Good morning!

iomart (LON:IOM)

Share price: 218p (down 6% today)

No. shares: 106.8m

Market Cap: £232.8m

Final results for y/e 31 Mar 2015 - as usual, the blue text on the left is a clickable link through to the results statement. I've not looked at this company before. It's a cloud computing company, which seems to provide domain name & cloud hosting services.

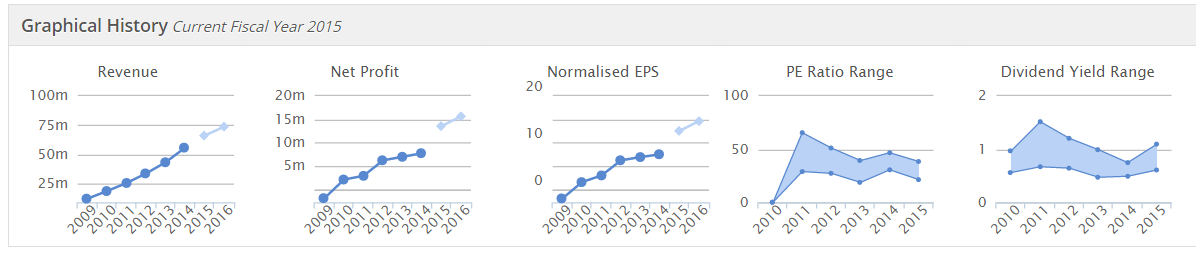

The Stockopedia graphs show a very good progression of sales & profitability. I note this has been achieved with only a 7.5% increase in the number of issued shares, over the same timeframe as the graphs below. Although note that the company has used up its cash pile, and moved into net debt over that period.

Valuation - adjusted diluted EPS reported today is up 16% to 12.63p.

That means the shares are valued on a PER of 17.3 times - which looks about right, i.e. the PER is similar to the current growth rate in earnings.

Outlook - sounds OK:

Balance Sheet - as you would expect for an acquisitive IT group, the balance sheet is dominated by intangibles, mainly goodwill. Writing off the intangibles, gives net tangible asset value of £6.3m.

The current ratio is a stand-out negative. It stands at only 0.45, which is particularly bad, indicating stretched creditors. However, in this case the reason is that the bank borrowings are nearly all shown within current liabilities. This is probably due to the facilities coming up for renewal, and that should sort itself out once the bank facilities are renewed, with bank debt dropping down into long term creditors. So it's not a particular concern. The level of bank debt looks reasonable, compared with cash generation.

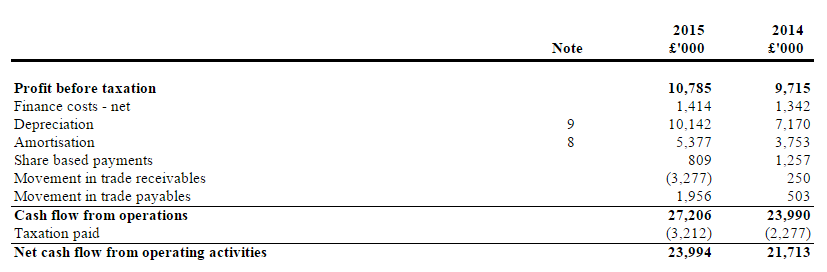

Cashflow - in my experience, the cashflow statement is a far more useful statement than the P&L for IT companies, as it shows you what's actually happening in cash terms, which is (in the long term) all that matters.

In this case, the top part of the cashflow statement shows a very cash generative business, once the large depreciation charge is added back:

However, before we get too carried away, the company spends about the same on capex as the depreciation charge. So presumably they're having to replace servers, etc, with newer and more powerful ones on an ongoing basis, as web traffic inexorably rises.

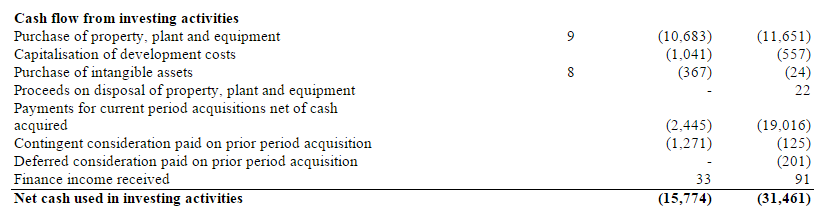

So most of the cashflow in 2015, and more than all the cashflow in 2014 was spent on capex and acquisitions. Nothing wrong with this, it's a perfectly valid strategy:

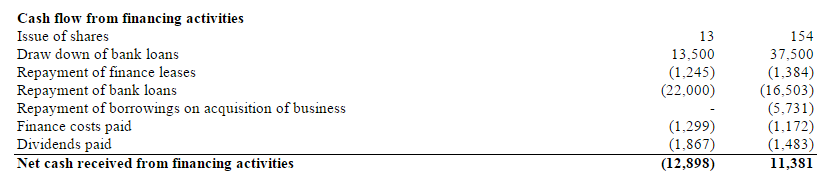

The final section of the cashflow statement shows that in a year when it spent little on acquisitions (2015), Iomart was able to make a substantial dent in its bank debt, which is a very positive thing in my view:

Dividends - barely worth bothering with, at under 1% yield. However the company notes today that "over time" it intends increasing the divi payout to 25% of adjusted earnings. That seems a reasonable policy, meaning that the other 75% is reinvested for growth, and repaying debt.

My opinion - it seems quite a good business, with a decent track record. The share price looks about right to me, so I can't see any reason to dig much deeper, as I'm looking for bargains, not things that are priced correctly.

I also have a reservation with the area of activity that Iomart operates within. Cloud hosting is a competitive area, subject to downward price pressure, although customers are quite sticky for a while at least. Also you have the danger that if something serious goes wrong with the service, then your customers will lose confidence, and jump ship to a competitor. There's also all the security issues with cloud computing - vulnerability to hacking, etc.

So I think it would be necessary to dig deeper, and investigate what competitive advantages Iomart has over other companies in the same space, and what it can do to maintain its current fairly high margins.

The two year chart seems to show a gentle downward trend in the share price, and notice the several sharp sell-offs, suggesting that the company is prone to issuing disappointing trading updates. I might look at this share again if it revisits the 160p area of about six months ago:

CML Microsystems (LON:CML)

Share price: 367p (down 5.8% today)

No. shares: 16.2m

Market Cap: £59.5m

(at the time of writing I hold a long position in this share)

Preliminary results for y/e 31 Mar 2015 - the market seems a little underwhelmed by the results today, although the shares have had a very good run of late. I think this is a good example of where momentum traders buy a stock because it's going up, and this then fuels the upward move further. It's only when results are published that everyone realises that the price has actually got a bit ahead of the fundamentals perhaps.

CML shares were in freefall this time last year, as its good run of profits growth shuddered to a halt. So the market has been expecting a poor year.

Basic EPS dropped from just under 30p to 16.7p.

Outlook - reading the narrative with these results feels like wading through treacle - it's a struggle to comprehend. Perhaps they could hand over the RNS writing to someone with a more clear & concise writing style?

The general tone sounds upbeat about the outlook though, and the conclusions says:

Valuation - there are two big factors to take into account. Firstly, obviously earnings. Broker forecasts show an expectation of a big rise this year, to 24.8p. If that's achieved, then the shares could go higher.

Secondly, there's a considerable amount of surplus cash on the balance sheet, which needs to be factored into the valuation. Net cash has now reached £13.2m, which is just over 81p per share (about 22% of the share price), so very much a material amount.

There is also some investment property on the balance sheet, although that is offset by a pension deficit.

My opinion - I like the safety buffer provided by the very strong balance sheet, and it sounds as if new products are likely to provide a boost to trading. On the downside, there is a remark in the narrative that industry changes might impact on the cash pile, and it sounds like S&M costs are being increased.

Overall, I'm feeling neutral to slightly positive on this share at the current level. There's a modest divi yield of about 1.8%, which is better than nothing.

This share is horribly illiquid I've found, and often you can only trade in 1,000 shares at a time, and at a wide spread, which rules it out for larger portfolios, unless you are prepared to take the risk of being left high & dry if something goes wrong (assuming you can get the stock in the first place).

I've run out of time unfortunately, as I have a lunch in the City, and then a company meeting afterwards. So I'll record a quick video now for the other bits & pieces that I don't have time to write up.

In today's video I comment briefly on:

Porta Communications (LON:PTCM) , Vislink (LON:VLK) , Creston (LON:CRE) , WYG (LON:WYG) , OMG (LON:OMG) , Penna Consulting (LON:PNA) , Software Radio Technology (LON:SRT) , £ SND , Plus500 (LON:PLUS) , Shoe Zone (LON:SHOE) , Tristel (LON:TSTL)

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CML, PTCM, CRE, SHOE, and a short position in PLUS. A fund with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.