Good morning from Paul & Graham!

That's it for today, we've covered everything.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

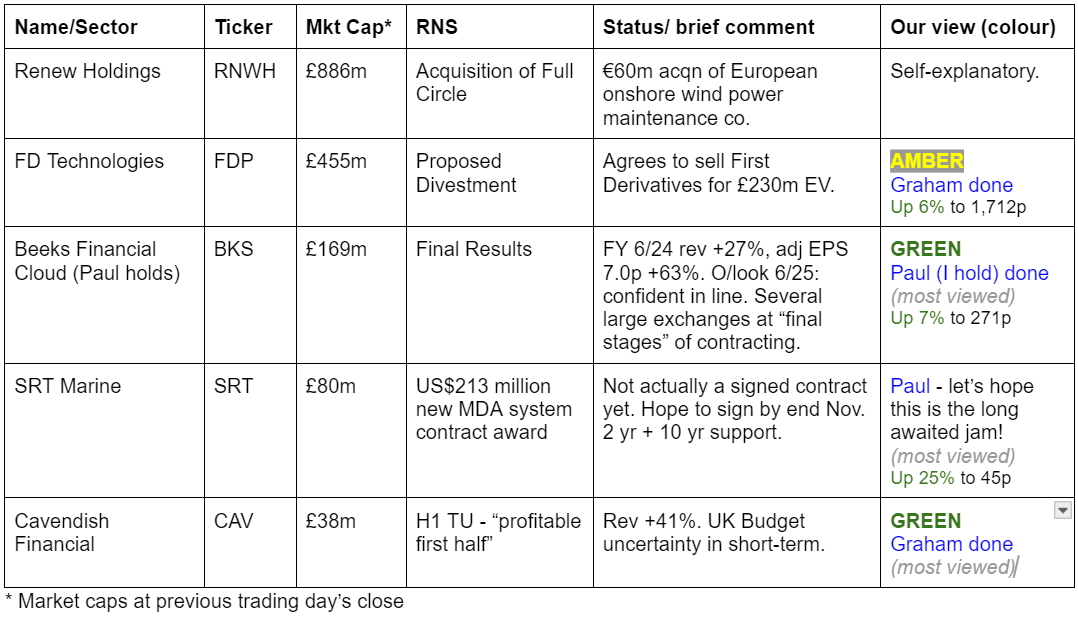

Companies Reporting

Summaries

Cavendish Financial (LON:CAV) - up 3% to 10.05p (£39m) - Half Year Trading Update: Profitable First Half - Graham - GREEN

It’s a positive update with like-for-like revenues up 41% and the company back in the black. Some patience may be needed before we see truly meaningful profits but I like the risk:reward on offer with the enterprise value here currently just £22m.

Beeks Financial Cloud (LON:BKS) [Paul holds] - up 6% to 268p (£179m) - Final Results - Paul (I hold) - GREEN

I run through the numbers, which show good growth and positive free cashflow for the first time. Strong growth expected to accelerate in FY 6/2025, and the NASDAQ contract isn't even in the forecasts yet, so likely to beat expectations. Plus more large exchange deals are close to signing. BKS shares look pricey, but I continue to believe this is an almost unique commercial opportunity for a UK small cap, that's taking off. So personally I can tolerate the lofty valuation metrics.

FD Technologies (LON:FDP) - up 6% to £17.06 (£481m) - Proposed Divestment - Graham - AMBER

FDP proposes to sell off what was its core asset, in order to focus on its software business KX. It hopes to receive £230m which will pay off its debts and enable a return of capital. I’ve always shared the bears’ scepticism on this stock and am most comfortable with a neutral stance at this time.

Paul’s Section:

Beeks Financial Cloud (LON:BKS)

Up 6% to 268p (£179m) - Final Results - Paul - GREEN

Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce its final results for the year ended 30 June 2024.

Revenue up 27% to £28.5m - this seems to be a little behind forecast (of £29.2m, and was £30.0m a few months ago), but it doesn’t really matter, as +27% organic revenue growth is more than enough. It’s due to timing of a new contract, which slipped past the year end date, but now boosts FY 6/2025 numbers.

Canaccord points out in a helpful update note today that this makes BKS one of the UK market’s fastest growing mostly recurring revenues businesses. Further significant (faster) growth is pencilled in for FY 6/2025, due to a large contract kicking in (still under a non-disclosure agreement, but it’s NASDAQ - investors found a document online proving this, there’s a link in a previous report of mine somewhere in our archive).

Canaccord has £39.6m revenues pencilled in for FY 6/2025, a rise of 39%, all organic and mostly recurring, so this share is going to attract a premium rating, and PERs are largely useless for rapid growth companies. Hence investors tend to use valuations linked to multiples of sales or EBITDA, which personally I’m not terribly comfortable with, but you’ll get nowhere fighting the market - standing on the sidelines saying it’s overvalued has already meant missing out on a bagger here.

Various profit measures for your perusal -

Underlying EBITDA £10.7m (up 27%), the most aggressive measure that ignores a lot of costs.

Underlying profit before tax is more sensible to my mind, at £3.9m (up 68%).

Statutory PBT is the most prudent measure, and it’s a maiden profit of £1.5m. This includes the cost of employee share options, which in this case particularly are used as a form of remuneration, so I think it’s right to expense them, not adjust them out.

Underlying diluted EPS is 6.36p (up 61%) - that’s helped heavily by adjusting out the share options, and a negative tax charge. So the PER of 42x FY 6/2024 numbers is high, and based on a fairly aggressive EPS number. Hence this share clearly won’t appeal to value investors looking in the rear view mirror!

On valuation metrics BKS shares are clearly expensive. However, given the rapid organic growth valuations at this type of growth company can move things from expensive to attractively cheap. Over the years I’ve missed out on a lot of multibaggers by refusing to pay a high PER early on. Concentrating on low PER shares is an important investing lesson to unlearn - sometimes, in carefully selected cases, paying a high PER is necessary, and justified. I think that applies to BKS, hence why I’ve made this my 2nd largest personal position (for full disclosure, as required for writers here).

Note that the PER is high, but the PEG is quite reasonable, due to rapid earnings growth -

The value score is only 6, and obviously the risk is that if growth conks out, the shares would have a long way to fall.

Thankfully, BKS has excellent visibility due to most of its revenues being recurring, and management are confident the rapid growth in the forecasts is realistic.

I don’t think there’s anything to be gained by over-analysing the historical numbers. This share is all about continuing (accelerating, even) growth, so let’s look at that.

Some good points in this operational section -

Note that the big contract (NASDAQ) is NOT currently in the forecasts. I confirmed that again today with the company, but I phrased it as the "large exchange", since they are not allowed to confirm the identity of the client, but I can mention it here because I independently, and from a public document, found out the client identity.

We’re nicely set up here for positive newsflow over the next year, as more big contacts get announced, and forecasts are raised to reflect the NASDAQ contract coming online. That’s already known of course, so you could argue some of the upside is already baked into the share price.

The words “final stages of contracting” above really stood out to me, and I think it’s probably that point which has driven the positive market reaction to today’s news. I tried to get more colour on this, but management won’t be drawn on the timing, as decisions from clients are outside their control, and there are often delays when dealing with large organisations.

Balance sheet - NAV £37.5m, less intangible assets of £9.4m gives NTAV £28.1m - a decent amount for the size of company, but remember it has to spend a fair bit (up-front) on servers and cabling, so it’s more capital-intensive than most small IT companies. Property plant & equipment have a NBV of £16.7m, including £2.9m freehold property. Computer equipment has a NBV (net book value, ie cost less accumulated depreciation) of £10.7m, so it’s not huge amounts by any means.

Cash is almost flat vs LY at £7.7m, and note £1.8m “Borrowings” have been repaid in the year.

It all looks fine to me. Risk of further dilution is now negligible, and I confirmed with the company today that it doesn’t intend raising any more equity, as it’s now self-funding. Unless an M&A opportunity came up, but it’s not an M&A focused company, so that’s probably not likely.

Cashflow statement - is the best so far from BKS. It’s genuinely cash generative now, about £2m free cashflow the way I look at it (taking off all real world costs, including £3.9m capex and £2.9m capitalised development costs). The cash generated was used to repay the £1.8m debt as mentioned above. No divis yet, as it’s a growth company.

So I think criticism from bears in the past about poor cash generation has now fallen away as an issue, with BKS now demonstrating maiden positive free cashflow, although it has been helped a bit by working capital movements.

The business model is that it puts in all the infrastructure, and then earns a long, sticky, and growing revenue stream from it, probably over many years, even decades.

Call with management - a few key points from our Q&A this morning, and remember this is just my recollection/interpretation of what was said, which might not be totally accurate, especially as I cheerfully admit that I don’t really understand IT.

Q. I’ve never really understood what moat BKS has, what is special about the company?

Highly specialised technology. Most cloud computing just sends information from A to B. Whereas exchanges require that all members receive the same information (prices, news, I assume) at precisely the same time. Beeks doesn’t really have any competition in this area.

Partnership business model - once BKS system is installed, exchanges earn a significant amount of money from white-labelling it to their customers. Hence business is sticky.

Everything is bespoke, tried & tested. So why would any exchange reinvent the same thing using another IT company, with the risk that it might not be 100% reliable, when BKS already has a proven system with major reference clients, that can be quickly installed & switched on.

Snowball effect - BKS is becoming the standard for exchanges, which are geographically based and don’t compete. They talk to each other, and word has got round that BKS is reliable & generates profits for the exchanges - a substantial & growing moat (my words).

Emerging markets are exciting growth opportunities, not just the major Western exchanges, because it’s harder to do business in emerging markets, so there can be strong demand as has been proven by the JSE (Johannesburg Stock Exchange), where annualised revenues are now a lot larger than originally planned - proving up the “land & expand” principle.

Other points -

Building out a new AI product, for real-time data analysis. Customer-driven request. Not spending a huge amount on it, don’t yet know if this will become significant or not.

No need to raise any more equity.

Have you seen any Budget-related, tax selling from BKS shareholders? A bit, yes. Plus some funds have had to sell, due to redemptions.

Paul’s opinion - I’ve mentioned previously that I don’t fully understand the services that BKS provides, but I can see that the very impressive organic growth and snowballing size of contract wins shows that there’s something special here. Hence management explaining to me on a call today, in simple layman’s terms, what is special about BKS was really helpful. I’ve invited the CEO to do another audio interview with me, which was well received last time, and will try to focus on the overview of the business model, rather than the technical detail.

BKS is not a value share, but I think it’s one of a handful of exciting growth companies on the UK market, and I feel the big rise in share price is justified by very good newsflow. So I’m staying bullish on it. That’s not just because I own some shares personally. It’s actually a comfortable hold for me, because I think the fundamentals are getting better. As I’ve mentioned before, I’m in this for a potentially big longer-term opportunity, so am not top-slicing my position despite a big rise. That does mean having to sometimes look away from the screen when it goes through a volatile, profit-taking patch, but I don’t think I can predict those moves, so I don’t even try.

Hence for me it’s a continuing GREEN (I hold).

Chart since listing -

Cavendish Financial (LON:CAV)

Up 3% to 10.05p (£39m) - Half Year Trading Update: Profitable First Half - Graham - GREEN

This small-cap broker has been on my best ideas list for two years running. The share price hasn’t cooperated with me yet:

But today’s H1 trading update to the end of September has some encouraging news:

Like-for-like revenues (taking into account the merger of Cenkos/finnCap in Sep 2023) are up by an impressive 41% to at least £27.5m.

H1 is described as “profitable” but for now I would assume that profits are small and much closer to breakeven than to anything more meaningful. Still, it’s an improvement on recent losses that have been posted.

Cash is at £17m which the company describes as a year-on-year improvement; however, this is the same cash balance as of November 2023 and is down from what it had reached by March 2024. So I don’t really feel that much progress has been made on that front in reality.

Forthcoming activity sounds promising although this paragraph doesn’t leave us with anything too concrete:

We have a solid pipeline of both public and private transactions in train including a number of potential IPOs and ongoing public M&A activity. We have increased our share in the public markets in terms of the number of AIM clients (rank 1st) and by adding clients on the Official List to meet our ambition of increasing the average market capitalisation of our client base.

Outlook refers to Budget uncertainty and “adjustments” that may be needed post-Budget. Come the end of this month, I guess there’s a strong possibility that we’ll be figuring out the implications of lost inheritance tax relief?

Graham’s view

This is a positive update, with the main points above all being that CAV has broken back into profitability and has seen a substantial increase in like-for-like revenues.

However, it is still far too soon for bulls (like me) to declare victory. I have always said that I see breakeven as the basic requirement for companies in this sector: bankers get paid well enough when things go right, and their pay should be flexible enough so that shareholders don’t have to take the hit when markets are quiet.

In the case of Cavendish, I did make an exception for FY March 2024 (discussed here). My reasoning was that during a merger, when there was a great deal of change, I thought it made sense for the company to pay bonuses to reward and retain staff even if that meant that there was a modest operating loss.

However, moving forward, I do expect CAV to be profitable even when markets are quiet. After all, the merger is supposed to have unlocked £7m of cost synergies. Now they just need salaries and bonuses to be linked to revenues in a reasonable way, as they have always been (Cenkos was particularly good at this).

Today’s update is a step in the right direction. For this stock to really take off, we need the UK small-cap market to take off again. Once the Budget is out of the way, perhaps that will provide the clarity that is needed?

Please note that the enterprise value here (market cap minus cash) is only £22m. In a bull market, I think CAV's EV to earnings multiples would be incredibly low at this valuation. But of course no one can predict with any certainty when that will happen!

FD Technologies (LON:FDP)

Up 6% to £17.06 (£481m) - Proposed Divestment - Graham - AMBER

Like Paul, I’ve been sceptical of this stock. For as long as I can remember, it has always traded at very rich valuations, and its financial performance hasn’t seemed to match up with its valuation.

Back in 2018, I discussed the attempt by short seller Matthew Earl to carry out a bear raid on it.

Here’s the 10 year chart. It has been quite a ride:

Figuring out what the company does has never been terribly straightforward.. The first line of the description on the StockReport reads: “FD Technologies plc is a group of data-driven businesses that unlock the value of insight, hindsight and foresight to drive organizations forward”.

The argument from bears was that FDP was a consulting business with some software investment thrown on top.

Today’s news is about a major simplification:

FD Technologies… announces that it has entered into an agreement to sell the Group's First Derivative Business to EPAM Systems, Inc… for an enterprise value of £230m (the "Divestment"). The Divestment is expected to complete in the fourth quarter of 2024, subject to shareholder approval, amongst other things.

The proposed sale will provide “the optimal organisational structure” and “enable the company to focus on KX, the part of the Group with the largest value creation potential”. It will also pay off FDP’s net debt (£20m) and bring about a return of excess cash to FDP’s shareholders.

KX is a US-based software company - homepage and Wiki article.

The proposed buyer of First Derivative is a software services company that is already in a partnership agreement with KX, and will enhance this partnership after the deal goes through.

New Trading update: H1 is in line with expectations for both KX and First Derivative. For FY25, KX is targeting to add annual contract value (an important metric in the software industry) of £16-18m.

CEO comment on the sale of First Derivative:

This Divestment is positive for all stakeholders, benefitting our shareholders and the customers and employees of KX and the First Derivative Business. For shareholders it enables the Group to focus on KX, and provides the resources to deliver on our exciting growth plans while also enabling us to return excess cash…

Graham’s view

KX has an impressive online presence but I wouldn’t want to make any suggestion as to what it might be worth. I can say with some confidence that FDP probably wouldn’t qualify as a “value investment” even if we assume that this proposed deal goes ahead.

After receiving £230m (net of any cash/debts at First Derivative), £20m will go to FDP’s debt repayment.

Let’s suppose we have roughly £200m left after costs. That leaves an enterprise value of £280m for FDP based on the current market cap.

KX generated revenues of £79m last year (FY Feb 2024).

When those results were released, FDP said that KX was targeting “positive cash EBITDA for FY27”. So there’s a few years to go before we can expect decent financial results from this entity.

Could this be worth a number like £280m? Perhaps, but it’s not a value investment.

I’ll just stay neutral on this for now.

FDP enjoys a high StockRank of 81 thanks to high Quality and Momentum scores, and despite offering poor value:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.