Good morning from Paul & Graham!

Interesting news from the BRC today, saying that shop prices are falling, down 0.6% for year to Sept 2024, a slightly steeper fall than -0.3% in the year to Aug. This might possibly help the Bank of England cut interest rates from the current excessive (in my opinion) level -

"Helen Dickinson OBE, Chief Executive of the BRC, said: “September was a good month for bargain hunters as big discounts and fierce competition pushed shop prices further into deflation. Shop Price inflation is now at its lowest level in over three years, with monthly prices dropping in seven of the last nine months. This was driven by non-food, with Furniture and Clothing showing the biggest drops in inflation as retailers tried to entice shoppers back. Food inflation edged up slightly as poor harvests in key producing regions led to higher prices for cooking oils and sugary products."

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Companies Reporting

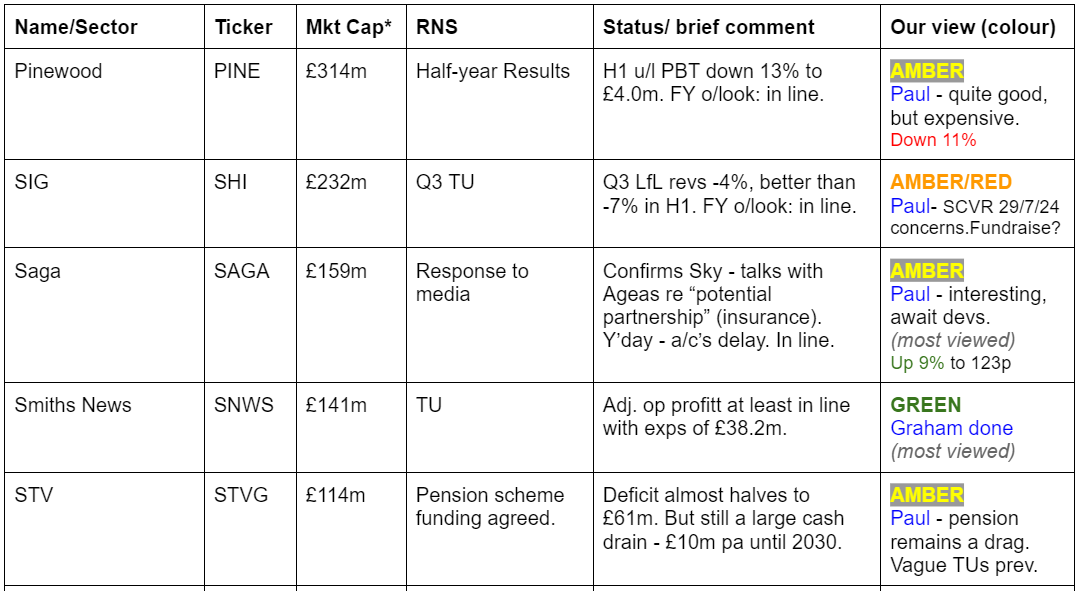

Summaries

Smiths News (LON:SNWS) - up 2% to 58.5p (£145m) - Post Close Trading Statement - Graham - GREEN

A positive update with performance described as “resilient” and “solid” at the UK’s largest wholesaler of newspapers and magazines. I like the valuation multiples on offer here even if it’s undeniably ex-growth and most likely facing a long-term decline.

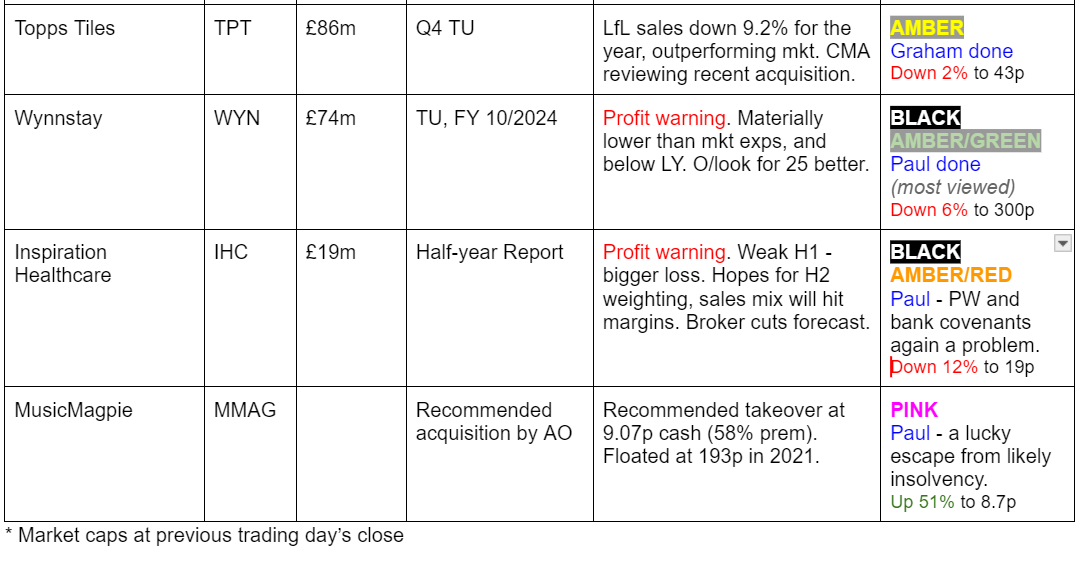

Topps Tiles (LON:TPT) - down 0.5% to 43.7p (£86m) - Q4 Trading Update - Graham - AMBER

There have been no changes to Edison’s forecasts here. TPT previously warned on profits for FY Sep 2024 but with that year finished, investors can now reasonably look forward to a bounce in performance in FY25, boosted by a recent acquisition.

Wynnstay (LON:WYN) - down 6% to 300p (at 12:28) £70m - FY 10/2024 Trading Update [profit warning] - BLACK (PW) / AMBER/GREEN (on fundamentals)

Quite a nasty profit warning, with Shore reducing FY 10/2024 forecast earnings by a third. So the 6% drop in share price today strikes me as surprisingly lenient. The bulletproof balance sheet has probably acted as a shock absorber. Plus shareholders may be relaxed about holding, given the 20 year unbroken record of rising divis, and a near-6% yield. I still like it, but have moderated a notch from green to AMBER/GREEN, to reflect the profit warning and only a slight share price fall.

Paul’s Section:

Wynnstay (LON:WYN)

Down 6% to 300p (at 12:28) £70m - FY 10/2024 Trading Update [profit warning] - BLACK (PW) / AMBER/GREEN (on fundamentals)

“The Board of Wynnstay, the agricultural supplies and specialist merchanting group, provides an update on trading for the financial year ended 31 October 2024 ("FY24").”

Oh dear, it’s not had a good year unfortunately, with the seasonally important season having disappointed -

“As highlighted in the Group's interim results, reported on 25 June 2024, the outturn for the financial year was expected to be driven by the Group's performance in the second half. With more challenging conditions being experienced in seasonally important months, it is now clear that results for the financial year will be materially lower than current market expectations and lower than the previous financial year.”

Forecasts had already been slashed, and will take another fall after today’s news -

Reasons given for weak performance -

Lower demand and prices for poultry feed. Farmers are being cautious, after heavy rains.

Outlook -

“The Group has a well-established market position and benefits from a strong balance sheet and good cash flows. While there are a number of headwinds in the short-term, the Board expects a better outlook for the livestock and dairy sectors and anticipates an improved financial performance in FY25 compared to FY24. The Group will continue to focus on operational improvements and efficiencies and continue to invest for the future.

The Board expects to announce its trading results for the year ended 31 October 2024 towards the end of January 2025 and will provide a further update on current trading at that time.”

Broker updates - Shore Capital helps us out with an update available on Research Tree. It’s really helpful when brokers provide a “Old” and “New” table for revised forecasts, which Shore does. It’s taken an axe to FY 10/2024 forecast, down from 37.9p to 25.2p (adj diluted EPS), down 34%. That also triggers a 28% drop in next year, to 27.3p, because broker spreadsheets tend to be based on year-on-year movements, so if the base year is dropped, all the following ones also drop.

Could this be low cycle earnings though? WYN does say that it expects 10/2025 to be better, but it only makes tiny profit margins, so the profit numbers are quite unpredictable.

Anyone who watches the brilliant Clarkson’s Farm has been educated into how difficult & problematic farming is (even more so considering Clarkson is a total clot! How much is put on for the cameras though?!), with weather, pests, and often onerous or even nonsensical rules & regulations making it a very difficult way to make a living.

Do we have any farmers in the house? If so, I'd love to hear your perspectives.

Valuation - I can’t justify a PER of more than 10 for this type of very low margin business, so I get to a price of 250p. The strangely resilient share price today (only down 6%, despite forecasts plunging by a third) to 300p strikes me as a bit too rich.

Balance sheet - this is a stand-out feature of WYN. The last balance sheet at 30/4/2024 is quite remarkable for a company valued at £70m market cap.

NAV was £136m, less £20m intangible assets, gives NTAV £116m. So you’re getting 40% of those net assets for free. However, given WYN makes a poor return on its assets, maybe it should trade at a discount?

It has about £12m in freehold property (note 16, last Annual Report) within fixed assets, plus £1.85m in investment property which is rented out.

Working capital is large, with £172m current assets (mostly inventories & receivables, but also £25m cash) at 4/2024.

All creditors (short and long term) total £101m, so you can see it’s a very healthy overall position, that might possibly attract a financial buyer who could maybe sell off assets, squeeze working capital down, gear it up a bit, and end up owning a business that almost paid for itself.

Does a strong balance sheet matter? I think it does, yes. As we’ve seen today, it’s a cushion. So even if trading is weak, a lot of investors won’t be perturbed because they know it’s so strongly asset backed. Hence a 34% drop in profit expectations today only triggered a 6% share price fall. I’d be surprised if that would have happened if WYN had a weak, geared up balance sheet.

Cashflow statement - nothing much of note, other than that it seems to have quite large swings in working capital, in the last year figures.

Dividends - Shore has not changed its dividend expectations for FY 10/2024, static at 17.5p - yield of a nice 5.8% - note the unbroken 20 year track record of rising divis, and of course the balance sheet strength to be able to afford generous divis, even in a bad year.

Paul’s opinion - this section has been a nightmare to write, as I’ve wasted most of the morning getting all the numbers muddled up, and had to start again, so sorry it took so long to write. Never mind. Can I stay at green, considering this is a hefty profit warning, with forecasts down by a third? I don’t think so, as we have to reflect reality. So I’ll trim back to AMBER/GREEN, because the 6% fall in share price today is not enough to make the shares look a raging bargain. If the share price had crashed to say 200p then I would happily have stayed at green. At 300p though, I think it might have got off a little too lightly on today’s bad news.

Fundamentally though, it’s an OK company, working hard to eke out a tiny profit margin each year, which is rather volatile.

Yet I expect long-term holders are probably quite happy with the reliable, rising, generous divis, and can wait out the weakness in its markets to improve.

Graham’s Section:

Smiths News (LON:SNWS)

Up 2% to 58.5p (£145m) - Post Close Trading Statement - Graham - GREEN

We have a “resilient” and “solid” H2 trading performance from this newspaper and magazine distributor.

Full-year adj. operating profit will be “at least in line” with expectations of £38.2m (last year: £38.8m).

Revenue growth for the year of 1.1% was boosted by various factors including an additional week of trading. Last year’s results were for the 52-week period ending 26/8/2023, while this year it’s the 53-week period ending 31/8/2024.

Since there’s an extra week involved, I would chalk up the real underlying revenue growth for the year as zero.

Cost savings: £5.6m of savings delivered, in line with budgets. At the same time “growth initiatives” are making an increasing contribution to profit. So it sounds to me more like a redirection of spending rather than anything else.

Refinancing agreement: the company no longer has to follow a dividend/distribution cap of £10m p.a., so more cash can be returned to shareholders. Paul mentioned this in his coverage in May.

Graham’s view

This is only a brief update - more detail will be provided in the full year results in November.

But for what it’s worth, I’m amazed at how cheaply this is trading.

Paul covered the key points in May, and I would highlight the following:

Results are clean, with few adjustments. Only a small gap between adjusted operating profit and actual operating profit.

Net debt fell to only £10m.

Mid single-digit earnings multiple.

This stock enjoys a perfect ValueRank of 99 (can’t get better than this) and a StockRank of 99, too.

The market is apparently treating this as a “cigar butt” with only a few puffs left before it runs out.

I can’t deny that this is ex-growth and doesn’t deserve to trade at an above-average multiple. But at only around five times earnings, I’m a bull.

Topps Tiles (LON:TPT)

Down 0.5% to 43.7p (£86m) - Q4 Trading Update - Graham - AMBER

Topps Tiles Plc ("Topps Group", or the "Group"), the UK's leading tile specialist, announces a trading update for the 52-week period ended 28 September 2024.

We last looked at this one in April, when Paul was neutral on the day of a profit warning. FY September 2024 estimates were clobbered, but there were hopes of a rebound for FY September 2025.

Visually this is the trend in EPS estimates:

FY September 2024 is now over, and here’s the update.

Group sales (excluding an acquisition) of £248m, down 5.7%.

Like-for-like sales at Topps Tiles (i.e. online sales plus same-store sales) down 9.1%.

The year-on-year performance was slightly better in Q4 than in the rest of the financial year.

The trading environment was “very challenging” and TPT believes the wider market has declined by 10-15%, i.e. that it outperformed the market as a whole.

Acquisition - a recent £9m acquisition of a tiles company including 30 stores will be reviewed by the Competition and Markets Authority. This isn’t good news but I find it hard to imagine the CMA taking any action here.

CEO comment:

We remain focused on the delivery of our new Mission 365 goal [GN note: the goal to reach £365m of annual sales]...

"Looking ahead, macro-economic indicators point to a stronger market in 2025. While the timing and trajectory of the recovery remains hard to predict, we are confident that our clearly articulated and proven strategy will enable the further development of the Group in all market conditions."

Estimates: Edison has published a note this morning that makes no changes to estimates. For FY24, they are expecting revenues of £247.3m and adj. PBT of £6.5m. For FY25, they are expecting revenues of £294.4m and adj. PBT of £11m.

Graham’s view

I can’t get away from our existing stance that TPT is priced about right.

At a tax rate of 25%, £11m of PBT translates to £8.2m of adjusted net income.

Based on results from previous years, we can expect a large gap between the adjusted and unadjusted numbers.

But I’m not taking a bullish stance on TPT, so I don’t need to be too strict on the adjustments. I am just checking whether the valuation is reasonable and I think it is - it’s trading at about 10x forward earnings, if you allow the adjustments.

Stockopedia’s calculations roughly agree with me:

Net cash at the interim report was £19m. That will be significantly lower after the acquisition, but according to forecasts it should still be positive. So I don’t think I need to make any adjustment for valuation related to the balance sheet.

In summary: if you like this business and are willing to look past the earnings adjustments, you can make this valuation make sense. So I’m fine with a neutral stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.