Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

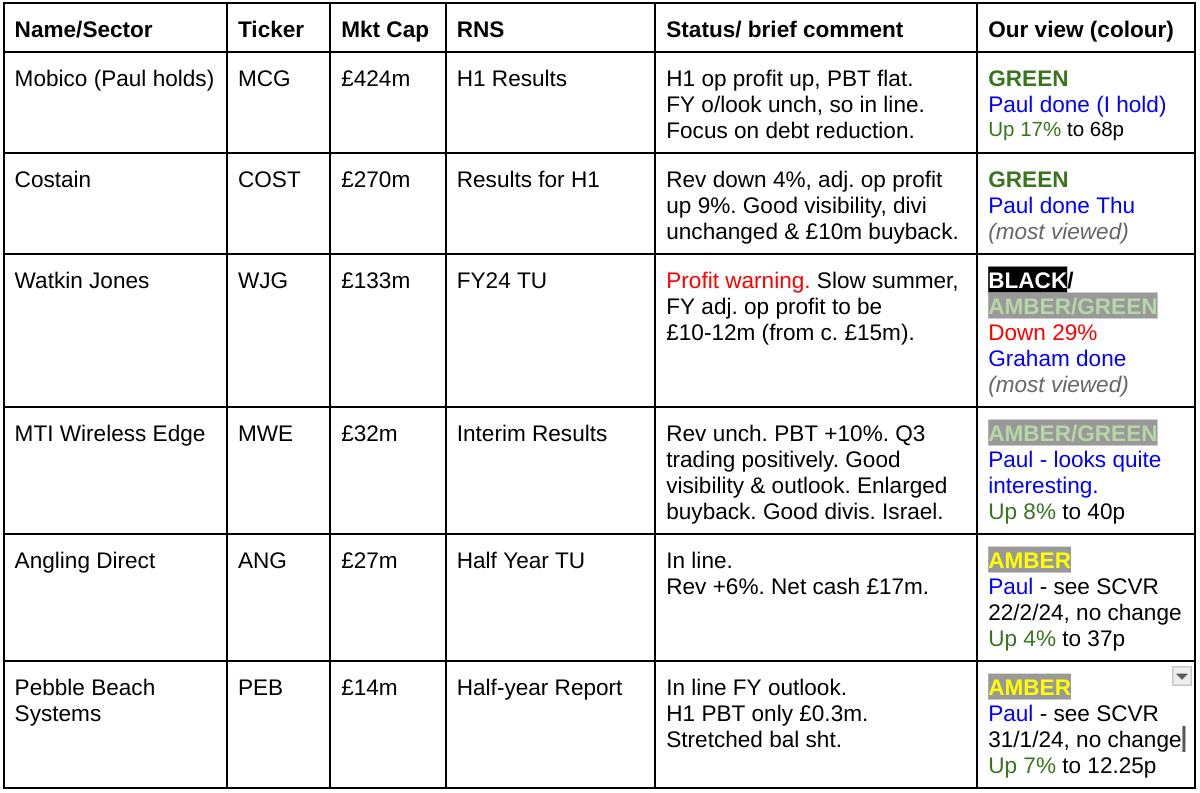

Companies Reporting

Summaries

Watkin Jones (LON:WJG) - down 29% to 36p (£93m) - FY24 Trading Update - Graham - BLACK/ AMBER/GREEN

Another profit warning from this developer of rental and student accommodation. It’s disappointing to see uncertainty around interest rate cuts being blamed for a failure to do deals, as interest rate hikes were previously seen as a problem. A reminder to all of us that this is a difficult sector. I like to keep things simple by taking a bullish stance when they trade at a deep discount to tangible NAV. WJG is back down at a discount so I’m happy with AMBER/GREEN.

Windward (LON:WNWD) - down 2% to 118p (£104m) - Half Year Report - Paul - AMBER

An interesting growth share, but tricky to value right now, as it's still loss-making. Seems to be moving in the right direction, with strong growth in recurring revenues. Cash adequate, but balance sheet overall is quite weak, and could benefit from a small top up placing I think - not a deal-breaker. I'm keeping an eye on this one, it does look intriguing, although comes with Israel risk.

Anexo (LON:ANX) - down 2% to 62.5p (£74m) - Interim Results - Paul - RED

No progress made in H1 to collect in the ludicrous giant receivables pile. This looks an almost exact re-run of the disastrous Accident Exchange & Quindell, which ended in tears. Although better borrowing facilities have been set up. A deeply flawed business model, don't be fooled by the low PER, it's cash collection that matters, and it's hopeless.

Mobico (LON:MCG) (Paul holds) - up 17% to 67.5p (£417m) - H1 Results [in line] - Paul - GREEN

I take a deep dive into H1 results from this international bus/coach operator. I think it looks good, and with debt reduction now a priority, equity could re-rate. Trading is in line, breaking a trend of reduced forecasts.

Paul's Section:

Mobico (LON:MCG) (Paul holds)

Up 17% to 67.5p (£417m) - H1 Results [in line] - Paul - GREEN

This is an international group of public transport companies, mostly buses & coaches, plus rail operations in Germany.

Presentation slides for H1 results are on Mobico’s website here - well worth looking at, for a user-friendly overview.

This slide below shows the revenue/profit by division. As you can see, ALSA (the leading bus company in Spain) is the jewel in the crown for profitability, putting in a barn-storming result this year so far, and the divisional outlook for ALSA is also good -

“We expect momentum across the business to continue in H2 24”

N.America is profitable too, but at a lower margin.

Whilst UK & Germany are problems - loss-making in H1. I wonder if Germany is worth keeping at all? It might make sense to dispose of that division, if it can’t be turned into a profit-maker again. It seems a highly regulated, and generally problematic division (eg driver shortages).

The US school bus division is up for sale, in order to reduce debt, but I can’t find any reference to how much might be raised from selling this part of the group. Let us know in the comments if you have any details on that.

No broker notes are available for guidance.

The financial highlights table below helpfully provides both adjusted and statutory H1 results, and obviously the large net debt is a big issue here, with de-gearing being prioritised by management -

Adjusted H1 PBT is unchanged at £25.4m, yet adj EPS has fallen from 1.0p to only 0.3p

The interim divi has been passed - which makes sense given the priority is debt reduction.

Outlook is reassuring -

“Based on current market conditions, Mobico remains on track for Adjusted Operating Profit for 2024 to be within the range of £185m to £205m, with improvement in covenant gearing, relative to FY 23, expected at 31 December 2024.”

However note that the commentary also says finance costs are expected to rise to £90m for FY 12/2024, consuming nearly half of that operating profit, leaving adj PBT of c.£105m for this full year - implying a heavy H2 weighting to profitability.

The trend of broker consensus forecasts has been poor, so seeing things stabilise with today’s in line outlook is encouraging.

The slide deck indicates that cost & efficiency actions are underway to improve the under-performing parts of the group.

Net debt - it’s the covenant debt that is the key number, and it’s big at £988m - over double the market cap, hence why the PER is so low at forecast 4.9x

Structure of the debt is good I think - loads of liquidity available, with £600m RCFs undrawn, and the bulk of the debt in use being bonds (secure, and long-dated) -

Note that some of the bonds were refinanced on very good terms (4.875% coupon, Euros) in Sept 2023 - see RNS here. This is how they have traded since issue, as you can see very close to par currently, hence no sign of financial distress here -

(Thanks to Frankfurt Boerse for this chart)

Debt reduction - this all sounds sensible -

“Mobico has made clear its commitment to debt and leverage reduction. Whilst we are able to achieve that through the growth of Adjusted EBITDA and Free Cash Flow, targeting net debt / covenant Adjusted EBITDA of 1.5x to 2.0x by FY 27; we have also made clear that accelerated solutions are preferred to reduce debt levels. As such, the Group confirms that the formal process to dispose of its North America School Bus business is underway. Furthermore, operational controls have been tightened over aged debt collection and capital expenditure appraisals, including an increased focus on asset-light transactions. “

As mentioned here before, I don’t see MCG’s debt as a crisis. It’s high, but maturities are long, and there’s loads of cash headroom. Although it’s getting a bit close to the covenant limits. That’s why an in line, unchanged FY 12/2024 profit outlook today is so important - as it means the covenants shouldn’t come under pressure from further profit falls -

“The Group maintains a disciplined approach to its financing and is committed to an investment grade credit rating. Our Moody's and Fitch ratings are Baa3 and BBB- respectively.

The Group has two key bank covenant tests; a <3.5x test for gearing and a >3.5x test for interest cover.

At 30 June 2024, covenant gearing was 2.8x (31 December 2023: 3.0x) and interest cover was 4.4x (31 December 2023: 5.2x).

At 30 June 2024, the Group had utilised £1.3 billion of debt capital and committed facilities, with an average maturity of 5.8 years.

At 30 June 2024, the Group's RCFs were undrawn and the Group had available a total of £0.8 billion in cash and undrawn committed facilities. The table below sets out the composition of these facilities.”

That’s loads of liquidity actually, and means MCG has been able to spend plenty of expansionary capex, eg this useful slide below on cashflow - note the heavy expansionary capex, which is not a business in financial trouble clearly - and remember these are only half year numbers, so it’s a lot of business for just a £417m market cap (plus the debt of course) -

Going concern statement - is clean.

Balance sheet - overall it’s lousy! NAV is £1,024m, including £1,567m intangible assets. Hence NTAV is horribly negative at £(543)m. That’s obviously wildly different to what I usually look for (positive NTAV, and net cash)!

But this is the reason why this share is so cheap, at only £417m market cap.

Equity could re-rate as debt reduces, especially if a decent price is achieved for the US school buses disposal - that’s our catalyst, I reckon.

Paul’s opinion (I hold) - I like MCG, and am encouraged that my decision to buy recently looks like a good move - there was an element of uncertainty, so I kept the position size small initially. I’m thinking about increasing it further now I have more up-to-date, and positive information.

It’s not a share I want to hold forever, I just took the view that it seemed to have fallen unreasonably low, and could be a good trading opportunity to make a turn on a re-rating and partial recovery in share price. A 100p price target feels about right to me to sell or top-slice, but that depends on the future newsflow and the US disposal. A favourable outcome there could keep me in for a longer term re-rating possibly.

A good rummage through today’s numbers confirms my view that this could be a good recovery share. Although maybe a deeper restructuring is needed, to clear out the stuff that isn’t worth owning (eg. German rail) and make a simpler, higher quality group with less debt, focused on ALSA, and further European expansion.

Debt is high, but not life-threatening.

So I’ll push the boat out here, and go with GREEN.

Obviously I’m biased since I own some myself, hence why we are required by Stockopedia to disclose our positions. Although we always try to be objective regardless of personal positions.

Company’s summary is nice and clear, I like this -

The long-term chart is striking. See how the pandemic starting in early 2020 clobbered things, but after the initial recovery bounce, shares have been in a seemingly relentless downward spiral. Note that the share count has risen, but not by a huge amount, from 513m to 613m shares. So theoretically, this share could multi-bag if they succeed in returning profitability to pre-pandemic levels. Maybe my personal price target should be more ambitious?!

Windward (LON:WNWD)

Down 2% to 118p (£104m) - Half Year Report - Paul - AMBER

Windward (LON: WNWD), a leading Maritime AI company, is pleased to announce its financial results for the six months ended 30 June 2024 ("HY 24").

Floated in Dec 2021 by Canaccord at 155p in Dec 2021 - admission document is here with 17m new shares, and 5.3m sale shares. The company received £22.5m in new funds from the IPO, and the total share count on admission was 81.6m.

Shares fell heavily, finding a bottom in 2023 c.37p. Since then, there’s been a strong recovery, with the price having roughly tripled to 118p currently.

It’s a nice story - an Israeli tech company that uses AI to monitor threats to shipping - very topical of course with the attacks on Red Sea shipping.

After it was flagged to us by readers, we’ve looked at WNWD here 3 times this year -

12/1/2024 - TU ahead exps, but still loss-making. Enough cash.

21/2/2024 - Could be an interesting trade for the adventurous.

27/3/2024 - In line TU.

H1 Results out yesterday, key points -

Strong revenue growth, up 37% to $17.6m in H1

ACV (which sounds similar to ARR) of $37.2m, so it sounds mainly recurring revenues.

EBITDA loss of $(1.3)m, reduced 66% from previous year’s H1 - so still loss-making, even at EBITDA (flattering) measure.

Loss before tax in H1 was $(4.0)m (H1 LY: $(5.7)m loss) - so it’s still well away from actual breakeven.

Cash pile has fallen in six months from $17.3m to $13.8m.

Outlook - closing in on breakeven, but the way this is worded, it’s not actually breakeven! -

“Strong base of recurring subscription revenues and reduced cash burn underlines confidence in achieving breakeven adjusted EBITDA run rate during FY24”

“Trading in line with recently upgraded market expectations* on revenue for FY24, and confident of achieving an adjusted EBITDA2 break-even run rate during FY24”

“* For the purposes of this announcement, Windward believes market consensus for the financial year ended 31 December 2024 to be revenue of $36.2m, adjusted EBITDA loss of $1.6m and cash of $16.1m.”

The main adjustment is the $1.9m share based payments, which seems excessive in a half year. Other than that, adj operating profit and adj EBITDA are quite similar, which is good -

Balance sheet - thin, with only $3.5m NAV, including $1.0m intangible assets = $2.5m NTAV.

Note that the cash pile of $13.8m has all come from advance payments by customers, recorded as “deferred income” creditors totalling $15.3m.

It’s quite normal for SaaS companies to be funded like this, but it’s worth noting that continued cash burn could tip this balance sheet into negative NTAV, so it doesn’t have much resilience.

Having a healthy market cap of £104m, and a good, topical story (AI, maritime safety, etc), if I were having a chat with management I would suggest their best move would be to raise say £10m fresh equity to bolster the balance sheet, which would only be 10% dilution. It’s a pity when you see under-funded companies with buoyant share prices miss the opportunity, only to regret it later if something goes wrong, and they have to raise funds from a position of weakness, and at a much lower price.

After all, the whole point of a listing is to provide access to growth capital.

Cashflow statement - share based payments of $1.9m in H1 TY, and $1.3m H1 LY seems a lot for a loss-making company. US-style rewards for management it seems.

The good news is that it capitalised very little into intangible assets, only $0.5m.

The rest of the cashflow looks pretty clean.

Paul’s opinion - I’m only checking the facts & figures remember. No surprises here, we already knew the story - rapid growth in recurring revenues, and breakeven within sight. Probably enough cash to get there without needing another equity raise (although I think the balance sheet is thin, and could benefit from a top-up equity raise - which would also help reassure blue chip customers).

I suppose the key question would be how much more growth is possible, and will it start generating cash and be able to pay divis in future?

The clients sound like blue chip organisations, and having high recurring revenues is positive.

I’ve no idea how to value Windward, but it looks an interesting growth story, so worth doing some more research on, I think. £104m market cap sounds up with events for the time being, maybe?

You have to assess what the future holds, which is the difficult bit! All I can say is that there are some good elements to this story, and I can see potential here, if strong growth continues. If growth stalls, then the market cap would crash of course, that’s the risk you take with loss-making growth companies. This seems one of the more credible ones I’ve seen.

The trouble is with all listed companies, we only get our information from the company itself, and obviously they tell the bullish story. Ideally it would be good to talk to someone who actually uses WNWD services as a customer, to find out what it’s really like. That’s true of all companies actually. Customers often have a very different view from what the RNSs say! As one fund manager once quipped, we should be employing private investigators, not financial analysts, to properly understand companies.

Since listing -

Anexo (LON:ANX)

Down 2% to 62.5p (£74m) - Interim Results - Paul - RED

I have a very low opinion of Anexo - see SCVR 1/5/2024 where I explain its horrendous accounts - my summary being -

“Same problems as before - reports huge profits, which then just sits in debtors on the balance sheet, uncollected. Receivables absolutely absurd, at £234m. Gross borrowings of about £62m are fiendishly expensive, as I think it borrows from anyone at any price. Hence finance costs on P&L more than doubled to £17m. Paul’s view - probably doomed to eventual collapse, in my view. Very similar to Quindell and Accident Exchange.”

Yes I know it’s awful to quote yourself! But they’re important points.

On to today, have things improved I wonder?

“Anexo Group plc (AIM: ANX), the specialist integrated credit hire and legal services provider, is pleased to report its Interim Results for the six months ended 30 June 2024 ('H1 2024' or the 'period').”

With this type of business, I almost completely ignore P&L numbers, as they can report anything they like. Cash collection (which ranges from very late, to never) is what matters. Failure to collect in cash is what killed off Accident Exchange and Quindell. This looks a re-run of those.

Let’s look at what matters -

Balance sheet - no major changes. NTAV is £162m - that’s more than double the market cap! Bargain then? I would say definitely not. The reason being that receivables (unpaid invoices sent to customers) is a ludicrous £243m, slightly up on 6m and 12m comparatives. This is the huge flaw in the business model of ambulance chasers like this. Their customers are not actually customers. They’re organisations that ANX has lodged legal claims against. As we saw with both Quindell and Accident Exchange, the insurance companies don’t pay the claims, and instead wait for the ambulance chasing firm to go bust, or in desperation offer a heavily discounted batch settlement. It’s just a terrible business model.

The market knows this, which is why ANX shares are priced at a large discount to NTAV - because the receivables contain an unknown amount which is uncollectable.

Don’t be fooled by the low PER!

Worse still, as they book large profits, they have to pay tax on the imaginary profits, making cashflow even worse, in this sector.

Cashflow statement - this is the thing to focus on. It’s very clear that Anexo didn’t generate any free cashflow at all in H1. Its operating cashflow of £9.2m quickly disappears once you take into account £4.4m interest paid, and £4.3m lease payments. It can’t afford the £1.8m dividends in my view, and as previously mentioned, it’s scrabbling around for debt wherever it can be found (in creditors).

Outlook comments - don’t seem to tie in with the numbers, which clearly show that cash collections have not improved - because receivables has gone up, not down -

“The focus in the first half of 2024 has been firmly on the conversion of profits to operating cash flows and managing claim acceptances in line with cash collections. The second half of the year is always more significant as a result of seasonality; this has been factored into our forecasts, which indicate that performance in the second half will outperform that of the first half.

The continued growth in cash collections, following ongoing investment in the legal teams and IT infrastructure, allows the Group to increase activity, without the need for significant increases in net debt. Management look to the second half of 2024 and beyond with optimism.”

In this sector, I’ve learned the hard way not to believe a word they say. Focus on the numbers - in particular cashflow, and receivables.

These companies only become viable if they can generate serious reductions in receivables, through co-operation with the insurance companies that decide whether to pay these claims, as demonstrated by ZIGUP (LON:ZIG)

Refinancing - this sounds quite positive -

“In August 2024 the Group agreed a £30m loan facility with Callodine Commercial Finance LLC. The Group has drawn down £20m of this facility, to provide further headroom and to repay the loan provided by Blazehill Capital Limited, the refinancing significantly reducing the overall cost of capital to the Group.

In August 2024 the Group also agreed an increase in the funding available under the facility provided by Secure Trust Bank PLC. Secure Trust have extended the funding period within the £40m facility limit previously agreed.”

I’m worried about Secure Trust Bank (LON:STB) as this looks a large exposure for them (market cap of £164m).

Paul’s opinion - other experienced investors might remember Accident Exchange and Quindell. Both had pretty much identical business models to Anexo - lots of legal claims made, big profits reported, but all the unpaid claims pile up into vast numbers in receivables.

I remember Accident Exchange vividly, as I kept buying more shares as it fell in price, eventually averaging down numerous times until it was a large part of my portfolio, and ultimately on a PER of 1.9x, which I thought was cheap, but of course it was a red flag. It took me a long time to realise that the business model was totally flawed, as it couldn’t turn its claims into cash. In the end it de-listed, with the shares worth almost nothing, and an aggressive financier gave it a cash lifeline to try and take legal action against the insurance companies who refused to pay its claims.

There’s only one number that matters in Anexo’s accounts, £243m in receivables.

Lenders seem willing to support it, hence a stay of execution, but sooner or later they might begin to realise that the receivables are of distinctly dubious quality and collectability (in a reasonable timeframe).

I’ve seen this all before, several times, hence I remain flagging a lot of risk here at RED.

It might turn out to be alright, but why take the risk? In this case, I think the high value scores are a mirage - because I’ve seen it all before in this sector. As my old company solicitor used to say, sales are a gift until the invoice is paid. Same here - those revenues & profits booked mean nothing until the cash is collected in, and there’s currently £243m of unpaid invoices! The only way to collect in such big arrears is to offer bulk settlement deals, which it sounds like Anexo has done with VW, but that’s not resulted in improved figures has it? This is a can of worms, I’ll be steering well clear, at any price.

Poor track record since listing -

Graham's Section

Watkin Jones (LON:WJG)

Down 29% to 36p (£93m) - FY24 Trading Update - Graham - AMBER/GREEN

Commiserations to anyone holding shares in this developer overnight.

Here is the bad news:

As set out in our half year results announcement on 21 May 2024, we had a number of schemes being actively marketed, with the subsequent sale of a substantial PBSA development located in Stratford, London, announced in July. Nevertheless, overall market activity through the summer has been slower than anticipated, principally due to the continued uncertainty over the pace of interest rate cuts, and as such we believe it is now unlikely that we will close any further transactions before the financial year end.

Operationally, the company has continued to “execute effectively”. But the absence of new deals will mean a weaker-than-expected full-year adj. operating profit of £10m to £12m (the financial year-end is in September, so there’s still one month left).

The existing forecast for adj. operating profit was £15m (with thanks to Progressive Research).

Their adj. PBT forecast gets cut from £11.5m to £7m, i.e. a 40% cut.

Unfortunately the bad news doesn’t stop there, as there are knock-on effects to future financial years.

Outlook section acknowledges that interest rate cuts should ultimately help, but:

…The lower number of transactions in FY24 will, however, have a consequential impact on the results in FY25, given that schemes will not contribute to revenue in future periods until they are forward sold. While we have a number of further schemes that we expect to take to market in FY25, given the slower pace of activity currently, we believe that a more prudent set of transaction assumptions should be applied to the next 12 months than previously assumed. As such, we do not currently expect adjusted operating profit in FY25 to be above FY24…

Progressive Research haven’t published estimates for FY25 yet, as they wait for the outlook to become clearer.

Remedial works: no change to the position here. As of March 2024, the gross provision was £55.7m, of which £33m was to be paid out in future financial years.

Net cash is described as “robust” and is anticipated to be c. £65m at year-end, ahead of expectations (£52m). After today’s share price fall, that cash balance covers c. 70% of the market cap.

But the company still isn’t convinced that it has enough cash:

While the Group's robust net cash position provides it with a strong financial underpin for its committed spending requirements, it is nevertheless a limiting factor on the extent to which we can take advantage of market conditions and further develop our pipeline. In light of this, the Board is undertaking a review of a range of options that may be available to enhance its medium and longer term funding position, thereby allowing the Group to capitalise on a market recovery.

I wonder if this is to a large extent because of the cost of remedial works, that will eat into the cash balance over the next few years?

Graham’s view

In October 2023 (at 33p), I upgraded my view on this share to GREEN as it was trading at only about 55% of its tangible NAV, and it passed Ben Graham’s Deep Value Checklist.

That was pretty much the low:

In January 2024, at 48p, Paul was neutral, noting the accident-prone nature of the business, including the growing provisions for remedial works.

Today I’m going to hedge my bets a little bit and go AMBER/GREEN.

As of March 2024, WJG had tangible balance sheet equity of £121m, a handy 30% premium to the market cap (and the company has been profitable since then).

Against that, we have to balance the importance of a series of profit warnings and the effect this should rightfully have on our confidence in the business. Interest rate hikes could be blamed for previous profit warnings, but now uncertainty around interest rate cuts are to blame for the latest one. Shareholders could be forgiven for running out of patience (as it seems many of them have this morning).

Provisions for remedial works haven’t grown recently, but are another legitimate source of concern.

Existing provisions will drain cash in future financial years, and the company is not entirely satisfied with its current cash balance - but would it really raise equity at this valuation? Surely an enlargement of its bank facilities would make sense? After all, if the opportunities thrown up by current market conditions are so attractive, then there should be little doubt around the company’s ability to repay increased debts.

I find this one puzzling, as I thought conditions were favourable for developers of rental properties, especially student accommodation. So I’m perplexed by WJG’s inability to hit its financial forecasts. But I do like this type of stock at a material discount to NAV! So I’m willing to take a mildly positive stance at this share price.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.