Good morning from Paul, and from about 08:30 Roland will be joining me. Graham & his family have come down with a bug, so sending them our best wishes to get well soon.

All done for today!

Considerable volatility in the US market again this week, with the Dow last night doing a c.900 point (2%) fall, then recovering all of the drop intra-day. What's going on? It seems to be uncertainty over inflation and interest rate expectations. I do think it's important not to let day-to-day volatility shake me out of good shares that I'm invested in, so I ignore it.

In our small-mid caps space, we're seeing some bargains appear again, as readers were discussing in yesterday's report. If we can get good companies, that are trading well, 10-20% cheaper than a week or two ago, then that's a good thing! BLASH (buy low and sell high) is the golden rule.

I suspect the UK small caps space is being disrupted by the anticipation of higher CGT in the late October budget. Hence people feel incentivised to bank profits now, to lock in a potentially lower rate of CGT. Although maybe some of the sellers will be wanting to buy back in, so this could just be a short-term dip. Again, personally I won't be letting unusual price falls disconcert me, that's more of a buying opportunity than a threat in my view, because the likelihood is that sellers are motivated by tax factors, rather than inside knowledge of poor trading. As always though, it's all educated guesswork, that's what makes investing so fascinating!

UK futures are showing a strong rebound today, as the UK plays catch up with the US strong bounce in later trading. So I'll be hovering over the buy button at the open, with any available scraps of cash I can locate for some possible bargain trades!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

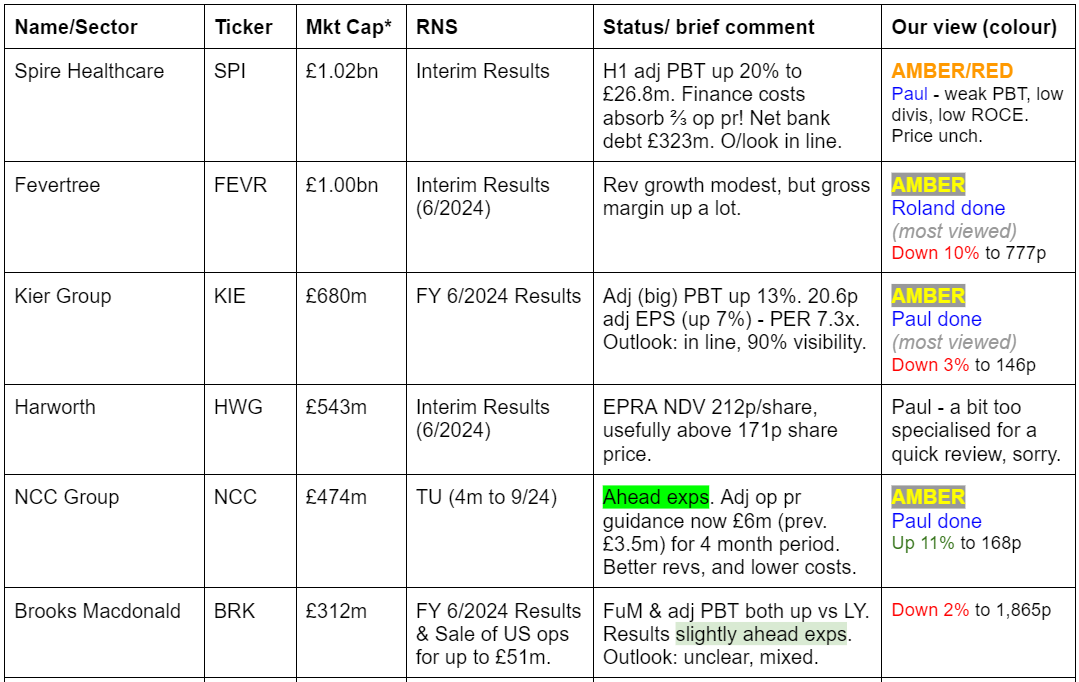

Companies Reporting

Other mid-morning movers (with news)

Trainline (LON:TRN)

Up 10% to 330p (£1.51bn) - H1 Trading Update - Paul - AMBER/GREEN

“ the leading independent rail and coach travel platform selling tickets to millions of customers worldwide”

Good revenue growth in all regions, up 16-17% overall (ahead of 7-11% guidance). Fastest growth in Spain & Italy. UK (largest market) also good rev growth +17% - more people switching to digital tickets, now c.half of total, and reduced impact from strikes.

Outlook improved -

Paul’s view - battered by the pandemic, Trainline is now producing good figures, and beating expectations. I think it looks worth a closer look, and there could be a better moat here than I previously realised (a fund manager interview recently highlighted that point).

My last notes from 3/5/2024 show a weak balance sheet, and excessive management share options (being mopped up with buybacks). Overall, I think we should go up from amber to AMBER/GREEN, as this does look an interesting IT business.

Marlowe (LON:MRL)

Up 7% to 460p (£405m) - Demerger of Occupational Health division - Paul - AMBER

Marlowe has had an interesting recent past. It did tons of acquisitions, got into too much debt, but then pulled a large rabbit out on 22/2/2024 which we covered here, clearing all its debt in one fell swoop with a big disposal. A big special divi of 155p was paid in July 2024. Shares have done quite well since then. Share buybacks have also been done.

Today it has decided to spin out Optima Health, which will become an AIM listed company. Each Marlowe shareholder will be given (in specie) 1 share in Optima, for every existing 1 existing share held in Marlowe. So obviously when the deal completes, Marlowe shares will drop in price accordingly, and the free Optima shares will become priced by the AIM market at whatever price the free market decides they’re worth.

I suppose the hope is that this might create shareholder value by shining a light on Optima, which could result in a higher valuation than it remaining a part of Marlowe. The initial Optima valuation is £225m, but that’s really just a guess. The stock market may decide to value it differently once dealings in Optima start.

Paul’s view - it amuses me when management are building these groups, and making multiple acquisitions, they always talk about the acquisitions being accretive, creating synergies from becoming part of a group. When that doesn’t work, they decide to divest parts of the group, which is also supposed to create shareholder value through unbundling! That said, Marlowe's strategy of divesting assets has clearly worked very well, so with hindsight it turns out there was a lot of hidden value in the group before these deals were done.

There’s some introductory information here on Optima’s website. It says the AIM Admission Document will be published on 23/9/2024.

Presumably there will need to be some buyers lined up, to hoover up Optima shares that some Marlowe shareholders may not want?

Quite an interesting development, hence me mentioning it. Last time I looked at Marlowe, I left it AMBER, as no strong opinion either way from me. Optima would be a NO COLOUR for now, as I await further details.

NCC (LON:NCC)

Up 11% to 168p (£525m) - Trading Update - Paul - AMBER

NCC Group plc (LSE: NCC, "NCC Group" or "the Group"), a people-powered, tech-enabled global cyber security and software escrow business, provides the following unaudited trading update for the four months ending 30 September 2024 (the "Period").

Good news - better than expected summer trading means it’s upping guidance for the 16-month period to 30/9/2024 (new year end).

Previous guidance was £100m revenues, and adj operating profit £3.5m - just for the 4 month period.

New guidance is £104m revenues, and adj operating profit of £6m for the 4 months extension to the year end.

Sounds good, but bear in mind that the 12-month interim results to 31/5/2024 were so heavily adjusted, that it’s difficult to work out what the real picture is at this company.

Eg FY 31/5/2024 showed revenue of £324m, adj EBITDA £42m, and a statutory operating loss of £(21.5)m! Goodwill impairments caused that loss, but demonstrate that previous acquisitions must have included some bad deals.

The last reported balance sheet was weak with £310m intangible assets, taking NAV of £235m down to NTAV negative £(75)m.

Paul’s view - not as good as today’s update suggests, when you look back at the last set of full numbers.

I can’t get above AMBER - unchanged from my review here on 21/6/2024.

Summaries

Kier (LON:KIE) - down 1% to 148p (£673m) - FY 6/2024 Results - Paul - AMBER

H1 results as expected, and outlook comments say it's trading in line with expectations. No surprises today, with everything as previously disclosed in the 19/7/2024 trading update. I'm shifting back down to neutral today, as the weak balance sheet with some strange elements to it reminds me that this is not a particularly well financed business. Maybe the reintroduced divis were premature? Bull & bear points covered below in more detail.

Fevertree Drinks (LON:FEVR) - down 9% to 784p (£910m) - Interim Results - Roland - AMBER

The premium drinks company has cut revenue guidance for the year, resulting in a fall in my estimate of likely profits. I think underlying operating trends are positive, but the valuation already prices in significant growth. Overall, I’m neutral.

Keystone Law (LON:KEYS) - up 3% to 682p (£215m) - Interim results - Roland - AMBER/GREEN

This founder-led legal firm appears to be generating strong growth and high returns on capital from its capital-light model. A strong H1 performance has prompted a modest upgrade to full-year guidance. I’m positive, albeit with a measure of caution on the valuation.

Paul's Section:

Kier (LON:KIE)

Down 1% to 148p (£673m) - FY 6/2024 Results - Paul - AMBER

Kier Group plc ("Kier", the "Company" or the "Group"), a leading UK infrastructure services, construction and property group, announces its results for the year ended 30 June 2024 ("FY24" or the "year").

Company’s headline -

“Year of significant growth; material debt reduction; new long-term growth plan”

For background, our previous notes on Kier were -

7/3/2024 - AMBER at 139p - Interim Results - Paul - H1 results as expected, and FY 6/2024 outlook remains in line (note that forecasts have been slightly reduced in the last 9 months). Balance sheet is large, complicated, and weak. Shares have had a great run, but look up with events to me now. (I later changed my mind on this, and should have stayed at amber/green with hindsight).

19/7/2024 - AMBER/GREEN at 161p - FY 6/2024 TU - interesting situation - traded in line, good visibility thanks to giant order book of public infrastructure projects. Shares have already re-rated significantly from a PER of 3.1x to 7.3x, and could possibly have further to go? I've shifted up a notch from amber to AMBER/GREEN.

On to today’s actual FY 6/2024 results.

Adj EPS of 20.6p is slightly ahead of the broker consensus data we have here of 20.0p. A note from Panmure dated 16/7/2024 on Research Tree suggests 20.6p adj EPS, so it looks in line (as the co told us in its 197/2024 y/e update). So that’s all good.

Net cash - of £167m is a red herring, as the 19/7/2024 TU previously mentioned, saying that it was boosted temporarily by seasonal cash inflows from the construction division. Average net debt of £115m was the more relevant number to reflect reality. So do be careful if you’re valuing this share using the unreliable EV/EBITDA method!

Today we’re given the updated figures for average net debt, which are very similar to the previous figure of £115m -

“Average month-end net debt halved to £(116.1)m (FY23: £(232.1)m)”

That’s a very good reduction in average net debt though, good to see. Given the huge revenues of c.£4bn pa, I reckon intra-month cash/debt swings could be very large, so personally I would prefer an average daily net debt disclosure, plus high and low points during the year (for all companies) to give us the accurate reality.

Adjustments - note that the adjusted to statutory profit is a big amount in both years above, so you need to be comfortable that these adjustments are reasonable. Statutory profit margin is wafer thin at only 1.7%.

Divis reintroduced, again as expected. 1.67p interim paid, 3.48p final proposed. Total 5.15p (yield 3.5% - not bad at all for the first year of divis resuming, as there’s usually upside on future payouts). Policy is to target 3x divi cover “through the cycle” - difficult to do, as a lot of the time companies don’t really know where they are in the cycle, until afterwards!

Bank refinancing also previously announced, so nothing new there.

Massive order book up 7% to £10.8bn, so "good multi-year” visibility - but as always in this sector, investors just have to hope nothing goes wrong with any projects, since they’re low margin. It’s a bold investor who assumes that all of the large & complex projects go according to plan, with no cost overruns or remedial work that cannot be reclaimed from the customer. These big contractors have to be very well managed, otherwise it’s only a matter of time until something hideous goes wrong.

Margin upside is an interesting possibility though. Kier is one of only 39 “strategic suppliers” to the UK Govt, which have close working relationships with the Cabinet Office. Hence I can see the point that this might give those companies greater pricing power, hence there could be potential margin upside since this sounds like a moat.

“The contracts within our order book reflect the bidding discipline and risk management now embedded in the business.”

Let’s hope it doesn’t go wrong again, as it has in the past.

Outlook - it says “Current trading in-line with Board expectations”. A bit more detail - this sounds fairly upbeat -

“The Group has started the financial year well and is trading in-line with the Board's expectations. The Group is well positioned to continue benefiting from UK Government infrastructure spending commitments and we are confident in sustaining the strong cash generation evidenced especially over the last two years allowing us to significantly deleverage, increase dividends to shareholders and deliver the evolved long-term sustainable growth plan which will benefit all stakeholders. “

Balance sheet - NAV of £520m, less intangible assets of £638m, gives NTAV negative at £(118)m.

Note the NTAV includes £133m deferred tax asset, and £105m pension surplus, which the prudent might remove, taking adj NTAV down further to £(356)m.

Pension deficit contributions appear to be dwindling issue which is positive -

“deficit payments will decrease from £9m in FY24 to £7m in FY25, £5m in FY26, £4m in FY27 and £1m in FY28.”

The cash/debt position below seems bizarre - this doesn’t tie in at all with the commentary on bank facilities, which it says are much smaller than the amount drawn down below -

“The facilities comprise £250.0m Senior Notes, £260.9m Revolving Credit Facility ('RCF'), £37.3m US Private Placement ("USPP") Notes as well as £18.0m of overdrafts.”

I imagine there’s a reasonable explanation for the huge cash and overdrafts disclosed below, so if anyone has figured out this peculiar situation, please let us know in a reader comment.

Paul’s opinion - it’s a bit more complicated than I imagined, due to all the various moving parts in particular on the balance sheet.

The bull case seems to be about potentially increasing margins, because the big infrastructure groups like Kier are important to Govt, to improve infrastructure & hence public services. Kier seems to have recovered from its past problems.

The bear case is that margins remain thin, especially if we ignore the large adjustments, and how long will it be before something else goes wrong?

Shares have nicely re-rated, which I think is justified given the progress made.

How much further upside is there? I think that depends more on investor confidence, and nothing going wrong on its big contracts. As mentioned last time, the shares could re-rate further (fwd PER 7.1x now) to maybe something like 10x, if we’re being generous? If earnings surprise on the upside, then the effect on EPS could be large, which combined with a higher PER could see shares at 200p+ if the upside case pans out.

Downside is obviously that something goes wrong, and profits are slammed with big exceptional costs. Shares crash, then the cycle begins again, as one-offs are adjusted out, and everyone focuses on recovery potential.

On balance, I think it makes sense to shift to a neutral view again, as I’ve been reminded that the balance sheet still isn’t good, although not in an alarming way.

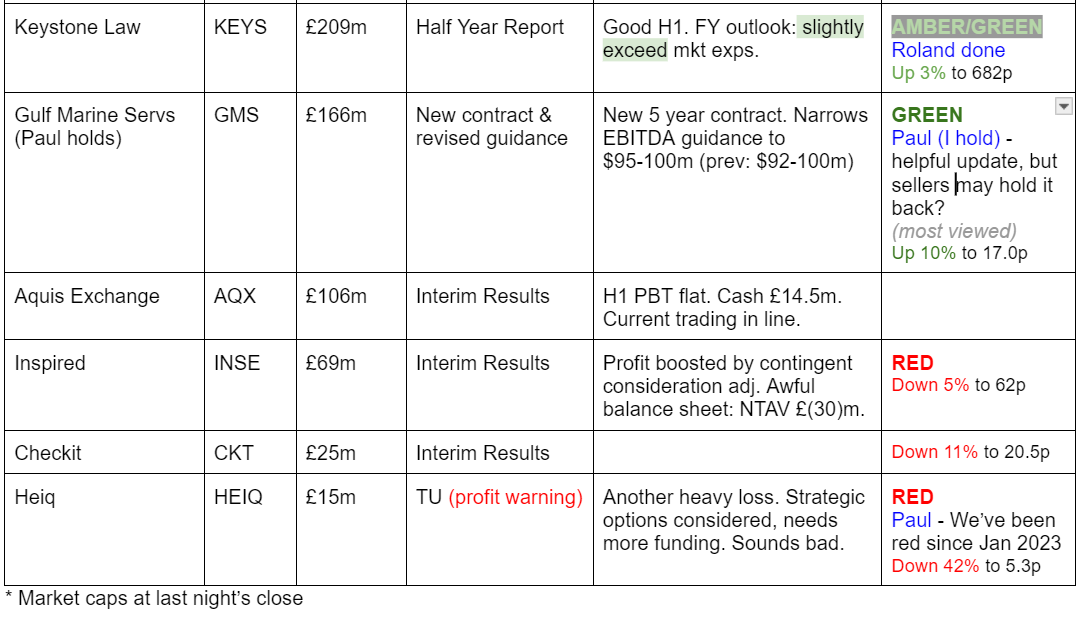

A reminder below that over the long-term, Kier shares have been a disaster, with it all going terribly wrong in 2019, pre-pandemic. The share count then quadrupled, so 150p/share price today is over 600p equivalent pre dilution that began in 2019. It seems very optimistic to me, to assume nothing will ever go wrong again, given the type of activities Kier deals in.

Roland’s Section:

Fevertree Drinks (LON:FEVR)

Down 9% to 784p (£910m) - Interim Results - Roland - AMBER

Shares in this premium mixer business are down by around 9% at the time of writing, despite some seemingly upbeat headlines at the top of today’s half-year results, such as this:

“Significant operational progress driving 520 bps of gross margin improvement and c.80% increase in Adjusted EBITDA”

When there’s a disconnect between market reaction and the tone of management commentary, I usually head for the outlook section to see if guidance has been cut. It looks like that may be the case here.

Fevertree has cut its revenue guidance for the full year, on the back of a damp summer (my bold):

“We expect to deliver brand growth for the second half of c.7% to c.10%, resulting in revenue growth of c.4% to c.5% across the full year for the Fever-Tree brand.”

Back in March, Fevertree said it was “comfortable with consensus expectations of c.10% [revenue] growth” in 2024. So the company’s original sales growth guidance for 2024 has been cut in half.

This is helpfully confirmed by a Reuters flash news update available in Stockopedia’s news feed for the shares – see here.

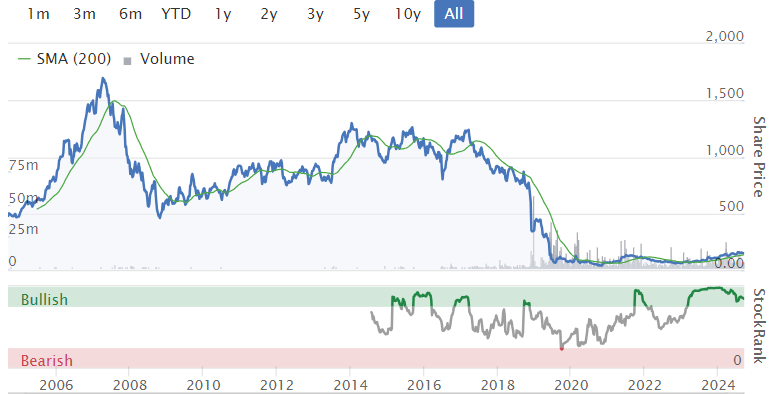

Fevertree’s share price has dropped nearly 40% in 12 months and is nearly 80% below its 2018 all-time high of c.£39. Is value finally emerging? Let’s take a look at today’s half-year results.

Half-year results summary: these figures cover the six months to 30 June 2024. The headline figures are mixed:

Group revenue down 1.5% to £172.9m

Adjusted EBITDA +79% at £18.2m (H1 23: £10.2m)

Reported pre-tax profit: £13.2m (H1 23: £1.4m)

Earnings per share: 6.49p (H1 23: 0.94p)

Interim dividend +2% to 5.85p per share

There are two elements here that interest me – the weak revenue performance and the improvement in profitability.

Revenue: today’s cut to revenue guidance is explained by a poor performance in the UK and Europe so far this year.

The “total Fever-Tree revenue” figure below is actually an adjusted figure relating to “brand revenue”, not total group revenue, which fell (see above):

UK (-6%): poor early summer weather and “a soft Gin category” held back sales, with the company noting that rum, tequila and vodka have been the growth categories in recent years. While tonics remain the biggest seller, UK sales growth is now driven by non-tonic mixers.

Europe (-12%): sales were held back by “phasing of distributor orders” (destocking?) and poor weather.

US (+7%): on a more positive note, US growth has continued, extending its position as the company’s largest sales region. Management say tonic water and ginger beer have gained share and grown “ahead of every competitor”. New distribution agreements also helped, including Hilton and Marriott hotels.

RoW (+56%): sales growth in the Rest of the World segment appears to have been driven by a strong performance in Australia and Canada. However, I’m not sure if some of this 56% gain is a one-off, following an inventory buy-back last year. The company doesn’t split out an underlying sales growth figure for RoW, unfortunately.

Improved profit margins: Fevertree’s gross profit rose by 15% to £62m during the first half of the year, compared to the same period of 2024. That’s equivalent to a 5.2% improvement in gross margin, from 30.7% to 35.9%.

This improvement has been driven by lower costs and some price increases:

the re-tender of UK and European glass supply, contracting of improved trans-Atlantic freight rates and pricing actions taken with customers across regions.

For comparison, gross margin in the peak profit years of 2018 and 2019 was about 51%. It seems the company’s continued international growth has come at a cost to profitability.

Operating costs (staff and marketing) were broadly flat during the first half, supporting an improved operating margin of 7.1% (H1 23: 2.2%). I’d hope to see some further recovery in this towards the 10%+ levels seen in the past. Rival soft drink manufacturers such as A G Barr (LON:BAG) and Britvic (LON:BVIC) routinely achieve double-digit operating margins.

Cash & dividend: net cash was £65.9m at the end of June, representing an increase of 10% over the first six months of the year (Dec 23: £59.9m).

A quick look at the cash flow statement suggests the company has returned to more normal patterns of strong cash generation, helped by some positive working capital movements.

A further reduction in working capital is expected over the remainder of the year and management expects the company to be able to return surplus cash to shareholders in 2025. The company has prior form on this, having previously returned £50m to shareholders in 2022.

I’m reassured to see FeverTree generating cash again and do not see anything to worry about on the balance sheet.

Outlook: I don’t have access to any updated broker notes today.

The company’s revised guidance for 4%-5% revenue growth suggests we could see revenue of c.£381m in 2024.

Assuming a slight improvement in operating margins to 7.5% and applying the company’s underlying effective tax rate of 25% suggests to me we could see a post-tax profit of perhaps £23-£24m, including some interest income.

I estimate that could drop through to earnings per share of around 21p, 27% below the 29p consensus figure shown in Stockopedia prior to today’s results.

That prices Fevertree shares on a pricey 37x forecast earnings with a c.2% dividend yield, assuming my sums are correct.

Roland’s view

Today’s results appear to amount to a profit warning, but I think the underlying trend is more positive than it might seem at first sight.

I’m also reassured by the return to positive cash generation and evidence that inventories and working capital are returning to more normal levels.

Having said that, justifying the current valuation still depends on significant further growth, in my view.

After all, Britvic has just been taken over at a valuation amounting to around 20x forward earnings.

I’m going to maintain our previous amber view on this stock, as I think it’s a good company, but do not have a strong view on the potential for further growth.

Keystone Law (LON:KEYS)

Up 3% to 682p (£215m) - interim results - Roland - AMBER/GREEN

Keystone now expects revenue and adjusted PBT slightly ahead of current expectations for FY 2025

This is a listed law group that floated on AIM in 2017. It remains under the leadership of founder James Knight, who also controls 28% of the stock. So there’s nice management-shareholder alignment.

The company’s business model is also somewhat differentiated, in my view. It operates a networked business model that allows self-employed lawyers to work from their own offices, but using Keystone’s admin/IT infrastructure. So this isn’t simply a conventional partnership law business that’s listed (a model I am not keen on).

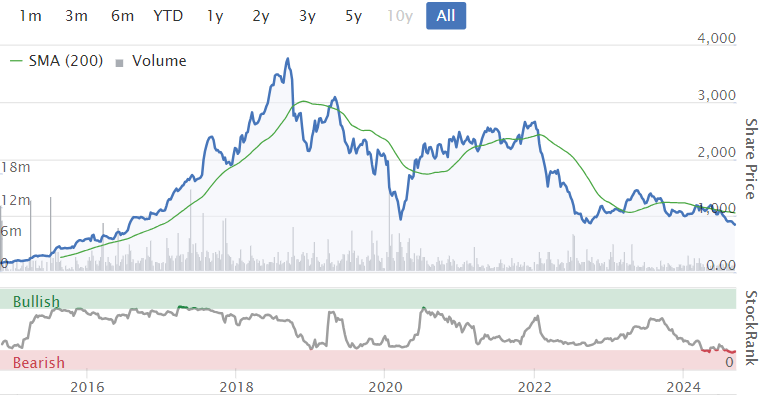

Keystone shares have multibagged since IPO, despite some weakness over the last couple of years:

Today’s half-year results are described as “strong” and have prompted management to upgrade full-year guidance.

Half-year results summary: today’s results cover the six months to 31 July 2024.

Keystone says it added 30 new principals to its network during the first half of the year, taking the total to 442. However, this is only a net increase of 10 from 432 at the end of January, so clearly there’s some attrition.

The total number of fee earners rose to 557, from 549 at the end of January.

The legal recruitment market is described as positive and Keystone has enjoyed a steady increase in demand from qualified applicants for its services:

These numbers suggest to me Keystone is reasonably selective about who it accepts onto its network, an important point.

Financial results from this continued growth appear strong:

Revenue up 8.3% to £46.5m

Adjusted pre-tax profit up 7.1% to £6.1m

Reported pre-tax profit up 5.3% to £5.5m

Operating margin 10.8%

Adjusted earnings up 7.4% to 14.6p per share

Interim dividend up 6.9% to 6.2p per share

Net cash: £8.3m (Jan 24: £8.4m)

Profitability: Keystone’s operating margin seems unexciting at first glance, but this business is capital light, with only a suite of offices and some central IT services.

As a result, Keystone generates exceptional returns on capital employed. Last year’s ROCE figure was 47.3%, a new record for the business:

I’d expect the business to continue to benefit from economies of scale, although I’m not sure how much further this figure is likely to rise.

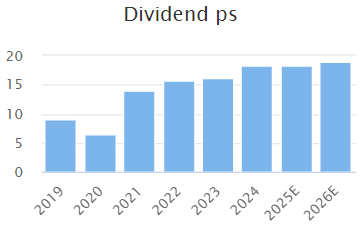

Even so, it’s a very attractive result for me. Keystone’s high ROCE supports strong cash generation and shareholder returns – dividends have risen rapidly since 2018 while the group has maintained a consistent net cash position:

Current trading & outlook: Keystone says that a strong start to the year has given the board confidence to upgrade full-year forecasts:

the Board is confident that Keystone will deliver both revenue and adjusted PBT slightly ahead of current market expectations.

Helpfully, an updated broker note from Panmure Liberum is available today – many thanks. Panmure’s analysts have upgraded their FY25 earnings forecasts by 4% to 27.9p per share.

That prices the shares on a FY25 P/E of 24, unchanged after today’s modest share price reaction.

There’s a 2.7% dividend yield as well – modest, but the payout has risen by an average of 15% per year since 2019.

Roland’s view

I’ve become interested in this company as I’ve learned about its network model. I’m also impressed that it remains founder led, with a strong balance sheet and excellent profitability.

I don’t have any insight into legal market recruitment conditions or the ultimate growth potential of this business. Clearly, there’s also the potential its success could attract additional competition.

My view on the business is favourable, but given that earnings growth is running at single-digit levels, I can’t argue a strong case on valuation, despite the quality metrics. On balance, I’m happy to go with AMBER/GREEN here, to reflect the positive momentum and upgraded expectations.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.