Good morning! Paul & Graham with you today.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

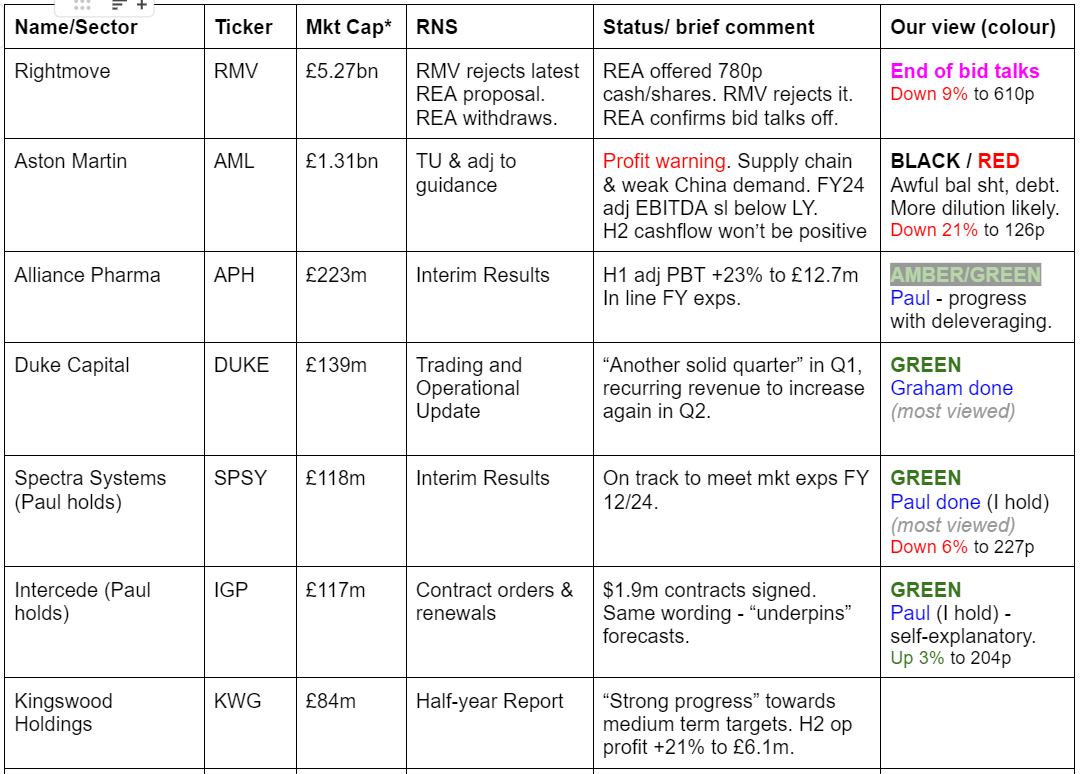

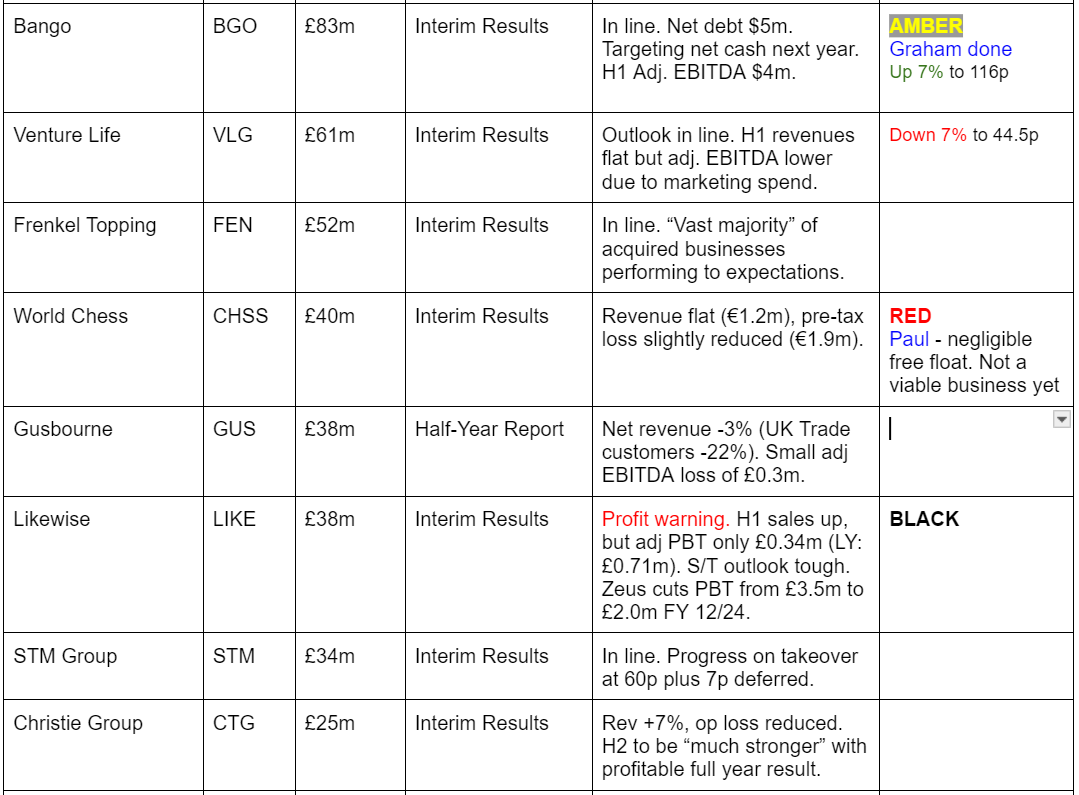

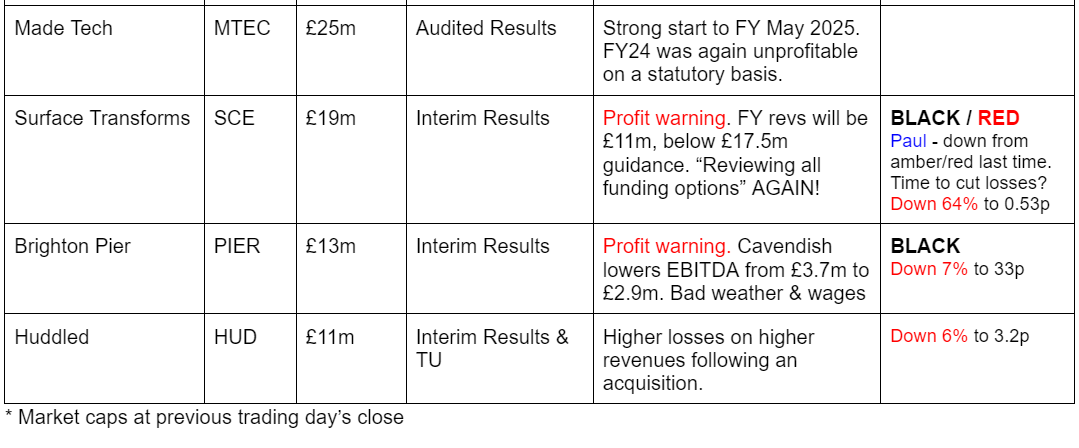

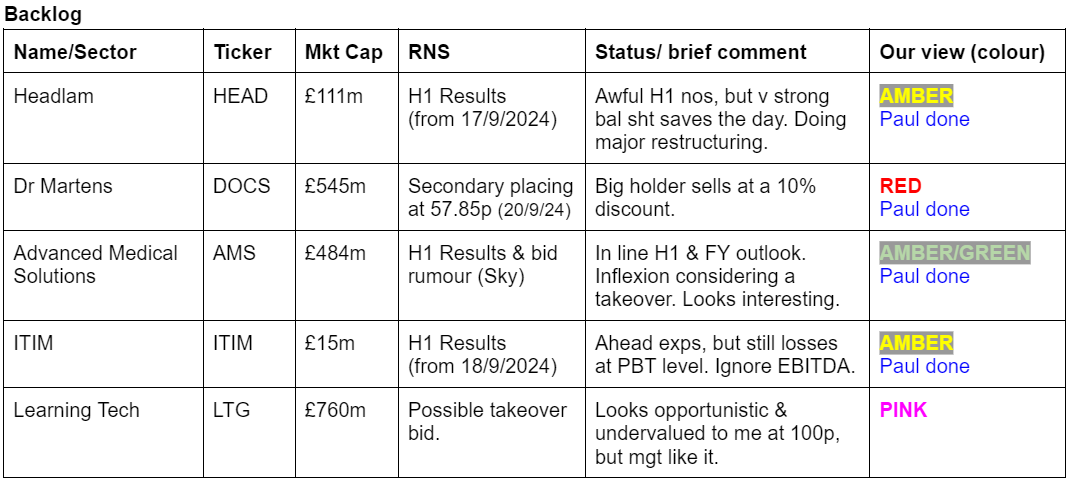

Companies Reporting

Summaries

Spectra Systems (LON:SPSY) (I hold) - down 2% to 235p (£115m) - Interim Results [in line] - Paul (I hold) - GREEN

A modest increase in H1 profit, and upbeat outlook says FY 12/2024 should be in line with expectations. FY 12/2025 should see profit double from a major contract kicking in. I'm happy with all the numbers, and think this is a very interesting growth company, still reasonably (modestly even) priced.

Learning Technologies (LON:LTG) - 95p (£760m) - Statement re possible offer - Paul - PINK

Announced late on Friday that it has received a 100p cash possible bid approach from General Atlantic, and mgt are minded to recommend it. Not a generous price at all, in my opinion, which makes me wonder what motivates mgt to want to do this deal?

Dr Martens (LON:DOCS) - 57p (£545m) - Secondary Placing - Paul - RED

A secondary placing on 20/9/2024 was done at a 10% discount. I re-assess whether bombed out shares are cheap, but conclude it's a mess with serious over-stocking, so I'm steering clear until that's resolved with a fire sale of product.

Advanced Medical Solutions (LON:AMS) - 223p (£484m) - H1 Results & takeover rumour - Paul - AMBER/GREEN

Another backlog item, which put out in line interims, and press reported rumours of a bid approach. It looks quite good to me, so worth a closer look.

ITIM (LON:ITIM) 47p (£15m) - Interim Results [ahead exps] 24/9/2024 - Paul - AMBER

Ahead of expectations update last week, but it's not very exciting when you dig into the detail, it's essentially trading around breakeven. There might be something interesting here, if the business can scale up.

Headlam (LON:HEAD) 141p (£114m) - H1 Results - Paul - AMBER

Awful H1 results, but it's got so much surplus freehold property that selling it more than pays for a major restructuring about 3x over. Can trading recover, or are the problems too deep-seated? I'm not sure either way, but the massive balance sheet NTAV gives it time to attempt a proper turnaround.

Duke Capital (LON:DUKE) - up 2% to 33.5p (£142m) - Trading and Operational Update - Graham - GREEN

A good update from Duke with steady recurring revenue that continues to grow at a modest pace with much of it sent out to shareholders in the form of a regular dividend (yield c. 8.5%). With the shares still trading at a discount to balance sheet equity, I can stay positive here although I will be quick to reduce my stance above c. 40p.

Bango (LON:BGO) - up 6% to 115p (£89m) - Interim Results - Graham - AMBER

Solid “in line” update. BGO remains loss-making but core products, customer wins and momentum are intriguing. Staying neutral on basis it has the potential to succeed and track record of managing its balance sheet is OK.

Paul's Section:

Spectra Systems (LON:SPSY) (I hold)

Down 2% to 235p (£115m) - Interim Results [in line] - Paul (I hold) - GREEN

Spectra Systems Corporation ("Spectra Systems" or the "Company"), a leader in machine-readable high speed banknote authentication, security printing, brand protection technologies and gaming security software, is pleased to announce its interim results for the six months ended 30 June 2024.

The acquisition of Cartor in Dec 2023 has kicked in for the full 6 months of the group H1 results to 30 June 2024, and it has changed the shape of SPSY’s group numbers by considerably raising revenues, but diluting profit margins. For reference, Cartor ‘s results for FY 9/2023, pre-acquisition by SPSY were: revenues £16.2m, EBITDA £2.53m, and PBT £436k.

Hence it looks like SPSY group (now including Cartor) H1 revenues of $22.7m are up 96%, but I reckon almost all the increase has probably come from Cartor’s c.$11m half year revenues (assuming revenues unchanged from its previous year, and adjusting sterling into SPSY’s reporting currency of US dollars).

Given that it’s a significant sized acquisition, it’s worth recapping on what Cartor does, and why SPSY acquired it. This was explained in this RNS from 4/12/2023. Cartor is a security printer, operating from factories in the UK & France, making postage stamps for over 180 administrations globally. It also makes high security tax stamps, vouchers, coupons & certificates. It has state of the art technology apparently. SPSY had already worked with Cartor for several years, and combining the two businesses looks set to produce good opportunities for both. So I like the look of this acquisition, although as mentioned it does dilute SPSY’s group numbers - much higher revenues, but not much change in profit, thus lowering SPSY’s quality measures somewhat. It also put SPSY’s cash pile to good use.

Back to SPSY’s H1 key numbers -

Revenue up 96% to $22.7m due to Cartor acquisition.

Operating profit up 16% to $6.2m

Note that having spent the cash pile on this acquisition, finance charges go from a net income ($172k H1 LY) to a charge of $308k H1 2024.

PBT up 7.5% to $5.89m

Adj EPS up 4% to 11.2 US cents = 8.36p, double it to annualise, is c.16.7p (PER 14.1x, hardly demanding for a growth company)

Note that the share count has been static at SPSY for years, at 49m, so it’s pleasantly averse to dilution, funding occasional acquisitions from internally generated cashflows. Note SPSY is quite a generous dividend payer for a growth company, yielding about 4.0% currently.

Forecast - Zeus gives a detailed update, very useful, thanks. This has revenue of $46m for FY 12/2024, and adj PBT at $12.0m - which looks credible since c.half is already in the bag from today’s H1 numbers.

Note the forecast for FY 12/2025 is more than doubling adj PBT to $25.4m, as a large & high margin sensors contract kicks in. So the results are likely to be spectacular in 2025, which seems to have largely been ignored by the market so far. Hence a nice catalyst here for a re-rating I suspect.

Adj EPS is forecast at 38.2 US cents next year, or 28.5 pence = 2025 PER of just 8.2x - although this earnings figure might not necessarily be repeatable.

Outlook - lots of interesting irons the fire, and management sound upbeat. They’ve delivered in the past, so I take this commentary seriously -

"The combination of the sensor contract award, the continued strong covert material sales, the boost in optical materials, and the significant advancements in our polymer substrate initiative including being asked to advise on a new series of polymer notes is all pointing towards an even more sustainable and growing profitability in the future. While all of this business growth is underway, we continue to be the most innovative company in the authentication sector with machine readable sustainable polymer substrate using circular certified polymer and new breakthroughs in smartphone technology which we are confident has the potential to reenergize this part of our product offering.

"The Board therefore believes that the Company is on track to achieve record earnings and meet market expectations for the full year."

Balance sheet - has changed shape, with the cash pile now mostly spent on the acquisition, and working capital build up for the large sensors contract underway. That should turn into cash (plus profits) in 2025, so there’s nothing of any concern to me.

Absorbing Cartor means fixed assets and goodwill have increased. Again, as expected, not a concern.

Debt of $4.8m was taken on as part of the Cartor acquisition.

Gross cash of $4.4m is slightly more than offset by Cartor’s debt of $4.8m. So it’s in a slight net debt position of $0.4m. That’s absolutely fine, given the strong profitability and cash generative nature of the business, and it’s large sensors contract underway that should provide a bonanza of cashflow in 2025. No concerns here from me.

Cashflow statement - the main feature is that operating cashflow has almost all been (temporarily) absorbed into working capital, due to inventory build-up for its large sensors contract. Note that the acquisition-related cashflows were recorded late in the 2023 financial year.

SPSY doesn’t seem to capitalise any development costs, which is nice prudent accounting. Yes, I’ve just confirmed that in the 2023 Annual Report -

“Internal research and development costs are expensed as incurred.”

[within note B, accounting policies).

The other big item is divis paid of $5.6m in H1, which is a single annual divi payment, there’s no interim divi.

Put all that together, and the cash pile has dropped from $16.6m in June 2023, to $4.4m June 2024. Expect this to rebuild in 2025.

Paul’s opinion (I hold) - this all looks fine to me, so I’m a happy holder.

I remain of the view this is an under-appreciated growth company, doing a lot of very clever stuff, and generating impressive contract wins, profits & cashflows. I suppose the main risk is possibly from large, lumpy contracts - there’s always a chance of the occasional fallow year.

Things seemed to drop into place from 2017, and it hasn’t looked back since -

Learning Technologies (LON:LTG)

95p (£760m) - Statement re possible offer - Paul - PINK

This announcement slipped through the net at 4pm on Friday, giving LTG shares a boost.

LTG confirms it had a conditional approach from General Atlantic, a US investment firm focused on growth companies ($71bn AuM according to Google).

Possible all-cash offer at 100p. Alternative offer for equity in unlisted holding co, for LTG shareholders who don’t want to sell out.

Subject to due diligence & paperwork.

LTG Board say they’re minded to recommend the 100p offer, so is engaging with GA.

Paul’s view - it’s hardly generous, as LTG (with most of the bid premium now in the 95p share price) is only rated at a fwd PER of 12.7x

Although note that LTG broker forecasts have been in steady decline for some time. Guidance with H1 results (issued 17/9/2024) was FY 12/2024 results would be at the lower end of broker forecast range. Last balance sheet was adequate, NTAV slightly negative, but doesn’t matter as it’s a very cash generative business, making good margins, and with majority recurring or long-term contracted revenues.

Overall, I think they’re selling it too cheaply, and would be better off rejecting this bid. Maybe management might prefer the upside for themselves under P/E ownership?

Another quality UK business being taken out by Americans on the cheap?

Dr Martens (LON:DOCS)

57p (£545m) - Secondary Placing - Paul - RED

DOCS took a sharp fall from 65p to 52p on 20/9/2024 (since bounced a bit to 57p) on news that Goldman Sachs was dumping 70m shares (c.7.3% of the total) in a secondary placing on behalf of a client. It looks like Fidelity took most of them, but at a painful 10% discount.

We’re seeing quite a few secondary placings at the moment, where market liquidity is inadequate for a large holder to exit through normal trades, and buyers demand a hefty discount. Whilst these sound bad, sometimes they can be buying opportunities. A recent example of that was a sharply discounted secondary placing in TI Fluid Systems (LON:TIFS) which has since shot up about 50% due to a subsequent takeover approach.

Is DOCS a buying opportunity? I would say not. See my notes here on 30/5/2024 where I marked DOCS shares as RED at 89p, viewing it as a big mess, and looking set up for another profit warning in H2. The main problem is that the 31/3/2024 balance sheet shows huge inventories of £255m at cost (which compares with cost of sales for a whole year of £302m). So it has warehouses full of boots that it can’t sell. Hence the only solution has to be clearing them at discounted selling prices, which means future profits take a bath from low margin clearance sales. The brand is also likely to be damaged from having to take this overdue action. So expect more profit warnings from DOCS I think. Presumably the big seller was prepared to take a discounted profit for their shares because they’ve come to a similar conclusion?

At what point do DOCS shares become cheap? Difficult to say, it depends, but the current £545m market cap doesn’t look sensible to me, for a business that I think is in a big mess. It was another ludicrous, opportunistic & overpriced 2021 float, that has amazingly lost almost 90% of its peak 2021 valuation. I suspect divis are likely to be cancelled too, with bank debt reduction looking more important. Could get worse before it gets better, maybe. I’m generally of the view now that fashion sector risk isn’t worth taking - eg look at how volatile profit & share price has been at Burberry (LON:BRBY) (which I think is another awful share incidentally).

Advanced Medical Solutions (LON:AMS)

223p (£484m) - H1 Results & takeover rumour - Paul - AMBER/GREEN

H1 results were out on 18/9/2024 which we very briefly commented on, being in line H1, and in line FY outlook. It’s quite a nice company, which I last properly looked at on 10/1/2024, concluding AMBER/GREEN at 213p. At the time it said strong growth was lined up for 2024. AMS had a nice cash-rich balance sheet, although it looks as if that has now been spent on a “transformative” acquisition of Peters Surgical, which completed 1 day after the H1 period end, initially costing c.£110m. So it will now have net debt. The plot thickened on 17/9/2024, when (as always) Sky News revealed that Inflexion is considering a possible takeover bid for AMS, along with other private equity firms. Market excitement rapidly fizzled out, after a spike to 254p on 18/9/2024 disappeared and it ended last week at 223p/share.

Paul’s view - I think this looks a decent quality business, at a reasonable price (fwd PER of 18.2x), so I think it could be worth some closer investigation. There doesn’t seem to have been any comment from the company re the takeover rumours. It looks quite an interesting potential punt to me, so I’ll stick at AMBER/GREEN.

ITIM (LON:ITIM)

47p (£15m) - Interim Results [ahead exps] 24/9/2024 - Paul - AMBER

itim Group plc (AIM:ITIM) a SaaS based technology company that enables store based retailers to optimise their businesses to improve financial performance, is pleased to announce its unaudited interim results for the six months ended 30 June 2024.

Very small and illiquid, with 5 large shareholders holding about 75% of the shares, including the founder with 38%.

I’ve briefly commented on ITIM several times this year, AMBER each time. That’s because the newsflow on contracts (eg Quiz, Majestic Wine) has been good, but it remains loss-making after you reverse out the capitalised development spend, and I’m not keen on the balance sheet. Not a bad little business, but can it scale up?

H1 saw revenue up 19% to £8.8m, and ARR hit £13.2m. Not bad.

H1 adj EBITDA moved from a £(0.2)m loss last year, to £1.2m positive this time, but of course it’s a nonsense number due to capitalised development costs.

Real world PBT is c. breakeven, at £(73)k loss in H1 - much improved on the £(1,090)k loss in H1 LY.

So we have a small business, trading at breakeven - not every exciting really.

Balance sheet - nothing much, with £11.4m NAV being almost all intangible assets of £11.2m, so just £0.2m NTAV - that that should be OK for a small software company, since they get paid up-front usually. Cash looks fine at £3.0m.

Cashflow in H1 was good, mainly thanks to collecting in receivables well (a £1.4m cash boost). Note that £0.8m of intangibles were capitalised. Overall then, it’s operating around cashflow breakeven in the real world, the way I view the numbers.

Outlook - is positive -

"As a consequence of the positive momentum, including new contract wins, in addition to encouraging trading since the beginning of H2, the Board anticipates delivering full year results ahead of current market expectations."

Broker forecast - Zeus helps us out with revised numbers. I reject EBITDA for companies which capitalise internal costs, so it’s PBT only for me. This is still loss-making, but forecast improving from £(1.0)m to £(0.7)m for FY 12/2024.

Strangely, Zeus actually reduces FY 12/2025 forecast revenue from £19.0m to £18.0m, which seems odd, given talk of a strong pipeline. Profit forecast for 2025 is left unchanged at £0.4m adj PBT.

Paul’s opinion - I’m a little underwhelmed (why does nobody ever have the correct amount of “whelm”?!) by the detail, which doesn’t sound as exciting as the ahead of expectations headline. What we have here is a very small business (probably too small & illiquid to be listed), trading around breakeven in real world terms. Not very interesting. That said, there are some aspects of this share that get my antennae slightly moving, if not fully twitching. So I’d like to learn more about the company, and if it has the potential to properly scale up or not? There are so many small EPoS software companies, that often have loyal, locked in clients, but never really go anywhere. ITIM won an interesting contract in Brazil, which seems unusual for a small UK software company - what was that all about? Client concentration worries me a bit, as I think Quiz is in trouble, and I’m not sure about Majestic Wines. Might it de-list, if the costs & hassle of an AIM listing become a bore to management? It was I’m afraid another overpriced and opportunistic 2021 float.

I’ll keep an open mind on ITIM, much the same as the StockRank which has been creeping up from the red into the middle ground (currently 55). My view is not dissimilar - there could be something here, possibly, but only time will tell. What we really need to do, is talk to a big client that actually uses ITIM’s software & services, and ask them what they think. That’s true of all software companies - ignore everything the company itself says, and find out what the customers really think. I’ve heard (and experienced myself) some horror stories, where you’re locked into using some dreadful, but mission-critical software, where the listed company’s version of events in its RNSs bears no relation whatsoever to the customer experience. Hopefully that’s not the case at ITIM. How can we find out? Do any readers know anyone that uses this software? Retail isn’t a great sector either, so I’d be a bit worried about the potential for ITIM’s customers to go bust.

Headlam (LON:HEAD)

141p (£114m) - H1 Results - Paul - AMBER

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings distributor, today announces its results in respect of the first six months of the year to 30 June 2024 (the 'Period')...

Ambiguous wording there, which would have benefitted from adding a comma. What they mean is this is the first six months results of FY 12/2024.

My view of HEAD was a good business, fairly reliably churning out c.40p EPS pre-pandemic, which was then obviously heavily disrupted in 2020 and 2021, but it got back to that level of earnings in 2022.

However, looking at the chart below, something’s clearly been going badly wrong since.

The deteriorating fundamentals are vividly depicted by the invaluable broker consensus graph below. As an aside, it’s interesting how brokers are sometimes reluctant to forecast losses. So when I see a downward direction in consensus forecasts, that flat-lines just above zero, it’s often best to assume that they’re desperately trying to remain positive, but the reality is that losses are actually becoming more likely. Then you often get a sudden lurch into forecast losses, as the restraining forces are snapped like old knicker elastic, probably.

H1 results to June 2024 are really bad - and remember these are the favourable, adjusted numbers too. Statutory PBT is £4m worse, due to £7.4m “non-underlying” costs (mainly restructuring), partially offset by a £3.2m profit on property disposal. Remember that HEAD has an unusually strong balance sheet, with loads of freehold property.

If H2 is equally bad, then we’re looking at a business making possibly £30m+ annual loss, which raises the question whether this is still a viable business, or is it doomed to go bust?

Also why has performance deteriorated this badly? Obviously subdued demand, but it’s being squeezed from all sides - revenue down 11.8%, but lower margin too, with gross profit down 14.3%. Then both distribution and administrative costs rose vs H1 LY. Hence why a £6.0m H1 profit last year became a £(16.4)m loss in H1 2024.

HEAD breezily comments -

“Results in line with expectations; acceleration of strategy through a two-year transformation plan”

It’s been restructuring for several years already, so it’s clearly not working so far.

Strategy -

“launches the acceleration of its strategy through a transformation plan to simplify the business and enhance the customer offer, generating at least £15 million of annual profit improvement and £70 million of one-off cash benefits.”

That’s a strikingly large cash benefits (one-off) figure.

Balance sheet - this is not a reason to buy HEAD shares, but it does provide considerable downside protection, that the business should be able to trade through this downturn, without coming under dilution or insolvency pressure (probably, it depends how bad things get - even well-financed companies can be overwhelmed if trading is bad enough) -

Pension scheme funding of £1m pa has now stopped, thanks to a deal with Aviva, which cost £1.1m (plus fees). That removes risk, so is good.

NAV is £200m, less intangibles of £19m, giving NTAV of a remarkably strong £181m. That’s much higher than the market cap of £114m. Although a cynic might say that all these assets are unproductive, since HEAD is now loss-making.

Net debt (excl leases) is modest at £28.3m, although covenants could now be a concern.

There’s plenty of liquidity, with £72m of cash & undrawn facilities (assuming facilities continue to be available).

Going concern statement is clean.

Restructuring - this strikes me as an extensive reorganisation of the business. Its current hotch-potch of 32 businesses (built through acquisitions) being consolidated into a single national business, called “Mercado” (strikes me as a dreary name, why choose that?! It means “market” in Spanish & Portuguese according to Google).

Broader, unified product list.

Reorganised sales teams.

Closing its big Ipswich distribution centre (freehold), which is to be sold.

Combining 2 Scottish warehouses into one (freeing up the other for sale).

Faster stock-turn, freeing up working capital.

Centralising back office & support.

Operational cost savings.

Restructurings normally consume cash, but in this case, the freehold property disposals pay for it almost 3-times over, which I find very encouraging, so insolvency/dilution risk should be minimal, assuming it’s able to sell its surplus properties as planned -

Property disposals -

“Headlam owns both the Ipswich and Uddingston properties, and both sites have recently been put on the market. We are actively engaging with buyers and offers are already being received. Collectively these properties were valued in January 2023 at £20.7 million.”

Property & bank debt - since they have security over freeholds, I’m not worried about the bank pulling the rug here -

“The Group continues to have strong asset backing; as at 30 June 2024, after the sale of the Stockport property in June 2024, the Group owned property with a market valuation of £142.1 million, and also had inventory and receivables of £124.9 million and £104.3 million respectively. The banks have a legal charge over six of the Group's properties, with a combined market valuation of £84.6 million; broadly equivalent to the size of the revolving credit facility.”

Longer-term outlook it still thinks is positive. It’s striking how much lower the market size is, so it does seem reasonable to assume that there could be a general market recovery as the housing market begins to pick up -

It seems to be the case that there was a surge of household improvements during the pandemic, as people spent surplus disposable income on making their homes nicer, during the enforced incarceration of lockdowns, and working from home. Home improvements have a long life, so it stands to reason that after the boom, there would be a lull. Although I don’t think anyone expected the lull to be this bad.

Market leader in furniture retail, DFS, mentioned last week that is was seeing “record low market demand”, on top of pressure from higher interest rates and Red Sea shipping delays. However, it also forecast a “gradual market recovery” in the pipeline. So perhaps investors should be positioning ourselves for that recovery, if we can find favourable risk:reward situations. DFS is so horribly over-geared that I can’t get comfortable with its diabolical balance sheet, but that might provide leveraged upside for punters who accept the financial risk (look at what happened with MCB when it pulled off a stunning turnaround, with the leveraged benefit flowing to equity holders). Could the same sort of thing happen here? DFS is the risky, geared option, whereas HEAD is effectively ungeared once you take into account its large freehold property assets & forthcoming disposals. So a bull case could be argued for either share, depending on how you see a recovery & the differing risk:reward.

Competition - HEAD says little about this, other than that it’s up against distributors lowering prices to protect market share. Up & coming competitor LIKE (TYO:2462) said on 19/6/2024 that sales are growing, and are expected to continue growing in the seasonally busier H2. So it’s obvious that HEAD is losing market share to LIKE. Although LIKE shares are also in the doldrums, because it’s only making a very modest profit margin, so seems to be chasing revenues for the sake of it - not an appealing business model from my point of view. I like businesses with at least some pricing power, or super-efficient operators, with both HEAD and LIKE seeming to be neither.

Outlook & current trading - very little to get excited about here, it sounds pretty gloomy to me -

Paul’s opinion - such a tricky share to assess. H1 trading was a disaster, but it’s got a radical restructuring underway, which is fully funded from its own surplus capital, and a supportive bank that has the security of substantial freehold properties. So I don’t see risk of dilution or insolvency here. That buys it time to execute the turnaround.

There should be at least some recovery in demand, as the consumer begins to recover, and residential property markets improve. So this could be the low point in the cycle for earnings. However, I also think HEAD is probably facing much tougher competition now from growing competitor LIKE.

It all now hinges on how much upside can be squeezed out of the restructuring (turning 32 independent businesses into 1 sounds a huge task).

On balance I feel moderately negative about the business itself. However the asset backing is so strong, that a lot of the risk is removed. Hence I’ll stick at AMBER, which is where we’ve been previously all this year to date. Although I’m very much losing patience with this share, and another profit warning would mean we’d have little choice than to shift down to amber/red. We’d already be there, if it wasn’t for the big balance sheet support, now well above market cap.

EDIT: Competitor Likewise (LON:LIKE) has issued a profit warning today, with Zeus lowering forecast adj PBT from £3.5m to £2.0m FY 12/2024. 25 and 26 forecasts left unchanged though.

Graham’s Section:

Duke Capital (LON:DUKE)

Up 2% to 33.5p (£142m) - Trading and Operational Update - Graham - GREEN

Let’s check in on Duke. We last reviewed it back in April.

As a brief reminder, Duke invests in medium-sized businesses and receives payments that are linked to the growth of the revenue of those businesses.

Key points from today’s update for Q1 (April to June 2024)::

Recurring revenue of £6.3m, up 5% year-on-year.

For Q2 FY25, recurring revenue of £6.4m is anticipated - this will be a new record high but only a modest c. 3% increase on Q2 FY24.

Operational update - details on two follow-on investments in existing portfolio companies. At one of these companies (United Glass Group), Duke now owns 74% of the equity.

Their tendency to buy equity stakes is something that previously affected my conviction in Duke, as I was far more interested in their “royalty” investments than in a private equity strategy.

CEO comment: Neil Johnson welcomes the August rate cut from the Bank of England.

The chart below shows the Duke share price since September 2021, when the Bank of England’s rate increases began. I’m not suggesting that the Bank of England is the only variable that counts here - but I do think it makes sense that in general, the value of Duke’s investments should fall as rates increase, and vice versa:

CEO comment concludes:

"Despite the macro headwinds, it is pleasing to report that Duke's diversified portfolio across the UK, Ireland, Canada and the United States continues to deliver reliable returns resulting in a strong dividend stream being paid out to its shareholders."

Graham’s view

As noted above, my conviction in the DUKE investment thesis has weakened a little over time, as some of their investments have seemed very high-risk to me, and with their growing private equity portfolio putting them first in line to take any losses at some of their portfolio companies.

However, I’m going to maintain my positive stance on these shares for the same reasons as before.

Duke has so far successfully avoided taking big losses, even when its portfolio companies have struggled. With a large, diversified portfolio that has been running for several years at this stage, it’s quite an achievement. The standout example here is Temarca, a Dutch riverboat operator crippled by the Covid crisis, which Duke exited in 2021 for only a very small loss.

Duke continues to trade at a discount to its balance sheet NAV (£142m market cap vs £165m net assets as of March 2024).

If Duke trades at or above its NAV again, I’ll revise my stance and perhaps switch to AMBER or AMBER/GREEN.

For now, I’m happy to stay positive. If I was still a shareholder here, I’d be inclined to reinvest the dividends back into DUKE until the shares trade at a higher level:

Bango (LON:BGO)

Up 6% to 115p (£89m) - Interim Results - Graham - AMBER

A mixed bag of results here, with revenues and adj. EBITDA improving, but with the company still loss-making. The main point is that trading is in line.

I’ve covered Bango a couple of times this year - see coverage in April and in January.

The main product is the “Digital Vending Machine” (DVM), a place where telcos, banks and retailers can connect to content providers and bundle their content into a package for consumers.

There is also a payment processor for app stores and merchants.

Today’s financial headlines are:

H1 revenue +19% ($24.1m)

H1 adj. EBITDA moves from breakeven to a $4m profit

The pre-tax loss improves from a $4.9m loss in H1 last year, to a $3.4m loss.

Net debt is $5m.

Customer wins/operational highlights are positive including various new customer wins and contract extensions achieved by the DVM, and new content providers signing up.

CEO comment:

"The first six months of 2024 have gone to plan and are in-line with the Trading Update issued in July. The payments business continues to deliver growth, providing cash to fund expansion of the Digital Vending Machine® (DVM), which continues to be adopted as the defacto standard platform for subscription bundling by the world's largest companies. The addition of Disney+ to the Bango eDisti program is further evidence of this and will help accelerate time-to-revenue from DVM deals. With 4 new DVM wins in the 1H and a further 3 in Q3, the pipeline built over the past years continued to deliver results and provides confidence in meeting market expectations for the full year…

Outlook: H2 will benefit from all of the new customer wins in H1 and also from Amazon Prime days, Cyber Monday, Black Friday, Christmas, etc.

Graham’s view

I continue to find the product interesting, with a convincing rationale. Bango’s CEO points to the lower churn rate enjoyed by Verizon after it started bundling 3rd party services using Bango’s DVM. Consumers like the simplicity of buying multiple products with one subscription.

Combine that with a confident self-description (Bango’s DVM is “the defecto standard problem for subscription bundling by the world’s largest companies”) and it starts to look like a very compelling investment.

So why have I been stuck on neutral? Simple: the company hasn’t been generating much by way of profits yet. Value investing tends to be a little impatient: it want’s profits today, when growing companies often can’t provide this.

Looking at today’s income statement, we again have a large and uncomfortable gap between adjusted EBITDA and the operating loss.

The left-hand side is H1 2024; the right-hand side is H1 2023:

I should note again that Bango capitalises a great deal of development spending, i.e. puts the spending on its balance sheet as an asset, instead of counting it as a cost as it goes along.

In H1 2024, Bango capitalised $7.6m of development spending. At the same time, it only counted a corresponding amortisation expense of $5m. So it could be argued that the “real” operating loss was nearly $3m worse than what was recorded.

But I don’t want to be too gloomy: the numbers are moving in the right direction and I am inclined to believe the commentary which says that H2 will be a big improvement.

Therefore, I’ll continue to resist the urge to take a negative view on this unprofitable but interesting growth story.

One important factor is that Bango’s share count hasn’t increased much in recent years: it’s only up by 10% since 2018. When I see an unprofitable growth company that is constantly raising fresh equity, I’m far more inclined to be sceptical about its investment prospects. But that’s not the case here.

Bango does carry some net debt but if H2 is as good as is promised, it will have little difficulty servicing that debt. Therefore I’m happy to stay neutral here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.