Good morning, it's Paul here today.

I have to leave it there for today.

There will definitely be at least 1 podcast this weekend! Not sure if I'm going to revisit the gap last weekend, or just draw a line under it, we'll see how things go.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Companies Reporting

Paul’s Section:

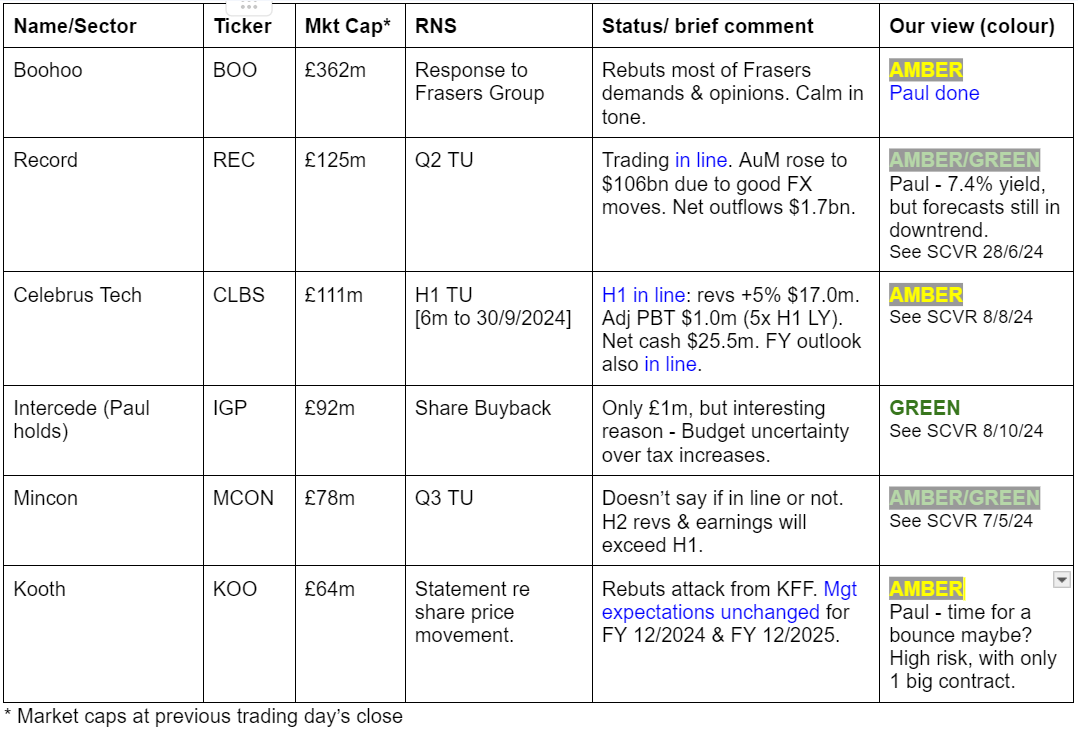

Brief Comments

Boohoo (LON:BOO)

28.8p (£365m) - Conflict with Frasers - Paul - AMBER

Yesterday BOO announced that it had received requisition notices for an EGM, called by 27% shareholder Frasers (LON:FRAS) . This audacious move seeks to have Mike Ashley (founder & majority owner of FRAS) brought in as CEO of BOO, along with another FRAS connected party, Mike Lennon. It also seeks the removal of BOO’s CEO, John Lyttle, who had already announced his intention to step down a week earlier.

FRAS was highly critical of BOO in this open letter, dated 23/10/2024, describing its performance as “abysmal”. They’ve got a point, I briefly mentioned BOO last week here on 18/10/2024, with a weak H1 trading update accompanied by a big reduction in forecasts from Zeus. BOO likes to focus on EBITDA, but the real numbers are a forecast adj loss before tax of £(42)m this year. Getting into dangerous territory if things don’t improve. Bank borrowings were however refinanced recently, so that has calmed investor nerves somewhat.

It’s amazing to see how growth powerhouses Asos and Boohoo are now on their knees, due to increased competition especially from Chinese giant Shein, which is just undercutting them on price & promotions for customers who want fast fashion (which has also somewhat gone out of favour).

What happens next? BOO is still inspecting the legal paperwork (presumably hoping to find some flaw in the requisition paperwork). We should hear in the next few days whether BOO is forced to call an EGM or not.

As BOO says today, it cannot just appoint a large shareholder as CEO, because that would break all the rules on corporate governance. The question is whether Mike Ashley can muster enough votes to carry any EGM vote in his favour. It looks a close call, with FRAS on 27%, Schroders on 8.5% (who seem to like Ashley), but the founding Kamani family + employee benefit trust seem to total c.22%. There could be other connected parties with smaller holdings not disclosed, I imagine.

Is it worth getting involved? I’ve decided not to, because I think both Asos and Boohoo are now in real trouble (Asos could even go bust in my opinion). Whereas BOO is likely to survive I think, but sounds like it needs a big sort out to make it leaner.

FRAS prowling around trying to take control is not necessarily going to deliver the best result for BOO shareholders. Ashley is clearly trying to take control by the back door, rather than making an offer for BOO that probably wouldn’t get the necessary shareholder support. I’d say it’s more likely that the founding family might try to buy it back, but why would they be generous on price?

Given that BOO is now loss-making, what is it worth? It’s difficult to say. I don’t think fashion brands are worth that much these days, other than to foreign buyers or licensors.

FRAS strategy really worries me. It seems chaotic and too aggressive, with some fairly major mistakes made in the past, all driven by Mike Ashley with no constraints on his personal dominance due to him owning 73% of FRAS. FRAS seems cheap on a forward PER of 7.2x, but I can’t help shake off the feeling that it could all go horribly wrong in some unforeseen way, because of the way Ashley operates.

Hence my view is that it will be a fascinating situation to watch but only from the sidelines. I’ve no idea how things will pan out, so have to give BOO AMBER again, although maybe I should be more bold at amber/red? It’s finely balanced, but I’m definitely struggling to see a positive case for BOO given that Shein has grabbed its market, and BOO now loses money.

Softcat (LON:SCT)

Rose 12% y’day to 1,719p (£3.37bn) - Results FY 7/2024 - Paul - NO COLOUR

Worth flagging for the very positive market reaction to results out yesterday.

I’m not familiar with this company, so have only had a quick skim of the fundamentals. It’s got a very nice track record but looks pricey on a forward PER of 26x -

Indivior (LON:INDV)

Up 10% y’day to 720p (£886m) - Q3 Results - Paul - NO COLOUR

I’ve looked at this a couple of times this year previously, flagging that it looked potentially interesting on 25/7/2024. There was a profit warning shortly before that, which we touched on here 9/7/2024. Shares seem to still be in a downtrend, albeit with sharp bounces occasionally.

It might be worth readers taking a look, given that shares rose 10% yesterday on results. This is a complicated situation though, with a highly profitable business, but substantial litigation costs, and other issues. The StockReport is now showing a fwd PER of only 5.2x, a rating which tends to be a good indicator of there being something wrong! (or it’s a bargain). Let me know what you think, we’ve had some interesting discussion about Indivior before here.

Kooth (LON:KOO)

Down 9% to 160p (£58m) - Statement re share price movement - Paul - AMBER

I thought this share might bounce today, given that KOO rejected some critical press comments here about its lucrative Californian contract.

KOO says today that its outlook for FY 12/2024 and FY 12/2025 are unchanged. It would have been more helpful for KOO to tell us what those expectations actually are.

Another small pilot contract was recently cancelled, which started off this calamitous fall in share price, worsened by the article linked to above.

I see that on 8/10/2024 Root Capital did a secondary, discounted (12%) placing at 280p, so it is difficult to avoid the impression they might have got wind of potential problems maybe?

Paul’s view - it’s a pity because I was warming to Kooth, after decent interim results showing a strong rise in revenues, and a move into a maiden profit.

The recent share price collapse and talk of contract problems could be giving us a bargain, but I must admit that the single contract risk has scared me off now, and it looks as if the market generally shares that view. Good luck to holders, but this is looking like a coin flip now over whether or not the California contract survives. It could all be a false alarm, if the company is to be believed, or there could be serious problems here. How can we invest without knowing for sure which it is?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.