Good morning from Paul & Graham, suitably refreshed from the long weekend!

Summary spreadsheet - for those of you who find this useful, I've got it up-to-date and there's a new link in the explanatory notes below, flagged as being the live version (which you might want to bookmark if you use it regularly). The idea is you can quickly look up any share we've covered here, using CTRL+F and the ticker.

I'm delighted to say we have already achieved our goal of covering more shares than in 2023. So far the tally is 610 unique companies in 2024! Some are only quick comments of course, but even so, that's a good proportion of the whole market that we're reviewing at least once in 2024 to date. I hope some of you find it useful anyway.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Very quiet for news again today, so looks like many CEO/CFOs have taken the week off!

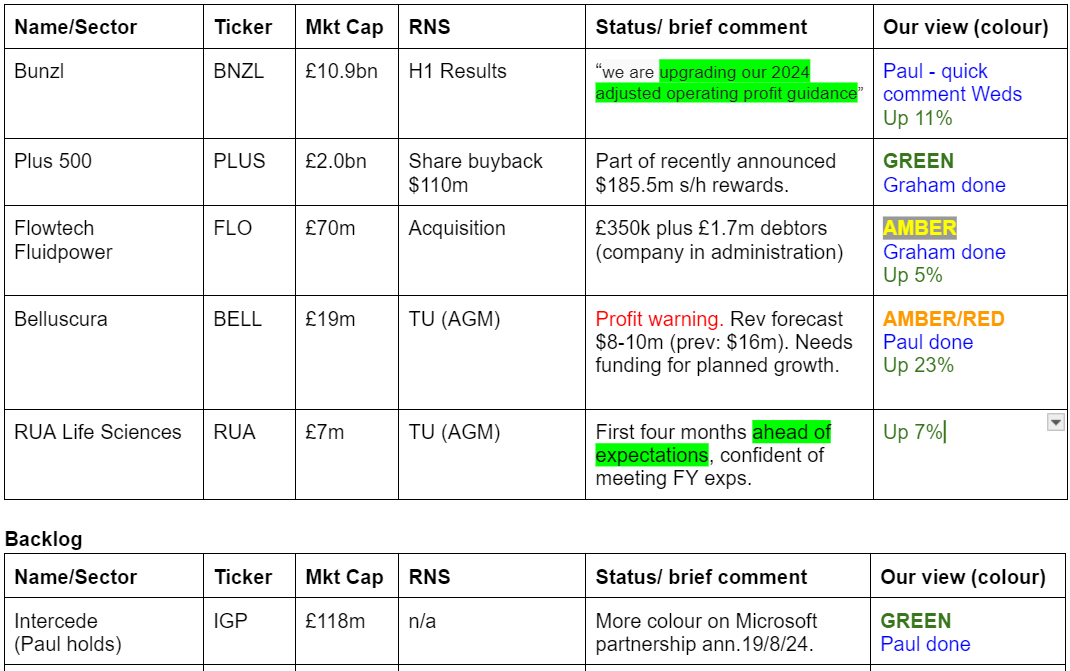

Summaries

Intercede (LON:IGP) (Paul holds) - 201p (£118m) - More colour on Microsoft partnership - Paul - GREEN

I try to better explain the Microsoft partnership deal announced on 19/8/2024.

Flowtech Fluidpower (LON:FLO) - up 6% to 118p (£75m) - Acquisition - Graham - AMBER

This looks to be a great bit of business by Flowtech as they acquire a small pneumatics company out of administration for a very cheap price (£350k for the business, and also separately buying its receivables). The skilled workforce are welcomed into the Flowtech group who will now seek to restore it to profitability in its first full year of ownership. Flowtech as a whole remains on the road to recovery and I can’t budge from a neutral stance just yet.

Belluscura (LON:BELL)

Up 50% to 16.5p (£28m) - AGM Trading Update [profit warning] - Paul - BLACK/ On fundamentals: AMBER/RED

Today's update tells us revenues are accelerating, but then considerably slashes the FY 12/2024 forecast. It's clearly desperate for more funding for both ongoing losses, and the necessary inventory build for higher sales, but tries to gloss over that reality. Punters might get lucky here, but for me the risks are still way too high. We can look at it fresh once the badly needed fundraising (more dilution with CLN's?) has been done. Bizarre to see a blue sky share rise 50% on a profit warning, but that's what has just happened.

Paul’s Section:

Intercede (LON:IGP) (Paul holds)

201p (£118m) - More colour on Microsoft partnership- Paul - GREEN

IGP issued an RNS last Monday 19/8/2024 re a partnership with Microsoft, which I reviewed here, concluding -

"Today's partnership with Microsoft sounds impressive, but doesn't alter the broker forecasts. Hence at this stage I don't know what the financial significance or structure of this deal is likely to be. I've reached out to the company asking for more colour, so at this stage all we can do is discuss amongst ourselves in the comments below - sector experts please help guide us!" [SCVR 19/8/2024]

Please bear in mind that I’m definitely not a tech analyst, so I don’t understand the technical details. However, this is the gist of things as I understand it -

Microsoft Entra ID is widely used for access to computer systems, including some existing IGP clients.

IGP’s existing PKI-based (high security) credential management system works with Entra already, but FIDO passkeys don’t.

Strong customer demand has led Microsoft to work with a small number of companies (including IGP) to make FIDO2 work with Entra ID.

Intercede’s MyID product suite will therefore be able to pass data between the two platforms.

Existing clients, and pipeline prospects are keen to use this new functionality apparently, in some sectors (esp Govt) driven by regulation.

There was a short comment from Cavendish on 19/8/2024, which I hope they don’t mind me mentioning here -

“Intercede (IGP): CORP Microsoft partnership Intercede has announced a strategic partnership with Microsoft, bringing FIDO passkey management to the enterprise. The and access management system, to allow administrators to create and register FIDO passkeys on devices. Importantly, this enables enterprise compliance with government security legislation (FIPS 201/SP 800-63). Full availability of the provisioning API will be available in the next release of MyID CMS, v12.12, in the next two weeks. While there are no changes to forecasts, the partnership reiterates the world-class quality and reach of Intercede’s technology. We place our target price under review.”

Paul’s view - this sounds encouraging, and I imagine would strengthen IGP’s position with its existing, and new clients. It's not clear yet what financial effect this will have.

Belluscura (LON:BELL)

Up 50% to 16.5p (£28m) - AGM Trading Update - Paul - AMBER/RED

Belluscura plc (AIM: BELL), a leading medical device developer focused on lightweight and portable oxygen enrichment technology…

I’ve got to take a look at this, as a 50% share price rise after a profit warning signals there’s something else going on maybe?

BELL is a jam tomorrow share, with historical heavy losses and negligible revenues. The story is that demand is now taking off for its special machines, which it claims are lightweight & more effective by weight where portability matters.

Sales in June 2024: $521k

Sales in July 2024: $708k (both are record highs)

“Expects strong sales to continue…”

Upcoming release of new patented DISCOV-R device.

Paul - note the July record sales only annualises to £6.4m, does that qualify as “strong sales”?

Reduced sales & EBITDA guidance - this is a significant profit warning -

“The Board anticipates that revenue for FY24 will be approximately $8 to $10 million (2023: $825,409) depending on timing of the full commercial launch of the DISCOV-R. and that the Company will be EBITDA positive for Q1 FY25. The Company expects annualised run rate revenue of $14 million to $16 million by the end of year.”

Liquidity - this is almost comical. It gives us no facts or figures at all, but implies it needs to raise more cash -

“As reported in the 2023 Annual Report to support expansion plans for future development the Group regularly reviews its financing arrangements and cash flows to ensure there is sufficient funding in place for working capital…

the Company is currently evaluating debt and credit facilities and other options to meet the preliminary high customer demand for the DISCOV-R™.”

Outlook - again, vague -

“Whilst it has taken time to bring both products to market, and we are grateful for the patience of our shareholders, we now have two leading lightweight portable oxygen enrichment concentrators that meet the stringent requirements of the FDA and we look forward to the full commercial launch of DISCOV-R™ later in the year.

The Board looks forward to the remainder of 2024 and into 2025 with a real sense of confidence”

Broker update - Dowgate kindly updates us via Research Tree. It is indeed a profit warning, with a substantial cut in forecast revenues for FY 12/2024 from $16m, to only $9m.

The EBITDA loss for 2024 was expected to be $1.5m, now a lot worse at c.$4.5m.

Dowgate confirms that BELL needs to raise fresh funding (“ramp-up continues to be restrained by the company’s limited financing”). I’d be surprised if it can meet its needs using debt alone, so another equity placing looks inevitable, on unknown terms of course, that’s the big risk here.

Paul’s opinion - I’m only looking at the numbers. It’s up to you to do the deeper research, and form a view on the potential for the products, which I have no view on.

As things stand now, BELL is clearly financially distressed, and badly needs more cash - probably from a mixture of debt and equity. Note that it has been raising scraps of cash along the way with convertible loans, so make sure you factor in that dilution if those loans are converted into equity. My guess would be more dilution from further convertible loan issues in the next few months. And/or an equity placing if they can find anyone to put the cash in. It’s obvious BELL is desperate for more cash, which it needs to fund losses, and to finance the hefty inventories and receivables that would be required to ramp up production & sales.

Take all that into account, and the current £28m market cap with 168m shares in issue is likely to change a lot when all the dilution coming is taken into account.

Good luck with it, but I’m sticking at AMBER/RED to flag the current situation, which looks high risk. Things will of course change in future.

I’ll happily move up to amber (or higher) in future, but only once it’s properly refinanced, and there’s a clearer path to profitability.

Today is a nasty profit warning too - it’s missed 2024 targets by a mile, and guidance is greatly reduced. Plus it doesn’t have the cash needed to ramp up production. So why on earth would anyone be buying the shares today? That strikes me as suspicious - share price manipulation perhaps? I'll be surprised if today's bounce in share price sticks. Bizarre, but there we go, maybe investors had already dismissed the previous forecasts, and are pleased to see revenues growing? Occasionally, punts like this do work, but it’s very rare. Rising revenues is a good sign though, even if it's well behind plan, assuming of course that sales invoices turn into cash.

Graham’s Short Sections:

Plus500 (LON:PLUS)

£26.40 (£2.0bn / US$2.6bn) - Share Buyback - Graham - GREEN

We already covered the interim results from Plus500 earlier this month.

Today we learn that the announced $110m share buyback is starting today. There will also be dividends of $75.5m, for total shareholder rewards of $185.5m.

Plus500 takes the opportunity to underscore its investment case for us once again:

This larger Share Buyback Programme, which follows on from the $100.0m buyback programme announced in February 2024 and completed in August 2024, highlights the Board's continued confidence in the future prospects of Plus500. It also reflects the Group's robust financial position, cash generative business model and ongoing ability to deliver strong shareholder returns over the medium-term. This confidence is supported by the significant operational and financial momentum Plus500 has achieved in recent years, including during H1 2024, as reflected in the H1 2024 Interim Results.

Graham’s view - a truly remarkable amount of cash has been returned to shareholders by Plus. This year we are heading for $210m of buybacks alone, and I think it’s right that the share price has responded to this:

At the current share price, the PER is still only 10x and that’s making no adjustment for over $1 billion of the company’s own funds. At this level, I think it makes perfect sense to keep reducing the share count.

The remaining funds will still leave plenty of flexibility for growth, and the company is contemplating “inorganic growth initiatives”, something it has very rarely dabbled in before (I think the last one was a strategic $30m acquisition in 2021, when it bought a US-based futures trading platform). So watch out for M&A to complement organic growth moving forward.

Now enjoying unprecedented diversification across products and geographies, I have little choice but to keep my positive stance on PLUS. I still prefer the risk management approaches of the more traditional platforms, such as IG group (LON:IGG) (where I’m a shareholder) and CMC Markets (LON:CMCX), but I respect what PLUS is achieving for its shareholders.

Flowtech Fluidpower (LON:FLO)

Up 6% to 118p (£75m) - Acquisition - Graham - AMBER

This sounds like a nice bit of business - a small acquisition, keenly priced.

The acquired business: appears highly complementary to Flowtech. “Thorite is a leading UK provider of pneumatics, compressed air, vacuum and fluid handling products and systems and has traded since 1850. It operates from seven sales and service centres across the UK.” I always sit up and take notice when a business has been trading since the 19th century!

FY March 2023 figures: Thorite generated £21m of revenues, with negligible operating profit.

In the prior year, according to the accounts at Companies House, Thorite generated £350k of operating profits despite revenues being lower.

But in FY March 2023, the company struggled to maintain profits, with the directors referring to post-Covid supply chain issues, extra staff costs “due to planned growth that didn’t fully materialise”, depreciation and higher IT costs as the company moved to an expensive new ERP system. As of the FY March 2023 report, this expensive system had yet to be implemented, “and a lot of staff time is being spent on the project”.

Ominously, they also noted that “price escalation due to supply chain shortages make customer relations more challenging”.

Fortunes must not have improved, as the company has ended up in the hands of administrators.

All of which brings us to:

The price: Flowtech are paying just £350k for “all the plant and machinery, vehicles, stocks, and intangible assets”. This seems like an incredible price for a company that generated revenues of £20m+ and an operating profit of £350k only a few years ago.

Working capital: Flowtech are also paying off Thorite’s debtor financing facility (for £1.7m) and in return, they get ownership of the unpaid bills from Thorite’s customers (£2.6m). Any profits on this deal will be shared with the administrator.

Can Thorite be returned to profitability? Flowtech thinks so:

Through a combination of the strategic benefits and synergies already identified, the Board expects profitability to be restored in the first full year of ownership with the associated benefits to Group earnings.

Graham’s view

This strikes me as a perfect example of the benefits of buying companies out of administration: you get great pricing. In the context of listed companies doing deals, I rarely see a purchase out of administration that ends up causing much damage to the buyer - even if the business fails again a few years later or needs to be shut down, the upfront price was usually so low that it doesn’t matter.

Flowtech’s entire existing revenues are £113m, so this very cheap acquisition is going to make a material difference to its top line. As for the more important bottom line, it’s too soon to tell but what a wonderful price to pay for the possibility that Thorite’s fortunes might improve. As part of a large group of similar businesses who face similar challenges, I would have to think that its prospects are decent. Flowtech as a whole remains on the road to recovery:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.