

In exchange for some macro risks and perhaps some day in the future, some regulatory risks, you get a PER of 7x and a nice dividend yield:

The company has sometimes struggled to generate an attractive ROE/ROCE, but it is doing pretty well on that front now:

Putting it all together, I continue to think that H&T holds many attractions for investors, with very little to dislike. At a PER of 7x, I suspect that the prospects are good from here. But I must admit that I’m a little frustrated by the manner in which the cuts to EPS forecasts were revealed, and I never like to see a change of accounting reference date. So today’s results have left a bad aftertaste.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.