Good morning! Paul is travelling and news flow is quiet, so I'm holding the fort this Friday morning.

All done now. Have a nice weekend! Graham.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

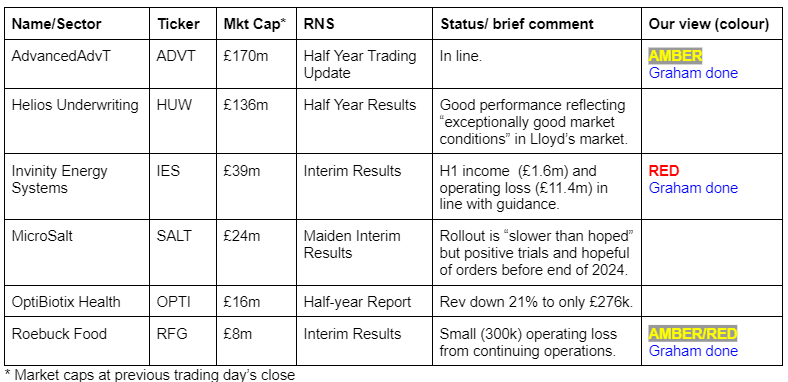

Companies Reporting

Summaries

AdvancedAdvT (LON:ADVT) - up 3% to 131p (£174m) - Trading Update - Graham - AMBER

An in line with expectations update from this vehicle led by Vin Murria. It includes a group of software businesses, over £80m of cash (likely to be used in substantially more M&A), and a stake in M&C Saatchi (LON:SAA). It is arguably trading around fair value here, if you’re happy to value its software businesses on a generous adj. EBITDA multiple.

Invinity Energy Systems (LON:IES) - up 10% to 9.6p (£42m) - Interim Results - Graham - RED

Financial results remain terrible here. The company has raised large sums from investors and the cash pile at the end of H1 (£49m) was larger than the current market cap. However, cash burn has been very heavy and I would continue to vigorously avoid these shares.

Short Section:

Roebuck Food (LON:RFG)

Unch. At 15.8p (£8m) - Interim Results - Graham - AMBER/RED

Until 2021, this was known as Norish plc. Our former colleague Jack Brumby referred to it as a “temperature controlled logistics provider” that year (link).

It has been through plenty of change since then, and today’s interim results outline more change.

A couple of disposals have taken place in H1; the company now consists of:

Moorhead & McGavin - a Motherwell-based business that supplies “pulses, cereals, pasta, rice and flours to the food industry, with clients including Aldi, Brakes, Kerry, Princes, Baxters, the NHS, Stirling Group and Booker”. Sales are up 22% in H1.

Foro Food Solutions - a Cork-based food sourcing business.

Net debt - close to zero as of June 2024 (£0.1m).

Outlook - the disposals have served to “greatly simplify” Roebuck, and management are excited for future prospects.

Financial statements - there is a £300k loss from continuing operations, on nearly £6m of sales. There are also substantial losses from the discontinued businesses.

The balance sheet shows net assets of £2m.

Graham’s view - it’s a Friday, which is a good day to check up on stocks that we don’t normally cover, to see if there is anything that we should be covering more often. Unfortunately based on the financial statements, this looks like it might be too small to be listed. The £8m market cap agrees with me. So for that reason alone I have to take a mildly negative view.

As a reminder, the number of AIM-listed stocks has more than halved from its peak (from 1,700 to 700). Takeovers have played a part in that, but much of it is due to plain old delisting, We need to take delisting risk very seriously for small companies. Let’s move on to something else!

Graham's Section

AdvancedAdvT (LON:ADVT)

Up 3% to 131p (£174m) - Trading Update - Graham - AMBER

AdvancedAdvT Limited (AIM: ADVT, "AdvT", "the Group"), the international software solutions provider for business, compliance and resource management, has published a trading update for the six months to 31 August 2024.

Paul looked at this one in July, noting that it had £82m of cash and a 9.8% shareholding in M&C Saatchi (LON:SAA).

Vin Murria is the Executive Chairperson and owns 13% of ADVT.

Trading update: in line with expectations. H1 revenue c. £19.5m, adj. EBITDA c. £4m.

Net cash rises slightly to £83m, and the shareholding in M&C Saatchi (LON:SAA) is worth about £25m.

Comment by Vin Murria:

We continue to experience positive momentum, with all the acquired units benefiting from the operational and financial actions implemented since acquisition.

"SaaS revenues have shown positive growth, with Resource Scheduling SaaS revenues recording significant gains. This combined with our focus on customer value has driven notable improvements in both revenue and EBITDA performance.

"Whilst we see numerous opportunities for organic business growth, particularly with AI, automation and SaaS offerings, we remain committed to exploring acquisition opportunities to expand the Group."

Graham’s view

Subtracting the value of cash and SAA shares, ADVT’s enterprise value today is £66m.

As noted above, the underlying businesses generated H1 revenues of £19.5m, and adj. EBITDA of c. £4m.

Let’s simply double these to get an idea of roughly where annual numbers might land: revenues of £39m, adj. EBITDA £8m.

One of the recent acquisitions did not actually join ADVT until July 2024. So performance will get a boost from this.

That business - Celaton - previously generated annual revenues of £3.3m and adj. EBITDA of £1.2m.

Adding these on to the numbers above,, I think ADVT’s underlying annual performance is at least revenues of £42m and adj. EBITDA of £9m.

Is that worth the £66m enterprise value? It could be. An adj. EBITDA multiple of 7x for business software businesses is not out of the question at all.

Therefore I’m happy to sign off on a neutral view on this stock, as Paul did in July.

Does it make sense for a large cash pile, a stake in M&C Saatchi, and a group of software businesses to sit together in the same corporate entity? I suppose it does, if you have faith in Ms Murria and you want to make a bet on her business acumen.

Invinity Energy Systems (LON:IES)

Up 10% to 9.6p (£42m) - Interim Results - Graham - RED

Invinity is “a leading global manufacturer of utility-grade energy storage”.

Paul has been RED on it (link). Today’s interim results are as follows:

Total income (sales + grants) of £1.6m

Loss from operating activities £11.4m (H1 last year: £12.6m).

Sales measured in megawatt hours were lower than H1 last year (4 MWh vs 5.38 MWh last year).

Cash finished the period at £49m after the company raised £57m in May 2024. This included £25m from the UK Infrastructure Bank.

Management: in H2, the CEO has retired and been replaced by the former CFO.

A new manufacturing facility has opened, and a new production line has been ordered for another facility (Bathgate).

Outlook:

During the remainder of 2024 we plan to deliver against the near-term corporate goals and set in place the foundations for 2025 and beyond. We believe Long Duration Energy Storage remains critical to increasing the penetration of renewable energy and in advancing the path to net-zero - this is not capable of being achieved by lithium alone. Vanadium flow batteries remain, in our view, the most credible and advanced such alternative and if we can deliver on our corporate goals, the market opportunity remains very significant.

Graham’s view

The fundraising has left it with enough cash to survive in the short to medium-term (at least two years).

So it’s not on the block for short-term insolvency. It has time to improve its financial performance under new management.

However, there is no denying that the numbers up to this point have been awful.

The involvement of the UK Infrastructure Bank is worth a mention. One of its primary purposes is to invest in climate change projects, particularly in projects that will help to meet the government's “net zero” target.

As IES are explicitly trying to help efforts to meet that target, it makes sense that the UKIB would want to get involved.

But for investors who are more concerned with the financial risk: reward on offer, I can see few reasons to invest here, even at a discount to the cash pile. The StockRanks agree with me:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.