Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

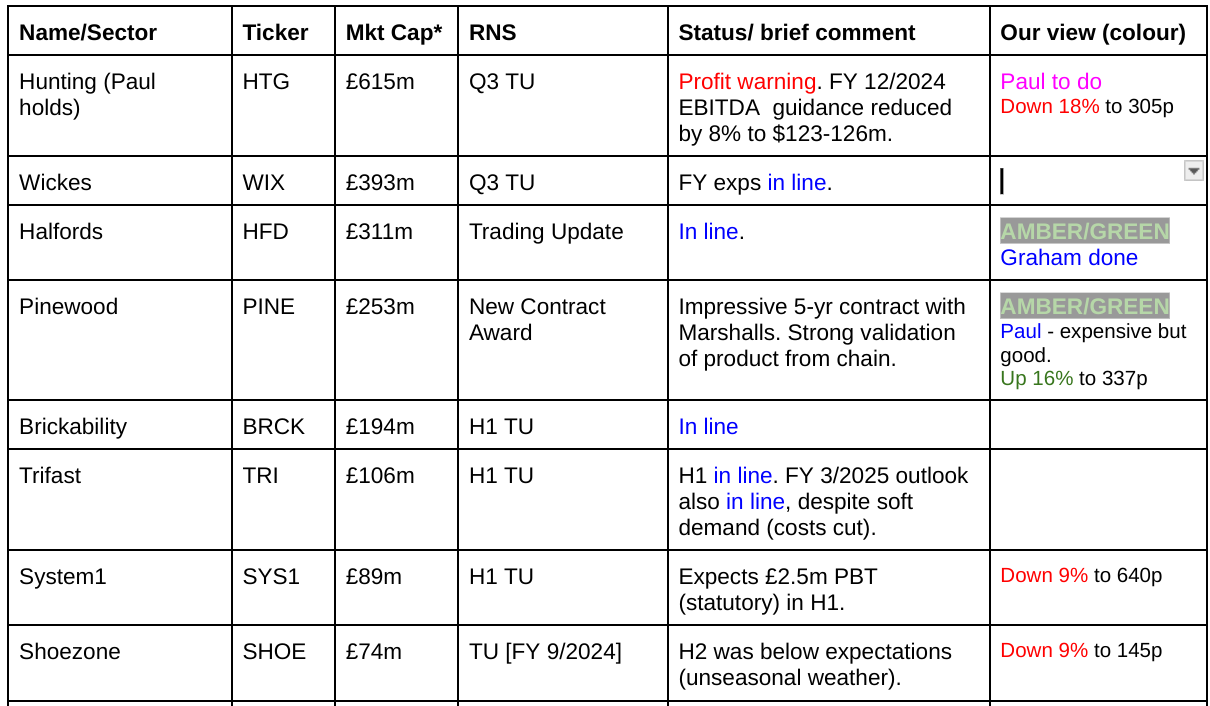

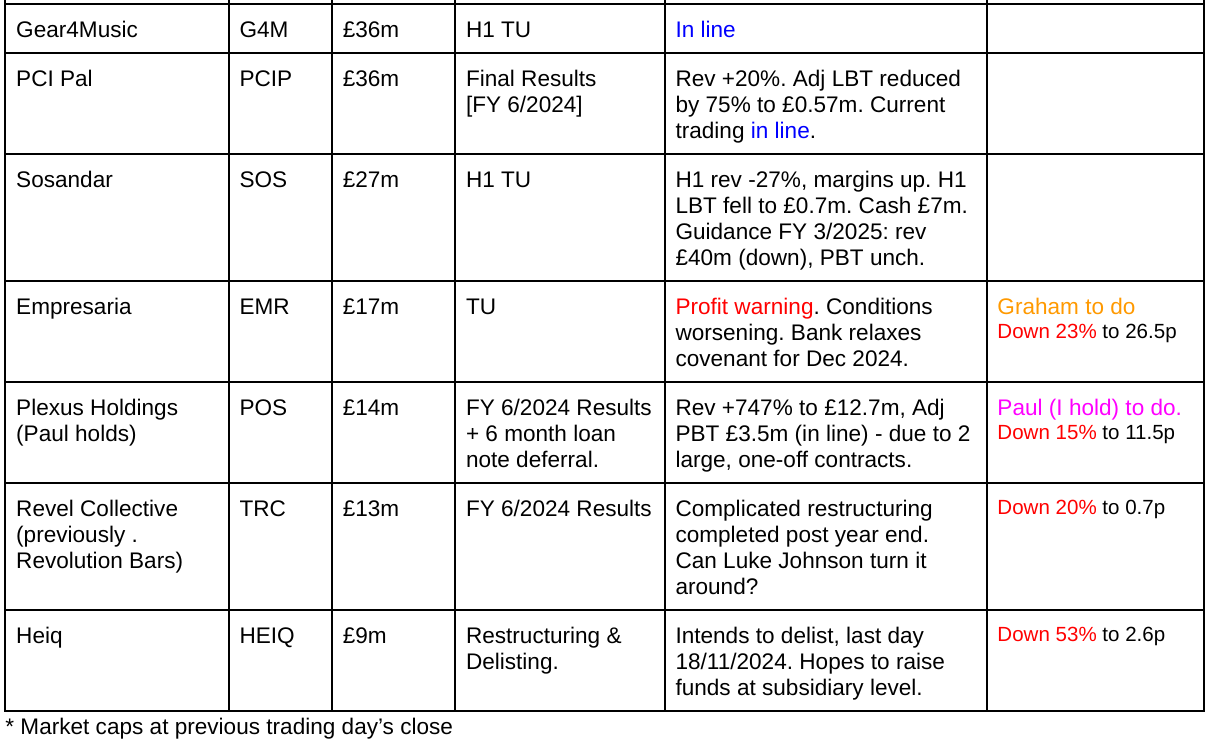

Companies Reporting

Summaries

Halfords (LON:HFD) - up 2% to 145p (£317m) - Trading Update - Graham - AMBER/GREEN

It’s an in-line update from the UK’s leading provider of motoring and cycling services and products. LfL sales are approximately flat which is reasonable considering the strong growth seen in H1 last year. At a modest earnings multiple and with the potential for margins to expand, this could be interesting.

Hunting (LON:HTG) (Paul holds) - down 18% to 305p (£504m) - Trading Update [profit warning] & Bank Facilities - Paul (I hold) - BLACK / GREEN

Slower demand in Q4 means this oil/gas engineering group lops -12% off EPS for 2024, and -15% from 2025. The earnings trend is still strongly upwards though, so it's a pity they over-egged the previously raised forecasts. Balance sheet is particularly good, with net cash now forecast for end 2024. A large new bank facility seems earmarked for acquisitions. For me, the improved value outweighs the disappointment on earnings forecasts.

Paul's Section:

Hunting (LON:HTG) (Paul holds)

Down 18% to 305p (£504m) - Trading Update [profit warning] & Bank Facilities - Paul (I hold) - BLACK / GREEN

Oh dear, this one isn’t panning out as hoped. Hunting is a specialist engineering group, mainly focused on the oil & gas industry.

Checking my previous notes, I was GREEN on 29/8/2024 on publication of in line H1 results, and re-confirmed guidance for FY 12/2024 which had been slightly raised in July. Prior to that, all seemed to be going so well at HTG with a series of large orders, record order books, strong balance sheet, negligible net debt. Management seemed ebullient in a recent webinar.

The tone has changed today, with an 8% drop in EBITDA guidance for FY 12/2024.

What’s gone wrong? The Q3 performance bullet points look OK apart from the last one -

“Ongoing subdued US onshore market and low natural gas pricing have led to trading within the Hunting Titan operating segment (Perforating Systems product group) being at break-even during the quarter. Cost cutting initiatives are being planned to further right-size the Titan business to prevailing market conditions.”...

“With the recent decline in the oil price and renewed falls in US natural gas pricing, sentiment has reduced in recent weeks in areas of the sector, which will likely lead to lower client activity within certain product groups throughout the remainder of the year, most notably within the short-cycle Perforating Systems product group, as highlighted above.”

Everything else seems to be going OK, and we’re given very precise guidance for the financial damage -

“While Hunting's other product groups continue to perform well, based on this short-term market outlook, 2024 full-year Group-level EBITDA guidance is being prudently reduced to between c.$123-$126 million, a reduction of c.8% on previous guidance issued in July 2024.”

That’s hardly a disaster, yet the share price has cumulatively lost about a third from its highs earlier this year. This seems a rather excessive reaction to me.

Broker updates - 3 brokers provide updates today, many thanks. ED doesn’t provide the customary New vs Old table, unless I missed it. We need this information to assess the scale of the downgrades. Zeus does provide this table, and for FY 12/2024 it lowers adj EPS from 39.6 US cents, to 35.0 cents, a 12% drop. That’s a fair bit, considering the shortfall is all from just Q4.

Zeus also lowers FY 12/2025 forecast EPS by 15% to 46.9 cents.

The context of these forecast drops is that HTG will still be showing a very impressive growth trend in both revenues and profit over the five calendar years from 2021 to 2025. What a pity they overcooked the previous forecasts, it’s a pity management didn’t under-promise and over-deliver, so the way I see this situation, HTG is performing very well, but there’s been a failure of its forecasting, with over-optimism. I can forgive that, assuming nothing else is likely to go wrong. The downside risk is that its large contract wins are one-offs, and we’re seeing an unsustainable burst of higher profits now. I don’t know the sector at all well, so can’t give a view on that.

Valuation - today’s hefty 18% share price fall to 305p, coming on top of a previous drift down from the 450p peak in Aug 2024, means this share could be a bargain providing nothing else goes wrong, perhaps?

FY 12/2024, 35 cents new forecast converts into sterling of 27.0 pence = PER 11.3x

FY 12/2025, 46.9 cents new forecast converts into sterling of 36.1 pence = PER 8.4x

Clearly then, if it avoids another profit warning, we might have a bargain on our hands. Especially considering HTG is also so well financed, with a remarkably strong balance sheet. After today’s fall, Price to Tangible Book Value is now under 1x.

Paul’s opinion - we all hate profit warnings, but they’re unavoidable sometimes.

In this case I find a very well-financed business, that’s in an excellent up-trend for growth in both revenues and profits, backed by a large order book.

What a pity then that a slowdown in one division has pulled the group forecasts down below guidance. That strikes me as a failure to budget prudently.

Even though the forecast blobs below will come down a bit, there’s still a lovely positive trend -

Valuation seems reasonable.

Year end net cash is now forecast to be $63m (previous forecast $32m) due to receivables being collected.

I have to flag it as BLACK due to this being a profit warning. However, that’s just a flag, it’s not an opinion.

As regards my opinion on fundamentals, I see this as a relatively minor disappointment, which has more than overshot on the downside in coming from 450p in August, to 305p now. That strikes me as an overreaction, hence why I’m sticking with GREEN. The profit warning isn’t due to performance collapsing, it’s just due to aggressive forecasting. The profit trend is still strongly upwards, but the PER is now into single digits for 2025, with complete NTAV backing too.

A more cautious view would be that the concerns noted about demand from the oil & gas sector could be a warning that further demand reductions may be in the pipeline. You can make your own mind up about that, I don’t know what the future holds.

Given the fundamentals looking attractive, I’m more inclined to add to my position by averaging down, than selling it despondently. Obviously at this stage nobody knows what the right decision is, it’s nothing more than educated guesswork - unless you’re a time traveller from the future.

Graham’s Section:

Halfords (LON:HFD)

Up 2% to 145p (£317m) - Trading Update - Graham - AMBER/GREEN

Let’s cover the key points in today’s H1 trading update:

Like-for-like sales "broadly flat” (-0.1%).

£30m of savings to mitigate £35m of inflation.

Expansion in gross margin.

Autocentres - LfL sales +0.8% vs. exceptionally strong period last year. Price-conscious customers trading down into budget tyres. Technician wage inflation.

Retail - wettest spring since 1986. LfL sales down 0.7%. Motoring products more resilient than expected, but Leisure cycling was challenging.

Outlook - unchanged.

Despite pockets of improving consumer sentiment, the short-term outlook remains uncertain, particularly for big ticket, discretionary purchases

CEO comment excerpt:

“While consumers remain cautious in their discretionary spending compounded by uncertainty around the contents of the upcoming Autumn Budget, we have continued to focus on controlling the controllables and I am pleased with our performance in the first half of FY25. Our services and B2B-led strategy has supported Halfords’ growth despite two of our core markets remaining significantly below pre-Covid levels, enabling us to absorb more than £130m of inflation since FY20 while maintaining a strong balance sheet…

Graham’s view

Paul and I had a funny interaction recently where we noticed that most, but not all, companies seemed unhappy with the weather in 2024. The weather often seems to be the scapegoat when companies do poorly.

As we are now in October, we have objective facts for Spring and Summer 2024.

Summer 2024: there was average rainfall in the UK. Scotland was particularly wet (18% more than average) but England was particularly dry (23% less than average). Temperatures were cooler than average, but in England they were very close to average.

(Recently Rank (LON:RNK) said that fewer visits to its bingo halls was in part caused by “sunny weather” - the weather was dry perhaps, but not particularly sunny!).

Spring 2024: was exceptionally hot and wet, especially in the south.

Overall, I think it’s reasonable to accept that the rain could have kept customers away from HFD’s retail stores in H1 (April - September), but that momentum should have improved as the period progressed and as we move into H2 (October - March).

I’m inclined to leave Paul’s AMBER/GREEN stance (as of June) unchanged. The balance sheet is probably fine - there isn’t any net debt worth talking about. The valuation multiple is modest, and the company remains profitable and dividend-paying:

It operates on razor-thin net profit margins, which is both a risk and an opportunity.

Anecdotally, I have started using Halford’s local car bulb fitting service and I regret that I wasn’t using it years ago. So they can count on me as a happy customer!

Empresaria (LON:EMR)

Down 22% to 27p (£13m) - Trading Update - Graham - AMBER/RED

We haven’t been following this one in 2024 as the market cap has been rather small. But it pops up on the radar this morning with a profit warning.

We last looked at it in November 2023, with Paul taking a neutral position.

Share price momentum hasn’t turned around since then:

Today’s news: the challenges in recruitment/staffing persist, as we have seen with other recruiters such as SThree (LON:STEM) . Empresaria’s sectors are defined as Professional, IT, Healthcare, "Property, Construction & Engineering” and Commercial, and it operates in 16 countries.

Empresaria has seen “conditions worsening in a number of markets and permanent recruitment demand generally remaining extremely subdued”.

Q3 net fee income is down 4% year-on-year (it was down 9% in H1).

Q4 is now expected to be “worse than previously forecast with market conditions in Germany particularly challenging”, and the adverse conditions are expected to continue into H1 2025.

Full-year adj. PBT is now expected to be “no less than £2.0m”.

At the interim results this year, the company said it was “broadly in line” with the consensus forecast at the time, which was for £4.3m of full-year adj. PBT.

Bank loans have run into covenant issues, which is always something I take very seriously as it is the first sign of financial distress developing. The interest cover covenant is being relaxed to 4x (from 3x) for the December 2024 test.

As of 30th September, net debt is £13.6m with available headroom of £6.5m (excludes invoice financing).

Graham’s view

The September level of net debt is the same as the interims (June 2024). Checking the interims for more detail, I find the following breakdown of gross borrowings:

I was hoping to find a greater emphasis on invoice financing, as that has a clear and specific purpose, but the borrowings are mostly in the form of overdrafts and a revolving credit facility.

The interims did show a surplus of current assets over current liabilities (£58m vs £53m), with over £40m of current assets sitting in receivables (amounts owed by customers). So Paul’s interpretation last year that the bank loans were funding receivables might still apply.

That said, it is possible for recruiters to fund their receivables without relying so heavily on external funds and it might be overly cautious but I do appreciate that when I see it.

For context, EMR’s net fee income was £25m in H1, so their gross borrowings (nearly £30m) exceeded what they earned from customers over six months.

The risk that interest cover is at risk of falling below 4x is a point of concern not just for the bank but also for shareholders.

Perhaps this is the low, and trading is about to turn around next year, but I am inclined to give this an AMBER/RED today on the basis that the company is struggling to make real profits (it made an operating loss in H1 2024 and made a loss in 2023) and now has a covenant issue. There is every chance that conditions could improve in 2025 and that these shares could take off once again, but the facts as they stand suggest to me that EMR should be treated with considerable caution.

The Altman Z-Score for bankruptcy risk has also noticed something:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.