Good morning from Paul & Graham!

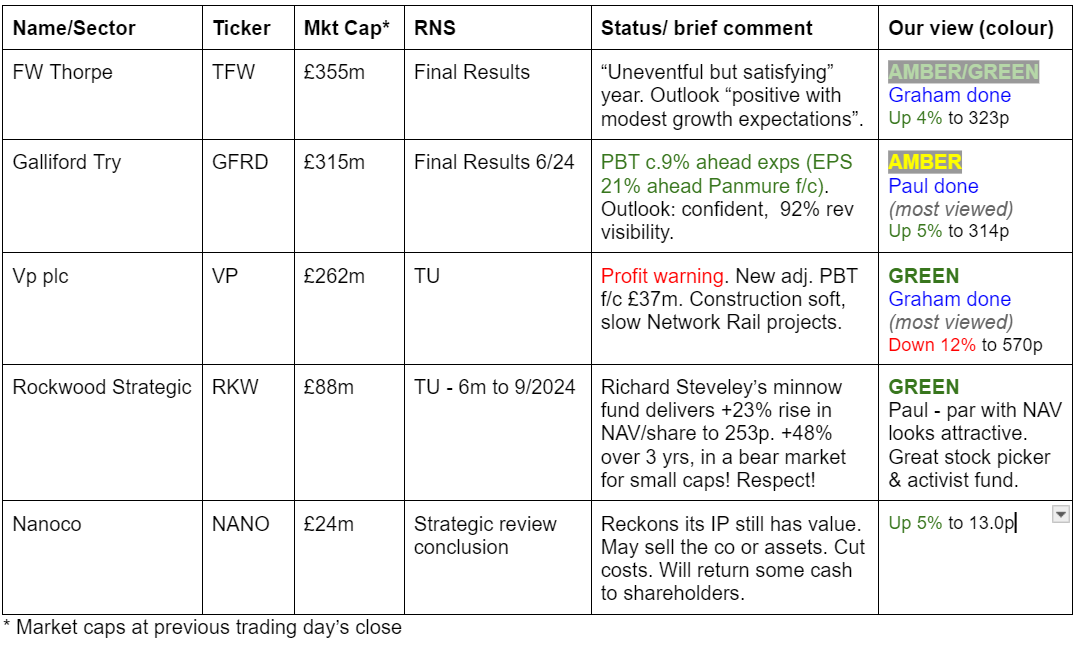

FYI, I've finished off yesterday's SCVR colourful table this morning, with everything now ascribed a colour to represent our view. I had to cut short yesterday, after getting into a complete muddle with WYN (I had a senior moment and started confusing WYN figures with forecasts from similar company NWF), resulting in me needing a lie down to clear my head, and then having to re-write the section from scratch!

Also there was my latest chat with Paul Hill to prepare for, which we recorded yesterday. I think that should go out today, which I hope people find interesting, where I focus on the latest best ideas that have cropped up in these reports, and we discuss other topical issues, such as IHT fears possibly causing some bizarre AIM price movements at the moment.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Companies Reporting

Summaries

VP (LON:VP.). - down 14% to 559.2p (£225m) - Trading Update - Graham - GREEN

It’s a profit warning as subdued house building/construction markets, and slower activity at Network Rail combine to shave more than 10% off the adj. PBT forecast for the current year. Perhaps it’s not such a big surprise in these economic circumstances; we maintain our overall positive view of VP.

FW Thorpe (LON:TFW) - down 1% to 308p (£361m) - Final Results - Graham - AMBER/GREEN

Nudging up the position on this to AMBER/GREEN after the company posts solid results: no change in revenues, but profits are higher by c. 10% and there’s a nice bounce in the cash pile. PER is about 16x but management are highly credible and may be worth it.

Galliford Try Holdings (LON:GFRD) - up 4% to 313p (£324m) - Launch of £10m Buyback & Final Results [ahead exps] - Paul - AMBER

Ahead of expectations results for FY 6/2024 are pleasing, together with a £10m share buyback (funded by a corporation tax rebate). GFRD is enjoying a good patch, but the profit margin remains wafer thin, and I think there's considerable risk here - eking out a tiny profit on large, complex contracts. Shares have had an amazing run, but I don't think the business is as good as they imagine. Also the cash pile comes from favourable timing, there's almost nothing on the balance sheet overall in NTAV. So I'm not keen, but good luck to holders!

Paul’s Section:

Galliford Try Holdings (LON:GFRD) - up 4% to 313p (£324m) - Launch of £10m Buyback & Final Results [ahead exps] - Paul - AMBER

£10m Buyback - which should shrink the share count by about 3%. There’s a nice clear explanation below. The main benefit of buybacks is to enhance EPS & DPS in future -

“The Group's capital allocation priorities, which remain unchanged, are designed to maintain a strong balance sheet provide confidence to the Group's clients and supply chain, support disciplined approach to project selection and mitigate against adverse market conditions. In order of priority, the Group will reinvest in the business, operate a sustainable dividend policy and any excess cash will be returned to shareholders. The Buyback reflects both the receipt of a corporation tax refund, of £9.6m, and our confidence in the ongoing future cash generation of the Group, whilst maintaining flexibility for growth related investments, including acquisitions.”

Note that this shareholder return is on top of a forecast 4.2% dividend yield. Not bad!

Moving on to results out today -

ANNUAL RESULTS STATEMENT FOR THE YEAR ENDED 30 JUNE 2024

“Strong Performance and Confident Outlook

Delivering Sustainable Growth”

Highlights -

My comments on highlights -

Massive revenue, but tiny operating profit margin. So there’s no buffer there for when inevitably some contracts go wrong. So this type of share is arguably just an accident waiting to happen. Can bulls really be so sure of perfect contract execution for ever more?!

Statutory profit is close to adjusted, a good thing.

Good net cash position is excellent.

I particularly like that GFRD provides a monthly average cash figure (well below the year end snapshot), although a much better disclosure (that all companies should routinely provide) is average daily cash/debt. Anything else is not necessarily telling us the full or accurate picture, due to timing of large in & outflows (eg payroll & supplier payment runs).

Large order book gives good visibility (it has 92% of FY 6/2025 revenue visibility).

Balance sheet - GFRD has favourable working capital flows, which mean it gets paid some cash up-front. It does mention holding average daily net cash, but declines to give us the number! That would be a good webinar question, to ask for this number. I bet you it's lower than average month end cash, but that's a guess.

“The Group has no debt or defined benefit pension obligations, and at 30 June 2024 had a cash balance of £227.0m (2023: £220.2m). The Group operates with daily net cash and the average month-end cash balance in the year was £154.8m (2023: £134.7m) demonstrating the Group's continued robust cash performance. We anticipate similar levels of average cash in FY25. “

No debt and no pension issues, that’s a very good start!

NAV overall is £122m. I take off all intangible assets of £98m, giving NTAV of a tiny £24m.

How come it’s loaded with cash then? It’s partly down to timing differences. Look at working capital overall (middle section of the balance sheet below, showing assets and liabilities that will turn into in or out flows of cash in the next 12 months) - it's a deficit! -

As you can see, there’s actually a deficit of £56.5m, with current liabilities of £665.9m exceeding current assets of £609.4m.

Also note there’s nothing in inventories. If GFRD was instead a manufacturer or distributor of physical goods, then it would have inventories of probably c.£200m. I’m presuming that GFRD possibly structures things so that sub-contractors buy & hold any inventories needed, and then invoice GFRD in stage payments, or as they are used. Hence all the inventories are off balance sheet for GFRD. That’s a nice setup. Also as a building contractor, GFRD probably wouldn’t need much inventories anyway, just getting building materials in as they’re needed probably.

Look at the size of “trade and other payables”, which is huge at £609.2m. That looks stretched to me, but the commentary suggests it pays suppliers on time, at an average 26 days, which sounds fine.

Drilling down into the large £609.2m of trade payables (money that has to be paid out within 12 months), note 15 shows that the bulk of it is "Accruals". These are usually costs incurred but not yet invoiced by suppliers. This seems a huge number at £307m, I don’t understand how it can be so large here -

When do these large liabilities have to be paid I wonder? Or maybe they just permanently rotate?

Receivables is similar, with very large “Contract assets” - ie work that is judged to have been done, but has not yet been invoiced. This is one of the things I dislike about these low margin contracting businesses, in that there are very large moving parts, often subject to estimates and assessments. Profit can swing considerably, just according to what estimates and judgements have been made, and prior year adjustments, etc, so profits are just not very transparent or predictable in my view -

I’ve left in the text in note 13 above, just to flag the point that even smallish disputes with customers can be material to profit. So this £2.8m provision is almost 10% of adj PBT of £32.7m. What’s my conclusion then? It’s that we cannot rely on this type of company making reliable, repeatable profits. If they do, it’s probably good luck. With these huge numbers above, and only a 2.5% operating margin, it’s only a matter of time before you’re clobbered with a profit warning because something big has gone wrong, as seems to happen so often with UK infrastructure work. It may not happen for a while, but sooner or later, I think it almost certainly will. It's a major risk anyway.

Hence valuing GFRD shares on an profit measure, be it EBITDA or PBT, etc, is problematic, as we don’t know (and cannot know) how reliable future profit forecasts will be. Whereas some of the other higher margin sectors we prefer, with recurring revenues at high margins, are so much more dependable, that’s why investors pay higher multiples for them.

Outlook - as things stand, I don’t like this share, as it’s a low quality business, making a tiny margin, with large and complicated accounts.

What about the future then? Contracting/infrastructure companies have done well recently because they’re pushing up margins, which could transform things for the better.

Some excerpts -

“Confident outlook with a high quality £3.8bn order book (2023: £3.7bn) positioned across our chosen sectors and 92% of FY25 revenue already secured.”

“...contract awards reflecting recognition of our differentiated quality offering, supporting delivery of our Sustainable Growth Strategy target of in excess of £2.2bn of revenue by 2030.”

Revenue was £1.78bn in FY 6/2024, so a target of £2.2bn by 2030 seems rather pedestrian to me.

Some other companies are delivering and targeting better growth than that. Costain (LON:COST) for example is targeting an increase in operating margin from 2.5% (same as GFRD) to 5.0%+.

Yes, GFRD is also planning to raise its tiny operating margin, from 2.5% to 4.0%, so a less ambitious target than COST, although at such small numbers, and these only being aspirations, maybe that’s splitting hairs? -

Paul’s opinion - as you’ve probably already gathered, going through these numbers is a reminder of why I rarely, if ever invest in low margin contractors. I cannot rely on the business producing reliable profits, because it’s a tiny number at the end of enormous in and outflows - both profit and cash. Its contracts are large and complex, and it’s inevitable things will go wrong, you just have to hope that any problems are contained within contingency reserves baked into contracts.

It’s difficult to think of a worse business model for investors. That said, GFRD shares have produced a stunning return for investors since 2019, look at this! - the sector is certainly back in fashion, with investors seemingly ignoring risk, and instead focused on the margin growth aspirations. Plus favourable Govt emphasis on improving infrastructure, and contracts for preferred bidder type companies perhaps having scope for higher margins in future?

Yet it’s still only producing a delicate profit of £33m on £1.77bn revenues, so a significant contract slip-up in future could wipe out those profits and send this share plummeting.

Hence why I think bulls should resist the urge to get complacent.

The balance sheet has negligible net tangible assets, but benefits from favourable timing of cash inflows.

Divis and buybacks are good.

I think people are maybe taking a lot more risk here than they realise. Hence despite ahead of expectations trading, I struggle to get above AMBER, in fact it’s only just amber in my view, due to the considerable underlying risk.

For balance, bulls might look at the 4% operating margin ambition, and believe management can deliver that, without anything going wrong. IF that plays out as hoped for, then the share price bull run could continue, who knows, it’s all unknown because nobody knows for sure what the future holds - hence "might" and "could" being much more sensible than the ubiquitous "will"!

For me though risk:reward actually looks quite poor. Don’t bite my head off, it’s just a personal opinion! Feel welcome to post your views in the comments, we like to hear a range of opinions.

Stockopedia likes it a lot, although it's interesting to see this is skewed more towards momentum than quality.

Graham’s Section:

FW Thorpe (LON:TFW)

Down 1% to 308p (£361m) - Final Results - Graham - AMBER/GREEN

FW Thorpe Plc - a group of companies that design, manufacture and supply professional lighting systems - is pleased to announce its preliminary results for the year ended 30 June 2024.

The Chairman says that the year was “largely uneventful but nevertheless satisfying”. In numbers:

In summary: revenues are about flat, but profits are up by 9-10% (depending on how you measure it). This is attributed to “improved internal efficiencies” - good job!

Dividends are up 5% to 6.78p in total and there is also a special dividend of 2.5p.

Net cash reached nearly £53m by year-end (previous year: £35m). New acquisitions are mentioned as a possibility.

Within the group, the large companies are performing well, but the Board wants more from its smaller companies.

The list of group companies (link):

Street lighting manufacturer TRT Lighting is mentioned as loss-making, after suffering a revenue decline of 15%. A new sales director and sales team are in place.

Management: Chairman Mike Allcock is the former CEO and has been employed by TFW for 40 years. He became Chairman in July.

Outlook is fine:

All Group companies are charged with growth; as ever, this is their target. With so many companies in the Group, there will be inevitable ups and downs in various locations. All the larger companies are in good shape with stable and experienced leadership teams with good order books at the start of the new financial year. Costs are generally under control, although people cost pressures remain and the companies need to keep working hard to find efficiency improvements.

The smaller companies have all struggled somewhat to get themselves back on a plan for growth in recent years. Changes have been made and each company has a plan to grow.

The change in governments in various Group locations raises a few questions about the future, but the Group setup gives good resilience overall.

Consolidated as a whole, the outlook is positive with modest growth expectations.

Graham’s view

I like the reporting style here - it strikes me as straightforward and honest, which is what you expect from a business owned by insiders and family members.

Here’s the complete list from Stockopedia of individuals with a notifiable interest, including many of these insiders and family members:

.

The financial statements show a business with healthy profit margins (operating margin >17%) and a nice cushion of tangible equity. Tangible NAV is £110m and as noted above the company has a large cash balance. The cash covers more than 10% of the market cap.

There’s very little to dislike here, so what about the price?

Paul was neutral on this stock last year (October 2023) at a share price of 380p and an earnings multiple of 20x

A year later, with the share price down at 308p and with profits and the cash balance having increased, I think I can justifiably nudge up the position to AMBER/GREEN.

It’s still not cheap, and lighting is a tricky sector, but maybe this is about as cheap as it will get?

VP (LON:VP.).

Down 14% to 559.2p (£225m) - Trading Update - Graham - GREEN

Vp plc, the specialist equipment rental business, today provides a trading update for the six months ended 30 September 2024.

This update amounts to a profit warning. Some of the key points from each segment:

Infrastructure: strong demand in power transmission, water and civil engineering, but there has been a “slower than anticipated rollout of projects following the beginning of the new Network Rail Control Period”.

Non-residential construction: remains subdued. Additionally, Brandon Hire Station has seen performance improvements that are “slower than anticipated”.

Housebuilding: continued short-term softness. VP “is encouraged by the UK Government's push for rapid progress in this area”.

Energy: market remains positive.

Turning briefly to the acquisition announced this morning, which is material to VP:

Acquisition: VP buys 90% of Charleville Plant Hire, described on its website as “Ireland’s largest construction services company”. The initial cash cost is €12m but there’s potentially another €22m to be paid over the next 2-3 years. So the total cost equates to c. €34m/£29m.

CPH generated a pre-tax profit of €2.3m in 2023, and VP are paying a multiple of up to 15 times that amount for the business. So it’s not cheap from the point of view of earnings and VP are also paying a big premium to the balance sheet value: CPH had gross assets of only €14m as of Dec 2023.

Outlook

Underpinned by a robust balance sheet, the Group remains in a strong financial position with an excellent track record of delivery. However, as a result of current market headwinds in Construction and Housebuilding, alongside a slower start to CP7, Vp now expects to report a profit* for the current financial year of c.£37 million.

Estimates

A note published by Equity Development in July this year suggested that the company was aiming for an adjusted PBT of £41.8m.

New guidance is more than 10% below that level, so I can agree with the 10%+ hit to VP’s share price this morning.

Graham’s view

Paul covered many of the details here in June, pointing out the company’s terrific record of paying dividends under the stewardship of the majority shareholder, who is also the Chairman.

I share Paul’s generally positive impression of the business although personally I’m on the fence between GREEN and AMBER/GREEN, my main reason being that this is an economically exposed and competitive sector in which VP has struggled to generate above-average quality metrics in recent years. And who can predict when the construction and house building sectors will be firing on all cylinders again?

For the sake of continuity I’ll leave the GREEN stance unchanged. Fingers crossed that next year is the year when demand picks up again.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.